Automotive Refinish Coatings Market

Automotive Refinish Coatings Market by Layer (Clearcoat, Basecoat, Primer), Resin Type (Polyurethane, Epoxy, Acrylic, Alkyd), Vehicle Type (Passenger Cars, Commercial Vehicles), and Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

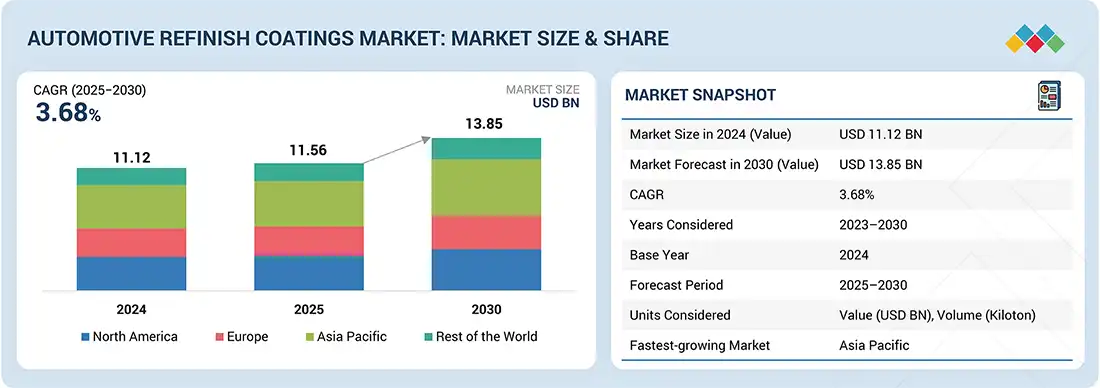

The automotive refinish coatings market is projected to reach USD 13.85 billion by 2030 from USD 11.56 billion in 2025, at a CAGR of 3.68% from 2025 to 2030. Automotive refinish coatings are specialized paints and coatings applied in non-production environments, such as auto body shops and repair facilities, to repair and refurbish automobiles and other vehicles. The growth of this market is driven by rising vehicle ownership, longer vehicle lifespans, and an increasing focus on aesthetics and maintenance, leading to growth in both mature and emerging economies.

KEY TAKEAWAYS

-

BY RESIN TYPEThe automotive refinish coatings market comprises polyurethane (PU), epoxy, acrylic, alkyd, and other resins (nitrocellulose and polyester), with PU and epoxy widely used in providing durability and chemical resistance, and acrylic and alkyd resins playing a critical role in surface finish quality and fast drying applications.

-

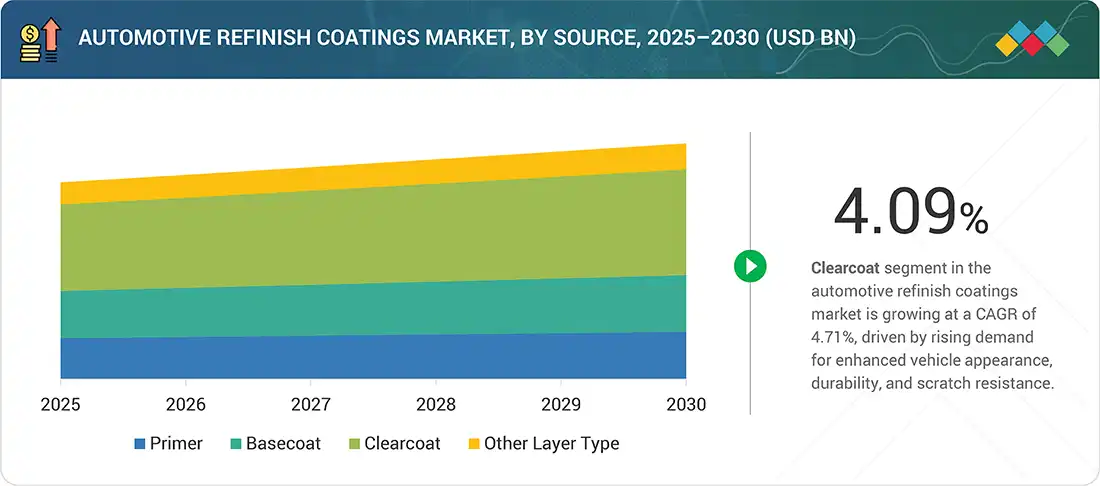

BY LAYER TYPEThe automotive refinish coatings market is categorized into primer, basecoat, clearcoat, and other segments. The clearcoat segment, known for its superior gloss and durability, is growing at the fastest rate.

-

BY VEHICLE TYPEThe automotive refinish coatings market is divided into three segments: passenger cars, commercial vehicles, and two-wheelers. Among these, passenger cars hold the largest market share. This growth is primarily driven by a high number of vehicles on the roads and an increasing demand for both aesthetic and performance coatings, particularly in developed regions.

-

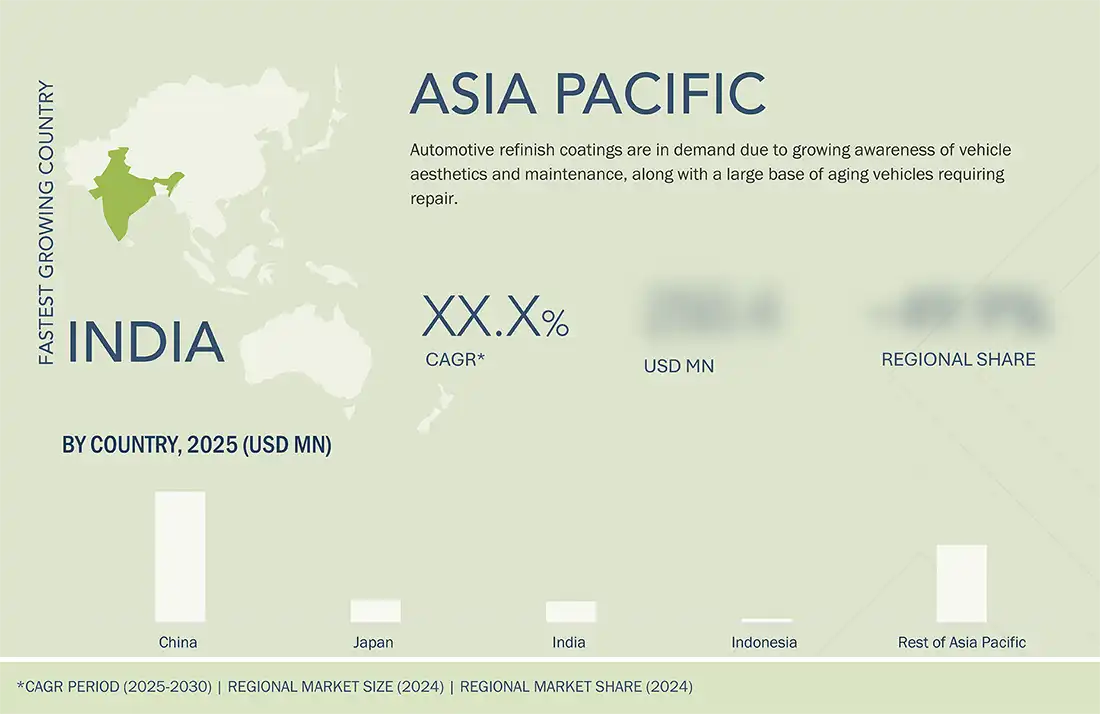

BY REGIONAsia Pacific is the largest and fastest-growing market, with a CAGR of 4.49%. The growth is driven by the rapid recovery of vehicle production and an increasing demand for vehicle refurbishment in emerging economies.

-

COMPETITIVE LANDSCAPEThe major market players have adopted both organic and inorganic strategies including partnerships and acquisitions. For instance, Axalta Coating Systems LLC, a leading global coatings company, announced a partnership with CESVIMAP R&D Centre, a leader in research and development for the collision repair industry.

The automotive refinish coatings market is expected to grow steadily over the next decade. This growth is driven by an increasing number of vehicles on the road, a rising demand for vehicle refurbishment, and stringent environmental regulations. Industry players are focusing on advanced coating technologies that provide superior durability, corrosion resistance, and improved aesthetic appeal. The growing emphasis on sustainability and regulatory compliance is accelerating the shift toward eco-friendly, high-performance coatings, which are being adopted more widely across both passenger cars and commercial vehicles.

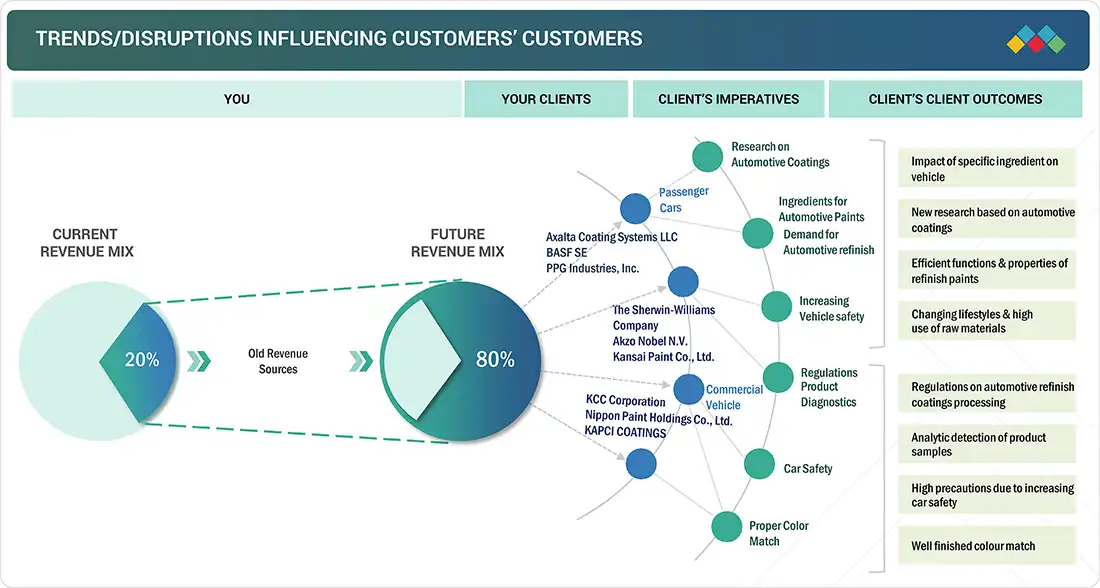

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The megatrends of digital transformation and renewable energy will significantly impact a company's future revenue streams. Emerging industry trends and technologies include waterborne coatings, UV-curable coatings technology, and low-VOC, high-solid coatings technology.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Expanding automotive aftermarket services

-

Technological advancements in coatings

Level

-

Shift toward paintless repair techniques

-

Toxicity and health concerns

Level

-

Adoption of eco-friendly coatings

-

Expansion into emerging markets

Level

-

Stringent environmental regulations

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Expanding automotive aftermarket services

The refinish coatings industry is significantly supported by the rapid growth of the global automobile aftermarket sector. Key factors driving this growth include increased car ownership, greater consumer awareness of vehicle maintenance and aesthetics, and the establishment of more organized accident repair networks. To meet changing customer demands for quality and fast turnaround times, body shops and collision repair facilities are investing in advanced refinish technologies. Additionally, improvements in the supply chain, integration with insurance services, and the digitization of repair estimates are making aftermarket services more accessible and efficient.

Restraint: Shift toward paintless repair techniques

The growing popularity of paintless repair techniques is hindering the growth of the automotive refinish coatings market. These methods provide faster, more cost-effective, and environmentally friendly alternatives for repairing minor dents and scratches, eliminating the need for traditional coating processes. Consequently, the demand for refinish coatings is affected, particularly in regions where the adoption of paintless repair is rising among service centers and vehicle owners.

Opportunity: Adoption of eco-friendly coatings

The increasing use of eco-friendly coatings presents a significant opportunity for the automotive refinish coatings market. With stricter environmental regulations and heightened consumer awareness, manufacturers are developing low-VOC (volatile organic compound) and waterborne coatings that minimize harmful emissions. These sustainable solutions not only offer improved performance but also ensure regulatory compliance, fueling market growth, particularly in developed regions that emphasize greener automotive maintenance practices.

Challenge: Stringent environmental regulations

Stringent environmental regulations pose a major challenge for the automotive refinish coatings market. Manufacturers must comply with strict limits on VOC content and hazardous chemicals, requiring continuous innovation in formulation and production processes. This increases R&D costs and complicates manufacturing, especially for small and medium-sized players, while slowing down the adoption of traditional solvent-based coatings in favor of more sustainable but costly alternatives.

Automotive Refinish Coatings Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Vehicle repair and repainting services for collision-damaged cars | Fast repair, high-quality finish, and corrosion protection |

|

Automotive body repair and refinish services for various vehicles | Durable coatings, improved aesthetics, and quick turnaround |

|

Refinish coatings used in restoring vehicles after accidents | Consistent color match, high gloss, and long-lasting finish |

|

Automotive refinishing as part of comprehensive collision repairs | Efficient process, enhanced surface protection, and eco-friendly options |

|

Mass-market vehicle paint and refinish services for minor repairs | Cost-effective, quick service, and visually appealing results |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The automotive refinish coatings market ecosystem involves identifying and analyzing the interconnected relationships among various stakeholders, including raw material suppliers, manufacturers, distributors, and end users. Raw material suppliers provide essential components like resins, pigments, and additives to manufacturers of automotive refinish coatings. These manufacturers utilize various technologies to produce the coatings. Distributors and suppliers facilitate communication between manufacturers and end users, focusing on optimizing the supply chain to increase operational efficiency and profitability.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Automotive Refinish Coatings Market, by Layer Type

The clearcoat segment accounted for the largest market share in 2024. A clearcoat is a transparent layer of paint or resin applied over a base coat to protect and enhance the appearance of the surface beneath. It acts as a protective barrier against environmental factors such as UV rays, moisture, and chemicals, helping to prevent the base coat from fading, chipping, or peeling.

Automotive Refinish Coatings Market, by Resin Type

The polyurethane resin segment dominated the overall market in 2024. Polyurethane resin is a versatile polymer widely used in coatings due to its excellent durability, chemical resistance, and strong adhesion properties. In the automotive refinish coatings market, its ability to provide smooth finish, high gloss, and resistance to wear and environmental factors makes it highly preferred for repair and refinishing applications. These properties contribute significantly to its leading position in the market, as it effectively meets the demanding performance requirements of automotive surfaces.

Automotive Refinish Coatings Market, by Vehicle Type

The passenger cars segment accounted for the largest share of the automotive refinish coatings market, driven by the high global production and sales of passenger vehicles. This segment demands frequent repair and refinishing services due to higher usage intensity and cosmetic requirements, supporting its dominant position in the market.

REGION

Asia Pacific to be fastest-growing region in global automotive refinish coatings market during forecast period

The Asia Pacific region is the largest automotive refinish coatings market and is expected to experience the highest CAGR during the forecast period. This growth is driven by an increasing population and a booming automotive manufacturing industry in the area. Rapid urbanization, rising automobile ownership, and improved living standards have turned this region into a key market for automotive refinish coatings. It includes both developing countries like China and India, as well as developed markets such as Japan.

Automotive Refinish Coatings Market: COMPANY EVALUATION MATRIX

In the automotive refinish coatings market matrix, Axalta Coating Systems LLC (Star) leads with a strong market presence and wide product portfolio, driving large-scale adoption across the industry. KCC Corporation (Emerging Leader) is gaining traction with sustainable automotive refinish coating solutions in the automotive industry for the passenger and commercial vehicle segments. While Axalta Coating Systems LLC dominates with scale, KCC Corporation shows strong growth potential to advance toward the leaders’ quadrant.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 11.12 BN |

| Market Forecast in 2030 (Value) | USD 13.85 BN |

| Growth Rate | CAGR of 3.68% from 2025-2030 |

| Years Considered | 2023−2030 |

| Base Year | 2024 |

| Forecast Period | 2025−2030 |

| Units Considered | Value (USD Billion), Volume (Kiloton) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered | By Layer Type: Primer, Basecoat, Clearcoat, and Other Layer Type By Resin Type: Polyurethane, Acrylic, Epoxy, Alkyd, and Other Resin Type By Vehicle Type: Passenger Cars and Commercial Vehicles |

| Regions Covered | North America, Asia Pacific, Europe, and Rest of the World |

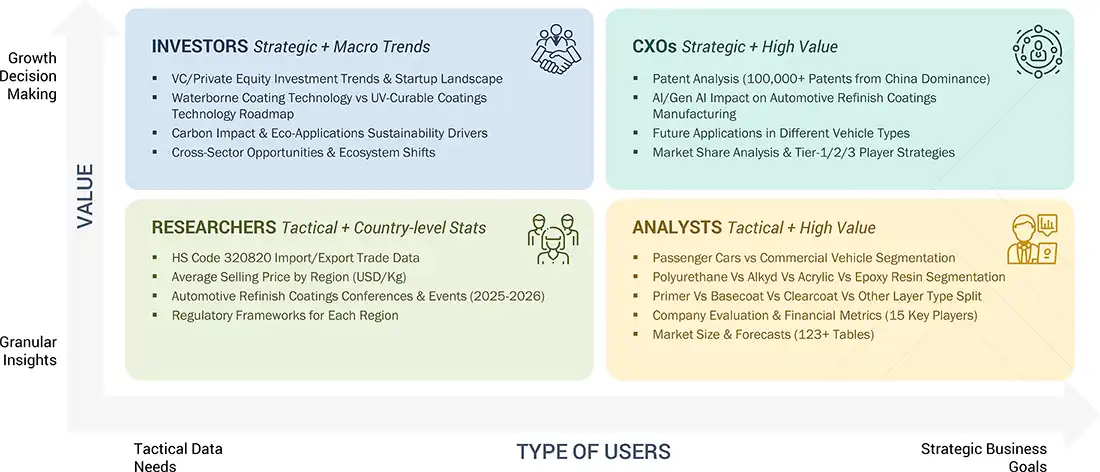

WHAT IS IN IT FOR YOU: Automotive Refinish Coatings Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| US-based Automotive Refinish Coatings Manufacturer | • Detailed US-specific company profiles of competitors (financials, product portfolio) • Customer landscape mapping by end-use sector • Partnership ecosystem analysis | • Identify interconnections and supply chain blind spots • Detect customer migration trends across industries • Highlight untapped customer clusters for market entry |

| Asia Pacific-based Automotive Refinish Coatings Manufacturer | • Global & regional production capacity benchmarking • Customer base profiling across the automotive industry | • Strengthen forward integration strategy • Identify high-demand customers for long-term supply contracts • Assess supply-demand gaps for competitive advantage |

RECENT DEVELOPMENTS

- March 2025 : Nippon Paint agreed to acquire AOC, a global specialty chemicals manufacturer, from Lone Star Funds. The deal was announced in October 2024 and closed in March 2025. This acquisition expands Nippon Paint’s presence in specialty resins and composites, supporting growth in infrastructure, transportation, and construction coatings markets.

- December 2024 : BASF SE and Shenergy signed an agreement to pursue global biomethane projects, targeting greener energy alternatives for BASF’s chemical production value chains.

- December 2024 : BASF SE teamed up with INOCAS to develop sustainable macauba oil supply for resin types in cosmetics and detergents, promoting biodiversity and responsible sourcing in Brazil.

- November 2024 : PPG partnered with SARO/Siccardi to expand its powder coatings footprint in Italy, enhancing its portfolio and regional presence.

Table of Contents

Methodology

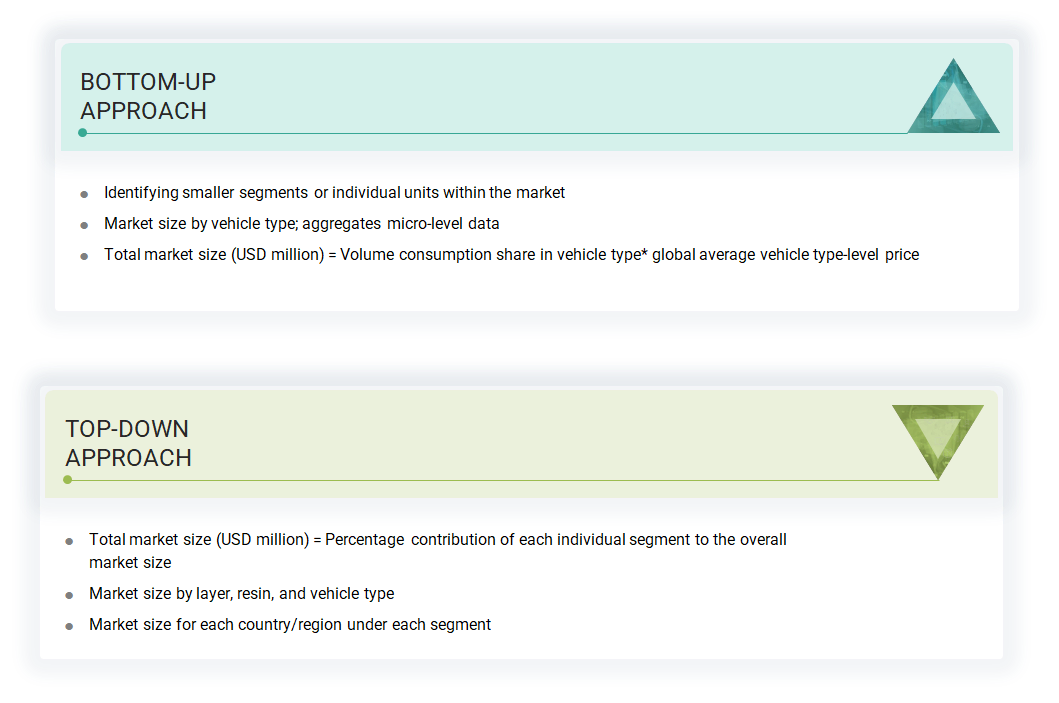

The study involved four major activities in estimating the market size for the automotive refinish coatings market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

Secondary sources used in this study included annual reports, press releases, and investor presentations of companies; white papers; certified publications; articles from recognized authors; and gold standard & silver standard websites such as Factiva, ICIS, Bloomberg, and others. The findings of this study were verified through primary research by conducting extensive interviews with key officials such as CEOs, VPs, directors, and other executives.

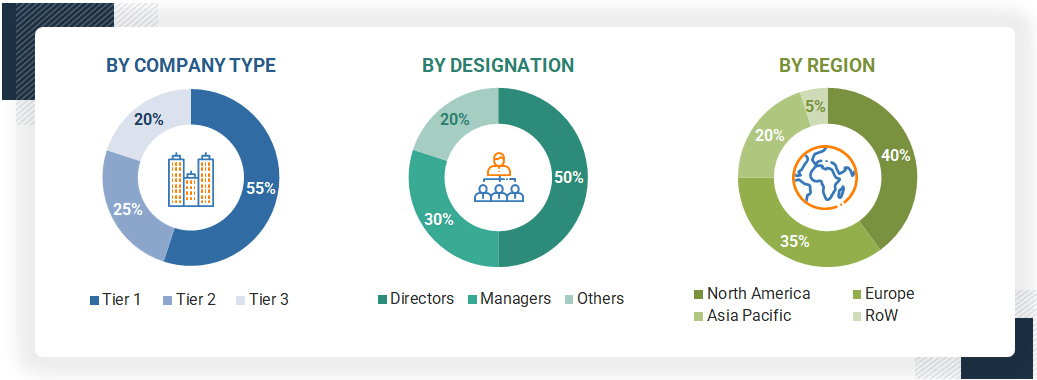

Primary Research

The automotive refinish coatings market comprises several stakeholders, such as raw material suppliers, end-product manufacturers, and regulatory organizations in the supply chain. The demand side of this market is characterized by key opinion leaders in various applications for the automotive refinish coatings market. The supply side is characterized by advancements in technology and diverse application industries. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

The breakdown of profiles of the primary interviewees is illustrated in the figure below:

Note: Tier 1, Tier 2, and Tier 3 companies are classified based on their market revenue in 2023/2024, available in the public domain, product portfolios, and geographical presence. Other designations include consultants and sales, marketing, and procurement managers.

Note: Tier 1, Tier 2, and Tier 3 companies are classified based on their market revenue in 2023/2024, available in the public domain, product portfolios, and geographical presence. Other designations include consultants and sales, marketing, and procurement managers.

To know about the assumptions considered for the study, download the pdf brochure

| COMPANY NAME | DESIGNATION | |

|---|---|---|

| Axalta Coating Systems LLC | Senior Manager | |

| PPG Industries, Inc. | Innovation Manager | |

| BASF SE | Vice President | |

| The Sherwin-Williams | Production Supervisor | |

| Akzo Nobel N.V. | Sales Manager | |

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the automotive refinish coatings market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry have been identified through extensive secondary research

- The supply chain of the industry has been determined through primary and secondary research

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources

- All possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the automotive refinish coatings industry.

Market Definition

Automotive refinish coatings are special paints and coatings used in non-manufacturing settings, including auto body shops and repair centers, to recondition and repair vehicles, primers, etc., as defined by the American Coatings Association. These coatings, unlike OEM finishes that are utilized as original finishes in manufacturing, will be intended to be used under ambient or low-temperature bake systems and are aimed at restoring vehicle appearance and protection from damage or wear. Examples of products they contain are primers, basecoats, and clearcoats, which are often designed to be very hard wearing, weatherproof, or improved in appearance in some way, with an eye toward reducing the environmental effects of coating products by including waterborne or high-solids systems.

Stakeholders

- Manufacturers, dealers, suppliers, and manufacturers of automotive refinish coatings and their raw materials

- Manufacturers in various end-use industries

- Traders, distributors, and suppliers of automotive refinish coatings

- Regional manufacturers’ associations and automotive refinish coating associations

- Government and regional agencies, and research organizations

Report Objectives

- To analyze and forecast the automotive refinish coatings market in terms of value and volume

- To provide detailed information about the key factors (drivers, restraints, opportunities, and challenges) influencing market growth

- To define, segment, and project the size of the global automotive refinish coatings market based on layer type, resin type, and vehicle type

- To project the market size for the four main regions: North America, Europe, Asia Pacific, and the Rest of the World, with their key countries

- To analyze the micromarkets1 concerning individual growth trends, prospects, and their contribution to the overall market

- To analyze opportunities in the market for stakeholders and provide a competitive landscape of the market leaders

- To track and analyze R&D and competitive developments such as expansions, product launches, collaborations, investments, partnerships, agreements, and mergers & acquisitions in the automotive refinish coatings market

Key Questions Addressed by the Report

Who are the major players in the automotive refinish coatings market?

The key players in the automotive refinish coatings market include Axalta Coating Systems LLC (US), PPG Industries, Inc. (US), BASF SE (Germany), Akzo Nobel N.V. (Netherlands), The Sherwin-Williams (US), Kansai Paint Co., Ltd. (Japan), Nippon Paint Holdings Co., Ltd. (Japan), KCC Corporation (China), and TOA Performance Coating Corporation Co., Ltd. (Thailand).

What are the drivers and opportunities for the automotive refinish coatings market?

Expanding automotive aftermarket services and technological advancements in coatings are the major drivers for the automotive refinish coatings market. Adoption of eco-friendly coatings and expansion into emerging markets are expected to create new opportunities for the market.

Which strategies are the key players focusing on in the automotive refinish coatings market?

The top players adopt strategies such as product launches, mergers and acquisitions, agreements, and expansions to expand their global presence.

What is the expected growth rate of the automotive refinish coatings market between 2025 and 2030?

The automotive refinish coatings market is projected to grow at a CAGR of 3.68% in terms of value during the forecast period.

Which major factors are expected to restrain the growth of the automotive refinish coatings market during the forecast period?

Shift toward paintless repair techniques is expected to restrict market growth during the forecast period.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Automotive Refinish Coatings Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Automotive Refinish Coatings Market