Triazine Market

Triazine Market by Type (Water Soluble, Oil Soluble, and Gas Phase), Product (MEA Triazine and MMA Triazine), End-use Industry (Crude Oil, Natural Gas, Geothermal Energy, and Industrial Processes), and Region – Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The triazine market is expected to reach USD 381.4 million by 2030 from USD 319.9 million in 2025, at a CAGR of 3.6% during the forecast period. The triazine market is undergoing robust growth fueled by increasing H2S removal demand in oil and gas production. Global crude output grew from 68.2?mb/d in 2020 to 72.6?mb/d in 2024 (Source: OPEC), due to growth in upstream activities, especially in high-sulfur reservoirs. Triazine scavengers are widely used for their effectiveness, economic pricing, and alignment with regulatory compliance to ensure safe and environmentally friendly operations. Upstream investments increased 7% during 2024 to USD 570?billion (Source: IEA), propelling exploration in the Middle East, Asia Pacific, and Latin America. Triazines assist operators in preventing corrosion of pipelines, controlling H2S under demanding pressure, temperature, and salinity, and ensuring emission standards, thus making them essential to hydrocarbon production worldwide.

KEY TAKEAWAYS

-

BY TYPEThe triazine industry is segmented into Water Soluble, Oil Soluble, and Gas Phase. They offer unique advantages such as increased reactivity, chemical stability, heat resistance, and operational flexibility, which make them suitable for diverse oilfield, industrial, and chemical applications.

-

BY PRODUCTThe industry is differentiated by product into MEA Triazine, MMA Triazine, and Others, each of which applies to specific H2S scavenging and industrial uses.

-

BY END-USE INDUSTRYKey end-use industries include natural gas, crude oil, geothermal energy, industrial processes, and other end-use industries. The crude oil sector dominated the triazine market.

-

BY REGIONThe Asia Pacific region is expected to register the highest growth due to rapid industrialization, increased oil and gas exploitation, and increasingly stringent environmental regulations.

-

COMPETITIVE LANDSCAPEMajor players employ inorganic and organic growth methods, including collaborations, acquisitions, and geographic expansions. SLB, Baker Hughes Company, Hexion Inc., and Dongying Dayong Petroleum Additive Co., Ltd. are investing in innovation to meet the increasing demand for effective and compliant triazine products.

The triazine market is anticipated to develop robustly in the next few years due to oil and gas exploration & production growth, tightening environmental regulations, and expanding industrial uses. H2S scavengers based on triazine are favored for their high activity, adaptability, and affordability, and are used in regulating hydrogen sulfide in sour crude, water treatment, and chemical processing. Their efficiency and reliability have placed them at the center of use in operations from upstream and midstream oil operations to industrial plants, enhancing operational safety, regulatory compliance, and long-term asset protection.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on customers’ businesses stems from shifts in oil, gas, and industrial operations. The primary customers of triazine producers are oilfield operators, water treatment companies, and chemical processing companies. The end-use applications of the triazines vary from operations that handle sour (acidic) crude to industrial H2S control applications. Demand for triazine products is greatly affected by changes in upstream and midstream activity levels, as well as changes to environmental regulations or changes to the reservoir conditions. The higher or lower operational levels for end-users correspond to the sales or non-sales figures for triazine suppliers. Market trends and changes to operations are the overall leading drivers for a supplier's revenues and operating strategies.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rising crude oil production

-

Rising demand for natural gas

Level

-

Overdosing concerns in triazine-based treatments

-

Performance constraints in water-intensive oilfields

Level

-

Rising oil & gas exploration activities

-

Integration of smart monitoring and dosing technologies

Level

-

Operational complexity in high-pressure and high-salinity conditions

-

Rising competition from alternative H2S scavengers

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rising crude oil production

Increased worldwide crude production, particularly from sour reservoirs (1,000–30,000?ppm H2S), is compelling the need for triazine-type H2S scavengers. Sour crude is associated with safety risks, risk of pipeline corrosion, and regulatory issues. Triazines are preferred due to their high reactivity, low price, and applicability in upstream and midstream oil and gas operations. Global oil consumption rose 1.1?mb/d in 2024 and is expected to reach 105.7?mb/d by 2028 (Source: IEA), with growth in high-sulfur reservoirs like the Permian Basin, Ghawar, and Rumaila. Projects like Jafurah shale gas, OPEC+ sour crude projects, and strict U.S. EPA and EU sulfur regulations provide further backing for uptake.

Restraint: Overdosing concerns in triazine-based treatments

Triazine-type H2S scavengers are highly effective; the possibility of overdosing is a major limitation in their use in the market. Overdosage can cause operational restraints, particularly with crude oil & natural gas processing. The main concern is emulsion formation, whereby excess scavenger reacts with water and hydrocarbons to produce stable emulsions that cannot be easily broken. The Society of Petroleum Engineers (SPE) documented that inadequate dosing of triazines in North Sea offshore platforms raised the amount of emulsion formed by 35%, increased chemical treatment costs, and extended separator downtime. It can also contribute to fouling of pipelines and equipment. In large-scale operations, especially when H2S concentrations fluctuate, suboptimal dosing can raise annual operating costs by 5–10%, according to the U.S. Energy Information Administration (EIA).

Opportunity: Rising oil & gas exploration activities

Growing world oil and gas exploration is driving demand for triazine-type H2S scavengers. With operators venturing into high-sulfur and complex reservoirs, effective H2S control is essential. In 2024, 778 well drilling activities were executed worldwide, representing a rising global upstream investment of $570 billion for the year (+7% from 2023; Source: IEA). New scavengers that can perform in advanced applications are emerging, including large exploration projects, specifically Brazil's pre-salt offshore basin and Saudi Aramco's Jafurah field. Triazines perform well under these conditions because they have effective H2S performance, facilitating its removal in the liquid phase. Furthermore, market growth is supported by recently applied, stricter H2S emission regulations in the US and EU, while significant proven reserves are to be established in Africa (119 billion barrels) and Latin America (345 billion barrels).

Challenge: Operational complexity in high-pressure and high-salinity conditions

Triazine-based H2S scavengers, although commonly used, perform poorly in harsh conditions, reducing treatment efficacy and raising operating costs. More specifically, thermal instability associated with H2S scavengers can decrease H2S removal from 95% to 40% within 48 hours, as could occur in Kuwait’s Burgan Field (>160°C) (Source: SPE). Furthermore, efficacy is compromised with high-pressure wells (>10,000 psi), salinity (Mukhaizna Field in Oman >250,000 ppm TDS), and co-contaminants such as CO2 (Duvernay Formation in Canada up to 8%), which may cause wellbore issues necessitating a dual-injection system, which can add a cost of up to USD 10 million per year. The conditions of the reservoir can affect these efficiencies significantly.

Triazine Market by: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

A natural gas plant faced frequent scavenger change-outs every 7–25 days, causing downtime, high costs, and inefficiency. Q2 introduced its tailored Triazine H2S scavenger and ran three trials under real operating conditions. | The optimized triazine program boosted runtime by 35% over competitor solutions. This reduced change-outs, cut downtime and maintenance, and lowered chemical disposal costs, delivering major operational savings. |

|

A 1,000-gallon contactor tower experienced frequent H2S scavenger change-outs. The 37% MEA-triazine-based scavenger was expected to last 30 days but broke through in 16–22 days, causing additional annual change-outs and increased costs. | OndaVia identified the actual triazine concentration as 32% (vs. labeled 37%), enabling corrective actions. This ensured accurate dosing, reduced change-outs, minimized downtime, lowered chemical costs by ~USD 25,000 annually, and improved operational efficiency. |

|

EPA created a PBPK model to assess triazine herbicides’ endocrine disruption risks. Computational tools like ToxCast/Tox21, ICE, and HTTK-Pop were used to validate human-relevant toxicological benchmarks. | Predictions closely matched PBPK standards, ensuring reliable human health risk assessment. This approach enhanced regulatory confidence and supported safer chemical management. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The triazine market ecosystem includes raw material suppliers, triazine manufacturers, distributors, and end users. Raw material suppliers offer essential base chemicals. Triazine manufacturers produce different types to meet the needs of numerous end-use industries without compromising regulatory requirements. Distributors bring market access through a proper supply chain. The crude oil, natural gas, geothermal energy, industrial processes, and other end-use industries employ triazine for effective hydrogen sulfide (H2S) removal, corrosion prevention, and environmental compliance.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Triazine Market, By Product

In 2024, MEA Triazine led the market due to its superior reactivity, economic efficiency, and adaptability in oilfield and industrial applications. Its extensive application in liquid-phase H2S scavenging, especially in sour oil reservoirs, has established it as the preferred option for upstream and midstream operations. The segment benefits from increased sour crude production, environmental regulations, and demand for safe and compliant hydrocarbon processing. MEA Triazine's versatility for severe conditions such as high temperature, pressure, and salinity reinforces its position in the market and promotes its continued use in key global regions (Asia Pacific, Middle East, Latin America).

Triazine Market, By Type

In 2024, water-soluble triazine was the most dominant type owing to good efficacy for inhibiting H2S in water-based systems. Water-soluble triazine is also widely used in oilfield water injection projects and for water treatment or chemical processes, due to reasonable costs, good solubility, and rapid reactivity. It is generally used in the most environmentally sensitive and challenged environments, such as high salinity and heat, as part of its improved performance reliability. Its performance adaptability and reliability also contribute to usage in upstream, midstream, and direct industrial uses, and it is widely used in major market areas like the Asia Pacific, the Middle East, and Latin America.

Triazine Market, By End-use Industry

Due to the expanding need for H2S scavengers in sour crude reservoirs, the crude oil industry accounted for the largest share of the triazine market in 2024. The rise in crude production globally, especially in high-sour regions, has increased the need for effective triazine-based scavengers to mitigate H2S to protect against corrosion of pipelines, ensure safety, and comply with environmental regulations. Triazines are favored due to their increased reactivity, economic viability, and resilience under extreme conditions, including high pressure, temperature, and salt. This extensive applicability has solidified their supremacy in global upstream and midstream oil operations.

REGION

Asia Pacific to be the fastest-growing region in the global triazine market during the forecast period

Asia Pacific is projected to experience the highest growth in the triazine market, led by accelerated industrialization, increasing oil and gas exploration, and rigorous environmental laws. In 2024, China generated only 4.3 million barrels per day (bpd) of crude oil, fulfilling merely 26% of its overall oil demand (Source: U.S. Energy Information Administration). In the financial year 2024-25, India's crude oil production was 28.7 million metric tonnes (MMT), accounting for less than 12% of its consumption (Source: ET Energyworld). This mismatch highlights the increasing demand for effective hydrogen sulfide (H2S) scavengers in high-sour reservoirs throughout the region. Triazine chemicals are preferred for their efficacy in preventing pipeline corrosion and maintaining operational efficiency. Triazine is essential for monitoring H2S levels and ensuring regulatory compliance in industrial applications such as wastewater treatment, chemical processing, and agriculture, all of which are expanding in the area.

Triazine Market by: COMPANY EVALUATION MATRIX

SLB (Star) dominates the triazine market because of its worldwide presence, varied product offerings, and innovative technological expertise, facilitating H2S scavenger and industrial applications. Dongying Dayong Petroleum Additive Co., Ltd. (Emerging Leader) is expanding by providing economical, innovative triazine solutions for oilfield and industrial applications, demonstrating progress towards the leader's quadrant.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 308.9 Million |

| Market Forecast in 2030 (Value) | USD 381.4 Million |

| Growth Rate | CAGR of 3.6% from 2025-2030 |

| Years Considered | 2023-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million), Volume (Kilotons) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered | Type: Water Soluble, Oil Soluble, and Gas Phase Product: MEA Triazine, MMA triazine, and Others End-use Industry: Crude Oil, Natural Gas, Geothermal Energy, Industrial Processes, and Other End-use Industries |

| Regions Covered | North America, Europe, Asia Pacific, Middle East & Africa, and South America |

WHAT IS IN IT FOR YOU: Triazine Market by REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| U.S.-based Triazine Manufacturer |

|

|

| MEA Triazine Manufacturer |

|

|

| MMA Triazine Manufacturer |

|

|

RECENT DEVELOPMENTS

- July 2025 : SLB acquired ChampionX to augment its competencies in production chemicals, artificial lift, and digital technology.

- July 2025 : Lubrizol inaugurated a new office in Jakarta, Indonesia, thereby enhancing its footprint in Southeast Asia.

- June 2024 : Halliburton partnered with GeoFrame Energy to develop demonstration wells for its geothermal and lithium extraction initiative in the Smackover Formation of East Texas.

- June 2024 : Lubrizol is expanding its activities in India by acquiring a 120-acre plot in Aurangabad.

- April 2024 : Baker Hughes entered into a memorandum of understanding with Halfaya Gas Company to cooperate on a gas flaring control initiative at the Bin Umar gas processing facility.

Table of Contents

Methodology

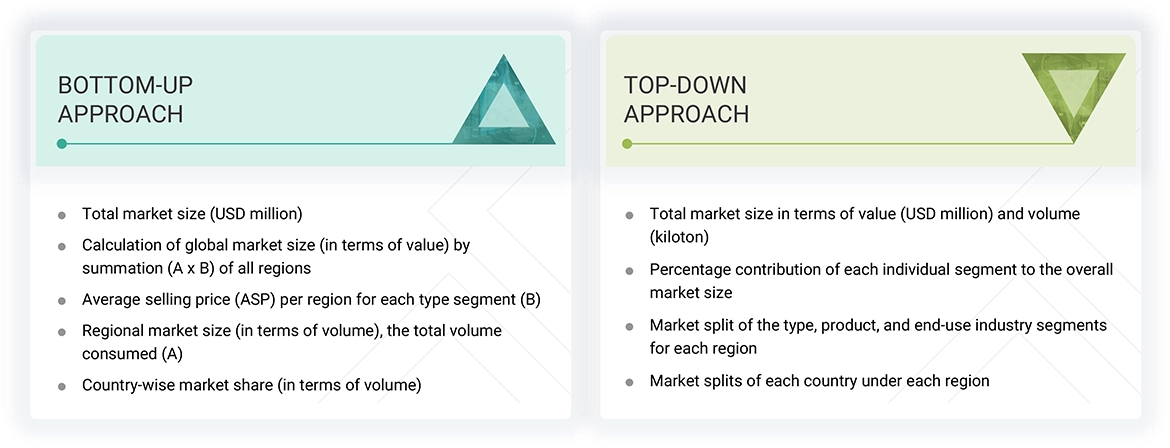

The study involved four major activities to estimate the current size of the global triazine market. Exhaustive secondary research was carried out to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizes with the industry experts across the value chain through primary research. The top-down and bottom-up approaches were employed to estimate the overall size of the triazine market. After that, market breakdown and data triangulation procedures were used to determine the size of different segments and subsegments of the market.

Secondary Research

The market for companies offering triazine is arrived at by secondary data available through paid and unpaid sources, analyzing the product portfolios of the major companies in the ecosystem, and rating the companies by their performance and quality. Various secondary sources, such as Business Standard, Bloomberg, World Bank, and Factiva, were referred to identify and collect information for this study on the triazine market. In the secondary research process, various secondary sources were referred to identify and collect information related to the study. Secondary sources included annual reports, press releases, and investor presentations of vendors, forums, certified publications, and whitepapers. The secondary research was used to obtain critical information on the industry’s value chain, the total pool of key players, market classification, and segmentation from the market and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side included industry experts, such as chief executive officers (CEOs), vice presidents (VPs), marketing directors, technology and innovation directors, and related key executives from several key companies and organizations operating in the triazine market. After the complete market engineering (calculations for market statistics, market breakdown, market size estimations, market forecasting, and data triangulation), extensive primary research was conducted to gather information and verify and validate the critical numbers arrived at. Primary research was also conducted to identify the segmentation types, industry trends, competitive landscape of triazine offered by various market players, and key market dynamics, such as drivers, restraints, opportunities, challenges, industry trends, and key player strategies. In the complete market engineering process, the top-down and bottom-up approaches and several data triangulation methods were extensively used to perform the market estimation and market forecasting for the overall market segments and subsegments listed in this report. Extensive qualitative and quantitative analysis was performed on the complete market engineering process to list the key information/insights throughout the report.

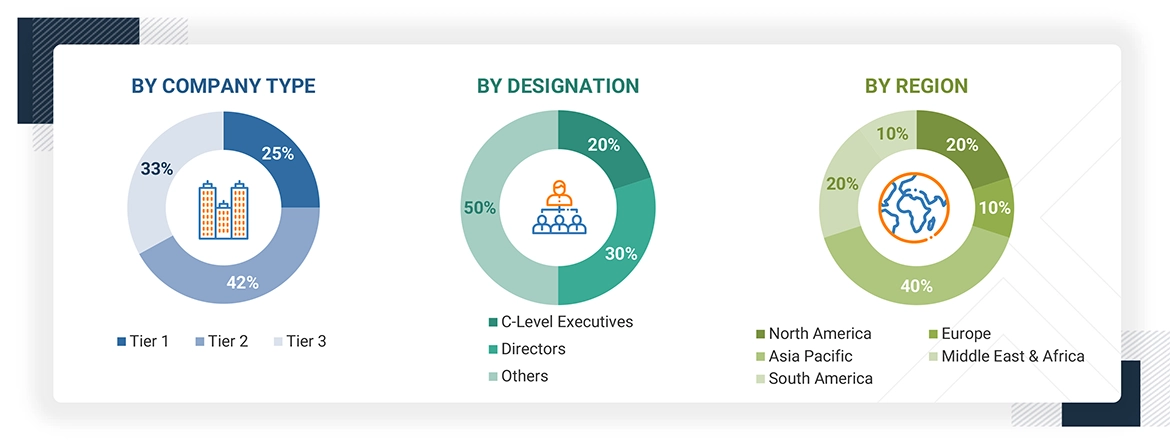

The following is the breakdown of primary respondents:

Notes: Other designations include sales, marketing, and product managers.

Tier 1: >USD 1 billion, Tier 2: USD 500 million–1 billion, and Tier 3: < USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down and bottom-up approaches were used to estimate and validate the size of the global triazine market. These approaches were also used extensively to estimate the size of various dependent market segments. The research methodology used to estimate the market size included the following:

Data Triangulation

After arriving at the overall market size using the market size estimation processes, the market was split into several segments and subsegments. Wherever applicable, the data triangulation and market breakup procedures were employed to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

Triazine is a nitrogenous heterocyclic compound with the formula C3H3N3. Triazine has a number of isomeric forms (1,2,3-triazine, 1,2,4-triazine, and 1,3,5-triazine). Triazine can be found in many applications, including crude oil, natural gas, geothermal energy, and other industrial processes, especially as a hydrogen sulfide (H2S) scavenger. Its high level of reactivity with sulfur compounds makes it a valuable chemical in the oil & gas industry, creating safety, environmental compliance, and efficiency. In addition to any energy-type applications, triazines are precursors to the production of resins, agrochemicals, dyes, and specialty chemicals. Triazine is often formed by condensation reactions of amidines or nitriles, and is well known for its stability and breadth of chemical characteristics. Due to triazine’s classification as a hazardous substance under the Globally Harmonized System (GHS), regulatory agencies, such as the US Environmental Protection Agency (EPA) and the European Chemicals Agency (ECHA), monitor its use.

Stakeholders

- Triazine Manufacturers

- Raw Material Suppliers

- Converters & Processors

- Distributors and Traders

- Industry Associations and Regulatory Bodies

- End Users

Report Objectives

- To define, describe, and forecast the size of the global triazine market based on type, product, end-use industry, and region in terms of value and volume

- To provide detailed information on the significant drivers, restraints, opportunities, and challenges influencing the market

- To strategically analyze micromarkets concerning individual growth trends, prospects, and their contribution to the market

- To assess the growth opportunities in the market for stakeholders and provide details on the competitive landscape for market leaders

- To forecast the market size of segments and subsegments for North America, Europe, Asia Pacific, South America, and the Middle East & Africa

- To strategically profile the key players and comprehensively analyze their market shares and core competencies

- To analyze competitive developments such as acquisitions, expansions, partnerships, and agreements in the triazine market

- To provide the impact of AI/Gen AI on the market

Key Questions Addressed by the Report

Which factors are propelling the growth of the triazine market?

Growth is driven by rising crude oil production, increasing demand for natural gas, and strict environmental regulations.

What are the major challenges to the growth of the triazine market?

Overdosing concerns and limited performance in water-intensive oilfields present key challenges.

What are the major opportunities in the triazine market?

Opportunities lie in the expansion of oil and gas exploration activities and the adoption of smart monitoring and dosing technologies.

What are the major factors restraining the growth of the triazine market?

Operational complexities in high-pressure, high-salinity environments and competition from alternative H2S scavengers are significant restraints.

Who are the major players in the triazine market?

Key players include SLB (US), Dow (US), Baker Hughes Company (US), Halliburton (US), and Clariant (Switzerland).

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Triazine Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Triazine Market