Tower Crane Rental Market

Tower Crane Rental Market by Capacity (Low (5–20 tons), Low to Medium (20–100 tons), Heavy (100–500 tons), Extreme Heavy (>500 tons)), End-use industry (Building & Construction, Infrastructure, Energy & Power), and Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The global tower crane rental market was valued at USD 16.29 billion in 2024 and is projected to reach USD 22.10 billion by 2030, at a CAGR of 5.2% during the forecast period. Tower crane rental constitutes a vital service for construction companies, enabling them to lease tall, fixed lifting machines for predetermined periods. These cranes play a crucial role in the construction of skyscrapers and substantial infrastructure projects. This leasing model allows builders to access top-tier lifting equipment without the substantial financial commitment of outright purchases, enhancing operational flexibility, minimizing maintenance responsibilities, and reducing costs, particularly for short-term or singular projects. The demand for tower crane rentals is on the rise, propelled by an increase in high-rise building projects, urban expansion, and a governmental focus on infrastructure modernization.

KEY TAKEAWAYS

-

BY PRODUCT TYPEThe tower crane rental market is segmented into Self-erecting Cranes, Hammerhead Cranes, Luffing Jib Tower Cranes, Mobile Tower Cranes, and Other Product Types. Each type serves distinct lifting and height requirements; self-erecting cranes are favored for low-rise or compact sites, while hammerhead and luffing jib cranes are more commonly used for large-scale infrastructure and high-rise projects. Mobile tower cranes provide on-site flexibility, offering quick setup and relocation for multiple project phases.

-

BY CAPACITYThe market is divided by lifting capacity into Low (5–20 tons), Low to Medium (20–100 tons), Heavy (100–500 tons), and Extreme Heavy (>500 tons). While low-to-medium capacity cranes mainly serve residential and mid-rise projects, heavy and extreme heavy cranes are increasingly used in power plants, offshore platforms, and large infrastructure projects that demand high lifting capacities and long jib reach.

-

BY END-USE INDUSTRYKey end-use industries include Building & Construction, Infrastructure, Energy & Power, Marine & Offshore, and Others. Demand is primarily driven by high-rise residential and commercial projects, transportation infrastructure such as bridges and metro lines, renewable energy installations (particularly wind turbine erection), and heavy industrial or offshore construction projects.

-

BY REGIONThe Asia Pacific region is projected to be the fastest-growing market, driven by rapid urbanization, infrastructure megaprojects, and government-backed smart city initiatives in China, India, and Southeast Asia. Europe and North America continue to maintain steady growth, supported by renovation projects, offshore wind installations, and technology integration in fleet operations.

-

COMPETITIVE LANDSCAPEThe tower crane rental market is moderately fragmented, with a mix of global and regional players competing through fleet expansion, technological integration, and strategic partnerships. Key players include NFT Group, Maxim Crane Works, Uperio, Sarens N.V./S.A., and Bigge Crane and Rigging Co. These companies are focusing on expanding rental fleets, integrating digital monitoring systems, and introducing eco-efficient crane models to enhance fleet utilization and sustainability. Strategic partnerships with OEMs and regional contractors, along with mergers, acquisitions, and geographic expansions, are further strengthening their competitive positioning in the global market.

The global tower crane rental market is poised for robust growth over the coming years, supported by the ongoing expansion of the construction and infrastructure sectors worldwide. Rapid urbanization, rising smart city developments, and large-scale public infrastructure investments are fueling demand for cost-efficient and flexible lifting solutions. Renting tower cranes offers significant advantages — reduced capital expenditure, access to advanced models, lower maintenance liabilities, and improved project flexibility — making it a preferred choice across contractors, EPCs, and developers. Furthermore, the growing adoption of digital technologies, telematics, and electric or hybrid cranes is expected to enhance operational efficiency and sustainability in rental operations.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The tower crane rental market is shifting toward sustainable and tech-driven solutions as clients demand higher efficiency and flexibility. Advancements such as electric and autonomous cranes and alternative fuel equipment are driving new revenue streams. These innovations enhance sustainability, energy efficiency, and project flexibility, meeting end-user goals of cost savings, reliability, and reduced maintenance. The industry’s future growth will center on eco-efficient and digitally enabled rental solutions.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Growth in construction and infrastructure projects

-

Increasing emphasis on smart city development

Level

-

Preference for older cranes by tower crane rental companies

-

Price wars, reduced profit margins, and financial constraints for new entrants

Level

-

Increasing requirements for installation and maintenance of wind turbines

-

Technological advancements and digitalization of equipment

Level

-

High maintenance and operating costs

-

Lack of skilled labor and maintenance and repair-related issues

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Growth in construction and infrastructure projects

Demand for tower crane rentals is driven by significant investments in construction and infrastructure, with Beijing allocating nearly USD 1 trillion for projects. In 2022, over USD 115.96 million was invested in canals, dams, and reservoirs (Bloomberg). Rapid urbanization in dense cities boosts demand for high-rise developments, enabling heavy material lifting at heights. Cities like New York, Toronto, and Los Angeles, along with Shanghai, Mumbai, and Sydney, are experiencing growth supported by government-led urban renewal and smart city plans. Large infrastructure projects, such as railway stations, commercial towers, and skyscrapers, sustain demand for advanced lifting equipment and rentals, fueling the tower crane rental market.

Restraint: Continued preference for older cranes among tower crane rental companies

Older tower cranes, usually 5–10 years old, are preferred by rental companies for their low upfront costs but pose challenges. Many countries restrict their use through age and safety regulations to prevent accidents and boost efficiency. Older models need frequent maintenance, have higher operating costs, and lack safety and digital features—reducing productivity and raising risks. They are also less energy-efficient and more polluting, conflicting with global sustainability goals. As standards tighten, dependence on such cranes can harm reputation and deter eco-conscious clients. The market is shifting toward newer, greener, tech-enabled cranes, and relying on outdated equipment risks losing competitiveness, trust, and viability.

Opportunity: Increasing requirements for installation and maintenance of wind turbines

The wind energy sector offers strong opportunities for tower crane rentals as countries boost renewable projects. Wind farm construction needs cranes with high capacity, reach, and durability, especially offshore. Since these cranes are costly, developers prefer rentals for installation and maintenance. Growing wind turbine installations increase demand for maintenance cranes, especially in remote areas with complex logistics. Providers offering transportation, assembly, disassembly, and on-site support gain an advantage. Strict safety and regulatory standards mean companies investing in operator training, compliance, and modern tech like telematics and remote operation will stand out. Partnerships with wind energy developers and a focus on eco-friendly equipment are crucial for market growth.

Challenge: High maintenance and operating costs

High maintenance and operating costs remain a major challenge for tower crane rental companies. Regular servicing, inspections, and replacement of specialized parts are essential to ensure safety and compliance, but significantly add to expenses. Skilled technicians are limited and command high wages, further driving up costs. For smaller firms, acquiring and maintaining fleets can be prohibitively expensive, restricting their ability to expand or invest in newer, efficient crane models. These financial burdens reduce profit margins and constrain overall market growth.

Tower Crane Rental Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Customized Comansa 21LC1050 tower crane for offshore platform lifting near the North Sea | Reliable heavy lifting up to 200 tons, weather-resistant design, reduced downtime |

|

Comansa 21CM550 crane for India’s first cable-stayed railway bridge (Anji Khad) | Safe, high-altitude heavy lifts; met deadlines in extreme terrain |

|

Liebherr 81.1K Self-Erecting Tower Crane for a 12-month housing project in UK | Quick assembly, efficient lifting for multiple contractors, boosted productivity |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The tower crane rental market ecosystem comprises original equipment manufacturers (OEMs), rental service providers, distributors, and end users such as contractors, developers, and EPC companies. OEMs supply advanced cranes equipped with modern safety and automation features, while rental companies maintain and operate fleets to meet the diverse lifting needs of various sectors. Distributors and service partners ensure equipment availability, logistics, and maintenance support, forming a crucial link in the value chain. End users—primarily from building & construction, infrastructure, energy & power, and marine & offshore industries—rely on rental cranes for their lifting efficiency, operational flexibility, and cost-effectiveness. Together, these stakeholders enable safe, compliant, and timely execution of complex construction projects.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Tower Crane Rental Market, By Capacity

The low- to medium-capacity (20–100 tons) segment dominated the tower crane rental market in 2024, driven by its versatility and wide applicability across residential, commercial, and infrastructure projects. These cranes offer an optimal balance between lifting capability, maneuverability, and cost efficiency, making them the preferred choice for mid-rise and urban construction projects. Their ease of assembly, transport flexibility, and suitability for confined construction sites have further strengthened their adoption. Moreover, growing demand for mixed-use developments and smart city projects continues to boost utilization of this capacity range. The segment’s operational efficiency and affordability position it as the most sought-after category within the global tower crane rental market.

Engineering Plastics Market, By End-use Industry

Building & Construction led the tower crane rental market in 2024, driven by rapid urbanization, rising residential and commercial developments, and the growing trend of vertical construction in densely populated cities. Tower cranes are essential for lifting heavy materials and equipment efficiently at significant heights, making them indispensable for high-rise and mixed-use projects. Additionally, increasing investments in smart city infrastructure, redevelopment of old structures, and expansion of commercial real estate have further boosted demand. The need for flexible and cost-effective lifting solutions has strengthened the reliance on rental cranes in this segment, firmly establishing Building & Construction as the dominant end-use industry in the tower crane rental market.

REGION

Asia Pacific to be the fastest-growing region in the global tower crane rental market during the forecast period

The Asia Pacific region is the fastest-growing market for tower crane rentals, driven by rapid urbanization, industrial expansion, and large-scale infrastructure investments. Countries such as China, India, Japan, and South Korea are key contributors, fueled by increasing construction of high-rise buildings, transportation networks, and renewable energy projects. Government initiatives promoting smart cities, affordable housing, and sustainable infrastructure continue to accelerate market growth. Additionally, the region’s growing emphasis on cost efficiency and project flexibility is boosting the preference for rental cranes over owned fleets. With strong demand from residential, commercial, and industrial sectors, the Asia Pacific region remains a pivotal hub for growth and innovation in the tower crane rental industry.

Tower Crane Rental Market: COMPANY EVALUATION MATRIX

BASF SE (Star) dominates the engineering plastics market matrix due to its substantial global presence, varied product offerings, and robust research and development capabilities. The corporation facilitates widespread use of high-performance polymers in the automotive, electronics, construction, and industrial sectors, solidifying its leadership position. Kingfa Sci. & Tech. Co., Ltd. (Emerging Leader) continues to grow by delivering inventive and cost-effective engineered plastics solutions in a narrow range of industries, like automotive lightweighting, consumer applications, and sustainably engineered materials broadly. BASF continues to maintain its position in the leader’s quadrant through the addition of scale and innovation, as Kingfa has significant momentum moving up into the leader’s quadrant.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 16.2 Billion |

| Market Forecast in 2030 (value) | USD 22.1 Billion |

| Growth Rate | CAGR of 5.2% from 2025-2030 |

| Years Considered | 2023-2030 |

| Base Year | 2024 |

| Forecast Period | 2030 |

| Units Considered | Value (USD Million/Billion), Volume (Unit) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Europe, Asia Pacific, Middle East & Africa, and South America |

WHAT IS IN IT FOR YOU: Tower Crane Rental Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Asia Pacific based Tower Crane Rental Compa |

|

|

RECENT DEVELOPMENTS

- April 2025 : Maxim Crane announced the acquisition of tower crane assets from a wholly owned subsidiary of Sims Crane & Equipment Co., a prominent player in the Florida crane market.

- April 2025 : Liebherr AG and Real Guindastes entered into a partnership under which Real Guindastes added Liebherr’s 1000 EC-H tower crane to its growing fleet. The crane will support Vale’s S11D mining complex in Para, Brazil.

- April 2025 : Morrow invested in two Liebherr 620 HC-L Luffing cranes. The 620 HC-L combines high lifting capacity with compact design – ideal for space-constrained urban sites.

- February 2025 : Liebherr AG launched the latest generation of Liebherr luffing jib cranes in Bauma, Munich. New models 440 HC-L 12/24 and 18/36 and 620 HC-L 18/36 mark a major update to the HC-L series. The performance values have significantly improved, resulting in a reduced out-of-service time.

Table of Contents

Methodology

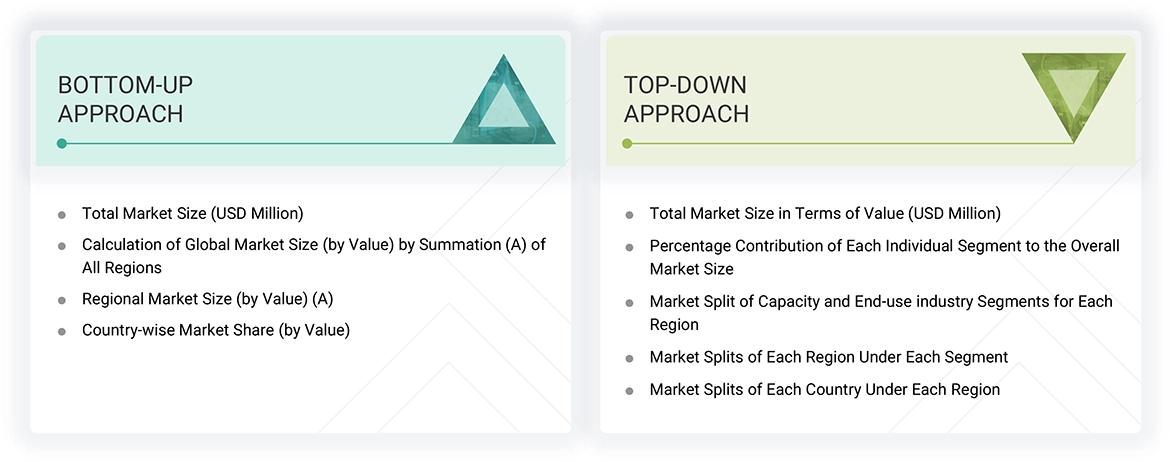

The study involved four major activities to estimate the current size of the global tower crane rental market. Exhaustive secondary research was carried out to collect information on the market, the peer product market, and the parent product group market. The next step was to validate these findings, assumptions, and sizes with the industry experts across the value chain through primary research. The top-down and bottom-up approaches were employed to estimate the overall size of the tower crane rental market. After that, market breakdown and data triangulation procedures were used to determine the size of different segments and sub-segments of the market.

Secondary Research

The market for the companies offering tower crane rental is arrived at by secondary data available through paid and unpaid sources, analyzing the product portfolios of the major companies in the ecosystem, and rating the companies by their performance and quality. Various secondary sources, such as Business Standard, Bloomberg, World Bank, and Factiva, were referred to identify and collect information for this study on the tower crane rental market. In the secondary research process, various secondary sources were referred to identify and collect information related to the study. Secondary sources included annual reports, press releases, and investor presentations of tower crane rental vendors, forums, certified publications, and whitepapers. The secondary research was used to obtain critical information on the industry’s value chain, the total pool of key players, market classification, and segmentation from the market and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from several key companies and organizations operating in the tower crane rental market. After the complete market engineering (calculations for market statistics, market breakdown, market size estimations, market forecasting, and data triangulation), extensive primary research was conducted to gather information and verify and validate the critical numbers arrived at. Primary research was also conducted to identify the segmentation types, industry trends, competitive landscape of tower crane rental offered by various market players, and key market dynamics, such as drivers, restraints, opportunities, challenges, industry trends, and key player strategies. In the complete market engineering process, the top-down and bottom-up approaches and several data triangulation methods were extensively used to perform the market estimation and market forecasting for the overall market segments and subsegments listed in this report. Extensive qualitative and quantitative analysis was performed on the complete market engineering process to list the key information/insights throughout the report.

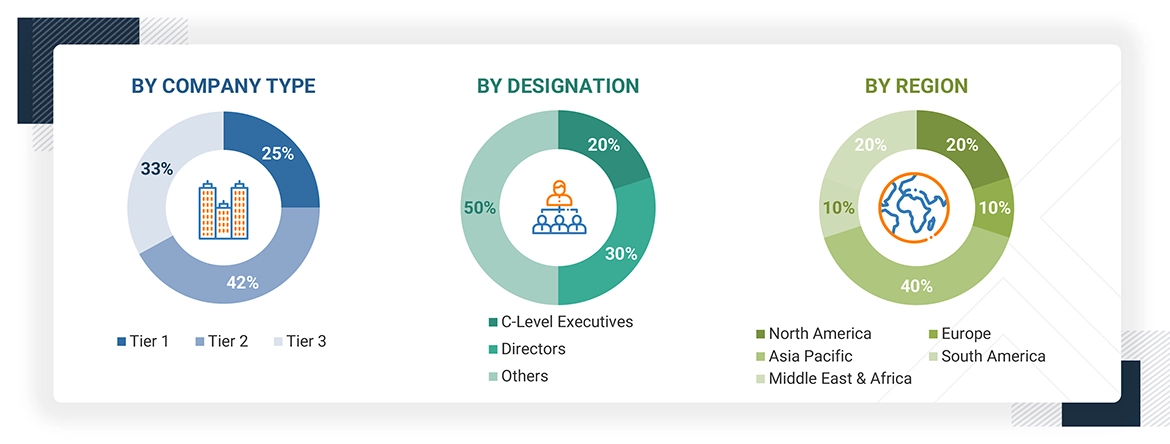

The following is a breakdown of the primary respondents:

Notes: Others include sales, marketing, and product managers.

Tier 1: >USD 1 Billion; Tier 2: USD 500 million–1 Billion; and Tier 3: < USD 500 Million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down and bottom-up approaches were used to estimate and validate the size of the global tower crane rental market. These approaches were also used extensively to estimate the size of various dependent market segments. The research methodology used to estimate the market size included the following:

Data Triangulation

After arriving at the overall market size using the market size estimation processes, the market was split into several segments and subsegments. The data triangulation and market breakup procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

The tower crane rental market is characterized by leasing tall, immobile cranes primarily employed in infrastructure projects, industrial facilities, and high-rise construction. Tower cranes are essential balance cranes that facilitate vertical construction by lifting extremely heavy loads high above the project site. These cranes can be either fixed to the ground or positioned on a building structure consisting of a mast, a jib (the horizontal arm), counterweights, and an operator cab.

Renting tower cranes provides construction companies with access to specialized equipment without the need for substantial upfront capital investment. This flexibility allows companies to adapt to varying project heights and timelines. Tower cranes are custom-fabricated in several configurations, including hammerhead, luffing jib, and self-erecting models, tailored to meet the specific requirements of diverse projects. They are particularly advantageous in lifting heavy loads and navigating tight spaces often found in urban development.

Key advantages of renting cranes include access to modern, reliable equipment that enhances project efficiency, reduced ongoing ownership costs, lower maintenance expenses, and minimized capital outlay. Most rental companies offer comprehensive services such as delivery, setup, takedown, and technical assistance at the job site throughout the rental period. Tower cranes are utilized across a broad spectrum of end-use industries, including energy and power, infrastructure, building and construction, marine, and offshore sectors.

Stakeholders

- Tower crane rental manufacturers

- Tower crane rental service providers

- Raw material suppliers

- Converters & processors

- Distributors and traders

- Industry associations and regulatory bodies

- End users

Report Objectives

- To define, describe, and forecast the size of the global tower crane rental market based on capacity, end-use industry, and region in terms of value and volume

- To provide detailed information on the significant drivers, restraints, opportunities, and challenges influencing the market

- To strategically analyze micromarkets concerning individual growth trends, prospects, and their contribution to the market

- To assess the growth opportunities in the market for stakeholders and provide details on the competitive landscape for market leaders

- To forecast the market size of segments and subsegments for North America, Europe, Asia Pacific, South America, and the Middle East & Africa

- To strategically profile key players and comprehensively analyze their market shares and core competencies

- To analyze competitive developments such as mergers, acquisitions, product launches, expansions, partnerships, and agreements in the tower crane rental market.

- To provide the impact of AI/Gen AI on the market

Key Questions Addressed by the Report

What are the major drivers influencing the growth of the tower crane rental market?

Increased construction and infrastructure projects, and a growing emphasis on smart city developments.

What are the major challenges in the tower crane rental market?

High maintenance and operating costs, lack of skilled labor force, and maintenance and repair-related issues.

What are the restraining factors in the tower crane rental market?

Preference for old cranes by rental companies, price wars, reduced profit margins, and financial constraints for new entrants.

What is the key opportunity in the tower crane rental market?

Increasing requirements for installing and maintaining wind turbines, technological advancements, and digitalization of equipment present significant opportunities for market expansion.

Who are the key players in the tower crane rental market?

Liebherr AG (Switzerland), Bigge Crane and Rigging Co. (US), Ace Construction Equipment Ltd. (India), Leavitt Cranes (US), Wasel GmbH (Germany), Falcon Tower Crane Services Ltd. (Ireland), Rapicon Inc. (US), NFT Group Skycrane (Saudi Arabia), Skycrane (Canada), and Maxim Crane Works (US).

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Tower Crane Rental Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Tower Crane Rental Market