Stainless Steel Powder Market

Stainless Steel Powder Market by Type (Austenitic, Martensitic, Duplex, Ferritic, Precipitation-Hardening), Manufacturing Process, Application (Powder Metallurgy, Metal Injection Molding, Additive Manufacturing, Other Processes), End-use Industry, and Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The stainless steel powder market is expected to reach USD 1.04 billion by 2030, up from USD 0.85 billion in 2025, at a CAGR of 4.2%. The stainless steel powder market is rapidly gaining momentum, given the increased demand for metal additive manufacturing and powder metallurgy across industries such as automotive, aerospace, and medical. Despite certain cost pressures emanating from fluctuating prices for nickel and chromium, the market is set to post healthy growth during the forecast period.

KEY TAKEAWAYS

-

BY REGIONAsia Pacific is expected to be the fastest-growing region in the stainless steel powder market in terms of value.

-

BY TYPEBy type, the austenitic stainless steel powder is estimated to account for 59.9% share of the market, in terms of value.

-

BY MANUFACTURING PROCESSBy manufacturing process, water atomization is estimated to account for a 39.7% share of the market, in terms of value.

-

BY APPLICATIONBy application, the additive manufacturing segment is expected to grow at a CAGR of 6.8% during the forecast period, in terms of value.

-

BY END-USE INDUSTRYBy end-use industry, the automotive sector is projected to account for largest market share during forecast period.

-

COMPETITIVE LANDSCAPE - KEY PLAYERSHoganas AB, Sandvik AB, Daido Steel Co., Ltd., and Mitsubishi Steel Mfg. Co., Ltd. are Star players in the stainless steel powder market, given their broad industry coverage and strong operational & financial strength.

-

COMPETITIVE LANDSCAPE - STARTUPSCNPC Powder and Chengdu Huarui Industrial Co., Ltd. have distinguished themselves among startups and SMEs due to their well-developed marketing channels and extensive funding to build their product portfolios.

The major driver of the stainless steel powder market is the growing adoption of metal additive manufacturing. Demand is on the rise with automotive, aerospace, medical, and industrial OEMs moving toward lightweight geometries, precision components, and rapid prototyping. All these factors spur the demand for high-purity, gas-atomized stainless steel powders that provide reliable flowability and high mechanical performance. Manufacturers are strengthening the driver further by expanding powder production capacity and enhancing atomization efficiency to cater to large-scale deployment of AM across global supply chains.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

New atomization technologies, increased adoption of additive manufacturing, and demand for high-performance lightweight components are driving the stainless steel powder market into a phase of rapid transformation. Novel production methods advance powder consistency while digital platforms change procurement and quality control. These shifts create opportunity and disruption as manufacturers adapt to faster qualification cycles, evolving end-use requirements, and increasing pressure for sustainable powder production.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rising demand for metal injection molding

-

Rising defense and aerospace production

Level

-

High production and processing cost

-

Presence of alternative metal powder

Level

-

Rising collaboration between OEMs and material producers

-

Rising adoption in additive manufacturing

Level

-

High capital investment and technology barrier

-

Need for process specific stainless steel powder grades tailored to each manufacturing method

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rising demand for metal injection molding

The high demand for stainless steel powder in metal injection molding accelerates the overall market growth. This technology offers the ability to deliver geometrically complex, high-strength components to mass-production scale. Industries such as automotive and consumer electronics increasingly prefer metal injection molding (MIM) because it makes small, intricate parts with tight tolerances at lower cost, thus increasing directly the consumption of fine powders of stainless steel. For example, growing production of smartphone vibration motors, camera modules, and automotive sensor housings relies heavily on MIM grade 316L and 17-4PH powders, developing consistent and growing pull for suppliers worldwide.

Restraint: Presence of alternative metal powder

The demand for stainless steel powders is constrained by alternative metal powders, as many OEMs opt to utilize materials optimized for weight, conductivity, corrosion resistance, or thermal properties. In applications like automotive EV components and aerospace interiors, the increased use of lightweight aluminum powders, as well as lower-priced options, displaces stainless steel, thus lowering the total stainless powder demand. This can be seen in the move to aluminum-based AM powders in battery housing brackets and heat-sink components, where stainless steel traditionally had been used but is being replaced to help extend vehicle range and thermal efficiency. The continuous substitution of materials further dilutes the share of stainless steel powder in high-growth applications.

Opportunity: Rising adoption in additive manufacturing

With application in additive manufacturing growing faster than traditional uses for the powders, many manufacturers are now placing strong focus on stainless steel powders designed specifically for additive manufacturing (AM). They are investing in new gas atomization lines, improving powder purity, and fine tuning particle size distribution to ensure consistent performance in laser powder bed fusion and binder jetting systems. Well-known producers such as Sandvik, Höganäs, Carpenter Technology, and GKN are expanding their AM-grade stainless steel powder portfolios, and several newer atomization companies are entering the space with customized 316L and 17-4PH powders that meet strict flowability and density requirements. This shift indicates that the industry recognizes AM as a major future demand driver and that manufacturers are adjusting production priorities, quality standards, and R&D strategies to capture the accelerating adoption of stainless steel in aerospace, medical, and industrial AM applications.

Challenge: Need for process specific stainless steel powder grades tailored to each manufacturing method

The need for different application and process-specific stainless steel powders constitute one of the biggest challenges in the market. Each manufacturing route-additive manufacturing, metal injection molding, or conventional powder metallurgy-requires powders with distinct particle sizes, flow characteristics, purity levels, and chemical stability. As an example, AM requires highly spherical, gas-atomized powders with tight size distribution, while MIM relies on ultra-fine powders that can mix efficiently with binders. This forces manufacturers to maintain several production lines, adopt more complex classification systems, and apply stricter quality controls, all of which has the consequence of raising operational costs and limiting economies of scale. The result is higher production complexity and longer qualification cycles, leading to reduced efficiency in meeting demand within the market.

stainless-steel-powder-market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

3D-printed locking wheel nuts (Automotive) one-piece nut-and-key made by laser-sintering stainless steel powder using a unique voice-biometrics pattern | Enables extremely complex, one-piece geometry (unique biometric pattern) that deters tampering |

|

Hearing aid sound tube (acoustic component) manufactured by Metal Injection Molding (MIM) of 316L stainless steel powderpim | Complex small geometry achieved net-shape in a multi-cavity mold, requiring only minimal post-sintering finishing |

|

Door lock mechanisms including latch bolts, deadbolts, cylinder housings, cams, etc. produced by conventional powder metallurgy (press-and-sinter) from stainless steel; Parts pressed and sintered to near-final shape and then heat-treated | Near-net-shape PM fabrication yields high dimensional accuracy and tight tolerances with minimal machining |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The stainless steel powder ecosystem includes raw material manufacturers (Vale, BHP), stainless steel powder producers (Hoganas AB, Sandvik AB), stainless steel component manufacturers (Desktop Metal, SLM Solutions), and end users (BMW, Stryker). Raw material suppliers provide iron, nickel, and chromium to stainless steel powder manufacturers. Component manufacturer and end users connect manufacturing companies to streamline the supply chain, boosting operational efficiency and profitability.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Stainless Steel Powder Market, By Type

Austenitic stainless steel powder is expected to hold the highest market share during the forecast period owing to its excellent combination of corrosion resistance, formability, and mechanical strength, making it suitable across a wide range of applications and industries. Grades like 304 and 316L are in particular demand due to their non-magnetic properties, weldability, and high resistance to oxidizing environments-qualities essential within the medical devices, food processing equipment, consumer electronics, and additive manufacturing industries. Additionally, austenitic powders are widely used in metal injection moulding and AM due to their consistent flowability and sintering behavior, which supports high-volume and precision component production. Their versatility across conventional and advanced manufacturing methods further drives their dominance in the stainless steel powder market.

Stainless Steel Powder Market, By Manufacturing Process

Water atomization has the largest market share in stainless steel powder production as it presents a cost-effective, high-volume manufacturing route that satisfies the needs of most mass-market applications. The process produces irregular-shaped powders at substantially lower operating costs than gas atomization and, thus, is ideal for industries where extremely high sphericity is not required, such as conventional powder metallurgy, press-and-sinter parts, and a number of MIM applications. Water atomization also supports large batch sizes, flexible alloy production, and efficient cooling rates that enable manufacturers to scale output quickly while keeping prices competitive. Due to the combination of low cost, high throughput, and wide applicability, water atomization stands out as the most widely adopted method in the stainless steel powder.

Stainless Steel Powder Market, By Application

Powder metallurgy is the leading application of stainless steel powder. It enables near-net-shape production that allows a reduction of machining steps and wastes of materials. This makes it especially suitable for making identical parts in millions of units, such as automotive pump components, sensors, brackets, and appliance mechanisms. Powder metallurgy also works well with a wide range of stainless grades; its strong mechanical properties and corrosion resistance make it suitable for use in high-stress or high-temperature environments. Consistently delivering complex geometries at competitive pricing, it maintains its status as the preferred choice among major automotive, industrial, and consumer electronics manufacturers around the world.

Stainless Steel Powder Market, By End-use Industry

The main demand driver for stainless steel powder comes from automotive applications, as the industry employs large volumes of high-performance metal powders for numerous different critical parts. Stainless steel powders are used for fuel system components, turbocharger housings, ABS components, sensor bodies, structural brackets, engine timing systems, and various heat-, vibration-, and corrosion-resistant precision sintered elements in vehicles. Automakers are interested in lightweight and compact components, which boosts the use of powder metallurgy, MIM, and additive manufacturing technologies, with high consumption of stainless steel powders. The industry also requires consistent quality, high-volume production, and close dimensional accuracy, driving the need for continuous consumption of grades of standardized powders. The growth in hybrid and electric vehicles acts as added stimuli for such components. In any case, EV platforms possess larger needs for stainless steel powder-based components in battery casings, cooling systems, magnetic assemblies, and drivetrain components. Meanwhile, automotive OEMs operate globally, guaranteeing large, stable, and repetitive procurement quantities that place the segment in a position to be the largest buyer of stainless steel powders over the forecast period.

REGION

Asia Pacific to be fastest-growing region in global stainless steel powder market during forecast period

Asia Pacific leads the growth of the stainless steel powder market due to the expansion of the end-use industries such as automotive, electronics, industrial machinery, and consumer goods. Manufacturers in the region increasingly use stainless steel powders in MIM, PM, and AM processes for lightweight components, miniaturized electronic parts, and cost-effective production. Strong support from governments for advanced manufacturing in China, India, Japan, and South Korea accelerates the switch to powder-based processes. Regional suppliers are also investing heavily in atomization capacity, lowering material cost and improving supply availability.

stainless-steel-powder-market: COMPANY EVALUATION MATRIX

In the stainless steel powder market, Hoganas AB (Star) leads with a strong market share and an extensive product footprint, driven by its collaborations and partnerships with end users. Outokumpu (Emerging Leader) is gaining visibility because of its product offerings specific to stainless steel powder manufacturing. While Hoganas AB dominates through scale and a diverse portfolio, Outokumpu shows significant potential to move toward the leaders’ quadrant as demand for stainless steel powder continues to rise.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Höganäs AB (Sweden)

- Sandvik AB (Sweden)

- Daido Steel Co., Ltd. (Japan)

- Mitsubishi Steel Mfg. Co. Ltd. (Japan)

- Shijiazhuang Lide Powder Material Co., Ltd. (China)

- Carpenter Technology Corporation (US)

- EOS GmbH (Germany)

- Outokumpu (Finland)

- Ametek Inc. (US)

- ArcelorMittal (Luxembourg )

- INDO-MIM (India)

- Fushel (China)

- Centurion Material Innovation Inc. (China)

- GKN Powder Metallurgy (England)

- Atlantic Equipment Engineers (US)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 0.82 Billion |

| Market Forecast in 2030 (value) | USD 1.04 Billion |

| Growth Rate | CAGR of 4.2% from 2025 to 2030 |

| Years Considered | 2023-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion), Volume (Kiloton) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, Latin America, Middle East & Africa |

WHAT IS IN IT FOR YOU: stainless-steel-powder-market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Raw Material Supplier |

|

|

| Stainless steel powder manufacturers |

|

|

| Additive Manufacturing Users |

|

|

| End -user |

|

|

RECENT DEVELOPMENTS

- August 2025 : Sandvik launched Osprey MAR 55, its advanced tool steel powder that combines the weldability of maraging steels with the strength and wear resistance of carbon-bearing steels. It offers excellent mechanical properties and fatigue strength in the as-built condition, removing the trade-off between performance and weldability.

- October 2025 : EOS launched StainlessSteel 316L-4404 along with Steel 42CrMo4, expanding its metal additive manufacturing portfolio. The new 316L-4404 offers high strength, ductility, and corrosion resistance, catering to aerospace, energy, chemical, automotive, and marine applications.

- March 2021 : Höganäs AB expanded its production capacity in Johnstown, Pennsylvania, to meet the growing demand for fine metal powders used in additive manufacturing, metal injection moulding, and surface coating. The new fine powder atomisation building, covering 24,000 square feet, enhanced the facility’s ability to produce existing products such as 45-micron stainless steels (316L, 17-4PH).

Table of Contents

Methodology

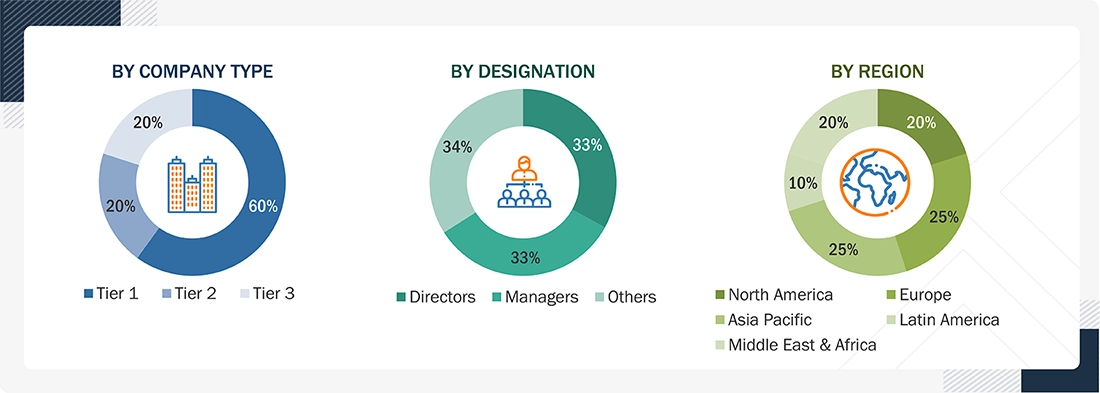

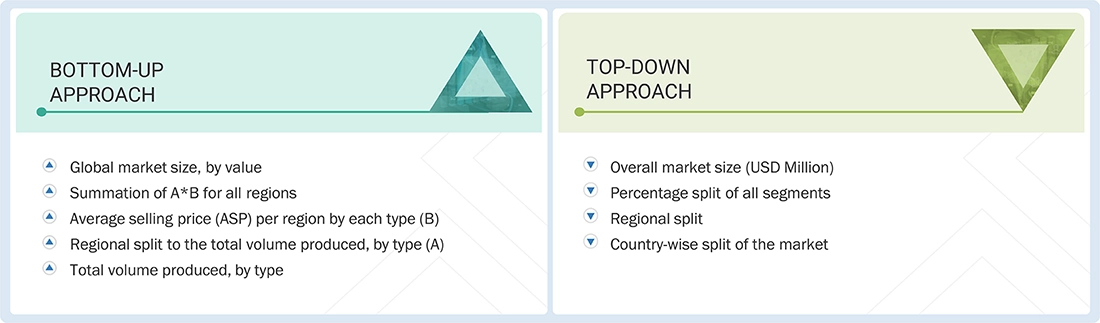

The study involves two major activities in estimating the current size of the stainless steel powder market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary sources referred to for this research study include financial statements of companies offering stainless steel powder and information from various trade, business, and professional associations. Secondary research has been used to obtain critical information about the industry’s value chain, the total pool of key players, market classification, and segmentation according to industry trends to the bottom-most level and regional markets. Secondary data was collected and analyzed to arrive at the overall size of the stainless steel powder market, which was validated by primary respondents.

Primary Research

Extensive primary research was conducted after obtaining information regarding the stainless steel powder market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand and supply sides across major countries of North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America. Primary data was collected through questionnaires, emails, and telephonic interviews. The primary sources from the supply side included various industry experts, such as Chief X Officers (CXOs), Vice Presidents (VPs), Directors from business development, marketing, product development/innovation teams, and related key executives from stainless steel powder industry vendors; system integrators; component providers; distributors; and key opinion leaders.

Primary interviews were conducted to gather insights such as market statistics, data on revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to type, manufacturing process, application, end-use industry, and region.

Stakeholders from the demand side, such as CIOs, CTOs, CSOs, and installation teams of the customer/end users who are using stainless steel powder, were interviewed to understand the buyer’s perspective on the suppliers, products, component providers, and their current usage of stainless steel powder and future outlook of their business, which will affect the overall market.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The research methodology used to estimate the size of the stainless steel powder market includes the following details. The market sizing of the market was undertaken from the demand side. The market was upsized based on procurements and modernizations in stainless steel powders in different end-use industries at a regional level. Such procurements provide information on the demand aspects of the stainless steel powder industry for each application. For each end-use industry, all possible segments of the stainless steel powder market were integrated and mapped.

Stainless Steel Powder Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall size from the market size estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for various market segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Market Definition

Stainless steel powder is a finely divided metallic material produced from stainless steel alloys that contain iron, chromium, and other elements. It is engineered into small, uniform particles through processes such as water or gas atomization, mechanical milling, or chemical reduction. The powder form retains the core properties of stainless steel. It offers corrosion resistance, strength, and thermal stability. In powder metallurgy, MIM, and additive manufacturing, these particles enable near-net-shape processing, uniform densification, predictable sintering kinetics, and stable phase evolution. This makes stainless steel powder a critical feedstock for high-precision, high-performance metal components used in demanding structural, thermal, and corrosive environments.

Key Stakeholders

- Stainless steel powder manufacturers

- Government and research organizations

- National and local government organizations

- Institutional investors

- Iron, Nickel, and Chromium suppliers

Report Objectives

- To define, describe, and forecast the stainless steel powder market size in terms of volume and value

- To provide detailed information regarding the key factors, such as drivers, restraints, opportunities, and challenges influencing the market growth

- To analyze and project the global stainless steel powder market by type, manufacturing process, application, end-use industry, and region

- To forecast the market size concerning five main regions (along with country-level data), namely, North America, Europe, Asia Pacific, Middle East & Africa, and Latin America, and analyze the significant region-specific trends

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions of the submarkets to the overall market

- To analyze the market opportunities and the competitive landscape for stakeholders and market leaders

- To assess recent market developments and competitive strategies, such as agreements, contracts, acquisitions, and product developments/product launches, to draw the competitive landscape

- To strategically profile the key market players and comprehensively analyze their core competencies

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

- Additional country-level analysis of the stainless steel powder market

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company in the market

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Stainless Steel Powder Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Stainless Steel Powder Market