UAV (Drone) Avionics Market Size, Share, & Growth

UAV (Drone) Avionics Market by Application (Military, Commercial, Government & Law Enforcement, Consumer), MTOW (<2 KG, 2–25 KG, 25–150 KG, 150–600 KG, 600–2,000 KG, >2,000 KG), System, Wing Type, and Region – Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

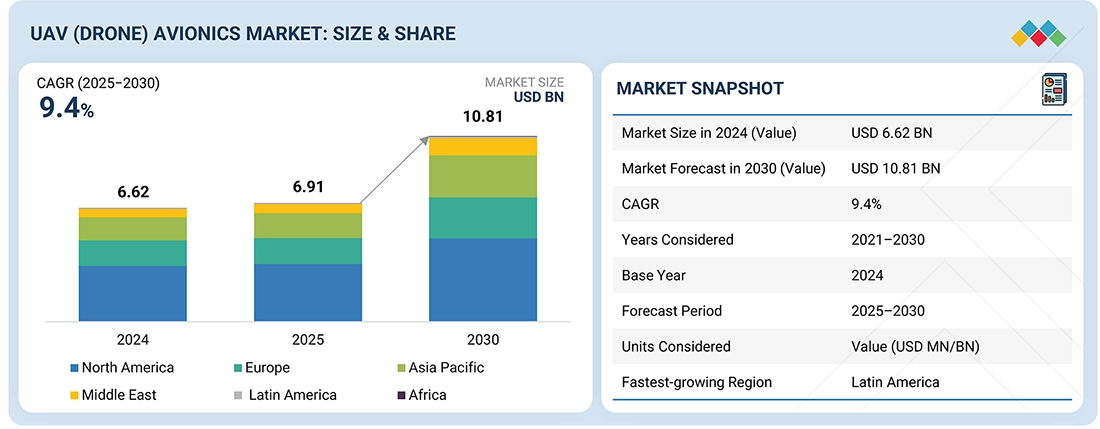

The UAV (Drone) Avionics Market is expected to reach USD 10.81 billion by 2030, from USD 6.91 billion in 2025, with a CAGR of 9.4%. The defense, security, and commercial sectors are using UAV avionics for longer missions. Advances in autonomy, onboard analytics, and BVLOS-ready communication systems are increasing demand for mission-ready avionics.

KEY TAKEAWAYS

-

By RegionNorth America is estimated to account for a 49% revenue share in 2025.

-

By Wing TypeThe fixed wing segment is estimated to hold the highest share in 2025.

-

By MTOWThe 150–600 kg segment is expected to grow at the fastest rate from 2025 to 2030.

-

By SystemThe payload & mission-specific instruments segment is projected to record the highest CAGR of 9.6%.

-

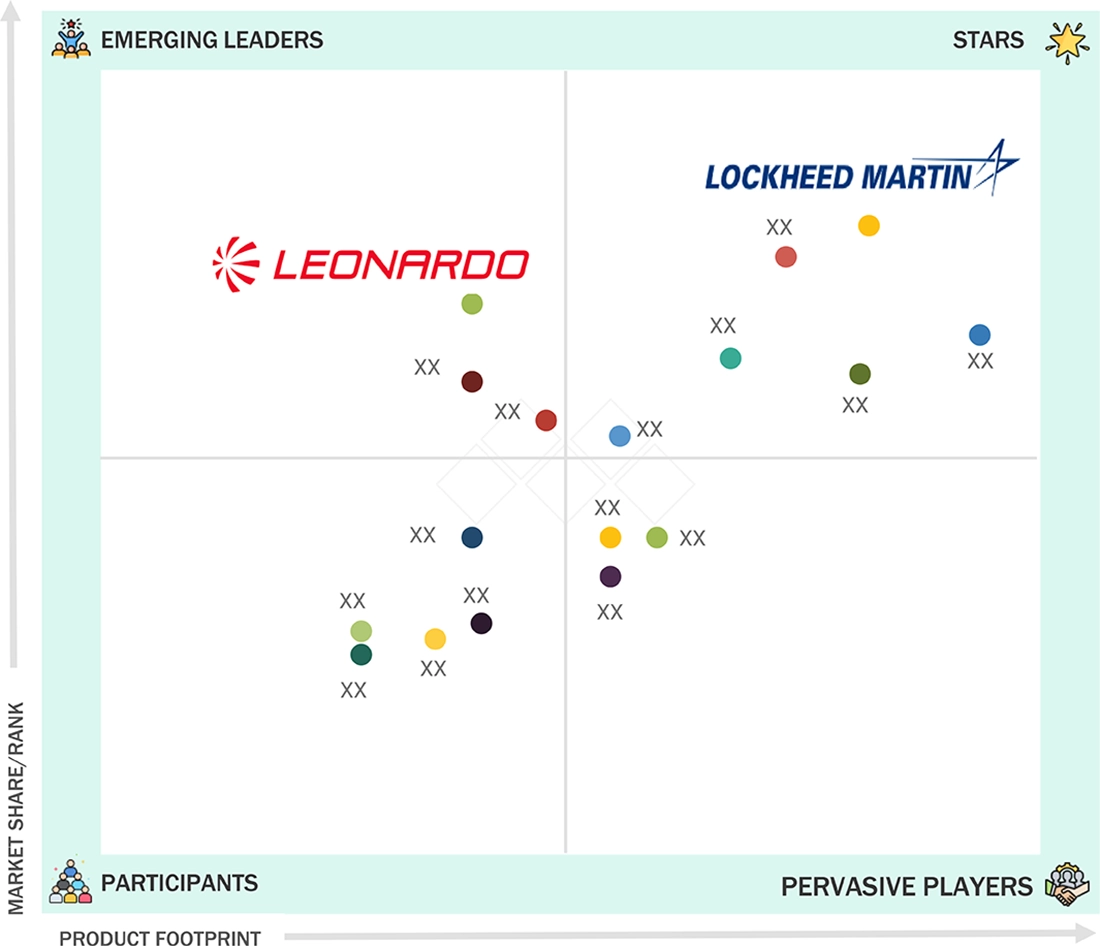

Competitive Landscape-Key PlayersLockheed Martin Corporation, Northrop Grumman, and Boeing were identified as the key players in the UAV (drone) avionics market, given their strong market share and product footprint.

-

Competitive Landscape-StartupsSkydio, Teledyne FLIR, and Shield AI are gaining momentum in the UAV (drone) avionics market. They offer smarter navigation, stronger sensing, and practical AI that supports real decision-making in the field.

The UAV (Drone) Avionics Industry is expanding as more defense, commercial, and public safety users adopt unmanned systems. Improvements in navigation, sensing, autonomous flight control, and secure communication support this growth. UAVs are now commonly used for border surveillance, infrastructure monitoring, emergency response, and environmental assessment, which increases demand for high-performance avionics.

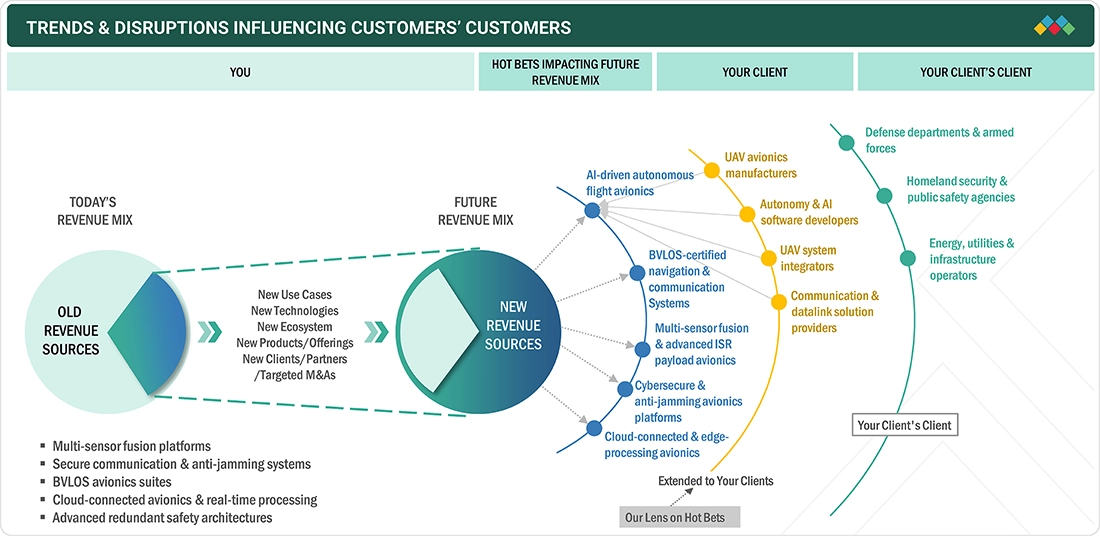

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

Geopolitical tensions and commercial needs are increasing the demand for advanced UAV avionics. Progress in autonomous navigation and AI analytics is enhancing BVLOS operations. These improvements are expanding UAV use across major sectors. The market is shifting toward the adoption of next-generation UAV avionics systems.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Growing defense modernization

-

Rising commercial UAV use

Level

-

Strict airspace rules and slow BVLOS approvals

-

Data security and privacy concerns

Level

-

AI-driven autonomy and sensor fusion

-

Expanding UAV use in inspection and monitoring

Level

-

Cybersecurity threats like GPS spoofing and hacking

-

Harsh weather and operational constraints

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Growing defense modernization

Growing defense modernization is increasing demand for advanced UAV avionics, as militaries focus on autonomous ISR, precision targeting, and secure communication capabilities. This trend is speeding up the adoption of advanced navigation, sensor, and mission-management systems in global defense programs.

Restraint: Strict airspace rules and slow BVLOS approvals

Strict airspace regulations and slow BVLOS approval processes restrict large-scale UAV avionics deployment by imposing operational limits on both commercial and defense users. These regulatory hurdles delay mission scalability and hinder the integration of autonomous UAV systems into national airspaces.

Opportunity: AI-driven autonomy and sensor fusion

AI-driven autonomy and multi-sensor fusion technologies are opening significant opportunities for next-generation UAV avionics by enabling smarter, more reliable, and more efficient mission execution. These advancements support a broader range of applications across defense, public safety, and commercial sectors.

Challenge: Cybersecurity threats like GPS spoofing and hacking

Cybersecurity threats like GPS spoofing, signal interference, and hacking weaken UAV avionics' reliability and pose serious risks to mission continuity. As UAV operations grow worldwide, protecting communication links and navigation systems has become a critical challenge.

UAV (DRONE) AVIONICS MARKET SIZE, SHARE, & GROWTH: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Provides UAV avionics and sensor-integrated platforms for large-area infrastructure monitoring, energy grid inspection, and environmental mapping using secure communication and high-endurance systems. | Enhances inspection accuracy, reduces operational downtime, and supports reliable data acquisition for commercial utilities and environmental agencies. |

|

Deploys advanced avionics suites and mission-management systems for commercial disaster assessment, coastal surveillance, and long-range environmental monitoring. | Improves situational awareness, enables rapid assessment in hazardous environments, and delivers high-precision geospatial intelligence to commercial operators. |

|

Through Insitu platforms, delivers UAV solutions equipped with autonomous avionics for pipeline inspection, agricultural analytics, and commercial land-survey operations. | Offers cost-efficient data collection, improved coverage across remote regions, and enhanced productivity for industrial and agricultural customers. |

|

Provides secure communication systems, ISR avionics, and lightweight sensing technologies for commercial emergency response, telecom inspection, and remote infrastructure monitoring. | Delivers real-time data transmission, supports safe BVLOS operations, and increases effectiveness of commercial field-response activities. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The UAV (drone) avionics market ecosystem is expanding due to collaborations between avionics manufacturers and UAV platform developers. Subsystem suppliers and technology integrators also contribute to this growth. Increasing usage across key sectors is strengthening the ecosystem and boosting demand for mission-specific UAVs.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

UAV (Drone) Avionics Market, By Application

The military segment dominates as defense agencies increasingly rely on UAVs for national security, border surveillance, and strategic reconnaissance missions. Growing investment in autonomous mission systems, encrypted communication, and high-precision sensors is driving widespread deployment of advanced military UAV avionics.

UAV (Drone) Avionics Market, By MTOW

The 2–25 kg segment dominates as operators prioritize lightweight UAVs for rapid-response missions, infrastructure inspection, and tactical field operations. Their maneuverability, modular payload capacity, and reliable performance in complex environments reinforce their strong adoption across defense and commercial sectors.

UAV (Drone) Avionics Market, System

The flight control management segment dominates due to the essential role of autonomous navigation, precise maneuvering, and safety-critical flight stability in UAV operations. Rising demand for BVLOS missions and high-precision autonomous flight is accelerating the integration of advanced flight-control avionics globally.

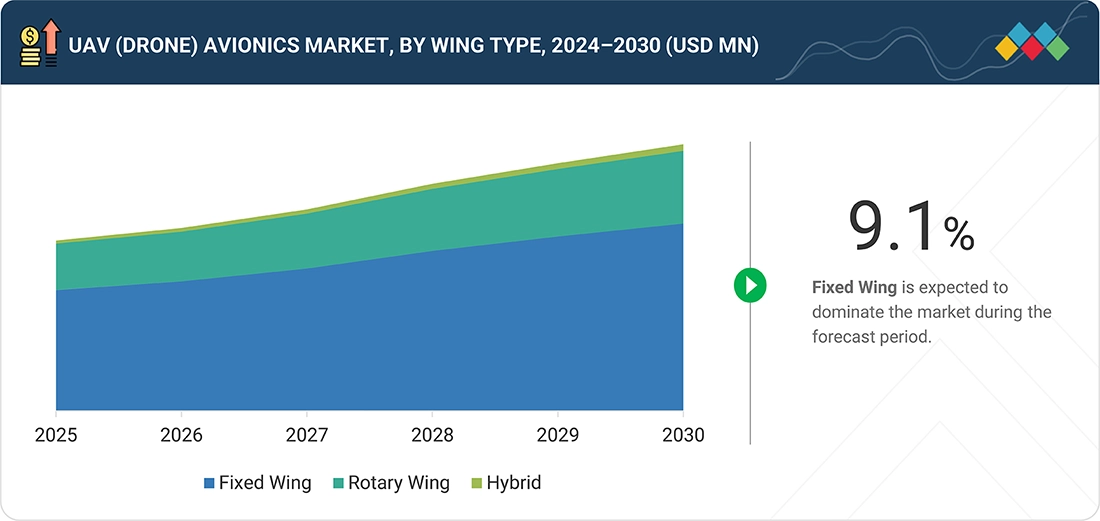

UAV (Drone) Avionics Market, Wing Type

The fixed wing segment dominates as agencies rely on long-endurance UAV platforms for wide-area mapping, maritime patrol, and border monitoring. Their higher payload capacity, extended flight efficiency, and superior coverage make them vital for mission-critical operations.

REGION

North America is expected to be the largest market in the global UAV (drone) avionics market.

The North America UAV (drone) avionics market is growing due to border-security needs, defense upgrades, and increased use of drones for wildfire and infrastructure monitoring. Regional companies are developing advanced avionics that support safer and more accurate missions.

UAV (DRONE) AVIONICS MARKET SIZE, SHARE, & GROWTH: COMPANY EVALUATION MATRIX

In the UAV (drone) avionics market matrix, Lockheed Martin (Star) leads with strong dominance and advanced UAV technologies. Leonardo S.p.A (Emerging Leader) is maintaining a competitive global presence with robust UAV avionics offerings, showing potential to strengthen its market position as global demand for drones expands.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

List of Top UAV (Drone) Avionics Market Companies

- Lockheed Martin Corporation

- Northrop Grumman

- Boeing

- L3Harris Technologies, Inc.

- Elbit Systems Ltd.

- AeroVironment, Inc.

- Israel Aerospace Industries Ltd.

- BAE Systems

- Thales

- Leonardo S.p.A.

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 6.62 BN |

| Market Forecast in 2030 (value) | USD 10.81 BN |

| Growth Rate | 9.4% |

| Years Considered | 2021–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD MN/BN) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Europe, Asia Pacific, Middle East, Latin America, Africa |

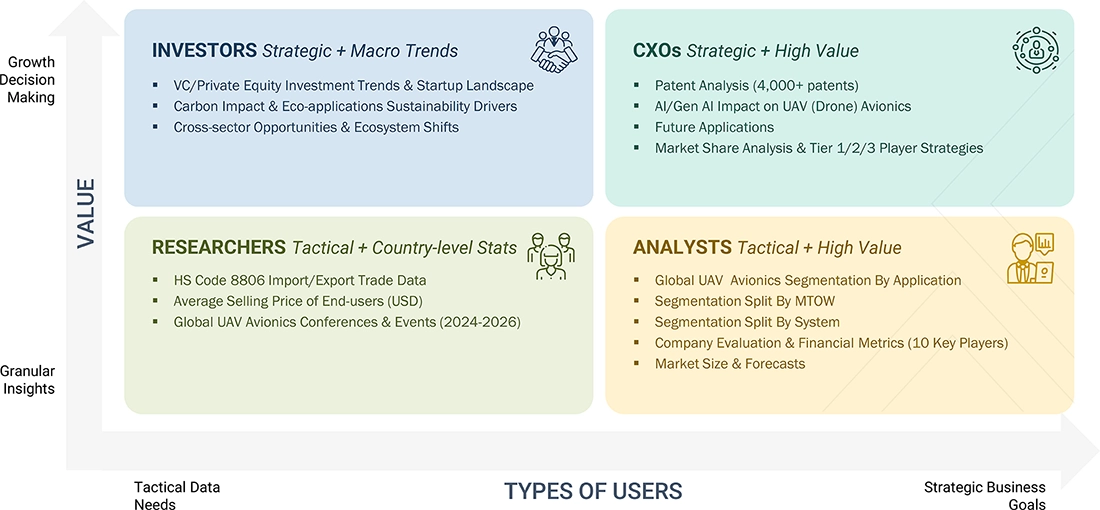

WHAT IS IN IT FOR YOU: UAV (DRONE) AVIONICS MARKET SIZE, SHARE, & GROWTH REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Leading Manufacturer | Additional segment breakdown for countries | Additional country-level market sizing tables for segments/sub-segments covered at regional/global level to gain understanding of market potential by each country |

| Emerging Leader | Additional company profiles | Competitive information on targeted players to gain granular insights on direct competition |

| Regional Market Leader | Additional country market estimates | Additional country-level deep dive for more targeted understanding of total addressable market |

RECENT DEVELOPMENTS

- December 2025 : AeroVironment announced an upgraded Puma Visual Navigation System Kit for the Puma LE platform. The system incorporates advanced autonomous navigation algorithms with enhanced onboard processing and stronger multisensor fusion. These improvements enhance the UAV avionics for extended ISR missions, tactical reconnaissance, and multi-domain military operations.

- October 2025 : L3Harris Technologies and Israel Aerospace Industries signed a Memorandum of Understanding (MoU) to integrate next-generation mission systems and avionics into the Sky Warden platform for the Israeli Light Attack Aircraft program. This agreement improves ISR capability with stronger communication resilience and greater operational flexibility. These upgrades support effective performance in complex defense environments.

- October 2025 : Israel Aerospace Industries introduced a new multi-layered C-UAS defense suite featuring integrated detection, tracking, avionics processing, and autonomous interception capabilities. The advanced system enhances protection against drone swarms and high-velocity threats, reinforcing IAI’s leadership in next-generation UAV defense technologies.

- December 2025 : Boeing secured a USD 1 billion agreement with the Australian government to start production of the MQ-28A Ghost Bat unmanned combat aircraft. The program adds advanced autonomous avionics. It also introduces mission-adaptive sensor architectures. It supports faster deployment of collaborative combat drone technology.

Table of Contents

Methodology

This research study on the UAV (drone) Avionics Market extensively used secondary sources, directories, and databases such as Hoovers, Bloomberg BusinessWeek, and Factiva to identify and collect information relevant to the market. Primary sources included industry experts, service providers, manufacturers, solution providers, technology developers, alliances, and organizations related to all segments of this industry’s value chain. In-depth interviews with primary respondents, including key industry participants, subject matter experts, industry consultants, and C-level executives, were conducted to obtain and verify critical qualitative and quantitative information about the UAV (drone) Avionics Market and assess the market’s growth prospects.

Secondary Research

The market share of companies in the UAV (drone) Avionics Market was determined using the secondary data acquired through paid and unpaid sources, and by analyzing the product portfolios of major companies operating in the market. These companies were rated based on the performance and quality of their products. Primary sources further validated these data points.

Secondary sources for this research study included financial statements of companies offering UAV services, infrastructure and software providers, and various trade, business, and professional associations. Secondary data was collected and analyzed, and was validated by primary respondents.

Primary Research

Extensive primary research was conducted after acquiring information on the UAV (drone) Avionics Market through secondary research. Several primary interviews were conducted with market experts from the demand and supply sides across major countries in North America, Europe, Asia Pacific, the Middle East, Africa, and Latin America. Primary data was collected through questionnaires, emails, and telephonic interviews.

Market Size Estimation

All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated, enhanced with detailed inputs, analyzed by MarketsandMarkets, and presented in this report.

- Top-down and bottom-up approaches were used to estimate and validate the size of the UAV (drone) Avionics Market.

- Key players were identified through secondary research, and their market ranking was determined through primary and secondary research. This included a study of annual and financial reports of the top market players and extensive interviews of leaders, including CEOs, directors, and marketing executives.

Data Triangulation

After arriving at the overall size of the UAV (drone) Avionics Market from the market size estimation process explained above, the total market was split into several segments and subsegments. Wherever applicable, data triangulation and market breakdown procedures described below were implemented to complete the overall market engineering process and arrive at the exact statistics for various market segments and subsegments. The data was triangulated by studying different factors and trends from both the demand and supply sides. Additionally, the market size was validated using both top-down and bottom-up approaches.

Market Definition

Unmanned aerial vehicles (UAVs) are remotely piloted, optionally piloted, or fully autonomous aerial vehicles that play a significant role in the defense and commercial sectors. They are commonly termed drones and are mostly known for their wide usage in various military missions, such as border surveillance and combat operations. These vehicles are also used for mapping, surveying, and determining the weather conditions of a specific area.

Key Stakeholders

- UAV (Drone) Suppliers

- UAV (Drone) Component Manufacturers

- UAV (Drone) Manufacturers

- UAV (Drone) Pilot Training Institutes

- Technology Support Providers

- UAV (Drone) Software/Hardware/Service and Solution Providers

- Regulatory Bodies

- UAV (Drone) Consultants

- Defense Forces

Report Objectives

- To define, describe, segment, and forecast the size of the UAV market based on platform, system, industry, application, mode of operation, maximum take-off weight (MTOW), type, range, sales channel, function, technology, and region

- To forecast the size of various market segments with respect to six major regions, namely North America, Europe, Asia Pacific, the Middle East, Latin America, and Africa

- To identify and analyze key drivers, restraints, opportunities, and challenges influencing the growth of the market across the globe

- To identify industry trends, market trends, and technology trends that are currently prevailing in the market

- To provide an overview of the tariff and regulatory landscape with respect to drone regulations across regions

- To analyze micromarkets with respect to individual growth trends, prospects, and their contribution to the overall market

- To analyze opportunities in the market for stakeholders by identifying key market trends

- To profile key market players and comprehensively analyze their market shares and core competencies

- To analyze the degree of competition in the market by identifying key growth strategies, such as acquisitions, product launches, contracts, and partnerships, adopted by leading market players

- To identify detailed financial positions, key products, and unique selling points of leading companies in the market

- To provide a detailed competitive landscape of the market, along with market ranking analysis, market share analysis, and revenue analysis of key players

Customization Options

Along with the market data, MarketsandMarkets offers customizations to meet the specific needs of companies. The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the market segments at the country level

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the UAV (Drone) Avionics Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in UAV (Drone) Avionics Market