Sodium Tripolyphosphate Market

Sodium Tripolyphosphate Market by Application (Detergents & Cleaners, Food Processing Additives, Anticorrosion & Antiscale Agents, Ceramic Tiles, Dispersant & Pigment Stabilizer, Metal Treatment), Form, End-Use, Grade, and Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The global sodium tripolyphosphate (STPP) market is expected to grow from USD 1.10 billion in 2025 to USD 1.53 billion by 2030, acat a CAGR of 6.9% during this period. This growth in the STPP market is primarily driven by heightened demand from various sectors, including detergents, water treatment, and food processing industries. The rise in consumption of both household and industrial cleaning products, particularly in developing regions of the Asia Pacific, is a significant factor contributing to this growth. Furthermore, the demand for industrial water-softening agents and metal sequestration agents is also anticipated to boost the market. Although there are environmental concerns and regulations regarding phosphates, ongoing research and development focused on environmentally sustainable formulations and alternative STPP production methods will support long-term market growth.

KEY TAKEAWAYS

-

BY GRADEThe market is segmented by grade into industrial grade and food grade. The pharmaceutical grade segment is expected to be the fastest-growing during the forecast period. This growth is driven by its increasing use as a buffering agent and emulsifier in drug formulations, which helps ensure product stability and purity in pharmaceutical applications.

-

BY APPLICATIONThe applications in the market include detergents & cleaners, food processing additives, anticorrosion & antiscale agents, ceramic tiles, dispersant & pigment stabilizers, metal treatment, and other applications. Food processing additives are the fastest-growing application in the market during the forecast period due to their widespread use as preservatives and texturizing agents, enhancing the shelf life, moisture retention, and quality of processed food products.

-

BY FORMThe key forms in the STPP market include powder, granule, and liquid. The powder form segment is expected to be the largest during the forecast period due to its superior solubility, ease of handling, and widespread application in detergents, food processing, and water treatment industries.

-

BY MANUFACTURING PROCESSThe manufacturing processes in the STPP market are divided into two segments: the dry process and the wet/slurry process. Both processes are anticipated to grow due to the increasing demand for high-purity STPP in detergents and food applications. Additionally, the industry's emphasis on energy-efficient and cost-effective production technologies is contributing to this growth.

-

BY END-USEThe end uses in the market include household cleaning, industrial & institutional cleaning, food & beverages, agriculture, textile, pharmaceuticals, cosmetics, water treatment, and other end uses. The end-use segments are expected to grow due to their versatile properties as dispersing, emulsifying, and chelating agents, which enhance product performance and efficiency across diverse industrial and consumer applications.

-

BY REGIONThe STPP market covers Europe, North America, Asia Pacific, and the Rest of the World. Asia Pacific is the largest and fastest-growing region in the STPP market due to rapid industrialization, expanding detergent and food processing industries, and increasing demand for water treatment solutions driven by rising urbanization and population growth.

-

COMPETITIVE LANDSCAPEWENGFU GROUP CO. LTD. (China), Yuntianhua Co., Ltd. (China), Yunphos (China), Wuhan Inorganic Salt Chemical Plant (China), PhosAgro Group (Russia), and Yibin Tianyuan Group (China) are the leading manufacturers of STPP.

The market for STPP is expanding due to its increasing applications across various sectors, including food processing, water treatment, and ceramics. Its properties as a dispersing agent, emulsifying agent, and chelating agent make it an essential component in numerous industrial formulations. The rapid growth of the urban population and the rising demand for processed food and effective cleaning agents are driving the increased consumption of STPP. Additionally, advancements in phosphate production technology and growing environmental concerns are promoting the development of high-purity and efficient grades of STPP for a variety of applications.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

Evolving customer trends or market disruptions impact consumers' businesses. The growth of end-use industries, such as household cleaning, industrial and institutional cleaning, food and beverages, agriculture, textiles, pharmaceuticals, cosmetics, water treatment, and others, leads to the growing demand for STPP. These megatrends are expected to drive growth and increase the market's revenue.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Growing usage of STPP in the food processing sector

-

Continued household detergent consumption in Asia Pacific supports stable demand

Level

-

Stringent phosphorus limits restrict consumer detergent use in EU, Canada, and the US

-

Enhanced nutrient discharge regulations impose upstream compliance challenges

Level

-

Expansion in industrial & institutional detergents, ceramics, glass, flame retardants, and rubber manufacturing industries

-

Growing demand in ready-to-cook and cold-chain food sectors with recognized standards

Level

-

Increased likelihood of stricter regulations, especially in the EU wastewater sector

-

Supply chain vulnerability from geographically concentrated raw materials

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Growing usage of STPP in the food processing sector

The increasing adoption of STPP in the food processing sector is a powerful driver of the global STPP market, as it underpins a wide range of processed, ready-to-eat, and frozen food products. STPP is valued for its ability to improve product consistency, maintain moisture, and enhance the overall quality of food items, which has made it a preferred additive for manufacturers looking to meet modern consumer demands. Rising urbanization, busier lifestyles, and greater disposable incomes—particularly in regions like the Asia Pacific are accelerating the consumption of convenience foods, thereby creating a steady and growing demand for STPP. Furthermore, the expansion of food processing industries, including meat, seafood, poultry, and ready-to-cook foods, is driving the requirement for reliable and high-quality additives to ensure shelf life and food safety. This sustained demand encourages STPP producers to increase production capacity and invest in robust supply chains, reinforcing the compound’s central role in the food sector. In addition, evolving standards and regulations for processed foods further emphasize the need for consistent quality, indirectly promoting the use of STPP. Collectively, these factors make the food processing sector not just a significant consumer but a continuous engine fueling growth and stability in the STPP market.

Restraint: Enhanced nutrient discharge regulations impose upstream compliance challenges

Enhanced nutrient discharge regulations represent a significant restraint on the STPP market, as they impose additional compliance requirements on manufacturers and industrial users. STPP, being a phosphate-based compound, contributes to the total phosphorus load in wastewater, which can lead to eutrophication, algae blooms, and deterioration of aquatic ecosystems. To comply with stricter nutrient discharge limits, manufacturers often need to invest in advanced wastewater treatment technologies, modify production processes, or limit STPP usage in their formulations. These measures increase operational costs and complexity, particularly for detergent producers and industrial consumers such as water treatment plants, food processors, and other heavy-use sectors. In regions with stringent nutrient management regulations, such as parts of Europe and North America, these upstream compliance challenges can discourage high-volume STPP use, slow expansion into new applications, and constrain overall market growth. The need to balance regulatory compliance with product performance creates additional barriers, making enhanced nutrient discharge rules a critical restraint for the industry.

Opportunity: Expansion in industrial & institutional detergents, ceramics, glass, flame retardants, and rubber manufacturing industries

The expansion of industrial and institutional sectors such as detergents, ceramics, glass, flame retardants, and rubber manufacturing presents a significant growth opportunity for the STPP market. STPP is widely used in these industries due to its versatile functional properties: in industrial and institutional detergents, it enhances cleaning efficiency and water softening; in ceramics and glass manufacturing, it acts as a dispersing and binding agent, improving consistency and quality of the products; and in flame retardants and rubber applications, it helps improve performance characteristics and stability. As these sectors grow to meet rising industrial, commercial, and construction demands, the consumption of STPP increases correspondingly. Additionally, industrial applications often involve higher volumes than consumer detergents, providing a larger and more consistent market for manufacturers. The ongoing development and modernization of these industries, coupled with the need for reliable chemical additives to ensure product quality, create sustained opportunities for STPP producers to expand their market reach and diversify applications beyond traditional household detergent use.

Challenge: Supply chain vulnerability from geographically concentrated raw materials

Supply chain vulnerability arising from the geographical concentration of raw materials poses a significant challenge to the STPP market. STPP production relies on key raw materials, such as phosphate rock, which are often mined and processed in a limited number of countries. This concentration creates susceptibility to supply disruptions caused by geopolitical tensions, trade restrictions, natural disasters, or logistical bottlenecks. Any interruption in the supply of these essential inputs can lead to fluctuations in production, increased costs, and potential delays in meeting market demand. Additionally, reliance on concentrated sources limits flexibility for manufacturers and increases exposure to regional market risks, making it difficult to ensure a consistent and stable supply of STPP. Such vulnerabilities can constrain production planning, impact pricing, and affect the overall reliability of STPP supply chains, posing a significant barrier to sustained market growth.

Sodium Tripolyphosphate Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Produces technical-grade STPP used in synthetic detergents, water treatment, ceramics, paints, and varnishes. Offers 15 grades of powder and granular types to meet various industrial needs | Enhances detergent efficiency, improves water softening, boosts cleaning performance, and supports diverse industrial applications |

|

Manufactures industrial-grade STPP for applications in oil fields, papermaking, textile dyeing, petrochemical, metallurgical, tanning, and construction industries | Provides effective water softening and dispersion, improves processing efficiency, and supports chemical stability across industrial processes |

|

Supplies food-grade STPP used as a water retention and quality improvement agent in processed food products | Improves texture in food, enhances moisture retention, and acts as a softener and thickener to extend product shelf life |

|

Produces STPP for construction and coating industries, serving as dispersants for calcium sulfate slurries and structural enhancers in gypsum boards. Also used in paper coatings to improve pigment dispersion | Enhances structural integrity, improves coating uniformity, and promotes even dispersion of fillers for high-quality industrial materials |

|

Provides food-grade STPP for a wide range of processed food products, including dairy and meat applications, under its specialized phosphate product portfolio | Improves texture and binding in meat and dairy products, enhances water retention, and ensures consistent quality in food processing |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The STPP ecosystem consists of raw material suppliers (e.g., Nutrien, OCP, Vinipul Chemicals Pvt. Ltd.), STPP producers (e.g., PhosAgro Group, Innophos, Hubei Xingfa Chemicals Group Co., Ltd.), distributors (e.g., Riverland Trading, Wego Chemical Group), and end users (e.g., Henkel, Kao Corporation, PPG Industries). STPP is used in various end-uses such as household cleaning, industrial & institutional cleaning, food & beverages, agriculture, textile, pharmaceuticals, cosmetics, and water treatment.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Sodium Tripolyphosphate Market, by Application

The STPP market is primarily driven by the food processing additives segment, due to its versatility as a preservative, emulsifier, and moisture retainer. STPP plays a crucial role in enhancing the texture and shelf life of meat, fish, and poultry, which are essential for meeting the global demand for pre-cooked and instant foods. Rapid urbanization, rising incomes, and changing eating habits are further contributing to the increased use of STPP in packaged food production. Additionally, the development of cold chain logistics and the export of food in developing countries are significant factors driving demand. Food manufacturers increasingly rely on STPP to enhance product quality and maintain nutrient stability during storage and transportation. Moreover, the growing demand for convenience foods and the rise of fast-food restaurants are also key factors promoting its use in food-grade applications worldwide.

Sodium Tripolyphosphate Market, by Form

The granular form of STPP offers superior handling, storage stability, and a wide range of applications, making it the fastest-growing market segment among all forms of STPP. Granular STPP effectively controls solubility and produces less dust, making it ideal for industries such as detergents, ceramics, and food processing. The uniform particle size ensures consistent mixing in formulations, enhancing the efficiency and performance of the final products. The increasing use of granular STPP in automatic dishwashing and laundry detergents—where precise dosing is essential—is driving demand in this market. Additionally, industries prefer the granule form for easier transportation and a reduced risk of contamination compared to powdered forms. Growth in detergent production facilities in the Asia Pacific and the Middle East are further fueling consumption. Furthermore, advancements in granulation technologies have enabled manufacturers to produce high-purity, free-flowing granules, thereby strengthening their position in the global STPP market.

REGION

Asia Pacific to be fastest-growing region in global STPP market during forecast period

The STPP market is primarily driven by the Asia Pacific region, which benefits from rapid industrialization, urbanization, and significant manufacturing activities in major economies like China, India, Japan, and South Korea. The consumption of household and industrial detergents is a key factor in this growth, fueled by increased awareness of hygiene and higher living standards among residents. Additionally, the food processing industry is a significant driver of STPP usage, especially in the food-grade sector, as it experiences growth due to changing eating habits and a rise in seafood and meat exports. The region also has strong sectors in ceramics, textiles, and water treatment, contributing further to the demand for STPP. Furthermore, government initiatives promoting industrial wastewater treatment and infrastructure development are leading to increased use of STPP as a dispersing and sequestrant agent. With abundant raw materials and low-cost production facilities, the Asia Pacific region has become the world's manufacturing hub for STPP, which explains its rapid growth rate compared to other regions.

Sodium Tripolyphosphate Market: COMPANY EVALUATION MATRIX

In the STPP market matrix, Wengfu Group (Star) leads with its integrated supply chain to maximize market reach and product diversification. This includes producing a broad product portfolio encompassing both technical and food-grade phosphoric acid, alongside a range of phosphate salts and fertilizers such as STPP, serving diverse applications, including food, pharmaceutical, and agricultural sectors. Aditya Birla Chemicals (Emerging Leader) is gaining visibility with its industrial and food phosphates used in food processing, paints, detergents, cleaning and sanitizing, ceramics, and water treatment.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 1.03 BN |

| Market Forecast in 2030 (Value) | USD 1.53 BN |

| CAGR (2025–2030) | 6.9% |

| Years Considered | 2021–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Million), Volume (Kiloton) |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered | By Grade (Industrial Grade and Food Grade) |

| Regions Covered | North America, Europe, Asia Pacific, and the Rest of the World |

WHAT IS IN IT FOR YOU: Sodium Tripolyphosphate Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Food Processing Industry | Assess STPP functionality in meat, seafood, and poultry preservation; benchmark regional regulations and purity grades | Support clients with optimized formulations, ensure compliance with FDA/EU food additive standards |

| Detergents & Cleaners | Evaluate STPP performance as a builder agent; compare with eco-friendly alternatives | Enable clients to balance cleaning efficiency and environmental compliance |

| Water Treatment | Analyze STPP role in softening and corrosion inhibition; map industrial consumption patterns | Help companies identify high-demand sectors and sustainable substitution opportunities |

| Industrial & Ceramic Applications | Study STPP use in ceramics, textiles, and oilfield chemicals; assess cost-performance benefits | Strengthen client positioning in high-value industrial-grade applications |

RECENT DEVELOPMENTS

- March 2024 : Prayon launched a unique low-sodium phosphate salt solution branded under the name Carfosel. Its properties not only enhance the appearance, color, and texture of seafood such as shrimp or fish but also offer producers a low-sodium option that contributes to good health. With this new solution, sodium levels can now be as low as less than 480 mg/100 g of shrimp, revolutionizing seafood processing.

Table of Contents

Methodology

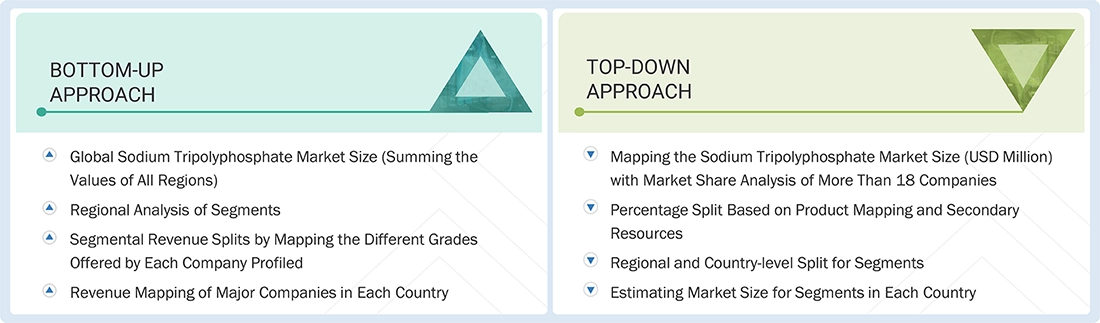

The research encompassed four primary actions in assessing the present market size of sodium tripolyphosphate (STPP). Comprehensive secondary research was conducted to gather information on the market, the peer market, and the parent market. The subsequent stage involved corroborating these findings, assumptions, and dimensions with industry specialists throughout the STPP value chain via primary research. The total market size is ascertained with both top-down and bottom-up methodologies. Subsequently, market segmentation analysis and data triangulation were employed to ascertain the dimensions of the market segments and subsegments.

Secondary Research

The research approach employed to assess and project the market size begins with the collection of revenue data from prominent suppliers using secondary research. In the course of secondary research, many secondary sources, such as D&B Hoovers, Bloomberg BusinessWeek, Factiva, the World Bank, and industry magazines, were utilized to identify and compile information for this study. The secondary sources comprised annual reports, press releases, and investor presentations from corporations, white papers, accredited periodicals, writings by esteemed authors, announcements from regulatory agencies, trade directories, and databases. Vendor offerings have been considered to ascertain market segmentation.

Primary Research

The STPP market comprises several stakeholders, such as manufacturers, suppliers, traders, associations, and regulatory organizations, in the supply chain. The demand side of this market is characterized by the development of detergents & cleaners, food processing additives, anticorrosion & antiscale agents, ceramic tiles, dispersant and pigment stabilizer, metal treatment, and other applications. Advancements in technology characterize the supply side. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

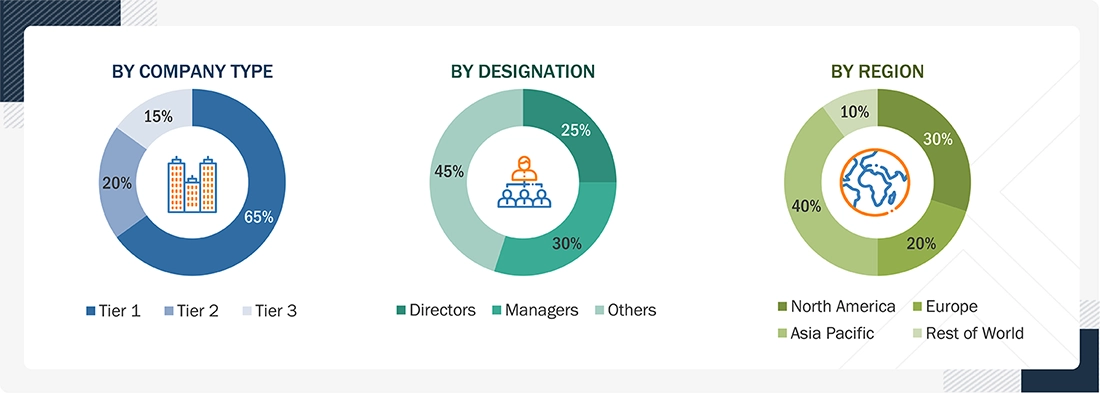

The following is the breakdown of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the STPP market. These methods were also used extensively to determine the size of various subsegments in the market. The research methodology used to estimate the market size included the following:

- The key players were identified through extensive primary and secondary research

- The value chain and market size of the STPP market, in terms of value, were determined through primary and secondary research

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data

- The research included the study of reports, reviews, and newsletters of top market players, along with extensive interviews for opinions from key leaders, such as CEOs, directors, and marketing executives

Global Sodium Tripolyphosphate Market Size: Bottom-up and Top-down Approach

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakdown procedures were employed, wherever applicable. The market size was calculated globally by summing up the country-level and regional-level data.

Market Definition

STPP is a white, crystalline inorganic compound widely recognized for its role as a builder in detergents and cleaning products. It functions as a chelating agent, binding calcium and magnesium ions to enhance cleaning efficiency and prevent scale formation. Beyond detergents, STPP is also used in the food industry as a preservative, emulsifier, and moisture-retaining agent, as well as in ceramics, water treatment, and various industrial processes as a dispersing and buffering agent. Its versatility, chemical stability, and ability to improve product performance make it a critical additive across multiple end-use sectors.

Stakeholders

- Sodium Tripolyphosphate Manufacturers

- Sodium Tripolyphosphate Suppliers

- Sodium Tripolyphosphate Traders, Distributors, and Suppliers

- Investment Banks and Private Equity Firms

- Raw Material Suppliers

- Government and Research Organizations

- Consulting Companies/Consultants in the Chemicals and Materials Sectors

- Industry Associations

- Contract Manufacturing Organizations (CMOs)

- NGOs, Governments, Investment Banks, Venture Capitalists, and Private Equity Firms

Report Objectives

- To define, describe, and forecast the size of the global STPP market in terms of volume and value

- To provide detailed information regarding the key factors, such as drivers, restraints, opportunities, and industry-specific challenges, influencing the growth of the global STPP market

- To analyze and forecast the size of various segments (raw material and application) of the STPP market based on four major regions—North America, Asia Pacific, Europe, and the Rest of the World, along with key countries in each of these regions

- To strategically profile the key players in the market and comprehensively analyze their core competencies

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Sodium Tripolyphosphate Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Sodium Tripolyphosphate Market