US Facility Management Market

US Facility Management Market by Solution (Integrated Workplace Management, Building Information Modeling, Facility Operations & Security Management, Facility Environment Management, Facility Property Management) - Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The US facility management market size is projected to grow from USD 13.7 billion in 2025 to USD 30.6 billion by 2030 at a CAGR of 15.5% during the forecast period. The integration of IoT-enabled sensors, building automation, predictive maintenance tools, and AI-driven analytics is transforming facility operations, enabling real-time monitoring, energy optimization, proactive maintenance, and improved space utilization. These technologies make professional FM services more valuable, especially for modern buildings and campus-style developments.

KEY TAKEAWAYS

-

By OfferingThe solutions segment accounted for a 70.9% share in 2025.

-

By SolutionsThe facility environment management segment is expected to register the highest CAGR of 16.1%.

-

By End UserThe government & public sector segment is projected to grow the fastest from 2025 to 2030.

-

Competitive Landscape - Key PlayersCompanies such as CBRE Group, Jones Lang LaSalle, and Johnson Controls were identified as some of the star players in the US facility management market, given their strong market share and product footprint.

One of the most significant macro-trends shaping facility management is the rapid expansion of data centers across the U.S., driven by surging demand from cloud computing, AI workloads, and digital transformation across various industries. The data center infrastructure investment is surging, driven in part by the demand for AI. As data centers proliferate, they require specialized facility management, encompassing cooling and HVAC, power supply and backup, security, and energy-efficiency measures.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on customers’ businesses in the US facility management market is shaped by the accelerating need for efficient building operations, smart infrastructure modernization, and enhanced workplace experiences. Enterprises, data-center operators, manufacturing facilities, and public-sector agencies increasingly depend on digital FM platforms for predictive maintenance, energy optimization, asset tracking, remote monitoring, and integrated command-center operations. Trends such as IoT-driven building automation, AI-powered asset performance analytics, digital twins, and sustainability-focused retrofits are redefining facilities strategy across the country. These advancements enable organizations to reduce operational costs, enhance asset uptime, strengthen compliance and safety, and create healthier, more resilient, and energy-efficient environments for occupants.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Federal Modernization and Energy-efficiency Programs Accelerating FM Digitalization

-

Corporate Decarbonization Commitments and Tech-driven Workplace Transformation

Level

-

Legacy Building Stock and Fragmented Procurement Slowing Upgrades

-

Skilled Labor Shortages and Cybersecurity Concerns for Connected Systems

Level

-

Scaling Digital Twin and Predictive Maintenance Across Public Portfolios

-

Integrated FM Services for High-performance Data Centers and Life Sciences Facilities

Level

-

Integrating Disparate Systems and Standardizing Data for Regulatory Reporting

-

Maintaining Operational Resilience Amid Extreme Weather and Energy Transition

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Federal Modernization and Energy-efficiency Programs Accelerating FM Digitalization

Federal initiatives and agency-led modernization programs have compelled facility owners to adopt advanced FM systems. Programs such as the Department of Energy’s Better Buildings Initiative and GSA modernization efforts incentivize upgrades to building automation, energy management, and performance benchmarking across federal and affiliated facilities. State and municipal grant programs linked to energy-efficiency retrofits and electrification further encourage investment in smart HVAC controls and centralized FM platforms. Large-scale public-sector procurement of digital monitoring and remote diagnostics has created a template for private-sector adoption, turning regulatory and funding mechanisms into a concrete catalyst for standardizing predictive maintenance, IoT integration, and lifecycle asset management across diverse building portfolios.

Restraint: Legacy Building Stock and Fragmented Procurement Slowing Upgrades

A substantial portion of US facilities remain legacy assets with antiquated mechanical and electrical systems that complicate rapid digital upgrades. Older HVAC infrastructure often requires significant capital investment for refurbishment before modern building automation or sensor networks can be effectively deployed. Procurement fragmentation, varying by federal, state, municipal, and private owners, produces inconsistent adoption timelines and technical standards, creating integration hurdles for FM vendors. Budgetary pressures at municipal and institutional levels further delay retrofits. As a result, the pace of FM modernization is uneven: flagship commercial and institutional properties move ahead while many public facilities and small-owner portfolios remain reliant on reactive maintenance and manual operations.

Opportunity: Scaling Digital Twin and Predictive Maintenance Across Public Portfolios

Public-sector modernization and private-sector sustainability targets create an opportunity to scale digital twin and predictive-maintenance applications across federal, state, and municipal portfolios. Building owners can utilize asset-level digital twins to simulate performance, optimize energy consumption, and prioritize capital projects by leveraging telemetry-driven risk scores. Federal grants and incentive programs often support pilot deployments that demonstrate ROI for cloud-based predictive analytics, enabling broader rollouts. Applied across campuses, healthcare systems, and public housing, digital twins can reduce unplanned downtime, extend equipment life, and centralize maintenance planning creating measurable operational efficiencies and aligning facility-level practice with larger resilience and decarbonization agendas.

Challenge: Integrating Disparate Systems and Standardizing Data for Regulatory Reporting

As building owners deploy sensors and analytics across heterogeneous portfolios, integrating disparate BMS, legacy controls, and vendor-specific telemetry becomes challenging. Facility Management teams must standardize data formats, ensure data integrity for ESG reporting, and consolidate operations into single-pane dashboards. Achieving end-to-end interoperability across older mechanical systems and new digital platforms requires investment in middleware, robust APIs, and governance frameworks. Regulatory reporting requirements add pressure to deliver auditable, accurate energy and emissions data. This systems-integration challenge demands both technical solutions and institutional coordination, increasing project complexity and extending timelines for digital transformation efforts.

US FACILITY MANAGEMENT MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Deploys AI-driven building operations platforms integrating HVAC, workspace occupancy analytics, energy monitoring, and predictive maintenance for commercial facilities. | Increases operational efficiency, lowers energy expenditure, prolongs asset life, and enhances space utilization. |

|

Implements IoT-based facility optimization solutions, including smart cleaning, real-time indoor air-quality monitoring, and automated work-order management. | Improves service quality, reduces downtime, strengthens indoor environmental health, and boosts workforce productivity. |

|

Provides integrated FM services with robotics for cleaning, smart parking management, and energy-as-a-service solutions for large campuses and industrial sites. | Cuts labor costs, improves sustainability performance, optimizes parking flows, and supports decarbonization goals. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The US facility management ecosystem is anchored by global FM majors and software vendors that deliver integrated workplace management and building operations platforms for corporate, healthcare, education, and government estates. Large service providers such as CBRE, JLL, Cushman & Wakefield, Aramark, and Sodexo combine hard and soft services with data-driven maintenance, energy optimization, and workplace experience offerings. Technology players such as IBM, Oracle, SAP, MRI Software, and Trimble offer CAFM/IWMS, analytics, and digital twin capabilities that connect assets, occupants, and service workflows. Professional bodies, including IFMA and BOMA International, establish best practices, while OSHA and USGBC shape safety and sustainability requirements that drive continued investments in compliant, high-performance facilities nationwide.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

US Facility Management Market, By Solution

Environmental management solutions are expanding quickly as US organizations intensify sustainability commitments and prepare for stricter emissions reporting requirements. Facility owners are adopting carbon-tracking dashboards, advanced energy analytics, waste-stream optimization tools, and IAQ monitoring to meet ESG targets. Increasing wildfire smoke events, indoor-health concerns, and severe weather risks have heightened the need for real-time environmental controls. States such as California, New York, and Washington enforce aggressive building-performance standards, prompting large-scale adoption of digital tools that manage energy, water, and air quality. These systems help organizations reduce utility costs, enhance resilience, and prepare for upcoming regulatory frameworks focused on facility carbon reduction.

US Facility Management Market, By Facility Property Management

Reservation management is expanding rapidly as hybrid work increases the need for booking systems for desks, meeting rooms, parking spaces, and shared amenities. US enterprises are adopting mobile-first, cloud-based reservation tools that integrate with access control and occupancy sensors to prevent conflicts and optimize space usage. These systems enhance the employee experience by enabling seamless scheduling and providing real-time visibility into availability. Universities and coworking operators also rely on reservation tools to manage high-demand shared spaces. As organizations standardize hybrid policies and consolidate real estate, reservation systems help achieve efficiency goals, reduce friction, and improve collaboration—driving fast adoption across industries.

REGION

US FACILITY MANAGEMENT MARKET: COMPANY EVALUATION MATRIX

In the US facility management market matrix, CBRE Group (Star) leads with a strong market share and an extensive service footprint, driven by its integrated facilities management, project management, and technology-enabled workplace solutions across corporate, healthcare, and public sector portfolios. Aramark (Emerging Leader) is gaining visibility with its specialized facilities services for education, healthcare, and sports & entertainment, strengthening its position through sector-focused delivery, energy-efficiency programs, and operational innovation. While CBRE dominates through scale, diversified offerings, and continued expansion in outsourcing contracts, Aramark shows significant potential to move toward the leaders’ quadrant as demand rises for bundled, outcome-based facilities management solutions tailored to specific verticals in the US market.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- CBRE Group (US)

- Jones Lang LaSalle (JLL) (US)

- Trimble (US)

- IBM (US)

- Oracle (US)

- Fortive (US)

- Infor (US)

- MRI Software (US)

- Eptura (US)

- Cushman & Wakefield (US)

- Aramark (US)

- Facilities Management eXpress (FMX) (US)

- UpKeep (US)

- FacilityONE Technologies (US)

- OfficeSpace Software (US)

- Facilio (US)

- Nuvolo (US)

- zLink (US)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2025 (Value) | USD 13.7 Billion |

| Market Forecast in 2030 (Value) | USD 30.6 Billion |

| Growth Rate | CAGR of 15.5% during 2025-2030 |

| Years Considered | 2017-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | US |

WHAT IS IN IT FOR YOU: US FACILITY MANAGEMENT MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Company Information | Detailed analysis and profiling of additional market players (up to 5) |

|

RECENT DEVELOPMENTS

- July 2025 : Pleasant Valley Corporation entered a strategic partnership with Dexterra Group, which made a minority equity investment to help both companies expand facilities and real estate services across North America. The deal combined Dexterra’s self-perform and P3 expertise with PVC’s technology-enabled service model while leaving PVC’s leadership, ownership, and staff unchanged.

- October 2024 : Johnson Controls and CBRE entered a strategic partnership to deliver smart building technologies and energy efficiency solutions, directly supporting integrated facility management for commercial clients.

- May 2024 : JLL acquired SKAE Power Solutions to strengthen its data center services, including critical facility operations and power infrastructure management. This acquisition is a direct extension of JLL's facility management offerings in the data center vertical.

Table of Contents

Methodology

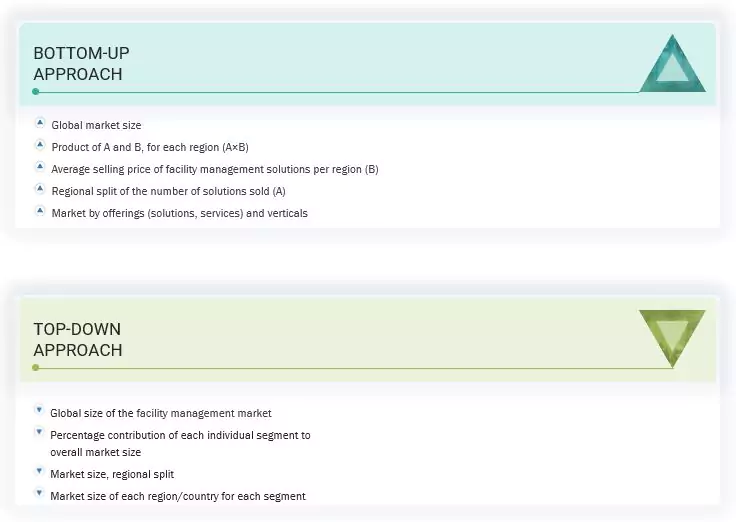

The research study involved four major activities in estimating the US Facility Management market size. Exhaustive secondary research has been done to collect essential information about the market and peer markets. The next step was to validate these findings and assumptions and size them with the help of primary research with industry experts across the value chain. The top-down and bottom-up approaches were used to estimate the market size. After the market breakdown, data triangulation was utilized to estimate the sizes of segments and sub-segments.

Secondary Research

The market size of the companies offering US facility management solutions to various end users was determined based on the secondary data available through paid and unpaid sources, analyzing the product portfolios of major companies in the ecosystem, and rating the companies based on their performance and quality. In the secondary research process, various sources were referred to identify and collect information for the study. These include annual reports, press releases, investor presentations of companies, white papers, certified publications, and articles from recognized associations and government publishing sources.

Secondary research was mainly used to obtain critical information about industry insights, the market’s monetary chain, the overall pool of key players, market classification and segmentation based on the industry trends to the bottom-most level, regional markets, and key developments from market- and technology-oriented perspectives.

Primary Research

In the primary research process, various sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information for the report, such as Chief Experience Officers (CXOs), Vice Presidents (VPs), directors from business development, marketing, and product development/innovation teams, and related key executives from US facility management solutions vendors, system integrators, professional and managed service providers, industry associations, independent consultants, and key opinion leaders.

Primary interviews were conducted to gather insights, such as market statistics, data on revenue collected from platforms and services, market breakups, market size estimations, market forecasts, and data triangulation. Stakeholders from the demand side, such as Chief Information Officers (CIOs), Chief Finance Officers (CFOs), Chief Strategy Officers (CSOs), and the installation team of end users who use US facility management solutions, were interviewed to understand buyers’ perspectives on suppliers, products, service providers, and their use of US facility management solutions which is expected to affect the overall US Facility Management market growth.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the US Facility Management market. These methods were also used extensively to estimate the size of various subsegments in the market.

US Facility Management Market : Top-Down and Bottom-Up Approach

Data Triangulation

The US Facility Management market was split into several segments and sub-segments after determining the overall market size from the above estimation process. To complete the overall market engineering process and arrive at the exact statistics for all segments and sub-segments, data triangulation and market breakdown procedures were used, wherever applicable. The data was triangulated by studying various factors and trends from the demand and supply sides. The US Facility Management market size was validated using top-down and bottom-up approaches.

Market Definition

According to IBM, facility management can be defined as the tools and services that support the functionality, safety, and sustainability of buildings, grounds, infrastructure, and real estate. The US facility management includes lease management (lease administration and accounting), capital project planning and management, maintenance and operations, energy management, occupancy and space management, employee and occupant experience, emergency management and business continuity, and real estate management.

BOMI Institute defines US facility management as the process of coordinating the physical workplace with the people and work of an organization. The primary function of US facility management is to plan, establish, and maintain a work environment that effectively supports the goals and objectives of the organization.

Stakeholders

- US facility management solution providers

- Managed service providers

- Integration service providers

- Cloud service providers

- US facility management service providers

- Building automation solution providers

- Architects, engineers, and contractors

- Consultancy firms and advisory firms

- Regulatory agencies

- Technology consultants

- Governments

Report Objectives

- To determine, segment, and forecast the US Facility Management market by offering, solution, service, vertical, and region in terms of value

- To provide detailed information about the major factors (drivers, opportunities, threats, and challenges) influencing market growth

- To study the complete value chain and related industry segments, and perform a value chain analysis of the US Facility Management market landscape

- To strategically analyze the macro and micro markets concerning individual growth trends, prospects, and contributions to the total market

- To analyze the industry trends, pricing data, patents, and innovations related to the market

- To analyze the opportunities for stakeholders by identifying the high-growth segments of the US Facility Management market

- To profile the key players in the market and comprehensively analyze their market share/ranking and core competencies

- To track and analyze competitive developments, such as mergers & acquisitions, product launches & developments, partnerships, agreements, collaborations, business expansions, and R&D activities

Available Customizations

With the given market data, MarketsandMarkets offers customizations based on the company’s specific needs. The following customization options are available for the report:

Geographic Analysis as per Feasibility

- Further break-up of the Asia Pacific market into countries contributing 75% to the regional market size

- Further break-up of the North America market into countries contributing 75% to the regional market size

- Further break-up of the Latin America market into countries contributing 75% to the regional market size

- Further break-up of the Middle East & African market into countries contributing 75% to the regional market size

- Further break-up of the Europe market into countries contributing 75% to the regional market size

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the US Facility Management Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in US Facility Management Market