Rigid Endoscopes Market Size, Growth, Share & Trends Analysis

Rigid Endoscopes Market by Type (Laparoscopes, Arthroscopes, Cystoscopes), Clinical Usage (Diagnostic, Surgical), Application (Laparoscopy, Cystoscopy, Arthroscopy, Other), End User (Hospitals, ASCs, Clinics), Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The global rigid endoscopes market is projected to reach USD 2.32 billion by 2030, growing from USD 1.83 billion in 2025, at a CAGR of 4.9% during the forecast period. The growth of the rigid endoscopes market is primarily driven by the rising demand for minimally invasive surgeries, the growing prevalence of chronic conditions requiring laparoscopic, urologic, and orthopedic procedures, and continuous technological advancements such as 4K/3D visualization and fluorescence imaging. However, challenges include high device costs, stringent regulatory approval pathways, and risks of cross-contamination due to complex sterilization requirements.

KEY TAKEAWAYS

-

BY TYPEBy type, the rigid endoscopes market is segmented into laparoscopes, urology endoscopes, gynecology endoscopes, arthroscopes, cytoscopes, neuroendoscopes, and other rigid endoscopes. Among these, the laparoscopes segment accounted for the largest market share in 2024, owing to its broad clinical utility across both diagnostic and surgical procedures for high-prevalence conditions. Laparoscopy is a preferred minimally invasive technique for diagnosing appendicitis, endometriosis, pelvic inflammatory disease, and various cancers, and is also widely used in surgeries such as appendectomy, cholecystectomy, hernia repair, hysterectomy, fibroid removal, and bariatric interventions.

-

BY CLINICAL USAGEBy clinical usage, the surgical usage segment accounted for the major share in 2024, owing to the widespread adoption of minimally invasive surgeries across specialties such as gynecology, orthopedics, urology, and general surgery. Rigid endoscopes provide superior image clarity, precision, and control, enabling accurate diagnosis and treatment. Additionally, rising surgical volumes, technological advancements, and faster recovery times further drive their extensive utilization in surgical procedures.

-

BY APPLICATIONBy application, the rigid endoscopes market is segmented into laparoscopy, cystoscopy, arthroscopy, neuroendoscopy, and other applications (including ENT, thoracoscopy, bronchoscopy, mediastinoscopy, pediatric, plastic/reconstructive surgery, and others). Among these, the laparoscopy segment accounted for the largest share in 2024. This is due to its broad clinical utility, high procedural demand, and critical role in minimally invasive surgery. The segment’s growth is further reinforced by the increasing global burden of chronic diseases; for instance, endometriosis affects approximately 10% (190 million) of women of reproductive age worldwide, while acute appendicitis shows a lifetime incidence of 8.6% in males and 6.7% in females, according to the National Library of Medicine.

-

BY END USERBy end user, the rigid endoscopes market is segmented into hospitals, ambulatory surgical centers, clinics, and other end users (diagnostic centers, mobile endoscopy facilities, and office-based endoscopy service providers). Among these, the hospitals segment accounted for the largest market share in 2024, owing to its extensive surgical infrastructure, high patient volumes, and the ability to perform a broad spectrum of diagnostic and therapeutic procedures. Hospitals invest heavily in advanced endoscopy systems to support specialties such as general surgery, orthopedics, gynecology, urology, and ENT, where rigid endoscopes are essential for precision and minimally invasive interventions.

-

BY REGIONThe global rigid endoscopes market is segmented into five key regions: North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, North America accounted for the largest market share in the rigid endoscopes market. The North American rigid endoscopes market is divided into the US and Canada. The US accounted for the largest share in 2024. This is due to a combination of high disease prevalence, advanced healthcare infrastructure, strong reimbursement frameworks, and accelerated adoption of innovative technologies. Rising incidences of cancers and chronic conditions significantly drive demand for minimally invasive diagnostic and therapeutic interventions. Robust reimbursement coverage under Medicare and private insurance reduces patients’ out-of-pocket burden, thereby encouraging wider adoption of endoscopic procedures across hospitals and outpatient centers.

-

COMPETITIVE LANDSCAPEThe major market players have adopted organic and inorganic strategies, including product launches, partnerships, and acquisitions. Leading companies such as Olympus Corporation (Japan), KARL STORZ SE & Co. KG (Germany), Stryker (US), Smith+Nephew (UK), B Braun SE (Germany), and others have strengthened their product portfolios and expanded their global presence to meet the rising demand for endoscopes. Continuous innovation in rigid endoscopes and advancements in technology have helped these players maintain a competitive advantage in a rapidly evolving market.

The growth of the rigid endoscopes market is driven by increasing procedural volumes resulting from the rise in chronic pulmonary and urological conditions, as well as growing patient preference for minimally invasive diagnostics. A surge in day-care endoscopy centers and a shift toward outpatient procedures are also accelerating demand. Opportunities for players in the market lie in the development of cost-effective rigid endoscopes, the rising penetration in underdeveloped healthcare markets, and the integration of AI-driven analytics and robotics for real-time diagnostics, which enhance accuracy and clinical decision-making across broader care settings.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The rigid endoscopes market is witnessing significant trends and disruptions that are impacting customer businesses, driven by advancements in minimally invasive surgery, the growing adoption of HD and 4K imaging technologies, and a rising demand across urology, gynecology, and laparoscopy. Customers are increasingly shifting toward precision-driven, value-based healthcare solutions, creating pressure on manufacturers to deliver superior visualization, cost-effective devices, and improved ergonomics. Additionally, disruptive factors such as hospital budget constraints, stringent regulatory requirements, and supply chain vulnerabilities are influencing purchasing decisions. The shift toward outpatient and ambulatory surgical centers, coupled with digital integration and enhanced service support, is reshaping procurement models, compelling customers to prioritize long-term partnerships, training, and after-sales services to ensure efficiency, safety, and sustainability in their practices.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rising requirement for endoscopy to diagnose and treat target diseases

-

Increasing preference for minimally invasive surgeries

Level

-

High overhead costs of endoscopy procedures

-

Increased risk of getting viral infections during endoscopic procedures

Level

-

Rapidly developing healthcare sector in emerging economies

Level

-

Increasing number of product recalls

-

Lack of proper sterilization and reprocessing

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rising requirement for endoscopy to diagnose and treat target diseases

The rising need for endoscopy to diagnose and treat target diseases is a key driving factor for the growth of the rigid endoscopes market. The increasing global burden of chronic conditions such as cancer, pulmonary diseases, and urological disorders has heightened the demand for accurate, minimally invasive diagnostic and therapeutic procedures. For instance, the American Cancer Society projects 2,041,910 new cancer cases and 618,120 cancer-related deaths in the United States in 2025, underscoring the critical need for early detection and intervention through advanced endoscopic techniques. Similarly, chronic pulmonary diseases are on the rise, with research estimating global COPD prevalence to reach nearly 600 million cases by 2050, reflecting a 23% increase from 2020. Rigid endoscopes, with their superior imaging quality, precision, and durability, play a central role in facilitating procedures such as laparoscopy, hysteroscopy, cystoscopy, and bronchoscopy, enabling clinicians to visualize, biopsy, and treat affected areas with greater efficiency. Growing awareness among the population about the benefits of early disease detection, combined with advancements in rigid endoscopic technology, is further accelerating adoption. This increasing reliance on endoscopy as a standard of care for diagnosing and treating target diseases positions rigid endoscopes as indispensable tools driving market expansion worldwide.

Restraint: Increased risk of viral infections during endoscopic procedures

A significant restraining factor for the rigid endoscopes market is the increased risk of viral and other infectious transmissions during endoscopic procedures. Rigid endoscopes are reusable devices that come into direct contact with mucosal surfaces and internal organs, creating potential pathways for cross-contamination if proper sterilization and disinfection protocols are not strictly followed. Outbreaks of infections, including hepatitis B, hepatitis C, and other viral pathogens, have been linked to inadequately sterilized endoscopic equipment, raising safety concerns among healthcare providers and patients. These risks necessitate rigorous cleaning, high-level disinfection, and adherence to stringent regulatory standards, which can increase operational complexity and procedural costs for healthcare facilities. Additionally, the fear of infection may limit patient acceptance, reduce procedural volumes, and slow the adoption of rigid endoscopes in certain regions. While innovations in disposable endoscopes and advanced sterilization technologies are emerging, the inherent risk associated with reusable rigid endoscopes remains a market challenge. Consequently, hospitals and clinics must invest in robust infection control measures, staff training, and compliance monitoring, which can act as a barrier to rapid market growth despite rising demand for minimally invasive diagnostic and therapeutic procedures.

Opportunity: Rapidly developing healthcare sector in emerging economies

The rapidly developing healthcare sector in emerging countries presents a significant growth opportunity for the rigid endoscopes market. Increasing investments in healthcare infrastructure, rising government initiatives to expand access to advanced medical services, and the establishment of new specialty units are driving demand for high-quality endoscopic equipment. For example, the Emirates Health Services Foundation reported that the Gastrointestinal Endoscopy Unit at Kuwait Hospital in Sharjah performed 425 advanced procedures in the first quarter of 2025, reflecting growing procedural volumes and capacity expansion. Similarly, the UAE’s upcoming gastroenterology-focused hospital in Dubai, developed by South Korea’s Asan Medical Centre in partnership with Scope Investment, is set to provide specialized services across endoscopy, bariatrics, gastrointestinal oncology, liver transplantation, and preventive health checkups. In India (September 2024), AIIMS Nagpur inaugurated a new endoscopy room under the Department of Medical Gastroenterology, further strengthening its diagnostic and therapeutic capabilities. Such developments in emerging markets not only increase procedural adoption but also attract global and regional rigid endoscope manufacturers seeking to expand their footprint. The combination of rising healthcare demand, increasing procedural volumes, and modern facility development positions emerging countries as lucrative markets, providing companies with opportunities to introduce advanced, durable, and cost-effective rigid endoscopic solutions to meet growing clinical needs.

Challenge: Lack of proper sterilization & reprocessing

A major challenging factor for the rigid endoscopes market is the lack of proper sterilization and reprocessing practices, which can significantly impede market growth. Rigid endoscopes are reusable instruments that come into direct contact with internal tissues and body fluids, making them highly susceptible to microbial contamination if not thoroughly cleaned and disinfected. Inadequate sterilization protocols, insufficient training of healthcare staff, and non-compliance with regulatory standards can lead to cross-contamination, hospital-acquired infections, and adverse patient outcomes, undermining confidence in endoscopic procedures. This challenge is particularly pronounced in emerging markets, where limited resources, a lack of standardized methods, and inconsistent adherence to guidelines can hinder the safe utilization of devices. The complexity and cost associated with high-level disinfection, sterilization equipment, and staff training further exacerbate the issue, making healthcare facilities cautious in adopting rigid endoscopes. Although advances such as automated reprocessing systems and disposable endoscope components are emerging to mitigate these risks, the dependence on rigorous reprocessing practices remains a critical barrier. Consequently, manufacturers and healthcare providers must invest in education, process optimization, and compliance monitoring to ensure safe usage, while the existing gaps in sterilization practices continue to pose challenges for the widespread adoption of rigid endoscopes globally

Rigid Endoscopes Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Rigid laparoscopes in 5 mm and 10 mm with 0°/30°/45° angles for minimally invasive general surgery and related specialties; designed for HD imaging across the chain and compatible with autoclave reprocessing | Superior HD resolution and contrast with aspherical lenses for distortion-free viewing, uniform illumination, and robust autoclavable construction backed by long-term warranty emphasis. |

|

HOPKINS rod-lens rigid telescopes used across arthroscopy, hysteroscopy, and other specialties, offered in 4 mm diameters with 0° and 30° viewing options, featuring fiber-optic light transmission and autoclavable designs with matched sheaths | High image quality with optimal brightness and contrast from the HOPKINS rod-lens system, scratch-resistant components, and reliable sterilization compatibility for OR workflows |

|

Rigid scopes that provide visualization of internal anatomy during general endoscopic procedures, integrated within Stryker surgical visualization platforms used across multiple specialties | Clear intraoperative visualization with 4K platform integration and fluorescence options that enhance identification of critical anatomy and overall image clarity |

|

4KO rigid arthroscopes and laparoscopes designed to pair with LENS HD or LENS 4K systems for sports medicine and general surgery visualization | Increased brightness and optimized color transmission for improved image quality, with durable stainless-steel/titanium construction and compatibility with autoclave and low-temperature sterilization modes |

|

Full HD-compatible rigid endoscopes for laparoscopy and ENT/arthroscopy with stainless-steel construction; complemented by 2D/3D camera platforms for minimally invasive surgery | Uniform illumination via high-quality fiber optics, fully autoclavable designs, and 3D platforms that improve depth perception, suturing, and hand-eye coordination while reducing fogging through sterile-handling concepts |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The rigid endoscopes market ecosystem comprises manufacturers, component suppliers, healthcare providers, regulatory bodies, and research institutions that collectively contribute to market growth and innovation. Manufacturers collaborate with OEMs and technology partners to develop advanced laparoscopes, urology endoscopes, cystoscopes, arthroscopes, neuroendoscopes, and other rigid endoscopes, enhancing procedural efficiency and patient outcomes. Hospitals, ambulatory surgical centers, and specialty clinics act as primary end-users, driving demand through increased adoption of minimally invasive procedures. Regulatory agencies, such as the FDA and EMA, ensure product safety and compliance, thereby shaping design and commercialization timelines. Strategic partnerships, government healthcare funding, and R&D investments further support market expansion, while medical training centers and professional associations facilitate physician education, accelerating clinical adoption and reinforcing the overall ecosystem

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Rigid Endoscopess Market, By Type

The laparoscopes segment accounted for the largest market share in 2024, owing to its broad clinical utility across both diagnostic and surgical procedures for high-prevalence conditions. Laparoscopy is a preferred minimally invasive technique for diagnosing appendicitis, endometriosis, pelvic inflammatory disease, and various cancers. It is also widely used in surgeries such as appendectomy, cholecystectomy, hernia repair, hysterectomy, fibroid removal, and bariatric interventions. The high global disease burden reinforces this demand. The extensive application portfolio, combined with patient preference for minimally invasive solutions, solidifies laparoscopes as the dominant segment within the rigid endoscopes market.

Rigid Endoscopess Market, By Clinical Usage

The surgical usage segment accounted for the largest share of the market in 2024. This is due to the increasing number of laparoscopic, arthroscopic, and urological surgeries globally. These procedures rely heavily on rigid endoscopes for enhanced visualization, precision, and reduced patient trauma. The growing preference for minimally invasive interventions, shorter hospital stays, and improved post-operative outcomes further enhances their adoption. Moreover, technological innovations and the expansion of surgical infrastructure in developing countries are expected to strengthen segmental growth.

Rigid Endoscopess Market, By Application

The laparoscopy segment accounted for the largest share in 2024. This is due to its broad clinical utility, high procedural demand, and critical role in minimally invasive surgery. Laparoscopes are extensively used for diagnosing conditions such as appendicitis, pelvic inflammatory disease, endometriosis, and various cancers, including liver and ovarian malignancies, as well as for therapeutic interventions like appendectomy, cholecystectomy, hernia repair, hysterectomy, fibroid removal, bariatric surgeries, and ectopic pregnancy management.

Rigid Endoscopess Market, By End User

Hospitals accounted for the largest market share in 2024, owing to their extensive surgical infrastructure, high patient volumes, and the ability to perform a broad spectrum of diagnostic and therapeutic procedures. Hospitals invest heavily in advanced endoscopy systems to support specialties such as general surgery, orthopedics, gynecology, urology, and ENT, where rigid endoscopes are essential for precision and minimally invasive interventions. Additionally, hospitals benefit from in-house trained specialists, high procedural throughput, and access to complex maintenance and sterilization facilities, which smaller clinics or outpatient centers may lack. The demand is further driven by rising surgical procedure volumes, growing prevalence of chronic and acute conditions, and the need for accurate diagnostics, positioning hospitals as the primary revenue contributor in the rigid endoscopes market.

REGION

Asia Pacific to be fastest-growing region in global wearable healthcare devices market during forecast period

The global rigid endoscopes market is segmented into five major regions: North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Among these, the Asia Pacific region is projected to grow at the highest rate during the forecast period. This is primarily due to the development of healthcare infrastructure, increasing healthcare expenditure, and rising awareness of early disease detection across populous nations such as China and India. These countries are investing heavily to enhance diagnostic and surgical capabilities, particularly to manage the rising cases of chronic diseases, such as cancer and pulmonary, and urological disorders. Japan’s well-established healthcare system with universal insurance coverage ensures wide accessibility to advanced endoscopic procedures. Moreover, increasing medical tourism, favorable government initiatives, and the rising adoption of minimally invasive technologies are accelerating market penetration, making the Asia Pacific a high-growth region in the global rigid endoscopes market.

Rigid Endoscopes Market: COMPANY EVALUATION MATRIX

The rigid endoscopes market is dominated by Olympus Corporation (Japan), Karl Storz SE & CO. KG (Germany), Stryker (US), Smith & Nephew (UK), and B. Braun SE (Germany) due to their strong brand reputation, extensive product portfolios, and continuous innovation in imaging, miniaturization, and ergonomic designs. Olympus Corporation (Japan) and Karl Storz SE & Co. KG (Germany) lead the industry with high-quality optics and advanced laparoscopic and arthroscopic solutions. Stryker (US) and Smith & Nephew (UK) leverage surgical expertise and global distribution networks, while B. Braun SE (Germany) focuses on reliability and precision. Their dominance is reinforced by robust R&D, regulatory compliance, and comprehensive after-sales support, ensuring customer trust and market leadership.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 1.83 Billion |

| Market Forecast in 2030 (Value) | USD 2.32 Billion |

| Growth Rate | CAGR of 4.9% from 2025-2030 |

| Years Considered | 2023-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/Billion), Volume (Thousand Units) |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered | By Type: Laparoscopes, Urology Endoscopes, Cystoscopes, Gynecology Endoscopes, Arthroscopes, Neuroendoscopes, Other Rigid Endoscopes By Clinical Usage: Diagnostic Usage & Surgical Usage By Application: Laparoscopy, Arthroscopy, Urology Endoscopy, Neuroendoscopy, Others By End User: Hospitals, Ambulatory Surgery Centers, Clinics, Others |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

WHAT IS IN IT FOR YOU: Rigid Endoscopes Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Company Information | Market Share Analysis, By Region (North America and Europe) & Competitive Leadership Mapping for Established Players in the US | Insights on market share analysis by region |

| Geographic Analysis | Further breakdown of the Rest of Europe rigid endoscopes market into Russia, Switzerland, Denmark, Austria, and others Further breakdown of the Rest of Asia Pacific rigid endoscopes market into South Korea, Taiwan, and others Further breakdown of the Rest of Latin America rigid endoscopes market into Argentina, Colombia, Chile, Ecuador, and others Further breakdown of the Southeast Asia rigid endoscopes market into Malaysia, Singapore, Australia, New Zealand, and others | Country level demand mapping for new product launches and localization strategy planning. |

RECENT DEVELOPMENTS

- April 2025 : KARL STORZ SE & Co. KG (Germany) announced the launch of the Slimline C-MAC S single-use video laryngoscope, engineered for high-performance airway management. The device offers enhanced visualization for reliable intubation, even in complex clinical scenarios, while upholding the company’s renowned quality standards.

- January 2025 : KARL STORZ SE & Co. KG (Germany) announced the strategic acquisition of its long-standing Swiss distributor, ANKLIN, to strengthen its direct sales presence in Switzerland. This move enhances customer proximity and supports tailored product and service delivery in the MedTech sector.

- January 2024 : Olympus Corporation (Japan) acquired Taewoong Medical Co., Ltd. (South Korea), a manufacturer of medical devices. This acquisition helped Olympus strengthen its GI Endo Therapy product portfolio capabilities, contribute to improving patient outcomes through comprehensive solutions, and elevate the standard of care.

- December 2022 : Medtronic plc (Ireland) has expanded its partnership with Cosmo Intelligent Medical Devices (Ireland), a subsidiary of Cosmo Pharmaceuticals, leveraging AI for the GI Genius endoscopy module. This collaboration aims to enhance global healthcare solutions, building on existing successes for patients and caregivers.

Table of Contents

Methodology

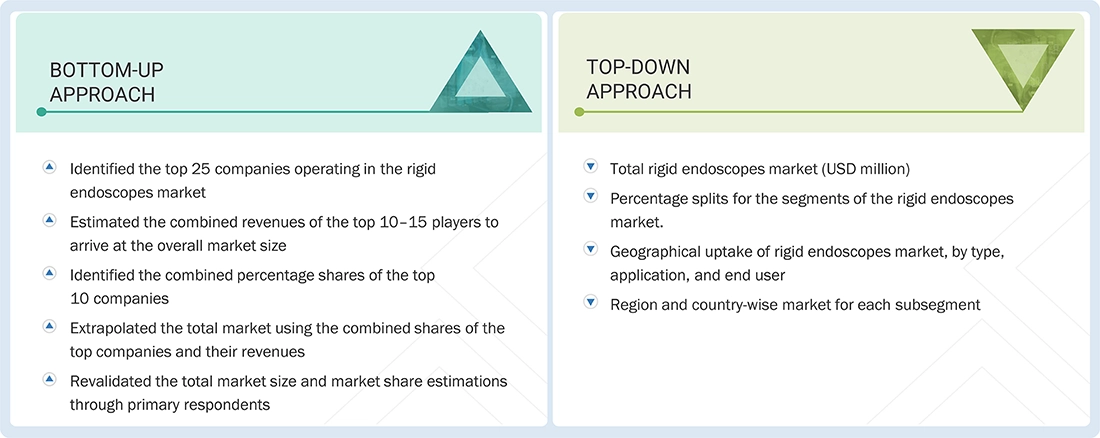

The research study involved major activities in estimating the current market size for the rigid endoscopes market. Exhaustive secondary research was done to collect information on the rigid endoscopes industry. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Different approaches, including top-down and bottom-up methods, were employed to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and subsegments of the rigid endoscopes market.

Secondary Research

The secondary research process involved the widespread use of secondary sources, directories, databases (such as Bloomberg Businessweek, Factiva, and D&B Hoovers), white papers, annual reports, investor presentations, SEC filings of companies and publications from government sources, such as National Institutes of Health (NIH), US FDA, US Census Bureau, World Health Organization (WHO), International Trade Administration (ITA), Global Burden of Disease Study, and Centers for Medicare and Medicaid Services (CMS) were referred to identify and collect information for the global rigid endoscopes market study. It was also used to obtain important information about key players and market classification & segmentation, according to industry trends, and to identify key developments related to market and technology perspectives, down to the most detailed level. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to gather qualitative and quantitative information for this report. The primary sources on the supply side include industry experts such as CEOs, vice presidents, marketing and sales directors, technology & innovation directors, and other key executives from major companies and organizations in the rigid endoscopes market. The primary sources on the demand side include ambulatory surgical centers, hospitals, clinics, and other end users. Primary research was conducted to validate market segmentation, identify key players, and gather insights on industry trends and key market dynamics.

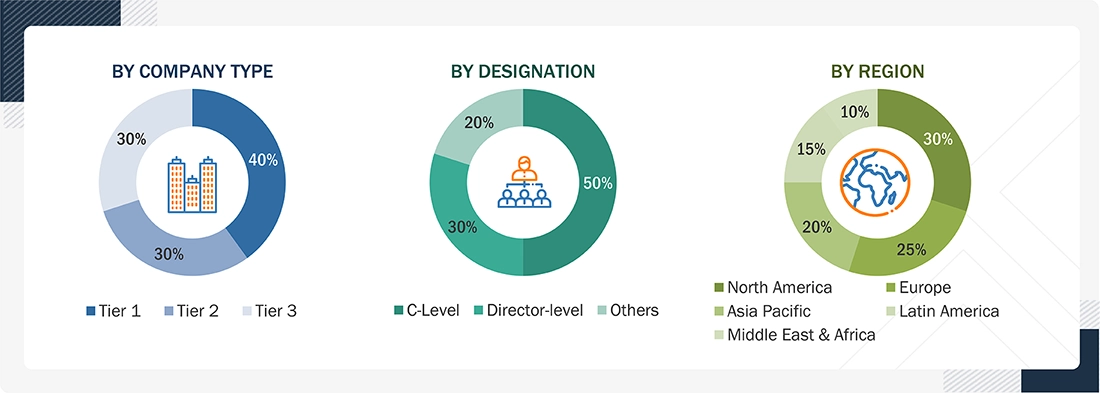

A breakdown of the primary respondents is provided below:

Notes: C-level primaries include CEOs, CFOs, COOs, and VPs.

*Others include Sales Managers, Marketing Managers, Business Development Managers, Product Managers, Distributors, and Suppliers.

Companies are classified into tiers based on their total revenue. The tiers are as follows:

Tier 1 = > USD 10.00 billion, Tier 2 = USD 1.00 billion to USD 10.00 billion, and Tier 3 = < USD 1.00 billion

Source: MarketsandMarkets Analysis

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

For the global market value, annual revenue figures were calculated based on the revenue mapping of major product manufacturers and OEMs active in the worldwide rigid endoscopes market. All leading product manufacturers were identified at both the global and country/regional levels. Revenue mapping was conducted for the respective business segments and subsegments for these key players. Additionally, the global rigid endoscopes market was divided into various segments and sub-segments based on:

- List of major players operating in the products market at the regional and/or country level

- Product mapping of various rigid endoscope manufacturers at the regional and/or country level

- Mapping of annual revenue generated by listed major players from rigid endoscopes (or the nearest reported business unit/product category)

- Extrapolation of the revenue mapping of the listed major players to derive the global market value of the respective segments/subsegments

- Summation of the market value of all segments/subsegments to arrive at the global rigid endoscopes market

The data mentioned above was consolidated and supplemented with detailed inputs and analysis from MarketsandMarkets, and is presented in this report.

Market Size Estimation (Bottom-Up & Top-down Approaches)

Data Triangulation

After determining the overall size of the global rigid endoscopes market using the methodology above, the market was segmented into several categories and subcategories. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact market value data for the key segments and subsegments. The extrapolated market data was triangulated by studying various macro indicators and regional trends from both demand- and supply-side participants.

Market Definition

Rigid endoscopes are non-flexible, tubular instruments equipped with lens systems and light sources, enabling direct visualization and access to internal body cavities. Primarily used in minimally invasive surgeries such as laparoscopy, arthroscopy, and cystoscopy, they offer superior image quality, stability, and precision for diagnostic and therapeutic procedures.

Stakeholders

- Manufacturers of endoscopes and related devices

- Suppliers and distributors of endoscopy devices

- Hospitals, diagnostic centers, and medical colleges

- Independent surgeons and private physicians

- Ambulatory surgery centers

- Teaching hospitals and academic medical centers

- Government bodies/Municipal corporations

- Business research and consulting service providers

- Venture capitalists

Report Objectives

- To define, describe, segment, and forecast the rigid endoscopes market by type, application, end user, and region

- To provide detailed information about the factors influencing market growth (such as drivers, restraints, opportunities, and challenges)

- To analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall rigid endoscopes market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the size of the rigid endoscopes market in five main regions (along with their respective key countries), namely, North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa

- To profile the key players in the rigid endoscopes market and comprehensively analyze their core competencies and market shares

- To track and analyze competitive developments such as acquisitions, product launches, expansions, collaborations, agreements, partnerships, and R&D activities of the leading players in the rigid endoscopes market

- To benchmark players within the rigid endoscopes market using the Competitive Leadership Mapping framework, which analyzes market players on various parameters within the broad categories of business strategy, market share, and product offerings

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Rigid Endoscopes Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Rigid Endoscopes Market