Veterinary Ophthalmology Equipment Market Size, Growth, Share & Trends Analysis

Veterinary Ophthalmology Equipment Market by Product (Ophthalmoscope, Retinoscope, Fundus Camera, Slit Lamp), Animal Type (Canine, Feline, Livestock), Application (Treatment, Surgery, Diagnosis, Monitoring), End User, Region - Global Forecast to 2031

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The global Veterinary Ophthalmology Equipment market, valued at USD 0.54 billion in 2025, stood at USD 0.57 billion in 2026 and is projected to advance at a resilient CAGR of 7.7% from 2026 to 2031, culminating in a forecasted valuation of USD 0.83 billion by the end of the period. Growth in the demand for early and precise diagnosis of ocular disorders among companion animals, rising adoption of advanced ophthalmic technologies such as digital slit lamps, optical coherence tomography (OCT), electroretinography (ERG), and tonometry systems, and growing focus on routine and preventive eye health examination of pets are some of the key factors driving this market. In addition, the increasing incidence of chronic, age-related, and infectious eye diseases, such as cataracts, glaucoma, retinal degeneration, and corneal ulcers, has been compelling veterinary clinics and specialty hospitals to invest in high-precision, high-performance ophthalmology equipment for reliable diagnosis, monitoring, and treatment planning.

KEY TAKEAWAYS

-

By RegionNorth America accounted for a share of 49.4% in 2025.

-

By ProductThe surgical equipment, disposables, and implants segment is expected to register the highest CAGR of 8.0%.

-

By Animal TypeThe canine segment is expected to dominate the market with a 45.0% share in 2025.

-

By ApplicationThe treatment segment is expected to register the highest CAGR of 8.0%.

-

By End UserThe veterinary hospital segment dominated the market, with a share of 40.0% in 2025.

-

Competitive Landscape - Key PlayersBausch + Lomb, Revenio Group Oyj, and Keeler Ltd were identified as some of the star players in the veterinary ophthalmology market, given their extensive global reach and comprehensive product portfolios.

-

Competitive Landscape - StartupsAJL Ophthalmic S.A., GerVetUSA, and Optibrand Ltd., among others, have distinguished themselves among startups and SMEs due to their specialized veterinary expertise and focused product capabilities.

The veterinary ophthalmology equipment market is witnessing steady growth due to increasing expenditure on specialty eye care in companion animals, rising interest in enhanced early diagnosis of eye ailments, and rising adoption of advanced technologies in veterinary practices. New-age technologies such as AI-based eye image evaluation, digital as well as portable eye imaging tools, and tele-ophthalmology solutions are gradually establishing themselves in the market. Also, rising partnerships among equipment manufacturers, veterinary centers, and research organizations are favoring the development of equipment as well as market development.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on consumer businesses within the veterinary ophthalmology equipment market is based on factors like the increasing requirement for specialized eye care services for companion animals, increasing complexities of eye diseases, and rapid innovations in eye testing and visualization tools. The increasing dependence of veterinary practices like animal hospitals, specialty animal practices, and referral practices on advanced equipment for performing eye tests, such as digital image systems, tonometer devices, and electrodiagnostic devices to enable faster and precise treatment options, represents another key element that is driving the effect of consumer businesses in the mentioned market space. The increasing demand for delivering precise and data-driven preventive ocular treatments and transforming practice workflows into a tele-ophthalmology platform also impact the market.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rising pet ownership and pet care expenditure

-

Increased prevalence of ocular diseases among animals.

Level

-

High cost of veterinary care

-

Limited awareness among pet owners

Level

-

Growing opportunities in emerging markets

-

Strategic developments by market players creating an opportunity for growth

Level

-

Limited availability of trained personnel

-

Variability in regulatory and reimbursement frameworks across regions

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rising pet ownership and pet care expenditure

The rising number of pet ownership, especially companion animals, and an increase in spending on their healthcare are key contributors to the growing veterinary ophthalmology equipment market. With an increase in the perception of pets being an essential part of families, their healthcare, especially ophthalmic healthcare, will be highly sought after. This trend will lead to an increase in the spending of animal healthcare facilities, including veterinary clinics, on advanced ophthalmic diagnostic tools, thereby boosting the veterinary ophthalmology equipment market.

Restraint: High cost of veterinary care

The relatively high cost involved in veterinary ophthalmology facilities and expensive equipment is currently proving to be one of the major factors hampering the growth of this market. Highly advanced equipment like digital slit lamps, fundus cameras, tonometers, and electrodiagnostic instruments is a prerequisite for veterinary practices worldwide. Such equipment oriented towards capital expenditures might act as a barrier for smaller veterinary practices. In fact, the cost involved in all kinds of ophthalmic procedures may prove to be a hindrance to pet owners seeking further consultations.

Opportunity: Growing opportunities in emerging markets

With improving veterinary infrastructure, increasing pet adoption, and rising awareness regarding companion animal health, emerging markets pose a strong growth opportunity for the veterinary ophthalmology equipment market. Growing urban populations coupled with higher disposable incomes spur demand for advanced veterinary services, including ophthalmic diagnostics and treatment. Additionally, specialty clinics and referral centers have established themselves only gradually in these regions, hence creating demand for ophthalmology equipment that is moderately priced, portable, and easy to use.

Challenge: Limited availability of trained personnel

The limited availability of trained veterinary ophthalmologists and qualified supporting personnel is an issue that may impede the adoption of advanced equipment for veterinary ophthalmology. Many advanced diagnostic equipment may necessitate training on how to operate them. In places where trained personnel are not available, the equipment may not be fully utilized or may be improperly operated, thus diminishing their benefits. This issue may result in a slowed adoption process for advanced veterinary ophthalmology equipment.

VETERINARY OPHTHALMOLOGY EQUIPMENT MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Provides veterinary-usable ophthalmic instruments, including surgical tools, lenses, and microsurgical equipment used in cataract extraction, corneal procedures, and general ophthalmic surgery in animals. | Supports high-precision eye surgery, improves surgical outcomes, and enables advanced treatment options for companion animals. |

|

Offers veterinary rebound tonometers (TONOVET Plus, TONOVET Pro, TONOVET Pet) designed for accurate intraocular pressure measurement in dogs, cats, rabbits, and horses. | Enables fast, accurate glaucoma screening without anesthesia; improves early disease detection and routine IOP monitoring in veterinary practices. |

|

Provides the Tono-Vera Vet tonometer, a veterinary-specific handheld device for objective IOP measurement with automated alignment for companion animals. | Improves reliability and consistency of IOP assessments; enhances clinical efficiency for glaucoma diagnostics in animals. |

|

Manufactures veterinary binocular indirect ophthalmoscopes (Vantage Plus), slit lamps (KSL-H range), and handheld ophthalmoscopes specifically used by veterinary ophthalmologists. | Enables detailed retinal and anterior segment evaluation, improving diagnostic accuracy and comprehensive eye examinations. |

|

Supplies handheld fundus cameras (e.g., Aurora IQ, Smartscope) adapted for veterinary eye imaging, allowing retinal, optic nerve, and anterior segment documentation in animals. | Facilitates high-quality imaging in general and specialty practices; supports tele-ophthalmology and early detection of retinal disease. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The ecosystem for the veterinary ophthalmology equipment market includes interdependent entities that promote the advancement, delivery, and application of ophthalmology solutions in the field of veterinary care. The central players in this market include the manufacturers of diagnostic and imaging equipment for the management of eye disease in companion animals, along with the support of distribution and service entities for the delivery of these solutions. The major end users of these products are the veterinary clinics, specialty ophthalmology practices, and referral hospitals. The other entities that help contribute towards the growth of the market include the technology companies that provide solutions for imaging and the regulatory authorities that ensure the safety and compliance of veterinary ophthalmology equipment.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Veterinary Ophthalmology Equipment Market, By Product

As of 2025, the surgical equipment, disposables, and implants segment held the largest share of the veterinary ophthalmology equipment market because of a huge number of ophthalmic surgeries in pets. This includes relatively common ailments in pets such as cataracts, glaucoma, corneal injuries, and eyelid abnormalities, where surgeries are common. Furthermore, ophthalmic surgeries also require disposables and implants repeatedly since they need to be replaced for every surgical procedure. Advanced veterinary ophthalmologic surgical procedures are also increasing in availability. In addition to this, pet owners are also more willing to undertake corrective eye surgeries which further fuels the growth of this segment.

Veterinary Ophthalmology Equipment Market, By Animal Type

In 2025, canines dominated the veterinary ophthalmology equipment market as they have the highest world population, and in addition, they suffer from eye diseases more frequently than other pets. A number of studies have shown that canine eye problems include cataracts, glaucoma, progressive retinal atrophy, corneal ulcers, and even breed-specific hereditary eye diseases that require the pets to be regularly screened, diagnosed, and probably operated on. Besides that, dogs are the animals brought most frequently to veterinary clinics for specialty eye care, and therefore, pet owners tend to be more willing to pay for advanced diagnostic and surgical treatments in the case of canines, which leads to a higher use of veterinary ophthalmology equipment.

Veterinary Ophthalmology Equipment Market, By Application

As of 2025, the treatment segment held the largest share of the veterinary ophthalmology equipment market since the incidence of ocular conditions requiring active medical or surgical intervention is very high in companion animals. Common eye disorders include cataracts, glaucoma, corneal injuries, and infections-all disorders usually needing long-term interventions by surgical instruments, implants, and therapeutic devices. Another important factor is that most ophthalmic conditions require follow-up procedures and long-term management, thus increasing repeat utilization of treatment solutions. Advancing availability of highly developed surgical techniques and a growing willingness of pet owners to opt for corrective and vision-preserving treatments support the leading market position of the treatment segment.

Companion Animal Diagnostics Market, By End User

The specialty clinics segment is expected to dominate the veterinary ophthalmology equipment market because they are specialized in providing sophisticated eye care, as compared with general veterinary practices. Specialty clinics can be expected to handle referrals, which could be related to the treatment and management of persistent, inherited, or severe ocular disease, thereby requiring sophisticated equipment for diagnosis, imaging, and surgery. Furthermore, the availability of sophisticated veterinary ophthalmologists and the financial capacity to invest in equipment would be significantly better in the case of specialty clinics, thereby making this segment the leading sector in the veterinary ophthalmology equipment market.

REGION

Asia Pacific to be fastest-growing region in global veterinary ophthalmology equipment market during forecast period

The Asia Pacific market is witnessing the fastest growth in the veterinary ophthalmology equipment market owing to the rapid adoption of pets, rising per capita disposable income, and growing awareness among individuals about animal health and specialty veterinary care practices. The rising rate of urbanization and the growing middle-class population are resulting in increased expenditure on high-quality veterinary care, including ophthalmologic treatment and testing. Furthermore, advancements in veterinary care, the increasing establishment of specialty veterinary care centers, and easy access to sophisticated equipment in countries like China, Japan, India and Australia are acting as the key drivers for the fast growth rate experienced in the Asia Pacific market. Government initiatives and the growing influence of global and regional manufacturers are adding to the fast-moving market.

VETERINARY OPHTHALMOLOGY EQUIPMENT MARKET: COMPANY EVALUATION MATRIX

In the matrix for veterinary ophthalmology equipment, Bausch + Lomb (Star) leads the market because of its strong market presence, due to its extensive ophthalmology portfolio. Its long-standing experience in the field of ophthalmology also supports its leading market position. At the same time, LKC Technologies, Inc. (Emerging Leader) is strengthening its market position with its innovative electrodiagnostic equipment, especially ERG systems for the diagnosis of retinal and inherited eye diseases in animals. Bausch + Lomb and LKC Technologies are thus at the forefront of the rapidly growing veterinary ophthalmology equipment market.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Bausch + Lomb (US)

- Revenio Group Oyj (Finland)

- Keeler Ltd (UK)

- Baxter (US)

- Alcon Inc. (Switzerland)

- Reichert, Inc. (US)

- HEINE Optotechnik GmbH & Co. KG (Germany)

- LKC Technologies, Inc. (US)

- Iridex Corporation (US)

- Optomed Plc (Finland)

- an-vision (Germany)

- Eidolon Optical, LLC (US)

- YSENMED (China)

- Kowa Company, Ltd. (Japan)

- Eickemeyer KG (Germany)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2025 (Value) | USD 0.54 BN |

| Market Forecast in 2031 (Value) | USD 0.83 BN |

| Growth Rate | CAGR of 7.7% during 2026-2031 |

| Years Considered | 2024-2031 |

| Base Year | 2025 |

| Forecast Period | 2026-2031 |

| Units Considered | Value (USD Billion), Volume (Thousand Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Related Segment & Geographic Reports | US Veterinary Ophthalmology Equipment Market |

WHAT IS IN IT FOR YOU: VETERINARY OPHTHALMOLOGY EQUIPMENT MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Product Analysis | Assessed key ophthalmic devices—ophthalmoscopes, slit lamps, tonometers, fundus cameras, ERG systems, surgical tools, and implants. Compared technology features, pricing, and adoption trends across major manufacturers. | Helped identify technology shifts, unmet clinical needs, and opportunities for product positioning and portfolio expansion. |

| Company Information | Profiled leading players (Bausch + Lomb, Alcon, Keeler, Reichert, Optomed, LKC Technologies). Analyzed portfolios, market presence, and competitive strategies. | Provided clarity on competitive strengths, differentiation areas, and partnership opportunities in the veterinary ophthalmology landscape. |

| Geographic Analysis | Provided detailed regional analysis of veterinary ophthalmology equipment demand across the Rest of APAC, focusing on pet ownership trends, availability of specialty veterinary eye care, clinic infrastructure, and adoption of advanced ophthalmic equipment. | Supported regional strategy planning by identifying high-growth markets, localization opportunities, and expansion priorities for veterinary ophthalmology equipment manufacturers. |

RECENT DEVELOPMENTS

- May 2025 : Revenio Group Oyj highlighted improved accuracy of its TONOVET Plus and TONOVET Pro tonometers for veterinary intraocular pressure measurement, strengthening their use in animal glaucoma assessment.

- February 2025 : Keeler Ltd has started local production in Shanghai of its main product, the binocular indirect ophthalmoscope and slit lamps, which would help in the distribution of BIO, the Vantage Plus, and the KSL-H slit lamp series in China while continuing operations in the UK.

Table of Contents

Methodology

The study involved four major activities in estimating the current size of the veterinary ophthalmology equipment market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

The secondary research process involved the widespread use of secondary sources, directories, databases (such as Bloomberg Businessweek, Factiva, and D&B Hoovers), white papers, annual reports, company house documents, investor presentations, and SEC filings of companies. Secondary research was used to identify and collect information useful for the extensive, technical, market-oriented, and commercial study of the veterinary ophthalmology equipment market. It was also used to obtain important information about the key players and market classification and segmentation according to industry trends to the bottom-most level, and key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing and sales directors, technology & innovation directors, and related key executives from various key companies and organizations operating in the veterinary ophthalmology equipment market. The primary sources from the demand side included industry experts, purchase & sales managers, doctors, and personnel from research organizations. Primary research was conducted to validate the market segmentation, identify key players in the market, and gather insights on key industry trends and key market dynamics.

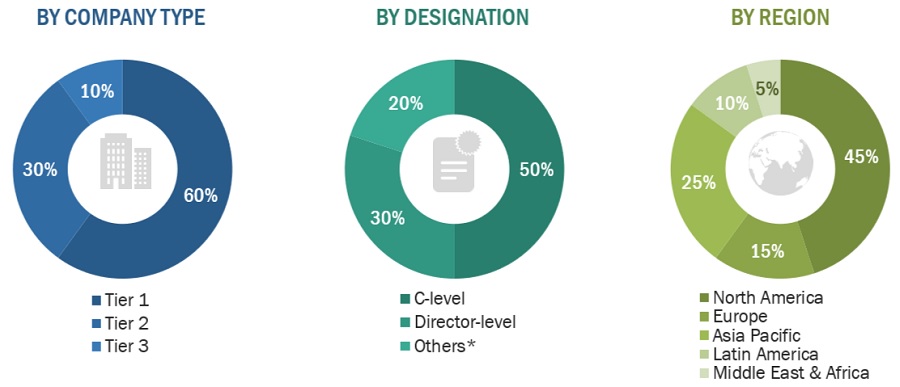

A breakdown of the primary respondents for the veterinary ophthalmology equipment market is provided below:

Note 1: C-level primaries include CEOs, COOs, CTOs, and VPs.

Note 2: Other primaries include Others include sales managers, marketing managers, and product managers.

Note 3: Companies are classified into tiers based on their total revenue. As of 2023: Tier 1=>USD 1 billion, Tier 2 = USD 500 million to USD 1 billion, Tier 3=<USD 500 million

To know about the assumptions considered for the study, download the pdf brochure

The research methodology used to estimate the size of the veterinary ophthalmology equipment market includes the following details.

The market sizing of the market was undertaken from the global side.

Country-level Analysis: The size of the veterinary ophthalmology equipment market was obtained from the annual presentations of leading players and secondary data available in the public domain. The share of products in the overall veterinary ophthalmology equipment market was obtained from secondary data and validated by primary participants to arrive at the total veterinary ophthalmology equipment market. Primary participants further validated the numbers.

Geographic market assessment (by region & country): The geographic assessment was done using the following approaches:

Approach 1: Geographic revenue contributions/splits of leading players in the market (wherever available) and respective growth trends

Approach 2: Geographic adoption trends for individual product segments by end users and growth prospects for each of the segments (assumptions and indicative estimates validated from primary interviews)

At each point, the assumptions and approaches were validated through industry experts contacted during primary research. Considering the limitations of data available from secondary research, revenue estimates for individual companies (for the overall veterinary ophthalmology equipment market and geographic market assessment) were ascertained based on a detailed analysis of their respective product offerings, geographic reach/strength (direct or through distributors or suppliers), and the shares of the leading players in a particular region or country.

Global veterinary ophthalmology equipment Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Global veterinary ophthalmology equipment Size: Top-Down Approach

Data Triangulation

After arriving at the overall market size—using the market size estimation processes explained above—the market was split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

Veterinary ophthalmology equipment refers to specialized tools, instruments, and devices used by veterinarians and veterinary ophthalmologists for the diagnosis, treatment, and management of eye-related conditions in animals. This equipment is designed to facilitate various aspects of ophthalmic care for animals, ranging from routine eye examinations to advanced surgical procedures. Veterinary ophthalmology equipment may include diagnostic tools such as ophthalmoscopes, tonometers, slit lamps, and ocular ultrasound machines, which enable veterinarians to assess the health of the eye, diagnose diseases, and monitor treatment progress.

Key Stakeholders

- Manufacturers of veterinary ophthalmology equipment

- Veterinary ophthalmology equipment suppliers & distributors

- Original equipment manufacturers (OEMs)

- Veterinary hospitals & clinics

- Distributors of veterinary ophthalmology equipment

- Contract research organizations (CROs)

- Medical device research & consulting firms

- Academic & research institutes

- Veterinary research institutes

- Veterinary diagnostic laboratories

- Animal health research & development (R&D) companies

- Government associations

- Market research & consulting firms

- Venture capitalists & investors

Objectives of the Study

- To define, describe, and forecast the veterinary ophthalmology equipment market by product, application, animal type, end user, and region

- To provide detailed information regarding the major factors influencing the market growth (such as drivers, restraints, opportunities, and challenges)

- To analyze the micromarkets with respect to individual growth trends, prospects, and contributions to the overall veterinary ophthalmology equipment market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the size of the veterinary ophthalmology equipment market in five regions: North America (US and Canada), Europe (Germany, the UK, France, Spain, Italy, and the Rest of Europe), the Asia Pacific (Japan, China, India, Australia, South Korea, and the Rest of Asia Pacific), Latin America, and the Middle East & Africa

- To analyze the impact of the economic recession on the growth of the veterinary ophthalmology equipment market

- To strategically profile the key players in the global market and comprehensively analyze their core competencies

- To track and analyze competitive developments, such as partnerships, collaborations, and agreements, of the leading players in the market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Geographic Analysis

Further breakdown of the Rest of Asia Pacific veterinary ophthalmology equipment market into Indonesia, Philippines, Vietnam, Hong Kong, and other countries

Further breakdown of the Rest of Europe veterinary ophthalmology equipment market into Belgium, Russia, the Netherlands, Switzerland, and other countries.

Further breakdown of the Latin America veterinary ophthalmology equipment market into Brazil, Argentina, Peru, and other countries.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Veterinary Ophthalmology Equipment Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Veterinary Ophthalmology Equipment Market