Veterinary Monoclonal Antibodies Market Size, Growth, Share & Trends Analysis

Veterinary Monoclonal Antibodies Market by Animal Type (Canine, Feline, Swine), Product (Cytopoint, Librela, Solensia), Therapy Area (Dermatology, Infectious, Osteoarthritis, Pain, Oncology, Others), Route of Administration - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The global veterinary monoclonal antibodies market is projected to reach USD 3.06 billion by 2030, from USD 1.70 billion in 2025, with a CAGR of 12.4%. The major factors driving market growth include a rise in companion animal population, increased pet ownership, heightened concerns about chronic diseases, improved awareness among animal welfare organizations, and a surge in animal healthcare expenditures. The market is expanding therapeutic indications beyond dermatology and osteoarthritis, as well as exploring novel administration routes for monoclonal antibodies.

KEY TAKEAWAYS

-

BY ANIMAL TYPEThe canines segment is expected to witness the fastest growth in the veterinary monoclonal antibodies market. The increased adoption of pets, heightened awareness about animal skin health, and the availability of advanced dermatological treatments have contributed to this growth. As dogs are more prone to skin conditions like atopic dermatitis, bacterial infections, and allergic reactions, they lead to higher veterinary visits and demand monoclonal antibody therapies.

-

BY PRODUCTIn 2024, the Lokivetmab (Cytopoint) segment held the largest share of the veterinary monoclonal antibodies market, mainly due to its critical role in managing canine atopic dermatitis, one of the most frequently diagnosed chronic allergic skin diseases in dogs. A rise in pet healthcare expenditure and improved awareness about pet care further drive this segment.

-

BY ROUTE OF ADMINISTRATIONThe subcutaneous segment secured a leading position in the veterinary monoclonal antibodies market. The subcutaneous route offers sustained drug release in the body and lowers the risk of infection compared to the intravenous route of administration. These benefits have contributed to the increased adoption of monoclonal antibodies administered subcutaneously in the veterinary field.

-

BY THERAPY AREADermatology accounted for the largest share of the veterinary monoclonal antibodies market in 2024. Conditions like allergic dermatitis and atopic dermatitis are the most common chronic diseases among companion animals. The increased awareness about animal health and the availability of advanced monoclonal antibody therapies in treating such conditions further contribute to the market growth.

-

BY END USERVeterinary hospitals/Specialty centers hold the highest share as they serve as the primary point of care for animals requiring advanced therapies. Their established infrastructure, access to trained veterinarians, and ability to provide specialized treatments make them a preferred channel for administering monoclonal antibody therapies, driving growth in this segment.

-

BY REGIONNorth America is expected to witness the fastest growth during the forecast period. The region’s rapid expansion is attributed to the rising pet population, increasing awareness about animal skin diseases, and growing expenditure on veterinary care. Additionally, advanced veterinary healthcare infrastructure and the presence of key market players are further driving growth in the region.

-

COMPETITIVE LANDSCAPEThe major market players have adopted both organic and inorganic strategies, including partnerships and collaborations. For instance, in October 2023, Zoetis launched Librela (bedinvetmab injection), the first-ever injectable monoclonal antibody, in the US for treating osteoarthritis pain in dogs.

The veterinary monoclonal antibodies market is growing steadily, driven by increasing rates of chronic diseases in animals and rising pet ownership. Conditions such as atopic dermatitis and osteoarthritis are common in companion animals. To treat these conditions, the market offers a variety of approved products, including Cytopoint, Librela, Solensia, Gilvetmab, and Canine Parvovirus Monoclonal Antibody (CPMA), which have gained significant traction, thereby fueling market growth. Moreover, advances in technology, including new biologic therapeutics, enhanced diagnostics, and teledermatology, are improving patient outcomes. Growing awareness, pet insurance protection, and R&D expenditure are also driving the market landscape, driving innovation and increasing treatment choices.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The veterinary monoclonal antibodies market is undergoing rapid transformation, driven by emerging technologies and evolving healthcare priorities. Innovations such as oral and intranasal monoclonal antibodies, along with recombinant biologics, are enhancing efficacy, safety, and speed to market. There is a growing focus on biologics targeting chronic diseases, aligned with global One Health initiatives. Increased awareness among pet owners and livestock producers is boosting demand for preventive and therapeutic biologics. Additionally, sustainability initiatives and digital tools for disease monitoring and biologic delivery are shaping product innovation. As regulatory standards tighten and the market expands globally, companies are adapting to meet the demand for safer, more effective, and species-specific biologic solutions.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Surge in companion animal population and pet ownership

-

Innovations in monoclonal antibodies targeting infectious diseases

Level

-

Regulatory hurdles and long approval timelines

-

High cost of development and treatment

Level

-

Novel administration routes for monoclonal antibodies

-

Expanding therapeutic indications beyond dermatology and osteoarthritis

Level

-

Emerging safety concerns and adverse events reporting

-

Limited species-specific knowledge

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Surge in companion animal population and pet ownership

The expansion of the companion animal population and a rise in pet ownership worldwide are the primary drivers of the veterinary monoclonal antibodies market. In developed regions, such as North America and Europe, and emerging economies, including India and China, more individuals are keeping pets, which is increasing the demand for veterinary healthcare treatments and services. The American Pet Products Association (APPA) reported that 86.9 million US households (66%) had a pet during the 2023–2024 period, and the American Veterinary Medical Association (AVMA) indicated an increase in households owning dogs, from 31.3 million in 1996 to 59.8 million in 2024. Additionally, according to the European Pet Food Industry Federation (FEDIAF), the number of dogs increased from 104.34 million in 2022 to 106.36 million in 2023. With more companion animals in need of dermatological treatments and pain management, the growth of the veterinary monoclonal antibodies market is significantly driven.

Restraint: Regulatory hurdles and long approval timelines

Regulatory barriers and extended timelines for product approval remain a key limitation to growth in monoclonal antibodies for animal health. In the US, regulatory influence is bifurcated: immunomodulatory monoclonal antibodies are regulated by the USDA's Center for Veterinary Biologics (CVB), while other products fall under the control of the FDA's Center for Veterinary Medicine (CVM). The two-way path creates complexity of classification and lengthens submission periods. In both the US and Europe, veterinary monoclonal antibodies are required to follow stringent standards comparable to those for human biologics. These involve strict standards for safety, efficacy, and manufacturing consistency. Moreover, regulators are increasingly harmonizing veterinary monoclonal antibody standards with those of human biologics, thereby extending timelines further. For instance, Elanco's Canine Parvovirus Monoclonal Antibody (CPMA) received conditional approval from the USDA in 2023. Although demonstrating enhanced survival rates in puppies, CPMA still requires post-approval studies. This conditional route, although helpful in cases of immediate necessity, does not decrease the regulatory burden overall. Extended approval durations add expense and fiscal risk for manufacturers. These barriers hinder innovation, slowing the introduction of viable therapies to the market and thereby limiting the overall growth potential of veterinary monoclonal antibodies.

Opportunity: Novel administration routes for monoclonal antibodies

Traditionally, veterinary monoclonal antibodies are injected subcutaneously (SC) or intravenously (IV), which increases visits to veterinarians and compliance hurdles for chronic treatments. Researchers are exploring new routes, such as oral and intranasal delivery, to overcome these factors. For instance, Animab's Nanoprotec, intended for piglets, will be administered orally through drinking water to provide passive immunity against enterotoxigenic E. coli (ETEC) F4. The disease causes havoc-inducing diarrhea in piglets, and Animab's technology provides tight, antibiotic-free regulation via a gut-delivered mAb, streamlining administration in livestock environments and eliminating the need for injections. The product is positioned to be filed with the European Medicines Agency (EMA) in 2025 and will be marketed in Europe by late 2026. Although currently directed toward swine, this oral delivery method presents opportunities for analogous uses in companion animals, such as gastrointestinal disease oral formulations or intranasal monoclonal antibodies against respiratory viruses. These non-parenteral routes have the potential to enhance pet owner compliance, decrease stress in animals, and expand biologic utilization into home care, particularly in regions with limited veterinary coverage.

Challenge: Emerging safety concerns and adverse events reporting

A growing concern regarding the use of monoclonal antibodies in veterinary medicine is the emergence of adverse events associated with their administration, particularly with respect to Zoetis' Librela (bedinvetmab) for the treatment of osteoarthritis in dogs. Since the US licensing in May 2023, the FDA's Center for Veterinary Medicine (CVM) has begun collecting an overwhelming number of adverse event reports, which were highlighted by the American Veterinary Medical Association (AVMA) in April 2024. Reported side effects were lethargy, vomiting, anorexia, diarrhea, pain at the injection site, and, in the most severe instances, neurological events such as seizures, ataxia, and death. It is essential to note that although several cases involved dogs with health issues that may have contributed to the events or were taking other concomitant medications, the frequency of these events prompted the FDA to conduct a formal assessment, stating the need for limitless scrutiny regarding adverse events. Moreover, there is also concern about the long-term safety of chronic administration of mAbs in veterinary medicine, such as Librela and Cytopoint, which involve monthly repeat dosing or long-term administration as needed for care. Due to the lack of strong longitudinal studies, the cumulative effects of chronic immune-modulation therapies, such as Librela, remain uncertain.

Veterinary Monoclonal Antibodies Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Approved veterinary monoclonal antibodies: Cytopoint (lokivetmab, canine atopic dermatitis), Librela (bedinvetmab, canine osteoarthritis), and Solensia (frunevetmab, feline osteoarthritis) | Clear market leader in veterinary monoclonal antibodies; first-to-market advantage; strong biologics R&D; trusted brand among veterinarians and pet owners |

|

Monoclonal anibodies for infectious and chronic conditions: Canine Parvovirus Monoclonal Antibody | Expanding biologics pipeline through M&A; focus on life-threatening infectious diseases and chronic conditions; ability to scale via Elanco’s global distribution |

|

Licensing and developing monoclonal antibodies for canine and feline diseases; collaborations with MabGenesis for species-specific antibodies | Strong mid-size animal health company; flexible licensing model; pipeline diversification beyond traditional small molecules and vaccines |

|

Partnering with MabGenesis for discovery of novel veterinary monoclonal antibodies | Global animal health presence; leveraging human biologics expertise; early but strategic investments in species-specific antibodies |

|

Investing in biologics and immunology; partnerships and acquisitions to expand antibody capabilities | Global scale, extensive distribution, strong R&D capabilities; ability to rapidly scale veterinary biologics market presence once pipeline matures |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The veterinary monoclonal antibodies ecosystem comprises a complex network of stakeholders, including manufacturers, research institutions, regulatory authorities, distributors, veterinary healthcare providers, and end users such as clinics, hospitals, and government agencies. R&D collaborations and high demand for preventive animal healthcare drive innovation. Regulatory bodies ensure safety and compliance, while distribution partners play a crucial role in facilitating market access and managing cold chain logistics. This interconnected ecosystem is influenced by disease prevalence, trends in pet populations, and shifts in animal health policies across regions.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Veterinary Monoclonal Antibodies Market, By Animal Type

In 2024, the canines segment held the largest share of the veterinary monoclonal antibodies market, primarily due to the high prevalence of chronic and immunological diseases, such as atopic dermatitis, osteoarthritis, and certain cancers, among dogs. The prevalence of chronic diseases increasingly demands monoclonal antibody therapies. Key product launches, such as Cytopoint (Lokivetmab) for allergic dermatitis and Librela (bedinvetmab) for osteoarthritis pain, have further accelerated the adoption of biologics in canine treatments. The growing popularity of pet ownership, coupled with increasing pet insurance coverage, also fuels market growth.

Veterinary Monoclonal Antibodies Market, By Therapy Area

In 2024, the dermatology segment held the largest share of the veterinary monoclonal antibodies market, driven mainly by the increasing prevalence of skin diseases, such as atopic dermatitis and allergic dermatitis, in companion animals. Such conditions often require long-acting biologics and targeted monoclonal antibody therapies. Products such as Cytopoint (lokivetmab) by Zoetis Services LLC (US) have gained significant traction due to their ability to provide rapid relief from itch and inflammation, without any adverse effects. The increasing willingness of pet owners to invest in advanced veterinary treatments has further boosted the adoption of monoclonal antibody therapies, thereby driving the overall market growth.

REGION

North America to be fastest-growing region in during forecast period

North America is expected to exhibit the fastest growth due to the increasing pet population in developed countries such as the US and Canada, as well as the presence of top market players in the region. Higher pet healthcare expenditure, advanced veterinary infrastructure, and increased awareness about animal health conditions are further driving the demand for veterinary monoclonal antibodies in the region. The surging number of veterinary professionals in North America also supports market growth. According to the Workforce Needs in Veterinary Medicine report by the National Academy of Sciences, the number of active veterinarians in the region is projected to reach 108,900 by 2030. The expansion of veterinary practices is likely to enhance access to advanced therapeutic solutions, driving demand for veterinary biologics in North America. Additionally, advancements in veterinary treatments, such as monoclonal antibody therapies (e.g., Cytopoint) and innovative topical treatments, fuel the market growth.

Veterinary Monoclonal Antibodies Market: COMPANY EVALUATION MATRIX

In the veterinary monoclonal antibodies market, Zoetis (Star) leads with a strong global presence, a diverse portfolio, and innovative animal-friendly formulations that enhance treatment outcomes across hospitals, clinics, and research institutes. Merck (Emerging Leader) is gaining traction with cost-effective, novel solutions, focusing on emerging markets and expanding in livestock and companion animal therapies.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 1.52 BN |

| Market Forecast in 2030 (Value) | USD 3.06 BN |

| Growth Rate | CAGR of 12.4% from 2025-2030 |

| Years Considered | 2023–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Million/Billion), Volume (Thousand Units) |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, Latin America, and Middle East & Africa |

WHAT IS IN IT FOR YOU: Veterinary Monoclonal Antibodies Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Product Analysis | In-depth assessment of Veterinary Monoclonal Antibodies by animal type, by therapy area | Analysis of emerging trends such as species-specific formulations, improved delivery systems, and enhanced bioavailability strategies. |

| Company Information | Comprehensive profiles of major players such as Zoetis, Merck, Elanco, Boehringer Ingelheim, Ceva, and others, detailing portfolios, strategies, and competitive positioning. | Identification of strategic partnerships, licensing deals, and mergers & acquisitions in the veterinary mAb space. |

| Geographic Analysis | Country-level Veterinary Monoclonal Antibodies demand mapping with a focus on APAC (ASEAN countries), Europe, and key emerging markets; evaluation of regional regulatory frameworks and adoption trends. | Regional market outlook with detailed growth opportunities, regulatory updates, and adoption trends across major countries. |

RECENT DEVELOPMENTS

- October 2024 : Sanofi partnered with Opella to form an independent consumer healthcare company through a 50:50 joint venture with Clayton, Dubilier & Rice (CD&R). The new entity, Opella Healthcare Group, will enable the more focused growth of OTC brands like Dulcoflex, while Sanofi will retain a 48.2% stake, allowing for strategic oversight while providing Opella with full operational independence.

- January 2024 : Sun Pharmaceutical Industries Ltd. acquired all outstanding ordinary shares of Taro Pharmaceutical. This acquisition helped Sun Pharma expand its OTC portfolio and geographical presence.

- May 2023 : Bayer expanded a new business unit in the US, focused on developing precision health consumer products. This initiative aimed to leverage data science, genetics, and digital technologies to create personalized, science-based solutions for pain management, digestive health, and dermatology.

- August 2023 : Zydus Group received US FDA approval for its Indomethacin Suppositories (25 mg), including Competitive Generic Therapy (CGT) designation, signifying its first generic approval for this product. This approval strengthens Zydus’ US portfolio, reinforcing its presence in niche and specialized drug segments.

Table of Contents

Methodology

This study involved the extensive use of both primary and secondary sources. The research process involved evaluating various factors affecting the industry to identify the segmentation, industry trends, key players, competitive landscape, market dynamics, and growth strategies.

Secondary Research

In the secondary research process, various secondary sources were referred to, including directories, databases such as Bloomberg Business, Factiva, and Dun & Bradstreet; white papers, annual reports, company house documents, investor presentations, and SEC filings of companies. Secondary research was used to identify and collect valuable information for an extensive, technical, market-oriented, and commercial study of the veterinary monoclonal antibodies market. It was also used to obtain information about the key players, market classification & segmentation according to industry trends to the bottommost level, and key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various primary sources from the supply and demand sides were interviewed to obtain critical qualitative and quantitative information for this report. Primary sources from the supply side include project/sales/marketing/business development managers, presidents, vice presidents, chairpersons, chief executive officers, chief operating officers, chief strategy officers, directors, chief information officers, and chief medical information officers related to the veterinary monoclonal antibodies market. Primary sources from the demand side include professionals from veterinary hospitals and clinics, academic & research institutes, and pet owners.

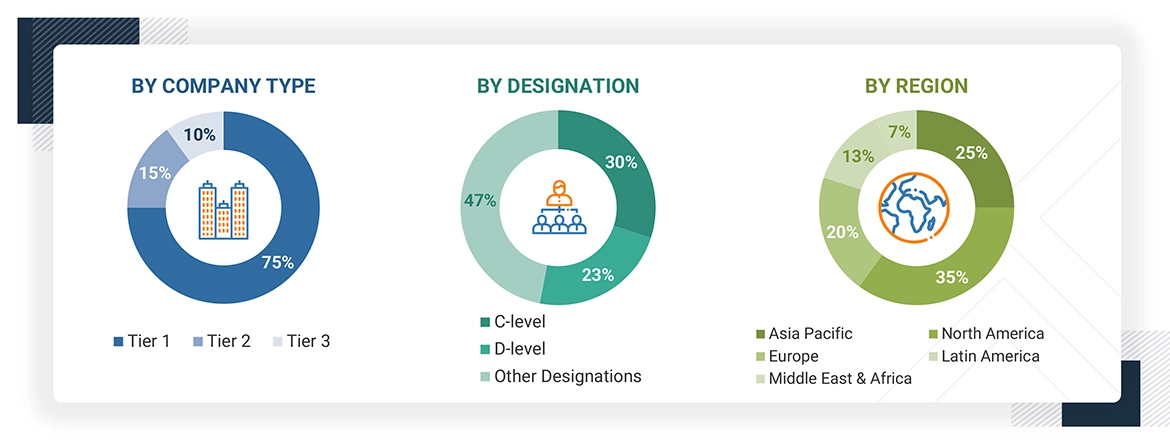

Breakdown of primary interviews

Note: Companies are classified into tiers based on their total revenue. As of 2024, Tier 1 = >USD 10.00 billion, Tier 2 = USD 1.00 billion to USD 10.00 billion, and Tier 3 = < USD 1.00 billion.

Other designations include sales managers, marketing managers, business development managers, product managers, distributors, and suppliers.

To know about the assumptions considered for the study, download the pdf brochure

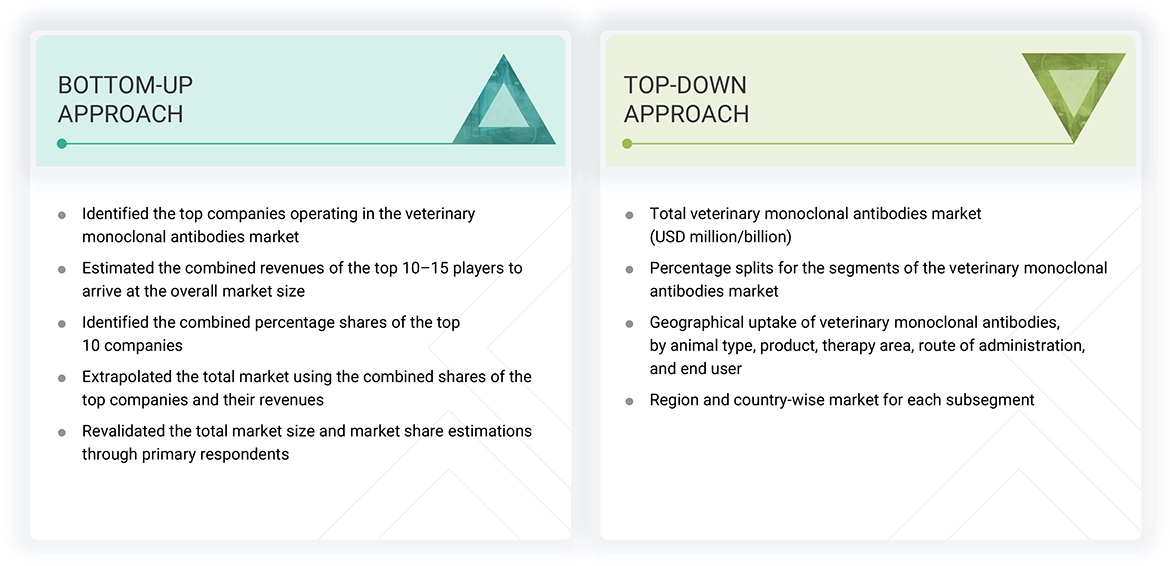

Market Size Estimation

The total size of the veterinary monoclonal antibodies market was determined after data triangulation from two approaches, as mentioned below. After each approach, the weighted average of these approaches was taken based on the level of assumptions used in each approach.

Data Triangulation

After arriving at the market size, the total market was divided into several segments and subsegments. Data triangulation and market breakdown procedures were employed wherever applicable to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments.

Market Definition

Veterinary monoclonal antibodies are laboratory-produced antibodies designed to target specific antigens in animals, offering precise treatment for conditions like atopic dermatitis, osteoarthritis, and infectious diseases. These species-specific biologics are engineered to work effectively in the immune systems of dogs, cats, or livestock. They represent a significant advancement over traditional drugs by providing targeted therapy with fewer side effects.

Stakeholders

- Veterinary monoclonal antibody manufacturers

- Animal healthcare product manufacturers

- Veterinary monoclonal antibody distributors and wholesalers

- Animal welfare associations

- Veterinary clinics and care centers

- Research and consulting firms

- Veterinary R&D organizations

- Contract research organizations

- Contract manufacturing organizations

- Venture capitalists

Report Objectives

- To define, describe, and forecast the veterinary monoclonal antibodies market by animal type, product, therapy area, route of administration, end user, and region

- To identify and analyze key drivers, restraints, opportunities, and challenges influencing market growth

- To strategically analyze the regulatory scenario, value chain analysis, supply chain analysis, Porter’s Five Forces analysis, ecosystem analysis, trade analysis, pricing analysis, patent analysis, impact of AI, case study analysis, adjacent market analysis, unmet needs/end user expectations, and trends and disruptions impacting customer business in the market

- To analyze micro markets with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze opportunities for stakeholders and provide details of the competitive landscape for key players

- To strategically profile key players in this market and comprehensively analyze their market shares and core competencies

- To track and analyze competitive developments such as product launches and approvals, partnerships, and expansions in the market

Key Questions Addressed by the Report

What are the emerging trends in the veterinary monoclonal antibodies market?

Trends include increased pet ownership and humanization, growing focus on pet wellness programs, and rising prevalence of chronic conditions like atopic dermatitis and osteoarthritis pain.

Which segments have been included in this report?

The market is segmented by Animal Type, Product, Therapy Area, Route of Administration, End User, and Region.

Which are the top players in the veterinary monoclonal antibodies market?

Leading companies include Zoetis Services LLC (US), Elanco (US), and Merck & Co., Inc. (US).

What are the factors expected to pose a challenge to the market's growth?

Challenges include limited species-specific knowledge and adverse events associated with antibody therapies.

Which is the fastest-growing animal type in this market?

The canine segment is projected to have the highest CAGR, driven by the increasing incidence of atopic dermatitis and a growing pet population.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Veterinary Monoclonal Antibodies Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Veterinary Monoclonal Antibodies Market