US Cloud Computing Market

US Cloud Computing Market by Service Model (IaaS [Compute, Storage, Networking], PaaS [Application Development & Integration, Database & Data Analytics & Reporting], SaaS [CRM, SCM, Collaboration & Productivity]), Impact of AI - Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

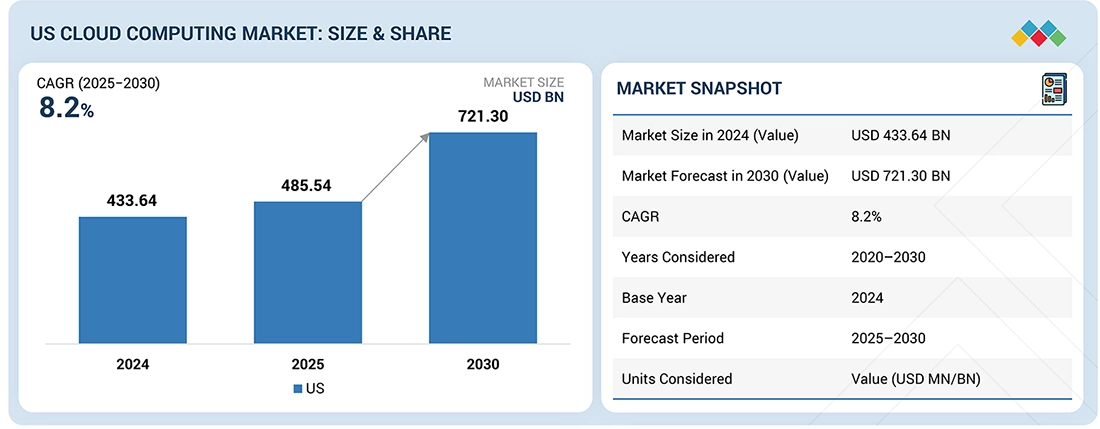

The cloud computing market in the US is expected to grow from USD 485.54 billion in 2025 to USD 721.30 billion by 2030, at a CAGR of 8.2%. This growth is largely supported by ongoing IT modernization efforts across enterprises. Companies from different industries are shifting ERP systems, banking platforms, and large data environments to cloud services provided by AWS, Microsoft Azure, Google Cloud, and Oracle Cloud. At the same time, businesses are expanding their use of virtual servers, managed databases, container platforms, and AI infrastructure to support continuous operations and increasing digital workloads. Adoption is accelerating further as organizations move toward hybrid and multi-cloud environments, introduce AI-based applications, and support remote work models. Rising demand for system flexibility, stronger security, faster data processing, and better cost control is positioning cloud platforms as a core part of digital transformation across the US economy.

KEY TAKEAWAYS

-

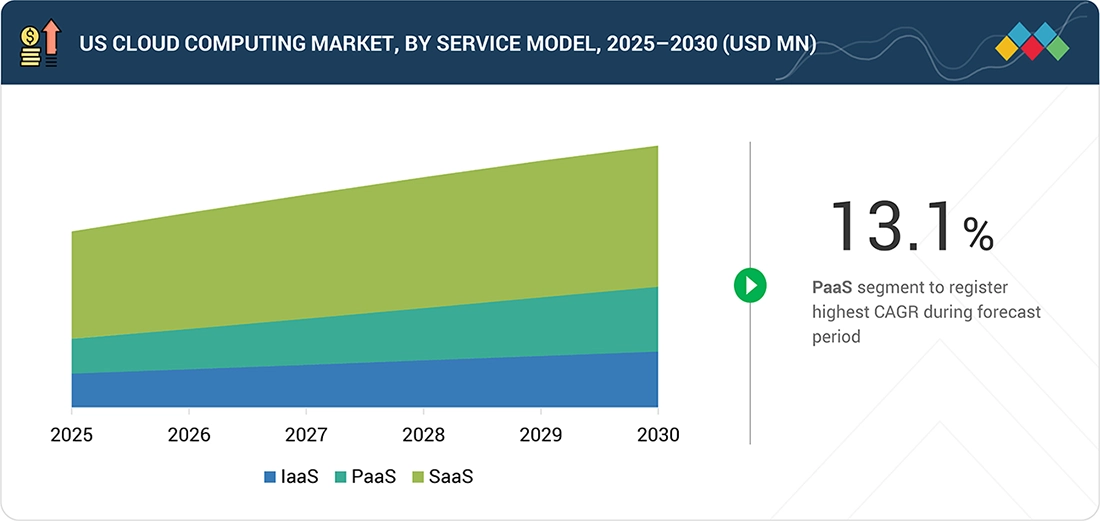

BY SERVICE MODELThe SaaS segment is estimated to lead the market with a market size of USD 295.14 billion in 2025, supported by the widespread adoption of subscription-based business applications.

-

BY IAAS MODELThe networking segment is expected to register the highest CAGR of 15.8% during the forecast period.

-

BY SAAS MODELThe system infrastructure software segment is estimated to account for the largest market size in 2025.

-

BY PAAS MODELThe analytics & reporting segment is expected to exhibit the highest CAGR during the forecast period.

-

BY DEPLOYMENT MODELThe hybrid cloud segment is projected to witness the highest CAGR of 14.3% during the forecast period, driven by enterprise demand for flexibility and control.

-

BY ORGANIZATION SIZELarge enterprises are estimated to lead the market in 2025, reflecting their higher cloud spending and complex workload requirements.

-

BY VERTICALThe healthcare & life sciences segment is projected to exhibit the highest CAGR during the forecast period, supported by rising digitalization and data-intensive workloads.

-

COMPETITIVE LANDSCAPE - KEY PLAYERSLeading players such as Microsoft (US), Google (US), AWS (US), IBM (US), and Oracle (US) are expanding their cloud portfolios through partnerships, technology enhancements, and strategic investments to meet demand for secure and AI-ready cloud platforms.

-

COMPETITIVE LANDSCAPE - STARTUPS/SMESStartups and SMEs such as Zymr, Vultr, Visartech, and Tudip Technologies compete by offering agile cloud services tailored to mid-market and fast-growing enterprises. These players focus on cost efficiency, cloud-native development, and customized digital solutions to support modernization efforts.

The increased use of AI and data analytics raises pressure on cloud service providers of the GPU-based ones, in particular, in fraud detection and recommendation engines, as well as medical image analysis. Adoption is also affected by government policies. The cloud-first and zero-trust policies are encouraging public-sector agencies to migrate their workloads to secure clouds. Federal governments are adopting the environment of AWS GovCloud and Azar Government into healthcare data systems, defense analytics, and digital public services provision. Regulated markets, such as healthcare, BFSI, and defense, are increasingly adopting cloud to meet security and compliance requirements.

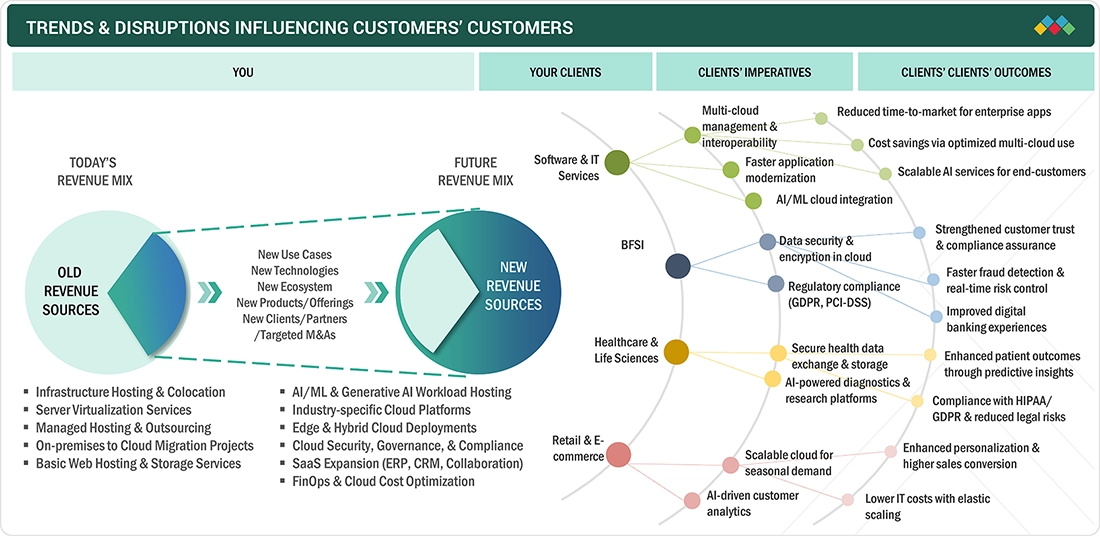

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

Cloud computing plays a growing role in shaping how US businesses operate as customer expectations evolve and digital transformation continues. Industries such as software and IT services, BFSI, healthcare and life sciences, retail, and e-commerce rely on cloud platforms to run core systems and customer-facing applications. The wider availability of cloud software, data tools, and digital services has led to higher overall cloud usage. Improvements in data management, security measures, and digital access are helping organizations manage revenue-related operations more efficiently. These changes directly affect both the volume and type of cloud services that providers need to deliver.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

AI and digital workload scale-up

-

Increasing cloud adoption by US government

Level

-

Weak cost governance and FinOps maturity

-

Data security & privacy concerns

Level

-

Verticalized and function-specific cloud platforms

-

Expansion of hybrid and edge cloud

Level

-

Multi-cloud and hybrid environments

-

Shortage of skilled cloud professionals

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: AI and digital workload scale-up

Cloud demand in the US is rising as companies expand their use of AI, data analytics, and digital platforms. Many organizations are moving AI initiatives from pilot stages into real business applications, which requires steady access to high-performance computing, scalable storage, and reliable networks. This shift is driving higher investment in cloud infrastructure, with Morgan Stanley estimating global cloud capital spending at USD 582 billion, significantly above earlier levels and expectations. For US enterprises, this increased investment improves cloud availability and capacity, strengthening cloud platforms as the primary foundation for AI-driven growth and large-scale digital operations.

Restraint: Weak cost governance and FinOps maturity

As cloud usage grows, many organizations struggle to track spending across different teams, applications, and departments. Cloud costs often increase faster than internal control systems, leading to limited visibility into expenses and unclear ownership. Many companies still lack mature financial management practices to link cloud spending with business outcomes, which can result in budget overruns and friction between IT, finance, and procurement teams. As a result, new cloud initiatives often face longer approval cycles and stricter budget reviews, slowing expansion even when business needs remain strong.

Opportunity: Verticalized and function-specific cloud platforms

Cloud platforms designed for specific industries and business functions are opening new adoption opportunities, especially in regulated and process-heavy sectors. Government and regulated cloud offerings help organizations move sensitive workloads securely through built-in compliance features. At the same time, platforms focused on sales, marketing, and customer service help standardize engagement processes. These solutions reduce customization requirements, speed up deployment, and allow organizations to focus more on business results than infrastructure setup. By combining secure cloud foundations with ready-to-use applications, companies can adopt workloads that were previously delayed or difficult to implement.

Challenge: Multi-cloud and hybrid environments

The increasing use of hybrid and multi-cloud environments across the US is making cloud operations more difficult to manage. Many organizations now run workloads across several cloud providers along with on-premise systems, which often results in fragmented tools, uneven security practices, and limited visibility across platforms. This adds to operational workload, lowers efficiency, and slows down problem resolution. For larger enterprises, these challenges can also lead to financial risks, such as overlapping services, avoidable downtime, and delayed business initiatives. As cloud environments grow more complex, the need for consistent processes and stronger standardization becomes more critical.

US CLOUD COMPUTING MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Nasdaq modernized its Boardvantage governance platform by adding AI capabilities built on Microsoft Azure. Using Azure OpenAI, document intelligence, and secure cloud infrastructure, Nasdaq automated document summaries and meeting workflows. The platform is designed to meet strict security, compliance, and data control requirements for board-level governance. | The AI-enabled platform reduced directors’ reading time by up to 60 percent and cut overall board preparation time by about 25 percent. It improved the quality of insights for strategic decision-making and ensured secure, controlled, and accurate AI outputs across sensitive governance processes. |

|

8x8 migrated its global video meeting and core communication services from AWS and legacy data centers to Oracle Cloud Infrastructure (OCI). The move focused on improving performance, lowering costs, and ensuring low latency and high availability for millions of users worldwide. OCI’s global regions and flexible compute options supports large-scale, cloud-native operations. | The migration delivered major cost savings, including an 80 percent reduction in network egress costs and more than 25 percent improvement in performance per node. 8x8 achieved faster issue detection, higher system uptime, and improved scalability across regions. Customers also benefited from better service reliability and experience. |

|

Shutterfly accelerated its cloud transformation by migrating VMware-based workloads from on-premises infrastructure to AWS native services. The company modernized hundreds of applications using Amazon ECS, EC2, S3, and other managed services to support its e-commerce and printing operations. | The migration reduced operating costs by about 25 percent through license savings and right-sizing. It improved system stability and reduced high-severity incidents. Faster CI/CD pipelines enabled quicker feature releases, while greater flexibility supported AI-driven automation and innovation at scale. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The US cloud ecosystem is made up of multiple players working together to deliver cloud services. Network providers and hardware vendors form the physical foundation, while cloud providers supply computing power, storage, and platforms. Software developers build applications on top of this infrastructure to create complete digital solutions. In addition, consulting firms, brokers, and system integrators help organizations with cloud deployment, management, and optimization. This combined effort across the ecosystem supports steady cloud adoption and continues to drive market growth nationwide.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

US Cloud Computing Market, by Service Model

The IaaS segment is projected to grow at the highest rate as US organizations increase demand for virtual computing, storage, and networking to support AI, analytics, and cloud-native applications. Large enterprises and digital-first companies are moving away from owning physical infrastructure and instead adopting hybrid and multi-cloud strategies to improve flexibility and reduce upfront investment. Growing use of GPU-based workloads and on-demand computing for AI training, automation, and real-time processing continues to drive IaaS adoption across industries.

US Cloud Computing Market, by IaaS

Within IaaS, cloud networking is expected to witness the highest demand as organizations require secure and low-latency connectivity across hybrid, multi-cloud, and edge environments. Businesses running AI workloads, IoT platforms, and real-time applications depend on strong network performance. Investments by major cloud providers in networking infrastructure to support data-heavy and distributed workloads are further driving demand for scalable cloud networking services.

US Cloud Computing Market, by PaaS

In the PaaS segment, database and data management platforms are gaining momentum as US companies modernize older systems and handle rapidly expanding data volumes. Organizations are adopting cloud-based databases and analytics platforms to support real-time insights, AI development, and application upgrades. These platforms help reduce operational effort while enabling large-scale data processing, making them important for businesses developing digital products and intelligent services.

US Cloud Computing Market, by SaaS

Within SaaS, supply chain management solutions are seeing strong demand as companies look for better visibility, automation, and control over inventory, demand planning, and supplier relationships. Retail and manufacturing firms increasingly depend on cloud-based SCM platforms to improve forecasting and streamline operations. The addition of analytics and automation tools further supports adoption by helping organizations respond more quickly to market changes and disruptions.

US Cloud Computing Market, by Deployment Model

The public cloud segment is estimated to hold the largest share of the US market as enterprises move workloads to shared cloud environments for better flexibility and cost efficiency. Public cloud platforms support AI projects, data analytics, and digital applications without the need for on-site infrastructure. Ongoing expansion of large data centers and edge locations is further strengthening public cloud adoption, especially for performance-sensitive workloads.

US Cloud Computing Market, by Organization Size

Small and medium-sized enterprises (SMEs) represent the fastest-growing customer group as they adopt cloud services to access advanced business tools. Cloud-based storage, collaboration platforms, and business applications allow SMEs to scale operations without large upfront investments. Flexible pricing and quick deployment make cloud solutions particularly attractive for smaller businesses adapting to changing market conditions.

US Cloud Computing Market, by Vertical

The healthcare & life sciences segment is expected to grow at the highest rate as organizations increasingly use cloud platforms to manage growing volumes of clinical, research, and patient data. Hospitals and research institutions rely on cloud infrastructure for clinical trials, data analysis, and digital health services. Cloud adoption also supports regulatory requirements, improves access to information, and enables AI-based research, making it a key driver of innovation across the US healthcare sector.

REGION

US CLOUD COMPUTING MARKET: COMPANY EVALUATION MATRIX

In the US cloud computing market, Microsoft holds the leading position due to its extensive Azure portfolio and strong market presence. Its integration of cloud infrastructure with AI and enterprise software strengthens adoption across regulated sectors. DigitalOcean is considered the emerging player, focusing on simple, scalable, and cost-effective cloud services. Its offerings are widely adopted by developers, startups, and small to mid-sized businesses in the US market.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Microsoft (US)

- Google (US)

- AWS (US)

- IBM (US)

- Oracle (US)

- Salesforce (US)

- Adobe (US)

- Workday (US)

- Broadcom (US)

- Rackspace Technology (US)

- DXC Technology (US)

- Digital Ocean (US)

- Zymr, Inc. (US)

- Citrix Cloud (US)

- Verizon (US)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 433.64 Billion |

| Market Forecast in 2030 (Value) | USD 721.30 Billion |

| Growth Rate | CAGR of 8.2% from 2025 to 2030 |

| Years Considered | 2020–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Million/Billion) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends. |

| Segments Covered |

|

| Country Covered | US |

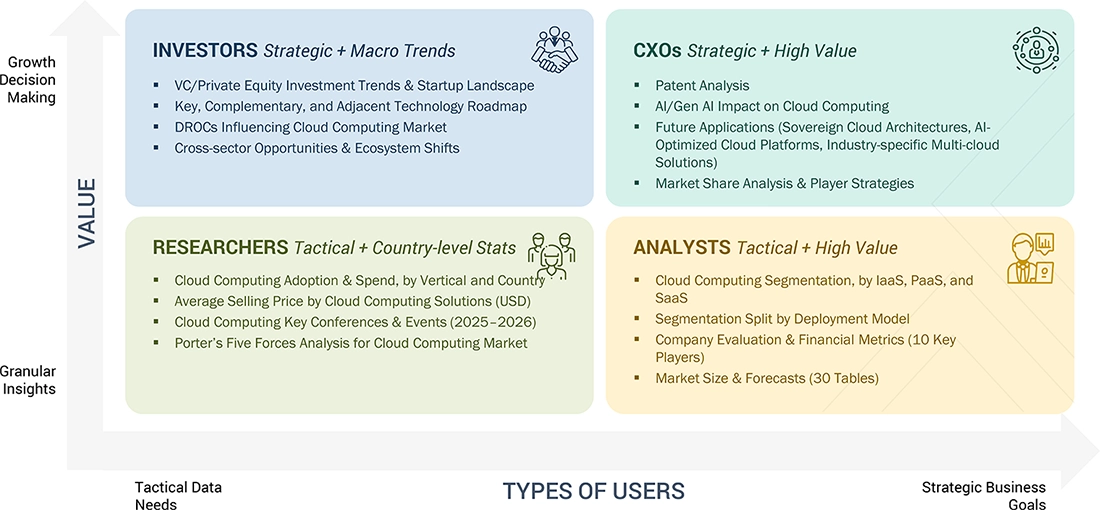

WHAT IS IN IT FOR YOU: US CLOUD COMPUTING MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Cloud Service Provider |

|

|

| Telecom Operator |

|

|

| Enterprise |

|

|

RECENT DEVELOPMENTS

- May 2025 : Microsoft and SAP launched the SAP Business Suite Acceleration Program to support SAP Cloud ERP on Azure with a 99.95% SLA. The initiative focuses on improving ERP reliability and performance for enterprises. Integration of SAP Databricks and Microsoft 365 Copilot highlights a shared focus on AI-enabled productivity and enterprise modernization.

- April 2025 : Capgemini and Google Cloud expanded their partnership to deliver industry-specific agentic AI solutions. The collaboration targets sectors such as telecommunications, retail, and financial services. It focuses on automation, personalization, and improved security to support enterprise digital transformation.

- March 2025 : Oracle and NVIDIA partnered to integrate NVIDIA AI tools and NIM microservices into Oracle Cloud Infrastructure. The collaboration supports scalable agentic AI deployment across data centers, public cloud, and edge environments. This move strengthens Oracle’s focus on AI-ready cloud infrastructure and enterprise-grade inference.

- February 2025 : Salesforce and Google Cloud expanded their collaboration to embed Gemini models into Agentforce. The integration improves real-time insights and deployment flexibility for enterprise users. It also supports secure data access, unified decision-making, and customer service automation.

Table of Contents

Methodology

This research study on the US Cloud Computing Market involved extensive secondary sources, directories, IEEE Communication-Efficient: Algorithms and Systems, International Journal of Innovation and Technology Management, and paid databases. Primary sources were mainly industry experts from the core and related industries, preferred cloud service providers, third-party service providers, consulting service providers, end users, and other commercial enterprises. In-depth interviews were conducted with various primary respondents, including key industry participants and subject matter experts, to obtain and verify critical qualitative and quantitative information and assess the market’s prospects.

Secondary Research

In the secondary research process, various sources were referred to identify and collect information for this study. Secondary sources included annual reports, press releases, and investor presentations of companies; white papers, journals, and certified publications; and articles from recognized authors, directories, and databases. The data was also collected from other secondary sources, such as journals, government websites, blogs, and vendors' websites. Additionally, the US cloud computing spending of various countries was extracted from the respective sources.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, such as Chief Experience Officers (CXOs), Vice Presidents (VPs), and directors specializing in business development, marketing, and cloud service providers. It also included key executives from cloud computing solution vendors, system integrators (SIs), professional service providers, industry associations, and other key opinion leaders.

Note: Tier 1 companies’ revenues are more than USD 10 billion; tier 2 companies’ revenues range between

USD 1 and 10 billion; and tier 3 companies’ revenues range between USD 500 million and USD 1 billion.

Other designations include sales managers, marketing managers, and product managers.

Source: Industry Experts

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Multiple approaches were adopted to estimate and forecast the US Cloud Computing Market . The first approach involved estimating the market size by companies’ revenue generated through the sale of cloud computing services.

Market Size Estimation Methodology- Top-down approach

In the top-down approach, an exhaustive list of all the vendors offering products in the US Cloud Computing Market was prepared. The revenue contribution of the market vendors was estimated through annual reports, press releases, funding, investor presentations, paid databases, and primary interviews. Each vendor's offerings were evaluated based on platform, degree of customization, type, application, end user, and region. The markets were triangulated through both primary and secondary research. The primary procedure included extensive interviews for key insights from industry leaders, such as CIOs, CEOs, VPs, directors, and marketing executives. The market numbers were further triangulated with the existing MarketsandMarkets’ repository for validation.

Market Size Estimation Methodology-Bottom-up approach

In the bottom-up approach, the adoption rate of cloud computing services among different verticals in key countries of the US with respect to their regions contributing the most to the market share was identified. For cross-validation, the adoption of cloud computing services among enterprises, along with different use cases with respect to their regions, was identified and extrapolated. Weightage was given to use cases identified in different regions for the market size calculation.

Based on market numbers, the regional split was determined by primary and secondary sources. The procedure included an analysis of the US Cloud Computing Market’s regional penetration. Based on secondary research, the regional spending on Information and Communications Technology (ICT), socio-economic analysis of each country, strategic vendor analysis of major cloud computing providers, and organic and inorganic business development activities of regional and global players were estimated.

US Cloud Computing Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakup procedures were employed, wherever applicable. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Market Definition

The Cloud Computing market involves delivering computing services such as servers, storage, databases, networking, software, and analytics over the internet, enabling organizations to access and manage data and applications remotely. It includes public, private, and hybrid cloud deployment models and supports various service models such as Infrastructure as a Service (IaaS), Platform as a Service (PaaS), and Software as a Service (SaaS). Cloud computing helps businesses reduce capital expenditure, improve scalability, enhance collaboration, and accelerate innovation. It plays a vital role in digital transformation, supporting emerging technologies such as AI, IoT, big data, and machine learning across industries.

Stakeholders

- Cloud Service Providers (CSPs)

- Networking companies

- Information Technology (IT) infrastructure providers

- Consultants/Consultancies/Advisory firms

- Component providers

- Telecom service providers

- System Integrators (SIs)

- Support and maintenance service providers

- Support service providers

- Third-party providers

- Government organizations and standardization bodies

- Datacenter providers

- Regional associations

- Independent hardware and software vendors

- Value-added resellers and distributors

Report Objectives

- To define, describe, and forecast the US Cloud Computing Market based on service model, Infrastructure as a Service (IaaS), Platform as a Service (PaaS), Software as a Service (SaaS), deployment model, organization size, vertical, and region

- To provide detailed information about the major factors (drivers, opportunities, restraints, and challenges) influencing the growth of the US cloud computing market

- To analyze the opportunities in the market for stakeholders by identifying the high-growth segments of the US cloud computing market

- To analyze the subsegments of the market with respect to individual growth trends, prospects, and contributions to the overall US cloud computing market

- To profile the key players of the US Cloud Computing Market and comprehensively analyze their market size and core competencies

- To track and analyze the competitive developments, such as product enhancements and product launches, acquisitions, and partnerships & collaborations, in the US Cloud Computing Market globally

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- The product matrix provides a detailed comparison of the product portfolio of each company.

Geographic Analysis as per Feasibility

- Further breakup of the North American cloud computing market

- Further breakup of the European cloud computing market

- Further breakup of the Asia Pacific cloud computing market

- Further breakup of the Middle East & African cloud computing market

- Further breakup of the Latin American cloud computing market

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the US Cloud Computing Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in US Cloud Computing Market