Saudi Arabia Cloud Computing Market

Saudi Arabia Cloud Computing Market by Service Model (IaaS (Compute, Storage, Networking), PaaS (Application Development & Integration, Database & Data Analytics & Reporting), SaaS (CRM, SCM, Collaboration & Productivity)), Impact of AI - Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The cloud computing market in Saudi Arabia is expected to increase from USD 5,069.5 million in 2025 to USD 14,608.9 million by 2030, at a CAGR of 23.6%. This growth is driven by the rising use of digital platforms across government and business sectors. Saudi Arabian regulations govern the handling of sensitive data, requiring government organizations to store such data in line with national security rules. Owing to this, demand for locally hosted cloud services is increasing among digital banking platforms and online government portals.

KEY TAKEAWAYS

-

BY SEVICE MODELThe SaaS segment is estimated to account for the largest market share in 2025.

-

BY DEPLOYMENT MODELThe hybrid cloud segment is projected to grow at the highest CAGR of 26.7% during the forecast period.

-

BY ORGANIZATION SIZEThe large enterprises segment is estimated to have the largest market size of USD 2,854.7 million in 2025.

-

BY VERTICALThe healthcare & life sciences segment is expected to grow at highest CAGR during forecast period.

-

COMPETITIVE LANDSCAPE - KEY PLAYERSMajor cloud providers are using both organic and inorganic strategies to expand their presence. These include partnerships, platform integration, and targeted investments. Companies such as Microsoft, Google, AWS, IBM, and Oracle are strengthening their portfolios to support AI workloads, hybrid deployment needs, and secure cloud adoption across industries.

-

COMPETITIVE LANDSCAPE- STARTUPSTudip Technologies operates in the Saudi Arabia cloud computing landscape as an agile SME delivering customized cloud-native development, integration, and managed services for enterprises undergoing digital transformation. Its strengths lie in flexible delivery models, rapid deployment capabilities, and strong expertise across multi-cloud environments, enabling it to compete by offering cost-efficient, scalable solutions tailored to local industry needs.

Cloud usage in Saudi Arabia is expanding across government, banking & financial services, healthcare, and retail. Vision 2030 has made digital systems a priority, pushing organizations to modernize older IT setups. Data residency rules are encouraging companies to work with cloud providers that have local data centers. Many enterprises are also starting to use artificial intelligence in customer service, operations, and data analysis. To support this demand, cloud providers are building more local infrastructure. As a result, cloud computing is becoming a basic requirement for digital operations in the country.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

For businesses, cloud adoption is changing how services are delivered and managed. Software and information technology services, banking and financial services, healthcare, and online retail are the main users of cloud platforms. These sectors use cloud systems to handle growing data volumes, improve system security, and support digital customer interactions. Cloud-based tools also help businesses respond faster to customer needs and manage operations more efficiently. These changes are increasing spending on cloud services and encouraging providers to expand their offerings.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Vision 2030-driven digital transformation

-

Demand for local data hosting and compliance

Level

-

Data security & privacy concerns

-

Trust deficit beyond basic security

Level

-

Growing use of AI and data analytics

-

Expansion of government digital and smart city projects

Level

-

Shortage of skilled workforce

-

Complexity of hybrid and multi-cloud environments

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Vision 2030-driven digital transformation

Government-led digital programs play a major role in cloud adoption in Saudi Arabia. Vision 2030 encourages public sector organizations to move services online to improve access, transparency, and efficiency. Digital government platforms, national portals, and internal systems require stable and scalable cloud infrastructure. As more services are delivered digitally, cloud platforms are becoming central to how government systems operate and expand.

Restraint: Data security and privacy concerns

Businesses that handle confidential or regulated information consider data security a major concern. Some sectors, such as banking and healthcare, require strict control over data access and storage. As a result, enterprises gradually move workloads rather than migrating entire systems at once. This careful approach can slow cloud adoption in certain sectors.

Opportunity: Growing use of AI and data analytics

Saudi enterprises are increasingly using data analytics and artificial intelligence to improve decision-making and daily operations. Cloud platforms provide the computing power needed to run these tools without heavy upfront investment. This is creating demand for cloud services that support data processing, application development, and AI workloads. As more organizations look for insights from data, advanced cloud services are becoming more important.

Challenge: Shortage of skilled workforce

A lack of skilled cloud professionals is another challenge in the market. Many organizations struggle to find experienced teams to design, manage, and maintain cloud environments. This can delay projects and affect system performance after deployment. As cloud adoption continues to grow, the need for trained professionals is increasing faster than the available talent pool.

SAUDI ARABIA CLOUD COMPUTING MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Zeotap adopted a DevOps architecture powered by big data automation to streamline operations and enhance compliance. | DevOps architecture and documentation were transformed by Rackspace Technology using its big data and automation expertise. Zeotap can use its multiple SKUs and implement best practices for privacy and compliance. |

|

The Saudi Commission for Tourism & National Heritage (SCTH) worked with HPE and eSense to deploy a private cloud and self-service portal using HPE Cloud Service Automation. This solution automated IT tasks, simplified service delivery, and reduced the time needed to provision virtual servers across its hybrid IT environment. | SCTH reduced server provisioning time by 88%, freeing IT staff from routine tasks and allowing them to focus on strategic work. The automation portal also improved service delivery, reduced costs, and created a roadmap for broader cloud services and infrastructure monitoring. |

|

Shgardi, a Saudi Arabia-based delivery platform, migrated its infrastructure to AWS to handle rapid growth and rising demand. By using containerization, microservices, and managed AWS services, the company improved platform scalability, performance, and reliability while reducing dependence on manual server management. | The migration helped Shgardi reduce infrastructure costs by 40% and cut platform update deployment time by 70%. It also improved customer outcomes, with a 20% increase in monthly orders and a 30% rise in new customer conversion rates, supported by better uptime and personalized recommendations. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The cloud computing ecosystem in Saudi Arabia includes several supporting players. These include network and hardware suppliers, cloud infrastructure providers, platform providers, and software companies. Consulting firms, cloud service brokers, and system integrators help organizations plan migrations, manage systems, and optimize usage. Together, these groups support cloud adoption and keep the market moving forward.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Saudi Arabia Cloud Computing Market, By Service Model

Software as a Service is the largest cloud segment in Saudi Arabia. Organizations use cloud-based applications to support everyday business and government operations. These applications are widely used for customer management, human resources, finance, and digital public services. Sectors such as government, healthcare, banking, retail, and education rely on SaaS as it is easy to deploy and maintain. Mobile usage and basic AI features are further increasing adoption.

Saudi Arabia Cloud Computing Market, By IaaS

Within Infrastructure as a Service, networking services are growing the fastest. As cloud usage increases, organizations need reliable and secure connections between data centers, users, and digital platforms. National digital projects and local data hosting requirements are adding to this demand. The rollout of fifth-generation mobile networks and the growing use of edge computing are also increasing the need for low-latency networks.

Saudi Arabia Cloud Computing Market, By PaaS

In Platform as a Service, database and data management tools hold the largest market share. Government departments, banks, retailers, and industrial companies are generating more data every year. Cloud-based databases help manage this data while reducing the burden of system maintenance. These platforms also support reporting, analytics, and application development, making them useful across multiple sectors.

Saudi Arabia Cloud Computing Market, By SaaS

Supply chain management software delivered through the cloud is growing rapidly. Retailers, manufacturers, and government logistics teams are adopting these tools to track inventory, manage suppliers, and improve coordination. Growth in online commerce and large infrastructure projects is increasing the need for connected supply chains. Cloud-based systems offer better visibility and easier integration across partners.

Saudi Arabia Cloud Computing Market, By Deployment Model

Public cloud services account for the largest share of cloud adoption in Saudi Arabia. Government bodies, large enterprises, and smaller businesses use public cloud platforms as they are cost-effective and easy to scale. Cloud providers are expanding local data centers to meet national hosting rules. Public cloud platforms also support analytics, digital services, and application development without heavy infrastructure investment.

Saudi Arabia Cloud Computing Market, By Organization Size

Small and medium-sized enterprises are adopting cloud services at a fast pace. These businesses use cloud platforms to avoid high IT costs and access modern tools such as accounting software, enterprise resource planning, and customer management systems. Government digital programs and startup initiatives are also encouraging cloud usage. Flexible pricing allows smaller firms to scale systems as their operations grow.

Saudi Arabia Cloud Computing Market, By Vertical

The software and information technology services sector represents the largest share of cloud spending in Saudi Arabia. Technology firms depend on cloud platforms for building, testing, and deploying applications. Demand is growing for cloud-based cybersecurity services and AI-driven solutions. IT service providers are strengthening cloud capabilities to support national digital programs and enterprise customers.

REGION

SAUDI ARABIA CLOUD COMPUTING MARKET: COMPANY EVALUATION MATRIX

In the competitive landscape, Microsoft holds a leading position in Saudi Arabia’s cloud market due to its wide service portfolio and strong presence across government and large enterprises. Its Azure platform is widely used for enterprise systems and AI-based workloads. STC Cloud is emerging as a strong local player, supported by domestic infrastructure and long-standing relationships with government organizations and large businesses.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Microsoft (US)

- Google (US)

- AWS (US)

- IBM (US)

- Oracle (US)

- Salesforce (US)

- Tencent Cloud (China)

- SAP (Germany)

- Alibaba Cloud (China)

- Adobe (US)

- Zain Cloud (Saudi Arabia)

- NourNet (Saudi Arabia)

- STC (Saudi Arabia)

- Sahara Net (Saudi Arabia)

- NashirNet (Saudi Arabia)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 4,096.6 Million |

| Market Forecast in 2030 (value) | USD 14,608.9 Million |

| Growth Rate | CAGR of 23.6% from 2025-2030 |

| Years Considered | 2020-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Country Covered | Saudi Arabia |

WHAT IS IN IT FOR YOU: SAUDI ARABIA CLOUD COMPUTING MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Cloud Service Provider |

|

|

| Telecom Operator |

|

|

| Enterprise (Government, BFSI, Energy) |

|

|

RECENT DEVELOPMENTS

- September 2025 : STC Group rebranded its cloud subsidiary as sccc by stc, highlighting its focus on locally hosted and secure cloud services in Saudi Arabia. The company offers IaaS, PaaS, and SaaS solutions to support government and enterprise digital needs. sccc by stc operates within the STC Group’s digital ecosystem and ensures all data is hosted locally to meet regulatory requirements. The rebranding reflects its role in supporting national digital transformation and cloud adoption.

- April 2025 : AWS and Oracle announced major skills development initiatives to strengthen cloud and AI talent in Saudi Arabia and the wider Middle East. AWS plans to train 2,500 software engineers through a partnership with Manara, focusing on cloud certifications and job readiness. Oracle is working with the Ministry of Communications and Information Technology and the National eLearning Center to train 50,000 Saudi nationals in AI skills. These initiatives support local talent development and align with Vision 2030 goals for digital and workforce growth.

- February 2025 : STC Group partnered with Amazon Web Services to strengthen cloud and AI infrastructure in Saudi Arabia. The collaboration focuses on expanding cloud-based workloads and AI services across key sectors such as healthcare, finance, energy, logistics, and government. STC will use AWS capabilities to support local cloud adoption, skills development, and sustainability initiatives. The partnership positions STC as a key system integrator for large-scale cloud and AI deployments.

Table of Contents

Methodology

This research study on the Saudi Arabia cloud computing market involved extensive secondary sources, directories, IEEE Communication-Efficient: Algorithms and Systems, International Journal of Innovation and Technology Management, and paid databases. Primary sources were mainly industry experts from the core and related industries, preferred cloud service providers, third-party service providers, consulting service providers, end users, and other commercial enterprises. In-depth interviews were conducted with various primary respondents, including key industry participants and subject matter experts, to obtain and verify critical qualitative and quantitative information and assess the market’s prospects.

Secondary Research

In the secondary research process, various sources were referred to identify and collect information for this study. Secondary sources included annual reports, press releases, and investor presentations of companies; white papers, journals, and certified publications; and articles from recognized authors, directories, and databases. The data was also collected from other secondary sources, such as journals, government websites, blogs, and vendors' websites. Additionally, the Saudi Arabia cloud computing spending of various countries was extracted from the respective sources.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, such as Chief Experience Officers (CXOs), Vice Presidents (VPs), and directors specializing in business development, marketing, and cloud service providers. It also included key executives from Saudi Arabia cloud computing solution vendors, system integrators (SIs), professional service providers, industry associations, and other key opinion leaders.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Multiple approaches were adopted to estimate and forecast the Saudi Arabia cloud computing market. The first approach involved estimating the market size by companies’ revenue generated through the sale of Saudi Arabia cloud computing services.

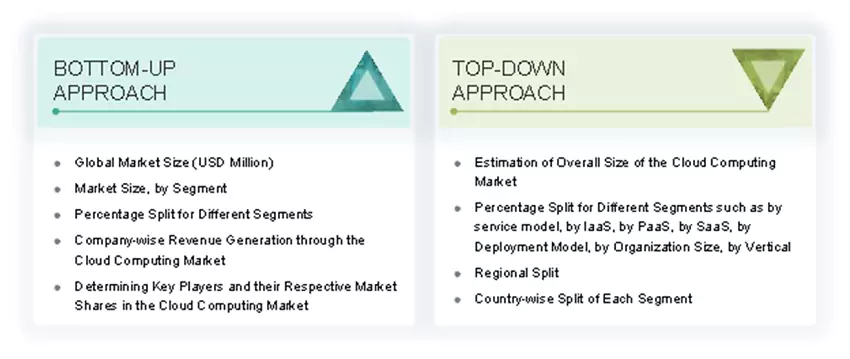

Market Size Estimation Methodology- Top-down approach

In the top-down approach, an exhaustive list of all the vendors offering products in the Saudi Arabia cloud computing market was prepared. The revenue contribution of the market vendors was estimated through annual reports, press releases, funding, investor presentations, paid databases, and primary interviews. Each vendor's offerings were evaluated based on platform, degree of customization, type, application, end user, and region. The markets were triangulated through both primary and secondary research. The primary procedure included extensive interviews for key insights from industry leaders, such as CIOs, CEOs, VPs, directors, and marketing executives. The market numbers were further triangulated with the existing MarketsandMarkets’ repository for validation.

Market Size Estimation Methodology-Bottom-up approach

In the bottom-up approach, the adoption rate of Saudi Arabia cloud computing services among different verticals in key countries, with respect to their regions contributing the most to the market share, was identified. For cross-validation, the adoption of Saudi Arabia cloud computing services among enterprises, along with different use cases with respect to their regions, was identified and extrapolated. Weightage was given to use cases identified in different regions for the market size calculation.

Based on market numbers, the regional split was determined by primary and secondary sources. The procedure included an analysis of the Saudi Arabia cloud computing market’s regional penetration. Based on secondary research, the regional spending on Information and Communications Technology (ICT), socio-economic analysis of each country, strategic vendor analysis of major Saudi Arabia cloud computing providers, and organic and inorganic business development activities of regional and global players were estimated.

Saudi Arabia Cloud Computing Market: Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakup procedures were employed, wherever applicable. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Market Definition

The cloud computing market involves delivering computing services such as servers, storage, databases, networking, software, and analytics over the internet, enabling organizations to access and manage data and applications remotely. It includes public, private, and hybrid cloud deployment models and supports various service models such as Infrastructure as a Service (IaaS), Platform as a Service (PaaS), and Software as a Service (SaaS). Saudi Arabia Cloud Computing helps businesses reduce capital expenditure, improve scalability, enhance collaboration, and accelerate innovation. It plays a vital role in digital transformation, supporting emerging technologies such as AI, IoT, big data, and machine learning across industries.

Stakeholders

- Cloud Service Providers (CSPs)

- Networking companies

- Information Technology (IT) infrastructure providers

- Consultants/Consultancies/Advisory firms

- Component providers

- Telecom service providers

- System Integrators (SIs)

- Support and maintenance service providers

- Support service providers

- Third-party providers

- Government organizations and standardization bodies

- Datacenter providers

- Regional associations

- Independent hardware and software vendors

- Value-added resellers and distributors

Report Objectives

- To define, describe, and forecast the global Saudi Arabia cloud computing market based on service model, Infrastructure as a Service (IaaS), Platform as a Service (PaaS), Software as a Service (SaaS), deployment model, organization size, vertical, and region

- To provide detailed information about the major factors (drivers, opportunities, restraints, and challenges) influencing the growth of the Saudi Arabia cloud computing market

- To analyze the opportunities in the market for stakeholders by identifying the high-growth segments of the Saudi Arabia cloud computing market

- To analyze the subsegments of the market with respect to individual growth trends, prospects, and contributions to the overall market

- To profile the key players of the Saudi Arabia cloud computing market and comprehensively analyze their market size and core competencies

- To track and analyze the competitive developments, such as product enhancements and product launches, acquisitions, and partnerships & collaborations, in the Saudi Arabia cloud computing market globally

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- The product matrix provides a detailed comparison of the product portfolio of each company.

Geographic Analysis as per Feasibility

- Further breakup of the Saudi Arabia cloud computing market

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Saudi Arabia Cloud Computing Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Saudi Arabia Cloud Computing Market