Solid Rocket Motors Market Size, Share and Trends, 2025 To 2030

Solid Rocket Motors Market by Platform (Missiles, Rocket Artillery, Space Launch Vehicles), End User (Government & Defense, Commercial), Component (Propellants, Nozzle, Igniter, Motor Casing) and Region - Global Forecast to 2029

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The Solid Rocket Motors Market projected to reach USD 10.00 billion by 2029 at a CAGR of 8.1%. The volume of Solid rocket motors by platform is projected to grow from 72,136 (In units) in 2024 to 95,859 (In units) by 2029. The growth of the Solid Rocket Motors Market is driven by the requirement for high-thrust, low-maintenance propulsion in defense applications, where solid rocket motors provide rapid readiness and long storage life. Increasing satellite launch activity and expanding commercial and government space programs further support adoption due to their operational simplicity and reliable performance.

KEY TAKEAWAYS

-

By RegionThe Asia Pacific solid rocket motors market accounted for a 9.4% revenue share in 2024.

-

By PlaformBy platfrom, the missiles segment is expected to register the highest CAGR of 6.8%.

-

By Component TypeBy Component tpye, the Motor Casing segment is projected to grow at the fastest rate from 2024 to 2029.

-

By End-use ApplicationBy End-use application, the Government and Defense segment will grow the fastest during the forecast period.

-

COMPETITIVE LANDSCAPE - KEY PLAYERSCompany Northrop Grumman, L3Harris Technologies, Inc, and RAFAEL Advanced Defense Systems Ltd were identified as some of the star players in the Solid Rocket Motors Market (global), given their strong market share and product footprint.

-

COMPETITIVE LANDSCAPE - START UPSCompanies Evolution Space, Bayern-Chemie Gmbh, and Ultramet, among others, have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders

The solid rocket motors market is driven by rising demand for high-thrust, low-maintenance propulsion in defense missions and increasing satellite launch activity, supported by solid rocket motors’ operational simplicity, reliability, and long storage life. Future growth of the solid rocket motors market will be shaped by expanding defense modernization programs and rising commercial space activity, driving sustained demand for reliable, high-thrust solid propulsion systems.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on customers' business in the solid rocket motors market is being driven by shifts in defense and space programs and changes in regulatory and technology priorities. Growing demand for tactical and ICBM systems, hybrid and green propulsion requirements, and reusable launch vehicles is reshaping procurement and investment decisions. Advances in materials, propellant techniques, and cleaner propulsion solutions are influencing.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Increasing adoption of solid rocket motors for defense platforms and applications

-

Increasing number of space missions by government and private organizations

Level

-

High development costs

-

Compliance with government policies

Level

-

Expanding space exploration and green propulsion adoption

-

Innovations in design of solid rocket motors and enhancement in specific impulse

Level

-

Supply chain management issues

-

Dual-use technology, export restrictions, and environmental compliance impacting production and R&D

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Increasing adoption of solid rocket motors for defense platforms and applications

The adoption of solid rocket motors is accelerating as defense programs prioritize stable, high-energy propulsion for tactical systems, ballistic missiles, and rapid-response platforms. Their long storage life, compact design, and high thrust output make them suitable for modern military requirements, especially as geopolitical tensions drive investment in resilient missile capabilities. Government initiatives to expand domestic manufacturing capacity and strengthen supply chains further reinforce demand for advanced SRM technologies across defense applications.

Restraint: High development costs

Solid Rocket Motors development remains capital-intensive due to complex engineering, specialized materials, and extensive testing required to meet defense and aerospace performance standards. High costs associated with precision manufacturing, safety compliance, and iterative testing limit market entry for smaller players and slow innovation cycles. These financial barriers compel many regions and companies to rely on established suppliers, reinforcing cost and competitiveness challenges across the SRM ecosystem.

Opportunity: Expanding space exploration and green propulsion adoption

Solid rocket motors are positioned to benefit from rising space exploration activities and increasing demand for reliable booster systems in launch vehicles. Growing emphasis on mission reliability and payload capacity is driving investments in SRM-based propulsion for heavy-lift and orbital applications. At the same time, regulatory shifts toward green propulsion are encouraging the development of lead-free, environmentally compliant propellants, opening new market prospects as agencies and private players adopt sustainable space technologies.

Challenge: Supply chain management issues

The industry faces significant supply chain pressures due to dependence on a limited supplier base for specialty materials and energetics required in SRM production. Capacity constraints, material shortages, and disruptions caused by geopolitical conflicts hinder timely procurement and restrict production scalability for defense and space programs. Companies are responding through supplier diversification, dual-source manufacturing, and advanced production methods, but bottlenecks continue to challenge delivery schedules and operational readiness.

SOLID ROCKET MOTORS MARKET SIZE, SHARE AND TRENDS, 2025 TO 2030: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Applied advanced 3D printing to streamline SRM manufacturing and address supply chain constraints | Improved production scalability, reduced delays, and enhanced mission-specific motor performance |

|

Employed additive manufacturing to accelerate and lower the cost of SRM production for tactical needs | Shortened manufacturing timelines, reduced costs, and enabled rapid design adjustments |

|

Developed the BOLE motor to improve SLS payload capacity through advanced materials and lightweight design | Higher total impulse and strengthened payload capability for future space missions |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The solid rocket motors market ecosystem is structured around platform manufacturers, defense contractors, and specialized propulsion providers that support the full development and integration cycle. Core participants deliver SRM systems, materials, and manufacturing technologies, while solution providers contribute propellants, energetic components, and mission-specific enhancements. Supporting functions such as data analytics, simulation, regulatory compliance, and service providers enable efficient production and operational reliability. This interconnected network strengthens supply capability and supports growing requirements across defense and space applications.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Solid Rocket Motors Market, By Platform

IN 2024, Missiles dominate the platform segment because they remain the primary and most consistent application area for solid rocket motors, supported by ongoing investments in tactical, strategic, and missile-defense systems. Rising geopolitical tensions, modernization of existing arsenals, and expansion of long-range and high-precision weapon programs continue to drive sustained demand for advanced Solid Rocket Motors technologies within missile platforms.

Solid Rocket Motors Market, By End User

Government and defense agencies lead the end-user segment as they are the principal buyers of solid rocket motors for missile development, strategic deterrence programs, and national space initiatives. Their long-term procurement cycles, dedicated defense budgets, and policy focus on strengthening domestic missile manufacturing and supply chain resilience reinforce the segment’s dominance.

Solid Rocket Motors Market, By Component

Motor casting represents the largest component segment because it is the structural foundation of solid rocket motors and requires specialized materials, controlled manufacturing environments, and high-precision engineering. Its direct impact on motor performance, safety, thermal resistance, and overall integration across missile and launch platforms makes it the most critical and resource-intensive part of SRM production, driving its leadership in the component mix.

REGION

Asia Pacific to be fastest-growing region in global aerospace materials market during forecast period

The Asia Pacific aerospace materials market is expected to register the highest CAGR during the forecast period, driven by accelerated naval modernization, expanding commercial shipbuilding, and increasing investment in electric and hybrid propulsion systems. Strong policy support for cleaner maritime operations and rising regional manufacturing capabilities are further strengthening adoption. These factors collectively position the region as a key driver of demand for advanced marine battery technologies.

SOLID ROCKET MOTORS MARKET SIZE, SHARE AND TRENDS, 2025 TO 2030: COMPANY EVALUATION MATRIX

In the aerospace materials market matrix, Northrop Grumman (Star) leads with a strong market presence and a broad production footprint, supported by its advanced propulsion technologies and proven SRM systems widely integrated into defense and space programs. The company’s capabilities in high-thrust motors, composite casings, and mission-specific propulsion solutions reinforce its leadership across major missile and launch vehicle platforms. Bayern-Chemie Gmbh (Emerging Leader) is strengthening its position in the solid rocket motors market through advanced propulsion technologies and mission-specific solutions for modern missile systems. With rising demand for high-efficiency and precision propulsion, the company shows strong potential to progress toward the leaders’ quadrant.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Northrop Grumman (US)

- L3Harris Technologies Inc. (US)

- China Aerospace Science and Technology Corporation (China)

- Nammo AS (Norway)

- RAFAEL Advanced Defense Systems Ltd. (Israel)

- Kratos Defense & Security Solutions, Inc. (US)

- Anduril Industries (US)

- United Launch Alliance, L.L.C (US)

- Mitsubishi Heavy Industries, Ltd. (Japan)

- Xbow (US)

- Ursa Major Technologies, Inc. (Finland)

- Avio SPA (Italy)

- Roxel Group (France)

- IHI Corporation (Japan)

- NOF Corporation (Japan)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 6.79 Billion |

| Market Forecast in 2039 (Value) | USD 10.00 Billion |

| Growth Rate | CAGR of 8.1% from 2024-2029 |

| Years Considered | 2022-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | Value (USD Million/Billion), Volume (Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Europe, Asia Pacific, Middle East, Rest of the World |

WHAT IS IN IT FOR YOU: SOLID ROCKET MOTORS MARKET SIZE, SHARE AND TRENDS, 2025 TO 2030 REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Access to cost information of solid rocket motor components | Provide component-level cost data for the last 5 years, segmented by platform | Enables detailed cost benchmarking, supports budgeting and procurement analysis, and enhances report decision value |

RECENT DEVELOPMENTS

- June 2022 : Northrop Grumman Corporation secured a multi-year contract exceeding USD 2 billion from United Launch Alliance (ULA) to boost the production of its GEM 63 and GEM 63XL solid rocket boosters, supporting Amazon’s Project Kuiper and other ULA customers, while expanding and modernizing its manufacturing facilities.

- April 2023 : Aerojet Rocketdyne secured a cooperative agreement valued at USD 215.6 million from the Department of Defense (DoD) to modernize and expand its solid rocket motor production facilities across three sites. Funded by the Additional Ukraine Supplemental Appropriations Act, the initiative aimed to address the growing demand for tactical missile systems.

- August 2024 : Nammo partnered with Raytheon, an RTX business, to scale up the production of solid rocket motors in its Florida facility. The expansion, expected to be operational by 2027, introduced manufacturing lines to enhance domestic production, ensuring a reliable supply of solid rocket motors for US and allied defense systems.

- June 2024 : Anduril Industries secured its first Pentagon contract to design and test second-stage rocket motors for the US Navy’s Standard Missile-6 (SM-6), a critical defense system against air, surface, and hypersonic threats. The contract is expected to be valued at USD 19 million.

- June 2024 : Xbow secured contracts worth USD 7.3 million to develop solid rocket motors for the US Navy’s Standard missile program. The first contract to develop Mk 72 booster motors was valued at USD 3.3 million. The second contract to develop Mk 104 second-stage motors was valued USD 4 million

Table of Contents

Methodology

This research study involved the extensive use of secondary sources, directories, and databases, such as D&B Hoovers, Bloomberg Businessweek, and Factiva, to identify and collect information relevant to the Solid Rocket Motors market. Primary sources included industry experts from the core and related industries, as well as preferred suppliers, manufacturers, solution providers, technology developers, alliances, and organizations related to all the segments of this industry’s value chain. All primary sources were interviewed to obtain and verify critical qualitative and quantitative information and assess prospects for market growth during the forecast period.

Secondary Research

The share of companies in the Solid Rocket Motors market was determined using secondary data made available through paid and unpaid sources and analyzing product portfolios of major companies in the Airport Information Systems market. These companies were rated based on the performance and quality of their products. These data points were further validated by primary sources.

Secondary sources referred to for this research study on the Solid Rocket Motors market included financial statements of companies offering and developing Solid Rocket Motors and information from various trade, business, and professional associations, among others. Secondary data was collected and analyzed to determine the total size of the Solid Rocket motors market, which primary respondents further validated.

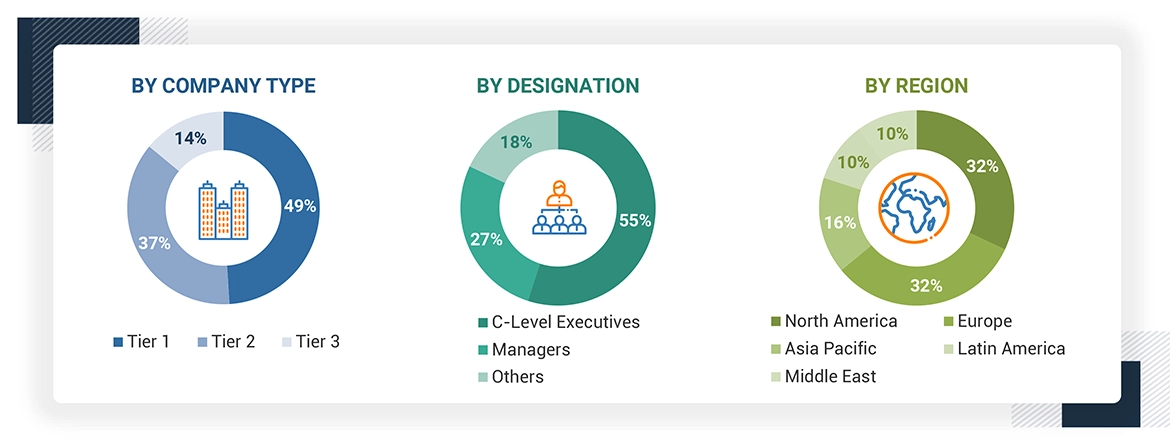

Primary Research

Extensive primary research was conducted after obtaining information about the current scenario of the Solid Rocket Motors market through secondary research. Several primary interviews were conducted with market experts from the demand and supply sides across North America, Europe, Asia Pacific, the Middle East, and Latin America. This primary data was collected through questionnaires, emails, and telephonic interviews. In the primary research process, varied primary sources from the supply and demand sides were interviewed to get qualitative and quantitative information on the market. Primary sources from the supply side include different industry experts like vice presidents, directors, regional managers, technology providers, product development teams, distributors, and end users.

Primary research has been done through interviews to get information that includes market statistics, revenue collection data from the products and services, and market breakups, size estimations, market forecasting, and data triangulation. Through primary research, the trends of technology, application, platform, and region were also understood. Demand-side stakeholders, such as CXOs, production managers, engineers, and installation teams of end users of Solid Rocket Motors, were interviewed to understand the buyer’s perspective on the suppliers, products, service providers, and their current usage and future outlook of their business, which could affect the Solid Rocket Motors market.

Note: C-level Executives include the CEO, COO, and CTO, among others.

Others include Sales Managers, Marketing Managers, and Product Managers. The tiers of the companies have been defined based on their total revenue as of 2022. Tier 1 = > USD 1 billion, Tier 2 = USD 100 million to USD 1 billion, and Tier 3 = < USD 100 million

To know about the assumptions considered for the study, download the pdf brochure

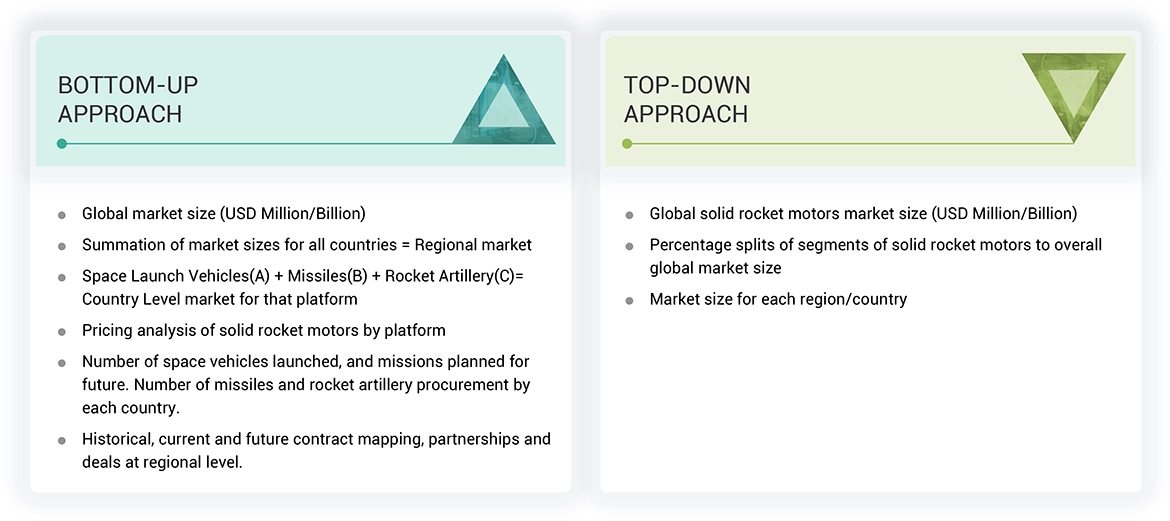

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the size of the Solid Rocket Motors market. The research methodology used to estimate the market size includes the following details:

- Key players were identified through secondary research, and their market ranking was determined through primary and secondary research. This included a study of annual and financial reports of the top market players and extensive interviews of leaders, including CEOs, directors, and marketing executives.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated, enhanced with detailed inputs, analyzed by MarketsandMarkets, and presented in this report.

Solid Rocket Motors Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall size of the Solid Rocket Motors market from the market size estimation process explained above, the total market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for various market segments and sub-segments, the data triangulation and market breakdown procedures explained below were implemented, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides. The market size was also validated using both the top-down and bottom-up approaches.

Market Definition

A solid rocket motor (SRM) or solid rocket booster is a device that propels rockets forward by burning a solid propellant and releasing the resulting hot gases through a nozzle. These motors consist of a rigid casing, typically metallic, filled with a solid mixture of fuel and oxidizer, nozzle, igniter, and other small components. SRMs are reliable and cost-effective, making them indispensable in various applications including missile systems and launch vehicles. Commonly used in military, aerospace, and commercial applications, solid rocket motors offer a cost-effective solution for generating thrust in various aerospace and defense missions.

Key Stakeholders

Various stakeholders of the market are listed below:

- Manufacturers

- Component Suppliers

- Defense Contractors

- Government Defense Agencies

- Space Agencies

- Commercial Space Companies

- R&D Institutions

Report Objectives

- To define, describe, segment, and forecast the size of the solid rocket motors market based on platform, component, end-user, and region

- To forecast the size of market segments based on five regions: North America, Europe, Asia Pacific, Middle East, and Rest of the World, along with key countries in each region

- To identify and analyze key drivers, restraints, opportunities, and challenges influencing the growth of the market

- To identify industry trends, market trends, and technology trends prevailing in the market

- To analyze micromarkets1 with respect to individual technological trends, prospects, and their contribution to the overall market

- To strategically profile key market players and comprehensively analyze their market ranking and core competencies2

- To provide a detailed competitive landscape of the market and analyze competitive growth strategies, such as product developments, contracts, partnerships, MOU’s, agreements, and collaborations adopted by key players in the market

- To identify the detailed financial position, key products, unique selling points, and key developments of leading companies in the market

1 Micromarkets are referred to as the segments and subsegments of the Solid Rocket Motors market included in the report.

2 Core competencies of companies were captured in terms of their key developments and key strategies adopted to sustain their positions in the market.

Available Customizations

Along with the market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company.

Regional Analysis

- Further breakdown of the market segments at the country level

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Key Questions Addressed by the Report

Share at:ChatGPT Perplexity Grok Google AI

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Solid Rocket Motors Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Solid Rocket Motors Market