Solid State Cooling Market Size, Share & Trends

Solid State Cooling Market by Cooling System, Refrigeration System, Thermoelectric Cooling, Electrocaloric Cooling, Magnetocaloric Cooling, Chiller, Cooler, Air Conditioner, Refrigerator and Freezer - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The global solid state cooling market is anticipated to grow from USD 0.97 billion in 2025 to USD 1.93 billion by 2030, at a CAGR of 14.8%. The surging demand for energy-efficient cooling solutions, the rising implementation of IoT-enabled smart home devices, and the increasing adoption of electric vehicles (EVs) and hybrid electric vehicles (HEVs) drive the market. Additionally, the booming data center industry, the emerging applications of solid-state cooling technology in aerospace, defense, and consumer sectors, and the rapid industrialization and urbanization will further influence market growth.

KEY TAKEAWAYS

-

BY PRODUCTRefrigeration systems are expected to record the highest CAGR, driven by demand in medical cold storage, food preservation, and sustainable refrigeration solutions. Cooling systems remain widely adopted in electronics and industrial applications due to their precision and reliability.

-

BY TECHNOLOGYThermoelectric cooling holds the largest share, owing to its maturity, ease of integration, and cost-effectiveness across consumer electronics and medical devices. Emerging technologies such as magnetocaloric and electrocaloric are gaining traction for future high-efficiency and eco-friendly solutions.

-

BY VERTICALAutomotive is set to witness the fastest growth as EV adoption accelerates, with solid-state cooling being applied in battery thermal management and cabin climate control. Meanwhile, healthcare and consumer electronics continue to drive steady demand for compact, silent, and precise cooling solutions.

-

BY REGIONAsia Pacific is expected to be the fastest-growing market, driven by large-scale consumer electronics manufacturing, rising EV production, and expanding data center infrastructure. Countries such as China, Japan, and South Korea are also investing in thermoelectric R&D.

-

COMPETITIVE LANDSCAPEThe major market players have adopted both organic and inorganic strategies, including partnerships, product launches, and expansions. For instance, Ferrotec Holdings Corporation expanded its manufacturing capabilities by developing a second high-tech facility in Kulim, Kedah, supported by an investment of USD 226 million (RM1 billion).

The solid state cooling market is being driven by a strong push toward energy-efficient and eco-friendly alternatives to conventional compressor-based systems, as global regulations tighten on harmful refrigerants. Growing adoption in consumer electronics, automotive, and healthcare is accelerating demand, with applications ranging from compact cooling in wearables to precise temperature control in medical diagnostics and EV battery thermal management. Advances in thermoelectric, magnetocaloric, and electrocaloric technologies are further expanding performance and efficiency potential, while integration with renewable energy systems and IoT-enabled monitoring is creating new opportunities across industries. Additionally, the need for silent, vibration-free, and reliable cooling is making solid-state solutions attractive for both industrial and consumer applications.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The solid state cooling market is witnessing a clear transition from conventional refrigeration methods toward next-generation cooling technologies such as thermoelectric, magnetocaloric, and electrocaloric systems. These advancements are gaining traction as industries seek energy-efficient, compact, and eco-friendly solutions to meet evolving regulatory and performance requirements.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Surging demand for energy-efficient cooling solutions

-

Growing adoption of electric and hybrid electric vehicles

Level

-

High initial investment and manufacturing costs associated with solid state cooling technology

-

Regulatory barriers and standards compliance requirements

Level

-

Growing deployment in aerospace, defense, and consumer sectors

-

Expanding industrialization and urbanization

Level

-

Complexities associated with designing and engineering solid state cooling systems

-

Shortage of qualified experts with technical knowledge

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Growing adoption of electric and hybrid electric vehicles

Rising adoption of EVs and HEVs is a key driver for the solid state cooling market, as these vehicles require effective thermal management to ensure battery safety, performance, and lifespan. Global EV sales exceeded 17 million units in 2024, expanding the fleet to nearly 58 million, with China accounting for almost two-thirds of sales. This rapid growth intensifies the demand for efficient battery cooling. Solid state cooling offers precise, uniform, and refrigerant-free temperature control, making it an ideal technology for EV battery systems.

Restraint: High initial investment and manufacturing costs associated with solid-state cooling technology

Solid state cooling technologies require high capital investment due to costly R&D, specialized semiconductor materials, and complex manufacturing processes. These expenses raise production costs, making products less competitive against conventional cooling systems. Smaller firms face barriers to entry, while end users in price-sensitive markets, including consumer electronics and refrigeration, often hesitate to adopt due to high upfront costs and concerns over cost-effectiveness.

Opportunity: Growing deployment in aerospace, defense, and consumer sectors

Solid state cooling offers strong opportunities in aerospace and defense, where lightweight, compact, and reliable solutions are essential for systems such as radar, communication, and electronic warfare. Its precision and efficiency enhance mission safety and performance. In the consumer sector, rising demand for eco-friendly, silent, and energy-efficient solutions is driving adoption in appliances, wearables, and smart home devices, gradually replacing conventional vapor compression systems.

Challenge: Shortage of qualified experts with technical knowledge

The industry faces a shortage of skilled professionals with expertise in thermodynamics, semiconductor physics, and thermal management, slowing innovation and product development. This talent gap makes it difficult for companies to design and optimize advanced solid state cooling systems. Limited technical know-how also hampers adoption, as businesses struggle to integrate solutions without adequate professional support, leading to delays and underperformance in implementations.

Solid State Cooling Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Thermoelectric modules and assemblies for applications in medical diagnostics, optical communications, and consumer electronics | High cooling precision |Silent operation | Enhanced reliability | Support for compact device integration |

|

Advanced thermoelectric materials and solid-state cooling components for industrial lasers, imaging devices, and scientific instrumentation | Improved thermal stability |Extended equipment lifetime |Higher accuracy in temperature-sensitive operations |

|

Solid state cooling solutions integrated into automotive electronics, EV battery management, and telecom infrastructure | Enhanced energy efficiency | Reduced maintenance costs | Iimproved safety in automotive and telecom systems |

|

Thermoelectric cooling devices and systems for data centers, consumer appliances, and cold chain logistics | Better temperature regulation | Eco-friendly cooling without refrigerants | Reduced carbon footprint |

|

Solid state cooling technologies applied in heavy machinery, industrial systems, and sustainable infrastructure projects | Enhanced equipment durability | Improved operational efficiency | Support for compliance with global energy standards |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The solid state cooling ecosystem involves component providers, solid state cooling technology and product providers, resellers and distributors, and end users. Each collaborates to advance the market by sharing knowledge, resources, and expertise to attain end innovation in this field. Solid state cooling system manufacturers, such as Ferrotec Holdings Corporation (Japan), Delta Electronics, Inc. (Taiwan), Coherent Corp. (US), Komatsu Ltd. (Japan), Tark Thermal Solutions (US), Same Sky (US), Crystal Ltd. (Russia), Solid State Cooling Systems (US), TE Technology, Inc. (US), and TEC Microsystems GmbH (Germany), are at the core of the market and are responsible for developing solid state cooling systems for various end users.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Solid State Cooling Market, by Product

Refrigeration systems are witnessing the highest CAGR as demand grows for sustainable cold storage in healthcare, food, and logistics. Their eco-friendly, refrigerant-free operation aligns with global energy efficiency mandates.

Solid State Cooling Market, by Technology

Thermoelectric cooling technology holds the largest share due to its maturity, cost-effectiveness, and widespread use in consumer electronics, medical devices, and industrial equipment. Emerging alternatives such as magnetocaloric are still in early adoption stages.

Solid State Cooling Market, by Vertical

The automotive vertical is expected to witness the highest CAGR in the solid-state cooling market, enhancing EV battery thermal management and in-vehicle climate control. The demand for safer, longer-lasting, and energy-efficient batteries is driving this adoption.

REGION

Asia Pacific to exhibit the highest CAGR in the solid state cooling market during the forecast period

Asia Pacific is expected to exhibit the highest CAGR in the solid state cooling market during the forecast period, spurred by the rapid industrialization, the rise in electronics manufacturing, and the robust demand for energy-efficient technology. Nations such as China, Japan, South Korea, and India are leading the world in manufacturing high-performance consumer electronics, semiconductors, and electric vehicles, all of which need precise, compact, and sustainable cooling systems. Large OEMs and an established supply base for thermoelectric components provide the region with a strong advantage in production scaling and embedding solid-state cooling in end products. China is a notable growth driver, with huge investments in electric mobility, intelligent medical devices, and green infrastructure, backed by supportive government policy and R&D support.

Solid State Cooling Market: COMPANY EVALUATION MATRIX

Ferrotec stands out as a star player in the solid state cooling market, with both high market share and an extensive product footprint, while Komatsu, despite holding a large share, has a narrower footprint and is, therefore, positioned as an emerging leader.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 0.85 Billion |

| Market Forecast in 2030 (Value) | USD 1.93 Billion |

| Growth Rate | CAGR of 14.8% from 2025 to 2030 |

| Years Considered | 2021–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Million) and Volume (Million Units) |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

|

| Regional Scope | North America, Europe, Asia Pacific, and RoW |

WHAT IS IN IT FOR YOU: Solid State Cooling Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| North American Appliance Manufacturer | Comparative benchmarking of solid state cooling vs. compressor-based cooling in household refrigeration |

|

| European Automotive OEM | Lifecycle cost-benefit analysis of thermoelectric cooling modules for EV battery thermal management |

|

| Asia Pacific Data Center Operator | Evaluation of solid state cooling integration with liquid cooling systems for high-density server racks |

|

| Global Consumer Electronics Brand | Assessment of miniaturized solid-state cooling solutions for wearables and handheld devices |

|

| Global Pharmaceutical Manufacturer | Market research study on global solid-state cooling solutions for temperature-sensitive drug storage and transport |

|

RECENT DEVELOPMENTS

- April 2025 : Ferrotec Holdings Corporation expanded its manufacturing capabilities by developing a second high-tech facility in Kulim, Kedah, supported by an investment of USD 226 million (RM 1 billion). This strategic move reflects the company’s sustained commitment to Malaysia and its expanding role in the global semiconductor industry. Expected to be completed within a year, the new facility will enhance the company’s presence in Southeast Asia, enabling improved delivery timelines, strengthened customer support, and increased innovation for markets across Asia, Europe, and the Americas.

- March 2025 : Delta launched its extensive range of next-generation power and liquid cooling solutions at NVIDIA GTC 2025. It aimed to enhance performance and energy efficiency in NVIDIA-powered AI and HPC data centers. Highlights include the newly introduced Power Capacitance Shelves and in-row 1.5 MW liquid-to-liquid Coolant Distribution Units (CDUs). The display also featured advanced air cooling technologies such as a 3D Vapor Chamber with 1,000 W cooling capacity in a 4RU form factor, a next-generation server fan offering a 20% performance boost over previous models, and new rack fans designed to support diverse rack power architectures, including HVDC (400–800 Vdc).

- January 2025 : Coherent Corp. released its CT-Series thermoelectric coolers, a new product line designed to offer outstanding thermal performance, reliability, and cost-efficiency. These coolers are ideal for challenging uses in the life sciences, medical, and industrial sectors.

- January 2025 : Same Sky expanded its product offerings by introducing its new SPG family of thermoelectric generator (TEG) modules. These modules convert temperature differences into usable electrical power, with individual units providing 5.4 to 21.6 watts of output. They come in various compact sizes, ranging from 30 x 30 mm to 56 x 56 mm, and are as thin as 3.5 mm.

- March 2024 : Solid State Cooling Systems, Inc. launched ThermoCube II, the next-generation model in its widely adopted ThermoCube product line, which has sold over 34,000 units globally. Known for its compact design, user-friendly operation, and exceptional reliability, the ThermoCube series uses thermoelectric technology to deliver precise temperature control (better than ±0.05°C) without compressors or harmful refrigerants. The new 200 to 500 watt ThermoCube II models maintain the same dimensions and configuration options as the original.

Table of Contents

Methodology

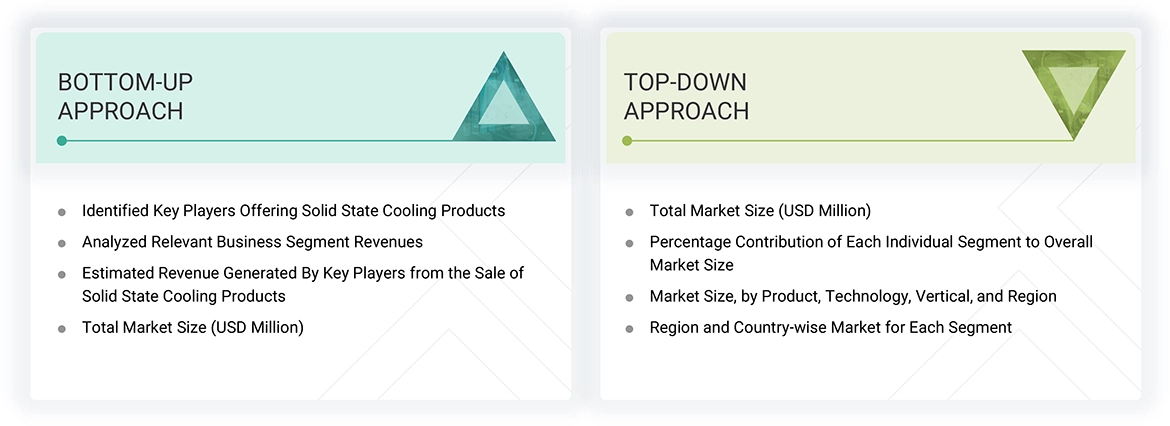

The study involved major activities in estimating the current market size for the solid state cooling market. Exhaustive secondary research was done to collect information on the solid state cooling industry. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Different approaches, such as top-down and bottom-up, were employed to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and subsegments of the solid state cooling market.

Secondary Research

The secondary research for this study involved gathering information from various credible sources. These included company annual reports, investor presentations, press releases, whitepapers, certified publications, and articles from reputable associations and government publications. Additional data was obtained from corporate filings, professional and trade associations, journals, and industry-recognized authors. Research from consortia, councils, and gold- and silver-standard websites, directories, and databases also contributed to the qualitative framework. Key global sources, such as the International Trade Centre (ITC) and the International Monetary Fund (IMF), were consulted to support and validate the market analysis.

Primary Research

Extensive primary research was conducted after understanding and analyzing the solid state cooling market scenario through secondary research. Several primary interviews were conducted with key opinion leaders from demand- and supply-side vendors across four major regions—North America, Europe, Asia Pacific, and RoW. Approximately 20% of the primary interviews were conducted with the demand side and 80% with the supply side. Primary data was collected through questionnaires, e-mails, and telephonic interviews. Various departments within organizations, such as sales, operations, and administration, were contacted to provide a holistic viewpoint in the report.

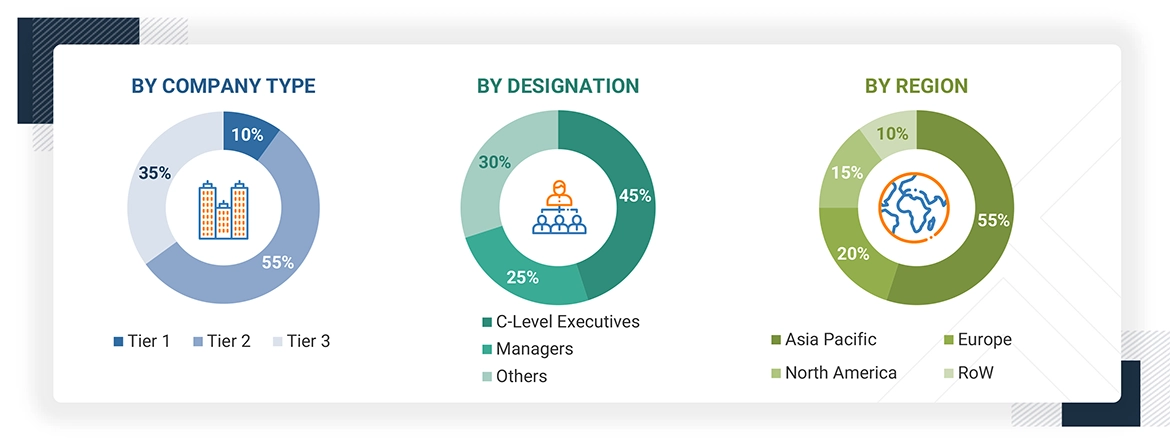

After successful interaction with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings of our primary research. This, along with the in-house subject matter experts’ opinions, led us to the findings described in the report. The breakdown of primary respondents is as follows:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the solid state cooling market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

Solid State Cooling Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall size of the solid state cooling market through the process explained above, the overall market has been split into several segments. Data triangulation procedures have been employed to complete the overall market engineering process and arrive at the exact statistics for all the segments, wherever applicable. The data has been triangulated by studying various factors and trends from the demand and supply sides. The market has also been validated using top-down and bottom-up approaches.

Market Definition

The solid state cooling market refers to the industry focused on thermal management solutions that utilize solid-state technologies, primarily thermoelectric, electrocaloric, magnetocaloric, and thermionic effects, to transfer heat without the use of moving parts or refrigerants. These systems provide precise, compact, energy-efficient, and environmentally friendly cooling for applications across sectors such as consumer electronics, automotive, medical, industrial, and aerospace.

Key Stakeholders

- Brand Product Manufacturers/Original Equipment Manufacturers (OEMs)/Original Device Manufacturers (ODMs)

- Solid State Cooling Product Manufacturers

- Solid State Cooling Material and Component Suppliers

- Manufacturing Equipment Suppliers

- System Integrators

- Technology/IP Developers

- Consulting and Market Research Service Providers

- Solid State Cooling-related Associations, Organizations, Forums, and Alliances

- Venture Capitalists and Startups

- Research and Educational Institutes

- Distributors and Resellers

- End Users

Report Objectives

- To define, describe, and forecast the solid state cooling market, by product, technology, vertical, and region, in terms of value

- To forecast the solid state cooling market, by product, in terms of volume

- To forecast the size of the market segments for four major regions—North America, Europe, Asia Pacific, and the Rest of the World (RoW), in terms of value

- To provide detailed information regarding the major factors, such as drivers, restraints, opportunities, and challenges, influencing the growth of the solid state cooling market

- To analyze micromarkets with respect to individual growth trends, prospects, and contributions to the total market

- To study the complete value chain and allied industry segments, and perform a value chain analysis of the market

- To analyze the regulatory landscape, tariffs, standards, patents, the impact of the 2025 US tariff, Porter’s five forces, import and export scenarios, trade values, and case studies pertaining to the market under study

- To strategically profile the key players and comprehensively analyze their market shares and core competencies

- To analyze the opportunities in the market for stakeholders and describe the competitive landscape of the market

- To analyze competitive developments, such as agreements, acquisitions, partnerships, product launches/developments, and research and development (R&D), in the market

Available customizations:

With the market data given, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Company Information:

- Detailed analysis and profiling of additional market players (up to 7)

Key Questions Addressed by the Report

What are the major driving factors and opportunities for the solid state cooling market?

Surging demand for energy-efficient cooling solutions, rising implementation of IoT-enabled smart home devices, rising adoption of electric vehicles (EVs) and hybrid electric vehicles (HEVs), booming data center industry, emerging applications of solid state cooling technology in aerospace & defense and consumer sectors, and growing industrialization and urbanization drive the market.

Which region is expected to hold the largest share of the solid state cooling market in 2025?

Asia Pacific is expected to capture the largest share of the solid state cooling market in 2025 due to the rapid expansion of electronics and EV manufacturing hubs in countries such as China, Japan, and South Korea.

Who are the leading players in the global solid state cooling market?

Leading players operating in the global solid state cooling market include Ferrotec Holdings Corporation (Japan), Delta Electronics, Inc. (Taiwan), Coherent Corp. (US), Komatsu Ltd. (Japan), Tark Thermal Solutions (US), Same Sky (US), Crystal Ltd. (Russia), Solid State Cooling Systems (US), TE Technology, Inc. (US), and TEC Microsystems GmbH (Germany).

Which advanced technologies are expected to drive the solid state cooling market?

Advanced technologies, such as nanostructured thermoelectric materials and multi-stage TEC designs, enhance cooling efficiency, miniaturization, and performance. Emerging methods, including electrocaloric and magnetocaloric cooling, are gaining traction for next-generation, refrigerant-free thermal solutions.

What is the size of the global solid state cooling market?

The global solid state cooling market is expected to grow from USD 0.97 billion in 2025 to USD 1.93 billion by 2030 at a CAGR of 14.8% from 2025 to 2030.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Solid State Cooling Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free CustomisationGrowth opportunities and latent adjacency in Solid State Cooling Market

Jason

Feb, 2021

Need the total cost of purchase of various companies, for their raw material in this sector. .