Ultra-high-purity Graphite Market

Ultra-high-purity Graphite Market by Source (Natural, Synthetic), Type (Pyrolytic Graphite, Synthetic Isotropic Graphite, Purified Natural Vein Graphite, High-Purity Synthetic Graphite Powder), Application, End-Use Industry, and Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The global ultra-high-purity graphite market is projected to grow from USD 0.87 billion in 2025 to USD 1.43 billion by 2030, at a CAGR of 10.5 % during the forecast period. The ultra-high purity (UHP) graphite market is witnessing robust growth, driven by its critical applications across advanced industries such as semiconductors, lithium-ion batteries, fuel cells, and solar panels. The increasing demand for high-performance materials in electronics and energy storage solutions is a key market driver, as ultra-high-purity graphite offers exceptional thermal and electrical conductivity, chemical stability, and structural integrity. Additionally, the rapid expansion of the electric vehicle (EV) sector, rising adoption of renewable energy technologies, and growing need for precision-engineered components in aerospace and industrial manufacturing are further propelling market growth. Supportive government initiatives, ongoing R&D in materials science, and the rising investments in next-generation energy solutions are also contributing to the widespread adoption of ultra-high-purity graphite, making it an indispensable material in modern high-tech applications.

KEY TAKEAWAYS

-

BY REGIONAsia Pacific is expected to grow at a CAGR 11.5% during the forecast period (2025–2030).

-

BY SOURCEBy source, the synthetic segment accounted for 86.0% of the market share in 2024.

-

BY TYPEBy type, the pyrolytic segment is expected to dominate the market during forecast period.

-

BY APPLICATIONBy application, the lithium-ion battery anode accounted for 40.0% share of the market in 2024.

-

BY END-USE INDUSTRYBy end-use industry, the electronics segment held a 36.0% share of the market in 2024.

-

Competitive Landscape - Key PlayersMerson, Ceylon Graphite Corp., and Superior Graphite were identified as some of the star players in the ultra-high-purity graphite market (global), given their strong market share and product footprint.

-

Competitive Landscape - Startups/SMEsNingbo Ruiyi Sealing Material Co., Ltd. and Xuran New Materials Limited, among others, have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders.

Growth is primarily fueled by the accelerating demand for ultra-high-purity graphite in semiconductors, where its superior thermal management capabilities support advanced wafer processing and chip fabrication. The market is further driven by the global shift toward electrification, with surging lithium-ion battery production and EV manufacturing requiring highly pure graphite for anode materials and high-temperature processing equipment.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on consumers' business emerges from customer trends or disruptions. The key trends and disruptions set to influence the ultra-high-purity graphite market include evolving technological trends, shifting demand from traditional applications toward rapidly growing sectors such as nuclear energy, advanced energy storage, aerospace & defense, and semiconductors. While today’s revenue mix is still dominated by lithium-ion batteries and electrodes, the next 4–5 years are expected to see an increased share from new high-value applications requiring reactor-grade graphite, high-conductivity carbon materials, lightweight composites, and contamination-free semiconductor components. These emerging client imperatives ultimately drive improved performance outcomes across industries from safer, longer-life nuclear reactors and higher-efficiency energy storage systems to lighter aerospace platforms and higher-yield semiconductor wafers positioning advanced graphite materials as a critical enabler of next-generation technologies.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

•Growing adoption of lithium-ion batteries in EV and energy storage

-

•Rising demand from semiconductor and silicon processing industries

Level

-

•Supply chain concentration and high import dependency

-

•Environmental and regulatory compliance challenges

Level

-

•Development of advanced high temperature nuclear reactor programs

-

•Increasing use of carbon-carbon thermal protection systems in aerospace and hypersonic platforms

Level

-

•High production costs driven by purification and processing intensity

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Growing adoption of lithium-ion batteries in EV and energy storage

Graphite of ultra-high purity has become essential in the rapid expansion of lithium-ion batteries for electric vehicles and grid-scale energy storage due to its superior purity, stability, and electrical performance. As the primary anode material, ultra-high-purity graphite enhances capacity, charge uniformity, and thermal resistance compared to standard grades. The increasing production of EVs and advanced energy storage systems continues to boost demand for battery-grade graphite, particularly high-purity, well-engineered products used in next-generation anode formulations. Stricter purity standards, refined particle sizing, and long-term supply contracts are driving further investment in purification, crystallization control, and vertical integration. Additionally, the push toward localized supply chains and supportive government policies for electrification is reinforcing domestic market growth. However, the sector still faces challenges related to feedstock limitations, energy-intensive purification, and environmental impacts.

Restraint: Supply chain concentration and high import dependency

The ultra-high-purity graphite market faces significant challenges due to limited supply and strong dependence on imports in regions without large-scale mining or processing capabilities. Production is concentrated in a few countries that possess advanced purification technologies and well-established refining infrastructure, which dominate the supply of battery-grade, spherical, and synthetic ultra-high-purity graphite. This concentration exposes critical industries such as semiconductors, electric vehicles, and energy storage systems to supply disruptions, price fluctuations, and geopolitical risks. Many countries rely on the import of unprocessed graphite, needle coke, or refined high-purity grades, creating vulnerabilities within essential technology supply chains. Additionally, stringent environmental regulations in major producing countries may limit output and further impact global availability. The growing demand for high-performance graphite in clean energy applications continues to increase these pressures, making long-term market stability and scalability difficult to achieve without diversified and localized supply networks.

Opportunity: Development of advanced high temperature nuclear reactor programs

The growing development of advanced high temperature nuclear reactor programs presents a major opportunity for the ultra-high-purity graphite market. These reactors, including high-temperature gas-cooled reactors, molten salt reactors, and very high temperature reactors, require graphite components that can withstand extreme heat, neutron radiation, and extended operational lifespans while maintaining structural integrity. Ultra high purity graphite offers outstanding thermal stability, minimal neutron absorption, and strong mechanical performance, making it essential for use in reactor cores, reflectors, moderators, control rod components, and insulation materials. As governments allocate increased funding toward small modular reactors, hydrogen-producing systems, and clean energy solutions, the demand for nuclear-grade graphite is expected to continue expanding. Domestic fuel development, low-carbon industrial heat applications, and local supply chain programs further reinforce this opportunity. The acceleration of advanced nuclear projects is expected to generate sustained long-term demand for ultra-high-purity graphite, positioning it as a critical material in the emerging clean and resilient energy infrastructure.

Challenge: High production costs driven by purification and processing intensity

High production costs remain a major constraint for the growth of the ultra high purity graphite market. The purification and processing stages required to achieve the desired purity levels are both technically complex and energy intensive. Producing ultra high purity graphite typically involves multiple processes such as advanced thermal treatment, high temperature graphitization, chemical purification, and precision milling and shaping. Each stage requires specialized equipment, strict quality control, and extensive technical expertise. Thermal purification, which often operates at temperatures exceeding 5,072.0°F (2,800°C), consumes large amounts of energy, while chemical purification relies on costly reagents and generates regulated waste streams. These factors raise overall production costs, prolong processing times, and limit scalability, posing challenges for new entrants. In addition, as industries such as semiconductors, electric vehicles, and nuclear energy continue to demand tighter material specifications, manufacturers must invest heavily in automation, advanced refining technologies, and process optimization. This sustained cost pressure constrains capacity expansion, compresses profit margins, and represents a long-term structural challenge for the industry.

Ultra-high-purity Graphite Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

UHP graphite components for wafer handling, susceptors, crucibles, and high-temperature furnaces used in epitaxy and ion implantation processes | Exceptional thermal stability for precise temperature control | Ultra-low impurity levels to prevent wafer contamination | Long service life under extreme thermal cycling |

|

UHP synthetic graphite used in high-performance lithium-ion battery anodes and coating systems | Higher energy density and improved charge/discharge efficiency | Longer battery cycle life and enhanced fast-charge performance | Consistent purity for safer large-scale EV battery production |

|

High-purity graphite for cylindrical and prismatic lithium-ion cells used in consumer electronics and energy storage systems | Lower internal resistance, improving power delivery | Stable SEI formation for extended battery lifespan | Higher reliability in thermal and high-load conditions |

|

UHP graphite parts in aerospace thermal protection systems, rocket nozzles, and high-temperature structural components | High mechanical strength at extreme temperatures | Lightweight alternative to metal alloys | Excellent resistance to oxidation and thermal shock |

|

Nuclear-grade UHP graphite moderators, reflectors, and insulation blocks for HTGRs, VHTRs, and emerging SMR designs | Low neutron absorption for efficient reactor moderation | Superior dimensional stability under radiation exposure | Long operational durability in high-temperature nuclear environments |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The ultra-high-purity (UHP) graphite ecosystem is built on a tightly interconnected value chain that spans raw material suppliers, specialized graphite manufacturers, and high-tech end users. At the foundation of the ecosystem, leading suppliers such as Sinopec, Mitsubishi Corporation, Himadri, and Phillips 66 provide essential precursors, including premium-grade needle coke and high-quality carbon materials required for producing ultra-high-purity graphite. These inputs flow to advanced manufacturers such as Mersen, SGL Carbon, Toyo Tanso, and SEC Carbon, which employ highly controlled purification, graphitization, and precision machining processes to achieve the extreme purity levels and structural performance demanded by modern applications. The resulting ultra-high-purity graphite products are integral to the operations of top-tier technology companies, including semiconductor foundries, electric vehicle producers, and battery manufacturers such as TSMC, Tesla, and Panasonic. These end users rely on ultra-high-purity graphite for critical functions ranging from high-temperature semiconductor fabrication and thermal management to lithium-ion battery anodes and next-generation energy systems. Together, this ecosystem forms a strategic, innovation-driven supply chain that underpins growth in semiconductors, electrification, and clean energy technologies.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Ultra-high purity graphite Market, By Source

Synthetic graphite exhibits the fastest as well as the highest growth rate among the source segments in the ultra-high-purity graphite market, driven by its unmatched purity, structural uniformity, and significant scalability compared to natural graphite. The demand is accelerating as high-tech industries, such as those for lithium-ion batteries, semiconductors, aerospace, and advanced nuclear reactors, require more materials with extremely low levels of impurities and precisely engineered performance characteristics. The rapid rise in production of electric vehicles (EVs) along with large energy storage systems has been a major factor in favor of synthetic graphite, as it provides the anodes of high-performance batteries with the characteristics of excellent electrochemical stability, long cycle life, and rapid charging. The global movement aimed at reinforcing domestic supply chains, cutting down on the reliance on mining natural graphite in specific regions, and eliminating contamination risks are some of the factors why the manufacturers are turning towards engineered synthetic alternatives. Upgraded purification technologies, more efficient graphitization processes, and investment in renewable-powered production are all contributing to the market appeal of synthetic graphite, positioning it as an essential material that supports the rapid growth of modern energy and semiconductor ecosystems.

Ultra-high purity graphite Market, By Type

Pyrolytic graphite has been the most rapidly expanding type of ultra-high purity graphite. Its extraordinary characteristics, like very high thermal conductivity that is almost directional, very low porosity, and very low impurity levels, have made it a necessity for cutting-edge, high-performance applications. The market growth is accelerating as demand for semiconductor, aerospace, high-power electronics, and next-generation nuclear reactor applications requiring pyrolytic graphite's properties of extreme thermal management, radiation resistance, and dimensional stability increases. Besides that, the demand for pyrolytic graphite has grown primarily due to the development of AI hardware, high-density computing, and miniaturized electronic devices, as it is the only material that can ensure both heat dissipation and maintain its structural integrity under extreme operational loads. On the other hand, the expansion in high-temperature industrial processes and the development of high-temperature gas-cooled and small modular reactors are creating new opportunities for the material due to its unparalleled properties of high-temperature stability. The improved techniques and processes in chemical vapor deposition (CVD), manufacturing, and R&D have been continually increasing the production efficiency and quality consistency which has further added to the market's current fastest-growing segment pyrolytic graphite's position.

REGION

Asia Pacific is estimated to be the fastest-growing market during the forecast period

The Asia Pacific is expected to be the largest market for ultra-high-purity graphite during the forecast period, primarily due to the rapid growth of the semiconductor, electronics, and electric vehicle manufacturing sectors in the region. The countries, including China, Japan, South Korea, and Taiwan, are considered to be the most important places worldwide for the production of chips, batteries, and the processing of advanced materials, which are the main users of ultra-high-purity graphite for wafer handling, high-temperature furnace components, lithium-ion battery anodes, and precision thermal management systems. High investments in semiconductor capacity expansion by governments, aggressive EV adoption targets, and the localization of battery supply chains are further accelerating demand in the region. Moreover, Asia Pacific is home to some of the largest producers and purification facilities of ultra-high-purity graphite globally, so the region has an advantage in terms of manufacturing scale, cost efficiency, and technological capability. The increasing adoption of renewable energy systems, advanced nuclear technologies, and high-performance industrial processes is also a factor driving the market's growth in the region. Therefore, all these reasons together make Asia Pacific a leading region in ultra-high-purity graphite market both in terms of size and growth rate in the years to come.

Ultra-high-purity Graphite Market: COMPANY EVALUATION MATRIX

In the ultra-high-purity graphite market matrix, SGL Carbon (Star) leads with a strong market share and extensive product footprint, driven by its ultra-high-purity graphite solutions, which are adopted by various end users. Amsted Graphite Materials (Emerging Leader) demonstrates substantial product innovations compared to its competitors. While SGL Carbon dominates through scale and diversified portfolio, Amsted’s ultra-high purity graphite shows significant potential to move toward the leaders’ quadrant as demand for ultra-high purity graphite continues to rise.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Superior Graphite. (US)

- SGL Carbon (Germany)

- GrafTech International (US)

- Toyo Tanso Co., Ltd. (Japan)

- Mersen (France)

- HPMS Graphite (US)

- Ceylon Graphite Corp. (Canada)

- Sarytogan Graphite Limited. (Australia)

- Amsted Graphite Materials (US)

- Entegris (US)

- East Carbon (China)

- Atlas Critical Minerals (Brazil)

- XRD Graphite Manufacturing Co., Ltd. (China)

- SEC CARBON, LIMITED. (Japan)

- American Elements. (US)

- Canada Carbon (Canada)

- Focus Graphite (Canada)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 0.78 BN |

| Market Size in 2030 (Value) | USD 1.43 BN |

| CAGR (2025–2030) | 10.5% |

| Years considered | 2021–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD MN/BN) |

| Report Coverage | The report defines, segments, and projects the ultra-high-purity graphite market size based on component, type, end-use industry, application, source, and region. It strategically profiles the key players and comprehensively analyzes their market shares and core competencies. It also tracks and analyzes competitive developments, such as new product developments, agreements, acquisitions, and expansions that they undertake in the market. |

| Segments Covered |

|

| Regional Scope | North America, Europe, Asia Pacific, South America, and Middle East & Africa |

WHAT IS IN IT FOR YOU: Ultra-high-purity Graphite Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Semiconductor & Electronics Manufacturers |

|

|

| EV Battery Manufacturers & Energy Storage Companies |

|

|

| Nuclear Reactor Developers & Advanced Energy Systems |

|

|

| Aerospace, Chemical, High-Temperature Industrial End Users |

|

|

RECENT DEVELOPMENTS

- September 2025 : Superior Graphite entered into a strategic agreement with ExxonMobil involving the transfer of selected assets, proprietary technologies, and international offices. The agreement brings together Superior Graphite’s expertise in graphite purification and processing with ExxonMobil’s global operational and resource capabilities. It includes the transition of a portion of Superior Graphite’s workforce and the integration of its established production processes into ExxonMobil’s broader materials portfolio. The arrangement is structured to expand the scale and efficiency of high-purity graphite manufacturing, strengthening supply chain resilience and supporting the growing demand for advanced energy and industrial materials.

- October 2024 : Mersen announced the acquisition of Bar-Lo Carbon Products Inc., a US-based precision machinist of graphite and ceramics, as part of its plan to strengthen its materials operations in the US. The acquisition expands Mersen’s capabilities in synthetic graphite manufacturing and provides broader access to customers in the semiconductor and process industries. Bar-Lo generates approximately 15 million USD in annual sales, and the transaction reflects Mersen’s continued focus on consolidating its position in the advanced materials market through strategic integration and capacity development.

- July 2024 : Mersen announced the acquisition of GMI Group, a US-based specialist in the purification and machining of graphite, carbon, and graphite composites, as part of its plan to strengthen its advanced materials operations in the US. The acquisition expands Mersen’s machining capacity for isostatic, extruded graphite, and insulation materials, supporting its position in sectors such as aerospace, process industries, and energy. GMI Group contributes approximately USD 40 million in annual sales. The transaction reflects Mersen’s objective to increase its graphite processing capacity and improve integration across its materials operations in the US.

- July 2023 : Mersen’s expansion in Columbia, Tennessee, reflects a strategic effort to increase synthetic and isostatic graphite production to support high-technology industries such as semiconductors, electric vehicles, and solar energy. The facility is designed with an annual production capacity of 2,000 tons of high-purity, fine-grained isostatic graphite suitable for silicon carbide semiconductor manufacturing and other advanced industrial uses. This development contributes to strengthening the availability of materials that require high thermal stability, structural uniformity, and controlled purity in precision manufacturing environments.

Table of Contents

Methodology

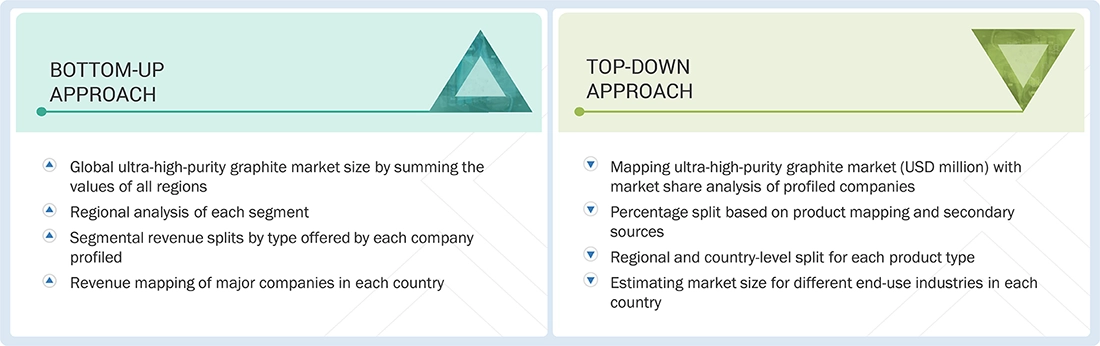

The research methodology used to estimate the current size of the ultra-high-purity graphite market consisted of four major activities. Extensive secondary research was performed to acquire detailed information about the market, peer markets, and parent markets. These findings, assumptions, and metrics were verified through primary research with experts from both the demand and supply sides of the ultra-high-purity graphite value chain. Both top-down and bottom-up approaches were used to estimate the total market size. The estimation of market sizes for various segments and subsegments in the market was finalized using complete market segmentation and data triangulation techniques.

Secondary Research

The research methodology for estimating and forecasting the ultra-high-purity graphite market begins with gathering data on key vendors' revenues by doing secondary research. The secondary research process involves consulting a range of secondary sources, including Hoover's, Bloomberg Businessweek, Factiva, the World Bank, and industry-specific journals. These secondary sources encompass annual reports, press releases, investor presentations, white papers, certified publications, articles from recognized authors, regulatory notifications, trade directories, and databases. Also, vendor offerings are taken into consideration to inform market segmentation.

Primary Research

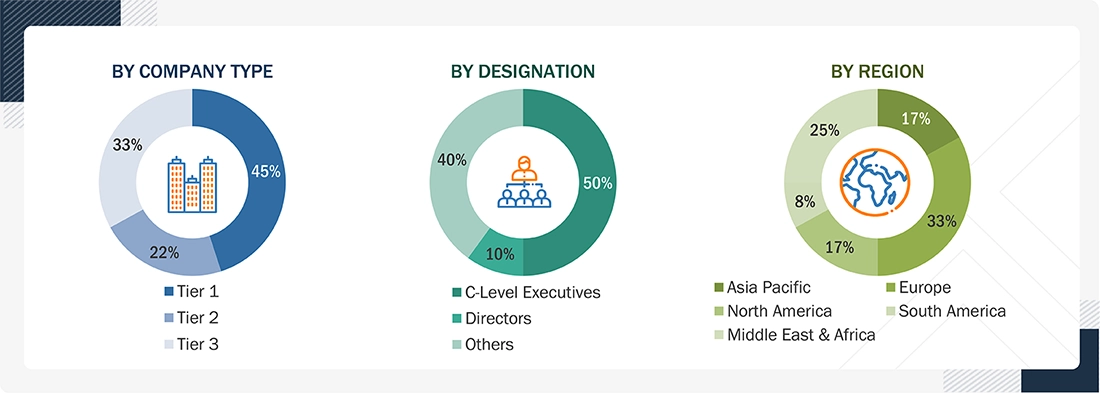

The ultra-high-purity graphite market comprises several stakeholders, including raw material suppliers, processors, end-product manufacturers, and regulatory organizations, throughout the supply chain. The demand side of this market is characterized by the development of various industries, including mobility, power, chemicals, industrial, and grid injection, among others. The supply side is characterized by advancements in technology and a wide range of diverse applications. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The following is the breakdown of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down and bottom-up approaches have been employed to estimate and validate the total size of the ultra-high-purity graphite market. These approaches have also been used extensively to estimate the size of various dependent market subsegments. The research methodology used to estimate the market size included the following:

- Extensive primary and secondary research was done to identify the key players.

- The value chain and market size of the ultra-high-purity graphite market, in terms of value, were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were collected through secondary sources and verified through primary sources.

- All possible parameters that affect the market were covered in this research study and were viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The study of reports, reviews, and newsletters of top market players, along with extensive interviews for opinions from key leaders, such as CEOs, directors, and marketing executives, is included in this research.

Ultra-high-purity Graphite Market Size: Bottom-Up & Top-Down Approach

Data Triangulation

After estimating the overall market size using the above estimation, the market was split into various segments and subsegments. Data triangulation and market segmentation techniques, along with the market engineering process, were employed to obtain precise market analysis data for each segment and its subsegments.

Research Methodology: The research methodology used to estimate and forecast the global market size began by aggregating data and information from various levels, including country-level data.

Market Definition

According to industry standards and materials science reports, ultra-high-purity graphite refers to graphite with a carbon content typically exceeding 99.99%, produced through advanced purification and processing techniques. This material exhibits exceptional thermal conductivity, electrical performance, and chemical stability, making it a critical component in high-technology applications. Ultra-high-purity graphite is widely used in semiconductor manufacturing, energy storage systems, nuclear reactors, and high-temperature industrial equipment. Its purity and structural integrity enable superior performance in demanding environments, supporting the development of next-generation energy and electronic technologies across global markets.

Stakeholders

- Ultra-high-purity Graphite Manufacturers, Processors, and Refining Technology Providers

- End-use Industry Participants, including Semiconductor, Nuclear Energy, and Battery Producers

- Research Institutions, Standards Organizations, and Regulatory Agencies such as ASTM, ISO, IAEA, and National Materials Authorities

- NGOs, Governments, Investment Banks, Venture Capitalists, and Private Equity Firms

Report Objectives

- To define, describe, and forecast the market size of ultra-high-purity graphite, in terms of value and volume

- To provide detailed information regarding the key factors, such as drivers, restraints, opportunities, and industry-specific challenges, influencing the growth of the ultra-high-purity graphite market

- To analyze and forecast the size of various segments (type, application, source, and end-use industry) of the ultra-high-purity graphite market based on five major regions—North America, Europe, Asia Pacific, South America, Middle East & Africa—along with key countries in each of these regions

- To analyze recent developments and competitive strategies, including expansions, partnerships, and acquisitions, to understand the market's competitive landscape

- To strategically profile the key players in the market and comprehensively analyze their core competencies

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Ultra-high-purity Graphite Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Ultra-high-purity Graphite Market