Satellite Propulsion Market Size, Share and Trends, 2025 To 2030

Satellite Propulsion Market by Platform (Small, Medium, Large), Propulsion (Solid, Liquid, Hybrid, Electric, Solar, Cold Gas), Systems (Hall Effect-Thruster, Bipropellant Thruster, Power Processing), End User and Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The Satellite Propulsion Market is projected to grow from USD 2.60 billion in 2024 to USD 5.19 billion by 2030, registering a CAGR of 12.2%. In terms of volume, the market is expected to increase from 2,917 units in 2024 to 4,580 units by 2030, at a CAGR of 7.8%. Growth is driven by the rising adoption of electric propulsion, venture capital funding, and the increasing deployment of small satellites for commercial and defense applications, supported by expanding LEO missions and government space budgets.

KEY TAKEAWAYS

- The Asia Pacific accounted for a 38.6% share of the satellite propulsion market in 2024.

- By end user, the defense segment is expected to grow at the fastest rate of 11.6% during the forecast period.

- By platform, the small platform segment is expected to register the highest CAGR of 19.9%.

- By system, the thrusters segment is projected to dominate the market and grow at the fastest rate from 2024 to 2030.

- Northrop Grumman, Safran S.A., and Thales Alenia Space were identified as some of the star players in the satellite propulsion market, given their strong market share and product footprint.

- Thrustme, Orbion Space Technology, and Enpulsion GmbH have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders.

The future growth of the satellite propulsion market will be driven by advancements in electric and green propulsion systems, the proliferation of small satellite constellations, and increasing private and government investments in space missions. Rising demand for efficient, lightweight, and cost-effective propulsion solutions will further accelerate market expansion.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on clients’ business emerges from shifts in propulsion technologies and industry dynamics. Hotbets represent propulsion developers, while target applications include satellite manufacturers and private space companies. Advances in green propellants, hybrid propulsion, and electric thrusters will influence revenues across the value chain, ultimately affecting communication, Earth observation, defense, and research sectors, as well as propulsion and material suppliers.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Increasing launch of satellites for communication and Earth observation services

-

Increased adoption of electric propulsion systems for efficiency and longevity

Level

-

Regulatory restrictions on toxic propellants

-

Complex and stringent government policies

Level

-

Increasing development of advanced thruster technologies

-

Increased investments by government agencies for space sustainability

Level

-

Thermal management issues

-

Supply chain management issues

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Increasing launch of satellites for communication and Earth observation services.

Rising satellite deployments for communication, remote sensing, and Earth observation are creating strong demand for efficient and reliable propulsion systems. The need for precise orbital placement, station-keeping, and extended mission life is accelerating the adoption of advanced electric and miniaturized propulsion technologies, particularly across global connectivity and observation initiatives.

Restraint: Complex and stringent government policies.

Stringent export controls, certification processes, and compliance regulations are constraining market expansion. Policies such as ITAR and varying international standards increase development costs, extend approval timelines, and limit collaboration between commercial and institutional stakeholders, slowing the pace of propulsion innovation.

Opportunity: Increasing investments by government agencies for space sustainability.

Rising investments in green propulsion technologies reflect the strategic shift toward sustainable and low-toxicity systems. Government-led initiatives promoting non-toxic propellants and environmentally responsible missions are creating new growth pathways for propulsion manufacturers focused on performance efficiency and reduced emissions.

Challenge: Supply chain disruptions.

The industry faces supply chain constraints due to reliance on specialized components and limited suppliers. Production delays, material shortages, and stringent certification requirements often disrupt timelines and increase costs, emphasizing the need for supply diversification and quality assurance across the propulsion value chain.

Satellite Propulsion Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Delivered an iodine-based electric propulsion system (NPT30-I2-1U) for SpaceTy’s 12U CubeSat to perform orbital maneuvers and maintain positioning. | Enabled efficient in-orbit mobility with reduced propellant storage complexity, lowering overall mission cost and system mass, while validating iodine as a scalable propellant option for small satellites. |

|

Developed the Green Propellant Infusion Mission (GPIM) using hydroxylammonium nitrate (AF-M315E) to replace hydrazine in satellite propulsion. | Demonstrated a non-toxic, high-performance propellant, reducing handling risk and lifecycle costs while supporting compliance with evolving environmental regulations. |

|

Integrated a green monopropellant micro-thruster on the LituanicaSAT-2 satellite for orbit correction and drag compensation in LEO. | Improved attitude and orbit control precision, extended operational endurance, and validated compact propulsion integration for CubeSat platforms. |

|

Conducted an on-orbit test of the RUDRA 0.3 HPGP green monopropellant thruster on POEM-3 (PSLV-C58) using an indigenous HAN-based formulation. | Verified India’s first in-orbit green propulsion system, achieving 400 mN thrust and 200 s specific impulse, establishing proof-of-concept for domestic, non-toxic propulsion manufacturing. |

|

Deployed the Xantus electric propulsion system with metal plasma thrusters (MPTs) on a SpaceX Transporter-10 mission for a 12U CubeSat. | Validated metal plasma propulsion for precision orbital maneuvers and deorbiting, enabling hybrid mission flexibility and advancing LEO sustainability compliance. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The satellite propulsion market ecosystem comprises prime contractors, niche propulsion developers, and space agencies, supported by commercial operators and defense users. This integrated network fosters innovation across electric, chemical, and hybrid propulsion technologies, enabling efficient system development and deployment for diverse orbital missions.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Satellite Propulsion Market, By Platform

Large satellites represent the largest platform segment in the market, supported by their widespread use in high-capacity communication, navigation, and Earth observation missions that demand advanced propulsion systems capable of sustaining long-duration operations.

Satellite Propulsion Market, By End User

The defense segment leads the market, driven by rising government investments in reconnaissance, surveillance, and secure communication satellites, with a strong focus on high-performance propulsion systems that enhance mission reliability and operational range.

Satellite Propulsion Market, By System

Power Processing Units dominate the system segment as they are essential for efficient power conversion and regulation within electric propulsion systems, enabling greater performance, reliability, and energy optimization across satellite missions.

Satellite Propulsion Market, By Propulsion Technology

Electric propulsion remains the leading technology in the market, offering high efficiency, lower propellant consumption, and longer operational endurance, making it the preferred solution for both commercial and defense satellite programs.

REGION

Europe to be fastest-growing region in global Satellite Propulsion Market during forecast period

The European Satellite Propulsion Market is expected to register the highest CAGR during the forecast period, driven by strong support from the European Space Agency (ESA) and increasing private investments in advanced propulsion technologies. The region’s focus on green, hybrid, and electric systems, along with initiatives like the Clean Space program, positions Europe as a key hub for sustainable and innovative space propulsion solutions.

Satellite Propulsion Market: COMPANY EVALUATION MATRIX

The company evaluation matrix for the Satellite Propulsion Market evaluates players based on product footprint and market share. It highlights their competitive positioning and ranks them according to market strength and growth strategies. Northrop Grumman is positioned as a leading player with a strong focus on advanced propulsion technologies, while Beoing is recognized as an emerging leader in this market.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2023 (Value) | USD 1.91 Billion |

| Market Forecast in 2030 (Value) | USD 5.19 Billion |

| Growth Rate | CAGR of 12.2% from 2025-2030 |

| Years Considered | 2020-2030 |

| Base Year | 2023 |

| Forecast Period | 2024-2030 |

| Units Considered | Value (USD Million/Billion), Volume (Unit) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, Middle East, Rest of the World |

WHAT IS IN IT FOR YOU: Satellite Propulsion Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Leading Manufacturer | Additional segment breakdown for countries | Additional country-level market sizing tables for segments/sub-segmetns covered at regional/global level to gain an understanding on market potential by each coutnry |

| Regional Market Leader | Additional country market estimates | Additional country-level deep dive for a more targeted undertanding on the Total Addressable Market |

RECENT DEVELOPMENTS

- December 2024 : Dawn Aerospace announce they have been selected by Infinite Orbits to provide one of the propulsion systems for the Endurance mission, France and Europe’s first satellite servicing initiative in Geostationary Orbit (GEO).

- February 2024 : Thales Alenia Space, the joint venture between Thales (67%) and Leonardo (33%), has signed a contract with the Korea Aerospace Research Institute (KARI) to provide electric propulsion for incorporation on their GEO-KOMPSAT-3 (GK3) satellite.

- August 2023 : Exotrail and Muon Space have inked their first contract for the supply of electric propulsion systems for the next phase of Muon Space’s climate monitoring constellation.Muon Space, a climate satellite company revolutionizing the way Earth is monitored from space, has selected Exotrail, the end-to-end space mobility solutions provider, to supply five of its spaceware electric propulsion systems to propel the next generation of its ESPA-class spacecraft currently in development at Muon Space’s manufacturing facility in Mountain View, California.

- August 2022 : Thales Alenia Space, a joint venture between Thales Group and Leonardo S.p.A, has signed an agreement with aerospace component manufacturer Miprons, Segni, Italy, to develop a propulsion system for satellites that will feature additively manufactured components and be powered by water.

- August 2022 : Thales Alenia Space, a joint venture between Thales Group and Leonardo S.p.A, has signed an agreement with aerospace component manufacturer Miprons, Segni, Italy, to develop a propulsion system for satellites that will feature additively manufactured components and be powered by water.

Table of Contents

Methodology

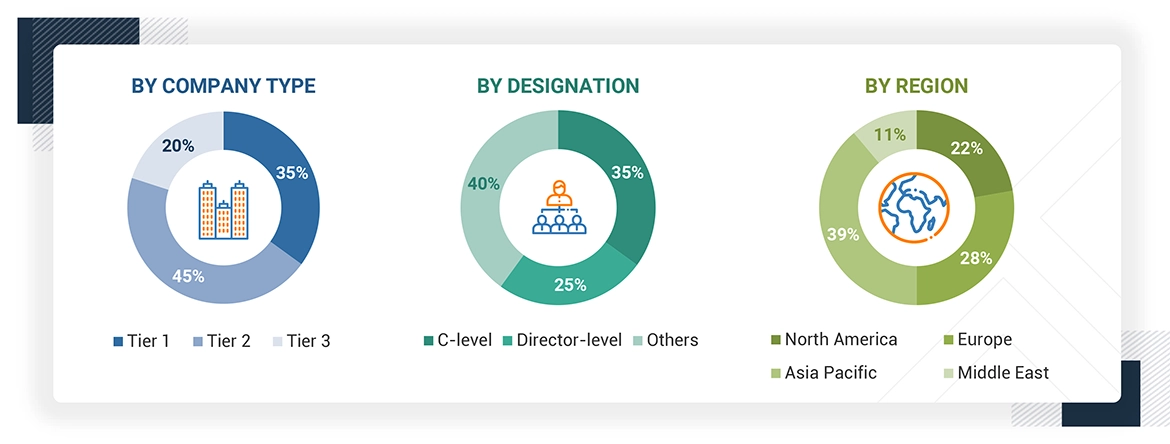

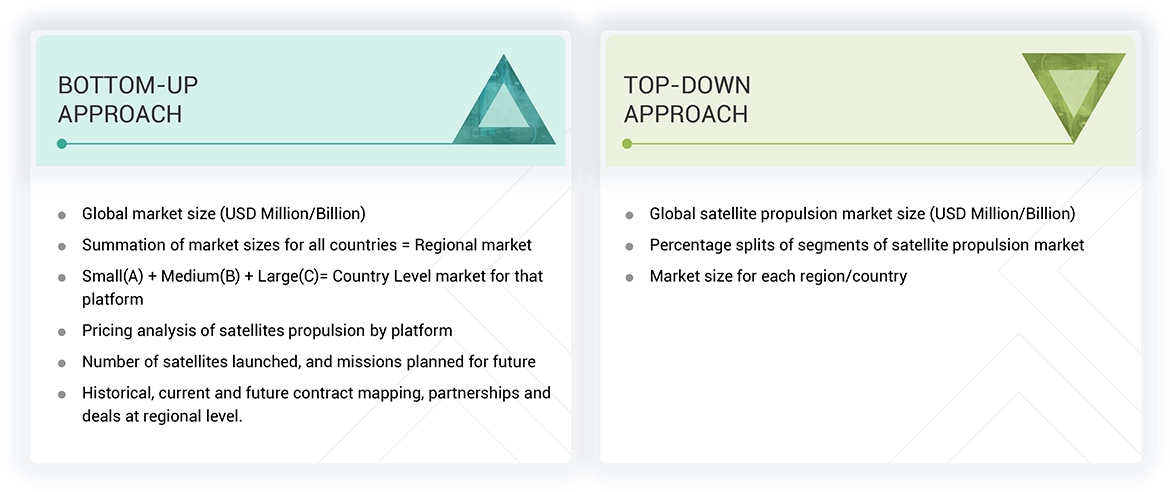

The research study conducted on the Satellite Propulsion market involved the extensive use of secondary sources, directories, and databases, such as D&B Hoovers, Bloomberg, and Factiva, to identify and collect relevant information. Primary sources included industry experts from the market as well as suppliers, manufacturers, solution providers, technology developers, alliances, and organizations related to all segments of the value chain of this industry. In-depth interviews of various primary respondents, including key industry participants, subject matter experts (SMEs), industry consultants, and C-level executives, were conducted to obtain and verify critical qualitative and quantitative information pertaining to the market as well as assess the growth prospects of the market. A deductive approach, also known as the bottom-up approach combined with the top-down approach, was used to forecast the market size of different market segments.

Secondary Research

The share of companies in the Satellite Propulsion market was determined based on secondary data made available through paid and unpaid sources and an analysis of the product portfolios of major companies. These companies were rated based on their performance and quality. These data points were further validated by primary sources. Secondary sources for this research study included corporate filings, such as annual reports, investor presentations, and financial statements from trade, business, and professional associations. The secondary data was collected and analyzed to arrive at the overall market size, which was further validated by primary respondents.

Primary Research

Extensive primary research was conducted after obtaining information about the current scenario of the Satellite Propulsion market through secondary research. Several primary interviews were conducted with market experts from both, the demand and supply sides across different regions. This primary data was collected through questionnaires, emails, and telephonic interviews.

Note: Tiers of companies are based on their revenue in 2023. Tier 1: company revenue greater than USD 1 billion; tier 2: company revenue between USD 100 million and USD 1 billion; and tier 3: company revenue less than USD 100 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down and bottom-up approaches were used to estimate and validate the size of the Satellite Propulsion market. The research methodology used to estimate the market size includes the following details.

Key players in the market were identified through secondary research, and their market share was determined through primary and secondary research. This included a study of the annual and financial reports of top market players and extensive interviews with industry stakeholders such as CEOs, technical advisors, military experts, and SMEs of leading companies operating in the Satellite Propulsion market.

All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data on the Satellite Propulsion market. This data was consolidated, enhanced with detailed inputs, analyzed by MarketsandMarkets, and presented in this report.

Satellite Propulsion Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall size of the Satellite Propulsion market from the estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for various market segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the Satellite Propulsion market size was validated using the top-down and bottom-up approaches.

Market Definition

Satellite propulsion refers to the methods and technologies used to control the trajectory and maintain the orbit of satellites after they are launched into space. This includes maneuvering them to their intended orbits, maintaining those orbits over their operational lifetimes, and deorbiting them at the end of their missions. The propulsion technologies vary from traditional chemical-based systems, which burn fuel to create thrust, to more modern electric propulsion systems that use electric fields to accelerate ions. Efficient satellite propulsion is critical for optimizing mission lifespans based on applications such as communications, Earth observation, and navigation.

Key Stakeholders

- Propulsion System Manufacturers

- Satellite Operators

- Raw Material Providers

- Component Providers

- National Space Agencies

- Launch Service Providers

- Original Equipment Manufacturers

- Regulatory Bodies

- Departments of Defense

- Satellite Propulsion Service Providers

Report Objectives

- To define, describe, segment, and forecast the size of the Satellite Propulsion market based on Satellite platform, Systems, End user, Propulsion Technology, and region.

- To forecast the size of market segments based on five regions: North America, Europe, Asia Pacific, Middle East, and Rest of the World, along with key countries in each region.

- To identify and analyze key drivers, restraints, opportunities, and challenges influencing the growth of the market across the globe.

- To identify industry trends, market trends, and technology trends that are currently prevailing in the market.

- To provide an overview of the regulatory landscape with respect to drone regulations across regions.

- To analyze micro markets with respect to individual growth trends, prospects, and their contribution to the overall market.

- To analyze opportunities in the market for stakeholders by identifying key market trends.

- To profile key market players and comprehensively analyze their market shares and core competencies.

- To analyze the degree of competition in the market by identifying key growth strategies, such as acquisitions, product launches, contracts, and partnerships, adopted by leading market players.

- To identify detailed financial positions, key products, and unique selling points of leading companies in the market.

- To provide a detailed competitive landscape of the market, along with market ranking analysis, market share analysis, and revenue analysis of key players.

Available Customizations

Along with the market data, MarketsandMarkets offers customizations as per the specific needs of companies. The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the market segments at country-level

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Key Questions Addressed by the Report

- Advanced Electric Thrusters are a significant industry and technology trend in the satellite propulsion market. These thrusters offer high efficiency and low fuel consumption compared to traditional chemical propulsion systems. These thrusters use electric or magnetic fields to ionize and accelerate propellant, typically xenon, to generate thrust. They are particularly valuable for long-duration space missions, where efficiency and fuel conservation are critical. The most prominent types of advanced electric thrusters are Hall Effect Thrusters (HETs) and ion thrusters. HETs are highly efficient, provide significant thrust with minimal fuel consumption, and are ideal for satellite station-keeping, orbit-raising, and deep-space missions. Ion thrusters, which operate at low thrust levels but high efficiency, are often used in scientific and exploratory satellites.

- Ionic Liquid Electrospray Systems are emerging as a significant industry and technology trend in the satellite propulsion market due to their high efficiency and precision in low-thrust applications. These systems use ionic liquids (charged particles) as propellants, ejected from a small nozzle by an electric field, creating a fine spray of ions. This technology is particularly suited for small satellites, such as CubeSats, where traditional propulsion systems would be too large or inefficient. Ionic electrospray technology is one of the most promising technologies for low power, high thrust, and nanosatellite ISP performance. AIS-ILIS1, a liquid ion source electrospray thruster developed by Applied Ion Systems (US), offers unprecedented access to advanced ionic liquid electrospray thruster technology for nanosatellites.

- Increasing launch of satellites for communication and Earth observation services

- Rise in adoption of electric propulsion technology for efficiency and longevity

- Miniaturization of Propulsion Systems for CubeSats and Nanosatellites

- Increase in public-private partnerships for the development of satellite propulsion systems

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Satellite Propulsion Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Satellite Propulsion Market