Steel Casting Market

Steel Casting Market by Type (Carbon Steel, Low-Alloy Steel, High-Alloy Steel), Process (Sand Casting, Investment Casting, Die Casting), Formulation (Solvent Based, Solventless, Emulsion), Application, & Region - Global Forecast to 2029

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The global steel casting market size is estimated at USD 36,553.9 million in 2024 and is projected to reach USD 47,754.7 million by 2029, growing at a CAGR of 5.5% during the forecast period. The market is witnessing robust growth driven by factors such as the expansion of railway networks across regions, increasing demand in the renewable energy sector, and rapid development in the automotive industry—particularly with the growing adoption of electric vehicles (EVs). Additionally, industrialization and infrastructure development activities are further supporting the market’s upward trajectory.

KEY TAKEAWAYS

-

BY TYPEThe steel casting market comprises carbon steel, low-alloy steel, high-alloy steel, and other specialized steel types used across industries such as construction machinery, rail, and energy. Carbon steel castings dominate the market due to their versatility and cost-effectiveness, while high-alloy and stainless steel castings are gaining traction in applications demanding superior corrosion and heat resistance.

-

BY PROCESSMajor casting processes include sand casting, investment casting, die casting, and other advanced methods. Sand casting remains the most widely used technique due to its flexibility in producing large components, while investment casting is preferred for precision parts in aerospace and oil & gas.

-

BY FORMULATIONSThe market is categorized into solvent-based, solventless, and emulsion formulations used primarily in molding and core-making. Solventless formulations are seeing strong adoption due to their eco-friendly characteristics and reduced VOC emissions.

-

BY APPLICATIONSteel castings find applications in power generation, rail & transit, mining, construction machinery, oil & gas, aerospace & defense, and shipbuilding. Construction machinery and mining segments lead demand due to high wear resistance needs, while aerospace and shipbuilding are emerging as niche growth areas.

-

BY REGIONThe market covers North America, Europe, Asia Pacific, Middle East & Africa, and South America. Asia Pacific dominates with over half the global market share, supported by industrialization, rail expansion, and manufacturing investments in China and India. North America and Europe continue to focus on high-value castings for energy and transport applications.

-

COMPETITIVE LANDSCAPEMajor market players have adopted both organic and inorganic strategies, including capacity expansions, partnerships, and acquisitions, to strengthen their position in the global steel casting market. For instance, ArcelorMittal (Luxembourg) and POSCO (South Korea) are investing heavily in advanced casting technologies to enhance production efficiency and sustainability. Doosan Corporation (South Korea) and Kobe Steel, Ltd. (Japan) are focusing on alloy innovation and precision casting for industrial and energy applications. Meanwhile, Nucor Corporation (US) and Ferraloy, Inc. (US) are emphasizing product diversification and mergers to cater to construction and automotive sectors. Emerging players like Isgec Heavy Engineering Ltd. (India) and Nelcast Limited (India) are expanding export capacity and regional presence, while Georg Fischer Ltd. (Switzerland) and The Japan Steel Works, Ltd. (Japan) continue to invest in R&D and automation to serve high-performance casting markets.

The steel casting market plays a crucial role within the global manufacturing sector by delivering durable, high-performance components for industries such as automotive, construction, and energy. As industries evolve and seek more efficient, resilient, and cost-effective materials, steel casting has become a preferred choice for producing critical parts capable of withstanding extreme mechanical stress and challenging environments. Steel castings are vital in producing machinery, infrastructure, and industrial components that ensure reliability and long service life. Their versatility, strength, and recyclability make them key contributors to achieving sustainability goals and enhancing production efficiency. The market is expected to witness robust growth driven by infrastructure development, industrial expansion, and advancements in casting technologies across multiple industries.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on consumers’ business in the steel casting market stems from ongoing industrial trends and disruptions. Key end users such as automotive, construction, and energy sectors drive demand for advanced and durable cast steel components. Shifts toward renewable energy, lightweight materials, and precision-engineered parts are reshaping procurement and production priorities. Fluctuations in raw material prices, high energy consumption, and evolving sustainability regulations are directly influencing end-user profitability and production timelines. These challenges, in turn, affect the revenue and investment cycles of casting manufacturers. As a result, the market is witnessing adaptive responses—such as the adoption of energy-efficient technologies, 3D mold printing, and alloy innovation—to align with changing customer needs and maintain competitiveness.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Expansion of railway networks

-

Rising demand in the renewable energy sector

Level

-

High initial investment costs

-

Growing preference for lightweight material alternatives

Level

-

Advancements in metal casting technologies

-

Increasing demand for customized steel castings

Level

-

Ongoing supply chain disruptions

-

Difficulty in achieving defect-free steel castings

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Expansion of railway networks

The global expansion of railway networks is a major driver of the steel casting market, as railways offer sustainable and efficient transportation while reducing carbon emissions. Growing investments in infrastructure across Asia, Africa, and South America—along with high-speed and freight rail projects in Europe and Asia—are boosting demand for durable steel castings like wheels, axles, and couplers. India’s rapid rail development under initiatives such as the Dedicated Freight Corridors and the Mumbai–Ahmedabad Bullet Train, supported by the “Make in India” program, has enhanced domestic production capacity. Similarly, projects in Ethiopia, Kenya, Indonesia, and Vietnam are strengthening the global steel casting market, positioning the railway sector as a key growth engine worldwide.

Restraint: High cost of advanced aerospace materials.

High initial investment remains a key barrier in the steel casting market, driven by the high cost of raw materials, energy-intensive processes, and advanced equipment. Steel casting requires significant energy for melting and refining, and rising electricity and fuel prices further inflate operating costs. Setting up modern foundries with technologies like electric arc furnaces and automated molding demands substantial capital, making it challenging for smaller manufacturers to compete with established players.

Opportunity: Advancements in metal casting technologies

Technological advancements in metal casting are driving market growth through innovative materials and processes that enhance strength, durability, and corrosion resistance. The adoption of rapid prototyping and automation enables faster, more efficient production, while sustainability initiatives—such as recycling and energy-efficient technologies—are reducing environmental impact and offering manufacturers a competitive edge.

Challenge: Ongoing supply chain disruptions

The steel casting market is highly dependent on the steady supply of raw materials like iron and ferroalloys. Disruptions from trade restrictions, logistics delays, or rising fuel and shipping costs increase production expenses and cause delays. Manufacturers often face higher prices or must source alternative materials, leading to uncertainty in cost forecasting and long-term planning.

Steel Casting Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Conducted an advanced analysis of steel casting components using Finite Element Modelling (FEM) to assess material properties, refine casting processes, and enhance durability for industrial, energy, and transportation applications. | Improved component lifespan and reliability, reduced defects and material waste, enhanced fatigue resistance, and lowered operational costs through optimized casting processes. |

|

Successfully manufactured the world’s largest steel casting for a major infrastructure project using advanced computer modeling, precision engineering, and custom casting processes to meet stringent performance and safety standards. | Delivered a high-strength, large-scale steel casting with superior material properties and dimensional accuracy, showcasing technical innovation and contributing to global infrastructure development. |

|

Explored the use of steel castings in mass timber construction to enhance structural strength, durability, and sustainability. Designed specialized castings to connect heavy timber elements for large-scale projects such as bridges and multi-story buildings. | Provided strong, lightweight connections improving both safety and aesthetics. Enabled higher performance levels for mass timber while maintaining sustainability, offering flexibility and durability in modern building designs. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The steel casting market ecosystem comprises raw material suppliers (iron, ferroalloys, scrap metal providers), component manufacturers (foundries, forging companies), and end users (automotive, construction, energy, rail, and heavy machinery industries). Raw materials are melted, refined, and cast into durable, high-strength components used in critical industrial applications. End users drive demand for performance, reliability, and sustainability, while manufacturers focus on precision casting and cost efficiency. Collaboration across the value chain—from material suppliers to end-use industries—is essential to innovation, quality improvement, and market growth.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Steel Casting Market, By Type

As of 2024, carbon steel casting accounted for the largest share of the market, driven by its wide use in infrastructure, automotive, and machinery applications due to its high strength and cost-effectiveness. Low-alloy steel castings follow closely, offering enhanced mechanical properties and durability for demanding environments. High-alloy steel castings are gaining traction in specialized sectors like aerospace and defense, owing to their superior corrosion and heat resistance.

Steel Casting Market, By Process

The sand casting process dominates the steel casting market, contributing over 75% of the total share in 2024, primarily because of its flexibility, lower cost, and suitability for large and complex components. Die casting holds a notable share due to its efficiency in mass production and fine surface finishing, while investment casting is preferred for high-precision and intricate industrial parts.

Steel Casting Market, By Application

The construction machinery and mining sectors collectively account for a significant share of steel casting demand, driven by rapid industrialization and infrastructure expansion. Power generation and rail & transit are emerging segments with growing demand for durable and reliable cast components. Meanwhile, oil & gas and shipbuilding applications continue to utilize specialized steel castings for high-stress and corrosion-prone environments.

Steel Casting Market, By Formulation

Solvent-based formulations dominate the market with over 60% share in 2024, supported by their superior mechanical strength and heat resistance during casting. Solventless formulations are increasingly adopted for their eco-friendly and low-emission characteristics, while emulsion-based systems offer a balanced solution between performance and environmental compliance, catering to evolving sustainability standards in the metal casting industry.

REGION

Asia Pacific to be the fastest-growing region in the global steel casting market during the forecast period

The Asia Pacific steel casting market is projected to register the highest CAGR during the forecast period, driven by rapid industrialization, infrastructure expansion, and growing investments in construction, railways, and renewable energy projects. Countries such as China, India, and Japan are witnessing strong demand for steel castings from automotive, machinery, and energy sectors. Government initiatives promoting domestic manufacturing, along with increasing urbanization and transportation projects, are further fueling market growth across the region.

Steel Casting Market: COMPANY EVALUATION MATRIX

In the steel casting market matrix, Kobe Steel Ltd. (Star) leads with a strong market presence and diverse product portfolio, driven by its advanced casting technologies and high-quality steel products catering to construction, automotive, and industrial sectors. Waupaca Foundry Inc. (Emerging Leader) is gaining prominence through its focus on innovation, process automation, and sustainability initiatives. While Kobe Steel dominates through scale and global reach, Waupaca Foundry shows strong potential to advance toward the leaders’ quadrant as demand for high-performance and precision-engineered steel castings continues to rise.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2023 (Value) | USD 30.4 Billion |

| Market Forecast in 2029 (Value) | USD 42.1 Billion |

| Growth Rate | CAGR of 5.6% from 2024-2029 |

| Years Considered | 2022-2029 |

| Base Year | 2022 |

| Forecast Period | 2024-2029 |

| Units Considered | Value (USD Billion), Volume (Kiloton) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, South America, Middle East & Africa |

WHAT IS IN IT FOR YOU: Steel Casting Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Leading Foundry & Casting OEM |

|

|

RECENT DEVELOPMENTS

- January 2025 : GF Casting Solutions is establishing a global network of mega-casting machines across China, Europe, and the US by 2026 to meet the rising demand for large structural components. This network is aimed at providing customized, state-of-the-art solutions to customers worldwide, supported by the company’s expertise in product and process development, as well as testing and validation.

- November 2024 : GF Casting Solutions launched its innovative products at an event hosted by SERES, the maker of AITO, a notable new player in the Chinese automotive market. GF presented cutting-edge lightweighting solutions designed to reduce weight and improve the range and performance of new energy vehicles.

- March 2024 : Nucor Corporation announced an agreement with Mercedes-Benz to supply Econiq™-RE steel for models produced at their Tuscaloosa, AL manufacturing plant. Econiq™ has been a leader in certifying low-embodied carbon materials within the global steel industry.

Table of Contents

Methodology

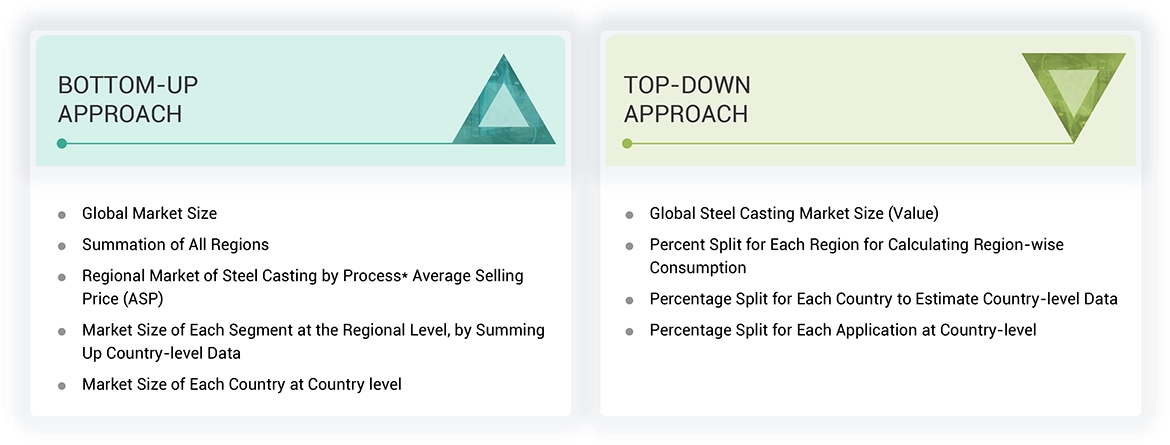

The study involved four major activities for estimating the current global size of the steel casting market. Exhaustive secondary research was conducted to gather information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizes with the industry experts across the value chain of steel casting through primary research. Both the top-down and bottom-up approaches were employed to estimate the overall size of the steel casting market. After that, market breakdown and data triangulation procedures were used to determine the size of different segments and sub-segments of the market.

Secondary Research

In the secondary research process, various secondary sources such as Business Standard, Bloomberg, World Bank, and Factiva were referred to, to identify and collect information for this study on the steel casting market. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, regulatory bodies, trade directories, and databases.

Primary Research

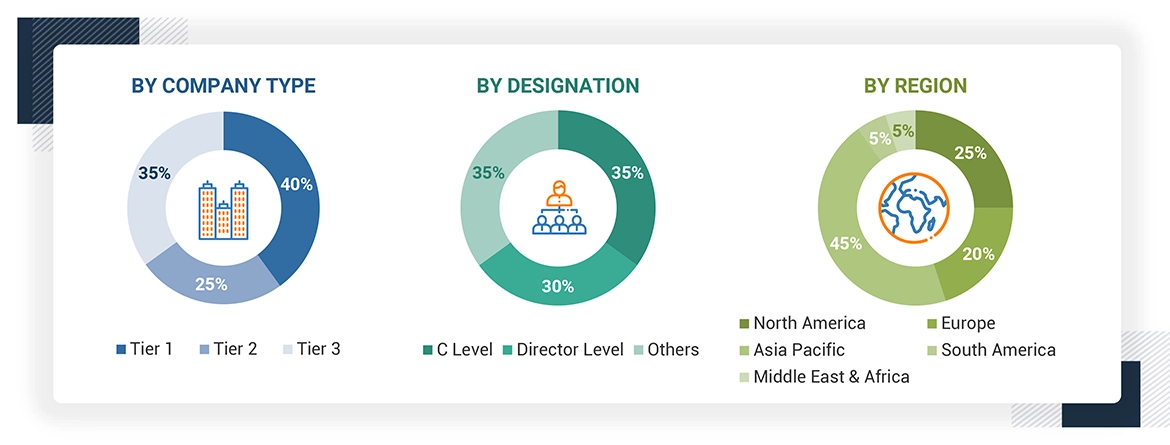

Various primary sources from both the supply and demand sides of the steel casting market were interviewed to obtain qualitative and quantitative information. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), vice presidents, marketing directors, sales professionals, and related key executives from various leading companies and organizations operating in the steel casting industry. The breakdown of the profiles of primary respondents is as follows:

Breakdown of Primary Interviews

Notes: Companies are classified based on their revenue–Tier 1 = >USD 7 billion, Tier 2 = USD 500 million to USD 7 billion, and Tier 3 = < USD 500 million.

Others include sales, marketing, and product managers.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the global size of the steel casting market. These approaches were also used extensively to estimate the size of various dependent segments of the market. The research methodology used to estimate the market size included the following details:

- The key players were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research includes the study of reports, reviews, and newsletters of key industry players, along with extensive interviews with key officials, such as directors and marketing executives.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and sub-segments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and sub-segments of the steel castingf market. The data was triangulated by studying various factors and trends from both the demand- and supply-side.

In addition, the market size was validated by using both the top-down and bottom-up approaches. Then, it was verified through primary interviews. Hence, for every data segment, there are three sources—top-down approach, bottom-up approach, and expert interviews. The data were assumed to be correct when the values arrived at from the three sources matched.

Market Definition

Steel casting is a manufacturing process that involves pouring molten steel into a mold to create solid metal components. This method allows for the production of complex shapes and sizes, making it suitable for various applications across multiple industries. The process begins with heating steel to its melting point, after which it is poured into a mold cavity where it cools and solidifies.

Stakeholders

- Steel products Manufacturers

- Steel casting service providers

- Raw Material Suppliers

- Research & development entities

- Industry associations and regulatory bodies

- End Users

Report Objectives

- To estimate and forecast the steel casting market, in terms of value and volume

- To provide detailed information about the major factors (drivers, restraints, opportunities, and challenges) influencing the market growth

- To define, describe, and forecast the market size, based on type, process, formulation, application, and region

- To forecast the market size along with segments and submarkets, in key regions: North America, Europe, Asia Pacific (APAC), Middle East & Africa (MEA), and South America along with their key countries

- To strategically analyze micro markets, for individual growth trends, prospects, and their contribution to the total market

- To analyze growth opportunities in the market for stakeholders and provide details on the competitive landscape for market leaders

- To strategically profile key players and comprehensively analyze their market shares and core competencies

- To analyze competitive developments, such as merger & acquisition, expansion & investment, and agreements in the steel casting market

Key Questions Addressed by the Report

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Steel Casting Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Steel Casting Market