Tools Plastic Market

Tools Plastic Market by Type (Acrylonitrile Butadiene Styrene (ABS), Polyamide (Nylon), Polycarbonate (PC), Polybutylene Terephthalate (PBT), Thermoplastic Elastomer (TPE), Other Types), Application (Power Tools, Garden Tools, Medical Tools, Construction Tools, Other Applications), End-use Industry (Industrial (Professional), Residential (Commercial)), and Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The tools plastic market is expected to reach USD 7.28 billion by 2030, up from USD 5.31 billion in 2025, registering a CAGR of 6.5% during the forecast period. The growth is driven by increasing demand for lightweight, durable, and corrosion-resistant plastics across the automotive, aerospace, consumer electronics, and industrial manufacturing sectors. These plastics offer enhanced design flexibility, cost savings, and easier molding, allowing for the production of precision tools, handles, housings, and components from engineered plastics.

KEY TAKEAWAYS

-

BY TYPETools plastic market is segmented on the basis of material into ABS, polyamide (nylon), PC, PP, PVC, HDPE, and other types. Polypropylene (PP) is the leader in the tools plastic market due to excellent strength, flexibility, and value, which makes it a great material for many types of manufacturing of hand tools, power tool components, and tool casings or housings. In addition to its capacity for manufacturing, PP exhibits excellent chemical resistance, low density, and excellent fatigue strength, providing longer-lasting, lighter tools for improved use.

-

BY FUNCTIONALITYTools plastic market is segmented by functionality, includes power tools and mechanical tools. Mechanical tools are the largest in the tools plastic market owing to their versatility in industrial, construction, and consumer applications. Plastics used in mechanical tools such as handles, housings, gears and casings provide strength and durability options to replace heavier metal tools, providing ergonomic benefits and reducing long-term fatigue for the user.

-

BY APPLICATIONBy application, the market is segmented into industrial (professional), residential, and commercial. Industrial (professional) is the largest end-use industry for tool plastics due to high demand for durable, high-performance, and lightweight tools across various markets such as manufacturing, construction, automotive, aerospace, and maintenance.

-

BY END-USE INDUSTRYBy end-use industry, the market is segmented into construction, medical, automotive, agriculture/farming/gardening, aerospace, manufacturing, shipbuilding, and other end-use industries. The tools plastic market's largest end-use segment is the construction industry due to significant usage of robust, durable, lightweight, and affordable materials to support large construction projects. Construction is a broad category of activities, with substantial ranges of tools including, hand tools, power tools housings, personal protective equipment, fasteners and fittings, etc., a wide variety of which are made from engineered plastics.

-

BY REGIONThe tools plastic market covers Europe, North America, Asia Pacific, South America, the Middle East, and Africa. Asia Pacific region holds the largest share of the tools plastic market due to growth in industrialization, ongoing expansion in manufacturing activities, and a strong consumer base in major countries like China, India, Japan, and South Korea.

-

COMPETITIVE LANDSCAPEMajor market players have adopted both organic and inorganic strategies, including partnerships and investments. DuPont (US), BASF (Germany), Eastman Chemical Company (US), Covestro AG (Germany), Solvay (Belgium), LG Chem (South Korea), SABIC (Saudi Arabia), Dow (US), Exxon Mobil Corporation (US), and LyondellBasell Industries Holdings B.V. (US) are some of the major players in the tools plastic market.

The global tools plastic market is expanding rapidly, driven by increasing demand for the high-performance material, cost-effective manufacturing processes, and technological advancements and ergonomics. Additionally, the rising adoption of electric vehicles (EVs) boosts demand for thermally insulating and electrically insulating plastics and polymers for use in energy-efficient, longer-range systems. Government and regulatory agencies like REACH, EPA, and RoHS influence the market through regulations related to environmental standards, safety protocols, and hazardous substances.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on consumers' business emerges from customer trends or disruptions. Companies likeStanley Black & Decker, Makita Corporation, and Robert Bosch, focus on attributes like lightweight design, durability, power efficiency, safety, precision, and reliability to deliver comfortable handling, extended product life, longer battery life, safe operation, high-quality output, and consistent performance. This strategic alignment highlights the focus on innovation and efficiency in the tools plastic market.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Expansion of key end-use industries

-

Technological advancements and cordless revolution

Level

-

Volatility in raw material prices

-

High cost of engineering plastic and tooling

Level

-

Growth in sustainable and recycled plastics

-

Innovation in high-performance applications

Level

-

Stringent environmental regulations and public scrutiny

-

Competition from substitute materials

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Expansion of key end-use industries

The primary and most powerful driver for the market is the sustained, robust growth across its core end-use sectors. The global construction industry, which is the largest single consumer of tools, continues to expand due to rapid urbanization in emerging economies and significant government investments in infrastructure in developed nations. Initiatives like the Infrastructure Investment and Jobs Act in the US are channeling billions into projects that require a vast array of industrial-grade tools. Similarly, the automotive industry's transformative shift toward electric vehicles (EVs) and lightweighting is fueling demand for specialized tools and the advanced, high-performance plastics used to make them. Finally, a growing and aging global population is increasing healthcare spending, which, in turn, drives the high-volume consumption of disposable plastic medical tools and devices, a segment that is foundational to the market's overall size.

Restraint: Volatility in raw material prices

A significant and persistent restraint on the market is the price volatility of the raw materials used to produce plastics. The cost of most plastic resins is intrinsically linked to the price of petrochemical feedstocks, such as crude oil and natural gas, which are subject to fluctuations in global commodity markets. This instability creates significant challenges for both resin producers and tool manufacturers in managing costs, forecasting budgets, and maintaining stable profit margins. Price spikes can either be absorbed, compressing profitability, or passed on to consumers, which can dampen demand for the final tool products.

Opportunity: Growth in sustainable and recycled plastics

A major market opportunity lies in the development and adoption of sustainable plastics. Driven by stringent environmental regulations and growing consumer demand for eco-friendly products, there is a significant push for manufacturers to incorporate recycled, bio-based, and biodegradable plastics into their tools and packaging. The European Union, for example, has set an ambitious target to use 10 million tons of recycled plastics in new products by 2025. Leading companies are already responding; Stanley Black & Decker has removed over 1.3 million pounds of problematic plastic from its packaging, and Bosch is increasingly using recycled materials in its tool housings. Companies that successfully innovate in this space can enhance their brand reputation, meet regulatory requirements, and capture a growing segment of environmentally conscious consumers

Challenge: Stringent environmental regulations and public scrutiny

The plastics industry faces a significant challenge from tightening environmental regulations and negative public perception related to plastic pollution. Governments worldwide, particularly in the European Union, are implementing strict policies to combat plastic waste, promote recycling, and move toward a circular economy. These regulations often include mandatory targets for recycled content, restrictions on certain types of single-use plastics, and extended producer responsibility (EPR) schemes. Complying with these evolving standards requires substantial investments in research & development, new manufacturing processes, and the reconfiguration of supply chains to source and validate recycled materials, which can be both costly and complex. The quality and consistent availability of high-grade recycled plastics also remain a significant industry-wide challenge.

Tools Plastic Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

High-performance engineering plastics for power tools, hand tools, and industrial equipment housings | Excellent dimensional stability, impact resistance, lightweight, and easy processability for durable tool parts |

|

Polyamide (Nylon) and acetal resins for mechanical tools, connectors, and functional components | High strength-to-weight ratio, wear resistance, and superior performance under mechanical stress |

|

Polycarbonate blends and thermoplastic polyurethane for protective casings and ergonomic tool designs | Transparent, tough, chemical resistant, and offers design flexibility for user comfort and safety |

|

Polypropylene and polyethylene compounds for tool handles, housings, and fastening systems | Cost-effective, recyclable, fatigue-resistant, and provides high rigidity with environmental stability |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The tools plastic market ecosystem consists of raw material suppliers (Arkema, Formosa Plastics Corporation, Asahi Kasei), manufacturers (BASF SE, DuPont, Covestro, Lyondellbasell Industries), distributors (Ravago Manufacturing, Piedmont Plastics, Nexeo Plastics, LLC.) and end users (Stanley Black & Decker, Robert Bosch GmbH, Makita Corporation). Raw material suppliers provide engineering plastics, composites, and specialty polymers. Manufacturers develop high-performance plastic components for power tools, hand tools, and industrial equipment. Distributors manage the supply chain, ensuring material availability and delivery. End users integrate these materials into durable, ergonomic, and efficient tool designs, while regulatory bodies enforce safety, quality, and sustainability standards.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Tools Plastic Market, By Type

Polypropylene (PP) is the leader in the tools plastic market due to excellent strength, flexibility, and value, which makes it a great material for many types of manufacturing of hand tools, power tool components, and tool casings or housings. In addition to its capacity for manufacturing, PP exhibits excellent chemical resistance, low density, and excellent fatigue strength, providing longer-lasting, lighter tools for improved use. Polymer polypropylenes moldability allows manufacturers to create complex tool features while maintaining precision. It also has the ability to resist the exposure to moisture and is highly resistant to impact provides more durability to PP tools in some of the harshest working environments.

Tools Plastic Market, By Functionality

Mechanical tools are the largest in the tools plastic market owing to their versatility in industrial, construction, and consumer applications. Plastics used in mechanical tools such as handles, housings, gears and casings provide strength and durability options to replace heavier metal tools, providing ergonomic benefits and reducing long-term fatigue for the user. Mechanical tool plastics possess excellent resistance to corrosion, impact, and chemicals in addition to durability in high heat conditions. Engineering plastics such as polyamides, ABS and polycarbonates can be molded with precision and high mechanical strength, which play important roles in many highly mechanical tools such as drills, wrenches, and power tool construction.

Tools Plastic Market, By Application

The commercial segment is the fastest-growing application in the tools plastic market due to rising demand from construction, maintenance, and industrial service sectors. Increasing adoption of power tools and hand tools for infrastructure development, repair, and facility management boosts plastic usage in tool housings, handles, and functional parts. Plastics such as polyamide, polycarbonate, and polypropylene offer lightweight strength, corrosion resistance, and cost efficiency, making them ideal for high-performance commercial tools. Additionally, the trend toward ergonomic, durable, and energy-efficient tools in professional environments further drives the preference for advanced engineering plastics in the commercial application segment.

Tools Plastic Market, By End-use Industry

The aerospace sector is the fastest-growing application in the tools plastic market due to increasing demand for lightweight, high-strength, and temperature-resistant materials used in aircraft maintenance and assembly tools. Engineering plastics such as polyamide, PEEK, and polycarbonate are replacing metals to reduce tool weight and operator fatigue while maintaining precision and durability. With the rapid expansion of commercial and defense aviation, the need for specialized plastic tools for component fabrication, inspection, and servicing is rising.

REGION

Asia Pacific to be fastest-growing region in global tools plastic market during forecast period

The Asia Pacific region is the fatest growing region in the tools plastic market due to growth in industrialization, ongoing expansion in manufacturing activities, and a strong consumer base in major countries like China, India, Japan, and South Korea. The region has the largest production centers for electrical, automotive, construction, and industrial tools, which are increasingly utilizing high-performance plastics for items such as housings, handles, and insulation. Countries benefit from low labor costs, readily available raw materials, and favorable government policies that boost large-scale production and exports of plastic-based tools. Rising urbanization and infrastructure development have also increased demand for construction and power tools. The growth of the middle class, with higher disposable incomes, drives increased consumption of consumer-grade tools, especially in India and Southeast Asian countries.

Tools Plastic Market: COMPANY EVALUATION MATRIX

BASF stands out as a star player in the tools plastic market with its broad range of advanced materials like Ultramid (PA) and Ultradur (PBT), known for strength, heat resistance, and design versatility. Its global reach, innovation focus, and partnerships with tool makers reinforce its dominance. Celanese Corporation, an emerging leader, is growing rapidly through engineered materials like POM and PPS, emphasizing lightweight, sustainable, and customized plastic solutions.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 5.00 Billion |

| Market Forecast in 2030 (Value) | USD 7.28 Billion |

| Growth Rate | CAGR of 6.5% from 2025-2030 |

| Years Considered | 2022-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/Billion), Volume (Kiloton) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, South America, Middle East & Africa |

WHAT IS IN IT FOR YOU: Tools Plastic Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Leading Tool OEM |

|

Improved supplier selection via profiling (certifications, mechanical capabilities, R&D strength) |

| Material Manufacturer |

|

Insight into adoption trends of advanced engineering plastics (PA, PC, PBT, PP) |

| Tool Component Manufacturer |

|

Technical and cost-benefit analysis for choosing plastic vs. metal components |

| Raw Material Supplier |

|

Benchmarking global and regional production capacity for engineering plastics |

RECENT DEVELOPMENTS

- April 2025 : BASF’s Cellasto expanded its production footprint in China by investing USD 64.82 million to build a second plant in Shanghai, targeting the rising demand in the electric vehicle sector. This move, set to boost capacity by nearly 70% by 2027, reinforced Cellasto’s leadership in NVH (Noise, Vibration, and Harshness) solutions—critical components often made from specialized plastics used in tools and automotive applications. The expansion highlighted BASF’s commitment to strengthening its tools plastic portfolio in Asia through localized production, advanced molding technologies, and deeper engagement with the growing Chinese market.

- June 2024 : DuPont completed its acquisition of Donatelle Plastics, a prominent medical device contract manufacturer known for its precision-engineered components. With over 400 employees, Donatelle was integrated into DuPont’s Industrial Solutions line under the Electronics & Industrial segment. The acquisition significantly strengthened DuPont’s tools plastic portfolio by adding advanced capabilities such as medical-grade injection molding, liquid silicone rubber processing, precision machining, and tool building. These technologies supported the production of high-performance plastic parts for critical medical applications. Donatelle’s alignment with fast-growing therapeutic areas positioned DuPont for greater innovation and growth in the healthcare-related tools plastics market.

- July 2023 : LyondellBasell Industries Holdings B.V. acquired Mepol Group, a manufacturer of recycled, high-performance technical compounds in Italy and Poland. Mepol and its subsidiaries were integrated into LyondellBasell’s Advanced Polymer Solutions (APS) business. This acquisition enhanced the company’s capabilities in recycled materials, supporting its circular economy goals and enabling the development of sustainable polymer solutions for various applications, including durable and high-performance plastics used in tool components and housings.

Table of Contents

Methodology

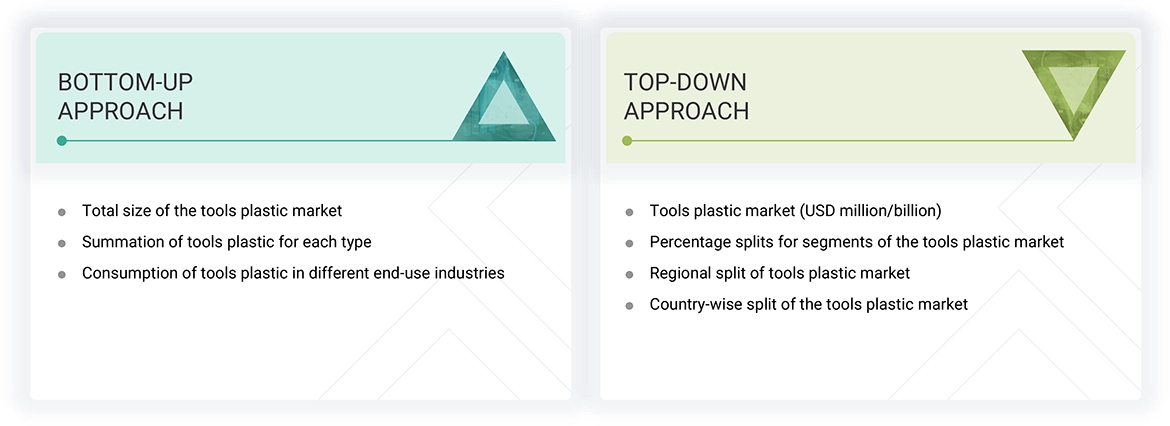

The study involved four main activities to estimate the current size of the global tools plastic market. Extensive secondary research was conducted to gather information on the market, peer product markets, and the parent product group market. The next step was to validate these findings, assumptions, and sizes with industry experts across the value chain of tools plastic through primary research. Both top-down and bottom-up approaches were used to estimate the market’s overall size. Then, market segmentation and data triangulation procedures were applied to determine the size of various segments and sub-segments of the market.

Secondary Research

In the secondary research process, various secondary sources such as Hoovers, Factiva, Bloomberg BusinessWeek, and Dun & Bradstreet were used to identify and collect information for this study on the tools plastic market. These secondary sources included annual reports, press releases & investor presentations of companies; white papers; certified publications; articles by recognized authors; regulatory bodies, trade directories, and databases.

Primary Research

The tools plastic market includes several stakeholders in the supply chain, such as raw material suppliers, distributors, end-product manufacturers, buyers, and regulatory organizations. Various key sources from both the supply and demand sides of the market have been interviewed to gather qualitative and quantitative data. On the demand side, primary participants include key opinion leaders, executives, vice presidents, and CEOs of companies in the tools plastic market. On the supply side, primary sources consist of associations and institutions involved in the tools plastic market, key opinion leaders, and processing companies.

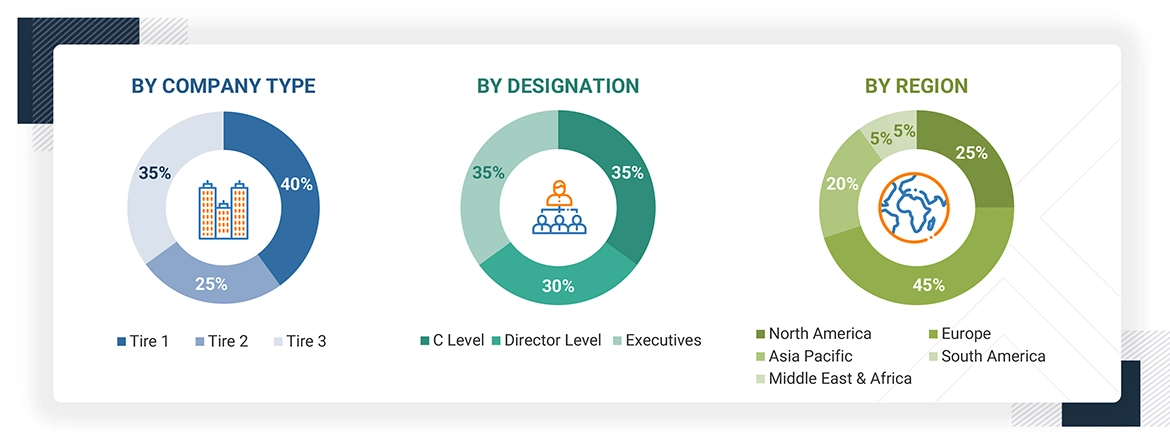

Following is breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The bottom-up and top-down approaches have been used to estimate the tools plastic market by type, application, end-use industry, and region. The research methodology used to calculate the market size includes the following steps:

- The key players in the industry and markets were identified through extensive secondary research.

- In terms of value, the industry’s value chain and market size were determined through both primary and secondary research processes.

- All percentage shares, splits, and breakdowns were established using secondary sources and verified via primary sources.

- All relevant parameters influencing the markets covered in this study were thoroughly considered, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research involved reviewing reports, reviews, and newsletters of top market players and conducting extensive interviews with leaders such as directors and marketing executives to gather opinions.

The following figure illustrates the overall market size estimation process employed for this study.

Data Triangulation

After estimating the overall size of the tools plastics market, the data was divided into several segments and subsegments. Data triangulation and market breakdown methods were used, where appropriate, to complete the market analysis and determine precise statistics for all segments and subsegments. The data was triangulated by examining various factors and trends from both the demand and supply sides. Additionally, the market size was validated using both top-down and bottom-up approaches.

Market Definition

The tools plastic market is defined as the segment involved in manufacturing plastics used in tools, including hand tools, power tools, garden tools, medical tools and devices, manual tools, and industrial equipment. The plastics used, often ABS, polycarbonate, nylon, and polypropylene, are selected for their qualities such as strength and durability, lightweight nature, chemical and heat resistance, and impact resistance. The tools plastic market has many end-use sectors, including construction, automotive, healthcare, and manufacturing. With advances in material technology and consumer demand for ergonomic, affordable, high-performance tools, the tools plastic market, with various consumer and professional applications, is diverse and expanding globally.

Stakeholders

- Tools plastic manufacturers

- Raw material suppliers

- Regulatory bodies and government agencies

- Distributors and suppliers

- End-use industries

- Associations and industrial bodies

- Market research and consulting firms

Report Objectives

- To define, describe, and forecast the size of the tools plastic market in terms of value and volume

- To provide detailed information regarding the key factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To forecast the market size based on type, application, end-use industry, and region

- To forecast the market size for the five main regions—North America, Europe, Asia Pacific, South America, and the Middle East & Africa, along with their key countries

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the total market

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for the market leaders

- To strategically profile leading players and comprehensively analyze their key developments, such as product launches, expansions, and deals in the tools plastic market

- To strategically profile key players and comprehensively analyze their market shares and core competencies

- To study the impact of AI/Gen AI on the market under study, along with the macroeconomic outlook

Key Questions Addressed by the Report

Which factors are propelling the growth of the tools plastic market?

Increasing demand for high-performance material, cost-effective manufacturing processes, and technological advancements and ergonomics are the primary factors propelling the growth of the tools plastic market.

What are the major challenges to the growth of the tools plastic market?

Environmental issues, regulatory restrictions, and competition from metal substitutes are the major challenges impacting the growth of the tools plastic market.

What are the major opportunities in the tools plastic market?

Innovation in sustainable and bio-based plastics and rising industrialization in emerging markets are expected to create lucrative opportunities for the tools plastic market players in the coming years.

What are the major factors restraining the growth of the tools plastic market?

Fluctuating raw material costs and economic and supply chain disruptions are the major factors restraining the growth of the tools plastic market.

Who are the major players in the tools plastic market?

Major players include DuPont (US), BASF (Germany), Eastman Chemical Company (US), Covestro AG (Germany), Solvay (Belgium), and LG Chem (South Korea).

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Tools Plastic Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Tools Plastic Market