Transformer Market

Transformer Market by Type (Power Transformer, Distribution Transformer, Instrument Transformer and Specialty Transformer), Coooling Type (Oil-cooled and Air-cooled), Power Rating (Low, Medium, High), Phase (Three and Single), Insulation (Oil, Solid, Air, Gas), End User (Power Utilities, Industrial, Residential & Commercial, Data Centers, and Other End Users), and Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The global transformer market is estimated to be valued at USD 64.64 billion in 2025 and is projected to reach USD 88.48 billion by 2030, growing at a CAGR of 6.5%. The growth of the global transformer market is being driven by rapid urbanization and the rising global demand for reliable electricity. This is compelling governments and utilities to upgrade and expand aging grid infrastructure.

KEY TAKEAWAYS

-

BY TYPEThe type segment includes power transformers, distribution transformers, instrument transformers, and specialty transformers. Growth in this segment is driven by rising electricity demand and grid modernization plans that are boosting power and distribution transformer installations.

-

BY COOLING TYPEThe transformer market has been segmented by cooling type into oil-cooled and air-cooled transformer types. The increasing need for efficient heat dissipation in high-load applications drives demand for oil-cooled and air-cooled systems.

-

BY POWER RATINGThe transformer market has been segmented by power rating into the low, medium, and high segments. Expansion of renewable energy projects and industrial infrastructure fuels demand across small, medium, and large power ratings, driving the transformer market.

-

BY PHASETby phase, the transformer market has been segmented into the three-phase and single-phase segments. The growing adoption of three-phase systems for industrial and utility applications are expected to support segment growth.

-

BY INSULATIONThe insulation segment of the transformer market includes oil, solid, air, and gas. Advancements in oil, gas, and solid insulation technologies enhance reliability and safety, driving adoption.

-

BY END USERThe end user segment covers power utilities, industrial, residential & commercial, data centers, and other end users. Rising investments in power utilities, data centers, and industrial automation are expected to accelerate transformer demand.

-

BY REGIONThe transformer market covers Europe, North America, Asia Pacific, South America, the Middle East, and Africa. Asia Pacific is expected to become the fastest-growing region during the forecast period, driven by rapid urbanization, large-scale infrastructure development, and increasing investments in power grid expansion across emerging economies such as China, India, and Japan.

-

COMPETITIVE LANDSCAPEThe major market players have adopted organic and inorganic strategies including partnerships and investments. For instance, Hitachi Energy Ltd., Siemens Energy, Eaton, and GE Vernova are entered into number of agreements and partnerships to cater to the growing demand for transformer market

The global push toward clean energy, fueled by climate commitments and net-zero targets, is accelerating the integration of renewables, which requires flexible, high-performance transformers to manage load variability and grid stability. The proliferation of data centers, electric mobility, and industrial automation is driving the need for more efficient, digitally enabled transformer solutions. These developments, backed by regulatory mandates for energy efficiency and grid resilience, are transforming transformers from passive grid components into strategic assets in the energy transition.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The transformer market is undergoing a significant transformation driven by technological advancements and evolving customer needs. Advancements in data analysis, coupled with the Internet of Things (IoT) and Industrial IoT (IIoT), are enabling the integration of sensors within distribution transformers. These sensors collect real-time data on transformer health, load conditions, and environmental factors. This data can be analyzed using advanced algorithms for predictive maintenance. Utilities and industries can avoid unplanned outages and optimize maintenance schedules by proactively identifying potential issues, leading to improved asset performance management.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Pressing need to modernize power infrastructure due to escalating energy demand

-

Strong focus on integrating renewable energy sources into power grids

Level

-

High initial investment cost and fluctuating raw material prices

Level

-

Evolution of smart, digital, and resilient grids

-

Growing focus of developing countries on electrification

Level

-

Sustainability and safety challenges linked to transformer insulating oils

-

Supply chain disruptions and component shortages

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Pressing need to modernize power infrastructure due to escalating energy demand

The growth of the global transformer market is sustained and accelerating, with surging demand for electricity worldwide. Interestingly, even in advanced economies, where power consumption had declined for several years, the demand is now rebounding. The rapid global increase in electricity usage is fueling parallel growth in the consumption of renewables, natural gas, coal, and nuclear power, each requiring efficient power transmission and distribution infrastructure, thereby creating a direct demand for transformers of different capacities for varied applications.

Restraint: High initial investment cost and fluctuating raw material prices

The high initial costs of manufacturing and installation significantly restrain the transformer market. These costs stem from the need for advanced engineering, precision manufacturing, and compliance with rigorous performance and safety standards. Transformers are capital-intensive assets requiring substantial investment in R&D, skilled labor, and specialized components. Moreover, installation involves complex logistics, site preparation, and integration with existing infrastructure, all of which contribute to elevated upfront expenditures. This financial barrier can deter smaller utilities and emerging markets from adopting modern transformer technologies, slowing market penetration.

Opportunity: Evolution of smart, digital, and resilient grids

The ongoing evolution of power systems toward digitalized, flexible, and resilient smart grids presents a transformative opportunity for the global transformer market. As countries worldwide pursue ambitious clean energy transitions, driven by electrification and the integration of renewable energy, the traditional grid infrastructure is facing mounting pressure. Smart grid technologies offer a forward-looking solution to these challenges by digitizing the electricity network, improving real-time supply and demand balancing, enhancing grid visibility, and ensuring the overall stability of the system.

Challenge: Sustainability and safety challenges linked to transformer insulating oils

The global transformer market is increasingly constrained by evolving environmental regulations, driven by heightened concerns over CO2 emissions from power generation, which are projected to reach approximately 13,800 million tonnes in 2024. This projection reinforces the sector’s significant contribution to global carbon output. Although adopting renewable energy sources is expected to slow the growth of fossil-fuel-based generation between 2025 and 2027, the broader power sector, including transformer manufacturing, deployment, and end-of-life management, is facing intensified scrutiny from regulatory authorities and environmental stakeholders worldwide.

Transformer Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Addressed transformer bushing challenges by introducing a dry-type, oil-free solution to overcome moisture ingress, insulation deterioration, and performance issues. | Enhanced reliability with oil-free, dry-type bushing design; reduced maintenance; simplified installation; eliminated environmental hazards from oil leaks |

|

Supported wind power projects in Iran (Abhar and Kahak regions) by facilitating grid integration through policy collaboration and stakeholder engagement. | Enabled renewable energy integration, improved grid stability, and promoted sustainable energy development |

|

Addressing failure analysis of distribution transformers at Ughelli Business Unit; solution targeted overloads and improper copper wiring. | Improved transformer reliability, technical guidelines for wire dimensioning, safer electrical distribution without dependency on HRC fuses |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The transformer market ecosystem is changing rapidly as part of the broader transition to digitalization. Key stakeholders in this ecosystem include raw material suppliers, transformer manufacturers, component manufacturers, distributors, and end users. Prominent companies in this market include Hitachi Energy Ltd. (Switzerland), Siemens Energy (Germany), Eaton (Ireland), GE Vernova (US), and Toshiba Energy Systems & Solutions Corporation (Japan).

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Transformer Market, By Type

Power transformers held the largest market share in 2024 primarily because of the growing demand for high-voltage transmission infrastructure to support renewable energy integration and long-distance power transfer. With rapid urbanization, industrialization, and the global shift toward clean energy, utilities are investing heavily in upgrading and expanding transmission networks. Power transformers are essential for stepping up voltages for efficient long-distance transmission, making them critical in large-scale grid projects and the interconnection of renewable energy sources like wind and solar farms.

Transformer Market, By Cooling Type

Oil-cooled transformers dominated the market in 2024 because they offer superior cooling efficiency and higher load-handling capacity. This makes them ideal for high-voltage and large-capacity applications in transmission and distribution networks. They can dissipate heat effectively, ensuring longer operational life and reliability under heavy loads, which is critical for utilities and industrial sectors. Oil-cooled designs are more cost-effective for large-scale installations than air-cooled alternatives, further driving their widespread adoption.

Transformer Market, By Power Rating

Low power transformers held the largest market share in 2024 because they are widely used in residential, commercial, and light industrial applications, which collectively account for a significant portion of electricity consumption. The rapid growth of urbanization, smart homes, and distributed energy systems such as rooftop solar has further increased demand for low-capacity transformers. Lower cost, ease of installation, and suitability for localized power distribution make them the preferred choice for utilities and end users in developed and emerging markets.

Transformer Market, By Phase

Three-phase transformers heldd the largest market share in 2024 because they are the standard choice for high-capacity power transmission and distribution systems, offering greater efficiency and cost-effectiveness than single-phase units. They provide balanced power loads, reduced losses, and improved voltage regulation, making them essential for industrial facilities, commercial complexes, and utility grids. Their ability to handle large-scale power requirements in a compact design further drives their dominance in the market.

Transformer Market, By Insulation

Oil-insulated transformers held the largest market share in 2024 because oil provides excellent dielectric strength and superior cooling properties, ensuring reliable performance under high voltage and heavy load conditions. This makes them the preferred choice for large-scale transmission and distribution networks. Oil insulation enhances durability and reduces the risk of overheating, which is critical for grid stability and long operational life, especially in utility and industrial applications.

Transformer Market, By End User

Power utilities held the largest market share in 2024 because they are the primary developers and operators of transmission and distribution networks, which require large volumes of transformers for grid expansion, modernization, and renewable energy integration. The global push for electrification and investments in smart grids and high-voltage infrastructure have significantly increased transformer demand from utilities. Their role in ensuring reliable and efficient power delivery makes them the dominant end-user segment.

REGION

Asia Pacific to be fastest-growing region in global transformer market during forecast period

Asia Pacific is set to be the fastest-growing market for transformers, fueled by a powerful mix of economic growth, urbanization, and aggressive electrification initiatives. China and India are heavily investing in expanding and modernizing their power grids to meet soaring electricity demand from residential, industrial, and commercial sectors. In parallel, ambitious renewable energy targets, particularly in China and India, are accelerating the integration of solar and wind power, which requires robust grid infrastructure and high-performance transformers to ensure stability and efficiency. Moreover, government-backed programs such as India’s Revamped Distribution Sector Scheme (RDSS) and China’s Belt and Road energy projects are catalyzing new installations across urban and rural areas. The rise of data centers, electric mobility, and smart city development in the region further amplifies the need for modern, efficient transformer technologies, positioning Asia Pacific as a clear frontrunner in market growth.

Transformer Market: COMPANY EVALUATION MATRIX

In the transformer market matrix, Hitachi Energy Ltd. (Star) leads with a strong market presence and a wide product portfolio. WEG (Emerging Leader) is gaining traction as it is expanding globally.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Hitachi Energy Ltd. (Switzerland)

- Siemens Energy (Germany)

- Eaton (Ireland)

- GE Vernova (US)

- Toshiba Energy Systems & Solutions Corporation (Japan)

- ABB (Switzerland)

- Schneider Electric (France)

- Hubbell (US)

- Bharat Heavy Electricals Limited (India)

- HD Hyundai Electric Co., Ltd. (South Korea)

- WEG (Brazil)

- Fuji Electric Co., Ltd. (Japan)

- CG Power & Industrial Solutions Ltd. (India)

- HYOSUNG HEAVY INDUSTRIES (South Korea)

- Mitsubishi Electric Corporation (Japan)

- LS ELECTRIC Co., Ltd. (South Korea)

- Ormazabal (Spain)

- MEIDENSHA CORPORATION (Japan)

- Arteche Group (Spain)

- CHINA XD GROUP (China)

- JSHP Transformer (China)

- Voltamp Transformer (India)

- TBEA (China)

- KONCAR d.d. (Croatia)

- Henan Hengyu Electric Group Co., Ltd.(China)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 61.50 Billion |

| Market Forecast in 2030 (value) | USD 88.48 Billion |

| Growth Rate | CAGR of 6.5% from 2025–2030 |

| Years Considered | 2021–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Million), Volume (Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered | • By type: Power Transformer, Distribution Transformer, Instrument Transformer, Specialty Transformer • By Cooling type: Oil-cooled, Air-cooled • By Power rating: Low, Medium, High • By Phase: Three-phase, Single-phase • By Insulation: Oil, Solid, Gas, an |

| Regions Covered | Europe, Asia Pacific, North America, Middle East & Africa, and South America |

WHAT IS IN IT FOR YOU: Transformer Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|

RECENT DEVELOPMENTS

- June 2025 : Hitachi Energy Ltd. expanded its transformer manufacturing operations by investing USD 70 million in Turkey to meet growing global demand for sustainable energy infrastructure. The expansion will enhance production capacity and technological capabilities at its existing facilities, positioning Turkey as a key hub for transformer exports. This move supports the broader strategy of the company to strengthen supply chains and accelerate the global energy transition by delivering advanced grid solutions.

- April 2025 : Eaton acquired Fibrebond, a leading modular electrical and data center infrastructure provider, to enhance its capabilities in delivering engineered-to-order enclosures that integrate power distribution and backup systems. The acquisition strengthens the company’s position in the data center, utility, and industrial markets, aligning with its focus on resilient, scalable, and protected power solutions.

- February 2025 : Eaton invested in a new manufacturing facility in South Carolina for its three-phase transformers, marking the company's third such facility in the US.

- May 2025 : GE Vernova expanded its manufacturing footprint in India with USD 16 million to meet the growing demand for advanced grid solutions amid the country's accelerating energy transition. This expansion includes upgrades to its existing facilities in Padappai (Tamil Nadu) and Noida (Uttar Pradesh), enhancing production capacity for high-voltage equipment such as instrument transformers, air-insulated switchgear, and control panels.

Table of Contents

Methodology

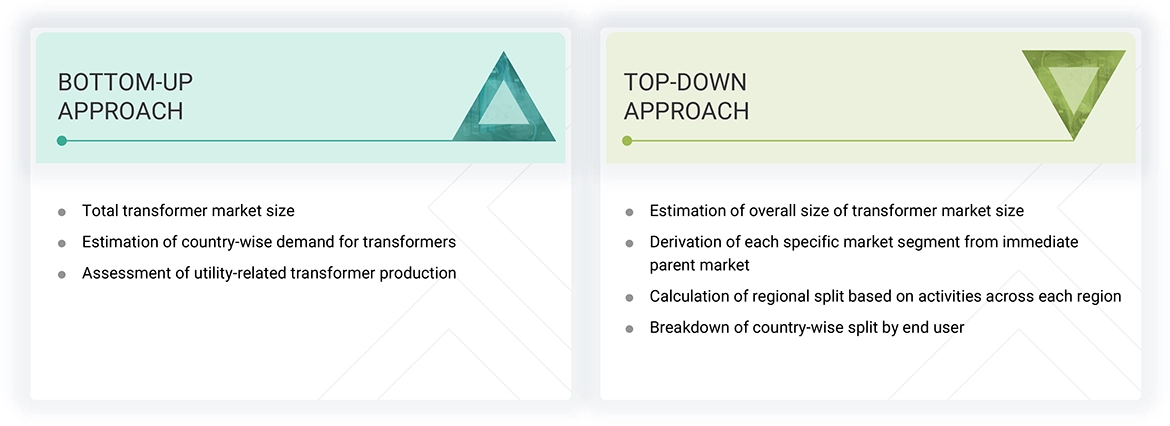

This study involved major activities in estimating the current size of the transformer market. Comprehensive secondary research collected information on the market, peer, and parent markets. The next step involved validating these findings, assumptions, and market sizing with industry experts across the value chain through primary research. The total market size was estimated through country-wise analysis. Then, the market breakdown and data triangulation were performed to estimate the market size of the segments and subsegments.

Secondary Research

Secondary sources for this research study include annual reports, press releases, investor presentations of companies, white papers, certified publications, articles from recognized authors, and databases of various companies and associations. Secondary research was mainly carried out to obtain key information about the industry's supply chain to identify the key players offering multiple products and services, market classification and segmentation according to the offerings of major players, industry trends to the bottom-most level, regional markets, and key developments from market- and technology-oriented perspectives.

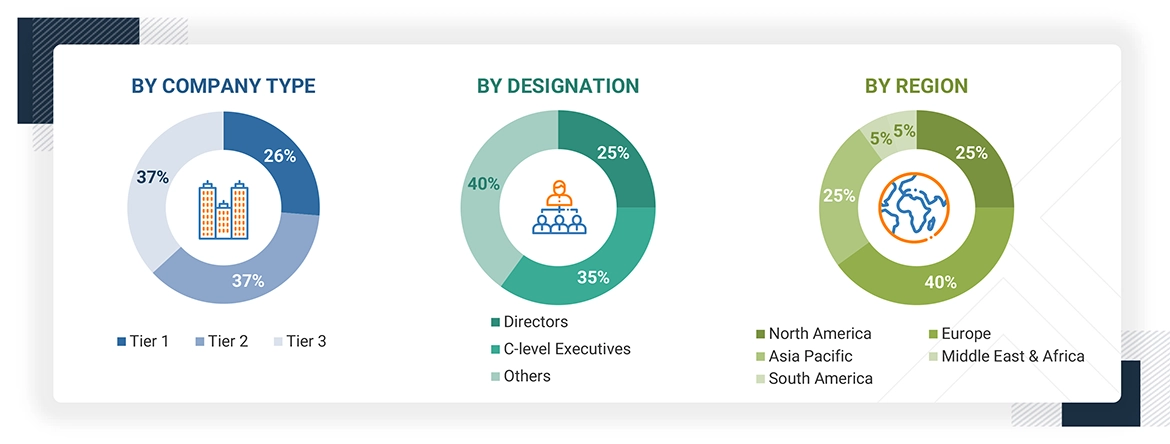

Primary Research

In the primary research process, various primary sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. Primary sources from the supply side included industry experts, such as chief executive officers (CEO), vice presidents, marketing directors, technology and innovation directors, and related key executives from various companies and organizations operating in the transformer market. Various primary sources from the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The breakdown of primary respondents is given below:

Note: Other designations include sales managers, engineers, and regional managers.

The tiers of the companies are defined based on their total revenue as of 2024: Tier 1: >USD 1 billion,

Tier 2: USD 500 million–1 billion, and Tier 3:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the solid biomass feedstock market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market were identified through extensive secondary research, and their market share was determined through primary and secondary research.

- The industry's value chain and market size, in terms of value, were determined through both primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Transformer Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and subsegments. Data triangulation and market breakdown processes were employed to complete the overall market engineering process and arrive at the exact statistics for all the segments and subsegments, wherever applicable. The data was triangulated by studying various factors and trends from both the demand- and supply sides. The market was also validated using the top-down and bottom-up approaches.

Market Definition

The global transformer market serves as a critical backbone of the power infrastructure, enabling efficient and safe transmission and distribution of electricity across various voltage levels. Transformers are essential for adjusting voltage levels—either stepping them up or down—to enable the efficient transmission of electricity from power generation sources, both conventional and renewable, over long distances with minimal losses. They are critical components not only for utility networks but also for industrial facilities, data centers, transportation infrastructure, and residential and commercial buildings. As global trends shift toward electrification, smart grid modernization, and integrating decentralized energy sources, the demand for advanced, reliable, and energy-efficient transformers has grown significantly.

The market encompasses various products, including power, distribution, instrument, and specialty transformers designed for specific applications such as marine, railways, and metros. Moreover, the evolution of transformer technology is increasingly influenced by digitalization trends, environmental regulations, and the growing focus on sustainability. Manufacturers are developing eco-friendly, low-loss, smart transformers to meet stringent energy efficiency mandates and grid reliability requirements. As global power demand rises and infrastructure ages, the transformer market is positioned for long-term growth, supported by grid expansion, renewable energy projects, and urban infrastructure developments across emerging and developed economies.

Stakeholders

- Government & research organizations

- State and national regulatory authorities

- Organizations, forums, alliances, and associations

- Institutional investors

- Investors/Shareholders

- Environmental research institutes

- Manufacturers’ associations

- Integrated device manufacturers (IDMs)

- Transformers raw material and component manufacturers

- Transformers manufacturers, dealers, and suppliers

- Electrical equipment manufacturers’ associations and groups

- Power utilities and other end-user companies

- Consulting companies in the energy and power domain

- Investment banks

Report Objectives

- To define, describe, analyze, and forecast the transformer market based on type, cooling type, power rating, phase, insulation, end user, and region, in terms of value

- To describe and forecast the market for five key regions: North America, Europe, Asia Pacific, South America, and the Middle East & Africa, along with their country-level market sizes, in terms of value and volume

- To forecast the transformer market, by region, in terms of volume

- To give comprehensive details regarding the drivers, restraints, opportunities, and challenges impacting the expansion of the transformer market

- To systematically examine the market for transformers in terms of each segment's contributions to the market, growth trends, and prospects

- To provide the supply chain analysis, trends/disruptions impacting customers’ businesses, market map, ecosystem analysis, regulatory landscape, pricing analysis, patent analysis, case study analysis, technology analysis, key conferences and events, trade analysis, Porter’s five forces analysis, key stakeholders and buying criteria, and regulatory analysis of the market

- To conduct a strategic analysis of micromarkets1 concerning their respective growth trends, planned expansions, and market share contributions

- To sketch a competitive environment for market participants and assess the potential for stakeholders in the transformers business

- To benchmark players within the market using the company evaluation quadrant, which analyzes market players on various parameters within the broad categories of business and product strategies

- To compare key market players for the market share, product specifications, and applications

- To strategically profile key players and comprehensively analyze their market ranking and core competencies

- To analyze competitive developments in the transformer market, such as sales contracts, agreements, investments, expansions, product launches, alliances, mergers, partnerships, joint ventures, collaborations, and acquisitions

Available Customizations

With the given market data, MarketsandMarkets offers customizations based on the company's specific needs. The following customization options are available for the report:

Product Analysis

- Product Matrix, which provides a detailed comparison of the product portfolio of each company

Geographic Analysis as per Feasibility

- Further breakdown of the transformer market by country

Company Information

- Detailed analyses and profiling of additional market players

Key Questions Addressed by the Report

What was the size of the transformer market in 2024?

The size of the global transformer market was USD 61.50 billion in 2024.

What are the major drivers for the transformer market?

Grid modernization & electrification, and renewable energy expansion are significant factors driving the transformer market.

Which is the largest region during the forecast period in the transformer market?

The Asia Pacific region is estimated to be the largest market during the forecast period.

By type, which is the fastest-growing segment during the forecast period in the transformer market?

The distribution transformer segment is estimated to be the fastest-growing segment during the forecast period.

What can be restraints for the transformer market?

Lengthy procurement cycles and extended lead times limiting market agility are restraints of the transformer market.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Transformer Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Transformer Market