Smoke Evacuation Systems Market Size, Growth, Share & Trends Analysis

Smoke Evacuation Systems Market by Product (Pencils & Wands, Systems [Portable, Stationary], Filters, Accessories), Application (General Surgery, Laparoscopic, Orthopedic, Aesthetics), End User (Hospitals, ASC, Dental Clinics) - Global Forecast to 2031

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

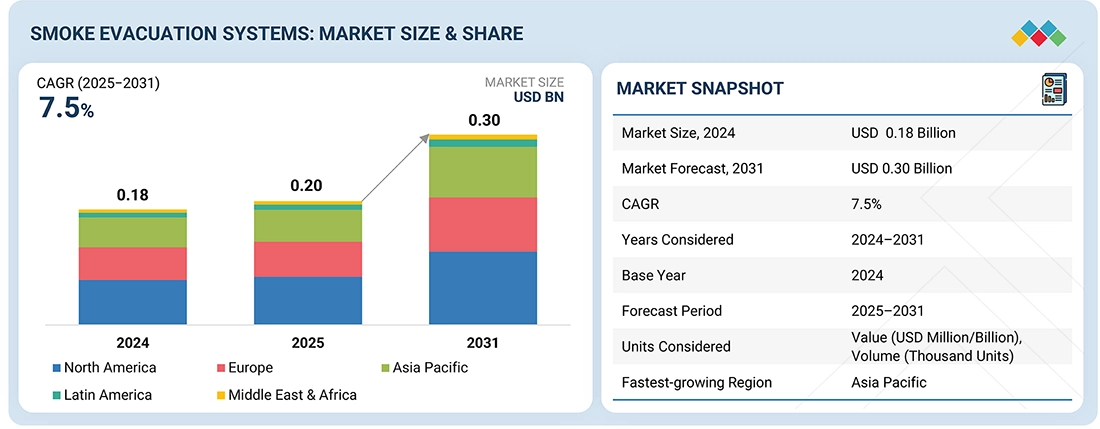

The global smoke evacuation systems market, valued at US$0.18 billion in 2024, stood at US$0.20 billion in 2025 and is projected to advance at a resilient CAGR of 7.5% from 2025 to 2031, culminating in a forecasted valuation of US$0.30 billion by the end of the period. The surge in the number of surgical procedures and the increased use of minimally invasive and electrosurgical methods that produce harmful surgical smoke have largely driven the growth of the smoke evacuation systems market. There is a growing understanding of the health hazards of the surgical plume, which is a mixture of contaminated air, chemicals, and pathogens, leading to a greater emphasis on safety for surgeons and operating room staff. Moreover, the enforcement of stricter occupational health legislations as well as the issuance of new directives by regulatory and professional authorities are impelling healthcare sectors to invest in efficient smoke control measures. Besides, continuous innovation in technologies, such as higher filtration performance, compatibility with surgical instruments, and the manufacturing of portable and budget-friendly devices, are additional factors contributing to the expansion of the market.

KEY TAKEAWAYS

-

By RegionAsia Pacific is set to be the fastest-growing regional segment at 7.9%.

-

By ProductBased on product, the smoke evacuation pencils and wands segment accounted for a larger share of 26.8% of the smoke evacuation systems market in 2024.

-

By ApplicationBased on application, in 2024, the laparoscopic surgery segment accounted for the largest share of the smoke evacuation systems market.

-

By End UserBased on end user, the hospitals segment held the largest share of 43.4% in the smoke evacuation systems market druing the forecast period

-

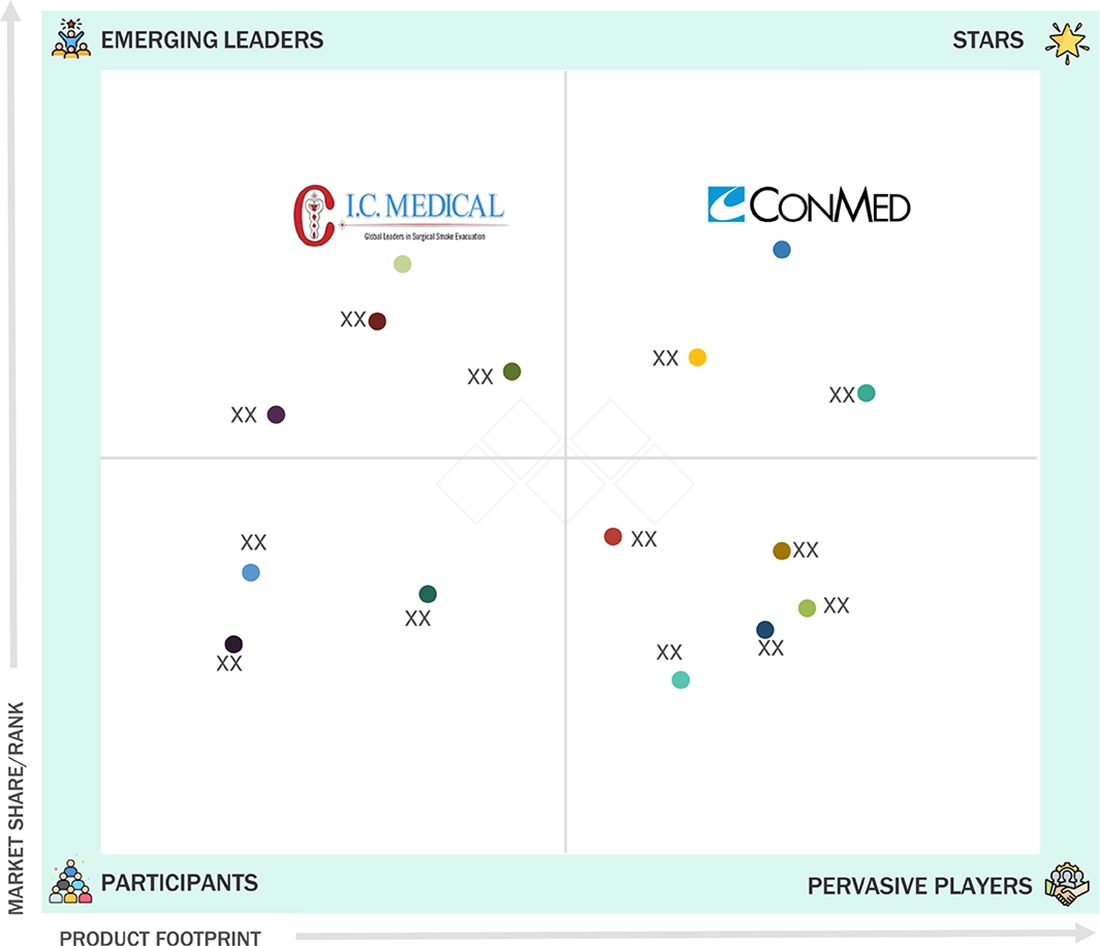

COMPETITIVE LANDSCAPECONMED Corporation and Medtronic were recognized as star players due to their established strong product portfolio.

-

COMPETITIVE LANDSCAPE- STARTUPSCompanies such as Acuderm, Inc. among others, have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders

The smoke evacuation systems market growth is largely driven by a rising global burden of chronic respiratory diseases (such as COPD and asthma). Among the key factors driving smoke evacuation systems demand in the US are the aging population requiring long-term oxygen therapy and an increasing number of surgical and critical care procedures using anesthetic and respiratory gases. The expansion and modernization of healthcare facilities, increased healthcare spending, and the growing trend of home healthcare by means of portable oxygen concentrators and other respiratory devices are some of the factors that, in addition to each other, are enabling demand growth.

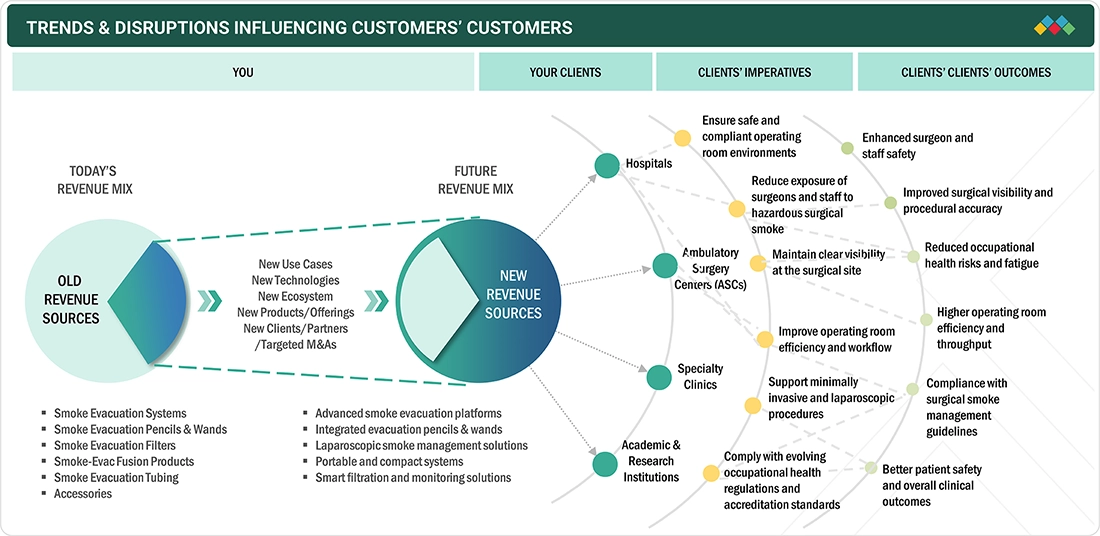

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The markets for smoke evacuation systems are rapidly changing, with increasing operating room safety, compliance, and a surge in minimally invasive and laparoscopic procedure volumes. Solution vendors are gradually accepting next-generation integrated and portable solutions that can keep pace with the dynamics in surgical practice and customer demands. Controlling toxic surgical smoke is being recognized as one of the primary focus areas for hospitals, ambulatory surgery centers, specialty hospitals, and academic institutions to provide a safe working environment for surgeons and staff. Such fast-changing demands are setting new trends in the acceptance and adaptation of surgical smoke evacuation technologies in order to keep pace with the growing need for improved safety and compliance in surgical practice.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Increased product availability

-

Rising patient preference for minimally invasive surgeries

Level

-

Lack of uniform regulatory guidelines regarding surgical smoke evacuation

-

High cost associated with procurement and installation

Level

-

Emerging markets

-

Rising technological advancements

Level

-

Resistance of surgeons to adopt smoke evacuators

-

Safety concerns regarding smoke evacuation systems

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Increased product availability

Increased product availability represents one of the main factors driving the market for smoke evacuation systems. Manufacturers, realizing this demand, have diversified their product offerings to include not only various standalone systems but also integrated smoke evacuation pencils and wands, laparoscopic smoke management solutions, and disposable accessories. The combination of numerous global and regional suppliers, coupled with robust distribution networks, has led to an increase in product availability for hospitals, ASCs, and specialty clinics. Moreover, technological advances in production, component standardization, and collaboration between medical device manufacturers and distributors have eliminated most supply constraints, and procurement cycles have become substantially shorter. Such an increased availability gives healthcare providers the opportunity to choose from a variety of solutions that not only meet their clinical needs but also are compatible with their budgets and surgical workflows, which in turn significantly helps in the overall adoption of smoke evacuation systems in a wide variety of healthcare facilities.

Restraint: Lack of uniform regulatory guidelines regarding surgical smoke evacuation

A major limiting factor of the smoke evacuation systems market is the absence of unified regulatory policies for surgical smoke evacuation. Different regions and healthcare systems have very different regulatory requirements and recommendations for the management of surgical smoke, so there is a lot of confusion among hospitals and surgical centers about which are compulsory and to what standards they have to comply. In some countries, the guidelines are only advisory and non-binding, so the implementation of smoke evacuation measures remains patchy, and investment in dedicated systems is postponed. Therefore, this regulatory disintegration tends to diminish the buying urgency, especially in cash-strapped institutions, and it also makes it hard for manufacturers to globally standardize their product portfolios. Consequently, variations in the level of awareness, enforcement, and institutional policies still hamper the wide-scale use of smoke evacuation systems.

Opportunity: Emerging markets

Emerging markets present a great opportunity for the smoke evacuation systems market to grow and expand. It is mostly because of the fast growth of healthcare facilities, a higher number of surgeries, and the popularity of minimally invasive and electrosurgical procedures. Another factor contributing to the rising demand for surgical smoke management solutions is the higher awareness among surgeons and OR staff regarding occupational health risks, as well as local training and international safety guidelines. Besides that, the increasing investments by governments and private players in hospitals and ambulatory surgery centers, as well as the ongoing improvement in access to advanced medical technologies, are leading to a favorable environment for market entry. Thus, manufacturers of smoke evacuation systems that are cost-effective, portable, and user-friendly, backed by the right local distribution partnerships, stand a very good chance of exploiting the unexploited potential of emerging markets.

Challenge: Resistance of surgeons to adopt smoke evacuators

A major challenge for the smoke evacuation systems market continues to be surgeons' resistance to installing smoke evacuation systems. Some surgeons are hesitant to clamp smoke evacuators on the surgical site because they feel these devices distract the surgical team and make the operation more complicated. They mention problems like getting extra instruments on the operating table, noise from evacuators, difficulties in handling surgical instruments, and the feeling that the work at the operating table is being slowed down and interrupted. Moreover, less thinking and awareness of the long-term health hazards of being exposed to surgical smoke may result in smoke evacuation not being prioritized during surgical procedures. In addition, dependence on conventional methods and distrust of new equipment can cause behavioral changes to occur slowly, especially in operating rooms with a very high throughput, where speed and familiarity are the most important factors. Eliminating this obstacle necessitates the implementation of a planned educational program, presentation of clinical evidence supporting the safety and efficiency of the products, ergonomic product design, and the combination of smoke evacuation solutions that fit very well with existing surgical techniques.

SMOKE EVACUATION SYSTEMS MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

CONMED offers surgical smoke evacuation systems that are intended to capture and filter dangerous surgical smoke produced during electrosurgical, laser, and other energy-based surgical procedures performed in operating rooms. The device is employed in both open and laparoscopic or minimally invasive surgical procedures to remove smoke and odors that are airborne during such procedures. | CONMED's smoke evacuation systems increase the safety of the surgeon and staff members by reducing their contact with toxic chemicals, bio-aerosols, and particulate matter. Proper removal of plumes from the procedure area optimizes vision in the area, thus facilitating compliance with occupational health and safety standards and maintaining a healthier environment for surgical operations. |

|

Medtronic provides smoke evacuation accessories such as tubing, filters, and connection devices, and these work in perfect synergy with electrosurgical units and surgical equipment. The use of these accessories has been pervasive in hospitals and ambulatory surgery centers, as they ensure effective surgical smoke evacuation. | Medtronic's smoke evacuation accessories are an affordable and versatile tool that can be used to address the issue of surgical plume without interfering with the ongoing process. They are also easily integrated with the already available electrosurgical platforms to ensure ease of use and improve visibility during the process. |

|

Stryker makes available smoke evacuation pencils that combine both electrosurgical cut-and-coag functions and smoke evacuation in one device. Such pencils are normally used in several different types of surgery. These include general surgery, orthopedic surgery, gynecology, and cosmetic surgery. | The smoke evacuation pencils available from Stryker allow for immediate removal of the plume, ensuring a clear surgical site and therefore accuracy in procedural performance. Their ergonomic design promotes ease of use and reduces the risk of smoke pollution in the operating room environment, and overall facilitates cost savings and increased efficiency. |

|

The company, Johnson & Johnson, deals with smoke evacuation disposables such as filters and tubing and single-use components specifically aimed at hygienic smoke evacuation as a result of operations in surgery. They work in conjunction with electrosurgical and energy-based equipment in a health facility environment, whether in-patient or outpatient. | The use of single-use smoke evacuators helps prevent cross-contamination and ensures a smooth filtration process. The products aim to help in infection control, handling of equipment, and compliance with regulations, which helps in improving operating room efficiency and safety. |

|

Olympus provides smoke management systems that are fully integrated with laparoscopic and endoscopic systems. Such systems manage the smoke that is generated in the course of minimally invasive procedures. | Olympus smoke management systems improve visualization and procedure precision during laparoscopic surgery by effectively removing the generated smoke while achieving a stable pneumoperitoneum. Improved surgical efficiency, reduced procedure times, enhanced comfort for the surgeons, and the safety and efficacy of minimally invasive surgical procedures can thus be achieved. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The ecosystem in the smoke evacuation systems market consists of a broad array of participants, ranging from the suppliers or distributors through the final consumers to the governing bodies. The suppliers of the smoke evacuation systems consist of the company names such as CONMED Corp, Stryker, Medtronic, Olympus Corp, Johnson & Johnson, Zimmer Biomet Holdings Inc, and IC Medical. These vendors are fully engaged in the development of the advanced technologies needed in the smoke evacuation systems. In the case of the distributors of the smoke evacuation systems, the major ones include McKesson Corp, Medline Industries Inc, Henry Schein Inc, Surgical Holdings Inc, and B. Braun. The primary consumers or the hospitals responsible for the amplified demand for the smoke evacuation systems consist of Mayo Clinic, Cleveland Clinic, Mount Sinai Health System, Johns Hopkins Medicine, and the NHS Trusts. The miscellaneous groups responsible for the control in the market include EMA, FDA in the US, the regulatory body in the UK, and other regulatory bodies around the world.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Smoke Evacuation Systems Market, By Product

Within the product segment of the smoke evacuation systems market, the segment of smoke evacuation pencils and wands represents the major part of the market. A significant aspect of it is its flawless integration with electrosurgical procedures and the operating room environment, being easy to use. This helps the doctors to carry out tissue cutting or coagulation whilst the surgical smoke is captured at the same time, so that the surgical area can be clearly seen and the risk of exposure to dangerous plumes can be minimized. Their wide usage has been significantly facilitated by the fact that they are compatible with the existing electrosurgical generators, their costs being much lower than those of a standalone smoke evacuation system, and their use in a variety of surgical specialties such as general surgery, gynecology, orthopedics, and cosmetic procedures. Moreover, a greater emphasis on the safety of surgeons and staff, compliance with occupational health regulations, and the increasing number of minimally invasive surgeries keep on strengthening the demand for smoke evacuation pencils and wands.

Smoke Evacuation Systems Market, By Application

Among the various segments of applications of smoke evacuation systems market, laparoscopic surgery represents the largest share, which is attributed to the vast number of minimally invasive surgeries performed globally and the surgical smoke generation that significantly accompanies these surgeries. In laparoscopic surgeries, electrosurgical and energy devices are commonly used in a sealed abdominal cavity. Without effective smoke evacuation, the operation can be disrupted by loss of visualization, instability of pneumoperitoneum, and a decrease in the overall efficiency of the procedure. The increasing trend of laparoscopic surgeries in general surgery, gynecology, urology, and bariatric surgery departments, owing to the benefits like less patient trauma, shorter hospital stays, and quicker recovery, not only shows considerable demand but also potential for further development. On top of that, surgeons' awareness of their exposure to harmful surgical smoke and the necessity to abide by the operating room safety and occupational health requirements are the two factors that continue to push the use of smoke evacuation systems in laparoscopic surgeries.

Smoke Evacuation Systems Market, By End User

In the hospital segment of the smoke evacuation systems market, hospitals have the biggest share because of the large number of surgeries performed and their sophisticated operating room settings. Hospitals are the ones that carry out the most complex and risky surgeries that depend on the frequent use of electrosurgical and energy-based devices, hence producing the most surgical smoke and requiring even more efficient evacuation solutions. Having several operating rooms, a great number of highly trained surgical staff, and bigger capital funds for advanced medical technologies further facilitate the purchase. Also, compliance with occupational safety regulations, infection control standards, and regulatory guidelines is strictly enforced. Besides, the growing emphasis on healthcare workers' safety and improving operating room air quality are two other factors that are leading to the increased installation of smoke evacuation systems in hospitals.

REGION

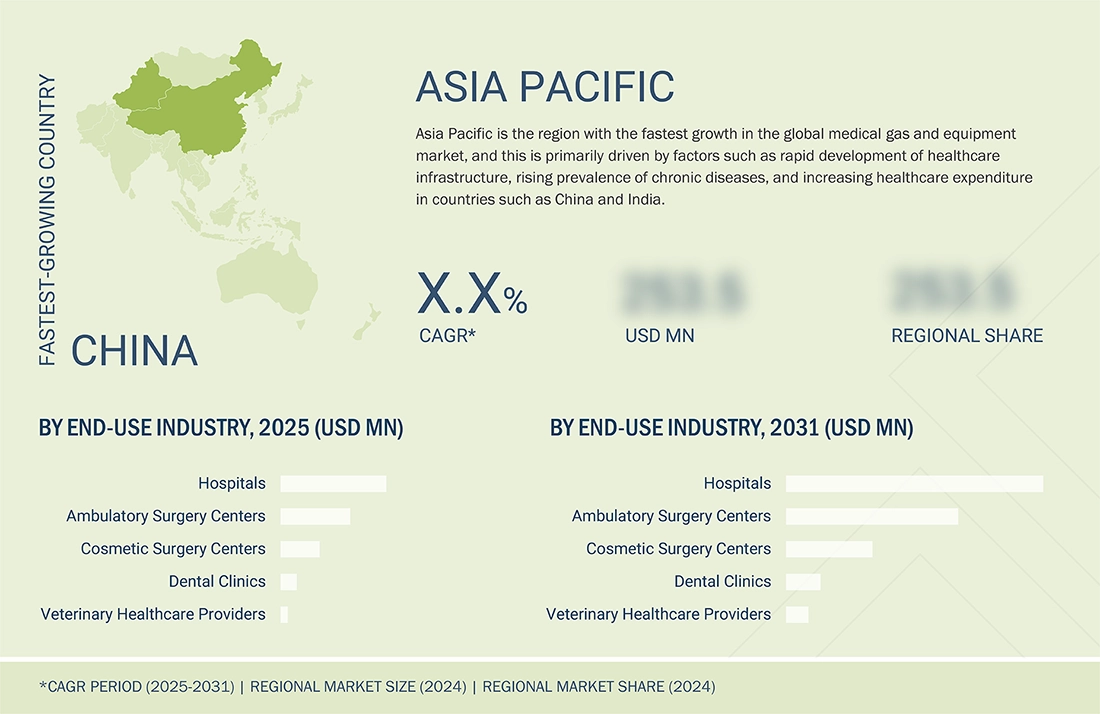

Asia Pacific to be fastest-growing region in global smoke evacuation systems market during forecast period

One of the major reasons behind Asia Pacific becoming the fastest-growing regional market for smoking evacuation systems is the healthcare infrastructure development, which has witnessed a sharp rise along with the increase in surgical volumes and the extensive use of minimally invasive and laparoscopic procedures across China, India, Japan, and South Korea. With the rising awareness about the health hazards of surgical smoke and the improvement of operating room safety standards, hospitals and ambulatory surgery centers are being encouraged to equip their facilities with smoke evacuation systems. In addition, the expansion in healthcare expenditure, the government's measures to renovate hospitals, and medical device manufacturers' activities at the global as well as regional levels are further assisting market growth. The surge in private healthcare facilities and medical tourism, coupled with a gradual move towards compliance with international surgical safety guidelines, is the other factor supporting Asia Pacific smoke evacuation systems market's strong growth predictions.

SMOKE EVACUATION SYSTEMS MARKET: COMPANY EVALUATION MATRIX

In the smoke evacuation systems market matrix, CONMED Corporation (US) (Star) and Medtronic (Ireland) (Star) lead with their global presence, strong brand recognition, and comprehensive portfolios of smoke evacuation systems. I.C. Medical Inc. (US) (Emerging Leader) is rapidly gaining traction with its versatile products, which offer Medical Gas and Equipment products for various therapeutic and diagnostic applications.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Conmed Corporation (US)

- Medtronic (Ireland)

- Stryker (US)

- Johnson & Johnson (US)

- Olympus Corporation (Japan)

- Danaher Corporation (US)

- Ecolab (US)

- Zimmer Biomet (US)

- Cooper Companies Inc (US)

- Utah Medical Products Inc (US)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size, 2025 | USD 0.20 Billion |

| Market Forecast, 2031 | USD 0.30 Billion |

| Growth Rate | CAGR of 7.5% |

| Actual data | 2024–2031 |

| Base year | 2024 |

| Forecast period | 2025–2031 |

| Units considered | Value (USD Million/Billion), Volume (Thousand Units) |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, Latin America, Middle East & Africa |

| Related Segment & Geographic Reports | APAC Smoke Evacuation Systems Market |

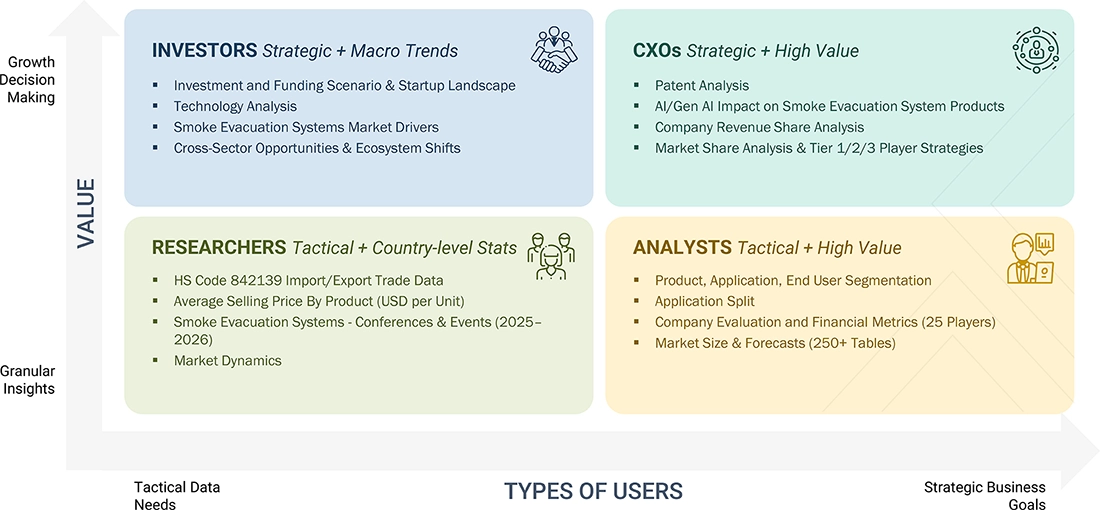

WHAT IS IN IT FOR YOU: SMOKE EVACUATION SYSTEMS MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Volume Analysis | Market assessment by volume (units) for dental equipment used in digital dentures ecosystem |

|

| Product Analysis | Further breakdown of other applications in the market | Insights into other applications involved in the market |

| Company Information |

|

Insights on market share analysis by country |

| Geographic Analysis |

|

Country level demand mapping for new product launches and localization strategy planning |

RECENT DEVELOPMENTS

- September 2024 : Alesi Surgical raised USD 6.28 million (GBP 5 million) in funding, led by Mercia Ventures, with contributions from IP Group and panakès partners, to hasten the development and commercialization of its own surgical smoke management solutions. The above information highlighted the significance of innovative technology in enhancing surgical procedures and, in this case, managing surgical smoke.

- August 2024 : The US FDA approval of the CONMED PlumeSafe X5 Smoke Management System added another regulatory-backed offering for the company in the surgical smoke evacuation technology space. The approval allowed for broader commercialization of the product in the US hospitals and ambulatory surgical centers.

Table of Contents

Methodology

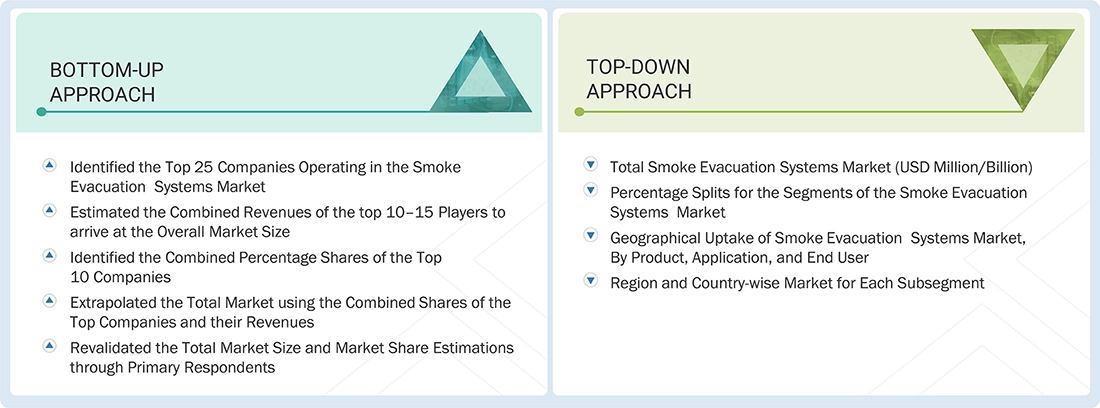

This study involved four major activities in estimating the current smoke evacuation systems market size. First, extensive secondary research was conducted to gather information on the market, including related and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

The secondary research process involved the widespread use of secondary sources, directories, databases (such as Bloomberg Businessweek, Factiva, and D&B Hoovers), white papers, annual reports, company house documents, investor presentations, and SEC filings of companies. Secondary research was used to identify and collect information useful for the extensive, technical, market-oriented, and commercial study of the smoke evacuation systems market. It was also used to obtain important information about the key players and market classification and segmentation according to industry trends to the bottom-most level, and key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

Primary Research

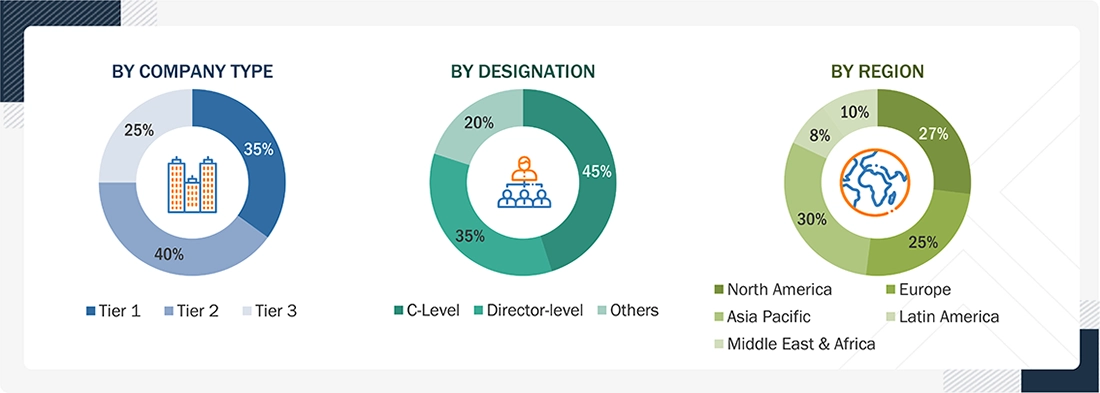

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing and sales directors, technology & innovation directors, and related key executives from various key companies and organizations operating in the smoke evacuation systems market. The primary sources from the demand side included industry experts, purchase & sales managers, doctors, and personnel from research organizations. Primary research was conducted to validate the market segmentation, identify key players in the market, and gather insights on key industry trends and key market dynamics.

A breakdown of the primary respondents for the smoke evacuation systems market is provided below:

Note 1: C-level primaries include CEOs, CFOs, COOs, and VPs.

Note 2: Other designations include sales managers, marketing managers, business development managers, product managers, distributors, and suppliers.

Note 3: Companies are classified into tiers based on their total revenue. As of 2023, Tier 1 = Greater than USD 10 billion, Tier 2 = USD 1 billion to USD 10 billion, and Tier 3 = Lesser than USD 1.00 billion

Source: MarketsandMarkets Analysis

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

For the global market value, annual revenues were calculated based on the revenue mapping of major product manufacturers and OEMs active in the global smoke evacuation systems market. All the major product manufacturers were identified at the global and/or country/regional level. Revenue mapping for the respective business segments/sub-segments was done for the major players. Also, the global smoke evacuation systems market was split into various segments and sub-segments based on the following:

- List of major players operating in the products market at the regional and/or country level

- Product mapping of various smoke evacuation systems manufacturers at the regional and/or country level

- Mapping of annual revenue generated by listed major players from smoke evacuation systems (or the nearest reported business unit/product category)

- Revenue mapping of major players to be covered

- Extrapolation of the revenue mapping of the listed major players to derive the global market value of the respective segments/subsegments

- Summation of the market value of all segments/subsegments to arrive at the global smoke evacuation systems market

The above-mentioned data was consolidated and added with detailed inputs and analysis from MarketsandMarkets and presented in this report.

Smoke Evacuation Systems Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall size of the global smoke evacuation systems market through the above-mentioned methodology, this market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact market value data for the key segments and subsegments. The extrapolated market data was triangulated by studying various macro indicators and regional trends from both demand- and supply-side participants.

Market Definition

A smoke evacuation system is a vacuum source with a single filter or multiple filters designed to evacuate surgical plume, smoke, and aerosol from the operative site, filter out the contaminants, and return the clean air into the operating room. These systems are made up of mainly five components, namely, filtration systems (trap smoke particles and allow the return of filtered air to the operation theater), vacuum sources (pull the air into a nozzle, through the tubing and the filter), disposable hoses and accessories (connect the unit to the surgical site), electronic control panels (control unit operations and eliminate interference with other devices), and activation devices (enabling the seamless integration in a system when used with electrocautery).

Key Stakeholders

- Smoke evacuation systems manufacturing companies

- Distributors, suppliers, and channel partners of smoke evacuation systems

- Group Purchase Organizations (GPOs)

- Veterinary healthcare service providers

- Healthcare service providers (hospitals, ambulatory surgery centers, cosmetic surgery centers, and clinics)

- Research institutions

- Market Research and Consulting Firms

- Research Institutes and Government Organizations

- Venture capitalists & investors

Report Objectives

- To describe, analyze, and forecast the smoke evacuation systems market by product, application, end user, and region

- To describe and forecast the smoke evacuation systems market for key regions—North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the growth of the smoke evacuation systems market.

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall smoke evacuation systems market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for market players in the moke evacuation systems market

- To profile key players and comprehensively analyze their market shares and core competencies in the smoke evacuation systems market

- To analyze competitive developments such as partnerships, collaborations, agreements & acquisitions, product launches, expansions, and R&D activities in the smoke evacuation systems market

- To benchmark players within the moke evacuation systems market using the proprietary 'Company Evaluation Matrix' framework, which analyzes market players on various parameters within the broad categories of business and product strategy

Available customizations:

With the given market data, MarketsandMarkets offers customizations as per your company’s specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakdown of the Rest of Europe smoke evacuation systems market into Russia, Switzerland, Denmark, Austria, and others

- Further breakdown of the Rest of Asia Pacific smoke evacuation systems market into South Korea, Taiwan, and others

- Further breakdown of the Rest of Latin America smoke evacuation systems market into Argentina, Colombia, Chile, Ecuador, and others

- Further breakdown of the Southeast Asia smoke evacuation systems market into Malaysia, Singapore, New Zealand, and others

Competitive Landscape Assessment

- Market share analysis, by region (North America, Europe, Asia Pacific, Latin America, Middle East, and Africa), which provides market shares of the top 3–5 key players in the smoke evacuation systems market

- Competitive leadership mapping for established players in the US

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Smoke Evacuation Systems Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Smoke Evacuation Systems Market