Sodium Benzoate Market

Sodium Benzoate Market by Application (Food & Beverages, Pharma, Cosmetics, Home Care) and Region (North America, Europe, Asia Pacific, Rest of the World) - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

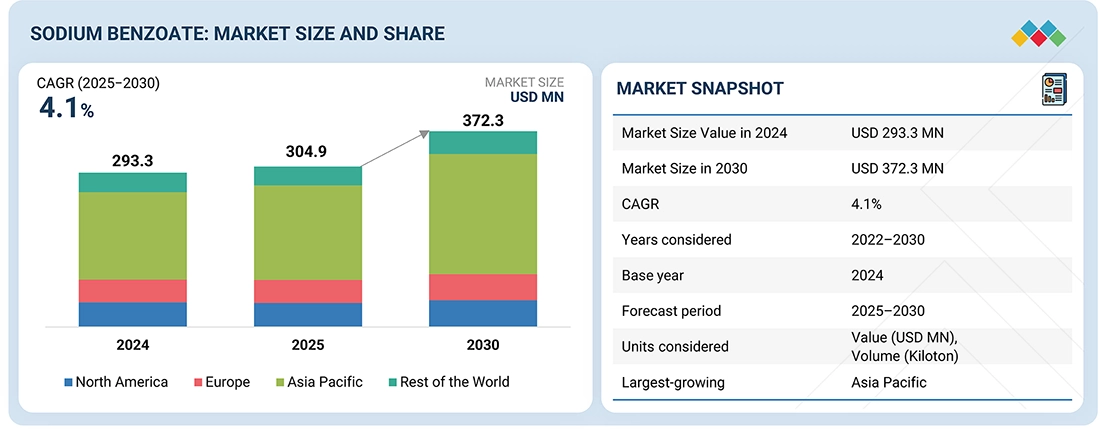

The sodium benzoate market is projected to reach USD 372.3 million by 2030 from USD 304.9 million in 2025, at a CAGR of 4.1% from 2025 to 2030. The market is driven by its extensive use as a preservative across multiple industries, particularly in food and beverages, where the rising demand for packaged, ready-to-eat, and long-shelf-life products has significantly boosted consumption.

KEY TAKEAWAYS

-

BY REGIONThe Asia Pacific is projected to register the highest CAGR of 4.9% during the forecast period.

-

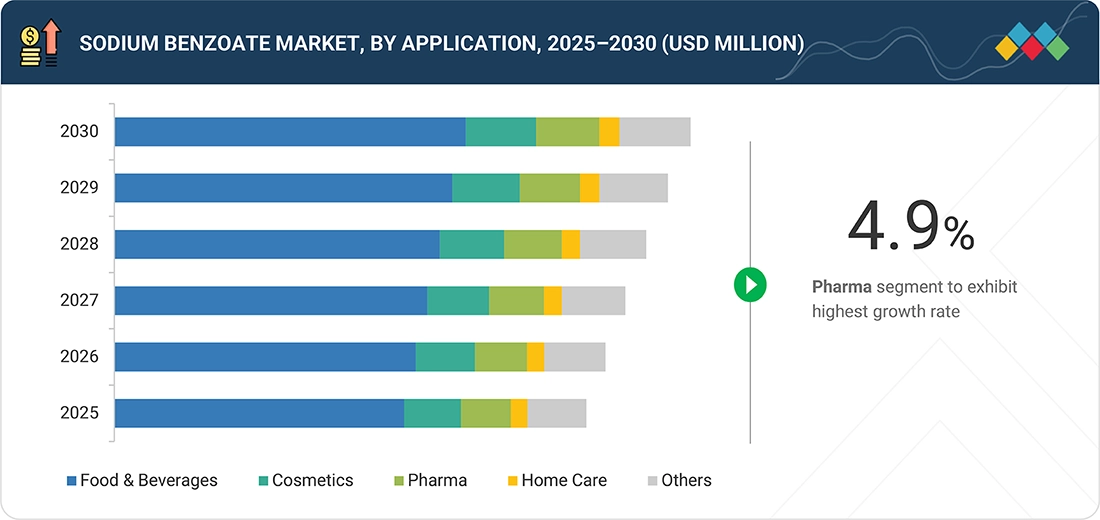

BY APPLICATIONThe food & beverages segment was the largest application of sodium benzoate in 2024, with a 61.3% market share in terms of value.

-

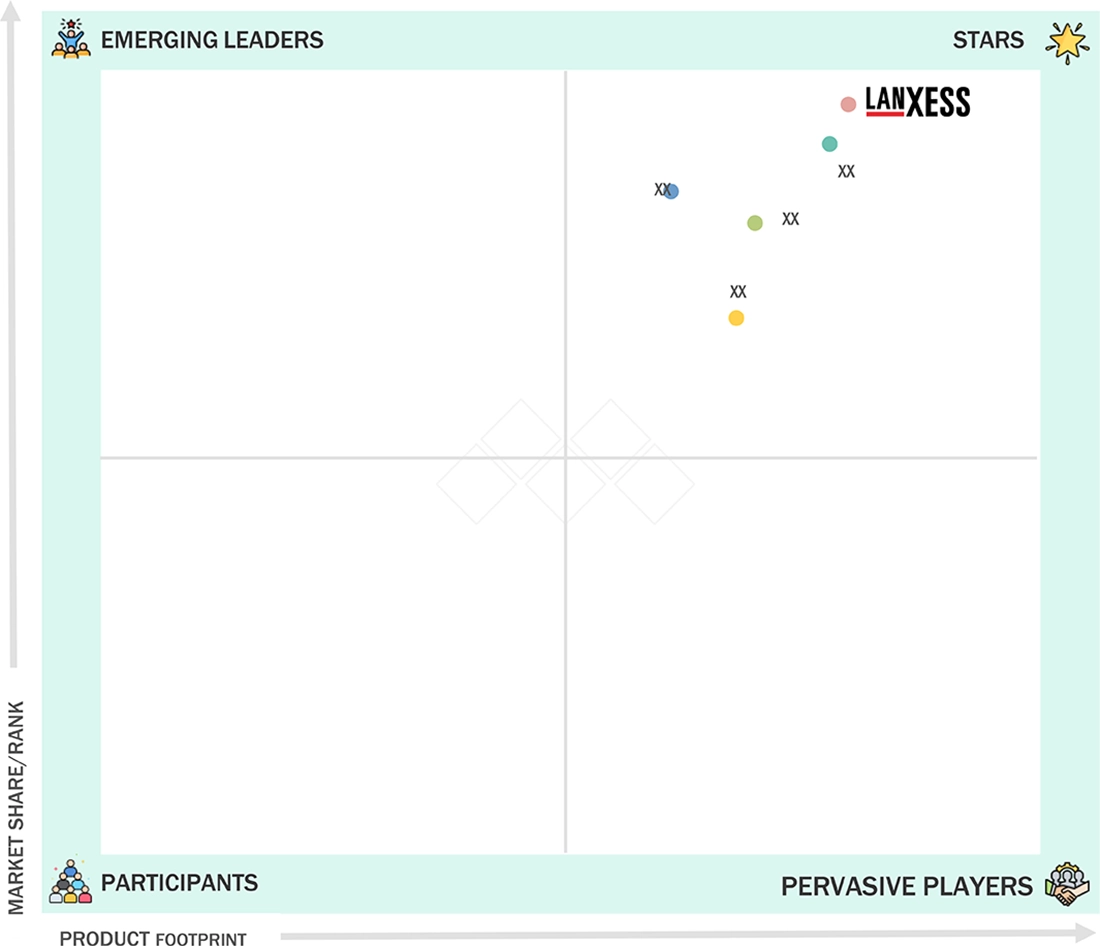

COMPETITIVE LANDSCAPELANXESS (Germany), Wuhan Youji Holdings Ltd (China), Eastman Chemical Company (US), Tianjin Dongda Chemical Group Co., Ltd (China), and Tengzhou Tenglong Food Technology Development Co., Ltd (China) are the major market players that have adopted both organic and inorganic strategies, including partnerships and expansions.

The sodium benzoate market is witnessing steady growth, driven by the growing demand in food & beverage applications and massive industrial growth in the Asia Pacific. New deals and developments, including strategic partnerships between OEMs and material suppliers, acquisitions, and investments, are reshaping the industry landscape.

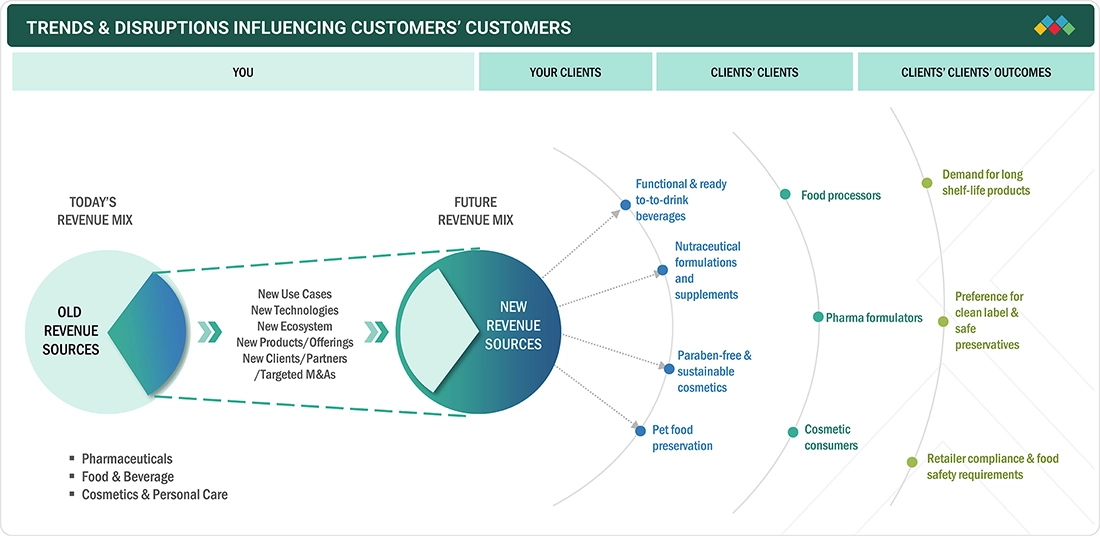

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on consumers' business emerges from customer trends or disruptions. Hot bets are the clients of sodium benzoate manufacturers, and target applications are the clients of sodium benzoate manufacturers. Shifts, which are changing trends or disruptions, will impact the revenues of end users. The revenue impact on end users will affect the revenue of hot bets, which will further affect the revenues of sodium benzoate manufacturers.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

•Rising demand for food and beverage preservatives

-

•Expanding use of sodium benzoate in pharmaceuticals

Level

-

•Growing shift toward natural preservatives

Level

-

•Growth prospects in animal feed segment of livestock industry

-

•Growing industrial applications

Level

-

•Regulatory restrictions

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rising demand for food and beverage preservatives

The escalating demand for food and beverage preservatives is one of the major factors propelling the sodium benzoate market growth. Manufacturers are dealing with the problem of unstable products and unsafe quality due to the ever-increasing global consumption of packaged food, ready meals, and convenience foods, and they are concerned about product life and quality during the long distribution process. Sodium benzoate, an already widely used and allowed (E211) preservative, is the key product with its involvement in the stoppage of bacteria, yeast, and fungi during the life cycle of acidic food and beverage products like soft drinks, juices, sauces, and pickles. It is the associated effectiveness at low doses, cost-efficiency, and wide compatibility with varied formulations that make it a sought-after preservative among producers. Furthermore, factors such as the urbanization trend, increased disposable incomes, and the rise of modern retailing in the emerging economies also stimulate the demand for preserved food products. Additionally, the acceptance by regulatory bodies like the FDA and EFSA for the use of sodium benzoate as a food-safe ingredient has added to the market confidence. Furthermore, the continuous development of clean-label and natural preservative formulations in which sodium benzoate is combined with other ingredients recognized as safe, is increasing the range of applications. All these factors lead to the steady growth of sodium benzoate in the global food and beverage sector.

Restraint: Growing shift toward natural preservatives

The transition to natural preservatives is becoming a major factor that limits the usage of sodium benzoate in the market. Increasing consumer concern over product contents and a growing inclination toward clean-label, chemical-free food and beverage consumption have prompted manufacturers to gradually abandon the use of artificial preservatives such as sodium benzoate and to adopt natural ones like rosemary extract, vinegar, salt, and plant-based antimicrobial compounds instead. Furthermore, the combination of regulatory pressures and stricter labeling for synthetic additives is forcing food and beverage manufacturers to switch to natural preservatives in their products. In the cosmetics & personal care sector, the shift toward “paraben-free” and “preservative-free” formulations gradually reduces the use of sodium benzoate, even though it has been proven safe and cost-effective as a preservative. The increasing demand for sustainability, transparency, and clean-label certifications as major factors influencing purchasing decisions is one of the reasons that the growing use of natural preservatives is likely to limit the growth potential of sodium benzoate, especially among the premium and organic product segments.

Opportunity: Growth prospects in animal feed segment of livestock industry

The sodium benzoate market can greatly benefit from the animal feed section of the livestock industry. The global demand for high-quality animal protein is increasing along with the concern for feed hygiene and safety; hence, sodium benzoate is being acknowledged as an effective preservative and mold inhibitor in compound feed formulations. It stops micro-organisms' growth, thus preventing spoilage and degradation of nutrients during storage and transportation, especially in humid or tropical areas where feed stability is a significant issue. The transition to antibiotic-free animal nutrition has made sodium benzoate even more relevant, as it possesses antimicrobial properties without being a cause for resistance to antibiotics. Major feed manufacturers are opting for sodium benzoate more and more to prolong the shelf life, keep the feed palatable, and enhance the quality of livestock and poultry feed overall.

Challenge: Regulatory restrictions

Sodium benzoate is a synthetic food additive that has been subjected to strict regulatory controls due to increasing scrutiny over such substances and preservatives. The regulations are mainly imposed by the authorities in the US and EU, which recognize it as safe to use. Its use is heavily controlled by the authorities in different regions, and the application of chemicals is heavily regulated due to its safety concerns and interactions. It is common for food and beverage products to have a maximum of 0.1% sodium benzoate, and manufacturers must be extra careful in their formulation to comply with the law and still achieve the desired quality. Furthermore, one of the major issues is the potential interaction of sodium benzoate with ascorbic acid (vitamin C) that leads to the creation of benzene in less than trace amounts, prompting the safety authorities to conduct further reviews and requiring the manufacturers to reformulate the products. One of the factors that makes it more difficult for producers to gain access to the international market is the difference in the regulatory frameworks between different regions. While countries in Europe, North America, and Asia are applying various standards for labeling, purity, and usage, they are facing the issue of high compliance costs. Moreover, in some cases, the stricter global standards for synthetic additives are making it difficult for the companies that rely on synthetic preservatives to keep the clean label trends influence at bay. Quality assurance, monitoring, and reformulation are the areas that they will have to keep investing in to remain competitive in the market.

Sodium Benzoate Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Used as a preservative (E211) in acidic foods and beverages such as soft drinks, fruit juices, pickles, jams, sauces, and salad dressings; prevents microbial spoilage and extends product shelf life | •Inhibits yeast, bacteria, and mold growth |

|

Used as an antimicrobial preservative in syrups, oral medications, and topical formulations; also serves as an excipient in certain formulations to stabilize active ingredients | •Extends product shelf life and stability |

|

Used as a preservative in lotions, creams, shampoos, and other personal care products, often replacing parabens in “clean-label” formulations | •Effective microbial control in water-based cosmetics |

|

Used as a corrosion inhibitor in automotive coolants, lubricants, and metalworking fluids to prevent oxidation and rust formation | •Enhances equipment lifespan and performance |

|

Acts as a feed preservative and mold inhibitor in livestock and poultry feed formulations, maintaining nutritional integrity | •Prevents mold and bacterial growth in feed storage |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The sodium benzoate market ecosystem consists of raw material suppliers (e.g., IGPL, Dow), manufacturers (e.g., LANXESS, Eastman Chemical), distributors (e.g., Graham Chemical, Vivochem), and end users (e.g., Cargill, Coca-Cola). Raw materials suppliers provide the basic chemicals needed for production. Manufacturers transform these materials into sodium benzoate. End users drive demand for industries like food & beverage, pharma, and cosmetics that use sodium benzoate in their products or processes, illustrating a complete flow from raw materials to finished goods in the industry. Collaborations across the value chain are key to innovation and market growth.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Sodium Benzoate Market, By Application

Based on application, the demand for sodium benzoate is mainly found in the pharmaceuticals industry, which is projected to be the fastest-growing segment of the sodium benzoate market during the forecast period. The rising demand for pharmaceutical products that are of good quality, stable, and with a long shelf-life has been the major argument for the increased use of sodium benzoate as a preservative and an anti-stabilizer. It is widely used in oral medicines, syrups, ointments, and skin treatments to prevent infection by keeping the product sterile and maintaining the product's effectiveness during the period of storage and distribution. The drug's effectiveness against both bacteria and fungi, and its excellent dissolving power and compatibility with many active pharmaceutical ingredients (APIs) have made it the preferred choice among pharmaceutical manufacturers. Moreover, the fact that it is listed in the U.S. Pharmacopeia (USP) and the European Pharmacopoeia (EP) indicates that it is acknowledged internationally and complies with the safety standards.

REGION

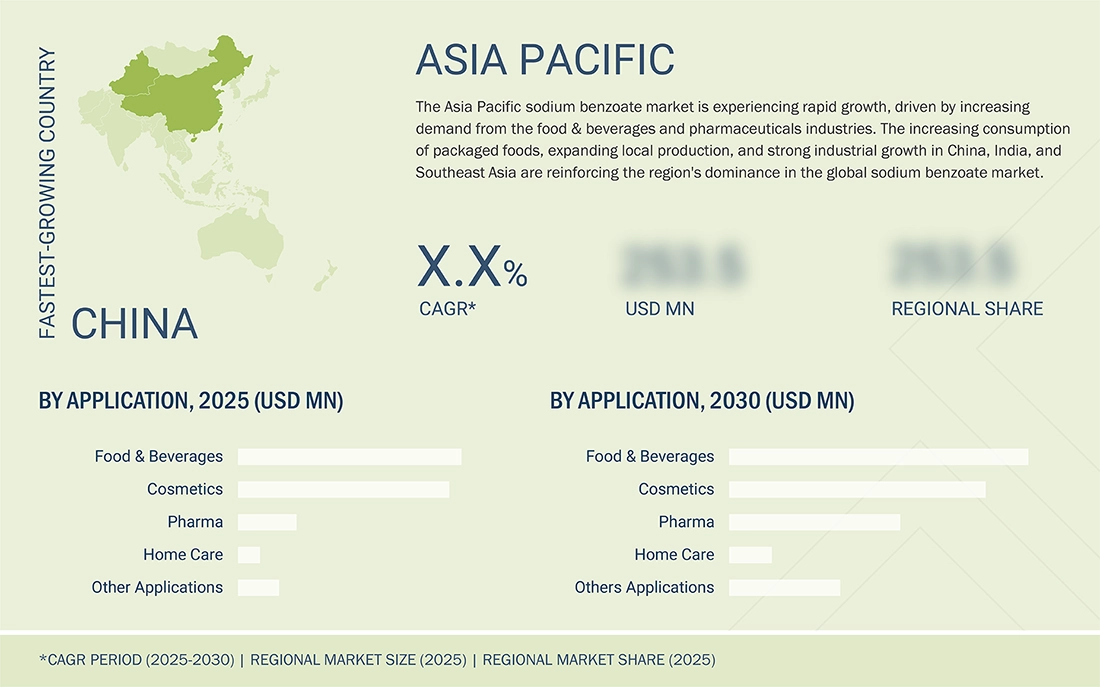

Asia Pacific to be fastest-growing region in global sodium benzoate market during forecast period

During the forecast period, the Asia Pacific region is projected to become the fastest-growing market for sodium benzoate, mainly due to rapid industrialization, urbanization, and the rise of the food & beverages, pharmaceuticals, and cosmetics segments, which are the key applications of sodium benzoate. The increasing population in this region, coupled with the increase in disposable incomes and the changes in dietary habits, has all contributed to the increase in demand for sodium benzoate, which is one of the most effective preservatives used in food and beverages. The pharmaceutical manufacturing base in countries like China, India, and South Korea is becoming more important as the use of sodium benzoate is widespread in drug formulations for its antimicrobial and stabilizing properties. The demand for sodium benzoate in the cosmetics & personal care industry is also growing in the region due to the consumers’ preference for safe, affordable, and long-lasting products. Besides, the availability of cheap raw materials, positive government policies, and the increase in export opportunities are consolidating the manufacturing capacity in the region.

Sodium Benzoate Market: COMPANY EVALUATION MATRIX

In the sodium benzoate market matrix, LANXESS (Star) leads with a strong market share and extensive product footprint, driven by its large sodium benzoate plant, which is adopted for food & beverage and other applications.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

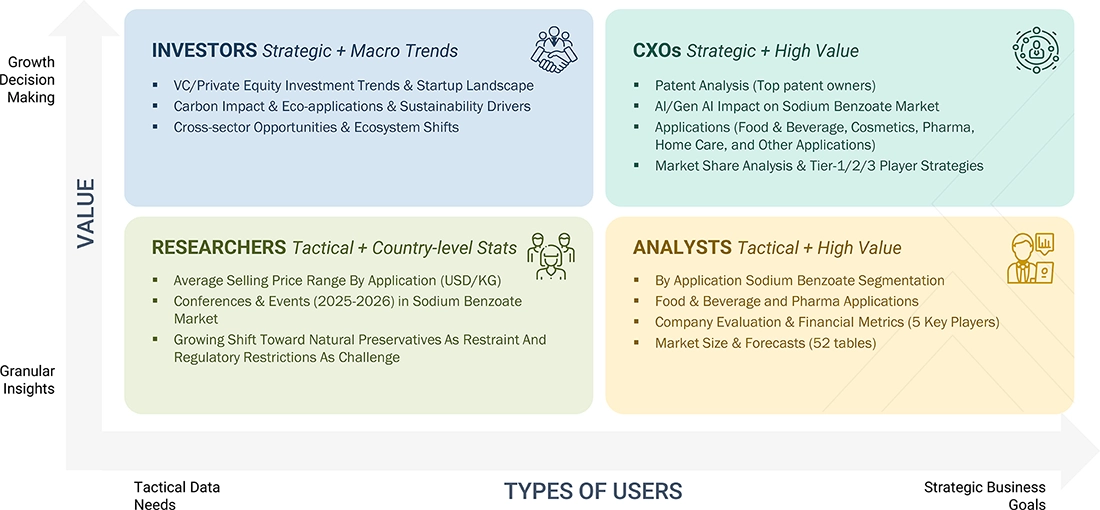

WHAT IS IN IT FOR YOU: Sodium Benzoate Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Food & Beverage | · Market sizing and consumption pattern analysis by application (soft drinks, sauces, bakery, dairy) | · Enable product positioning for cost-effective and regulatory-compliant preservatives |

| Pharmaceuticals & Healthcare | · End User mapping of sodium benzoate adoption in syrups, ointments, and injectables | · Enhance supplier visibility in regulated pharma markets |

| Cosmetics & Personal Care | · Lifecycle and safety evaluation of sodium benzoate in cosmetic emulsions | · Strengthen brand compliance with EU Cosmetic Regulation and FDA standards |

| Animal Feed & Agriculture | · Feed-grade sodium benzoate market sizing across Asia Pacific, Europe, and Latin America | · Support expansion into antibiotic-free feed additive markets |

RECENT DEVELOPMENTS

- January 2023 : Wuhan Youji established a joint venture with SINOPEC to increase the production capacity to 15KT/year for sodium benzoate and 60KT/year for benzoic acid.

- August 2021 : LANXESS acquired the microbial control business of IFF, one of the leading suppliers of antimicrobial active ingredients and formulations for material protection, preservatives, and disinfectants, thereby strengthening its specialty chemicals portfolio.

- August 2021 : Through the acquisition of Emerald Kalama, LANXESS broadened its preservatives portfolio with sodium and potassium benzoates marketed under the Kalama, Purox, and Kalaguard brands.

Table of Contents

Methodology

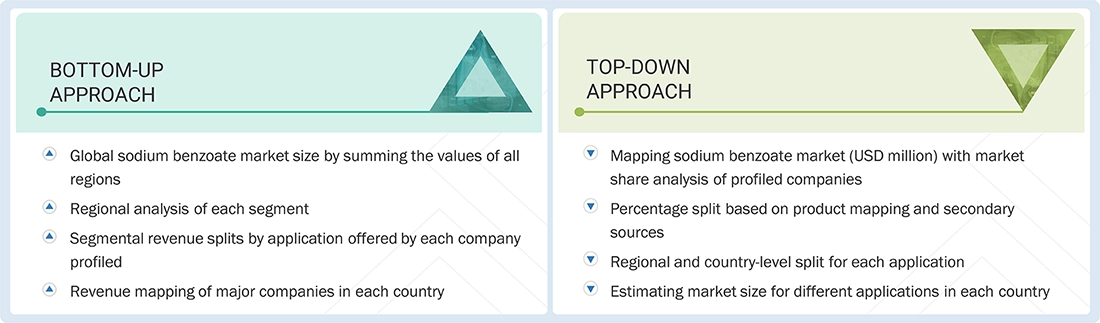

The study involved four major activities in estimating the current size of the sodium benzoate market exhaustive secondary research was conducted to collect information on the market, peer markets, and parent markets. The next step was to validate these findings, assumptions, and sizing with the industry experts across the sodium benzoate value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary sources for this research study included annual reports, press releases, and investor presentations of companies; white papers; certified publications; articles by recognized authors; gold- and silver-standard websites; sodium benzoate manufacturing companies, regulatory bodies, trade directories, and databases. The secondary research was mainly used to obtain key information about the industry’s supply chain, the pool of key players, market classification, and segmentation according to industry trends, down to the bottom-most level and regional markets. It was also used to obtain information about key developments from a market-oriented perspective.

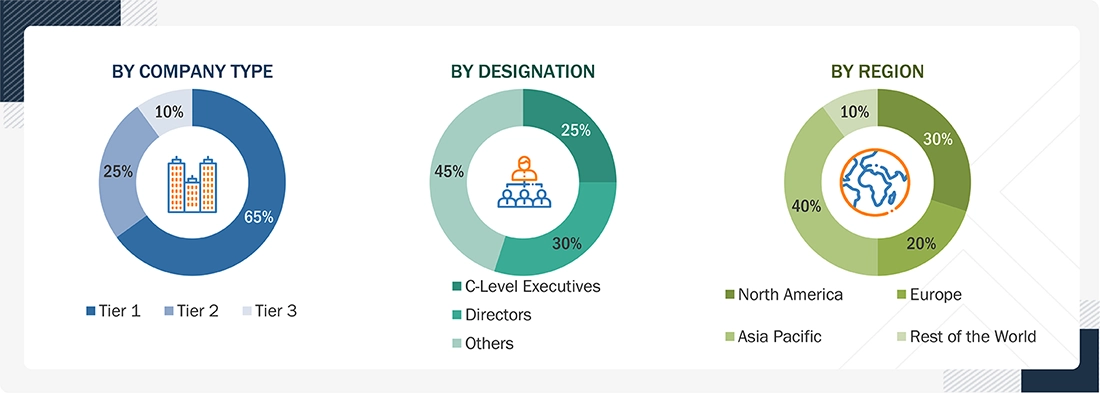

Primary Research

The sodium benzoate market comprises several stakeholders, such as raw material suppliers, technology support providers, sodium benzoate manufacturers, and regulatory organizations in the supply chain. Various primary sources from the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Primary sources from the supply side included industry experts such as chief executive officers (CEOs), vice presidents, marketing directors, technology and innovation directors, and related key executives from various companies and organizations operating in the sodium benzoate market. Primary sources from the demand side included directors, marketing heads, and purchase managers from various sourcing industries.

The following is the breakdown of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down and bottom-up approaches were used to estimate and validate the total size of the sodium benzoate market. These approaches were also used extensively to estimate the size of various dependent market subsegments. The research methodology used to estimate the market size included the following:

The following segments provide details about the overall market size estimation process employed in this study:

- The key players in the market were identified through secondary research.

- The market shares in the respective regions were identified through primary and secondary research.

- Primary and secondary research determined the value chain and market size of the sodium benzoate market in terms of value and volume.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research included studying the annual and financial reports of the top market players and interviewing industry experts, such as CEOs, VPs, directors, sales managers, and marketing executives, for key insights, both quantitative and qualitative.

Global Sodium Benzoate Market Size: Bottom-up Approach and Top-down Approach

Data Triangulation

The market was split into several segments and subsegments after arriving at the overall market size using the market size estimation processes as explained above. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the sodium benzoate market.

Market Definition

Sodium benzoate is a salt derivative of benzoic acid. It is prepared by neutralizing benzoic acid with sodium hydroxide. It is a versatile preservative with applications across various industries. It is used as a preservative in food and beverages to prevent food from molding and extend the shelf life of food and beverage products, such as carbonated drinks and soft drinks. The food & beverages segment is the major application of sodium benzoate, which is also used in cough syrups and other pharmaceutical liquids due to their antimicrobial properties. Sodium benzoate is used in cosmetics and home care products, including mouthwash and toothpaste.

Stakeholders

- Manufacturers of sodium benzoate

- Traders, distributors, and suppliers of sodium benzoate

- Government and research organizations

- Associations and industrial bodies

- Research and consulting firms

- R&D institutions

- Environment support agencies

- Investment banks and private equity firms

Report Objectives

- To analyze and forecast the market size of the sodium benzoate market in terms of value and volume

- To provide detailed information regarding the major factors (drivers, restraints, challenges, and opportunities) influencing the regional market

- To analyze and forecast the global sodium benzoate market based on application and region

- To analyze the opportunities in the market for stakeholders and provide details of a competitive landscape for market leaders

- To forecast the size of various market segments based on four major regions: the Asia Pacific, Europe, North America, and the Rest of the World, along with their respective key countries

- To track and analyze the competitive developments, such as acquisitions and investments in the market

- To strategically profile the key players and comprehensively analyze their market shares and core competencies

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Sodium Benzoate Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Sodium Benzoate Market