Temperature Data Logger Market Size, Share & Trends, 2025 To 2030

Temperature Data Logger Market by Type (USB, Bluetooth, Wireless (Web-based, Cloud-based, IoT-based, Battery-operated)), Configuration (Standalone, Connected), Utility (Single-use, Reusable) and Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The temperature data logger market is estimated to be USD 0.52 billion in 2025 and is projected to reach USD 0.70 billion by 2030, registering a CAGR of 5.8%. The temperature data logger market is experiencing significant growth due to the increasing demand for real-time, precise temperature measurement in key industries, including pharmaceuticals, food & beverage, chemicals, and logistics. Strict regulations by organizations such as the FDA, WHO, and EU Good Distribution Practices (GDP) require temperature monitoring of sensitive commodities, particularly vaccines and biologics, with stringent cold chain requirements. This regulatory momentum has contributed to the broad acceptance of temperature data loggers across transportation and storage uses.

KEY TAKEAWAYS

-

BY REGIONAsia Pacific is estimated to dominate the temperature data logger market with a share of 35.5% in 2025.

-

BY TYPEAmong types, the wireless segment is projected to grow at a CAGR of 7.3% during the forecast period.

-

BY CONFIGURATIONThe connected temperature data loggers are projected to witness a growth 6.6% CAGR during the forecast period.

-

BY UTILITYSingle-use temperature data loggers are estimated to account for a share of 58.1% in 2025.

-

BY INDUSTRYBy industry, the pharmaceuticals & life sciences segment accounted for a share of 30.2% in terms of value in 2024.

-

COMPETITIVE LANDSCAPE (KEY PLAYERS)Testo, Hiokii, Elpro-BUCHS AG, Dickson, and Onset Computer Corp were identified as star players in the temperature data logger market, given their broad industry coverage and strong operational & financial strength.

-

COMPETITIVE LANDSCAPE (STARTUPS/SMES)Omega Engineering Inc., Deltatrak, Inc., and Sensitech Inc. have distinguished themselves among SMEs due to their well-developed marketing channels and extensive funding to build their product portfolios.

The demand for temperature data loggers has surged, with these devices providing wireless connectivity for remote access and real-time alerts. They are crucial in the food industry for preventing spoilage and ensuring safety during distribution, as well as in industrial settings for monitoring thermal processes.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The advent of Industry 5.0, AI, and the IoT ecosystem has only increased demand in the market. Temperature data loggers are equipped with wireless connectivity (Bluetooth, Wi-Fi, LoRa, or cellular) to provide remote access, real-time alerts, and cloud-based analytics, which are essential for predictive maintenance and quality control. For the food industry, temperature compliance during distribution has become a non-negotiable requirement to prevent spoilage and ensure consumer safety, given the spurt in e-commerce and online grocery delivery. In industrial applications, temperature data loggers are crucial for monitoring thermal cycling and heat-sensitive processes. The global temperature data logger market in the Asia Pacific and North America is driving adoption, fueled by growing logistics, pharmaceutical, and food export infrastructure.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Increasing penetration of temperature data loggers in pharmaceutical and medical devices industries

-

Stringent monitoring requirements in the food & beverage and cold chain logistics sector

Level

-

High initial cost involved in advanced data loggers

-

Complexities in deployment and integration

Level

-

Incorporation of temperature control systems in food safety management

-

Supportive government initiatives & funding for IoT projects that require temperature measuring devices

Level

-

Stringent performance requirements for advanced applications

-

Data security concerns

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Increasing penetration of temperature data loggers in the pharmaceutical and medical devices industries

The increasing penetration of temperature data loggers in industries such as pharmaceuticals and medical devices is primarily driven by the growing need for accurate temperature monitoring to ensure product safety, compliance, and quality. In the pharmaceutical sector, stringent regulatory standards, such as those enforced by the FDA and EMA, require precise temperature tracking of temperature-sensitive products, including vaccines, biologics, and drugs, during manufacturing, storage, and distribution. Similarly, many medical device products require controlled environments to maintain efficacy and prevent degradation. The rise of cold chain logistics, especially for biologics and advanced therapeutics, further amplifies the demand for reliable temperature data loggers.

Restraint: High initial cost involved in advanced data loggers

The high costs associated with advanced temperature data loggers significantly restrain their widespread adoption, particularly in budget-constrained applications. These devices often incorporate technologies, such as wireless connectivity, cloud integration, multi-sensor capabilities, and extended battery life, which drive manufacturing and purchase costs. Additionally, features such as high data storage capacity, waterproof designs for harsh environments, and calibration for precise measurements further contribute to their expense.

Opportunity: Incorporation of temperature control systems in food safety management

Temperature control plays a vital role in food safety management. In food safety management, temperature control or monitoring is required in various stages, such as cooking, hot holding, reheating, refrigeration, cooling, freezing, and defrosting. According to food safety standards, potentially hazardous food must be stored, displayed, transported, and prepared at safe temperatures. The safe temperature range for potentially hazardous food is 5 °C (41 °F) or colder and/or 60 °C (140 °F) or hotter. Such food needs to be stored at these temperatures to prevent food poisoning bacteria present in the food from multiplying/increasing to dangerous levels. These bacteria can grow at temperatures between 5 °C (41 °F) and 60 °C (140 °F). Accurate and precise temperature data loggers are needed to maintain food quality at such stringent temperatures.

Challenge: Stringent performance requirements for advanced applications

Stringent performance requirements for advanced applications pose a significant challenge in the temperature data logger market. Industries such as pharmaceuticals, healthcare, food storage, and environmental monitoring demand high precision, reliability, and compliance with strict regulatory standards. Meeting these requirements often necessitates specialized designs, rigorous testing, and certification processes, increasing product complexity and cost.

Temperature Data Logger Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Used for component-level and vehicle-wide temperature measurement in R&D, electronics, automotive, and energy efficiency settings | Enables remote, multi-channel, and wireless data logging in industrial, environmental, and automotive tests | Multi-channel, wireless measurements | Real-time display and alarm functions | Easy configuration and no dedicated PC needed |Robust for predictive maintenance and process optimization |

|

Environmental monitoring in pharmaceutical, biotech, and healthcare; supports regulatory and GxP compliance worldwide; automated PDF reporting and secure, cloud-based data management | Advanced monitoring systems and GxP support | Compliance with industry standards |Cloud integration and automated reporting for audit reliability |

|

Compliance monitoring in healthcare, pharma, food & beverage, medical devices; real-time access to temperature, humidity, and pressure via cloud-based systems; simplifies regulatory recordkeeping | Cloud-based monitoring and reporting | User-friendly interface and easy regulatory compliance | Maintains product integrity through precise monitoring |

|

Environmental and energy monitoring (HOBO brand); agricultural, research, building management, and cold-chain logistics data collection and analysis; focus on ease-of-use for non-technical users | Reliable performance in diverse applications | Wide range for environmental monitoring and IoT readiness | Highly accessible for users with minimal technical expertise |

|

Industrial, pharmaceutical, HVAC, and process monitoring with high-precision, multi-industry solutions; integrates temperature/humidity loggers for environmental and process monitoring | Extensive industry coverage and product variety | High-precision measurements | Strong global reputation for quality and innovation |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The temperature data logger market is competitive, with key players such as Onset Computer Corporation (US), HIOKI E.E. Corporation (Japan), Testo SE & Co. KGaA (Germany), ELPRO-BUCHS AG (Switzerland), and Dickson (US) holding a major share in the said market. The market has numerous small and medium-sized vital enterprises. The ecosystem of the temperature data logger market comprises sensor manufacturers, component suppliers, device assemblers, and end users across industries such as pharmaceuticals, food & beverage, logistics, and environmental monitoring. Many players offer temperature data loggers, while others offer integration services required in various applications.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Temperature Data Logger Market, by Utility

Single-use temperature data loggers are projected to dominate the market due to their affordability, simplicity, and widespread use in industries like pharmaceuticals, food & beverage, and cold chain logistics. Designed for one-time use, they are ideal for transporting temperature-sensitive products, as they require no calibration or maintenance. Their lightweight and compact design makes them easy to deploy, particularly in developing regions. Advances such as Bluetooth and NFC integration enhance data retrieval through smartphones or tablets. With the growing demand for temperature-sensitive products and e-commerce, single-use loggers offer an efficient and cost-effective solution, ensuring compliance and quality while maintaining market dominance.

Temperature Data Logger Market, by Type

Wireless temperature data loggers are estimated to grow the fastest and dominate the temperature data logger market due to their superior convenience, real-time monitoring capabilities, and seamless integration with IoT and cloud-based systems. Unlike traditional wired loggers, wireless devices allow remote data access, automated alerts, and easy scalability across multiple locations, which is especially critical for industries such as pharmaceuticals, cold chain logistics, and food processing, where temperature compliance is mandatory. Additionally, ongoing advancements in low-power wireless communication and miniaturized sensor technology further enhance their adoption, making wireless loggers the preferred choice for businesses seeking efficiency, accuracy, and regulatory compliance.

Temperature Data Logger Market, by Industry

Based on industry, the temperature data logger market is segmented into food & beverages, pharmaceutical & life sciences, medical devices, cold chain logistics, electronics & semiconductors, and other industries. The pharmaceutical and life sciences industry segment is expected to dominate the temperature data logger market due to the critical need for precise temperature monitoring in the storage and transportation of temperature-sensitive products, such as vaccines, biologics, and clinical trial samples. Increased global demand for vaccines, particularly due to immunization programs and pandemics, has heightened the dependence on temperature data loggers in the cold chain. Biologics and personalized medicine demand accurate temperature control, with data loggers ensuring compliance and product quality.

REGION

Asia Pacific to be fastest-growing region in global temperature data logger market during forecast period

The Asia Pacific region is poised to drive significant growth in the temperature data logger market, driven by rapid industrialization, the expansion of the pharmaceutical and food & beverage sectors, and a growing emphasis on cold chain monitoring. Rising investments in smart manufacturing, IoT-enabled monitoring systems, and stringent regulatory standards for product safety and quality are boosting adoption. Countries such as China, India, Japan, and South Korea are witnessing an increased deployment of data loggers in logistics, healthcare, and industrial applications. Additionally, favorable government initiatives, growing e-commerce, and technological advancements in wireless and portable data loggers further accelerate market expansion across the region.

Temperature Data Logger Market: COMPANY EVALUATION MATRIX

In the temperature data logger market, HIOKI E.E. CORPORATION is positioned as a star player due to its advanced, high-precision, multi-channel, and wireless data logging solutions backed by a strong global presence and technological innovation. Tempmate is classified as an emerging player as it continues to expand its capabilities in real-time, cloud-integrated temperature monitoring and strengthen its market reach through partnerships and product diversification.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size, 2024 (Value) | USD 0.50 Billion |

| Market Forecast, 2030 (Value) | USD 0.70 Billion |

| Growth Rate | CAGR of 5.8% from 2025 to 2030 |

| Years Considered | 2021–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Million/Billion), Volume (Million Units) |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

|

| Regional Scope | North America, Asia Pacific, Europe, the Middle East, Africa, South America |

WHAT IS IN IT FOR YOU: Temperature Data Logger Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Asia Pacific-based data logger adoption |

|

|

| European OEM Partner Assessment |

|

|

| North American Cold-chain & Logistics Operator |

|

|

| Japan-based Stakeholder for industrial, automotive, transportation, water-pumps, communication and so on. |

|

|

| Material/Component Provider |

|

|

RECENT DEVELOPMENTS

- November 2024 : HOBO Data Loggers announced the launch of the HOBO MX20L data logger, the industry’s first self-contained water level logger featuring Bluetooth technology for fast and easy wireless data offload in the field. This data logger enhanced decision-making and provided easy viewing of the field or office water level and temperature data.

- November 2024 : LI-COR Environmental, the global leader in greenhouse gas measurements, announced the acquisition of Onset, owner of the HOBO brand. With this acquisition, LI-COR, backed by global investment firm Battery Ventures, expands its greenhouse gas portfolio to include sensor networks, data acquisition, and cloud-based data monitoring.

- November 2024 : Vaisala announced that it is building a new automated logistics center in Vantaa, Finland, to centralize its logistics operations and boost efficiency. The EUR 10 million investment, announced in May 2024, would double logistics capacity and convert existing logistics space into production use, increasing production capacity by 20%. The new logistics center would span approximately 2,000 square meters with a height of 12 meters, compared to the 3,000 square meter space and 4-meter height of the current facilities. This compact yet vertically efficient space, achieved through advanced automation, will allow for optimized storage and logistics processes.

- October 2024 : Vaisala announced the acquisition of Nevis Technology Limited, a UK-based software, weather monitoring systems, and services company. The acquisition enabled Vaisala to further develop its business in the offshore wind sector with solutions for safer and more efficient installation, crew transfer, and service operations.

- September 2024 : The Dickson Company launched DicksonOne in the EMEA region. This cloud-based platform offered 24/7 remote monitoring for critical assets, featuring a user-friendly interface and wireless connectivity. Designed for regulated industries, it ensured compliance, integrates data management, and enables real-time access across devices and teams.

Table of Contents

Methodology

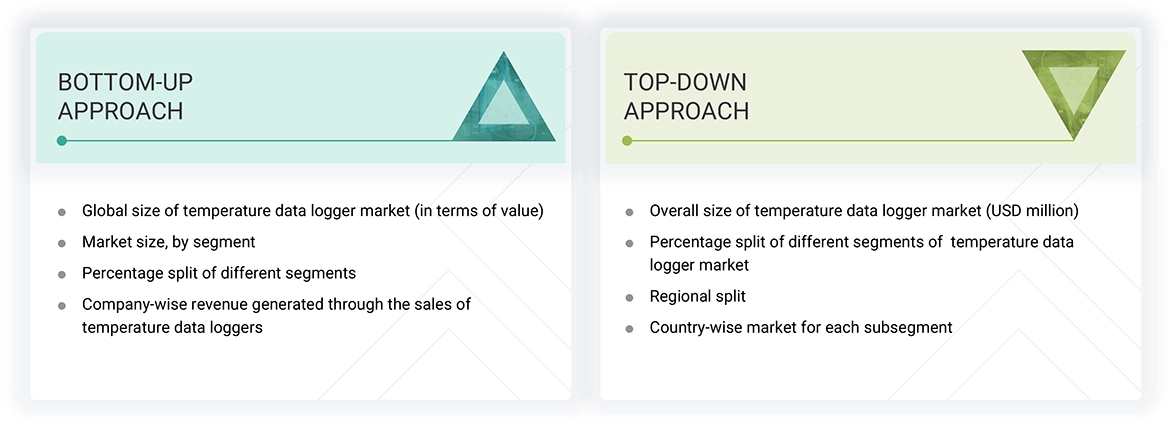

The study utilized four major activities to estimate the temperature data logger market size. Exhaustive secondary research was conducted to gather information on the market and its peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the total market size. Finally, market breakdown and data triangulation methods were utilized to estimate the market size for different segments and subsegments.

Secondary Research

In the secondary research process, various sources were used to identify and collect information on the temperature data logger market for this study. Secondary sources for this research study include corporate filings (such as annual reports, investor presentations, and financial statements), trade, business, and professional associations, white papers, certified publications, articles by recognized authors, directories, and databases. Secondary data was collected and analyzed to determine the overall market size, which was further validated through primary research.

List of Key Secondary Sources

|

Source |

Web Link |

|

The International Organization of Motor Vehicle Manufacturers |

https://www.oica.net/ |

|

International Society of Automation |

|

|

Technology & Services Industry Association (TSIA). |

|

|

Process Equipment Manufacturers' Association (PEMA) |

www.pemanet.org/ |

|

European Semiconductor Industry Association |

https://www.ama-sensorik.de/en/ |

|

AMA Association for Sensor Technology |

https://www.ama-sensorik.de/en/ |

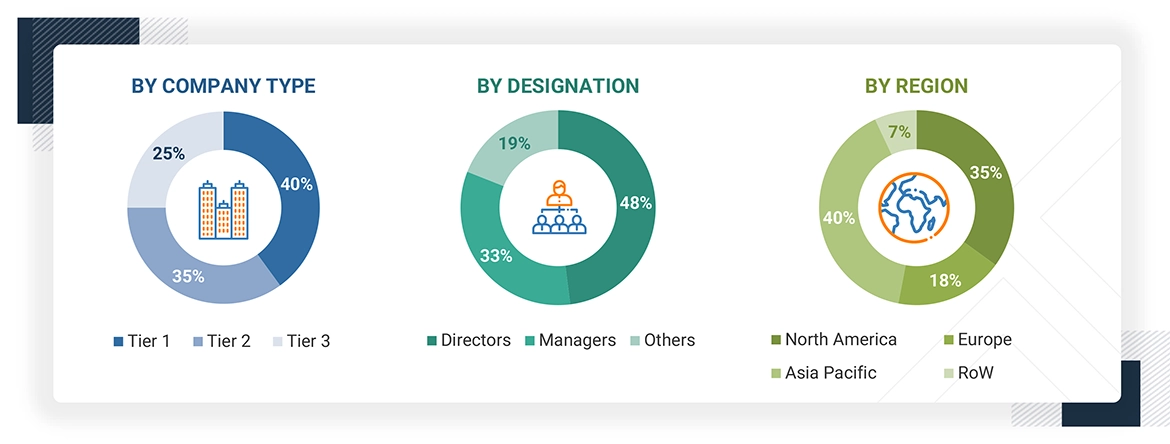

Primary Research

Primary interviews were conducted to gather insights on market statistics, revenue data, market breakdowns, size estimations, and forecasting. Additionally, primary research was used to comprehend the various technologies, types, end-uses, and regional trends. Interviews with stakeholders from the demand side, including CIOs, CTOs, CSOs, and customer/end-user installation teams using temperature data logger offerings and processes, were also conducted to understand their perspective on suppliers, products, component providers, and their current and future use of temperature data logger, which will impact the overall market. Several primary interviews were conducted across major countries in North America, Europe, Asia Pacific, and RoW.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the complete market engineering process, the top-down and bottom-up approaches and several data triangulation methods have been used to estimate and forecast the overall market segments and subsegments listed in this report. Key players in the market have been identified through secondary research, and their market shares in the respective regions have been determined through primary and secondary research. This entire procedure includes the study of annual and financial reports of the top market players and extensive interviews for key insights (quantitative and qualitative) with industry experts (CEOs, VPs, directors, and marketing executives).

All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources. All the parameters affecting the markets covered in this research study have been accounted for, viewed in detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data has been consolidated and supplemented with detailed inputs and analysis from MarketsandMarkets and presented in this report. The following figure represents this study's overall market size estimation process.

Temperature Data Logger Market : Top-Down and Bottom-Up Approach

Data Triangulation

Once the overall size of the temperature data logger market was determined using the methods described above, it was divided into multiple segments and subsegments. Market engineering was performed for each segment and subsegment using market breakdown and data triangulation methods, as applicable, to obtain accurate statistics. Various factors and trends from the demand and supply sides were studied to triangulate the data. The market was validated using both the top-down and bottom-up approaches..

Market Definition

A temperature data logger is an electronic device designed to monitor, measure, and automatically record temperature data. Temperature data loggers come in various shapes and sizes and have various features and capabilities equipped with different technologies. Some of these are compact, portable devices that can be battery-powered and equipped with a microprocessor that uses internal memory to store temperature measurements. A few data loggers connect directly to a personal computer, allowing users to activate the device and analyze the recorded data remotely via specialized software. Some function as standalone devices with a built-in user interface, enabling them to operate independently without requiring a separate computer.

The report study covers a comprehensive analysis of the temperature data logger market based on type, utility, configuration, industry, and region. The temperature data logger market is competitive, with prominent players such as Onset Computer Corporation (US), HIOKI E.E. Corporation (Japan), Testo SE & Co. KGaA (Germany), ELPRO-BUCHS AG (Switzerland), and Dickson (US).

Key Stakeholders

- Original equipment manufacturers (OEMs)

- Pharmaceutical manufacturers

- Components suppliers

- Temperature data logger distributors and traders

- Research organizations and consulting companies

- Government bodies such as regulating authorities and policymakers

- Venture capitalists, private equity firms, and startup companies

- Forums, alliances, and associations related to temperature monitoring

- Financial institutions, analysts, and strategic business planners

- Existing end users and prospective ones

- System integrators and technology consultants

Report Objectives

- To describe and forecast the temperature data logger market size by type, utility, configuration, industry, and region in terms of value

- To describe and forecast the market for various segments across four main regions, namely, North America, Europe, Asia Pacific, and RoW, in terms of value

- To strategically analyze micromarkets about individual growth trends, prospects, and market contributions

- To provide detailed information regarding drivers, restraints, opportunities, and challenges influencing market growth

- To analyze opportunities for stakeholders by identifying high-growth segments in the market

- To provide a detailed overview of the temperature data logger value chain

- To strategically analyze key technologies, indicative selling price trends, trends impacting customer business, ecosystem, regulatory landscape, patent landscape, Porter's five forces, import and export scenarios, trade landscape, key stakeholders and buying criteria, and case studies about the market under study

- To strategically profile key players in the temperature data logger market and comprehensively analyze their market share and core competencies

- To analyze competitive developments, such as partnerships, acquisitions, expansions, collaborations, and product launches, along with R&D in the temperature data logger market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to five)

- Additional country-level analysis of the temperature data logger market

Product Analysis

- Product matrix, for a detailed comparison of the product portfolio of each company in the temperature data logger market

Key Questions Addressed by the Report

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Temperature Data Logger Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Temperature Data Logger Market