Aniline Market

Aniline Market by Technology (Vapor Phase Process and Liquid Phase Process), End User (Building & Construction, Automotive, Rubber, Healthcare), Application (Rubber Chemicals, Fuel Additives, Dyes & Pigments), and Region - Global Forecast to 2030

OVERVIEW

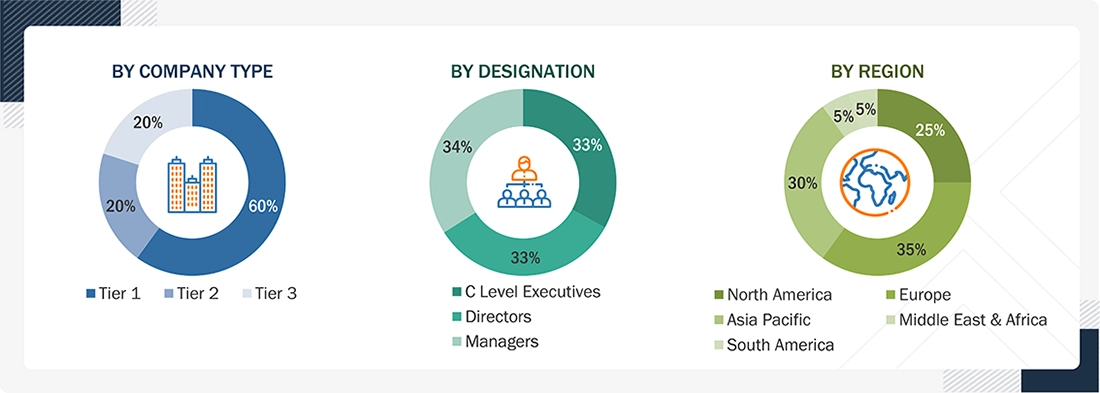

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The aniline market size is projected to grow from USD 10.17 billion in 2025 to USD 13.27 billion by 2030, registering a CAGR of 5.5% during the forecast period. The demand for methylene diphenyl diisocyanate, which manufacturers utilize to produce polyurethane foams used in construction, appliances, and automotive lightweighting, drives the aniline market forward. The rubber processing chemicals market will experience growth because of increased demand for tire manufacturing. The textile, dye, and pigment industries' expansion drives the need for aniline-based intermediates. The growing pharmaceutical and agrochemical industries will increase demand for active ingredient synthesis. Emerging economies experience rising demand driven by urbanization, infrastructure development, and industrial growth. The development of efficient low-emission aniline production technologies together with major producers' capacity expansions will create reliable supply chains, which will lead to increased adoption in downstream operations.

KEY TAKEAWAYS

-

By RegionAsia dominated the aniline market, with a 52.9% share in terms of value in 2025.

-

By TechnologyBy technology, the liquid phase process dominates the aniline market with a market share of 39.1%, in terms of value, in 2025.

-

By ApplicationBased on application, MDI is the fastest-growing application with a CAGR of 5.7% in the aniline market during the forecast period.

-

By End UserThe building & construction industry holds the highest market share of 52.5%, in terms of value, during the forecast period.

-

COMPETITIVE LANDSCAPE- KEY PLAYERSCompanies such as BASF SE, Dow, and Covestro AG were identified as some of the star players in the Aniline market, given their strong market share and product footprint.

-

COMPETITIVE LANDSCAPE- STARTUPSGujarat Narmada Valley Fertilizers & Chemicals Ltd. and Anhui Bayi Chemical Industry Co., Ltd., among others, have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders.

The Asia Pacific region experiences significant aniline consumption due to a strong manufacturing base for polyurethane products, rubber chemicals, dye, and pharmaceutical intermediates. China, India, Japan, South Korea, and Southeast Asia dominate the market in the region. The demand for MDI-based insulation materials is increasing due to rapid urbanization and infrastructure development, while the growing automotive industry is driving demand for rubber processing. The pharmaceutical and agrochemical industries produce more output, leading to increased aniline consumption as export and contract manufacturing activities grow. The regional market is experiencing strong growth because domestic chemical manufacturing is supported by government policies, combined with local producers expanding production capacity and adopting cleaner aniline production methods.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The aniline market is experiencing significant changes that are creating new competition and altering its development path. The industry is driving an important environmental shift by pursuing aniline production with improved hydrogenation catalysts and cleaner production methods that comply with stricter environmental rules. The capacity expansions occurring in Asia Pacific, especially in China and India, are changing international trade patterns while boosting the region's capacity to produce its own goods. The production costs and profit margins of companies are being affected by unpredictable changes in benzene prices and supply chain breakdowns that are disrupting the distribution of aromatics. The growing use of bio-based and alternative intermediates in specific downstream markets, including specialty chemicals and coatings, poses a replacement threat to traditional aniline products. Aniline producers and MDI manufacturers are establishing stronger connections, leading to market transformations through better expense management and improved material availability. The aniline value chain is experiencing pricing changes due to these trends, which also affect investment strategies and capacity-building efforts.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Growing demand in dyes & pigments industry

-

Growing demand for rubber processing chemicals in automotive and industrial rubber goods

Level

-

Stringent environmental and occupational safety regulations

-

Fluctuating benzene prices impacting production economics for non-MDI derivatives

Level

-

Increasing demand for high-performance rubber chemicals in EV tires and industrial belts

-

Growth of specialty dyes, pigments, and ink formulations for digital printing & packaging

Level

-

Ensuring safe handling, storage, and transport across downstream

-

Regulatory pressure to replace aniline-based intermediates with safer alternatives

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Growing demand in dyes & pigments industry

The aniline market is driven by the dyes and pigments industry, which uses aniline as a crucial ingredient to produce many dye intermediates, including aniline black, azobenzene derivatives, and various aromatic amines. The textile and apparel industry in Asia Pacific is experiencing rapid growth, leading to increased demand for synthetic dyes used to dye polyester, nylon, and acrylic materials. The rising use of pigments in paints and coatings, plastics, printing inks, and construction materials drives the demand for aniline-based intermediates. The industry is moving toward high-performance specialty colorants that use aniline-derived chemistries to achieve greater color strength, durability, and fastness. The growth of textile and finished goods exports, together with the development of the packaging industry and decorative applications, creates demand for stable dye supplies. The worldwide dye and pigment manufacturing industry shows constant growth, which results in increased aniline usage.

Restraint: Stringent environmental and occupational safety regulations

Stringent environmental and occupational safety regulations act as a key restraint on the aniline market, as aniline has toxic, flammable, and hazardous properties. The main regulatory agencies in major regions establish stringent restrictions on aniline emissions, wastewater discharge, and workplace exposure, thereby forcing producers to spend substantial sums on advanced pollution control, waste treatment, and monitoring systems. Chemical management frameworks, such as REACH in Europe and TSCA in the US, make operations more challenging and expensive. The strict requirements for transportation, storage, and labeling of products increase logistics costs, hindering the efficiency of supply chain processes. Regulatory requirements create delays in project authorization, reducing production capacity and revenue for small- and mid-sized manufacturers. The increasing need to use safer or bio-based materials instead of hazardous substances in downstream processes restricts the long-term growth potential of aniline-based products, which leads to decreased market growth.

Opportunity: Increasing demand for high-performance rubber chemicals in EV tires and industrial belts

The rising demand for advanced rubber chemicals used in electric vehicle tires and industrial belts creates a major opportunity for the aniline market, as aniline serves as the essential base material for manufacturing antioxidants, accelerators, and other rubber production chemicals. The need for enhanced abrasive resistance, reduced rolling resistance, and advanced thermal stability in electric vehicle tires stems from the need to manage increased torque and vehicle weight, leading to the use of cutting-edge rubber materials that rely on aniline-based chemical compounds. Industrial belts used in mining, material handling, and heavy machinery applications require specialized rubber compounds to meet the demands of extreme mechanical endurance, heat resistance, and chemical resistance. The increasing production of electric vehicles, the establishment of renewable energy sources, and the growth of automated industrial systems drive the need for these advanced rubber production materials. Tire companies are developing new compounding methods and producing durable goods, which is increasing demand for their products. The combination of these developments leads to higher demand from downstream markets, which results in long-term growth potential for aniline manufacturing companies throughout the world.

Challenge: Ensuring safe handling, storage, and transport across downstream

The aniline market experiences major challenges because its dangerous, corrosive, and flammable characteristics create problems for industries that need to store, handle, and move the material. The safety rules that workers must follow require them to wear protective equipment and complete special training because aniline exposure creates severe health dangers. The design of storage facilities uses corrosion-resistant materials that require temperature control and secondary containment systems to prevent leaks that can cause contamination. The transportation of aniline must comply with hazardous material regulations, which require proper packaging and labeling and emergency response readiness, creating extra challenges for logistics operations and increasing operational costs. Spills and improper handling cause environmental harm, while manufacturers and users face regulatory fines and damage to their brand image.

ANILINE MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Supplies aniline for captive production of MDI used in polyurethane foams for insulation panels, refrigerators, appliances, and automotive seating across Europe, China, and North America | Enables large-scale PU manufacturing, improves thermal insulation performance, and supports lightweight, energy-efficient end products |

|

Uses aniline as a key feedstock for MDI production serving construction, furniture, and automotive polyurethane applications worldwide | Ensures consistent raw material supply, high product quality, and cost-efficient polyurethane production |

|

Uses aniline to manufacture rubber antioxidants and accelerators for tire and industrial rubber goods | Improves rubber durability, heat resistance, and service life in tires and technical rubber products |

|

Converts aniline into MDI and downstream polyurethane systems for insulation foams, coatings, adhesives, and elastomers | Supports production of high-performance materials with superior mechanical and insulation properties |

|

Produces aniline for supply to MDI producers, rubber chemical manufacturers, and dye intermediates plants in China | Supports domestic chemical self-sufficiency and large-scale downstream manufacturing |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The aniline market ecosystem comprises upstream suppliers of benzene, hydrogen, and catalysts, integrated aniline manufacturers, and a wide range of downstream processors producing MDI, polyurethanes, rubber chemicals, dyes, pigments, and pharmaceutical and agrochemical intermediates. These intermediates are further converted into insulation foams, automotive components, tires, coatings, textiles, and specialty chemicals. The ecosystem is supported by petrochemical complexes, logistics providers, technology licensors, and regulatory bodies, ensuring safe and compliant operations. Increasing backward and forward integration, capacity expansions, and the adoption of cleaner production technologies are strengthening supply reliability. Strong demand from the construction, automotive, and industrial manufacturing sectors continues to drive global ecosystem growth.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Aniline Market, By Technology

The aniline market is segmented based on technology into vapor phase process and liquid phase process. The vapor phase process is the preferred method for industrial use, as it achieves higher conversion rates, produces purer products, generates less wastewater, and delivers superior environmental performance compared to modern industrial facilities. The liquid phase process uses traditional technology, which is still implemented in specific areas because its equipment requirements are straightforward, its initial costs are minimal, and its users have built up operational knowledge. The two technologies work together to influence how aniline manufacturing operations worldwide manage production costs and growth plans.

Aniline Market, By Application

The aniline market is segmented based on application into MDI, rubber chemicals, dyes & pigments, pharmaceuticals, fuel additives, and other applications. The MDI segment holds the highest market share because the construction, appliance, and automotive industries highly demand polyurethane foams. Rubber chemicals use aniline to produce antioxidants and accelerators for tires and industrial rubber goods. Dyes and pigments require aniline-based intermediates to create their colorants. Aniline serves as a chemical component in the production of essential active pharmaceutical ingredients and their production intermediates in the pharmaceutical industry. Fuel additives enhance combustion efficiency while agrochemicals and specialty intermediates serve as other application fields.

Aniline Market, By End User

The aniline market is segmented based on end user into building & construction, automotive, rubber production, consumer goods, packaging, healthcare, and other end users. The building & construction industry leads the overall market as MDI-based polyurethane insulation materials are widely used. The automotive industry uses aniline as a secondary product in the production of lightweight polyurethane parts and high-performance tires. The rubber industry uses aniline-derived chemicals to manufacture tires and industrial products. Consumer goods and packaging rely on foams, coatings, and colorants.

REGION

Asia Pacific to be fastest-growing region in aniline market during forecast period

Asia Pacific is the fastest-growing aniline market. The regional market is driven by rapid industrialization and urbanization, as well as manufacturing expansion in China, India, Southeast Asia, Japan, and South Korea. The region produces MDI and polyurethanes through its extensive manufacturing operations which serve the needs of the construction and appliance and automotive sectors. Aniline consumption increases due to strong expansion in tire manufacturing, textile production, dye production, pharmaceutical development, and agrochemical manufacturing. Production costs remain low due to readily available, affordable raw materials, a skilled workforce, and the existing petrochemical network. The chemical production capacity expansion by local manufacturers, together with government support for domestic manufacturing, helps Asia Pacific build its reputation as a worldwide aniline production center.

ANILINE MARKET: COMPANY EVALUATION MATRIX

Covestro (Star) is a leading company in the global aniline market. The company has established itself as a top industry player through its extensive portfolio of high-purity aniline products, chemical intermediates, and specialty solutions, supported by strong research and development capabilities and technical expertise. Covestro has established long-term relationships with chemical manufacturers, downstream polymer producers, and industrial end users across Europe, Asia, and North America. China Risun Group Limited (Emerging) is steadily expanding in the Asia Pacific aniline market, focusing on high-quality aniline production, sustainable processes, and innovative applications in specialty chemicals. The company has become a rising contender through its increased focus on operational efficiency and strategic partnerships, which have created new growth opportunities while it builds its market presence.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- 1. BASF SE (Germany)

- 2.Dow (US)

- 3. Covestro AG (Germany)

- 4. Lanxess (Germany)

- 5. Huntsman Corporation (US)

- 6. China Risun Group Limited (China)

- 7. Sinopec (China)

- 8. Sumitomo Chemical Co., Ltd. (Japan)

- 9. Tosoh Corporation (Japan)

- 10. Wanhua Chemical Group Co., Ltd. (China)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2025 (Value) | USD 10.17 Billion |

| Market Forecast in 2030 (value) | USD 13.27 Billion |

| Growth Rate | CAGR of 5.5% from 2025-2030 |

| Years Considered | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Billion), Volume (Kiloton) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Europe, Asia Pacific, Middle East & Africa, and South America |

WHAT IS IN IT FOR YOU: ANILINE MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Demand for region-specific market insights | Provided detailed analysis of aniline demand, production capacity, pricing trends, and regulatory landscape for major regions, including Asia Pacific, North America, Europe, and the Middle East & Africa | Helps clients identify high-growth regions, assess regional regulatory impacts, and plan targeted expansion strategies based on region-specific market dynamics |

| Request for competitor benchmarking | Delivered a comparative assessment of leading aniline manufacturers, including product grades, production capacities, pricing strategies, and regional strategic initiatives | Enables better strategic positioning, highlights competitive gaps, and identifies market opportunities for growth and innovation in Asia Pacific region |

| Application-specific insights | Provided insights on aniline applications in dyes, pigments, rubber chemicals, pharmaceuticals, and other industrial uses, highlighting market trends, adoption rates, and regulatory requirements | Supports product development, targeted marketing, and alignment of aniline grades with industry-specific requirements in different regions |

| Custom material & product grade support | Evaluated and recommended tailored aniline grades and formulations for downstream applications, including high-purity, technical-grade, and derivative production | Reduces R&D cycle times, ensures product performance, enhances compatibility with client processes, and supports end-use application efficiency |

| Technical feasibility & process guidance | Delivered guidance on aniline production technologies (vapor phase, liquid phase, and green processes), handling, storage, and safety practices | Improves production efficiency, reduces material waste, ensures worker safety, and ensures consistent product quality |

| Regulatory & compliance support | Provided analysis of regional regulations related to aniline manufacturing, transport, storage, and use, including environmental and safety standards | Ensures adherence to legal standards, mitigates risk, supports sustainable production, and enables compliance with downstream industry requirements |

RECENT DEVELOPMENTS

- March 2024 : Sinopec’s Nanjing Chemical Company began construction of a major aniline–rubber additives industrial chain project at the Gulei Petrochemical Base in Fujian. The project includes a 300,000-tpa aniline unit, an 86,000-tpa rubber additives plant, a 45,000-tpa MIBK facility, and supporting utilities, strengthening Sinopec’s benzene-based fine chemicals platform.

- February 2024 : Covestro commissioned the world’s first pilot plant for bio-based aniline at its Leverkusen site, marking a major step toward petroleum-free chemical production.

- October 2023 : China Risun Group and Jilin Connell Group formed a strategic partnership to resume operations at Jilin Connell’s aniline plant, supported by the Jilin municipal government. The collaboration integrates Risun’s chemical management expertise with Connell’s existing assets, reviving a 300,000-tpa aniline facility and strengthening the regional chemical value chain

- September 2023 : Dow commissioned a new MDI distillation and prepolymers facility at its Freeport, Texas site, replacing North America capacity at La Porte. The facility increases product supply by 30%, enhances operational flexibility, and integrates a more sustainable production process by reducing greenhouse gas emissions, freshwater intake, and wastewater discharge.

- October 2022 : Covestro began construction of a new world-scale aniline production plant in Antwerp in October 2022, investing over USD 350 million to strengthen its European MDI supply network.

Table of Contents

Methodology

The study involves two major activities in estimating the current market size for the aniline market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary sources referred to for this research study include financial statements of companies offering aniline and information from various trade, business, and professional associations. Secondary research has been used to obtain critical information about the industry's value chain, the total pool of key players, market classification, and segmentation according to industry trends to the bottom-most level and regional markets. Secondary data was collected and analyzed to arrive at the overall size of the aniline market, which was validated by primary respondents.

Primary Research

Extensive primary research was conducted after obtaining information regarding the aniline market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand and supply sides across major countries of North America, Europe, Asia Pacific, the Middle East & Africa, and South America. Primary data was collected through questionnaires, emails, and telephonic interviews. The primary sources from the supply side included various industry experts, such as Chief X Officers (CXOs), Vice Presidents (VPs), Directors from business development, marketing, product development/innovation teams, and related key executives from aniline industry vendors; material providers; distributors; and key opinion leaders. Primary interviews were conducted to gather insights such as market statistics, data on revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to technology, application, end user, and region. Stakeholders from the demand side, such as CIOs, CTOs, CSOs, and installation teams of the customer/end users who are seeking aniline services, were interviewed to understand the buyer's perspective on the suppliers, products, component providers, and their current usage of aniline and future outlook of their business, which will affect the overall market.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The research methodology used to estimate the size of the aniline market includes the following details. The market sizing of the market was undertaken from the demand side. The market was upsized based on the demand for aniline in different end-use industries at a regional level. Such procurements provide information on the demand aspects of the aniline industry for each end-use industry. For each end-use, all possible segments of the aniline market were integrated and mapped.

Aniline Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall size from the market size estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for various market segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Market Definition

Aniline (C6H5NH2) is a colorless to slightly yellow aromatic amine with a distinctive smell that serves as a chemical intermediate for multiple industrial applications. The main method of producing this compound involves nitrobenzene reduction which serves as a primary material for manufacturing rubber, chemicals, dyes & pigments, pharmaceutical products, and MDI (methylene diphenyl diisocyanate). Aniline serves as a fundamental material for developing coatings, adhesives, polymers, and specialty chemicals, which find applications in the automotive, textile, construction, and industrial fields.

Key Stakeholders

- Aniline Manufacturers

- Aniline Distributors and Suppliers

- End-use Industries

- Universities, Governments, and Research Organizations

- Associations and Industrial Bodies

- R&D Institutes

- Environmental Support Agencies

- Investment Banks and Private Equity Firms

- Research and Consulting Firms

Report Objectives

- To define, describe, and forecast the aniline market size in terms of volume and value

- To provide detailed information regarding the key factors, such as drivers, restraints, opportunities, and challenges influencing market growth

- To analyze and forecast the market by technology, end-user, application, and region

- To forecast the market size concerning five main regions (along with country-level data), namely, North America, Europe, Asia Pacific, the Middle East & Africa, and South America, and analyze the significant region-specific trends

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions of the submarkets to the overall market

- To analyze the market opportunities and the competitive landscape for stakeholders and market leaders

- To assess recent market developments and competitive strategies, such as agreements, contracts, acquisitions, partnerships & collaborations, and new product developments/new product launches, to draw the competitive landscape

- To strategically profile the key market players and comprehensively analyze their core competencies

Available customizations:

MarketsandMarkets offers the following customizations for this market report:

- Additional country-level analysis of the aniline market

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Aniline Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Aniline Market