US Energy as a Service (EAAS) Market

US Energy as a Service (EAAS) Market by Service Type (Energy Supply Services, Operational & Maintenance Services, Energy Efficiency & Optimization Services), End User (Industrial, Commercial), - Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

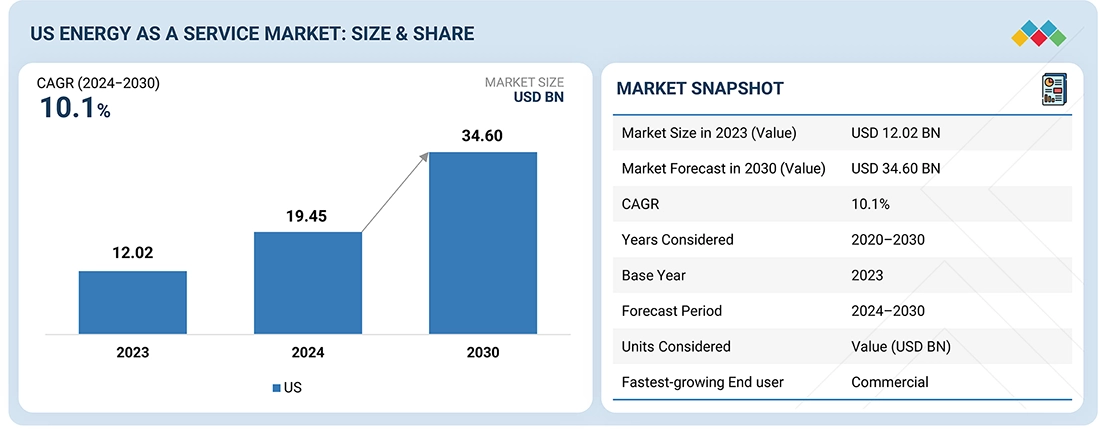

The US energy as a service market is projected to reach USD 34.60 billion by 2030 from USD 19.45 billion in 2024, at a CAGR of 10.1%. Supportive policies are a key driver of the market. State-level clean energy mandates, building performance standards, utility efficiency programs, and incentives for renewables and decarbonization are encouraging businesses to adopt service-based energy solutions. Additionally, advancements in digital energy technologies, such as real-time monitoring, automated demand response, and data-driven optimization, are making these services more attractive by enhancing visibility, reliability, and day-to-day control of energy use.

KEY TAKEAWAYS

-

BY SERVICE TYPEEnergy supply services are likely to account for the largest share of 60.1% of the US energy as a service market in 2030.

-

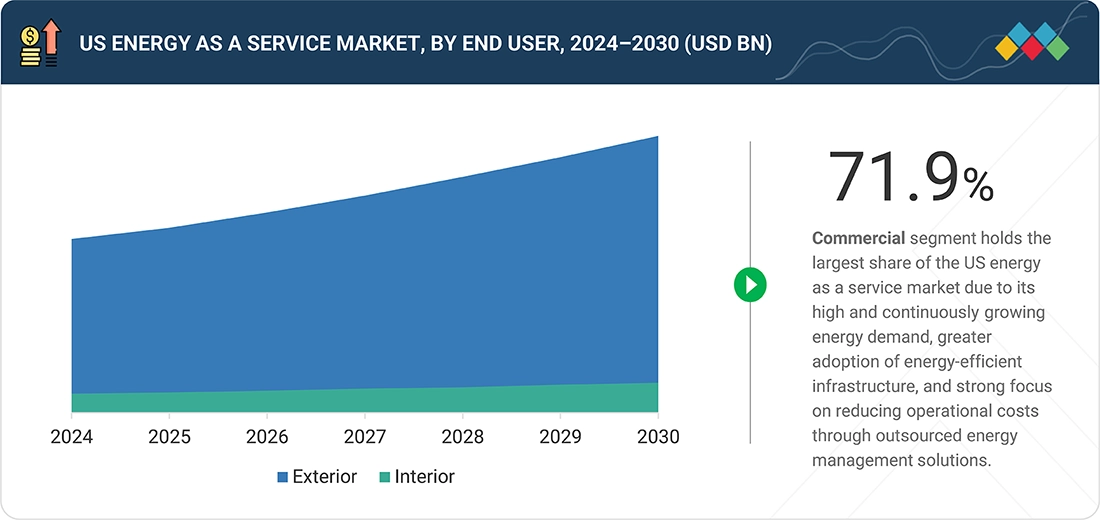

BY END USERThe commercial segment is expected to grow at a higher CAGR of 10.6% during the forecast period.

-

COMPETITIVE LANDSCAPEKey players such as Ameresco, Siemens, Schneider Electric, Johnson Controls, and Veolia have formed strategic collaborations and project-based partnerships to deliver integrated EaaS solutions that combine renewable energy generation, storage, and digital energy management systems.

-

COMPETITIVE LANDSCAPENextEra Energy Services; Wendel; Entegrity Energy Partners, LLC; Redaptive; and NORSECO have been identified as startups and SMEs reflecting their emerging market presence and expanding capabilities.

Energy as a service is being used more and more to support flexible and grid-responsive operations as US commercial and industrial facilities upgrade their energy systems. EaaS models include on-site solar energy, storage, and load management in demand-response programs. These services help meet changing state efficiency and sustainability goals. They also assist clients in managing high energy demand, keeping costs stable, and using energy more effectively when renewable energy is readily available.

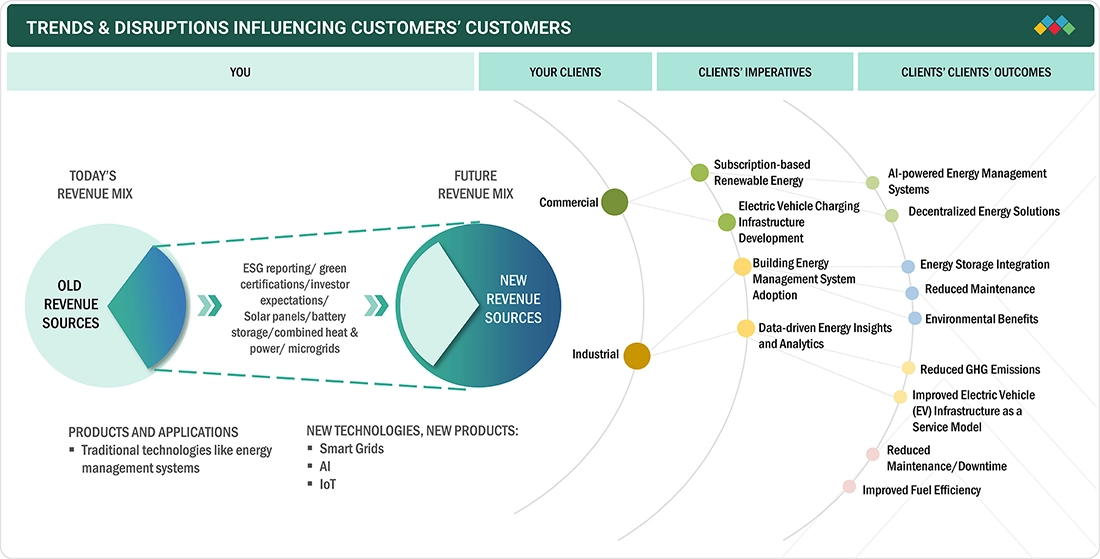

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

Digital technologies such as Internet of Things (IoT), artificial intelligence, and analytics are transforming the US energy as a service market by integrating smartness, connectivity, and performance-driven energy management. Although demands for a low-carbon future and sustainability drivers are fueling technology for renewable energy, energy storage, electric cars, and micro-grids, growing dependence on digitalization in the value chain has significantly increased the focus on cybersecurity risks, culminating in increased spending in this segment. Key participants in the US energy as a service market, such as Siemens AG, Schneider Electric, and Ameresco, Inc., are increasingly focusing on providing digital lifestyle services rather than relying solely on the sale of hard equipment. This shift is driven by paradigms such as the transition to a low-carbon future, the demand for sustainability, and the overall need for efficient and resilient energy solutions in the US. Significant demands for smart energy management services are emerging across various industries, including automotive, energy production, and healthcare, reflecting a strong push toward environmental sustainability and efficiency.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Advanced Technology Integration

-

Renewable and Distributed Energy Resource (DER) Growth

Level

-

Regulatory Complexity and Fragmentation

-

High Upfront and Contractual Costs

Level

-

Smart City and Public-Private Partnerships

-

Corporate Sustainability Mandates

Level

-

Integration with Legacy Infrastructure

-

Customer Awareness and Trust

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Advanced Technology Integration

Technological advancements in the digital era have come out as the key driving force propelling the market for US Energy as a Service forward. The large-scale usage of IoT sensors, cloud-based energy management systems, and AI-based analysis techniques has enabled the possibility of analyzing the usage of energy in the commercial and industrial sectors. Technological advancements have played a major role in the EaaS industry for the optimization of load management, improved equipment performance based on predictive analytics, and responding to pricing signals for the EaaS companies in the grid. Technological advancements in the US, with large differences in the cost of energy and the grid in different parts of the country, have made the incorporation of technology a key driving force behind the adoption of the EaaS industry.

Restraint: Regulatory Complexity and Fragmentation

Regulatory fragmentation across U.S. states remains a significant challenge for the energy-as-a-service (EaaS) industry. Differences in utility market structures, interconnection rules, net metering policies, and incentive programs create uncertainty for both EaaS providers and end users. As a result, EaaS companies must tailor their solutions to meet each state’s specific regulatory framework, increasing compliance costs and operational complexity. This lack of regulatory consistency slows multi-state expansion, particularly for offerings such as solar-plus-storage systems and microgrids, which face varying permitting processes and utility connection requirements across jurisdictions.

Opportunity: Corporate Sustainability Mandates

Corporate sustainability commitments are one of the strongest growth opportunities facing the US EaaS market in the near term. Large corporations across industries are pledging to achieve net-zero emissions, science-based targets, and enhanced ESG disclosure requirements. Energy-as-a-Service models enable these corporations to achieve their sustainability objectives with minimal upfront investments by offering bundled solutions that integrate renewable energy, efficiency upgrades, energy storage, and digital monitoring into long-term service agreements. In this regard, EaaS providers become strategic partners rather than just pure-play equipment vendors by providing measurable energy and carbon reductions, driving long-term revenue growth and customer retention.

Challenge: Integration with Legacy Infrastructure

One of the most significant challenges to EaaS implementation in the United States is legacy system integration. A large share of nonresidential, industrial, and government buildings continues to rely on outdated electrical infrastructure, building management systems, and control technologies that are not designed to support modern digital platforms, distributed energy resources, or advanced analytics. Integrating EaaS solutions into these environments often requires extensive system redesigns and phased rollouts, increasing technical complexity, project costs, and deployment timelines. As legacy systems remain prevalent across US sectors, achieving seamless integration continues to be a major barrier to broader EaaS adoption.

US ENERGY AS A SERVICE (EAAS) MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

The University of Northwestern Ohio (UNOH) is working with Centrica Business Solutions on a USD 3.1 million project to improve energy efficiency across its 28 buildings on a 200-acre campus. This project aims to lower energy costs, boost operational efficiency, and increase comfort without any upfront investment. It includes upgrades to LED lighting, replacements for heating and cooling systems, improvements to motors, and enhancements to the water system, all funded by the savings from energy performance. | UNOH saved 1.9 million kWh of electricity in a year. This led to a reduction of 1,393 tons of CO2 emissions and helped conserve water | The improvements also increased indoor comfort and air quality while ensuring the long-term reliability of the infrastructure | These efforts support UNOH’s sustainability and financial goals. |

|

A Fortune 100 company that aims to improve energy efficiency faced challenges in getting funding for big projects. This led them to work on smaller projects that were often inefficient and inconsistent. To solve this problem, the company teamed up with a national energy solutions provider and chose the Energy-as-a-Service (EaaS) model. This model combines financing, technology, construction, monitoring, and reporting into one framework. It allows a third party to cover all implementation costs and own the assets. As a result, the company can optimize energy use across the enterprise without needing to invest upfront. | The company used an energy as a service approach to improve its energy use in a smart and cost-effective way | By removing the need for large upfront investments, it was able to upgrade three times more facilities each year, speeding up its efforts to be more sustainable | This standardized method made operations run more smoothly, improved data sharing, and helped track performance, allowing teams to focus on their main business goals | Overall, the project resulted in noticeable energy savings, lowered emissions, and created a strong foundation for future growth |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

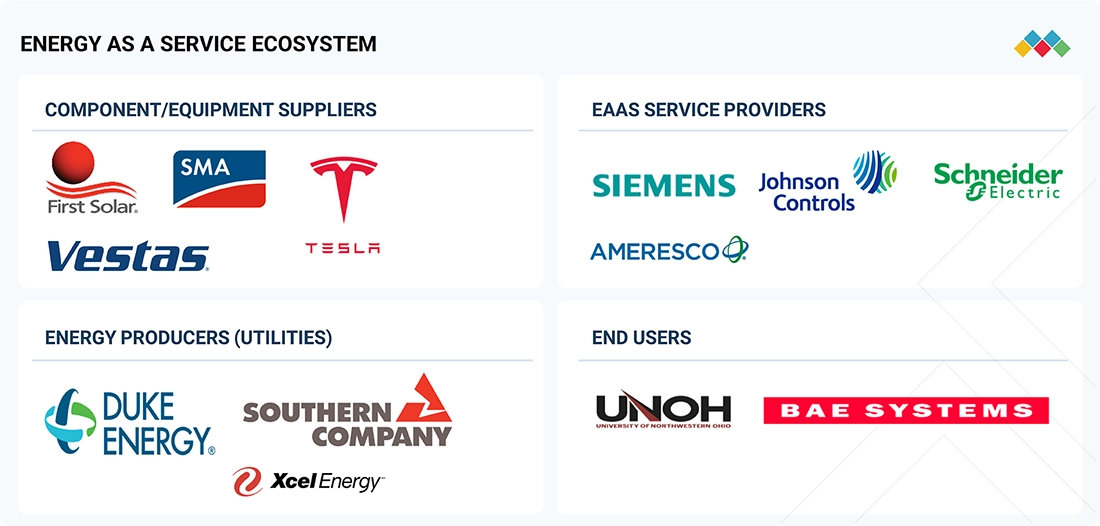

MARKET ECOSYSTEM

The analysis of energy as a service (EaaS) shows how different industries and applications interact and impact this market. Key players include equipment suppliers such as First Solar, Vestas, Tesla, and SMA Solar Technology, who provide essential components. Major service providers, such as Schneider Electric, Siemens, Ameresco, and Johnson Controls, offer EaaS solutions for industrial and commercial customers. Energy producers such as Duke Energy, Southern Company, and Xcel Energy support EaaS providers by integrating renewable energy and managing grid distribution. End users including the University of Northwestern Ohio and BAE Systems depend on these providers for energy management. This network drives innovation and growth in the energy as a service market.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Energy as a Service Market, By Service Type

The US market, based on service type, has been classified into energy supply services, operational & maintenance services, and energy-efficiency & optimization services. Energy supply services hold the largest market share as organizations look for predictable energy costs and access to cleaner power without owning generation assets. The US market is also shaped by growing adoption of solar, storage, and building-level load management systems, which are commonly delivered through service-based contracts, making them easier for customers to adopt and manage.

Energy as a Service Market, By End User

To manage budgets and increase efficiency without making significant capital investments, commercial facilities in the US are adopting energy as a service models because their electricity costs are higher than those of many industrial users. Commercial sites are depending more on EaaS providers to coordinate energy use and align with organizational sustainability goals as distributed resources and digital energy platforms proliferate.

US ENERGY AS A SERVICE (EAAS) MARKET: COMPANY EVALUATION MATRIX

Ameresco is a leading integrator of clean energy, Energy as a Service, energy efficiency, and renewable energy solutions, offering solar, microgrids, energy storage, EV infrastructure, and ESPCs. Growth will be fueled by innovation and expanded offerings to a mix of new and existing customers. TThe company is highly focused on the United States, which accounted for approximately 84.5% of its total revenue in 2023.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- ENGIE (France)

- Schneider Electric (France)

- Ameresco (US)

- Siemens (France)

- Johnson Controls (Ireland)

- Enel X S.r.l (Italy)

- EDF Energy (US)

- Edison Internationalv (US)

- GE Vernova (US)

- Veolia (France)

- Honeywell International Inc. (US)

- NextEra Energy Services (US)

- Bernhard (US)

- Entegrity Energy Partners, LLC (US)

- Enertika (Spain)

- Norseco (US)

- Wendel (US)

- Centrica plc (UK)

- Duke Energy Corporation (US)

- WGL Energy Services, Inc (US)

- Ørsted A/S (Denmark)

- Iberdrola, S.A (Spain)

- Southern Company (US)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2023 (Value) | USD 12.02 BN |

| Market Forecast in 2030 (Value) | USD 34.60 BN |

| Growth Rate | CAGR of 10.1% from 2024-2030 |

| Years Considered | 2020-2030 |

| Base Year | 2023 |

| Forecast Period | 2024-2030 |

| Units Considered | Value (USD BN) |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

|

| Country Covered | US |

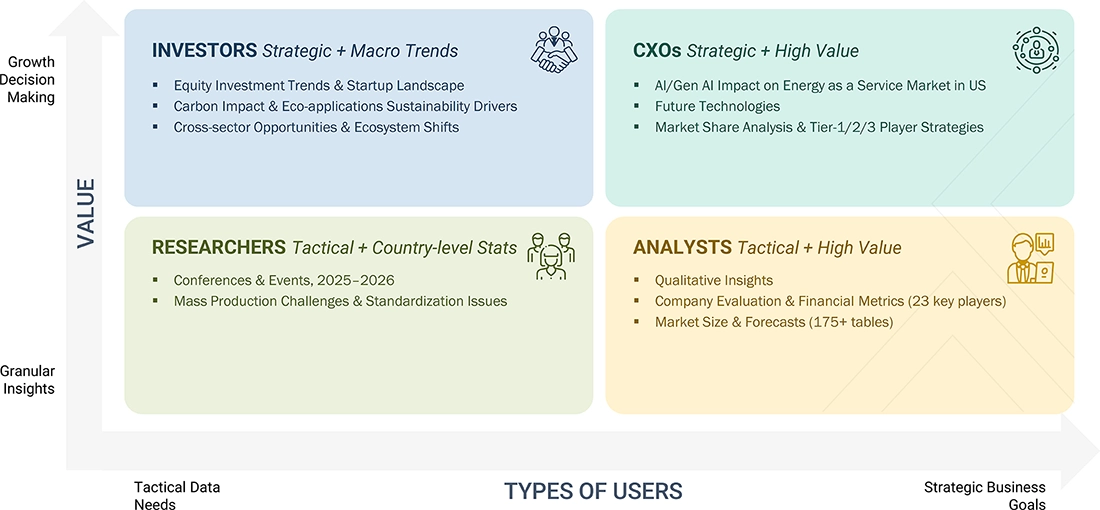

WHAT IS IN IT FOR YOU: US ENERGY AS A SERVICE (EAAS) MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Country-level Analysis | Country-wise mapping of EaaS-relevant incentives & subsidies | Helps clients identify high-potential markets where policy support improves EaaS economics and adoption by providing a clear view of how country-level incentives directly impact project viability, return on investment, and customer affordability |

RECENT DEVELOPMENTS

- October 2024 : ENGIE and the OCP Group agreed to work together to speed up energy transition in Morocco. Both companies weere expected to create a complete energy system through OCP Group. This system will include activities related to renewable energy production, energy consumption, and storage.

- May 2023 : Enel X S.r.l. and Ferrari launched Italy's first Industrial Renewable Energy Community in Fiorano, featuring a 1 MW photovoltaic system that will produce 1,500 MWh of energy annually. This initiative will prevent about 650 kg of CO2 emissions each year and is designed for local renewable energy optimization with future scalability in mind. Enel X reinforces its commitment to Italy's energy transition through this partnership, building on a strong foundation of sustainable initiatives with Ferrari.

- June 2022 : Schneider Electric partnered with Hitachi Energy to accelerate the transition to cleaner energy solutions. Together, these companies aim to enhance their mid- and high-tier offerings, promoting more intelligent solutions to improve supply chain efficiency. Their collaboration focuses on sustainable practices and decarbonization across various sectors, including renewable energy operations and data center management.

- December 2021 : Schneider Electric acquired 85.85% of Qmerit and integrated it into its Energy Management segment. Qmerit is focused on helping people transition from fossil fuels to sustainable electric technologies.

Table of Contents

Methodology

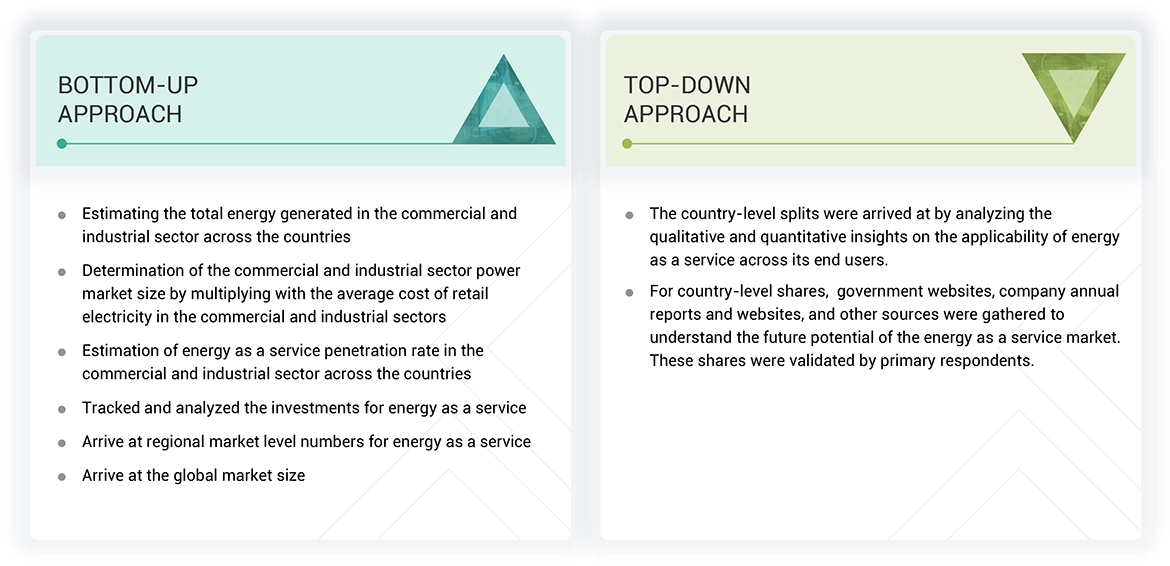

This study consisted of four major phases in estimating the current size of the US Energy as a Service market. Extensive secondary research was done to extract information from the market, peer markets, and parent markets. The next stage was the validation of these data from secondary findings, assumptions, and market sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were incorporated in estimating the entire size of the market. Then, the market break-down and data triangulation were done for estimating the market size of the segments and sub-segments.

Secondary Research

The research study on US Energy as a Service market included maximum utilization-or-indirect utilization-of directories, databases, and secondary sources, including Hoovers, Bloomberg, Businessweek, UN Comtrade Database, Factiva, International Energy Agency, International Monetary Fund, United Nations Conference on Trade and Development, US Energy Information Administration, BP Statistical Review of World Energy, US Energy Information Administration, European Committee of Electrical Installation Equipment Manufacturers, US Environmental Protection Agency, among others, to identify and gather relevant information helpful for preparing the technical, market-oriented and commercial study. Other secondary sources included white papers, articles by renowned authors, annual reports, press releases & investor presentations of companies, recognized publications, manufacturer associations, trade directories, and databases.and supply chain to identify key players based on products; services; market classification and segmentation according to offerings of major players; industry trends related to product types, deployment mode, architecture, end user and regions; and key developments from both market- and technology-oriented perspectives.

Primary Research

Amidst primary sources mentioned are various industry experts from core and allied industries, service providers, IoT, cloud-based solution providers, and utility provider in all segments of these industries' value chain. Several primary sources on both the supply side and demand sides of this market had been interviewed to gather qualitative and quantitative information. In the canvassing of primaries, several departments within organizations namely sales, engineering, operations, and managers were covered in order to provide an all-sided viewpoint in our report The primary respondents' breakdown is provided.

In the complete market engineering process, the top-down and bottom-up approaches and several data triangulation methods were extensively used to perform the market size estimations and forecasts for all segments and subsegments listed in this report. Extensive qualitative and quantitative analyses were conducted to complete the market engineering process and list key information/insights throughout the report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the size of the US Energy as a Service market and its dependent submarkets. The key players in the market were identified through secondary research, and their market share in the respective regions was obtained through primary and secondary research. The research methodology includes the study of the annual and financial reports of top market players and interviews with industry experts, such as chief executive officers, vice presidents, directors, sales managers, and marketing executives, for key quantitative and qualitative insights related to the US Energy as a Service market.

US Energy as a Service (EAAS) Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market has been split into several segments and sub-segments. Data triangulation and market breakdown procedures have been used wherever applicable to complete the overall market engineering process and to arrive at the exact statistics for all segments and sub-segments. The data has been triangulated by studying various factors and trends from both the demand and supply sides. The market has been validated using both the top-down and bottom-up approaches. Then, it was verified through primary interviews. Hence, for every data segment, there are three sources—the top-down approach, the bottom-up approach, and expert interviews. When the values arrived at from the three points matched, the data was assumed to be correct.

Market Definition

Energy as a Service (EaaS) is the process in which customers pay for energy services by means of subscription or pay-per-use, rather than installing a large piece of energy infrastructure. This in effect provides businesses and consumers access to energy solutions like renewable energy generation, energy efficiency upgrades, and energy management systems without the burden of ownership and maintenance. There are three key trends that define the EaaS market, viz., growing adoption of renewable energy sources, growing smart grid technologies, and the rise in reliance on data-driven decision making for energy management.

The EaaS market is rapidly evolving, driven by government initiatives and private sector investments, with a focus on various technologies such as AI, IoT, and energy management. The market for Energy as a Service is defined as the sum of revenues generated by global companies through the services offered by them.

Stakeholders

- Analytics companies

- Combined Heat and Power (CHP) project developers

- Consulting companies in the power sector

- Distributed Energy Resources (DER) technology manufacturers

- End users with a heavy energy portfolio across industrial, commercial, military, and government sectors

- Energy management companies

- Energy service companies

- Financiers

- Microgrid developers

- Solar PV project developers and technology manufacturers

- Utilities

Report Objectives

- To define, characterize, segment, and forecast the US Energy as a Service market with respect to market size and volume, end-user, and region.

- To strategically analyze each of the subsegments to understand individual growth trends, prospect, and contribution of segments to cumulative market size.

- To provide detailed information about the key drivers, restraints, opportunities, and challenges affecting the growth of the market

- To analyze the market opportunities for stakeholders and details of the competitive landscape for market leaders

- To analyze competitive developments, like sales contracts, agreements, investments, expansions, new product launches, mergers, partnerships, joint ventures, collaborations, and acquisitions in the US Energy as a Service market

- To benchmark market players using the company evaluation matrix, which analyzes market players on broad categories of business and product strategies adopted by them

- To compare key market players for the market share, product specifications, and applications.

- To strategically profile key players and comprehensively analyze their market ranking and core competencies.

Note: 1. Core competencies of companies are captured in terms of their key developments and product portfolios, as well as key strategies adopted to sustain their position in the US Energy as a Service market.

Available Customizations

MarketsandMarkets offers customizations according to the specific needs of the companies with the given market data.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis as per Feasibility

- Further breakdown of the US Energy as a Service market, by country

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the US Energy as a Service (EAAS) Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in US Energy as a Service (EAAS) Market