Thin-Film Electrode Market

Thin-Film Electrode Market by Material (Metal Based, Boron-Doped Diamond Based, Carbon Based, Polymer Based, Other Materials), Manufacturing Facility (Physical Vapor Deposition, Chemical Vapor Deposition, Sputtering, Electrochemical Deposition/Electroplating, Other Manufacturing Technology), End-Use Industry (Healthcare & Biotechnology, Electronics & Semiconductor, Energy & Power, Chemical & Petrochemical, Other End-Use Industries) - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The thin-film electrode market is projected to reach USD 0.97 billion in 2030 from USD 0.57 billion in 2025, at a CAGR of 11.3% from 2025 to 2030. The thin-film electrodes market is driven by the growing demand for miniaturized and flexible electronic devices, rapid advancements in biosensors and wearable technologies, and the expanding semiconductor and renewable energy sectors that rely on high-performance, lightweight, and efficient electrode materials.

KEY TAKEAWAYS

-

BY MATERIAL TYPEThe thin-film electrodes market by material type encompasses metal based, boron-dopes diamond based,caron-based, polymer based and other materials. Metal-based electrodes hold the largest market share due to their superior electrical conductivity, mechanical stability, and durability, making them ideal for applications in semiconductors, biosensors, and energy storage devices requiring high precision and performance.

-

BY MANUFACTRUING TECHNOLOGYThe thin-film electrode market by manufacturing technology is segmented into Physical Vapor Deposition (PVD), Chemical Vapor Deposition, Sputtering, Electrochemical Deposition/ Electroplating, and Other Manufacturing Technology. PVD is the most widely used technology for manufacturing thin-film electrodes because it enables precise control over film thickness, composition, and uniformity, ensuring high performance, conductivity, and stability essential for applications in electronics, sensors, and energy devices.

-

BY END-USE INDUSTRYBased on end-use industry, the thin-film electrode market is segmented into Healthcare & Biotechnology, Electronics & Semiconductor, Energy & Power, Chemical & Petrochemical, and Other End-Use Industries. The electronics and semiconductor end-use industry dominates the thin-film electrode market, as it requires high-precision, miniaturized, and reliable components for integrated circuits, sensors, and microchips, driving extensive use in smartphones, wearables, and advanced computing devices.

-

BY REGIONThe thin-film electrodes market covers Europe, North America, Asia Pacific, South America, the Middle East, and Africa. Asia Pacific holds the largest market share due to its strong electronics and semiconductor manufacturing base, rapid industrialization, government-backed investments in renewable energy and healthcare, and dominant players in China, Japan, South Korea, and Taiwan driving thin-film electrode demand.

-

COMPETITIVE LANDSCAPEMajor market players have adopted both organic and inorganic strategies, including collaboration and product launches. For instance, MicruX is excited to announce the expansion of its screen-printed dual electrode (D2PE) lineup, offered in gold alongside the high-performance carbon version.

The thin-film electrodes market is primarily influenced by key drivers. The thin-film electrodes market is driven by rising demand in semiconductors, electronics, and healthcare applications, fueled by advancements in miniaturization and energy efficiency. Growing investments in AI chips and flexible electronics, alongside expanding renewable energy systems, further accelerate global market growth and technological innovation.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The thin-film electrode market is evolving rapidly, driven by advancements in electronics, energy storage, and healthcare technologies. Increasing demand for miniaturized and flexible devices has boosted the use of thin-film electrodes in sensors, batteries, and medical implants. As industries focus on compact, efficient, and sustainable technologies, thin-film electrodes are becoming essential components across diverse end-use sectors.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Growing demand for flexible and wearable technology

-

Miniaturization in Sensors and Biosensors

Level

-

Elevated production costs and challenges in scaling manufacturing processes

-

Material limitations and degradation concerns

Level

-

Expanding market for flexible and transparent electronic applications

-

Potential for cost savings through the adoption of carbon-based electrode materials

Level

-

Achieving sustained stability and biocompatibility for thin-film electrodes in practical settings

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Miniaturization in Sensors and Biosensors

Advancements in sensor technologies have led to the miniaturization of devices, necessitating the use of thin-film electrodes. Miniaturized sensors and biosensors require electrodes that can operate effectively at small scales while maintaining sensitivity and accuracy. The development of miniaturized integrated thin-film biosensors has enabled the creation of compact devices capable of performing complex analyses in real-time. The ongoing trend towards miniaturization in sensors and biosensors is expected to drive the demand for advanced thin-film electrodes that offer high performance, scalability, and compatibility with diverse substrates

Restraint: Elevated production costs and challenges in scaling manufacturing processes

The production of thin-film electrodes involves complex processes that can be costly; for example, large-area deposition techniques, such as chemical vapor deposition (CVD). Scaling these manufacturing processes to meet market demands presents significant challenges. The high production costs associated with thin-film electrodes can limit their widespread adoption, particularly in cost-sensitive applications.

Opportunity: Expanding market for flexible and transparent electronic applications

The increasing demand for flexible and transparent electronic applications presents significant opportunities for the thin-film electrodes market. These applications require electrodes that can conform to various substrates and maintain performance under mechanical stress. Thin-film electrodes, with their inherent flexibility and transparency, are well-suited for integration into devices such as flexible displays, smart textiles, and transparent sensors.

Challenge: Achieving sustained stability and biocompatibility for thin-film electrodes in practical settings

A key challenge for thin-film electrodes is achieving sustained stability and biocompatibility, particularly in medical, healthcare, and wearable applications. These electrodes must maintain consistent electrical performance over extended periods while withstanding mechanical stress, environmental variations, and repeated use. Equally important is ensuring compatibility with biological tissues to prevent cytotoxicity or adverse reactions, which is critical for safe operation in practical settings. Overcoming these obstacles is essential for the broader adoption of thin-film electrodes in healthcare devices, implantable sensors, and wearable technologies.

thin-film-electrode-market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Used in advanced semiconductor fabrication for precise current control and wafer-level sensing during microchip production | Enables high conductivity, miniaturization, and improved device reliability in next-generation semiconductor processes |

|

Integrated into flexible displays, wearable sensors, and advanced microelectronic components | Supports lightweight, bendable designs, and enhances performance in flexible and wearable electronics |

|

Applied in OLED panels, touch sensors, and energy devices like thin-film batteries | Improves energy efficiency, sensitivity, and device durability for consumer electronics |

|

Utilized in electrochemical biosensors and point-of-care diagnostic strips for glucose and coagulation testing | Provides high sensitivity, rapid signal response, and miniaturized diagnostic platforms for healthcare applications |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

Thin-film electrodes are ultra-thin conductive layers made from materials such as gold, platinum, or carbon, deposited onto solid surfaces such as silicon or glass. These electrodes are created using advanced techniques like Physical Vapor Deposition (PVD) and Chemical Vapor Deposition (CVD) to ensure high precision, conductivity, and durability. Manufacturers such as MicruX Technologies is leading innovators in this field, producing electrodes used in semiconductors, biosensors, and electrochemical systems. As industries increasingly demand miniaturized and high-performance components, thin-film electrodes are becoming vital for improving efficiency and enabling advanced technological applications across electronics, healthcare, and industrial sectors.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Thin-Film Electrode Market, By Material Type

As of 2024, metal-based thin-film electrodes hold the largest share due to their excellent electrical conductivity, mechanical stability, and compatibility with diverse substrates. Their superior performance in sensors, semiconductors, and energy devices, along with widespread use in flexible and miniaturized electronics, strengthens their dominance over carbon- or polymer-based alternatives.

Thin-Film Electrode Market, By Manufacturing Technology

In 2024, physical vapor deposition (PVD) dominates thin-film electrode manufacturing due to its ability to produce uniform, high-purity, and strongly adherent films. Its precise control over film thickness and composition makes it ideal for advanced electronics, sensors, and energy applications, ensuring superior performance and scalability across industrial processes.

Thin-Film Electrode Market, By End-use Industry

The electronics and semiconductor segment held the largest share in 2024 due to the widespread use of thin-film electrodes in microchips, sensors, and flexible electronic devices. Their high electrical conductivity, stability, and compatibility with miniaturized circuits make them essential for enhancing device performance and reliability in modern electronic and semiconductor applications.

REGION

Asia Pacific to be fastest-growing region in global thin-film electrode market during forecast period

Asia Pacific is the fastest-growing market for thin-film electrodes due to rapid industrialization, strong expansion of the electronics, semiconductor, and medical device sectors, and increasing investments in renewable energy technologies. Countries like China, Japan, South Korea, and India are leading in electronics manufacturing, flexible devices, and energy storage systems, driving large-scale demand. The region’s growing R&D capabilities, cost-effective manufacturing, and rising adoption of miniaturized electronic components make Asia Pacific a key hub for thin-film electrode production and development.

thin-film-electrode-market: COMPANY EVALUATION MATRIX

In the thin-film electrode market matrix, MicruX Technologies (Star) leads with a strong product portfolio and extensive manufacturing capability, driven by its expertise in custom thin-film and screen-printed electrodes, complete in-house design-to-manufacture services, and academic-derived innovation. On the other hand, PalmSens BV (Pervasive Player) functions mainly as a distributor of thin-film electrodes.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 0.57 Billion |

| Market Forecast in 2030 (value) | USD 0.97 Billion |

| Growth Rate | CAGR of 11.3% from 2025–2030 |

| Years Considered | 2021–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Million/Billion), Volume (TONS) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, South America, Middle East & Africa |

WHAT IS IN IT FOR YOU: thin-film-electrode-market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Semiconductor & Electronics Manufacturer |

|

|

| Thin-Film Electrode Manufacturer |

|

|

RECENT DEVELOPMENTS

- March 2025 : n MicruX is excited to announce the expansion of its screen-printed dual electrode (D2PE) lineup, now offered in gold alongside the high-performance carbon version. These D2PEs feature advanced design and are fabricated on flexible, high-resistivity PET substrates, providing enhanced durability, reliability, and exceptional performance for researchers and developers across diverse applications.

- June 2025 : n Linxens and FlexMedical Solutions have partnered to develop and deliver ready-to-use functionalized electrodes designed for next-generation biosensor applications.

- May 2023 : n MicruX is pleased to introduce its new line of graphene-based screen-printed electrodes, designed on both flexible PET and rigid ceramic substrates. These electrodes feature low electrical resistance and excellent scratch resistance, ensuring enhanced durability and performance.

Table of Contents

Methodology

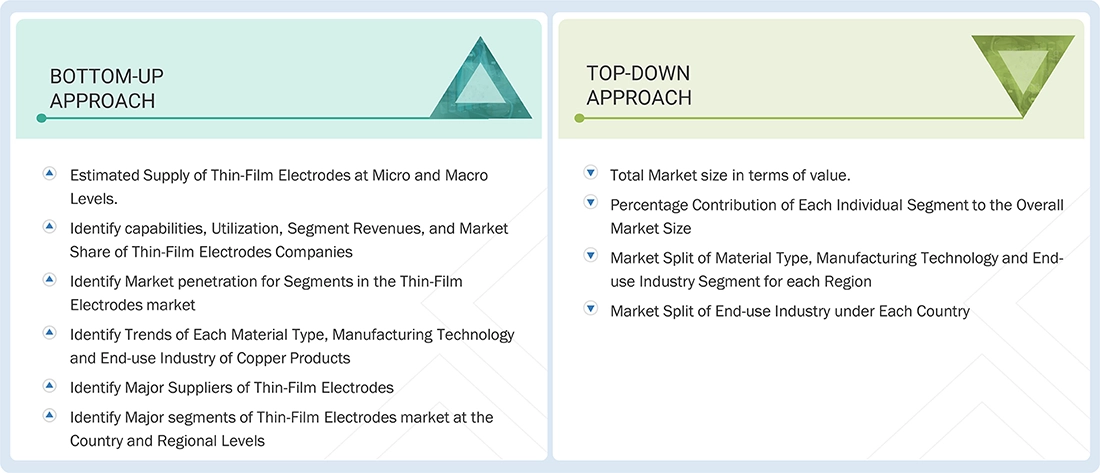

The study involved four major activities in estimating the market size of the thin-film electrode market. Exhaustive secondary research was conducted to gather information on the market, its peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information for this study. These secondary sources include annual reports, press releases, investor presentations of companies, white papers, certified publications, trade directories, certified publications, articles from recognized authors, gold standard and silver standard websites, and databases.

Secondary research has been used to obtain key information about the value chain of the industry, monetary chain of the market, the total pool of key thin-film electrodes, market classification and segmentation according to industry trends to the bottom-most level, and regional markets. It was also used to obtain information about the key developments from a market-oriented perspective.

Primary Research

The thin-film electrode market comprises several stakeholders in the value chain, including raw material suppliers, manufacturers, and end users. Various primary sources from the supply and demand sides of the thin-film electrode market have been interviewed to obtain qualitative and quantitative information. The primary interviewees from the demand side include key opinion leaders in end-use sectors. The primary sources from the supply side include manufacturers, associations, and institutions involved in the thin-film electrode industry.

Primary interviews were conducted to gather insights, including market statistics, revenue data collected from products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to material, manufacturing technology, end-use industry, and region. Stakeholders from the demand side, such as CIOs, CTOs, and CSOs, were interviewed to understand the buyer’s perspective on the suppliers, products, component providers, and their current usage of thin-film electrode and future outlook for their business, which will affect the overall market.

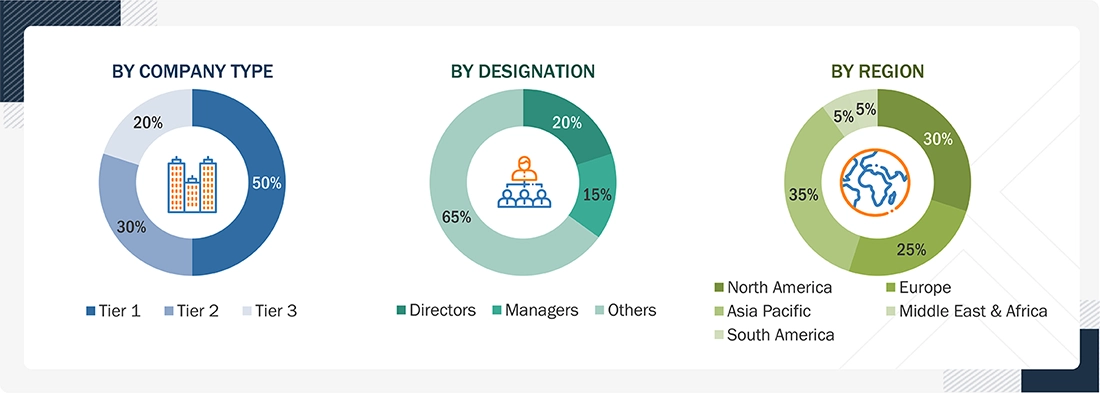

The breakdown of profiles of the primary interviewees is illustrated in the figure below:

Notes: Tier 1, Tier 2, and Tier 3 companies are classified based on their market revenue in 2024, available in the public domain, product portfolios, and geographical presence.

Other designations include sales representatives, production heads, and technicians.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

A top-down approach was used to estimate and validate the size of various submarkets for thin-film electrodes in each region. The research methodology used to estimate the market size

included the following steps:

- The key players in the industry have been identified through extensive secondary research.

- The supply chain of the industry has been determined through primary and secondary research.

- The global market was then segmented into five major regions and validated by industry experts.

- All percentage shares, splits, and breakdowns based on material, manufacturing technology, end-use industry, and regions were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. This data was consolidated, supplemented with detailed inputs and analysis, and presented in this report.

Thin-Film Electrode Market : Top-Down and Bottom-Up Approach

Data Triangulation

After determining the total market size through the estimation process mentioned above, the overall market has been divided into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics for all the segments and sub-segments, the data triangulation and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Additionally, the market size has been validated using both top-down and bottom-up approaches, as well as primary interviews. Hence, for every data segment, there have been three sources—top-down approach, bottom-up approach, and expert interviews. The data was assumed correct when the values arrived from the three sources matched.

Market Definition

A thin-film electrode is an ultra-thin conductive layer, typically a few nanometers to micrometers thick, deposited on a solid substrate such as silicon, glass, ceramic, or flexible polymer to enable precise electrical or electrochemical performance. These electrodes are manufactured using advanced deposition technologies such as Physical Vapor Deposition (PVD), Chemical Vapor Deposition (CVD), or sputtering, ensuring uniform thickness, strong adhesion, and high conductivity. Common materials include metals (gold, platinum, titanium, silver), carbon-based compounds (graphene, graphite), and boron-doped diamond (BDD), chosen for their superior chemical stability and electrical efficiency. Thin-film electrodes are widely used in biosensors, medical diagnostics, microelectronics, energy storage, and environmental monitoring systems. In healthcare, they power wearable and implantable sensors, while in the electronics and semiconductor industries, they are vital for integrated circuits and microdevices. Their use in fuel cells, batteries, and electrochemical reactors supports the global shift toward clean energy. Market growth is driven by the demand for miniaturized, high-performance, and flexible electronic components, along with advances in nanomaterials and deposition technology.

Key Stakeholders

- Thin-Film Electrode Manufacturers

- Thin-Film Electrode Traders, Distributors, and Suppliers

- Raw Type Suppliers

- Government and Private Research Organizations

- Associations and Industrial Bodies

- R&D Institutions

- Environmental Support Agencies

Report Objectives

- To define, describe, and forecast the size of the thin-film electrode market, in terms of value and volume

- To provide detailed information about the significant drivers, opportunities, restraints, and challenges influencing the growth of the market

- To estimate and forecast the market size based on material, manufacturing technology, end-use industry, and region

- To forecast the size of the market with respect to major regions, namely, Europe, North America, Asia Pacific, Middle East & Africa, and South America, along with their key countries

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and their contribution to the overall market

- To analyze opportunities in the market for stakeholders and provide a competitive landscape of market leaders

- To track and analyze recent developments such as product launches and deals in the market

- To strategically profile key market players and comprehensively analyze their core competencies

Available Customizations

Along with the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Regional Analysis

- Further breakdown of a region with respect to a particular country or additional application

Company Information

- Detailed analysis and profiles of additional market players

Tariff & Regulations

- Regulations and impact on thin-film electrode market

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Thin-Film Electrode Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Thin-Film Electrode Market