Steel Wire Rope Market

Steel Wire Rope Market by Lay Type (Regular, Lang), Material Type (Carbon Steel, Galvanized Steel, Stainless Steel), Coating, Diameter, Application (Construction, Mining, Marine & Fishing, Industrial & Crane, Oil & Gas), and Region - Global Forecast to 2030

Updated on : November 27, 2025

STEEL WIRE ROPE MARKET OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The steel wire rope market is projected to reach USD 13.88 billion by 2030 from USD 10.49 billion in 2025, at a CAGR of 5.8%. The global steel wire rope market is primarily driven by increasing global infrastructure and construction activities, especially in emerging economies where urban development is rapidly advancing. Demand is notably strong in sectors such as construction, mining, oil & gas, and marine, where steel wire ropes are essential for lifting, hoisting, and rigging heavy materials. The material’s high tensile strength, durability, and resistance to corrosion make it indispensable in these applications. Government initiatives, such as national infrastructure programs and large-scale industrial projects, further stimulate demand.

KEY TAKEAWAYS

-

BY LAY TYPEThe steel wire rope market mainly consists of two types of lay: regular lay and lang lay. The regular lay type is estimated to account for the largest share in the market in terms of value because this configuration offers strong all-around performance and is the default choice for the bulk of standard industrial and construction applications.

-

BY MATERIAL TYPEThe steel wire rope market is segmented based on material type into carbon steel, galvanized steel, stainless steel, and other material types. Carbon steel accounted for the largest market share in 2024, while the stainless steel segment is projected to register the highest CAGR during the forecast period.

-

BY COATINGThe steel wire rope market is characterized into two types of coatings: non-plastic-coated and plastic-coated. Plastic-coated steel wire ropes are estimated to register the highest CAGR, in terms of value, during the forecast period due to their superior protection against corrosion, abrasion, and environmental damage offered by coatings such as PVC, PE, and nylon.

-

BY DIAMETERThe steel wire ropes are bifurcated based on the diameter: ≤1/4 inch and >1/4 inch. The ≤1/4 inch segment accounted for the largest market share in 2024 due to its widespread use across various industries where flexibility, light weight, and cost-efficiency are essential.

-

BY APPLICATIONMajor applications of steel wire ropes include construction, mining, marine & fishing, industrial & crane, oil & gas, and other applications. The construction segment is projected to register the highest CAGR during the forecast period, due to the need for high-strength, durable, and reliable materials to support heavy loads and ensure safety in critical operations.

-

BY REGIONThe steel wire rope market covers Europe, North America, Asia Pacific, Latin America, and the Middle East & Africa. Asia Pacific is estimated to be the largest market for steel wire rope. The region is also projected to register the highest CAGR during the forecast period.

-

COMPETITIVE LANDSCAPEMajor market players have adopted both organic and inorganic strategies, including partnerships and investments. Bekaert (Belgium), WireCo (US), and Kiswire Ltd. (South Korea) have entered into a number of agreements and partnerships to cater to the growing demand for steelwire ropes across innovative applications.

The steel wire rope market is experiencing significant growth driven by a surge in construction, mining, and marine applications worldwide. Advanced manufacturing techniques and the adoption of high-strength, lightweight wire ropes are enhancing product performance, safety, and efficiency, which is fueling market expansion. Industrial automation and infrastructure development, particularly in the Asia Pacific region, are principal factors boosting demand as countries like China and India invest heavily in large-scale projects. The integration of advanced rope monitoring technologies has helped steel wire rope manufacturers improve operational safety and longevity.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

Changes in customer trends or disruptions impact consumers’ businesses, which in turn affects the revenues of end users. Consequently, the revenue impact on end users is expected to affect the revenues of steel wire rope suppliers, which in turn impacts the revenues of steel wire rope manufacturers. Corrosion resistance, sustainability, and recyclability are key to improved safety, lower lifecycle costs, and reduced equipment downtime. Energy efficiency and smart monitoring of rope safety are key outcomes that vendors are aiming for.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

STEEL WIRE ROPE MARKET DYNAMICS

Level

-

Rising demand from construction and infrastructure development

-

Expansion of mining operations and industrial activities

Level

-

Fluctuating raw material prices

-

High competition from synthetic ropes

Level

-

Growing expansion in renewable energy & marine applications

-

Integrating automation with smart rope technologies

Level

-

Intense market competition

-

Fatigue & breakage risk

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rising demand from construction and infrastructure development

Global infrastructure expansion is driving strong demand for steel wire ropes, which are essential for lifting, hoisting, and structural applications in construction. As governments and private sectors invest in major projects such as bridges, tunnels, metros, wind farms, and high-rise buildings, the need for durable, high-tensile wire ropes continues to grow. This demand is closely linked to infrastructure spending, particularly in rapidly urbanizing and industrializing economies. Programs like India’s USD 4.5 trillion National Infrastructure Pipeline exemplify this trend. Beyond lifting, steel wire ropes play a critical role in ensuring safety and stability in modern construction, with their use expanding across megaprojects including airports, metro systems, and renewable energy installations.

Restraint: Fluctuating raw material prices

A key restraint in the steel wire rope market is the high volatility of raw material prices, especially steel and related alloys. Fluctuations in the costs of iron ore, coking coal, and scrap steel, driven by global supply chain issues, energy prices, trade policies, and geopolitical tensions, create unstable production expenses and pricing. This volatility makes it difficult for manufacturers to forecast costs, manage contracts, and maintain profitability. Smaller producers are particularly vulnerable to price shocks, reducing their competitiveness. Inconsistent material availability also disrupts production and delivery schedules, weakening supply chain reliability and hindering long-term industry growth.

Opportunity: Growing expansion in renewable energy & marine applications

The global steel wire rope market is poised for strong growth driven by the rapid expansion of renewable energy projects and marine industries. Increasing investments in offshore wind, tidal, and solar installations are boosting demand for durable, high-performance materials used in lifting, mooring, and cable management. Steel wire ropes, valued for their tensile strength, corrosion resistance, and load-bearing capacity, are vital in offshore wind farms for turbine installation, anchoring, and subsea operations. With global offshore wind capacity expected to exceed 100 GW in the EU alone by 2030, the need for corrosion-resistant ropes is set to surge. Similarly, marine sectors such as shipping, oil & gas, and port operations continue to demand advanced, long-lasting wire rope solutions. This growing focus on renewable and offshore applications presents major opportunities for manufacturers to innovate with lightweight, corrosion-resistant, and high-fatigue-life products to meet evolving industry needs.

Challenge: Intense market competition

The steel wire rope market is highly competitive due to numerous global and regional players offering largely standardized products, leading to intense price-based competition. Low-cost manufacturers, especially from countries with cheaper labor and materials, have escalated this pressure. To stay competitive, companies must cut costs, boost efficiency, and innovate through advanced technologies and R&D to meet growing demand for high-performance, durable ropes in industries like construction, mining, oil and gas, and marine. Additionally, strict regulatory standards add compliance costs. Success in this market depends on differentiation through innovation, quality, strong distribution, and after-sales support.

Steel Wire Rope Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Uses steel wire ropes in bridge cable systems, tower cranes, and hoisting assemblies for heavy-lift operations on large building sites | Enhances site safety, allows for high-capacity lifts, essential for large-scale infrastructure works |

|

Employs steel wire ropes in mine hoists, draglines, and bulk material conveyors in both surface and underground mining | Supports extremely heavy loads, withstands abrasion, and improves operational uptime in rugged settings |

|

Utilizes wire ropes for ship mooring, cargo winches, and offshore support vessels, where corrosion resistance is key | Facilitates safe and efficient docking, cargo handling, and supports offshore rig deployment |

|

Applies steel wire ropes in offshore crane installation, deepwater mooring, and subsea construction | Delivers high fatigue resistance, secure anchoring, and long service life in harsh marine environments |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

STEEL WIRE ROPE MARKET ECOSYSTEM

The steel wire rope ecosystem includes manufacturers, suppliers, distributors, and end-users across industries like construction, mining, oil and gas, shipping, and elevators. It relies on raw materials such as high-carbon steel, machinery for stranding and closing ropes, and quality control systems to ensure durability and safety. The ecosystem is also supported by maintenance services, testing laboratories, and standards organizations that regulate performance and safety requirements.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

STEEL WIRE ROPE MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Steel Wire Rope Market, by Lay Type

Regular lay type led the steel wire rope market because it offers very good structural stability due to the opposing stranding of wires and strands, making it more resistant to external twist and easier to evaluate for wire breaks. Its design results in lower rope torque compared to lang lay ropes, making it widely applicable, especially in construction, mining, and other heavy-duty industries. Regular lay ropes are more cost-effective and commonly used unless there's a specific design need for lang lay ropes, contributing to their dominance in global infrastructure projects. This broad applicability and balance of durability and performance have established regular lay ropes as the market leader.

Steel Wire Rope Market, by Material Type

The carbon steel segment dominated the steel wire rope market due to its high tensile strength, cost-effectiveness, and excellent wear resistance, making it suitable for heavy-duty applications. Its durability and fatigue resistance allow steel wire ropes made from carbon steel to withstand high pressure, load, and frequent stress cycles, extending service life and ensuring safety. The carbon steel's availability and adaptability in construction, industrial, and infrastructure sectors reinforce its widespread use, especially when combined with coatings like galvanization to enhance corrosion resistance.

Steel Wire Rope Market, by Coating

The non-plastic-coated steel wire ropes holds the largest share in the steel wire rope market because they offer cost efficiency and strong mechanical properties suitable for heavy-duty industrial and infrastructural applications. Their zinc (galvanized) coating provides effective corrosion resistance, making them highly durable in harsh environments such as marine, construction, and mining sectors. The uncoated ropes avoid the higher costs and temperature limitations associated with plastic-coated ropes, which can be a critical factor in price-sensitive projects. These characteristics make non-plastic-coated steel wire ropes the preferred choice for long-term, rugged use where performance and budget considerations are important.

Steel Wire Rope Market, by Diameter

The > 1/4 inch diameter holds the largest share in the steel wire rope market due to its superior strength and durability, which are essential for heavy-duty applications in construction, mining, oil & gas, and industrial machinery sectors. These ropes can endure higher tensile loads, mechanical stress, and abrasion, making them ideal for lifting, hauling, and rigging in large-scale infrastructure and industrial projects. The growing infrastructure development and industrialization, especially in regions like Asia Pacific, drive demand for larger diameter wire ropes that offer enhanced safety and longevity under tough environmental conditions.

Steel Wire Rope Market, by Application

The construction application led the steel wire rope market because steel wire ropes are essential for critical construction activities like lifting heavy materials, suspending scaffolding, supporting cranes, and building bridges. Their high tensile strength, corrosion resistance, and durability make them ideal for demanding structural and lifting functions in residential, commercial, and infrastructure projects. The global growth in urbanization, infrastructure investments, and industrial construction further drives the strong demand for steel wire ropes in construction. The growing government-led initiatives and the need for reliable lifting systems in projects such as high-rise buildings and bridges contribute significantly to the demand for these ropes.

REGION

Asia Pacific to be fastest-growing market for steel wire rope during forecast period

Asia Pacific is projected to be the fastest-growing market for steel wire rope during the forecast period due to rapid industrialization, extensive infrastructure development, and increasing investments in construction and mining sectors across countries like China, India, Japan, and South Korea. The region's urbanization and large-scale government-backed projects, including smart cities and port infrastructure, fuel strong demand for steel wire ropes. Additionally, Asia Pacific's dominance in steel production ensures a steady supply of raw materials, supporting cost-effective manufacturing and market growth. The push for advanced, corrosion-resistant, and high-strength wire rope solutions in heavy-duty applications also drives the market expansion in this region.

Steel Wire Rope Market: COMPANY EVALUATION MATRIX

In the steel wire rope market, WireCo (Star) leads with a strong global presence, a broad product portfolio, and a robust distribution network across mining, oil & gas, and construction sectors. Tokyo Rope Mfg. Co., Ltd. (Emerging Leader) is gaining prominence through technological innovation and sustainable manufacturing, showing rising potential to join the leaders’ quadrant as demand grows for precision and eco-efficient steel wire ropes.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size, 2024 (Value) | USD 9.88 Billion |

| Market Forecast, 2030 (Value) | USD 13.88 Billion |

| Growth Rate | CAGR of 5.8% from 2025 to 2030 |

| Years Considered | 2023–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Million/Billion), Volume (Kiloton) |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, Latin America, Middle East & Africa |

WHAT IS IN IT FOR YOU: Steel Wire Rope Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Raw Material Suppliers |

|

|

| Steel Wire Rope Manufacturers |

|

|

| OEMs & Equipment Manufacturers |

|

|

| End Users |

|

|

RECENT DEVELOPMENTS

- May 2025 : WireCo launched Boomfit, a plastic-coated steel wire rope, utilizing CASAR’s renowned Plast rope technology. It was specifically designed for use as an adjustment rope in telescopic cranes, crawler cranes, and large tower cranes.

- May 2025 : Usha Martin’s UK arm, Brunton Shaw Ltd, manufactured and delivered a 102 mm, 3,300 m long OCEANMAX35 steel wire rope weighing 187 tons for a 250-tone crane on a construction vessel. The rope and socket were supplied with third-party certifications, showcasing the company’s advanced manufacturing capability and strong position in the global offshore and heavy-crane rope market.

- February 2025 : Bekaert announced that it reached an agreement on the sale of its Steel Wire Solutions businesses in Costa Rica, Ecuador, and Venezuela to Grupo AG. This transaction valued the underlying entities at a consolidated enterprise value of approximately USD 73 million and is expected to result in net proceeds for Bekaert of approximately USD 37 million.

Table of Contents

Methodology

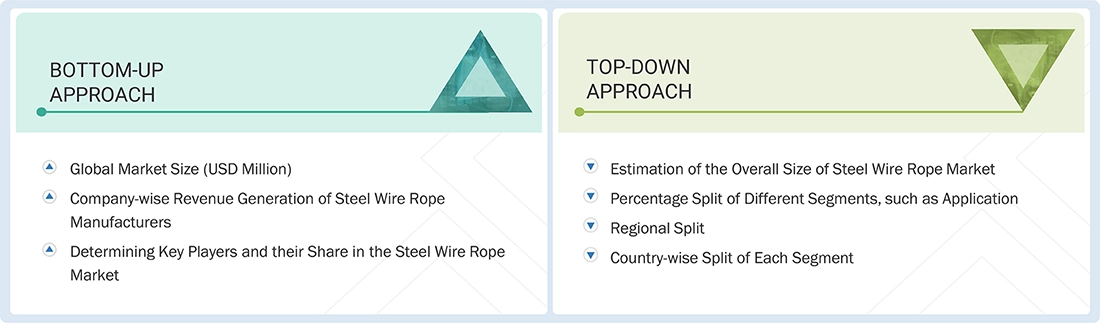

The study involves two major activities in estimating the current market size for the steel wire rope market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary sources referred to for this research study include financial statements of companies offering steel wire rope and information from various trade, business, and professional associations. Secondary research has been used to obtain critical information about the industry’s value chain, the total pool of key players, market classification, and segmentation according to industry trends, to the bottom-most level, and regional markets. Secondary data was collected and analyzed to arrive at the overall size of the steel wire rope market, which was validated by primary respondents.

Primary Research

Extensive primary research was conducted after obtaining information regarding the steel wire rope market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand and supply sides across major countries of North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America. Primary data was collected through questionnaires, emails, and telephonic interviews. The primary sources from the supply side included various industry experts, such as chief experience officers (CXOs), vice presidents (VPs), business development/marketing directors, product development/innovation teams, related key executives from the steel wire rope industry, system integrators, component providers, distributors, and key opinion leaders. Primary interviews were conducted to gather insights such as market statistics, data on revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to lay type, material type, coating, diameter, application, and region. Stakeholders from the demand side, including CIOs, CTOs, CSOs, and installation teams of customers/end users for steel wire rope services, were interviewed to understand the buyer’s perspective on the suppliers, products, component providers, and their current usage of steel wire rope and future outlook of their business, which will affect the overall market.

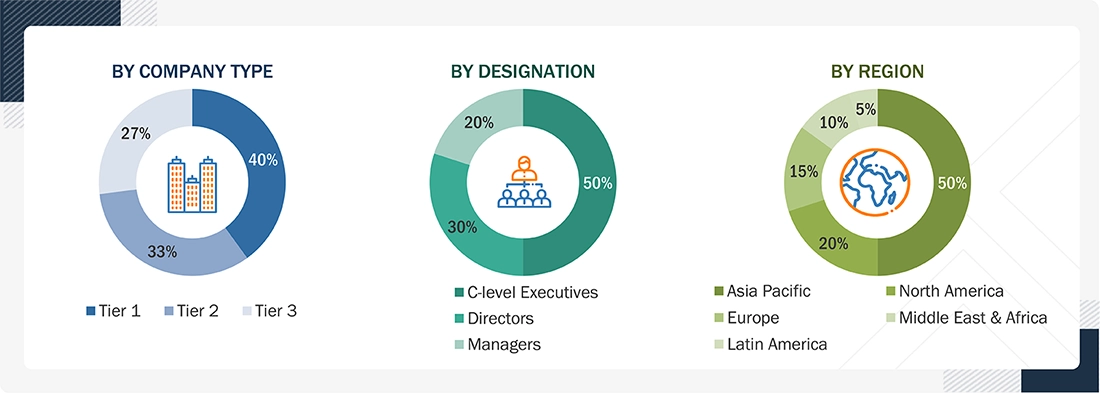

Breakup of Primary Research:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The research methodology used to estimate the size of the steel wire rope market includes the following details. The market size was determined from the demand side. The market was upsized based on the demand for steel wire rope in different applications at the regional level. Such procurements provide information on the demand aspects of the steel wire rope industry for each application. For each application, all possible segments of the steel wire rope market were integrated and mapped.

Data Triangulation

After arriving at the overall size from the market size estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for various market segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Market Definition

The steel wire rope market comprises manufacturers, suppliers, and distributors involved in the production and commercialization of steel wire ropes. These ropes are primarily used for lifting, hoisting, towing, and anchoring applications across various industries, such as construction, mining, oil & gas, marine, cranes, elevators, and infrastructure.

The market encompasses a wide range of product types, including galvanized, stainless steel, plastic-coated, and uncoated ropes, available in different diameters and configurations based on industry-specific requirements.

Stakeholders

- Steel wire rope manufacturers

- Steel wire rope distributors and suppliers

- Universities, governments, and research organizations

- Associations and industrial bodies

- R&D institutes

- Environmental support agencies

- Investment banks and private equity firms

- Research and consulting firms

Report Objectives

- To define, describe, and forecast the steel wire rope market size in terms of volume and value

- To provide detailed information regarding the key factors, such as drivers, restraints, opportunities, and challenges influencing the market growth

- To analyze and project the global steel wire rope market by lay type, material type, coating, diameter, application, and region

- To forecast the market size concerning five main regions (along with country-level data), namely, North America, Europe, Asia Pacific, Middle East & Africa, and Latin America, and analyze the significant region-specific trends

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions of the submarkets to the overall market

- To analyze the market opportunities and the competitive landscape for stakeholders and market leaders

- To assess recent market developments and competitive strategies, such as agreements, contracts, acquisitions, and product developments/product launches, to draw the competitive landscape

- To strategically profile the key market players and comprehensively analyze their core competencies

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Steel Wire Rope Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Steel Wire Rope Market