Roof Coating Market

Roof Coating Market By Coating Type (Bituminous, acrylic, silicone, epoxy, polyurethane), Roof Type (Flat, low-sloped, steep-sloped, and roof types others), Solution Technology (water-based, and solvent-based), End-Use Sector - Global Forecast to 2029

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The roof coatings market is predicted to grow from USD 8.72 billion in 2024 to USD 10.16 billion by 2029, exhibiting a CAGR of 3.1% from 2024 to 2029. Over the forecast period, the market is expected to grow steadily due to increasing demand for energy-efficient and sustainable construction materials. Increasing focus on extending roof life, lowering maintenance costs, and increasing aesthetics of buildings has boosted the uptake of advanced coating formulations. In addition to this, heightened awareness of cool roof technologies which reduce energy consumption by reflecting sunlight and reducing building temperatures, will raise the growth of roof coating market. Government initiatives to promote green projects and energy conservation are driving the growth of such coatings within the end-use sectors. The non-residential sectors are rapidly adopting several types of roof coatings, which includes, acrylic, elastomeric, and silicone-based formulations for both waterproofing and UV protection. Rapid urbanisation, infrastructure development, and renovation projects in emerging economies further strengthen demand. Moreover, manufacturing companies are developing high-performance formulations with improved durability, weather resistance, and other benefits. In addition to this, the rising preference for low-VOC and water-based coatings aligns with sustainability goals and regulatory standards. Therefore, the global roof coatings market will benefit from current growth in both developed and developing regions from investments in long-lasting, sustainable coatings.

KEY TAKEAWAYS

-

The roof coatings market by type includes bituminous, acrylic, silicone, polyurethane, epoxy, and other types. Acrylic dominates the market due to several reasons, which include cost-effectiveness and excellent performance in diverse weather conditions. These types of roof coatings are generally water-based, which makes them environmentally friendly, and easy to apply using conventional methods such as spray, brush & roller.

-

The roof coating market by end-use sector includes residential and non-residential. The Non-residential segment held the largest market share in the roof coating market due to the extensive usage on commercial buildings, industrial complexes, and institutional buildings. Such complexes or buildings have large roof surfaces which require energy-efficient, durable, and waterproof protection. These coatings help to extend the life of the roof, reduce the overall maintenance costs, and improve the thermal performance.

-

The roof coatings market by roof types includes flat, low-sloped, steep-sloped, and other roof types. The flat roof type segment had the largest market share in the roof coating industry due to extensive use in commercial, residential, and industrial complexes, where most of the roofs are flat in shape. Flat roofs are generally more prone to water pooling, thermal expansion, and UV degradation. Hence, to prevent this, roof coatings are used, which help to extend the roof's life.

-

The roof coatings market is segmented on the basis of technology, i.e., solvent-based and water-based. Water-based roof coatings hold the largest market share in the market. It is because of its environmental friendliness, ease of application, and regulatory compliance. In addition to this, these water-based coatings have a low level of VOC content, which makes them safer for both applicators and the environment, while aligning with increasingly stringent environmental regulations across North America, Europe, and other regions.

-

The Middle East & Africa (MEA) region is the fastest-growing region in the roof coatings market, resulting from a mix of rapid urbanization, building activities, and severe weather conditions that require the use of protective and energy-saving roofing solutions. For instance, the Kingdom of Saudi Arabia, the United Arab Emirates, Qatar, and South Africa are going through the development of numerous commercial, industrial, and infrastructure projects, which will boost the demand for roof coatings in the coming years.

-

PPG (US), SIKA (Switzerland), Sherwin-Williams (US), AkzoNobel (Netherlands), Nippon Paint Holdings Co., Ltd. (Japan) are leading companies of the roof coating market. These companies are pursuing both organic and inorganic growth strategies, such as product launches, acquisitions, and expansions, to increase their market presence.

The market for roof coatings is anticipated to record a significant surge over the coming years due to the rising demand from the construction, industrial, and infrastructure sectors. One of the key aspects leading to market expansion is the awareness of energy conservation and the increasing use of sustainable building materials. Roof coatings are leading the charge for their durability, attaining energy efficiency, and offering complete protection against severe weather conditions. The need for advanced formulations like acrylic, silicone, and polyurethane has kept going up as builders and property owners continue to look for the wear-resistant and low-maintenance solution. Thus, the greater consciousness of buyers is forcing manufacturers to innovate and create more durable products. The boom of renovation and retrofitting is, among other reasons, responsible for the rising demand for industrial and commercial buildings which, in turn, are facilitating product adoption at a higher pace further. The Middle East & Africa (MEA) region is likely to become the most lucrative market that will lead the way in growth rate and will be supported by the fast urbanization process, the large-scale infrastructure projects, and the government initiatives fostering energy-efficient construction.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on consumers business emerges from customer trends or disruptions. Hot belts are the clients of roof coatings manufacturers, and target applications are the clients of roof coatings manufacturers. Shifts, which are changing trends or disruptions, will impact the revenues of end users. The revenue impact on end users will affect the revenue of hotbeds, which will further affect the revenues of roof coatings manufacturers.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rising investments in construction activities

-

Expansion of housing markets

Level

-

High cost of advanced coatings

-

Lack of awareness in developing regions

Level

-

Increasing demand for roof coatings from emerging markets

-

Growing focus on retrofitting and renovating

Level

-

Unpredictability of raw material prices

-

Compliance with strict environmental regulations

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rising investments in construction activities

The rising money spent on construction activities is one of the main factors that are driving the roof coatings market, as the money spent on public, private, and industrial infrastructures directly generates the demand for the products that are protective as well as nice in appearance. Roof coatings provide the features of water resistance, durability, and energy efficiency; therefore, they are chosen in new as well as old building works. Growing urbanization and large-scale real estate development in developing countries are the factors that drive the demand for roof coating consumption. In addition, the measures taken by the government to promote green buildings and energy-saving construction buildings with reflective, insulating, and other sustainable coating formulations that are easily adaptable and available in the market.

Restraint: Lack of awareness in developing regions

One of the major restraints that prevents the growth of the roof coatings market in developing regions is the lack of awareness. The Building owners, contractors, and other end-users in many emerging economies frequently take the cheapest route for construction, maintenance, and other protective solutions, which results in little use of roof coatings. The benefits of roof coatings, such as increased longevity, water resistance, energy efficiency, and protection against UV, are not fully understood by the end-users due to low awareness. The majority of small-scale construction projects in these areas are being carried out without professional consultation, which, in turn, hinders the exposure of advanced coating technology. On top of that, potential users do not have enough knowledge of different coating types, product features, and application techniques, due to which they showing moderate interest in trying out the product. The lack of awareness among consumers, which is evident in the absence of advertising campaigns, a lack of technical training, and a lack of demonstration projects, is reflected in the market penetration of both water-based and solvent-based coatings. Moreover, in locations with low literacy rates or where there are few resources for the industry, it is quite a difficult task to enlighten the people concerned about the cost savings that the maintenance of the roof and the extension of the roof lifespan can bring. As a consequence, manufacturers often struggle with persuading their clients to invest in quality roof coatings and are more likely to go for low-cost, traditional materials.

Opportunity: Growing focus on retrofitting and renovating

One of the ways the roof coatings market is finding more space to grow is through the emphasis on retrofitting and renovating the existing building stock. Refurbishing is gaining traction, and with it the demand for roof coatings as the main installation solution. The coming trend of roof coating is fueled by the pursuit for eco-friendliness and cost-effectiveness by building owners and facility managers who instead of tearing down the structures, will try to extend their life span. Coatings for roofs are the most efficient and ideal ways to achieve durability, resistance to elements, and energy efficiency in the case of older roofing. Governments and regulatory bodies' incentives to develop green buildings are the main cause of this demand for coatings that lead to thermal insulation and less energy use; that is, retrofitting projects are becoming more popular. The wide range of renovation activities in these sectors is significantly contributing to such developments, as the telecom and residential sectors are the two main areas where the number of potential clients is increasing.

Challenge: Compliance with strict environmental regulations

Adherence to strict environmental regulations has become a major hurdle within the roof coatings sector due to the increasing focus on sustainability and lowering environmental footprint in building practices. Governments and regulatory authorities around the world are pushing forward with new rules on, among others, volatile organic compounds (VOCs), hazardous chemicals content and emissions from coating materials, which impact raw material development and production of roof coatings. Manufacturers have to find new ways to innovate by developing environmentally friendly products that meet environmental regulations, yet still have performance, durability, and cost effectiveness. Innovation in roof coatings sometimes requires investment in research and development, new technology to produce roof coatings and developing alternative raw materials, which is often used to increase production costs. The introduction of new environmentally compliant formulations can require a lengthy approval process time before the manufactured product can be sold and lead to product delays. The incentives for international manufacturers have become more complex and at times costly due to the various regions associated with and regulated by specific guidelines for its region. The introduction of a new manufacturing product that is non-compliant may lead to consequences of fines, product recall, restrictions to the market, and strain on the brand reputation and merchandise. In addition to groups making viable, environmentally compliant products, the education and proper use of the coating by the contractors and end users are extremely important to avoid regulatory control measures.

Roof Coating Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

The Bitexco Financial Tower in Ho Chi Minh City needed roof deck refurbishment due to weather-related damage after nearly a decade. Instead of a full roof replacement, Tremco CPG Vietnam applied the AlphaGuard BIO waterproofing system. This fast-curing, seamless solution included a reflective, eco-friendly top coat to improve energy efficiency. Around 400?m² was restored, completing the project in April 2022. | The solution saved up to 60% in costs compared to replacement and extended the roofs lifespan. It provided effective waterproofing, especially on vulnerable areas like laps and flashings. The reflective coating lowered rooftop temperatures, reducing energy use, and the bio-based formula enhanced sustainability, all while maintaining a clean, seamless finish. |

|

A semi-detached residential property on Tanah Merah Besar Lane in eastern Singapore faced two key challenges: protecting the roof from water ingress to safeguard the ceiling below, and ensuring that the roof contributed to heat regulation within the home for enhanced comfort. | The Tremco AlphaGuard BIO system was chosen as the optimal solution. The process began with the application of a fully-compatible primer, followed by the AlphaGuard BIO base coat: a two-part, bio-based polyurethane roof coating reinforced with a fiberglass mat for added durability. To complete the system, the AlphaGuard BIO topcoat was roller-applied, utilizing its catalyzed curing technology for faster drying times and a seamless, uniform finish. This approach eliminated the risk of blistering, gassing, and pinholing. |

|

Climate change and urbanization have intensified the "urban heat island" effect, causing city temperatures to be significantly higher than rural areas due to dark, heat-absorbing surfaces like roofs. This leads to increased energy consumption, reduced thermal comfort, and accelerated roof wear. Formulators of elastomeric roof coatings (ERC) face the challenge of creating cost-effective, long-lasting coatings that address these issues while complying with environmental regulations and meeting consumer demand for eco-friendly solutions. | HALOX CW-314, a non-toxic, heavy-metal-free anti-corrosive pigment, was developed to enhance TSR and corrosion resistance in waterborne and solvent-borne ERC systems. A comparative study demonstrated that substituting 5% HALOX CW-314 for calcium carbonate in a white elastomeric roof coating resulted in improved solar reflectance and corrosion resistance, eliminating the need for a separate primer. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The market of roof coatings passes through a value chain which includes sourcing raw materials, formulations, manufacturing, and finally the application in construction works of the commercial, residential, and industrial areas. This market sector deals with the use of materials like acrylics, silicones, bitumen, and elastomers, which are the products of the newest technologies, aimed at durability, weather, and energy resistance, and of course, at the long-term protection of the roofs. Manufacturers are mainly focusing on the part of creating new formulations and bringing the already existing ones to life with the help of advanced application techniques, which include, among others, reflective coatings, water-based solutions, and high-performance membranes. Along with the customers requirement for continuous innovation in the area of formulation and application techniques, combined with the regulations and environmental standards, the efficiency and performance in the market are stimulated. Furthermore, the trend in the ecological and low-VOC products is consistent with the major idea of sustainable construction practices. The cooperative network of the suppliers, the manufacturers of the coatings, and the firms of the construction sector leads to the achievement of the accepted standards of quality and reliability as well as the long-term value creation in the global roof coatings market, which is indubitably inseparable from the competitiveness.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Roof Coating Market, By Type

Polyurethane roof coatings are the fastest growing segment in the roof coatings market due to their high performance characteristics and usefulness across all roofing applications. Polyurethane coatings are durable, highly UV resistant, and provide great waterproofing making them very useful in areas that experience severe weather. Their seamless, elastomeric, protection greatly reduces leaks and building damage which is important to all buildings, residential and commercial. Polyurethane coatings stick well to just about any substrate including metal, concrete, and asphalt; they are applicable to new construction and renovations. Polyurethane coating curbside appeal also reflects light and heat which energizes your energy efficiency schemes and promotes growing sustainable and green building solutions. As property owners and contractors become more aware of the benefits of regular roof maintenance and lifecycle savings, demand goes up driving sales.

Roof Coating Market, By Roof Type

Flat roofs have become the fastest growing segment in the roof coatings market, owing to their high usage in commercial, industrial, and modern residential construction. The surge in flat roofs usage is driven by cost savings, simplicity of installation, and ability to integrate HVAC, solar panels and others, which is increasingly requested in the marketplace and urban landscape. The flat roofs are basically prone to water ponding, creating an urgent need for roof coatings that provide waterproofing and durability. This has driven an uptick in the usage of roof coatings that provide seamless protection, UV resistance and thermal reflectivity for improved energy efficiency. Additionally, flat roofs enable simple upkeep and visibility for inspection while making them optimal candidates for new or advanced coating application specifications for prolonging roof life and the reduction of lifecycle costs. The increase in both industrial and commercial construction worldwide, especially in developing economies, has accelerated the implementation of flat roofs designs.

Roof Coating Market, By End-use Sector

The roof coatings market is experiencing rapid growth, with non-residential being the largest end-use sector and the fastest growing. The development and construction of commercial, industrial, and institutional buildings continues to expand across the globe and is increasing the demand for roof coatings. Commercial buildings typically involve large-scale construction projects, including warehouses, factories, shopping malls, airports, and office complexes, which all require a durable, high-performing roof coating solution. In addition, many commercial buildings feature flat or low-slope roofs, which are more susceptible to water infiltration, thermal stress, and environmental damage, increasing the demand for protective roof assemblies that extend the life of the roof and lower long-term maintenance costs. Moreover, the building envelope for non-residential buildings demands direct exposure to weather and requires roof coatings to have good resistance to water, chemicals, abrasion, and UV exposure. Incorporating advanced design characteristics, most modern roof coatings - acrylic, polyurethane, and silicone are specifically formulated to provide these protective properties. The rapid growth in developing economies in both industrialization and urbanization has also contributed to the role of roof coatings in the non-residential sector. Additionally, the increased focus on energy efficiency and sustainability has influenced the trend of equipped roof coatings in non-residential roof assemblies.

Roof Coating Market, By Technology

Water-based roof coatings have emerged as the rapidly growing segment of the roof coatings market with respect to environmentally friendly attributes and performance characteristics. Water-based roof coatings release much lower amounts of volatile organic compounds (VOCs) than solvent-based roof coating systems, and are therefore highly capable of meeting increasingly strict requirements for environmental regulations globally. In addition to drying quickly, application of water-based coatings provides low odor, and promotes minimal disruption on projects, making them valuable for commercial and residential applications. Moreover, water-based roof coatings provide excellent adhesion to concrete, metal, asphalt, and most building substrates to maintain durable protection against UV exposure, moisture, and weather degradation. Increased interest in sustainable buildings and energy efficiency has also caused the use of water-based technologies to rise, as many water-based roof coatings contain reflective components which help to reduce heat build-up and energy costs. Advances and improvements in technology have also improved water-based coatings resistance to ponding water, cracking, and microbial growth which improve roof longevity.

REGION

Asia Pacific's urban growth and growing end-use application areas drive paper and paperboard packaging demand

The Middle East & Africa (MEA) region is emerging as the fastest-growing segment in the roof coating market, due to rapid urbanization, infrastructure development, and the expansion of commercial construction projects. The region experiences a hot and dry climate with high temperatures and intense UV exposure, resulting in a strong demand for durable, weather-resistant coatings that will protect buildings and can provide increased energy efficiency. Governments across the MEA region are also continuing to invest in smart city projects, expanding or building industrial facilities and adding residential units, and this is contributing to the demand for high performance roofing solutions. In addition, the increased emphasis on sustainability and energy efficiency in building has resulted in the increase of waterbased and reflective coatings in commercial and institutional buildings. The expansion of the industrial sector (logistics, manufacturing, etc.) is also increasing the demand for durable protective coatings that will withstand extreme environmental conditions. The availability of advanced roof coating technologies and increasing awareness by architects, contractors, and property owners, will also contribute to the increased demand.

Roof Coating Market: COMPANY EVALUATION MATRIX

PPG (Star) dominates the roof coatings market by having a diversified product range, robust global supply chain, and many years of experience in the coatings industry. PPG is an innovation-driven company that influences markets, including commercial construction, residential roofing, and industrial applications, by delivering operational excellence and customer-driven products that keep pace with industry changes. H.B. Fuller, on the other hand, has built an emerging player in roof coatings with significant investment in R&D, and advanced manufacturing methods. H.B. Fuller has embraced a collaborative culture with its specialty brands to offer sustainable and eco-friendly coating solutions, positioning the company to further enhance its reputation and competitive agility.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2023 (Value) | USD 8.46 Billion |

| Market Forecast in 2029 (Value) | USD 10.16 Billion |

| Growth Rate | CAGR of 3.1% from 2024-2029 |

| Years Considered | 2020-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | Value (USD Million), Volume (Kiloton) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends. |

| Segments Covered | By Type: Bituminous, Acrylic, Silicone, Polyurethane, Epoxy. By Roof Type: Flat, Low-sloped, Steep-sloped By End-use Sector: Residential, Non-Residential. By Technology: Water based, Solvent based |

| Regions Covered | North America, Asia Pacific, Europe, South America, the Middle East & Africa |

WHAT IS IN IT FOR YOU: Roof Coating Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Architectural Coatings Market | Detailed Company profiles of architectural coatings competitors (financials, product description, developments) Market segmentation on the basis of resin type (acrylic, alkyd, vinyl, polyurethane). Market segmentation on the basis of technology (waterborne, solvent borne). Market segmentation on the basis of coating type (interior, exterior). Market segmentation on the basis of user type (DIY, Professional). Market segmentation on the basis of application (residential, non-residential). | Identified & profiled key players for architectural coatings companies. Track adoption trends in high-growth APAC end-use areas (residential, and non-residentail) |

RECENT DEVELOPMENTS

- Octobe 2024 : PPG Industries Inc. entered into a definitive agreement to sell its entire architectural coatings business in the US and Canada to American Industrial Partners (AIP), an industrials-focused investor, for a transaction value of USD 550 million

- January 2024 : Nippon Paint Holdings Co., Ltd. completed the acquisition and payment on January 17, 2024, for a 75% stake in Alina Group LLP. The transaction was carried out through its consolidated subsidiary, Nippon Paint Holdings SG Pte. Ltd. Alina Group, located in Kazakhstan, specializes in manufacturing and selling dry-mix mortars, paints, coatings, and related products

- Apri 2022 : AkzoNobel N.V. acquired Grupo Orbis, a Colombia-based paints and coatings company, enhancing its long-term presence in Latin America

- February 2022 : Sherwin-Williams Company signed an agreement with the state of North Carolina, Iredell County, and the city of Statesville. This agreement significantly expanded the company's architectural paint and coatings manufacturing capacity and developed a larger distribution facility in Statesville

- July 2021 : RPM International Inc. announced that its Carboline subsidiary acquired Dudick Inc., a company specializing in high-performance coatings, flooring systems, and tank linings

Table of Contents

Methodology

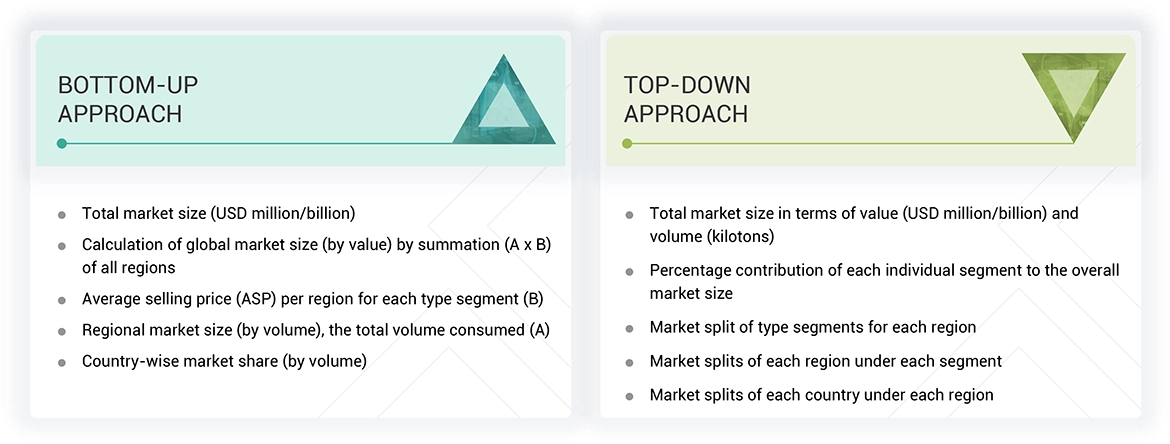

The study involved four major activities for estimating the current size of the global roof coating market. Exhaustive secondary research was carried out to collect information on the market, the peer product market, and the parent product group market. The next step was to validate these findings, assumptions, and sizes with the industry experts across the value chain of roof coating through primary research. Both the top-down and bottom-up approaches were employed to estimate the overall size of the roof coating market. After that, market breakdown and data triangulation procedures were used to determine the size of different segments and sub-segments of the market.

Secondary Research

The market for the companies offering roof coating is arrived at by secondary data available through paid and unpaid sources, analyzing the product portfolios of the major companies in the ecosystem, and rating the companies by their performance and quality. Various secondary sources such as Business Standard, Bloomberg, World Bank, and Factiva were referred to, to identify and collect information for this study on the roof coating market. The secondary sources include annual reports, press releases, investor presentations of companies, white papers, journals, certified publications, and articles from recognized authors, directories, and databases. In the secondary research process, various secondary sources were referred to for identifying and collecting information related to the study. Secondary sources included annual reports, press releases, and investor presentations of roof coating vendors, forums, certified publications, and whitepapers. The secondary research was used to obtain critical information on the industrys value chain, the total pool of key players, market classification, and segmentation from the market and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the roof coating market. After the complete market engineering (calculations for market statistics, market breakdown, market size estimations, market forecasting, and data triangulation), extensive primary research was conducted to gather information and verify and validate the critical numbers arrived at. Primary research was also conducted to identify the segmentation types, industry trends, competitive landscape of roof coating offered by various market players, and key market dynamics, such as drivers, restraints, opportunities, challenges, industry trends, and key player strategies. In the complete market engineering process, the top-down and bottom-up approaches were extensively used, along with several data triangulation methods, to perform the market estimation and market forecasting for the overall market segments and subsegments listed in this report. Extensive qualitative and quantitative analysis was performed on the complete market engineering process to list the key information/insights throughout the report.

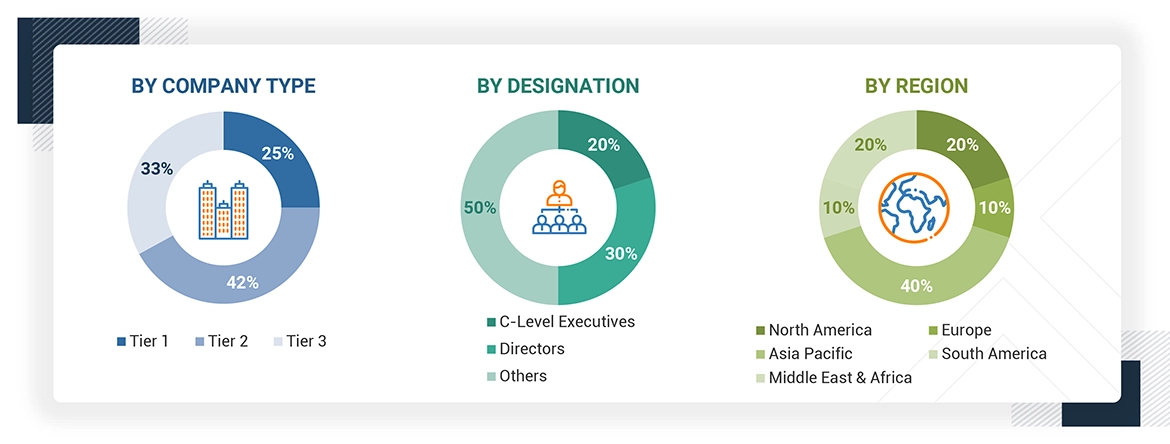

Following is the breakdown of primary respondents

Notes: Others include sales, marketing, and product managers.

Tier 1: >USD 1 Billion; Tier 2: USD 500 million1 Billion; and Tier 3: < USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the global size of the roof coating market. These approaches were also used extensively to estimate the size of various dependent segments of the market. The research methodology used to estimate the market size included the following:

Data Triangulation

After arriving at the overall market size using the market size estimation processes explained above, the market was split into several segments and subsegments. The data triangulation and market breakup procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

Roof coatings are materials applied to roof surfaces to protect and extend the lifespan of new and existing roof assemblies, such as built-up roofs (BUR), metal, modified bitumen, single-ply membranes, and spray polyurethane foam. Roof coatings are thicker and more resilient than paint. They are formulated with a high solids content and top-quality resins that provide long-lasting protection against environmental and weather-related damage, including UV light, excessive water, and wind. Once cured, these coatings form an elastomeric, durable film that enhances waterproofing capabilities and bridges small cracks and membrane seams on roofs. Unlike paint, roof coatings are applied in multiple gallons per 100 square feet, offering superior coverage and protection for low-slope roofs on residential, commercial, and industrial buildings. They are available in various types, such as acrylic, asphalt, polyurethane, and silicone coatings. Roof coatings provide cost-effective and energy-efficient solutions for extending the life of roofs. These coatings shield roofs from water, chemical, and physical damage and contribute to energy savings by reflecting sunlight and reducing heat absorption. Roof coatings offer an alternative to traditional roof replacement, which is often expensive, disruptive, and time-consuming. The roof coating market is experiencing growth due to the increasing demand for energy-efficient and sustainable roofing solutions and increasing construction activities and environmental regulations. The advancements in coating materials, such as cool roofing and reflective technologies, further fuel market expansion.

Stakeholders

- Roof Coating Manufacturers

- Raw Material Suppliers

- Service Providers

- Distributors and Retailers

- Research & Development Entities

- Industry Associations and Regulatory Bodies

- Waste Management and Recycling Companies

- End Users

Report Objectives

- To estimate and forecast the roof coating market, in terms of value and volume

- To provide detailed information about the major factors (drivers, restraints, opportunities, and challenges) influencing the market growth

- To define, describe, and forecast the market coating type, roof type, solution technology, end-use sector, and region

- To forecast the market size along with segments and submarkets, in key regions: North America, Europe, Asia Pacific (APAC), Middle East & Africa (MEA), and South America along with their key countries

- To strategically analyze micro markets, for individual growth trends, prospects, and their contribution to the total market

- To analyze growth opportunities in the market for stakeholders and provide details on the competitive landscape for market leaders

- To strategically profile key players and comprehensively analyze their market shares and core competencies

- To analyze competitive developments, such as acquisition, agreements, and expansions in the roof coating market

Key Questions Addressed by the Report

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Roof Coating Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Roof Coating Market