Stainless Steel Seamless Pipes Market

Stainless Steel Seamless Pipes Market by Grade (Austenitic, Ferritic, Duplex), Technology (Piercing, Extrusion), End-use Industry (Oil & Gas, Automotive & Transportation, Energy & Power, Nuclear, Green Hydrogen, Others), & Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The Stainless steel seamless pipes market is projected to grow from USD 3.37 billion in 2024 to USD 5.15 billion by 2030, at a CAGR of 5.8%. The global stainless steel seamless pipes market is enjoying surge in growth, driven by growing applications in several end-user industries such as oil and gas, automotive, transportation and aviation. These high-performance pipes are tough and corrosion resistant and are ideal for optimal performance in extreme conditions. The demand for seamless pipes is also on the rise as the cost for energy grows increasingly around the world, and as a very cost-effectual mode of transportation system. Furthermore, the advancements of manufacturing techniques, allowed the increase of the precision, reliability and cost-effective prospect for seamless pipes, that contributed another level of growth in their use within the most delicate industries.

KEY TAKEAWAYS

-

BY GRADEBased on grade, the market is segmented into 304/304L, 316/316L, 2205, 430, and Other Grades. 304/304L dominates due to its broad chemical resistance and versatility across industries. 316/316L is preferred for marine and chemical applications involving chloride exposure. 2205 duplex stainless steel is gaining traction in high-pressure and offshore applications due to its strength and stress corrosion resistance. 430 is used in lower-cost, non-critical applications such as automotive exhaust systems. Other Grades, including 310, 321, and 904L, serve specialized needs where elevated temperature or superior corrosion resistance is required.

-

BY TECHNOLOGYBased on production process, the seamless stainless steel pipe market is segmented into Piercing and Extrusion. Piercing technology involves creating hollow tubes from solid billets, suitable for applications requiring high precision, such as energy and aerospace. Extrusion provides excellent surface finish and uniform wall thickness, making it ideal for heat exchangers, instrumentation, and chemical plant systems. Technological advancements in process automation and defect detection are enhancing pipe consistency and reducing production costs.

-

BY END-SUEThe seamless stainless steel pipe market is segmented into Oil & Gas, Chemical & Petrochemical, Energy & Power (Excl. Nuclear), Aerospace & Defence, Food & Beverage, Automotive, Industrial Equipment, Water & Wastewater Treatment, and Others. Oil & Gas remains the leading consumer segment, where these pipes are extensively used in drilling, offshore pipelines, and refinery systems due to their superior corrosion resistance and pressure tolerance. The Chemical & Petrochemical sector relies on them for handling high-temperature and aggressive fluids. Aerospace & Defence uses precision-grade pipes for hydraulic and fuel systems, while Food & Beverage industries depend on hygienic stainless pipes that comply with safety standards. Water & Wastewater applications are rising rapidly, driven by desalination and municipal infrastructure projects.

-

BY REGIONThe global market is segmented into North America, Europe, Asia Pacific, Middle East & Africa, and South America. Asia Pacific dominates the market, led by China, India, and Japan, due to rapid industrialization, refinery expansions, and water infrastructure projects. North America shows strong demand from the oil & gas and chemical sectors, with increased shale exploration activities. Europe is driven by sustainable manufacturing and advanced process industries, supported by leading producers like Alleima and AMETEK Inc. The Middle East & Africa region benefits from pipeline projects and desalination investments, while South America is witnessing growth in energy and petrochemical applications.

-

COMPETITIVE LANDSCAPEKey players such as AMETEK Inc., Alleima, Centravis, Tubacex S.A, ISMT Limited, Jindal SAW Ltd., Tenaris, JFE Steel Corporation, Vallourec, and Nippon Steel Corporation focus on expanding their manufacturing capabilities, introducing higher-grade alloys, and establishing long-term supply contracts with major EPC and process industries.

Technological innovation, industrial expansion, and stricter quality standards are driving global demand for seamless stainless steel pipes. These pipes are preferred across sectors where corrosion resistance, pressure endurance, and durability are essential, such as oil & gas, chemical processing, power generation, and automotive applications. Manufacturers are focusing on producing high-performance grades that can withstand harsh environments, elevated temperatures, and corrosive media. Growing investment in renewable energy, refinery expansions, and infrastructure modernization are strengthening market adoption. Additionally, regulatory frameworks promoting cleaner materials and energy-efficient transport systems are fueling the uptake of seamless stainless steel pipes globally.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The industry is increasingly adopting advanced production methods like hot rotary piercing, cold pilgering, and continuous mandrel rolling. These technologies improve product quality (e.g., precision, durability) and production efficiency (e.g., reduced waste, faster output). Automation and digital monitoring (e.g., smart pipelines with sensors) are also gaining traction, enabling real-time performance tracking and predictive maintenance. These advancements lower production costs, enhance product reliability, and meet stringent quality standards, providing manufacturers a competitive edge. They also enable customization for niche applications, such as high-pressure oil pipelines or aerospace components. In July 2021, the Russia-based TMK Group collaborated with Gazprom to introduce smart seamless pipes with built-in sensors for gas pipelines. This innovation, one of the first globally, monitors stress and predicts maintenance needs, reducing downtime and preventing emergencies in Russia’s vast energy infrastructure. Such developments are setting a precedent for other manufacturers to follow in 2025.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Continuous expansion of oil & gas industry

-

Enhanced recyclable properties compared to alternative materials

Level

-

Raw material price volatility and supply chain disruptions

-

Material yield loss and production inefficiencies

Level

-

Expansion into high-performance and specialty alloys with rising demand in hydrogen & renewable energy sectors

Level

-

Long sales cycles & certification delays hindering revenue generation

-

China’s offloading surplus steel eroding Indian manufacturers of market share and growth

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver:Continuous expansion of oil & gas industry

Growth in the oil & gas industry drive the market for stainless steel seamless pipes since these pipes are widely utilized in upstream, midstream, and downstream operations. With the increase of global energy demand and productions are intensified to the more severe drilling and pipeline systems such as deepwater, ultra-deepwater and all the unconventional reserves that need the materials with high strength, corrosion resistance and superior property of durability. There are stainless steel seamless pipes which are able to handle the extreme temperatures, pressures and other harsh corrosive material. Upstream applications included drilling and well completion where reliability was a necessity. In midstream seamless pipes are necessary for the construction of pipelines and processing facilities. Downstream, they are essential to refineries and petrochemical plants. The investment on LNG facilities and offshore platforms, shale gas project soars up in line with the demand for high-performance piping systems. In addition, ever more stringent environmental and safety requirements, quality materials are more and more in high demand which are making the stainless steel seamless tubes more relevant.

Restraint: Raw material price volatility and supply chain disruptions

The stainless steel seamless pipe industry has a particularly low tolerance for raw material price volatility, particularly relating to essential feedstocks, such as nickel, chromium and molybdenum. Markets volatility in commodity markets, as the result of geopolitical instability, environmental regulation, and shifting trade policies, represents a great risk for manufacturers. In addition, global supply chain disruptions stimulated by the COVID-19 pandemic, the Russia-Ukraine conflict, and the trade tensions between major countries, are adding another layer of cost uncertainty and extending lead times. Such disturbances lead to delay in buying of raw material, affect production schedule and lead to higher cost of operations. That’s pressure on profit margins, especially for small and medium-size makers who do not have the heft to hedge against market risks or expand the variety of sources they use. In addition, the increasingly variable trade tariffs and export/import bans render supply contracts and planning cycles more fragile. Accordingly, volatility of the price of raw materials and instability of solutions in supply chains] are two major factors contributing to cost competitiveness and have long-term implications.

Opportunity: Expansion into high-performance and specialty alloys with rising demand in hydrogen & renewable energy sectors

Rapidly increasing demand for stainless steel seamless pipes, especially to tap evolution of new product, high performance, and specialty alloys, is emerging as a major growth opportunity for the market. The composition of the global energy mix is shifting away from fossil fuels (involving carboniferous, organic materials) in favour of energy sources like hydrogen, solar, wind or other forms of renewable energy, creating a growing need for materials that are able to withstand extreme temperatures, high pressures and corrosive environments. Specialty Alloys for stainless steel seamless pipe is the widely used seamless steel pipe which is made of high quality raw materials by automatic production line with strict production process of cold drawing and hot rolling. Hydrogen causes problems because of its tiny molecule size and how it makes regular materials brittle. Special stainless steels and nickel alloys solve this issue well so they're key parts in hydrogen pipelines and fuel cell setups. Also green energy plants need tough pipes to exchange heat, move fluids, and stay stable. This shift is pushing makers to put money into research and new alloys opening up big chances for long-term growth. Countries like Germany, Japan, and India are leading this trend by investing a lot in green hydrogen and renewables. Suppliers who can meet tough tech and safety rules are in a good spot to gain from this changing opportunity.

Challenge:China’s Offloading Policy of Surplus Steel to Create Price Suppression and Margin Pressure

One big problem for stainless steel seamless pipe makers in countries like India, is how China floods the world market with extra steel. China makes more steel than it needs and sells the extra stuff to other countries. This pushes prices way down messing up fair competition and putting other companies under serious pressure. Indian manufacturers struggle because they can't always match China's low prices while still keeping up quality and meeting environmental rules. That means they could lose buyers both in India and abroad. It doesn’t help that Chinese steel companies often get government help and enjoy lower production costs that other countries don't have. This flood of cheap Chinese steel hurts profits, throws off pricing strategies, and makes it hard for companies to spend money on quality upgrades or better technology. Worse, it also brings unfair trade practices that make it tough for Indian producers and nearby regions to stay competitive . Fixing this problem will need teamwork, like putting anti-dumping rules in place offering government aid to local makers, and focusing more on top-quality products instead of just cheaper ones.

Stainless Steel Seamless Pipes Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Supplies precision seamless stainless tubing and pipe components for instrumentation, analytical equipment, process control systems, and industrial OEMs. Often used where small-bore, high-tolerance tubing is required (manifolds, sensors, sample lines). | High dimensional accuracy reliable instrumentation readings; excellent corrosion resistance long service life in aggressive process streams; traceable quality compliance with calibration and safety requirements. |

|

Provides high-performance seamless stainless tubes for chemical & petrochemical processing, heat exchangers, and high-pressure process lines where corrosion, purity and metallurgical consistency matter. | Superior corrosion & high-temperature resistance reduced failure risk; metallurgical consistency predictable lifetime and weldability; lower maintenance & downtime in continuous processes.. |

|

Serves food & beverage, pharmaceuticals, water treatment, and sanitary process piping with sanitary seamless stainless pipes that meet hygiene and regulatory standards. | Smooth internal finishes and traceability easier cleaning and reduced contamination risk; compliance with food/pharma standards market access; cost-effective regional supply competitive pricing and faster lead times. |

|

Supplies heavy-duty seamless stainless pipes for power generation (thermal & nuclear), petrochemical high-temp/pressure systems, and large industrial boilers/heat recovery systems. | High creep and fatigue strength at elevated temperatures reliable long-term operation; strict material controls and certifications suitability for safety-critical installations; longevity reduces lifecycle costs. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The ecosystem analysis of the stainless steel seamless pipes market evaluates the interconnected network of raw material suppliers, manufacturers, distributors, end-use industries, such as oil & gas, automotive & transportation, and aerospace & defense. It highlights the impact of factors such as advancements in manufacturing technologies, stringent regulatory standards, and increased demand for corrosion-resistant and high-strength materials. Understanding these dynamics enables stakeholders to identify growth opportunities, navigate supply chain challenges, and adapt to shifting customer requirements, fostering a more resilient and innovative market ecosystem

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Stainless Steel Seamless Pipe Market, By Grade

Austenitic grades are the most prevalent form of stainless steel utilized in the seamless pipes industry because of their wonderful properties combination. 304 and 316 stainless steels are examples of such grades that possess greater corrosion resistance, high ductility, great toughness, and good weldability, and these make them ideal for vast applications requiring superior performance. Their resistance to extreme temperatures and hostile environments, including those in chemical processing, oil and gas, power generation, and food and beverage applications, makes them more appealing. Austenitic stainless steels are also resistant to mechanical strength at extremely high and extremely low temperatures and are versatile in industries. Their non-magnetic quality and stress corrosion cracking resistance also make them superior to other grades. The worldwide supply of austenitic steel raw material and standard production methods also add to their popularity. With industries focusing on durability, cleanliness, and performance, seamless pipes made of austenitic stainless steel remain market leaders.

Stainless Steel Seamless Pipe Market, By Technology

Piercing is the largest technology segment of the stainless steel seamless pipes market since it constitutes the initial crucial step in the production of high-quality seamless pipes. During piercing, a solid round billet is heated and pierced along the center by a piercing mill to form a hollow tube, which is later elongated further and formed to shape. This technique is most popular as it provides excellent control over diameter uniformity, surface finish, and thickness of walls, which are most important in applications involving high precision and strength, such as the automotive, power generation, and oil and gas industries. This technique is more versatile compared to other technologies to manufacture pipes of different sizes and grades, including heavy-wall and large-diameter pipes used in heavy industry. The process is also more cost-effective to produce in high volume and is ideal for the handling of the hard, high temperature-resistant austenitic stainless steels widely used today. Furthermore, improvements in piercing mill technology have made the process more efficient, lower in material wastage, and higher quality to be the technology of choice among large manufacturers globally

Stainless Steel Seamless Pipe Market, By End-Use

Stainless steel seamless pipes have the highest demand in the market from the oil and gas sector due to its stringent operational requirements. Operations of exploration and drilling in the oil and gas sector need to deal with hostile environments that offer extreme pressures and temperatures along with corrosive factors like hydrogen sulfide and carbon dioxide. Seamless stainless steel pipes provide superior strength and corrosion resistance and can withstand high pressure without weld seams, which makes them ideal for harsh conditions. Seamless pipes are vital in the operation of offshore platforms and subsea pipelines and refinery processes due to the fact that they offer safety and long-term reliability for hydrocarbon transportation. Industry demand increases as a result of growing attention on deepwater and ultra-deepwater exploration as well as the development of unconventional resources such as shale oil and gas. Oil and gas operations rely on high-performance piping materials since regulatory requirements necessitate such materials. The oil and gas industry continues to be the largest consumer of stainless steel seamless pipes with continued expansion.

REGION

Asia Pacific to be larget and fastest-growing region in stainless steel seamless pipes market during forecast period

Asia Pacific is the largest market for stainless steel seamless pipes, driven by its robust industrial base, rapid urbanization, and growing energy and infrastructure industries. Key economies including China, India, Japan, and South Korea propel this growth through large investments in oil and gas schemes, petrochemicals, power generation, and massive construction works. China dominates world steel production, and as a result, it has a huge domestic market for seamless pipes utilized throughout refineries, chemical plants, and the automotive sector. In India, policies such as "Make in India" and heavy infrastructure investment are driving increased demand for high-performance piping solutions. The area is also favored by low-cost manufacturing, a rich availability of raw materials, and a qualified workforce, leading many international manufacturers to reinforce their production base in Asia Pacific. Moreover, increasing use of advanced technologies and tighter quality requirements are boosting demand for long-lasting, high-quality seamless pipes. With continued industrialization, urbanization, and growth in the energy sector, Asia Pacific is likely to continue its dominance in the world stainless steel seamless pipes market.

Stainless Steel Seamless Pipes Market: COMPANY EVALUATION MATRIX

Nippon Steel Corporation (Star) leads the stainless steel seamless pipe market with a robust market share and an extensive product footprint, driven by its advanced manufacturing capabilities, strong global distribution network, and consistent focus on high-quality, corrosion-resistant products tailored for critical industries such as Oil & Gas, Power, and Petrochemicals.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 3.37 Billion |

| Market Forecast in 2030 (Value) | USD 5.15 Billion |

| Growth Rate | CAGR of 5.8% from 2025-2030 |

| Years Considered | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/Billion), Volume (Kiloton) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered | By Grade: 304/304l, 316/316L, 2205, 430, and others, By Technology: Piercing, extrusion, By End-Use: Oil & Gas, Chemical & Petrochemical, Enegy & Power, Aerospace & defence, Food & Beverage, Automotive, Industrial Equipmet, Water & Wastewater, and Other end-uses |

| Regions Covered | North America, Asia Pacific, Europe, Middl East & Africa, South America |

WHAT IS IN IT FOR YOU: Stainless Steel Seamless Pipes Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Country-Level Breakdown | Instead of analyzing only at the regional level (e.g., North America, Europe), the report provides country-level insights for key markets such as the U.S., Germany, China, India, etc. This includes demand dynamics across industries like Oil & Gas, Automotive, and Power Generation, alongside policy and infrastructure impacts. | Helps companies identify fast-growing national markets and optimize go-to-market strategies based on localized demand, policy frameworks, and industrial growth. |

| Grade-Specific Deep Dive | Detailed analysis by stainless steel grades such as 304/304L, 316/316L, 2205, 430, and other specialty grades. Includes evaluation of mechanical properties, corrosion resistance, and end-use suitability. | Enables manufacturers and distributors to align product offerings with application-specific requirements and emerging demand for high-performance alloys. |

| Forming Technology Comparison | Comparative study of manufacturing technologies—Piercing vs. Extrusion—highlighting their impact on product quality, dimensional accuracy, and cost-effectiveness for different end-use applications. | Assists engineering and procurement teams in choosing the right manufacturing method based on quality, tolerances, and project-specific technical specifications. |

| Competitive Benchmarking | Detailed profiling of key global and regional players in the stainless steel seamless pipe market, covering product portfolios, production capacities, strategic partnerships, and expansion activities. | Provides insights into market positioning, helps identify potential collaborators or acquisition targets, and supports strategic planning and investment decisions. |

RECENT DEVELOPMENTS

- July 2023 : Tenaris (Luxembourg) acquired the oil and gas division of ISOPLUS Group (Germany) for USD 10 million, rebranding it as Tenaris Coating Italy. This acquisition expanded Tenaris’s coating capabilities for seamless stainless steel line pipes, particularly Super 13Cr and 13Cr grades used in offshore pipelines. Specializing in anti-corrosion coatings, the unit enhances pipe durability for deepwater and carbon capture projects. The acquisition also strengthened Tenaris’s European operations, supporting sales growth in Norway and the North Sea, where European sales rose 30% sequentially in Q4 2023

- August 2024 : ISMT Limited (India) and Kirloskar Ferrous Industries Limited (KFIL,India) successfully completed their merger, marking a major milestone in KFIL’s strategic growth journey. This consolidation aims to enhance operational efficiency, unlock synergies, and deliver sustained value to stakeholders. The combined entity is expected to benefit from a stronger market presence, an expanded product portfolio, and improved financial resilience

- October 2024 : Tubacex S.A. (Spain) secured a significant contract from Petrobras for the Sépia-2 and Atapu-2 offshore gas projects in Brazil, valued at approximately USD 69 million (€64.5 million). This agreement strengthens Tubacex’s position as a leading provider of premium solutions for the global gas extraction industry and contributes to its record-high order backlog. Deliveries are scheduled to begin in 2025 as each injector well is completed. The contract covers more than 80 kilometers of CRA OCTG pipes, premium connections, and accessories for deepwater operations at depths of 2,197 meters, connecting to Petrobras’ FPSO P84 and P85 platforms. Tubacex will also provide logistics, repairs, and technical support

- October 2024 : Centravis (Ukraine) secured a contract from the South Korean Government (South Korea) to supply seamless stainless steel H2FIT tubes for a new hydrogen production plant in Ulsan, South Korea. These specialized tubes, featuring elevated nickel content, are designed specifically for hydrogen production and storage, supporting Centravis’s focus on advancing low-carbon energy solutions.

Table of Contents

Methodology

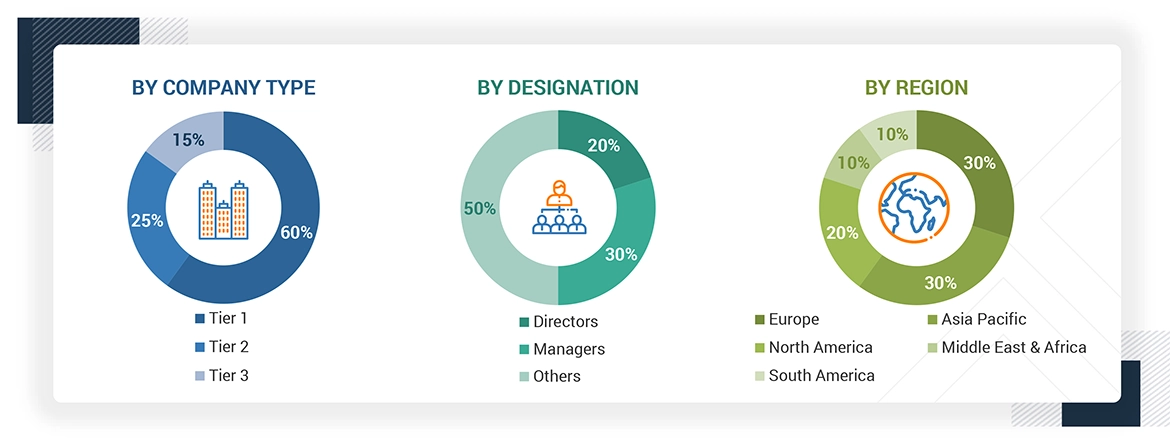

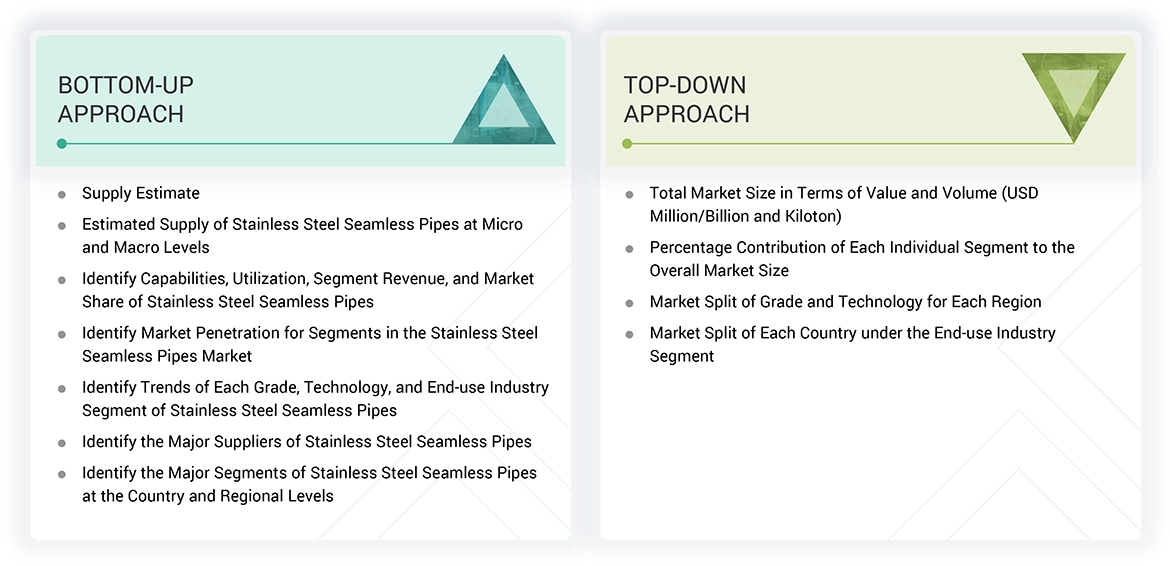

The study involved four major activities in estimating the size of the stainless steel seamless pipes market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources were referred to identify and collect information for this study. These secondary sources include annual reports, press releases, investor presentations of companies, white papers, certified publications, trade directories, articles from recognized authors, the gold standard and silver standard websites, and databases.

Secondary research has been used to obtain key information about the value chain of the industry, the monetary chain of the market, the total pool of key players, market classification, and segmentation according to industry trends to the bottom-most level and regional markets. It was also used to obtain information about the key developments from a market-oriented perspective.

Primary Research

The stainless steel seamless pipes market comprises several stakeholders in the value chain, which include raw material suppliers, manufacturing, distribution, and end users. Various primary sources from the supply and demand sides of the stainless steel seamless pipes market have been interviewed to obtain qualitative and quantitative information. The primary interviewees from the demand side include key opinion leaders in the chemical sectors. The primary sources from the supply side include manufacturers, associations, and institutes involved in the stainless steel seamless pipes industry.

Primary interviews were conducted to gather insights such as market statistics, data on revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to grade, technology, end-use industry, and region. Stakeholders from the demand side, such as CIOs, CTOs, and CSOs, were interviewed to understand the buyer’s perspective on the suppliers, products, fabricators, and their current usage of stainless steel seamless pipes and the outlook of their business, which will affect the overall market.

Note: Tier 1, Tier 2, and Tier 3 companies are classified based on their market revenue in 2024, available in the public

domain, product portfolios, and geographical presence.

To know about the assumptions considered for the study, download the pdf brochure

|

Company Name |

Designation |

|

NIPPON STEEL CORPORATION |

Product Manager |

|

AMETEK, Inc. |

Sales Executive |

|

Alleima |

Research Scientist |

|

JFE Steel Corporation |

Marketing Personnel |

Market Size Estimation

The top-down and bottom-up approaches have been used to estimate and validate the size of the stainless steel seamless pipes market.

- The key players in the industry have been identified through extensive secondary research

- The industry’s supply chain has been determined through primary and secondary research

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources

- All possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data

- The research includes the study of reports, reviews, and newsletters of the key market players, along with extensive interviews for opinions with leaders such as directors and marketing executives

Stainless Steel Seamless Pipes Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size using the market size estimation processes explained above, the market was split into several segments and subsegments. The data triangulation and market breakup procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

Stainless steel seamless pipes are produced from stainless steel, where the pipes are produced without any welded seams. The pipes are immensely sought after for their corrosion-resistant properties, strong durability, and high strength, which can be employed in oil and gas, chemical processing, power generation, automotive, construction, and food processing industries. The market is spurred by the rising demand for high-performance materials in demanding applications, manufacturing process innovations, and demand for pipelines to resist harsh environments.

Stakeholders

- Stainless Steel Seamless Pipe Manufacturers

- Distributors and Suppliers of Stainless Steel Seamless Pipes

- End Users of Stainless Steel Seamless Pipes

- Retailers of Stainless Steel Seamless Pipes

Report Objectives

- To define, describe, and forecast the size of the stainless steel seamless pipes market in terms of value and volume

- To provide detailed information regarding the major factors (drivers, opportunities, restraints, and challenges) influencing the growth of the market

- To estimate and forecast the market size based on grade, technology, end-use industry, and region

- To forecast the size of the market with respect to major regions, namely, Europe, North America, Asia Pacific, the Middle East & Africa, and South America, along with their key countries

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and their contribution to the overall market

- To analyze opportunities in the market for stakeholders and provide a competitive landscape of market leaders

- To track and analyze recent developments such as expansions, product launches, partnerships, agreements, and acquisitions in the market

- To strategically profile the key market players and comprehensively analyze their core competencies.

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for this report:

Geographic Analysis as per Feasibility

- Further breakdown of a region with respect to a particular country or additional grade

Company Information

- Detailed analysis and profiles of additional market players

Key Questions Addressed by the Report

What are the factors influencing the growth of the stainless steel seamless pipes market?

Strong domestic demand from key sectors and government policies are driving India’s stainless steel seamless pipes market. Additionally, demand for these pipes in the Middle East and Europe is expected to rise internationally.

What are stainless steel seamless pipes?

The stainless steel seamless pipes market involves the manufacturing, distribution, and consumption of seamless pipes made from stainless steel, which are produced without any welded seams. These pipes are highly valued for their corrosion-resistant properties, strong durability, and high strength, making them suitable for various industries, including oil and gas, chemical processing, power generation, automotive, construction, and food processing. The market is driven by the increasing demand for high-performance materials in challenging applications, innovations in manufacturing processes, and the need for pipelines that can withstand harsh environments. Key factors influencing the market include material innovations, industrial development, and environmental policies.

Which region is expected to have the largest market share in the stainless steel seamless pipes market?

The Asia Pacific region will account for the largest share of the stainless steel seamless pipes market during the forecast period.

What are the key market players covered in the report?

The key players in this market are NIPPON STEEL CORPORATION (Japan), Alleima (Sweden), Vallourec (France), AMETEK, Inc. (US), JFE Steel Corporation (Japan), Tenaris (Luxembourg), Jindal SAW Ltd. (India), ISMT Limited (India), Tubacex S.A. (Spain), and Centravis (Ukraine)

What will the size of the stainless steel seamless pipes market be during the forecast period?

The stainless steel seamless pipes market is projected to grow from USD 3.88 billion in 2025 to USD 5.15 billion by 2030, at a CAGR of 5.8%.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Stainless Steel Seamless Pipes Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Stainless Steel Seamless Pipes Market