Varistor and Gas Discharge Tubes (GDT) Market Size, Share & Trends, 2025 To 2030

Varistor and Gas Discharge Tubes (GDT) Market by Product (Varistor & GDT), by Varistor (Metal Oxide, SiC, Zinc Oxide), GDT (Through-hole, SMT, Hybrid), Material (Ceramic & Glass, Quartz), Electrode (2-electrode, 3-electrode) - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The varistor and gas discharge tubes (GDT) market, is projected to reach USD 9.19 billion by 2030 from USD 7.61 billion in 2025 at a CAGR 3.8% from 2025 to 2030. Rapid digitalization, expansion of 5G and IoT-connected devices, and investments in smart grid and renewable energy require robust protection against voltage transients and surges. Miniaturization trends and the proliferation of sophisticated electronic circuits make reliable circuit protection essential in modern electronics. Moreover, strict safety regulations and the need to ensure high reliability and longevity for sensitive equipment continue to fuel strong adoption of varistors and GDTs globally.

KEY TAKEAWAYS

-

BY PRODUCT TYPEThe gas discharge tube (GDT) segment is projected to dominate the growth due to its superior surge-handling capability and suitability for high-energy transient protection in communication and power systems.

-

VARISTOR MARKET BY TYPEMetal oxide varistors dominate the market due to their wide voltage range, high energy absorption capacity, and effectiveness in protecting sensitive electronic circuits from transient surges.

-

VARISTOR MARKET BY APPLICATIONThe industrial equipment exhibits the highest growth as industrial automation and heavy machinery increasingly rely on surge protection to ensure operational reliability and minimize downtime.

-

GDT MARKET BY TYPEThe hybrid segment is witnessing strong growth as it combines GDT and MOV technologies, offering enhanced performance, faster response time, and extended protection life for high-voltage applications.

-

GDT MARKET BY NUMBER OF ELECTRODESThe three-electrode GDTs are growing rapidly due to their superior protection for multi-line systems and improved performance in high-speed communication and data networks.

-

GDT MARKET BY VOLTAGEThe high voltage surge segment is expanding quickly, driven by the increasing need for robust protection in power transmission, renewable energy, and industrial high-voltage systems.

-

GDT MARKET BY MATERIAL TYPECeramic-based GDTs dominate the market because of their excellent insulation properties, high thermal resistance, and durability in extreme environmental conditions.

-

GDT MARKET BY APPLICATIONThe power distribution systems segment is growing fastest due to rising investments in smart grids and the need for reliable overvoltage protection in power infrastructure.

-

BY REGIONAsia Pacific is the fastest-growing region with 4.9%, fueled by rapid industrialization, expansion of telecom networks, and increased adoption of surge protection components in automotive and electronics manufacturing.

-

COMPETITIVE LANDSCAPEThe competitive landscape features major players such as Littelfuse, Inc., TDK Corporation, YAGEO Group, and Bourns, Inc., which have adopted organic growth strategies, including product launches and technology upgrades.

The market is witnessing significant growth driven by the expanding use of sensitive electronic components across automotive, industrial, consumer electronics, and telecom sectors. With the rising dependence on digital systems and networked infrastructure, the need for robust protection against voltage surges, transients, and electrostatic discharge has surged considerably. Surge protection devices ensure system reliability and safety, especially in mission-critical applications. Furthermore, the growing adoption of electric vehicles, smart grids, and industrial automation is accelerating the demand for compact, cost-effective, high-performance surge protection solutions.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on consumers’ business emerges from customer trends or disruptions. Hot belts are the clients of varistor and gas discharge tubes (GDT) providers, and target applications are the clients of varistor and GDT providers. Shifts, which are changing trends or disruptions, will impact the revenues of end users. The revenue impact on end users will affect the revenue of hotbeds, which will further affect the revenues of varistor and GDT providers.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rising adoption of varistors in power supply systems

-

Proliferation of consumer electronics and smart devices

Level

-

Environmental and regulatory compliance challenges

Level

-

Growing opportunities for MOV in smart homes and IoT-enabled devices

-

Surge protection in EV charging stations and smart mobility infrastructure

Level

-

Degradation over time and repeated surges

-

Availability of alternative surge protection technologies

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rising adoption of varistors in power supply systems

The growing use of varistors in power supply systems is a key driver for market growth, as these components play a vital role in protecting sensitive electronic devices from voltage transients and surges. The need for efficient overvoltage protection has intensified with the increasing complexity of power electronics in industrial, automotive, and consumer applications. Varistors provide cost-effective and reliable surge suppression, ensuring consistent system performance and extending equipment lifespan. Their integration into AC/DC converters, power distribution units, and renewable energy inverters has become standard practice, further driving their adoption globally.

Restraint: Environmental and regulatory compliance challenges

The varistor market faces constraints due to stringent environmental and regulatory compliance standards, particularly concerning hazardous materials like lead and barium. Regulations such as RoHS (Restriction of Hazardous Substances) and REACH in Europe impose restrictions on the use of toxic substances in electronic components. Manufacturers must invest heavily in research and reformulation to develop eco-friendly varistors without compromising performance or durability. These compliance efforts increase production costs and limit the use of certain raw materials, thereby creating challenges for smaller manufacturers and affecting overall market growth.

Opportunity: Growing opportunities for MOV in smart homes and IoT-enabled devices

The rise of smart homes and IoT-enabled devices presents significant growth opportunities for metal oxide varistors (MOVs). As connected appliances, smart meters, and home automation systems become increasingly widespread, protecting them from power fluctuations and transient surges is critical. MOVs offer compact and reliable surge suppression for these low-power, sensitive electronic applications. The ongoing expansion of IoT ecosystems and 5G infrastructure further boosts demand for miniaturized, high-performance varistors, enabling enhanced device reliability and longer operational life in interconnected environments.

Challenge: Degradation over time and repeated surges

One of the major challenges in the varistor market is the gradual degradation of these components when exposed to repeated surge events. Each surge slightly alters the varistor’s material characteristics, eventually reducing clamping performance or causing failure. This degradation poses reliability concerns in applications requiring continuous surge protection, such as industrial power systems and communication networks. Frequent maintenance or replacement increases operational costs for end users. Consequently, manufacturers develop advanced materials and designs to improve surge endurance and extend product lifespan.

Varistor and Gas Discharge Tubes Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

MOV varistors in automotive infotainment, ECU, and battery management systems | Protection from load dump and ESD events; enhances vehicle safety, reliability, and compliance with automotive EMC standards |

|

SMD varistors in telecom base stations and 5G networking equipment | Prevents damage from lightning surges and power-line disturbances; ensures network uptime and protects critical infrastructure |

|

High-voltage GDTs for industrial powerline and medical equipment | High insulation resistance, wide temperature range, reliable AC isolation, extends service life of sensitive systems |

|

Compact varistors and GDTs in smart home/consumer devices (TVs, ACs, power strips) | Secure suppression of voltage spikes; prevents fire hazards, enhances product safety for end users |

|

Varistor and GDT solutions in smart grid substations and renewable energy installations | Robust surge protection in AC/DC systems, increases grid reliability and reduces equipment downtime |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The varistor and gas discharge tubes (GDT) market ecosystem comprises several interconnected stakeholders ensuring innovation, quality, and efficient deployment across industries. Raw material suppliers provide specialized ceramics, metals, and glass essential for varistor and GDT performance. Manufacturers utilize these materials to produce compact, high-energy-absorption surge protection devices optimized for automotive, telecom, industrial, and consumer electronics applications. Testing and certification bodies ensure compliance with global standards for reliability and safety. OEMs and system integrators embed these components into complex electronic systems like EVs, smart grids, and telecommunications infrastructure. Distributors maintain a robust supply chain to deliver products globally, while end users across sectors rely on these devices to protect sensitive equipment from voltage surges, ensuring system stability and safety in increasingly electrified and connected environments. This ecosystem supports steady market growth driven by innovation, digitalization, and electrification trends.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Varistor and Gas Discharge Tubes (GDT) Market, By Product Type

Varistors hold the largest share in the overall surge protection market due to their cost-effectiveness, versatility, and ability to protect a wide range of electronic devices from transient voltage spikes. They are widely used in industrial, automotive, and consumer electronics applications, making them preferred over other protection devices. The simplicity of integration and high reliability in low-to-medium voltage circuits further consolidate their dominant market position.

Varistor Market, By Type

Metal oxide varistors (MOVs) dominate the varistor market as they offer superior energy absorption, rapid response to voltage surges, and durability under repeated transient events. Their ability to handle high current and voltage fluctuations makes them ideal for protecting sensitive electronics, industrial equipment, and power supply systems. MOVs’ compatibility with various applications, from consumer electronics to industrial automation, drives their significant market share.

Varistor Market, By Application

The consumer electronics segment holds the largest share in the varistor market due to the widespread use of electronic devices such as smartphones, laptops, TVs, and smart home appliances. With the proliferation of connected devices and rising electricity fluctuations, the demand for reliable surge protection in consumer electronics has surged. Varistors help safeguard these devices against voltage spikes, ensuring longevity and uninterrupted operation.

Gas Discharge Tubes Market, By Type

Through-hole GDTs account for the largest share in the gas discharge tubes market because of their robustness, high voltage tolerance, and ease of installation in power and communication circuits. They are commonly used in telecom equipment, power supplies, and industrial devices where long-term reliability is essential. Their established presence and cost-effectiveness contribute to their leading market position.

Gas Discharge Tubes Market, By Number Of Electrodes

Two-electrode GDTs dominate the market, providing reliable surge protection for most standard single-line and dual-line systems. Their simple design, ease of integration, and proven performance in communication networks and power lines make them the preferred choice for a wide range of applications. This practical design ensures efficiency while maintaining cost-effectiveness.

Gas Discharge Tubes Market, By Voltage

The high voltage surge segment (above 1,000V) holds the largest share due to the increasing deployment of high-voltage equipment in power transmission, industrial automation, and renewable energy systems. These applications require robust surge protection solutions capable of handling large energy spikes without failure. GDTs in this voltage range are critical for preventing expensive and sensitive electrical equipment damage.

Gas Discharge Tubes Market, By Material Type

Ceramic-based GDTs command the highest market share because of their excellent insulation properties, thermal stability, and long-term durability. Ceramic materials ensure consistent performance under repeated high-voltage surges, making them suitable for telecom, industrial, and power distribution applications. Their reliability and cost-effectiveness support their widespread adoption in surge protection devices.

Gas Discharge Tubes Market, By Application

The power distribution systems segment holds the largest share in the GDT market due to the critical need for surge protection in electricity transmission and distribution networks. With the expansion of smart grids, industrial automation, and renewable energy integration, GDTs help protect transformers, circuit breakers, and other power infrastructure from transient overvoltages, ensuring system stability and safety.

REGION

Asia Pacific to be fastest-growing region in global varistor and gas discharge tubes (GDT) market during forecast period

Asia Pacific holds the largest share and is also the fastest-growing region in the overall varistor and GDT market, driven by rapid industrialization, expanding consumer electronics manufacturing, and increased investments in power and smart grid infrastructure. Countries like China, Japan, South Korea, and India are key contributors, fueled by rising automotive, telecommunications, and industrial demand. The region’s strong manufacturing capabilities, adoption of advanced electronics, and growing focus on IoT and smart home applications further accelerate market growth and reinforce its dominance.

Varistor and Gas Discharge Tubes Market: COMPANY EVALUATION MATRIX

Littelfuse, Inc. (Star) leads the varistor and gas discharge tubes (GDT) market with a broad portfolio of high-performance surge protection components widely used in automotive, industrial, telecom, and consumer electronics sectors. Würth Elektronik (Emerging Leader) is gaining market share quickly by offering innovative, compact varistor and GDT products designed for emerging applications like electric vehicles and smart grids. Both companies drive market growth through continuous innovation and strong customer focus on reliability and integration flexibility.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 7.37 Billion |

| Market Forecast in 2030 (Value) | USD 9.19 Billion |

| Growth Rate | CAGR of 3.8% from 2025-2030 |

| Years Considered | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million), Volume (Milllion Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regional Scope | North America, Asia Pacific, Europe, the Middle East & Africa, and South America |

WHAT IS IN IT FOR YOU: Varistor and Gas Discharge Tubes Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Electric Vehicle & Automotive Electronics Manufacturers |

|

|

| Industrial Control & Automation Solutions Providers |

|

Optimize uptime, reduce equipment failure, and strengthen resilience in Industry 4.0 environments |

| Renewable Energy & Smart Grid Integrators |

|

|

| Consumer & IoT Electronics Product Developers |

|

|

RECENT DEVELOPMENTS

- April 2025 : Bourns introduced the BVRA1210 and BVRA1812 Series, automotive-grade multilayer varistors designed for enhanced surge protection in sensitive automotive circuits. These AEC-Q200 compliant components offer a fast transient response (<1.0 ns), a wide working voltage range (11–100 VDC), and meet IEC 61000-4-5 standards.

- December 2024 : TDK introduced the X-series, a new family of eco-friendly SMD multilayer varistors (MLVs) featuring a reduced carbon footprint and compliance with demanding automotive qualification standards. These varistors offer robust overvoltage and ESD protection for automotive, industrial, and consumer applications, handling surge current up to 400 A, low leakage current, and operation from -55?°C to +150?°C without derating.

- January 2024 : Littelfuse launched the SM10 Series Varistor, the industry's first surface-mount metal oxide varistor (MOV) compliant with the AEC-Q200 automotive standard. This MOV delivers superior transient surge protection for automotive electronics, EVs, and more. The SM10 Series features ultra-high surge capability with up to 40 pulses of 6 kV/3 kA surges, operates reliably at temperatures up to 125°C, and comes in a compact, SMT-friendly design that saves PCB space.

- September 2023 : Bourns released four new high-energy gas discharge tube (GDT) series: Model GDT212E, GDT216E, GDT220E, and GDT225E. These products are designed to provide robust surge protection for AC power lines and other demanding applications exposed to high-current surges.

- February 2023 : Littelfuse, Inc. announced the acquisition of Western Automation Research and Development Limited, which specializes in designing and manufacturing electrical shock protection devices. These devices are utilized across several high-growth markets, including e-mobility off-board charging infrastructure, industrial safety, and the renewable energy sector.

Table of Contents

Methodology

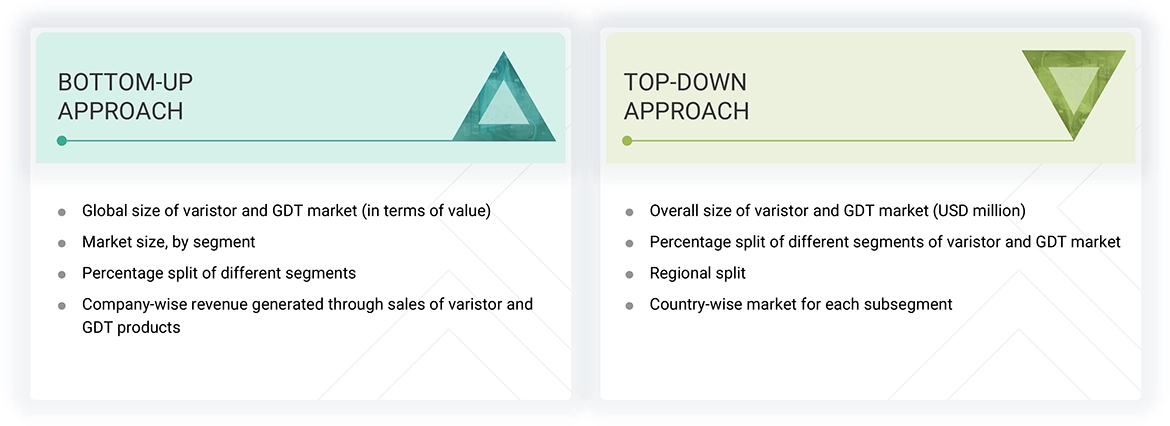

The study utilized four major activities to estimate the varistor and GDT market size. Exhaustive secondary research was conducted to gather information on the market and its peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. Finally, market breakdown and data triangulation methods were utilized to estimate the market size for different segments and subsegments.

Secondary Research

In the secondary research process, various sources were used to identify and collect information on the varistor and GDT market for this study. Secondary sources for this research study include corporate filings (such as annual reports, investor presentations, and financial statements); trade, business, and professional associations; white papers; certified publications; articles by recognized authors; directories; and databases. Secondary data was collected and analyzed to determine the overall market size, and was further validated through primary research.

List of key secondary sources

|

Source |

Web Link |

|

International Electrotechnical Commission |

|

|

The Electronic Components Industry Association (ECIA) |

|

|

Japan Electronics and Information Technology Industries Association |

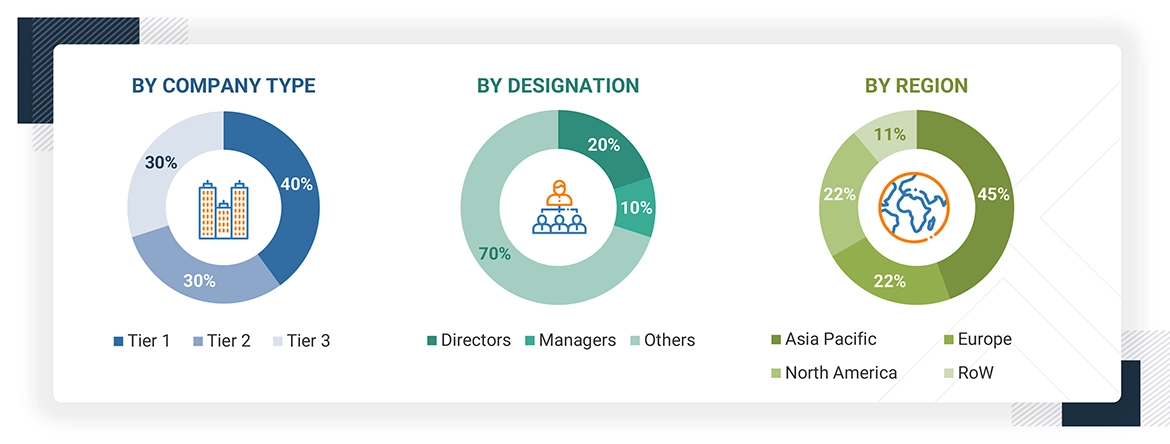

Primary Research

Primary interviews were conducted to gather insights on market statistics, revenue data, market breakdowns, market size estimations, and forecasting. Additionally, primary research was used to comprehend various trends related to technology, type, end user, and region. Interviews with stakeholders from the demand side, including CIOs, CTOs, CSOs, and customer/end-user installation teams using varistor and GDT offerings and processes, were also conducted to understand their perspective on suppliers, products, component providers, and their current and future use of varistor and GDT, which will impact the overall market. Several primary interviews were conducted across major countries in North America, Europe, Asia Pacific, and RoW.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the complete market engineering process, top-down and bottom-up approaches and several data triangulation methods have been used to estimate and forecast the overall market segments and subsegments listed in this report. Key players in the market have been identified through secondary research, and their market shares in the respective regions have been determined through primary and secondary research. This entire procedure includes the study of annual and financial reports of the top market players and extensive interviews for key insights (quantitative and qualitative) with industry experts (CEOs, VPs, directors, and marketing executives).

All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources. All the parameters affecting the markets covered in this research study have been accounted for, viewed in detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data has been consolidated and supplemented with detailed inputs and analysis from MarketsandMarkets and presented in this report. The following figure represents this study's overall market size estimation process.

Varistor and Gas Discharge Tubes (GDT) Market : Top-Down and Bottom-Up Approach

Data Triangulation

Once the overall size of the varistor and GDT market was determined using the methods described above, it was divided into multiple segments and subsegments. Market engineering was performed for each segment and subsegment using market breakdown and data triangulation methods, as applicable, to obtain accurate statistics. Various factors and trends from the demand and supply sides were studied to triangulate the data. The market was validated using both the top-down and bottom-up approaches.

Market Definition

The varistor and gas discharge tube (GDT) market encompasses components designed to protect electronic circuits and systems from voltage surges and transient events. Varistors, primarily metal oxide varistors (MOVs), offer voltage-dependent resistance that clamps excess voltage to prevent circuit damage, while GDTs provide high-energy surge protection by conducting large currents to the ground when a specific breakdown voltage is exceeded. These components are essential in applications such as consumer electronics, telecommunications, industrial equipment, automotive systems, and power distribution networks, where reliable protection against overvoltage, lightning strikes, and electrostatic discharge (ESD) is critical to ensuring device longevity and safety.

The report comprehensively analyzes the varistor and GDT market based on product type, application, and region. A few key manufacturers of varistors and GDTs are Littelfuse, Inc. (US), TDK Corporation (Japan), YAGEO Group (Taiwan), KYOCERA AVX Components Corporation (US), Bourns, Inc. (US), Eaton (Ireland), Weidmüller Interface GmbH & Co. KG (Germany), and HUBER+SUHNER (Switzerland).

Key Stakeholders

- Raw material suppliers

- Component manufacturers and providers

- Manufacturers and providers of varistor and GDT

- Original equipment manufacturers (OEMs)

- Varistor suppliers and distributors

- Market research and consulting firms

- Associations, organizations, forums, and alliances related to the varistor and GDT industry

- Technology investors

- Governments and financial institutions

- Venture capitalists, private equity firms, and start-ups

- End users

Report Objectives

- To describe and forecast the varistor and gas discharge tubes (GDT) market size by product type and region in terms of value

- To describe and forecast the varistor market size by type, application, and region in terms of value

- To describe and forecast the GDT market size by type, number of electrodes, voltage, material type, and application in terms of value

- To describe and forecast the market for various segments across four main regions, namely, North America, Europe, Asia Pacific, and RoW, in terms of value

- To describe and forecast the market for varistors and GDT in terms of volume

- To strategically analyze micromarkets1 with regard to individual growth trends, prospects, and contributions to the markets

- To provide detailed information regarding drivers, opportunities, and challenges influencing the market growth

- To analyze opportunities for stakeholders by identifying high-growth segments in the market

- To strategically analyze key technologies, average selling price trends, trends impacting customer business, ecosystem, regulatory landscape, patent landscape, Porter's five forces, import and export scenarios, trade landscape, key stakeholders and buying criteria, and case studies pertaining to the market under study

- To strategically profile key players in the varistor and GDT market and comprehensively analyze their market share and core competencies

- To analyze competitive developments such as partnerships, acquisitions, expansions, collaborations, and product launches, along with R&D in the varistor and GDT market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

- Detailed analysis and profiling of additional market players (up to 5)

- Additional country-level analysis of the varistor and GDT market

Product Analysis

- The product matrix provides a detailed comparison of the product portfolio of each company in the varistor and GDT market.

Key Questions Addressed by the Report

Which companies are leading the varistor and GDT market, and what strategies are they using to strengthen their market presence?

The major companies in the varistor and GDT market include Littelfuse, Inc. (US), TDK Corporation (Japan), Bourns, Inc. (US), Eaton (Ireland), and Weidmüller Interface GmbH & Co. KG (Germany). Their significant strategies include product launches & developments, collaborations, acquisitions, and expansions.

Which region has the highest potential in the varistor and GDT market?

The Asia Pacific region is projected to record the highest CAGR during the forecast period.

Which product will dominate the varistor and GDT market during the forecast period?

The varistor segment is expected to dominate the varistor and GDT market during the forecast period.

What key strategies do established players employ in the varistor and GDT market?

Product launches, partnerships, acquisitions, and collaborations remain major strategies key players adopt to grow in the varistor and GDT market.

Which major end users of varistors and GDTs are expected to drive market growth in the next five years?

The significant users of varistors and GDTs are automotive and consumer electronics.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Varistor and Gas Discharge Tubes (GDT) Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Varistor and Gas Discharge Tubes (GDT) Market