True Random Number Generator Market Size, Share & Trends, 2025 To 2030

True Random Number Generator (TRNG) Market by Type (Noise-based TRNG, Chaos-based TRNG, FRO-based TRNG, QRNG), Application (Security & Cryptography, Simulation & Modeling, Data Processing, Networking), Vertical - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The global true random number generator market is expected to grow from USD 3.81 billion in 2025 to USD 7.71 billion by 2030 at a CAGR of 15.1%. The market is experiencing exponential growth, driven by the rising demand for secure cryptographic systems, which are essential for encryption, authentication, and secure communications.

KEY TAKEAWAYS

-

BY REGIONNorth America is estimated to dominate the true random number generator (TRNG) market with a share of 37.8% in 2025.

-

BY TYPEBy type, the FRO-based TRNG accounted for the largest market size in 2024.

-

BY APPLICATIONBy application, the security & cryptography segment accounted for a share of 51.3% in terms of value in 2024.

-

BY VERTICALBy vertical, the consumer electronics segment is projected to grow at a CAGR of 17.7% during the forecast period.

-

COMPETITIVE LANDSCAPESynergy Quantum India Private Limited, Quantum eMotion Corp., EYL, Inc., Qrypt, and Quantum Dice have distinguished themselves among startups and SMEs due to their well-developed marketing channels and extensive funding to build their product portfolios.

The true random number generator market is witnessing growth as rising cyber threats drive adoption across BFSI, government, defense, and IoT industries. TRNGs provide high-entropy randomness, which is essential for secure encryption, AI simulations, gaming, and scientific research. Leading players, such as Intel, Apple, Qualcomm, and Infineon, integrate TRNGs into processors, chips, and mobile devices to ensure data integrity. With the expanding use in blockchain, cloud computing, and quantum cryptography, TRNGs are becoming increasingly vital for safeguarding trust in digital and connected ecosystems.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The true random number generator market is shifting from traditional sources, such as noise-based, chaos-based, and FRO-based TRNGs, toward quantum random number generators (QRNGs), which offer superior randomness and security. QRNGs are expected to drive future growth, reducing reliance on older technologies and creating opportunities across IT & telecom, BFSI, automotive, government & defense, healthcare, and retail sectors.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Increasing demand for cryptography and security applications

-

Rising frequency of cyberattacks in digital era

Level

-

High complexity and cost of implementing TRNGs

-

Slow commercialization

Level

-

Expanding use cases in secure communication, financial transactions, and defense applications

-

Significant government funding and initiatives to implement quantum technologies

Level

-

Emergence of new cyber threats

-

Integration challenges

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rising frequency of cyberattacks in digital era

With cybercriminals increasingly exploiting vulnerabilities in conventional encryption systems, the need for TRNGS is increasing. Emerging threats such as “Harvest Now, Decrypt Later” (HNDL) attacks highlight the need for more robust security. Attackers can stockpile encrypted data until quantum computers can break existing encryption algorithms. TRNGS can combat these threats by producing highly secure cryptographic keys that cannot be predicted or reverse-engineered, providing long-term data protection.

Restraint: High complexity and cost of implementing TRNGs

High implementation costs and complexity restrain the TRNG market, as these systems rely on sophisticated hardware that captures quantum events, noise, or optical signals. Their design requires advanced expertise, precise calibration, and extensive testing, making them more expensive than PRNGs. For edge and IoT devices, embedding TRNGs at scale further raises challenges due to affordability constraints.

Opportunity: Expanding use cases in secure communication, financial transactions, and defense applications

The TRNG market is growing with applications in secure communications, financial transactions, blockchain, and defense. Rising cyber threats and the increasing use of digital payments drive demand for high-quality random numbers to protect data and enable fraud-proof systems. Increased military spending, IoT adoption, cloud security, and AI integration further boost the use of TRNGs, making them vital for next-generation cybersecurity solutions.

Challenge: Integration challenges

Integrating TRNGs poses challenges in balancing performance, security, and compatibility across diverse hardware and software environments. Customization for different architectures, meeting throughput demands, and ensuring energy efficiency in edge devices add complexity. Compliance with global standards, scalability in cloud and IoT, and robust security against evolving threats further complicate deployment, slowing widespread adoption.

True Random Number Generator Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Used in iPhones, iPads, and Macs to generate cryptographic keys, secure Apple Pay transactions, and protect biometric data | End-to-end protection of sensitive information, stronger user privacy, compliance with global data security standards |

|

Embedded in Intel CPUs and servers for cryptography in cloud computing, AI workloads, and enterprise security platforms | High-quality entropy for encryption, resistance against prediction attacks, secure processing at hyperscale data centers |

|

Deployed in Snapdragon-based smartphones, 5G devices, and IoT systems for authentication and real-time security | Secures mobile payments and communication, ensures tamper-proof IoT ecosystems, enhances trust in connected devices |

|

Integrated into automotive ECUs and V2X systems to secure vehicle-to-vehicle communication and digital car keys | AIS31-compliant entropy source, trusted automotive encryption, resilience against cyberattacks on connected vehicles |

|

Applied in industrial, aerospace, and defense embedded systems requiring ultra-low power secure random number generation | SP800-90 A/B/C compliance, tamper-resistant hardware, suitable for mission-critical and rugged environments |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The true random number generator market ecosystem comprises IP providers, manufacturers, distributors, and end-users. Each collaborates to advance the market by sharing knowledge, resources, and expertise to attain end innovation in this field. Manufacturers such as Apple Inc. (US), Intel Corporation (US), and Qualcomm Technologies, Inc. (US) are at the core of the true random number generator market and are responsible for developing TRNGs for various applications.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

True Random Number Generator Market, by Type

FRO-based TRNGs dominate the market due to their cost-effectiveness, scalability, and easy integration into FPGAs, ASICs, and SoCs for cryptographic applications and secure key generation. Leveraged by top semiconductor players like Intel, ARM, and AMD, they are ideal for consumer electronics, IoT, and server computing. Their low power consumption makes them suitable for battery-operated devices, while their use in HSMs, TPMs, and embedded systems supports financial, defense, telecom, and IoT sectors, ensuring robust randomness for secure communication and encryption.

True Random Number Generator Market, by Application

Security and cryptography applications dominate the TRNG market as demand for strong cybersecurity rises in an interconnected world. TRNGs generate true randomness from electronic noise or quantum phenomena, making them secure against attacks and vital for cryptographic keys, encryption, and authentication. Critical sectors like BFSI, defense, healthcare, and government rely heavily on them. With quantum computing, IoT, and 5G increasing security needs, TRNG adoption is accelerating. Companies like ID Quantique, Quantum Dice, QuNu Labs, and QuantumCTek lead innovation in this space.

True Random Number Generator Market, by Vertical

The consumer electronics vertical will hold the largest market share and grow at a high CAGR in the TRNG market due to rising demand for secure smartphones, wearables, laptops, and connected devices. TRNGs embedded in processors and security chips safeguard mobile payments, biometrics, and personal data, ensuring user trust in digital ecosystems. With the rapid adoption of 5G, IoT, and AI-enabled devices, consumer electronics increasingly require hardware-based randomness for encryption, making this vertical the fastest-growing driver of TRNG adoption.

REGION

North America to hold largest market share in global true random number generator market during forecast period

North America is estimated to account for the largest share in the TRNG market due to its strong presence of leading semiconductor and technology companies such as Intel, Qualcomm, and Microchip, which actively integrate TRNGs into processors, mobile devices, and secure ICs. The region’s advanced cybersecurity ecosystem, high digital transaction volumes, and strong adoption of cloud computing, IoT, and AI technologies fuel demand for high-entropy random number generation.

True Random Number Generator Market: COMPANY EVALUATION MATRIX

In the TRNG market matrix, Intel Corporation (Star) leads with a strong market share and a broad product portfolio, integrating TRNGs into its CPUs, chipsets, and servers to secure cloud computing, enterprise data, and consumer devices. Its established ecosystem and widespread adoption across IT, telecom, and defense strengthen its leadership position. ID Quantique (Emerging Leader) is gaining prominence with quantum random number generators (QRNGs), pioneering high-entropy solutions for cybersecurity, telecom, and financial services.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size, 2024 (Value) | USD 3.22 Billion |

| Market Forecast, 2030 (Value) | USD 7.71 Billion |

| Growth Rate | CAGR of 15.1% from 2025 to 2030 |

| Years Considered | 2021–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Million), Volume (Thousand Units) |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, Rest of the World |

WHAT IS IN IT FOR YOU: True Random Number Generator Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Semiconductor OEM (Cryptography / Security Chips) |

|

|

| Cybersecurity Solution Provider |

|

|

| Cloud & Data Center Operators | Benchmarking adoption of hardware-based TRNGs in high-performance computing | Analysis of entropy generation bottlenecks in large-scale workloads |

| Financial Institutions / FinTech |

|

|

| Healthcare & IoT Device Manufacturer | Technical & regulatory benefits of TRNGs in securing patient data, medical IoT, and connected devices | Certification benchmarking for HIPAA / GDPR compliance Identify partnerships with security chipmakers for healthcare innovation |

RECENT DEVELOPMENTS

- January 2025 : ID Quantique and Elmos Semiconductor SE partnered to develop the world’s smallest monolithically integrated quantum random number generator (QRNG). This collaboration addresses the growing cybersecurity threats by creating a robust, quantum-based solution that generates high-quality randomness for secure cryptography, protecting against various cyberattacks, such as temperature, voltage, light, pressure, or electromagnetic changes.

- September 2024 : Quside Technologies and PQShield Ltd. partnered to create a quantum-safe security solution by integrating Quside’s quantum random number generators with PQShield’s post-quantum cryptographic solutions. This integration enabled easy adoption of quantum-safe cryptography in OpenSSL 3.2+ environments, ensuring high-level security for TLS 1.3, X.509 PKI, VPNs, and zero-trust architectures while complying with NIST standards.

- May 2024 : Terra Quantum launched the TQ42 Cryptography library, an open-source post-quantum cryptography suite designed for secure data protection. This launch expanded their quantum-as-a-service ecosystem with quantum-resistant algorithms, key management functions, and secure file deletion. Future upgrades include Quantum Keys-as-a-Service and Entropy-as-a-Service, using Terra Quantum’s proprietary single-photon quantum random number generator (QRNG) for enhanced cryptographic security.

Table of Contents

Methodology

The research process for this technical, market-oriented, and commercial study of the true random number generator market included the systematic gathering, recording, and analysis of data about companies operating in the market. It involved the extensive use of secondary sources, directories, and databases (Factiva, Oanda, and OneSource) to identify and collect relevant information. In-depth interviews were conducted with various primary respondents, including experts from core and related industries and preferred manufacturers, to obtain and verify critical qualitative and quantitative information as well as to assess the growth prospects of the market. Key players in the true random number generator market were identified through secondary research, and their market rankings were determined through primary and secondary research. This included studying annual reports of top players and interviewing key industry experts, such as CEOs, directors, and marketing executives.

Secondary Research

In the secondary research process, various secondary sources were used to identify and collect information for this study. These include annual reports, press releases, and investor presentations of companies, whitepapers, certified publications, and articles from recognized associations and government publishing sources. Research reports from a few consortiums and councils were also consulted to structure qualitative content. Secondary sources included corporate filings (such as annual reports, investor presentations, and financial statements); trade, business, and professional associations; white papers; Journals and certified publications; articles by recognized authors; gold-standard and silver-standard websites; directories; and databases. Data was also collected from secondary sources, such as the International Trade Centre (ITC), and the International Monetary Fund (IMF).

List of key secondary sources

|

Source |

Web Link |

|

Congressional Research Service |

|

|

QWorld |

|

|

Stanford Quantum |

|

|

Quantum Industry Coalition |

|

|

IMDEA |

https://www.imdea.org/international-seminar-on-quantum-networking/ |

|

quantum.gov |

Primary Research

Extensive primary research was accomplished after understanding and analyzing the true random number generator market scenario through secondary research. Several primary interviews were conducted with key opinion leaders from both demand- and supply-side vendors across four major regions—North America, Europe, Asia Pacific, and RoW. Approximately 30% of the primary interviews were conducted with the demand side, and 70% with the supply side. Primary data was collected through questionnaires, emails, and telephonic interviews. Various departments within organizations, such as sales, operations, and administration, were contacted to provide a holistic viewpoint in the report.

Note: Other designations include technology heads, media analysts, sales managers, marketing managers, and product managers.

The three tiers of the companies are based on their total revenues as of 2023 ? Tier 1: >USD 1 billion, Tier 2: USD 500 million–1 billion, and Tier 3: USD 500 million

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

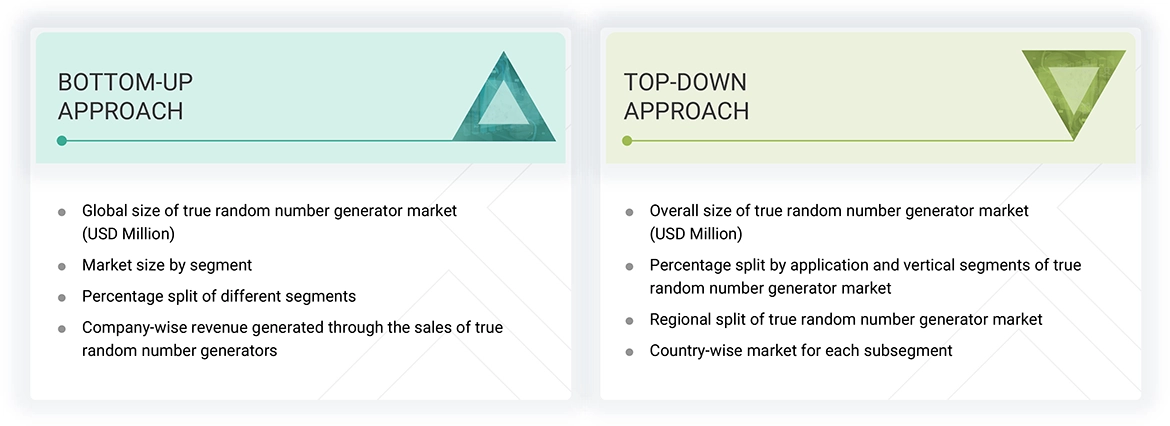

In the complete market engineering process, top-down and bottom-up approaches and several data triangulation methods have been used to perform the market size estimation and forecasting for the overall market segments and subsegments listed in this report. Extensive qualitative and quantitative analyses have been performed on the complete market engineering process to list the key information/insights throughout the report. The following table explains the process flow of the market size estimation.

The key players in the market were identified through secondary research, and their rankings in the respective regions determined through primary and secondary research. This entire procedure involved the study of the annual and financial reports of top players, and interviews with industry experts such as chief executive officers, vice presidents, directors, and marketing executives for quantitative and qualitative key insights. All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated, supplemented with detailed inputs and analysis from MarketsandMarkets, and presented in this report.

Bottom-Up Approach

- The first step involved identifying companies that offer various types of true random number generators such as noise-based TRNG, chaos-based TRNG, FRO-based TRNG, and QRNG. Their products were mapped based on type, application and end user.

- After understanding the different types of TRNGs offered by various manufacturers, the market was categorized into segments based on the data gathered through primary and secondary sources.

- To confirm the global market size, primary interviews were conducted with a few major players in the true random number generator industry.

- To determine the compound annual growth rate (CAGR) of the true random number generator market, both historical and projected market trends were analyzed by examining the industry's penetration rate, as well as the supply and demand in various application areas.

- All estimates at each stage were confirmed through discussions with key opinion leaders, including corporate executives (CXOs), directors, and sales heads, as well as industry experts from MarketsandMarkets.

- Several paid and unpaid information sources, such as annual reports, press releases, white papers, and databases, were also reviewed during the research process.

Top-Down Approach

- To estimate the global size of the true random number generator market, revenue information from leading manufacturers and providers of true random number generator was gathered and analyzed.

- The true random number generator market is projected to exhibit a steady growth trend during the forecast period.

- The revenues, geographic footprint, key market sectors, and product offerings of all identified players in the true random number generator market were studied to estimate the percentage distribution of different market segments.

- Major players in each category (by application, by vertical) within the true random number generator market were identified through secondary research, and information was confirmed through brief discussions with industry experts.

- Several discussions with key opinion leaders from leading companies involved in developing true random number generator were conducted to validate the market segmentation based on application, vertical and region.

- Geographic splits were estimated using secondary sources, taking into account various factors, such as the number of companies offering true random number generator in a specific country or region, and the types of true random number generator provided by these players.

True Random Number Generator (TRNG) Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall size of the true random number generator market through the process explained above, the overall market has been split into several segments. Data triangulation procedures have been employed to complete the overall market engineering process and arrive at the exact statistics for all the segments, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. The market has also been validated using both top-down and bottom-up approaches.

Market Definition

A True Random Number Generator (TRNG) is a hardware-based system that generates random numbers by utilizing inherently unpredictable physical processes. Unlike Pseudo-Random Number Generators (PRNGs), which rely on deterministic algorithms and require an initial seed, TRNGs derive randomness from natural entropy sources, ensuring high unpredictability and security. TRNGs are widely used in sectors such as BFSI, government & defense, consumer electronics, and IT & telecom to secure sensitive data and communications. Their ability to provide non-deterministic outputs enhances encryption strength, safeguarding against cyber-attacks and data breaches.

Key Stakeholders

- Government and financial institutions and investment communities

- Analysts and strategic business planners

- Business providers

- Manufacturers

- IP providers

- Existing and prospective end users

- Venture capitalists, private equity firms, and startup companies

- Distributors

Report Objectives

- To define, describe, segment, and forecast the size of the true random number generator market, in terms of type, application, vertical, and region

- To forecast the size of the market segments for four major regions—North America, Europe, Asia Pacific, and RoW

- To define, describe, segment, and forecast the size of the true random number generator market, in terms of volume, based on QRNG.

- To give detailed information regarding drivers, restraints, opportunities, and challenges influencing the growth of the market

- To provide an value chain analysis, ecosystem analysis, case study analysis, patent analysis, Trade analysis, technology analysis, pricing analysis, key conferences and events, key stakeholders and buying criteria, Porter's five forces analysis, investment and funding scenario, impact of AI, and regulations pertaining to the market

- To provide a detailed overview of the value chain analysis of the true random number generator ecosystem

- To strategically analyze micromarkets1 with regard to individual growth trends, prospects, and contributions to the total market

- To analyze opportunities for stakeholders by identifying high-growth segments of the market

- To strategically profile the key players, comprehensively analyze their market positions in terms of ranking and core competencies2, and provide a competitive market landscape.

- To analyze strategic approaches such as product launches, acquisitions, agreements, and partnerships in the true random number generator market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to 7)

Key Questions Addressed by the Report

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the True Random Number Generator (TRNG) Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in True Random Number Generator (TRNG) Market