Vector Database Market Size, Share, Latest Trends, Growth

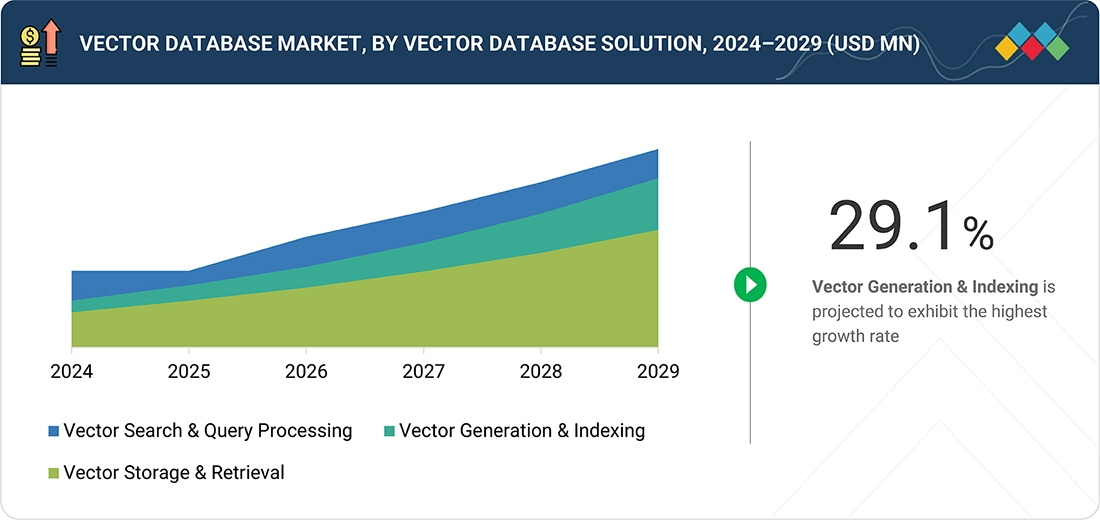

Vector Database Market By Vector Database Solution (Vector Generation & Indexing, Vector Search & Query Processing, Vector Storage & Retrieval), AI Language Processing, Computer Vision, Recommendation Systems - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

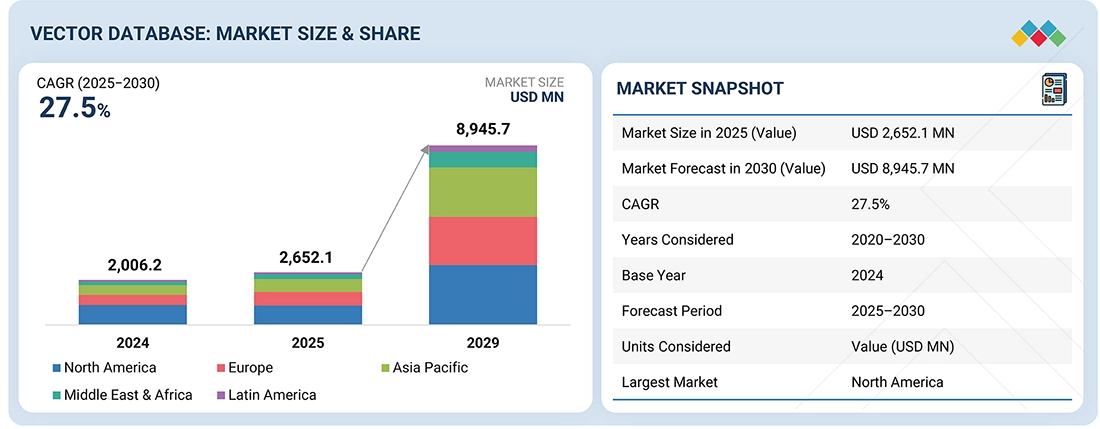

The global vector database market is expected to grow substantially, projected to rise from USD 2,652.1 million in 2025 to USD 8,945.7 million by 2030, reflecting a CAGR of 27.5%. This expansion is fueled by the rapid adoption of AI, LLMs, and multimodal applications that require high-performance vector search, scalable indexing, and real-time retrieval. Organizations across finance, retail, healthcare, media, and technology are deploying vector databases to support RAG pipelines, semantic search, and personalized user experiences. As enterprises shift toward AI-native architectures, vector databases enable low-latency retrieval, hybrid search, and efficient embedding storage, aligning with the rising need for intelligent, scalable, and cloud-ready AI infrastructure. Key growth drivers include: Explosion of unstructured and high-dimensional enterprise data | Rising deployment of RAG, semantic search, and LLM-driven applications | Increasing adoption of cloud-native, GPU-accelerated, and scalable vector storage architectures | Growing demand for real-time, low-latency retrieval across AI-heavy industries

KEY TAKEAWAYS

-

BY REGIONThe North American vector database market accounted for a 36.6% share in 2025.

-

BY OFFERINGBy offering, the services segment is expected to register the highest CAGR of 32.7%.

-

BY TYPEBy type, above mulimodal vector DBS segment is projected to grow at the highest CAGR.

-

BY TECHNOLOGY/AI APPLICATIONBy technology/AI application, the natural language processing segment is expected to dominate the market.

-

BY DEPLOYMENT TYPEBy deployment type, cloud will hold the largest market share.

-

BY DATA TYPEBy data type, hybrid & multimodal data is anticipated to grow at the highest CAGR.

-

BY VERTICALBy vertical, the retail & e-commerce segment is projected to grow at the highest rate of 33.8% during the forecast period.

-

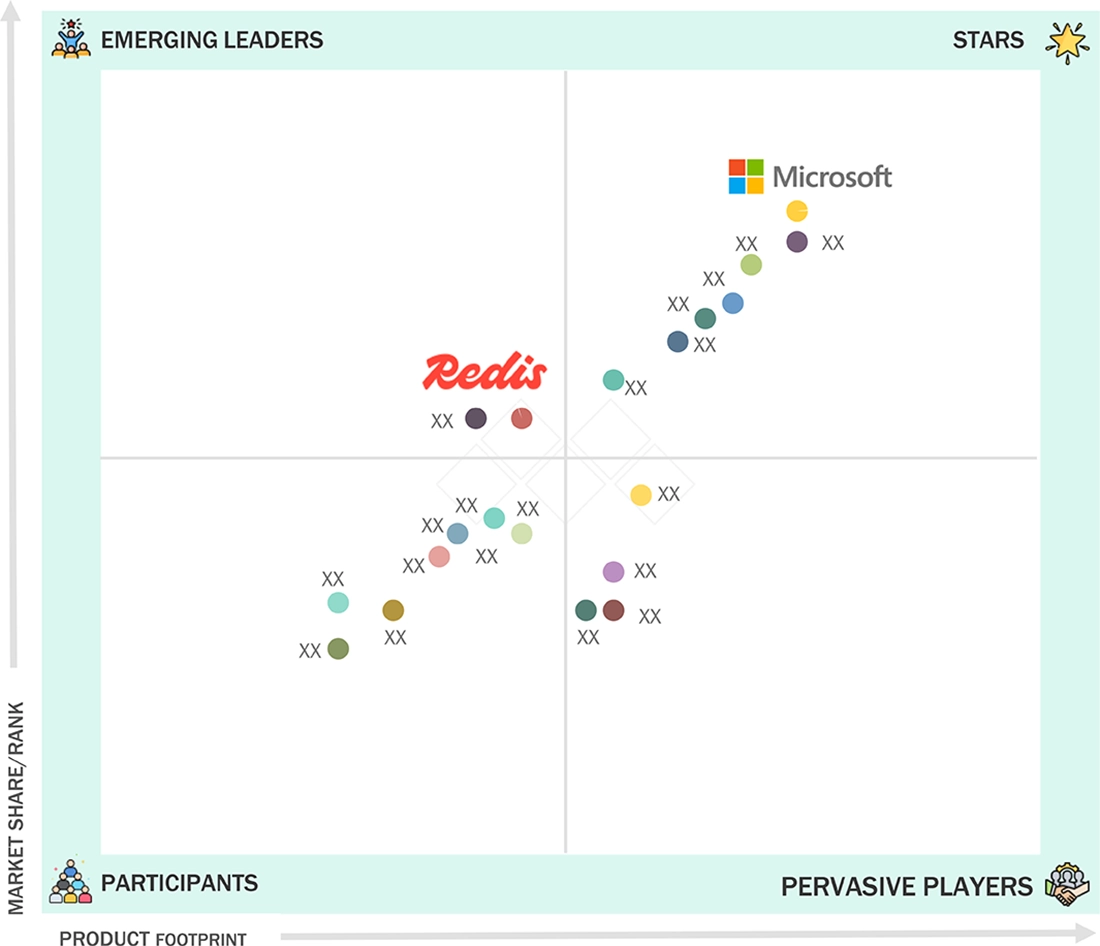

COMPETITIVE LANDSCAPEMicrosoft, MongoDB, and Elastic were identified as some of the star players in the vector database market (global), given their strong market share and product footprint.

-

COMPETITIVE LANDSCAPEWeaviate and Clickhouse, among others, have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders.

The rapid acceleration of AI adoption, multimodal data creation, and real-time personalization is intensifying the need for flexible, scalable, and high-performance vector databases. At the core of this shift, vector databases are emerging as foundational infrastructure for modern AI applications by enabling: High-speed storage and retrieval of embeddings across text, images, audio, video, and sensor data | Real-time semantic search and intelligent retrieval that power RAG pipelines, copilots, and context-aware decision systems | Seamless integration with LLMs, model-serving frameworks, orchestration tools, and AI development ecosystems to support scalable, production-grade AI workloads | As enterprises prioritize data security, privacy, and low latency, vector database vendors are investing in cloud-native architectures, GPU acceleration, hybrid search capabilities, and multimodal indexing to enhance performance and scalability

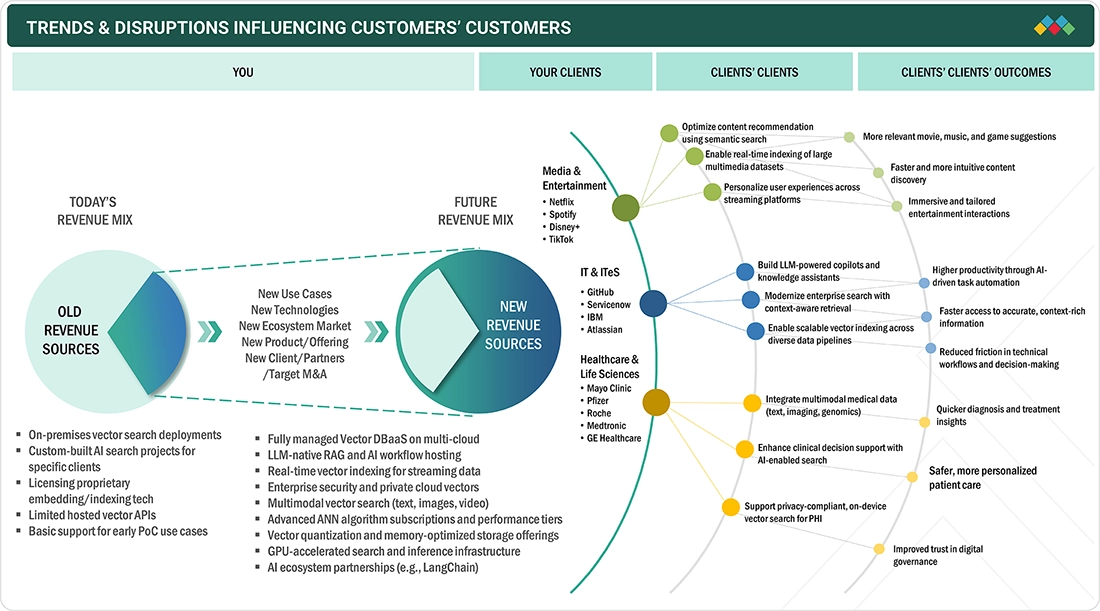

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The vector database market currently generates revenue from on-premises deployments, custom AI projects, proprietary embedding licenses, limited hosted APIs, and basic PoC support. Over the next 4–5 years, growth will shift to fully managed multi-cloud services, real-time streaming indexing, multimodal search, advanced ANN subscriptions, GPU-accelerated infrastructure, and AI ecosystem partnerships. Key users span media (Netflix, Spotify), IT (GitHub, IBM), and healthcare (Mayo Clinic, Roche). Clients seek enhanced semantic search, scalable AI workflows, and privacy-compliant multimodal data integration, driving faster, personalized, and secure AI-powered outcomes.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Explosion of unstructured and high-dimensional data

-

Demand for real-time search and personalization

Level

-

Rapidly evolving AI and embedding models

Level

-

Growing need for scalable storage and retrieval of LLM embeddings

-

Expansion of RAG to enable more accurate AI

Level

-

Data privacy and security concerns

-

Lack of standardization across vector indexing techniques

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Explosion of unstructured and high-dimensional data

The explosion of unstructured and high-dimensional data is transforming how organizations store, search, and analyze information. With 80-90% of enterprise data unstructured—ranging from emails and videos to IoT sensor feeds—traditional systems struggle to handle complex, multi-attribute datasets efficiently. Vector databases convert this data into compact numerical vectors, enabling fast similarity searches and real-time analysis. This drives strong demand for vector solutions that support semantic search, personalized recommendations, and advanced AI workflows, unlocking insights from previously untapped data. Key drivers include: Massive growth of unstructured multimedia and sensor data | Rising dimensionality in datasets across finance, healthcare, and telecom | Limitations of traditional databases in scaling high-dimensional queries | Increasing need for fast, real-time, and scalable vector search capabilities

Restraint: Rapidly evolving AI and embedding models

The rapid evolution of AI and the embedding of models present key challenges for vector databases. What works seamlessly for a 768-dimensional BERT embedding today may not be optimal for newer models, such as OpenAI’s text-embedding-3-large or Meta’s E5 series, which produce longer, richer vectors. Organizations face costly re-indexing, schema redesigns, and storage changes to support these updates. Lack of backward compatibility complicates the management of existing data and compliance, while performance tuning must be revisited. This leads to higher costs, technical debt, and slower deployments. Key restraints include: Frequent embedding dimension and format changes | Costly and complex re-indexing processes | Backward compatibility issues with legacy data | Increased infrastructure and storage demands | Performance risks during model upgrades

Opportunity: Expansion of RAG to enable more accurate AI

The expansion of Retrieval-Augmented Generation (RAG) is creating significant opportunities in the vector database market. As enterprises adopt AI for customer support, knowledge management, and content creation, the demand for context-aware and accurate responses is rising. RAG enhances large language model outputs by retrieving real-time, relevant data from trusted sources, improving factual accuracy and relevance. This shift positions vector databases as critical infrastructure, enabling efficient storage and fast similarity search of high-dimensional embeddings necessary for scalable RAG implementations. This trend is highlighted in the 2024 State of Generative AI in the Enterprise report by Menlo Ventures, noting that RAG now dominates 51 percent of enterprise AI implementations, up from 31 percent a year earlier. Key opportunities include: Rising enterprise adoption of RAG for AI accuracy | Increasing reliance on real-time retrieval layers in AI workflows | Growing need for scalable, high-performance vector search | Vector databases as foundational tools for contextual data access | Enabling more reliable, fact-based AI applications

Challenge: Data privacy and security concerns

Data privacy and security concerns pose a significant challenge for the vector database market as organizations increasingly use vector embeddings in AI applications. Although embeddings are dense numerical arrays, they can inadvertently leak sensitive information due to semantic proximity to the original data. Advanced attacks may reconstruct or infer private content from vectors, thereby risking breaches even without direct access to raw data. Without robust privacy frameworks, these risks limit adoption in regulated industries and require costly investments in secure indexing and inference technologies. Key challenges include: Potential leakage of sensitive data from embeddings | Risk of reconstruction or inference attacks | Inadequate privacy controls in multi-tenant and cloud environments | Compliance challenges with regulations like GDPR, PCI-DSS, and CCPA | Need for anonymization, secure indexing, and governance frameworks | High costs for privacy-enhancing technologies limiting broader adoption

vector-database-market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Vanguard improved its customer support experience by deploying Pinecone as the vector backbone for its AI-driven Agent Assist platform. The solution enabled hybrid search, real-time updates, and precise metadata filtering, allowing agents to instantly retrieve accurate financial information. This upgrade reduced call times, enhanced response quality, supported compliance requirements, and delivered a more efficient and scalable support workflow. | Faster access to relevant financial insights | Lower call handling time during peak periods | More accurate, regulation-aligned responses | Scalable support operations with reduced staffing pressure |

|

L’Oréal boosted the speed and responsiveness of its internal AI-driven application by migrating from a traditional NoSQL system to MongoDB Atlas. The switch enabled faster calculations, simplified backend workflows, and eliminated heavy scripting. With auto-indexing, aggregation pipelines, and seamless scalability, the platform delivered millisecond-level latency, strengthening performance for high-velocity Beauty Tech applications and accelerating iterative development. | Latency reduced to 10ms | Faster and scalable backend performance | Higher developer agility and productivity |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

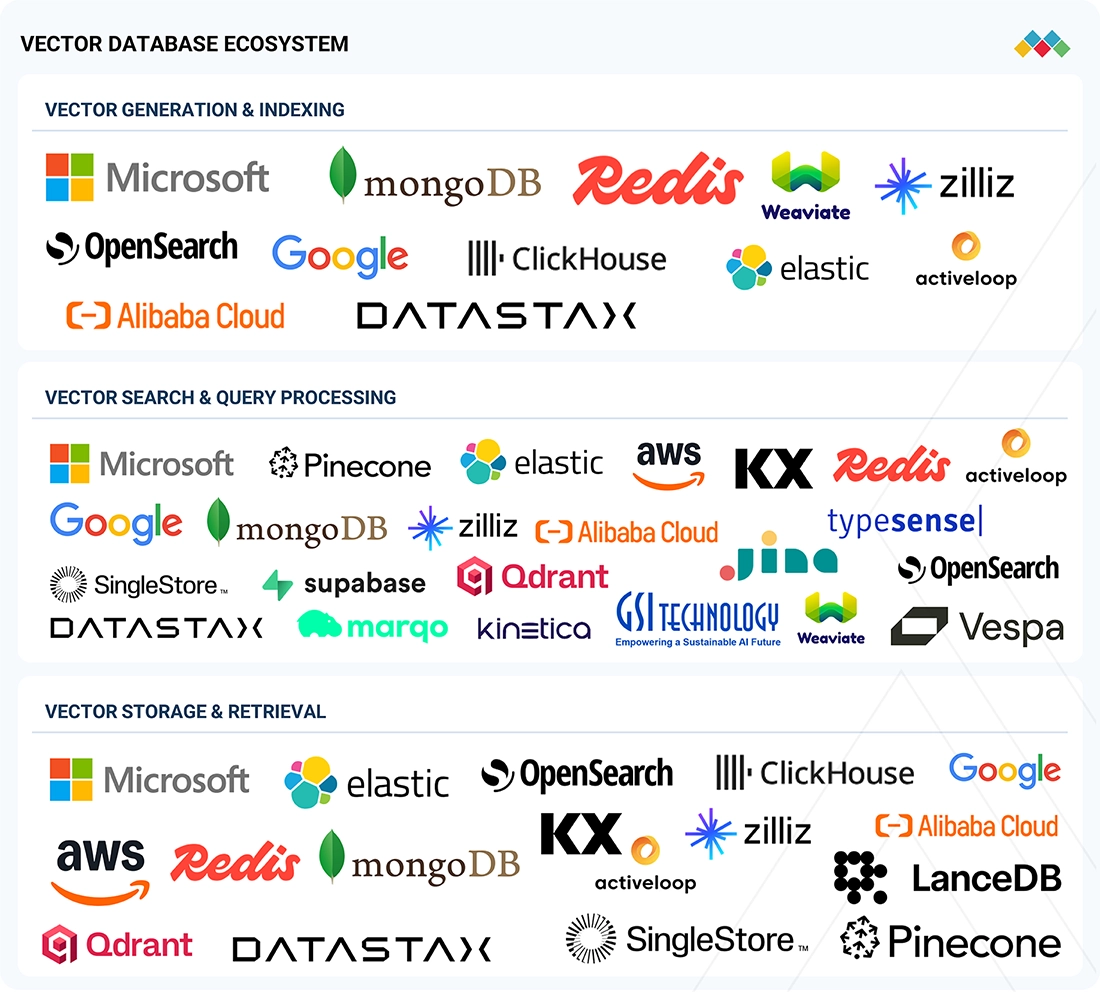

MARKET ECOSYSTEM

Prominent vector database providers serve industries such as media, healthcare, finance, and IT, offering comprehensive solutions across vector generation and indexing, vector search and query processing, and vector storage and retrieval. These vendors—including platform developers, cloud service providers, and system integrators—leverage cloud-native architectures, GPU acceleration, and AI-powered optimization to deliver scalable, low-latency, and accurate vector search capabilities that support advanced AI applications and real-time data workflows across diverse enterprise environments.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Vector Database Market, By Offering

The vector database solutions segment is expected to hold the largest market share throughout the forecast period, driven by demand for: High-performance vector generation and indexing to handle complex embeddings | Efficient and scalable vector search and query processing for real-time AI applications | Robust vector storage and retrieval supporting multimodal data and large-scale datasets | Flexible deployment options including on-premises, cloud, and hybrid environments | Advanced features like GPU acceleration, ANN algorithms, and seamless integration with AI workflows | These capabilities empower enterprises to deliver faster, more accurate, and scalable AI-driven solutions.

Vector Database Market, By Type

Multimodal vector databases are projected to grow at the highest rate due to their critical role in: Supporting diverse data types including text, images, audio, and video for unified search and analysis | Enabling advanced AI applications like semantic search, recommendation, and anomaly detection across multiple modalities | Enhancing real-time indexing and retrieval of complex, high-dimensional datasets | Integrating seamlessly with LLMs and AI workflows for richer contextual understanding | Offering scalable deployment with GPU acceleration and optimized storage | These capabilities drive adoption across media, healthcare, and IT sectors demanding comprehensive AI-powered solutions.

Vector Database Market, By Data Type

The advanced data segment—including video, sensor, geospatial, and 3D data—is expected to hold the largest market share in the vector database market, as organizations require solutions that: Handle complex, high-dimensional datasets from diverse sources | Enable real-time indexing and retrieval for streaming and spatial data | Support multimodal AI applications combining visual, spatial, and sensor inputs | Provide scalable, low-latency search optimized for large volumes of rich data | Integrate with AI workflows for enhanced analytics, anomaly detection, and decision support | Drive adoption across industries like media, healthcare, smart cities, and manufacturing due to growing demand for rich data insights.

Vector Database Market, By Vertical

The IT & ITeS vertical is expected to hold a large share in the vector database market, driven by the demand to: Develop LLM-powered copilots and knowledge assistants for enhanced productivity | Modernize enterprise search with context-aware and semantic retrieval | Scale vector indexing across diverse, rapidly growing data pipelines | Enable AI-driven automation and intelligent workflow optimization | Integrate seamlessly with cloud platforms and AI ecosystems | Support faster, more accurate decision-making and technical problem solving across IT organizations.

REGION

North America is expected to hold the largest share in the vector database market during the forecast period.

North America is emerging as a dominant region in the vector database market, supported by rapid digital expansion, high data intensity, and strong enterprise adoption of AI-driven retrieval systems. Growth is reinforced by the region’s advanced infrastructure and large-scale data generation initiatives. Key factors include: Robust Digital Infrastructure & Hyperscale Growth: Data center capacity increased by 10 percent, availability hit a record-low 2.8 percent, and under-construction projects rose by 69 percent, creating strong demand for high-performance vector retrieval | Massive Data Generation From Scientific & Geospatial Programs: Copernicus Sentinel surpassed 760,000 users, published 80 million datasets, and delivered 45 PiB of data, requiring advanced vector indexing | Expansion of Hyperspectral and Multimodal Data: Planet Labs’ Tanager-1 introduced 420-band hyperspectral imaging, generating complex datacubes ideally suited for multimodal vector search | Strong AI & Defense Adoption: Enterprises and government agencies rely on RAG, semantic search, and real-time retrieval, accelerating investment in vector database systems across the region

vector-database-market: COMPANY EVALUATION MATRIX

Microsoft (Star) leads the vector database market with deep integration across Azure AI, Fabric, and Cognitive Services, offering enterprise-grade vector search, indexing, and retrieval at a global scale. Its ecosystem supports multimodal embeddings, RAG pipelines, and real-time inferencing, making it a top choice for large organizations modernizing search, recommendation, and analytics workloads. Redis (Emerging Leader) is gaining traction with lightweight, high-performance vector search built into Redis Stack, appealing to developers seeking fast, flexible, and cost-efficient deployments. While Microsoft dominates through scale, AI alignment, and end-to-end cloud capabilities, Redis demonstrates strong momentum in developer-first, memory-accelerated vector applications.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Microsoft (US)

- Elastic (US)

- MongoDB (US)

- Google (US)

- AWS (US)

- Redis (US)

- Alibaba Cloud (US)

- DataStax (US)

- SingleStore (US)

- Pinecone (US)

- Zilliz (US)

- KX (US)

- Marqo.ai (US)

- ActiveLoop (US)

- Supabase (US)

- Jina AI (Germany)

- Typesense (US)

- Weaviate (Netherlands)

- GSI Technology (US)

- Kinetica (US)

- Qdrant (Germany)

- ClickHouse (US)

- OpenSearch (US)

- Vespa.ai (Norway)

- LanceDB (US)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market size in 2025 | USD 2,652.1 MN |

| Market forecast in 2030 | USD 8,945.7 MN |

| Growth rate | CAGR of 27.5% during 2025-2030 |

| Actual data | 2020-2030 |

| Base year | 2024 |

| Forecast period | 2025-2030 |

| Units considered | Value (USD Million) |

| Report coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments covered |

|

| Regional scope | North America, Asia Pacific, Europe, the Middle East & Africa, and Latin America |

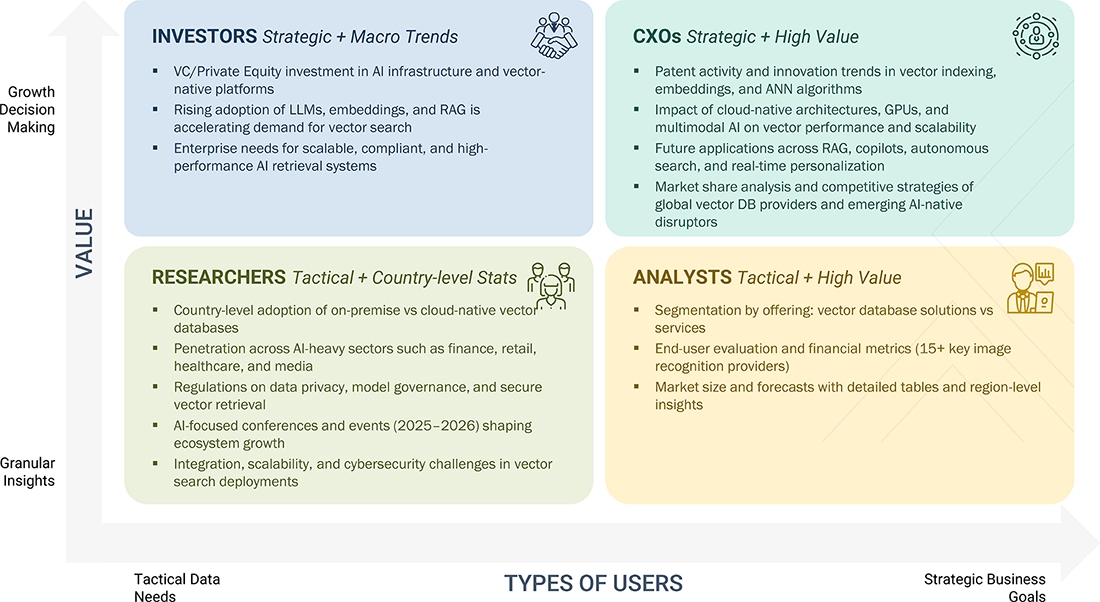

WHAT IS IN IT FOR YOU: vector-database-market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Leading Solution Provider (US) | In-depth segmentation of the North American vector database market and extended regional breakdowns for Europe, Asia Pacific, the Middle East & Africa, and Latin America. |

|

| Leading Solution Provider (EU) | Detailed profiling of up to 5 additional market players, including: Product portfolios Strategic initiatives Regional presence | Enhanced competitive intelligence to inform strategic planning and go-to-market execution Revealed market gaps and white spaces for differentiation and innovation Supported targeted growth initiatives by aligning: Product development with unmet customer needs Sales strategies with emerging demand clusters across verticals and geographies |

RECENT DEVELOPMENTS

- October 2025 : Microsoft announced an enhancement with the launch of Azure Cosmos DB Python SDK 4.14.0, adding faster batch reads, automatic write retries, and AI-driven features like Semantic Reranking to strengthen performance, reliability, and OpenAI-integrated workloads for modern data-intensive applications.

- October 2025 : Elastic introduced DiskBBQ, a new disk-friendly vector search algorithm for Elasticsearch, which reduces memory usage, improves query speed, and lowers infrastructure costs. By combining Hierarchical K-means clustering and Better Binary Quantization, DiskBBQ enables faster, more scalable vector search on large datasets.

- September 2025 : MongoDB introduced an enhancement by extending its search and vector search capabilities to Community Edition and Enterprise Server. The update introduces full-text, semantic, and hybrid search capabilities to self-managed environments, allowing developers to build and test AI applications locally with integrated retrieval tools.

- February 2025 : Google introduced enhancements to AlloyDB, including new vector search upgrades, such as inline filtering for faster ANN queries, improved observability tools, and real-time vector index distribution statistics. These features strengthen in-database vector search accuracy, performance, and stability for AI and RAG workloads.

Table of Contents

Methodology

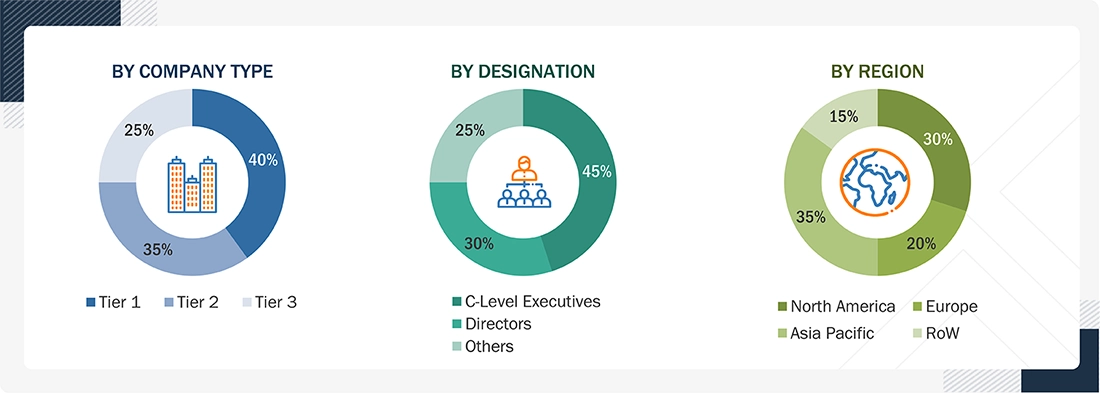

This research study utilized extensive secondary sources, including directories and databases such as D&B Hoovers, Bloomberg Businessweek, and Factiva, to identify and collect information for a technical, market-oriented, and commercial study of the global vector database market. A few other market-related reports and analyses published by various industry associations, such as the National Security Agency (NSA) and SC Magazine, were considered while doing the extensive secondary research. The primary sources were primarily industry experts from core and related industries, as well as preferred suppliers, manufacturers, distributors, service providers, technology developers, and technologists from companies and organizations related to all segments of this industry's value chain.

In-depth interviews were conducted with primary respondents, including key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants to obtain and verify critical qualitative and quantitative information and assess the prospects. The market has been estimated by analyzing various driving factors, such as improving organizational compliance requirements, enhancing operational efficiency, and simplifying workflows to eliminate bottlenecks.

Secondary Research

The market size of companies offering vector database was derived based on secondary data available through paid and unpaid sources, analyzing the product portfolios of major companies in the ecosystem, and rating the companies based on their product capabilities and business strategies.

Various sources were referenced in the secondary research process to identify and collect information for the study. These sources included annual reports, press releases, investor presentations from companies, product data sheets, white papers, peer-reviewed journals, certified publications, and articles from recognized authors, as well as government websites, directories, and databases.

Secondary research was primarily used to obtain key information about the industry's supply chain, the total pool of key players, market classification and segmentation according to industry trends, and regional markets, all of which were further validated by primary sources.

Primary Research

During the primary research process, various sources from both the supply and demand sides were interviewed to gather qualitative and quantitative information for this report. The primary sources from the supply side included industry experts, such as chief executive officers (CEOs), vice presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the vector database market.

Primary interviews were conducted to gather insights, such as market statistics, the latest trends disrupting the market, new use cases implemented, data on revenue collected from products and services, market breakups, market size estimations, market forecasts, and data triangulation. Primary research also helped to understand various technology-related trends, segmentation types, industry trends, and regional differences.

Demand-side stakeholders, such as Chief Information Officers (CIOs), Chief Technology Officers (CTOs), Chief Security Officers (CSOs), installation teams of governments and end users who utilize vector database, and digital initiatives project teams, were interviewed to understand the buyers' perspectives on suppliers, products, service providers, and their current use of services, which would influence the overall vector database market.

Primary interviews were conducted to gather insights such as market statistics, data on revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to type, manufacturing process, application, end-use industry, and region.

Note 1: Tier 1 companies have revenues greater than USD 10 billion; tier 2 companies' revenues range between USD 1 and 10 billion; and tier 3 companies' revenues range between USD 500 million and 1 billion.

Note 2: Others include sales, marketing, and product managers.

Source: Secondary Literature, Interviews with Experts, and MarketsandMarkets Analysis

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Multiple approaches were adopted to estimate and forecast the vector database market. The first approach involved estimating the market size by summing up the companies' revenue generated through the sale of services.

The research methodology used to estimate the market size included the following:

- Primary and secondary research were conducted to assess the revenue contributions of major market participants in each country, with secondary research identifying these participants.

- Critical insights were obtained through in-depth interviews with industry professionals, including directors, CEOs, VPs, and marketing executives, as well as by reviewing the annual and financial reports of the top firms in the market.

- Primary sources were used to verify all percentage splits and breakups, which we calculated using secondary sources.

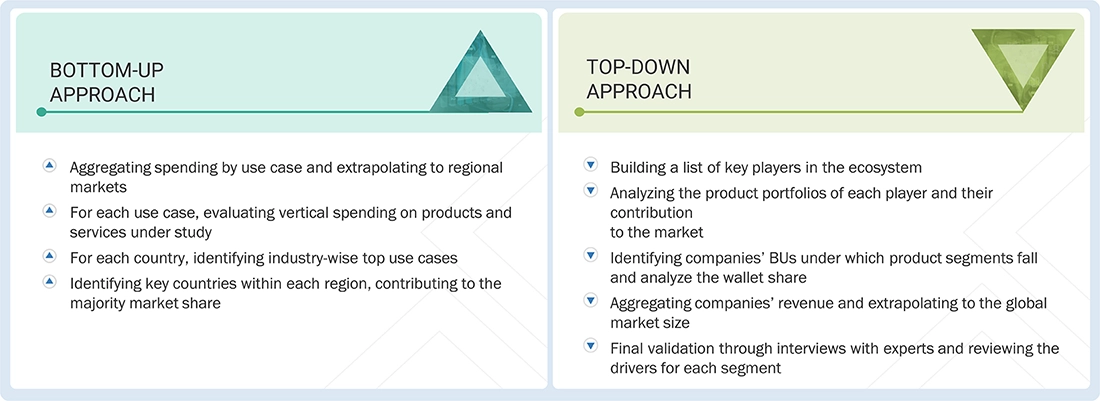

Vector Database Market : Top-Down and Bottom-Up Approach

Data Triangulation

Once the overall market size was determined, we divided the market into segments and subsegments using the previously described market size estimation procedures. When required, market breakdown and data triangulation procedures were employed to complete the market engineering process and specify the exact figures for every market segment and subsegment. The data was triangulated by examining several variables and patterns from the government entities' supply and demand sides.

Market Definition

According to MarketsandMarkets, "Vector databases are specialized data management systems designed to store, index, and search high-dimensional vector embeddings generated by AI and machine learning models. It enables similarity search and retrieval based on semantic meaning, rather than exact matches, allowing organizations to efficiently manage and query unstructured data, such as text, images, audio, and video. These databases are essential for powering AI-driven applications like recommendation engines, natural language processing, computer vision, and generative AI, providing faster, more accurate, and context-aware search and analytics capabilities."

According to IBM, "A vector database stores, manages, and indexes high-dimensional vector data. Data points are stored as arrays of numbers called 'vectors,' which are clustered based on similarity. This design enables low-latency queries, making it ideal for AI applications."

According to Pinecone, "A vector database indexes and stores vector embeddings for fast retrieval and similarity search, with capabilities like CRUD operations, metadata filtering, horizontal scaling, and serverless."

Key Stakeholders

- Vector Database Providers

- AI & Machine Learning Platform Vendors

- Cloud Service Providers

- Embedding Model Developers

- System Integrators & Data Infrastructure Providers

- Managed Service Providers (MSPs)

- API & Search Platform Developers

- Consulting & Implementation Firms

- Enterprise End Users across Key Verticals

- Research & Standardization Bodies

Report Objectives

- To define, describe, and forecast the vector database market based on offering, technology/AI application, deployment type, data type, vertical, and region

- To forecast the market size of five major regional segments: North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America

- To strategically analyze the market subsegments with respect to individual growth trends, prospects, and contributions to the total market

- To provide detailed information related to the significant factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To strategically analyze macro and micromarkets with respect to growth trends, prospects, and their contributions to the overall market

- To analyze industry trends, patents, innovations, and pricing data related to the market

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for major players

- To analyze the impact of AI/generative AI on the market

- To profile key players in the market and comprehensively analyze their market share/ranking and core competencies

- To track and analyze competitive developments such as mergers & acquisitions, product launches, and partnerships & collaborations in the market

Available Customizations

MarketsandMarkets provides customizations based on the company's unique requirements using market data. The following customization options are available for the report.

Product Analysis

- The product matrix provides a detailed comparison of each company's portfolio.

Geographic analysis

- Further breakup of the vector database market

Company information

- Detailed analysis and profiling of five additional market players

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Vector Database Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Vector Database Market