Transformer Insulation Market

Transformer Insulation Market by Material (Liquid, Solid Insulation), Voltage Class, Type (Liquid Filled, Dry-type Transformer), End-use Industry (Electrical Utilities, Data Centers, Oil & Gas, Power), and Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The transformer insulation market is projected to reach USD 9.68 billion by 2030 from USD 6.97 billion in 2025, at a CAGR of 6.8% from 2025 to 2030. The transformer insulation market is driven by rising global electricity demand, grid modernization, and increasing adoption of renewable energy sources. Additionally, the need for reliable, durable, and eco-friendly insulation materials to enhance transformer efficiency and lifespan further boosts the market growth.

KEY TAKEAWAYS

-

BY MATERIALThe material segment of the transformer insulation market includes liquid insulation, solid insulation, and other materials. Solid insulation dominates due to its superior mechanical strength, dimensional stability, and reliability in withstanding electrical and thermal stresses over long operational cycles.

-

BY TYPEThe transformer insulation market by type is categorized into liquid filled transformer and dry-type transformers. Liquid filled transformers dominate the market due to their superior efficiency, enhanced cooling performance, and extended service life. These type of transformer has capacity to manage higher voltage loads, along with extensive adoption in utility-scale and industrial applications, reinforces their dominant position in the market.

-

BY END-USE INDUSTRYThe end-use industry segment is divided into electrical utilities, data centers, marine & offshore, railways, oil & gas, power, and other end-use industries. The power segment dominates as large-scale power generation and transmission networks rely heavily on high-performance insulation for efficiency and grid stability, driving continuous demand.

-

BY REGIONThe medical polymer market covers Europe, North America, Asia Pacific, South America, and the Middle East & Africa. Asia Pacific is the largest market for medical polymer due to improvements in healthcare infrastructure, high demand for medical devices, and increase in investments to improve production capability. Furthermore, the rising population, urbanization, and a growing middle class in countries, such as China, India, and Southeast Asian countries, support the large-scale increase in healthcare spending and access to specialty medical treatments.

-

COMPETITIVE LANDSCAPEMajor market players have adopted both organic and inorganic strategies, including partnerships and investments. For instance, SABIC (Saudi Arabia) and Covestro AG (Germany) entered agreements and partnerships to cater to the growing demand for medical polymer across innovative applications.

The transformer insulation market is experiencing significant growth. The growing cosumption of electricity, driven by urbanization, industrial growth, and other electrical devices, augments the demand for transformer insulation syste,s. Emerging economies, such as China and India, also facilitate the growth of the transformer insulation market owing to their substantial investments in infrastructure and improvements in the electrical grid to expand electricity access.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on consumers' business emerges from customer trends or disruptions. Hotbets are clients of transformer insulation manufacturers, and target applications are clients of transformer insulation manufacturers. Shifts, which are changing trends or disruptions, will impact the revenues of end users. The revenue impact on end users will affect the revenue of hotbets, which will further affect the revenues of transformer insulation manufacturers.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rising global demand for electricity due to rapid industrialization, urbanization, and infrastructure development

-

Expansion of smart grids and increasing adoption of digitalization across power systems

Level

-

High initial cost of advanced insulation materials

-

Volatility in raw material prices

Level

-

Development of eco-friendly bio-based insulation fluids

-

Rising renewables and electrification in emerging economies

Level

-

Concerns over material aging and durability in extreme environments

-

Supply chain disruptions affecting insulation material availability

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rising global demand for electricity due to rapid industrialization, urbanization, and infrastructure development

The transformer insulation market grows due to the increasing demand for electrical energy globally, which mainly results from rapid industrial development and the establishment of new urban localities. Infrastructure development is required to support the development of reliable power grids, especially in emerging economies. Such demand dictates the improvement of insulation materials to perfectly insulate transformers so that they can work efficiently and have longer lifespans in the large and dispersed energy networks.

Restraint: High initial cost of advanced insulation materials

The high upfront costs of advanced insulation materials-new-generation nanocomposite materials, bio- and environment-friendly insulators hinder the growth of the transformer insulation market. These expensive materials would discourage their use, especially for price-sensitive regions, although they may offer long-term benefits in terms of efficiency, durability, and environmental compliance.

Opportunity: Development of eco-friendly bio-based insulation fluids

Growth opportunity in the transformer insulation market is the development of bio-based insulation fluid alternate on the global sustainability premise. They demand biodegradability and fire resistance properties, increasing the demand for their application to environmentally sensitive domains such as urban power systems and renewable energy sources.

Challenge: Concerns over material aging and durability in extreme environments

Material aging and durability under extreme conditions have become the upkeep of transformer insulation threats in the market. Harsh environmental conditions consisting of extreme temperature and humidity actually set about damaging the insulation. In such conditions, the lifespan and reliability of transformers are compromised. Hence, there remains a continuous pursuit to pursue adequate solutions for these exigent uses.

Transformer Insulation Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Provides aramid fibers (Nomex) and advanced insulation materials for transformers, ensuring thermal stability and electrical reliability | Superior thermal endurance | High dielectric strength | Extended transformer lifespan | Reduced maintenance needs |

|

Develops advanced cellulose-based insulation papers and pressboards for power and distribution transformers | Excellent electrical insulation | Mechanical robustness | Optimized for high-voltage applications | Sustainability focus |

|

Manufactures transformer board, insulation paper, and engineered insulation solutions for liquid-immersed and dry-type transformers | High mechanical strength | Precise dimensional stability | Reliability under stress | Proven global track record |

|

Supplies epoxy resins, polyurethanes, and specialty materials used in transformer insulation systems | Strong adhesion | Chemical resistance | High thermal stability | Compatibility with advanced transformer designs. |

|

Produces high-quality cellulose-based insulation papers and specialty fibrous materials tailored for transformers | High purity | Excellent impregnation properties | Electrical reliability | Eco-friendly solutions |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The transformer insulation market ecosystem consists of raw material suppliers (Eastman Chemical Company, BASF, Solvay), manufacturers (DuPont, 3M, Weidman Electrical Technology, Huntsman International LLC, Ahlstrom), distributors (ACC Insulation, Govik Industries Private Limited), and end users (Bharat Heavy Electricals Limited, Siemens, Eaton, Schneider Electric). Raw materials, such as cellulose-based kraft paper, aramid paper, pressboard, mica, and resins, used for transformer insulation. End users drive demand for product development, quality standards, and pricing strategies. Collaboration across the value chain is key to innovation and market growth.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Transformer Insulation Market, By Material

Solid insulation is expected to hold the largest market share in the transformer insulation market during the forecast period due to its affordability and versatility. Materials such as cellulose paper, pressboard, and advanced composites deliver exemplary dielectric strength and thermal stability in high voltage and high temperature situations. They have become a common choice for dry type transformers that have been adopted in urban locations, data centers, and renewable energy systems as they are considered safe and do not pose a risk of leaking fluids.

Transformer Insulation Market, By Type

Liquid filled transformers are the leading type of insulation due to their superior method of cooling, high capacity, and widespread aodption in heavy load applications. These transformers can use liquid insulation to get rid of excess heat generated by operation with high voltage, making them suitable for large power distribution, manufacturing facilities, and utility networks. They also handle large electrical requirements and are ideal for long-haul transmission or large, infrastructure projects. This can particularly be seen in emerging economies, which are expanding energy requirements.

Transformer Insulation Market, By End-use Industry

Power industry to be the largest end-use industry in the transformer insulation market during the forecast period. The power industry is vital to power generation, power transmission, and power distribution, and therefore requires heavy-duty and reliable transformer insulation. Rapid urbanization and industrialization are driving increased global energy consumption. There is a pressing need for substantial power grid infrastructure, especially in developing economies, including China and India, where the development of large-scale grids are currently being executed.

REGION

Asia Pacific to be the fastest-growing region in the global transformer insulation market during forecast period

Asia Pacific is the fastest-growing region in the transformer insulation market, driven by rapid urbanization, industrial growth, and soaring electricity demand across China, India, and Southeast Asia. Significant investments in renewable energy, grid modernization, and ultra-high-voltage projects boost the demand for advanced insulation materials. Expanding data centers, EV adoption, and transport electrification, supported by government initiatives on efficiency and energy security, further accelerate growth.

Transformer Insulation Market: COMPANY EVALUATION MATRIX

In the transformer insulation market matrix, DuPont (Star) leads with a strong market share and extensive product footprint, due to to its pioneering high-performance materials, particularly the Nomex family of aramid papers and pressboards, which deliver unmatched thermal stability, mechanical toughness, and dielectric strength for both liquid-immersed and dry-type transformers. Nordic Paper (Emerging Leader) has high-purity electrotechnical kraft papers characterized by superior dielectric strength, stable insulation, and exceptional mechanical properties. While Dupont dominates through scale and a diverse portfolio, Nordic Paper shows significant potential to move toward the leaders’ quadrant as demand for high-purity electrotechnical kraft papers continues to rise.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 6.56 Billion |

| Market Forecast in 2030 (Value) | USD 9.68 Billion |

| Growth Rate | CAGR of 6.8% from 2025-2030 |

| Years Considered | 2022-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/Billion), Volume (Kiloton) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends. |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, South America, and the Middle East & Africa |

WHAT IS IN IT FOR YOU: Transformer Insulation Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Transformer Manufacturer | Comprehensive benchmarking of insulation performance across high-voltage transformers, dry-type transformer, and liquid-filled transformers, including thermal and dielectric testing under varied load conditions |

|

| Utility Company | In-depth market adoption analysis across urban power grids, renewable energy integration (solar/wind), and heavy industrial applications, with regional demand trends | Provide actionable insights on demand growth in high-potential segments like smart grids and rural electrification |

| Power Infrastructure Provider | Technical and economic evaluation of eco-friendly insulation versus conventional options, focusing on environmental impact and installation feasibility | Improve procurement efficiency by negotiating bulk contracts with certified suppliers |

| Renewable Energy Developer | Global and regional production capacity benchmarking for insulation materials, including supply chain resilience for solar, wind, and hybrid systems | Map certifications and compliance with IEC 60076 and ISO 9001 standards to ensure quality |

| Insulation Material Supplier | Patent and IP mapping for nanotechnology-enhanced insulation and bio-based composites, analyzing competitive landscapes and innovation trends | Assess material performance under thermal and mechanical stress to guide product development |

RECENT DEVELOPMENTS

- August 2025 : Hitachi Energy India Ltd expanded its Mysuru facility by investing USD 36 million to as part of its USD 240 million India growth plan. The project doubled the capacity for producing extra-high-voltage pressboard and laminated board, essential for transformers, and was scheduled for completion by 2027. The site transitioned into an ultra-low carbon facility by replacing fossil fuel boilers with a fully fossil-free system powered by sustainable heat and electricity. This expansion addressed the global shortage of transformer-grade insulation materials, supported India’s renewable energy and grid integration, strengthened supply chain security, and served markets across the Middle East, Asia, and Africa.

- June 2024 : Huntsman Corporation inaugurated a cutting-edge 11,000-square-meter Innovation Center in Tienen, Belgium, aimed at advancing research across its Polyurethanes and Performance Products divisions. This strategic investment enhances Huntsman's capacity to innovate in markets such as coatings, adhesives, insulation, and energy systems. For the transformer insulation market, the center is expected to drive the development of advanced electrical insulation and protective coatings, particularly those offering improved thermal stability, fire resistance, and moisture protection.

- September 2024 : Krempel GmbH acquired full ownership of Mexico-based EIC Insulation Company (EIC) through a share deal, which also included the ECC Conversion Center. This strategic move broadened Krempel’s presence across North and South America and reinforced its portfolio of electrical insulation solutions. EIC contributed advanced production facilities, extensive storage capacity, and a development and sales center in Monterrey, ideally located close to the US market. The site became a central hub for production and logistics across the Americas. Through this acquisition, Krempel strengthened its capability to supply a complete range of insulation products more efficiently to its global energy customers.

Table of Contents

Methodology

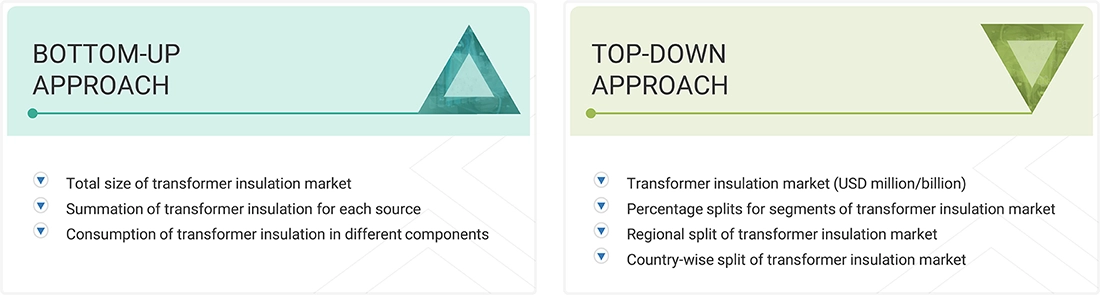

The study involved four major activities to estimate the current size of the global transformer insulation market. Exhaustive secondary research was conducted to collect information on the market, the peer product market, and the parent product group market. The next step was to validate these findings, assumptions, and sizes with the industry experts across the value chain of transformer insulation through primary research. The top-down and bottom-up approaches were employed to estimate the overall size of the transformer insulation market. After that, market breakdown and data triangulation procedures were used to determine the size of different segments and sub-segments of the market.

Secondary Research

In the secondary research process, various secondary sources, such as Hoovers, Factiva, Bloomberg BusinessWeek, and Dun & Bradstreet, were referred to identify and collect information for this study on the transformer insulation market. These secondary sources included annual reports, press releases & investor presentations of companies; white papers; certified publications; articles by recognized authors; regulatory bodies, trade directories, and databases.

Primary Research

The transformer insulation market comprises several stakeholders in the supply chain, which include raw material suppliers, distributors, end-product manufacturers, buyers, and regulatory organizations. Various primary sources from the supply and demand sides of the markets have been interviewed to obtain qualitative and quantitative information. The primary participants from the demand side include key opinion leaders, executives, vice presidents, and CEOs of companies in the transformer insulation market. Primary sources from the supply side include associations and institutions involved in the transformer insulation market, key opinion leaders, and processing players.

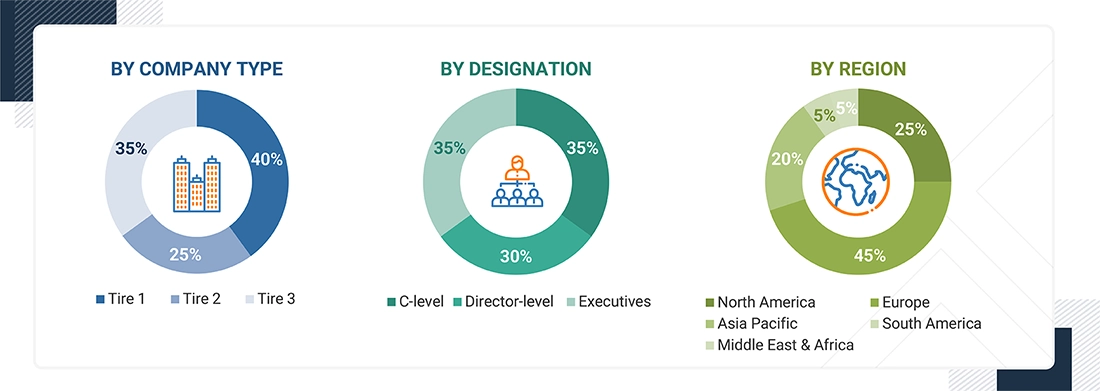

The following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The bottom-up and top-down approaches have been used to estimate the transformer insulation market by material, type, end-use industry, and region. The research methodology used to calculate the market size includes the following steps:

- Key players in the industry and markets were identified through extensive secondary research.

- In terms of value, the industry’s supply chain and market size were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research included studying reports, reviews, and newsletters of top market players and extensive interviews with leaders, such as directors and marketing executives, to obtain opinions.

The following figure illustrates the overall market size estimation process employed for this study.

Data Triangulation

After arriving at the overall size of the transformer insulation market from the estimation process explained above, the total market was split into several segments and sub-segments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Market Definition

The transformer insulation market includes materials and technologies that electrically, thermally, or mechanically isolate and protect components of transformers, and ensure safety under thermal, electrical, and mechanical stress over long periods. There are solid insulation materials, such as cellulose papers and pressboards, and solid-liquid combinations, of which cellulose is a natural product. Liquid insulation materials also provide dielectric protection to insulation while dissipating heat energy. Insulation systems serve a key function in transformers, providing efficiency, preventing short circuits, and prolonging life to independent users or owner-operators of transformers in transportation, industrial, and renewable energy applications. Infrastructure modernization, growing demand for electricity, and new high-performance and green insulation products drive the transformer insulation market, making it an important part of the electrical and power equipment market.

Stakeholders

- Transformer Insulation Manufacturers

- Raw Material Suppliers

- Regulatory Bodies and Government Agencies

- Distributors and Suppliers

- End-Use Industries

- Associations and Industrial Bodies

- Market Research and Consulting Firms

Report Objectives

- To define, describe, and forecast the size of the transformer insulation market, by material, type, and end-use industry, in terms of value and volume

- To forecast the market size for the five main regions—North America, Europe, Asia Pacific, South America, and the Middle East & Africa, along with their key countries, in terms of value

- To provide detailed information regarding the key factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To strategically analyze micro markets with respect to individual growth trends, prospects, and contributions to the total market

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for the market leaders

- To strategically profile leading players and comprehensively analyze their key developments, such as product launches, expansions, and deals, in the transformer insulation market

- To strategically profile key players and comprehensively analyze their market shares and core competencies

- To study the impact of AI/Gen AI and the 2025 US tariff on the market under study, along with the macroeconomic outlook for each region covered under the study

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Transformer Insulation Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Transformer Insulation Market