Vaccine Storage Equipment Market: Growth, Size, Share, and Trends

Vaccine Storage Equipment Market by Product (Refrigerator (Large & Small Capacity)), Freezer ((Low & Ultra-Low Temperature Freezer)), Vaccine Carrier/Cold Box, Monitoring Device ((Temperature Monitoring & Alarm)), Type, End User - Global Forecast to 2029

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The vaccine storage equipment market is projected to reach USD 1.21 billion by 2029 from USD 0.86 billion in 2024, at a CAGR of 7.2% during the forecast period. The growth in the vaccine storage equipment market is driven by rising need for temperature control devices to prevent vaccine loss & potential health hazard and increasing government & various regulatory body support for the establishment and maintenance of an efficient vaccine cold chain system.

KEY TAKEAWAYS

-

By ProductBased on the product, the vaccine storage equipment market is divided into refrigerators, freezers, vaccine carrier/cold box, monitoring devices and others. The market fro refrigerators is again divided into large capacity refrigerator and small capacity refrigerator. Among these, in 2023 large capacity refrigerator segment account for the largest market share in vaccine storage equipment market by refrigerator. These large capacity refrigerators are manufactured to hold large amounts of vaccine at precise temperatures, as these devices offer excellent temperature uniformity and plenty of storage space, large-capacity refrigerators are essential in healthcare facilities.

-

By TypeBased on type, the vaccine storage equipment market is segmented into refrigerated storage and refrigerated transport. Among these the refrigerated storage segment accounts for the largest share in the vaccine storage equipment market in 2023, owing to increasing government-led vaccination campaigns and efforts to improve healthcare facilities have increased funding for refrigerated storage.

-

By End UserBased on end user, the vaccine storage equipment market is segmented into vaccination centers, pharmaceutical companies, hospitals & Clinics, and others including pharmacies, research laboratories, public health organizations, and among others. Among these hospitals & Clinics is holding the largest share in the vaccine storage equipment market in 2023, owing to increasing collaborations between government and hospitals & Clinics for vaccine campaigns. These initiatives ensure vaccinations stay within permissible temperature ranges until they are delivered to the designated patients.

-

By RgionThe vaccine storage equipment market is segmented into six major regional segments, namely, North America, Europe, Asia Pacific, Latin America, Middle East & Africa, and GCC Countries. The North America accounts for the largest market share in the vaccine storage equipment market in 2023. This is due to strict regulatory criteria set by regulatory bodies for appropriate storage of vaccines in North America.

-

Competitive LandscapeThe vaccine storage equipment market is moderately competitive, with key players such as Thermo Fisher Scientific Inc., Eppendorf SE, Azenta Inc., Haier Biomedical, and Cardinal Health leading through extensive product portfolios and global presence. These companies emphasize technological innovation, product diversification, and strategic collaborations to enhance cold chain reliability and expand their market footprint. Continuous advancements in energy-efficient, IoT-enabled, and sustainable cold storage solutions drive competition, supporting vaccine integrity across diverse healthcare and research settings.

The maret is driven by increasing need for temperature control to prevent vaccine loss and potential health hazard. Temperature control is critical in preventing vaccine wastage and ensuring the safety and efficacy of vaccines consequently increasing the demand for the vaccine storage equipment.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The vaccine storage equipment market is witnessing significant trends and disruptions driven by the growing need for temperature precision, automation, and real-time monitoring across the supply chain. Customers’ customers, such as hospitals, vaccination centers, and pharma companies, are increasingly adopting IoT-enabled and energy-efficient cold chain systems to ensure vaccine potency and regulatory compliance. Additionally, the shift toward sustainable refrigeration technologies, portable vaccine carriers, and AI-based predictive maintenance is enhancing operational efficiency, reliability, and last-mile vaccine delivery outcomes.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Need For Temperature control to prevent vaccine loss and potential health hazard

-

Increasing government & regulatory body support for establishing and maintaining vaccine cold chain systems

Level

-

High energy cost and need for capital investments

Level

-

Rising disease prevalence to boost demand for vaccination and storage equipment

-

Availability of cold chain logistics in developing countries

Level

-

Shortage of trained manpower & limited resources to maintain equipment

-

Environmental concerns regarding greenhouse gas emissions

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Increasing government & regulatory support for establishing and maintaining vaccine cold chain systems

The growth of the vaccine storage equipment market is fuelled by the increasing government & various regulatory body support for establishing and maintaining an efficient vaccine cold chain system. The increasing collaborations and resource distribution targeted at bolstering vaccine cold chain infrastructure, government backing, and favorable regulations have driven the demand for vaccine storage equipment. Governments from all over the world are collaborating with organizations to ensure that vaccinations are carried and kept in the best possible conditions.

Restraint: High energy costs and need for capital investments

The high energy consumption and significant initial capital investment required for vaccine storage equipment present a major restraint to market growth. Medical freezers, consuming between 1,200 kWh and 6,000 kWh annually, account for energy usage 2 to 10 times that of an average household. Healthcare facilities, particularly those with limited resources, suffer financial challenges due to the high operating expenses brought on by this significant power requirement. These state-of-the-art vaccination storage equipment come with an upfront expense, which adds to the burden. Emerging countries are particularly impacted since the extremely high upfront costs exceed financial allocations for healthcare infrastructure.

Opportunity: Rising disease prevalence to boost demand for vaccination and storage equipment

The growth of vaccine storage equipment is fueled throughout the forecast period by the increasing prevalence of diseases such as dengue, influenza, tuberculosis, malaria, Zika virus, chikungunya, pneumonia, and HIV. To prevent these diseases, vaccination is essential, and maintaining the effectiveness of vaccines throughout storage and transport requires dependable storage equipment. For instance, as per UNICEF data published in 2021, pneumonia kills more than 700,000 children under five every year. According to WHO, the number of new tuberculosis cases increased from 7.5 million in 2022 to 8.2 million in 2023. Additionally, CDC statistics from 2023 revealed that only 24.9% of US individuals had received a pneumococcal vaccination, highlighting vaccination gaps. These figures highlight the rising need for vaccines and sophisticated storage devices

Challenge: Environmental concerns regarding greenhouse gas emissions.

Refrigerators and freezers, essential for vaccine storage and transport, contribute to global greenhouse gas emissions, including carbon dioxide, methane, and fluorinated gases. Medical refrigerators are included in the 5% of greenhouse gas emissions from the healthcare industry worldwide. Healthcare facilities are adopting energy-efficient equipment that produces little to no greenhouse gases. In line with global environmental goals, solar direct-drive technologies are becoming more and more viable. These developments not only lessen their negative effects on the environment but also give market participants who care about the environment a chance to stand out in a sector that is becoming more and more ecologically sensitive.

Vaccine Storage Equipment Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Offers ultra-low temperature (ULT) freezers, cryogenic storage systems, and automated sample management platforms for vaccine and biologics preservation. | Provides precise temperature uniformity up to -190°C with continuous monitoring and automated inventory management, minimizing manual errors and ensuring vaccine stability and traceability. |

|

Provides a comprehensive portfolio of vaccine storage solutions including ULT freezers, lab refrigerators, and smart connected cold chain systems integrated with monitoring software. | Ensures vaccine potency through stable temperature control (-86°C to +8°C), real-time data logging, and remote alarms to prevent temperature excursions and product loss. |

|

Manufactures energy-efficient ULT freezers and laboratory refrigerators optimized for vaccine and biological sample storage. | Delivers high reliability and uniform cooling with low power consumption and eco-friendly refrigerants, reducing operating costs while maintaining vaccine integrity. |

|

Develops WHO PQS-certified vaccine refrigerators, solar direct-drive cold chain units, and ULT freezers for immunization programs and healthcare facilities. | Offers sustainable cold chain solutions with solar power compatibility, intelligent temperature control, and remote monitoring for vaccine storage in resource-limited settings. |

|

Distributes pharmaceutical-grade vaccine storage equipment and temperature-controlled logistics solutions for hospitals, clinics, and pharmacies. | Provides reliable supply chain continuity through validated equipment, calibrated temperature mapping, and end-to-end cold chain visibility ensuring vaccine efficacy from production to administration. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The vaccine storage equipment market functions within a complicated ecosystem with numerous players, essential to ensuring the effective and safe delivery of vaccinations. Manufacturers are essential to this ecosystem because they manufacture and distribute vaccine carriers, cold boxes, refrigerators, freezers, and monitoring equipment that adhere to strict government regulations. Hospitals & clinics, pharmaceutical companies, vaccination centers, pharmacies, public health institutions, and research institutes are the end users in the vaccine storage equipment market. This ecosystem also consists of international organizations like WHO and UNICEF and regulatory entities that have a supervisory role in defining quality standards and certifying equipment for worldwide vaccination programs. This interconnection ensures a smooth movement of vaccine storage equipment, improving vaccination delivery worldwide and protecting public health fractionation.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Vaccine storage equipment Market, By Product

Based on product, the vaccine storage equipment market is divided into refrigerators, freezers, vaccine carriers/cold boxes, monitoring devices, and others. Among these, in 2023, the refrigerator segment accounted for the highest market share in the vaccine storage equipment market. This is owing to increasing investments from key players such as Thermo Fisher Scientific Inc. (US), Cardinal Health Inc. (US) in vaccine storage equipment market. These players are actively investing to increase their product portfolios and global presence.

Vaccine storage equipment Market, By Type

Based on type, the vaccine storage equipment market is segmented into refrigerated storage and refrigerated transport. Among these the refrigerated storage segment accounts for the largest share in the vaccine storage equipment market in 2023, owing to the strict regulatory compliance coupled with the efforts undertaken by the government to boost the market growth.

Vaccine storage equipment Market, By End User

By end user, Hospitals & Clinics hold the largest share in the vaccine storage equipment market. Based on end user, the vaccine storage equipment market has been classified into vaccination centers, pharmaceutical companies, hospitals & clinics, and others including pharmacies, research laboratories, public health organizations, and among others. Among these, the hospitals & clinics segment accounts for largest share in the vaccine storage equipment market. This is due to rising funding programs to build infrastructure in rural and underserved areas and increasing prevalence of diseases necessitating the vaccines.

REGION

Asia Pacific to be fastest-growing region in vaccine storage equipment market during forecast period

The Asia Pacific segment is the fastest-growing regional market due to the rapid expansion of pharmaceutical and biopharmaceutical companies across key countries like China, India, and Japan. Because these businesses always invest in the latest technology, their presence supports the region’s growth. India’s cost advantages and improved regulatory climate make it an appealing destination for vaccine storage equipment manufacturers. The need for advanced storage technologies to ensure vaccine quality and compliance grows as pharmaceutical manufacturing in the Asia Pacific region continues to rise, driven by cost efficiencies, increasing production capacities, and government support. This solidifies Asia Pacific’s position as the fastest-growing segment in the market.

Vaccine Storage Equipment Market: COMPANY EVALUATION MATRIX

The vaccine storage equipment market is a fragmented yet highly competitive landscape, led by established global players like Thermo Fisher Scientific, Eppendorf SE, and Haier Biomedical. Competitive advantage is critically dependent on technological innovation, particularly in ultra-low temperature (ULT) storage for advanced biologics and integrated IoT-based monitoring systems. These leaders leverage strong R&D capabilities, diverse product portfolios, and extensive global distribution networks to maintain their market position. Strategic growth is pursued through aggressive product launches, acquisitions, and partnerships aimed at expanding geographic reach and addressing the evolving demands of the global cold chain.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size, 2024 (Value) | USD 0.86 Billion |

| Market Forecast, 2029 (Value) | USD 1.21 Billion |

| Growth Rate (2024–2029) | CAGR of 7.2% from 2024 to 2029 |

| Years Considered | 2022–2029 |

| Base Year | 2023 |

| Forecast Period | 2024–2029 |

| Unit Considered | Value (USD Million/Billion); Volume (Thousand Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, Latin America, and the Middle East & Africa |

WHAT IS IN IT FOR YOU: Vaccine Storage Equipment Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Company Information |

|

Insights on market share analysis by region |

| Geographic Analysis |

|

Country level demand mapping and localization strategy planning. |

RECENT DEVELOPMENTS

- April 2024 : Thermo Fisher Scientific introduced its latest high-performance ultra-low temperature (ULT) freezers. The Thermo Scientific TSX Universal Series ULT Freezers feature improved performance, enhanced user experience, and increased energy efficiency.

- August 2023 : Thermo Fisher Scientific introduced the Thermo Scientific TSG Series Refrigerators, designed to ensure the secure storage of critical vaccines and pharmaceuticals in laboratory, pharmacy, and clinical environments.

- October 2022 : Thermo Fisher Scientific expanded its ULT green portfolio by introducing the Thermo Scientific TDE Series -80°C Chest Freezer. As laboratories increasingly depend on temperature-sensitive materials and therapeutics, this freezer delivers the precise and consistent cold storage solutions they require.

- October 2022 : Azenta announced the acquisition of B Medical Systems S.á.r.l. and its subsidiaries, enhancing Azenta’s cold chain capabilities with advanced solutions for the reliable and traceable transport of temperature-sensitive specimens.

Table of Contents

Methodology

This study involved the extensive use of both primary and secondary sources. The research process involved the study of various factors affecting the industry to identify the segmentation types, industry trends, key players, competitive landscape, fundamental market dynamics, and key player strategies.

Secondary Research

The secondary research process involves the widespread use of secondary sources, directories, databases (such as Bloomberg Businessweek, Factiva, and D&B Hoovers), white papers, annual reports, company house documents, investor presentations, SEC filings of companies and publications from government sources [such as National Institutes of Health (NIH), US FDA, US Census Bureau, World Health Organization (WHO), International Trade Administration (ITA), Global Burden of Disease Study, and Centers for Medicare and Medicaid Services (CMS) were referred to identify and collect information for the global vaccine storage equipment market study. It was also used to obtain important information about the key players and market classification & segmentation according to industry trends to the bottom-most level and key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing and sales directors, technology & innovation directors, and related key executives from various key companies and organizations in the vaccine storage equipment market. The primary sources from the demand side include pharmaceutical companies, vaccination centers, hospitals & Clinics, pharmacies, and research academics and universities. Primary research was conducted to validate the market segmentation, identify key players in the market, and gather insights on key industry trends & key market dynamics.

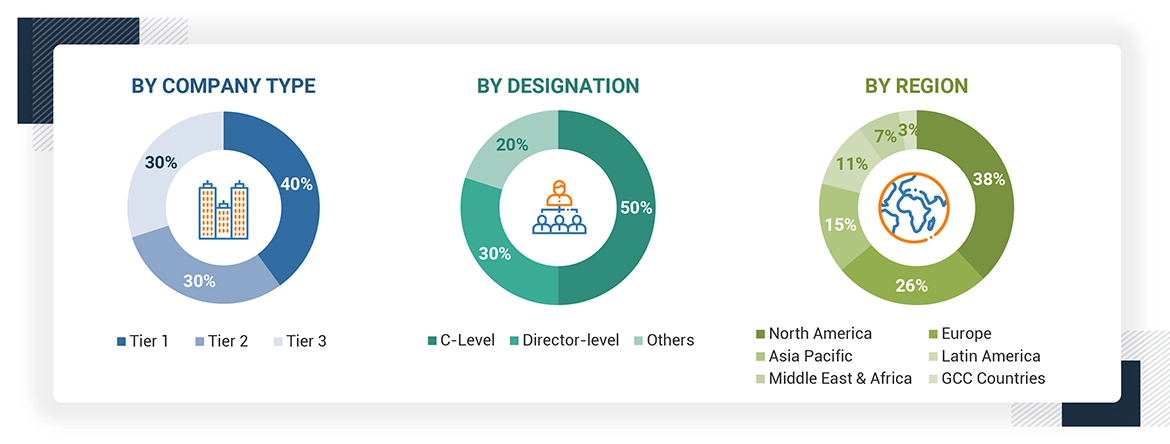

A breakdown of the primary respondents is provided below:

*C-level primaries include CEOs, CFOs, COOs, and VPs.

*Others include sales managers, marketing managers, business development managers, product managers, distributors, and suppliers.

Note: Companies are classified into tiers based on their total revenue. As of 2023, Tier 1 = >USD 10.00 billion, Tier 2 = USD 1.00 billion to USD 10.00 billion, and Tier 3 = < USD 1.00 billion.

Source: MarketsandMarkets Analysis

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

For the global market value, annual revenues were calculated based on the revenue mapping of major product manufacturers and OEMs active in the global vaccine storage equipment market. All the major product manufacturers were identified at the global and/or country/regional level. Revenue mapping for the respective business segments/sub-segments was done for the major players. Also, the global vaccine storage equipment market was split into various segments and sub-segments based on:

- List of major players operating in the products market at the regional and/or country level

- Product mapping of various vaccine storage equipment manufacturers at the regional and/or country level

- Mapping of annual revenue generated by listed major players from pain management devices(or the nearest reported business unit/product category)

- Extrapolation of the revenue mapping of the listed major players to derive the global market value of the respective segments/subsegments

- Summation of the market value of all segments/subsegments to arrive at the global vaccine sstorage equipment market

The above-mentioned data was consolidated and added with detailed inputs and analysis from MarketsandMarkets and presented in this report.

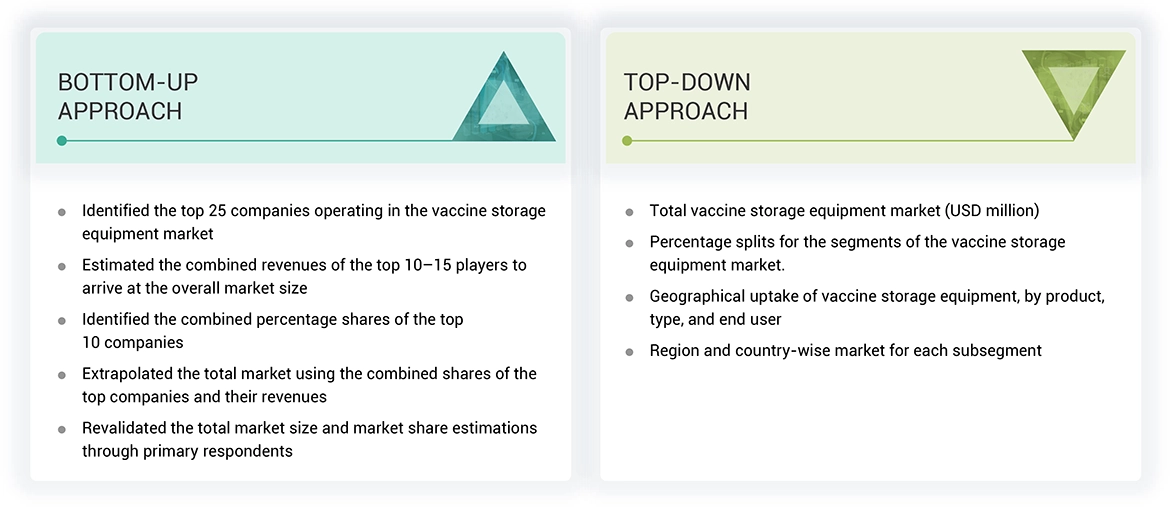

Market Size Estimation (Bottom Up approach & Top down approach)

Data Triangulation

After arriving at the overall size of the global vaccine storage equipment market through the above-mentioned methodology, this market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact market value data for the key segments and subsegments. The extrapolated market data was triangulated by studying various macro indicators and regional trends from both demand- and supply-side participants.

Market Definition

Vaccine storage equipment are defined as the specialized equipment which are used for keeping vaccines at the proper temperature ranges to retain their potency and efficiency. Vaccine carriers/cold boxes for safe transit, freezers for sub-zero storage, and refrigerators for keeping vaccines at 2°C to 8°C are essential elements. The associated accessories such coolant packs and storage racks improve their functionality. The monitoring devices such as data loggers are used to keep track of and control temperature conditions. These devices are crucial to avoid the vaccine spoilage.

Stakeholders

- Vaccine storage equipment Manufacturers

- Cold chain equipment Manufacturers

- Cold chain equipment Distributors

- Medical device R&D Companies

- Clinics and Hospitals

- Vaccine Research Institutes and Universities

- Venture Capitalists and Investors

- Government agencies

- Raw material suppliers

- Regulatory bodies

- Importers and exporters of vaccine storage equipment

- Traders, distributors, and suppliers

- Government and research organizations

Report Objectives

- To describe, analyze, and forecast the vaccine storage equipment market by product, by type, by end user, and region

- To describe and forecast the vaccine storage equipment market for key regions—North America, Europe, the Asia Pacific, Latin America, the Middle East & Africa, and GCC Countries

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the market growth

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for market players

- To profile key players and comprehensively analyze their market shares and core competencies2 in the vaccine storage equipment market

- To analyze competitive developments such as partnerships, collaborations, agreements & acquisitions, product launches, expansions, and R&D activities in the vaccine storage equipment market

Key Questions Addressed by the Report

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Vaccine Storage Equipment Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Vaccine Storage Equipment Market