Vibration Damping Materials Market

Vibration Damping Materials Market by Type (Polymer, Metal, Composite), Form (Films & Sheets, Pads & Tapes, Foams & Gaskets), Application (Automotive, Industrial Machinery, Aerospace & Defense, Electronics) - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The vibration damping materials market is estimated to grow from USD 10.70 billion in 2024 to USD 14.16 billion by 2030, at a CAGR of 4.81% between 2025 to 2030. This growth is due to increasing urbanization which further leads to expansion of construction, automotive, and electronics industries, which demands the vibration damping materials. vibration damping materials are specialized materials designed to reduce noise, vibrations, and harshness (NVH) in various applications across industries. These materials help in absorbing and dissipating vibrational energy, preventing excessive wear and structural fatigue in machinery, vehicles, and infrastructure.

KEY TAKEAWAYS

-

BY TYPEComposites have come to be regarded as the rapidly growing type of vibration damping materials because of their lightweight, high strength, and excellent damping properties. The materials are plastic-metal-fiber reinforced compound combinations that show better vibration absorption than rubber and conventional foams, now a well-established type of vibration damping materials. The growing investments in composite damping solutions in automotive, aerospace, electronics, and construction sectors are driving demand for electric vehicles, aircraft structures, and high-tech consumer devices. Composites are actively helping with noise and durability enhancement and with performance enhancement toward sustainability. Increased demand for lightweight and high-performance materials with environmental-friendliness has set the stage for composites to be the choice for innovation in the area of next-generation vibration damping technologies.

-

BY FORMThe pads and tapes vibration damping materials are projected to be the fastest-growing segment in the market since they are easy to apply, flexible, and feature high-performance damping properties. The materials are usually viscoelastic polymers, foams, and composites, which are generally applied in automotive, electronics, aerospace, and industrial applications for the reduction of noise, vibrations, and harshness (NVH). The demand for these materials in the market is mainly propelled by their use in self-adhesive damping tapes in electric vehicles (EVs), smartphones, home appliances, and machinery. Light enough and customizable, self-adhesive damping tapes also find applications in miniaturized electronic devices and lightweight vehicle components. Pads & tapes therefore constitute the most important material for next-generation noise control technologies, especially with increasing demand for vibration damping solutions that are efficient, durable, and easier to install.

-

BY END-USE INDUSTRYThe end-use industry for electronics, primarily due to its rising usage in smartphones, laptops, various wearables, and consumer appliances, shall be the fastest growing in terms of end-use markets for vibration-damping materials. Because of miniaturization, as it inevitably has been, technology shrinkage reduces the size of electronic devices and leads to the growing need for vibration control for protection of delicate electronic components, such as PCBs, hard drives, and microchips, from possible mechanical shocks and performance degradation. The further mass distribution of 5G technology, IoT devices, and AI-compatible systems is accelerating the growing demand for highly efficient damping materials. Riding on the waves of demand created by the automotive electronics sector-EV battery management systems, infotainment units-the electronics altogether end-use segment is set to ride the wave of miniaturization, increasing production, and stringent durability requirements of electronic products to be one of the key engines driving vibration damping innovations.

-

BY REGIONThe Middle East & Africa segment, according to the projections, will register the third highest growth in the vibration damping materials market in value, during the forecast period 2025-2030. The newly emerging applications in industrial machinery and construction and automotive sectors will spur this use in the region. Increasing urbanization and infrastructural development in countries such as Saudi Arabia, the UAE, and South Africa demand efficient noise and vibration control solutions. The growing aerospace and defense industries and increased investments in oil & gas refineries and manufacturing plants are expected to add more fuel for adopting vibration damping materials in Middle East & Africa.

-

COMPETITIVE LANDSCAPEThe major market players have adopted both organic and inorganic strategies including expansion, collaborations, partnerships, acquisitions and investments. For instance, Marian Inc. expanded its Indianapolis headquarters in 2020, adding 30,000+ square feet to enhance die-cutting and converting capabilities, supporting increased demand for precision-engineered solutions, including vibration damping materials.

The major factors contributing to the growth of the global vibration damping materials market are the increasing demand in automotive, electronics, industrial machinery, especially in Asia Pacific. The burgeoning disposable income, rising standard of living, and increasing manufacturing facilities, and infrastructural development contribute to the market growth in the region. Factors restraining the growth of the vibration damping materials market are the performance trade-offs and material durability issues and limited awareness and adoption in emerging economies. Emerging applications in renewable energy and industrial automation is expected to act as an opportunity for stakeholders to grow in the vibration damping materials market.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

In the automotive, industrial machinery, electronics, and building & construction sectors, advancements in sustainability, smart materials, andd regulatory compliance are driving the change. Stricter global regulations in automotive, industrial equipment, and infrastructure development are pushing end users toward eco-friendly, non-toxic, and high-performance vibration damping solutions. The demand for lightweight, recyclable, and adaptive damping materials is increasing aligning with sustainability goals across industries.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rising demand for Noise and Vibration Reduction in Automotive Industry

-

Stringent Noise and Safety Regulations Across Industries

Level

-

Performance trade-offs and material durability issues

-

Limited awareness and adoption in emerging economies

Level

-

Emerging applications in renewable energy and industrial automation

-

Advancements in aerospace and space exploration

Level

-

Complex manufacturing processes and high R&D costs

-

Supply chain disruptions and raw material availability

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rising demand for Noise and Vibration Reduction in Automotive Industry

The increasing demand for noise and vibration reduction in the automotive industry is one of the drivers for the vibration-damping materials market. Consumers want silent, smoother, and comfortable driving experiences therefore, the automobile companies have no recourse but to employ advanced damping solutions. More stringent vehicle noise regulations and rising concern for NVH (noise, vibration, and harshness) control only speed up this phenomenon. The great uptake of EVs, which already lack traditional engine noise, renders vibration damping critical to reduce road, wind, and mechanical sounds. Finally, lightweight and high-end materials are also being introduced into modern vehicle design to create durable, efficient, and passenger-comfort-enhanced combinations of design concepts, leading thus to more opportunities for new damping technologies in the automotive sector.

Restraint: Performance trade-offs and material durability issues

Performance trade-offs and durability from the materials are one of the key constraints in the noise and vibration damping material market. Damping materials typically reduce noise and vibration but compromise on the following factors: strength, weight, or thermal resistance. For instance, polymer-based materials hear up good damping performance, but they fail in very high temperatures, or they are exposed to chemicals and UV continuously. Metal-based solutions for strength can add considerable weight, making them unsuitable for lightweight applications such as those found in the automotive and aerospace industries. Also, the fact that they will wear down in high-vibration environments means that they can have a reasonably short life and not only does this cause frequent replacement, but also high costs associated with maintenance which is one of the major barriers to market adoption and growth.

Opportunity: Advancements in aerospace and space exploration

Space advancement in aerospace and space exploration creates a huge avenue for the market of vibration damping materials. As aircraft as well as spacecraft operate in extreme conditions, it becomes necessary to reduce their vibrations so that the structures are not compromised in integrity, safety, and performance. Adding to the intensifying demand for high-performance damping technology turns out to be the high use of lightweight composite materials in aerospace manufacturing as they generate strong vibrations due to a plethora of factors- engine, aerodynamics, and external forces when subjected to extreme conditions. Rising numbers of commercial space travel, satellite launches, and missions into deep space not only increase the demand for damping materials that will perform under more extreme conditions but also require qualities like life and robustness. Advanced coatings, nanomaterials, and smart damping technology particularly enhance the performance and make this segment a high-growth segment of vibration control solutions.

Challenge: Complex manufacturing processes and high R&D costs

The major challenges that vibration-damping materials faces in the market are rooted in complex manufacturing processes and high research and development costs. To develop high-performance damping materials, advanced formulations precision engineering, and extensive testing are required for development, implying long development cycles and expensive costs. Manufacturers also must balance damping efficiency with durability, weight, and environmental compliance, thus making the production process a little bit more complicated. Adoption of nanotechnology, smart materials, and bio-based solutions raises R&D further. Additionally, small and medium-scale companies face the challenge of using expensive production techniques and scalability issues, which limits their entry into markets. Thus, high initial investments and continuous innovation requirements restrict widespread adoption to a good extent and are most used in price-sensitive industries like automotive and consumer electronics.

Vibration Damping Materials Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Used in vehicle body panels, engine compartments, and dashboards to reduce noise, vibration, and harshness (NVH). | Enhances ride comfort, lowers cabin noise, and improves overall vehicle quality and customer satisfaction. |

|

Applied in fuselage structures and cabin interiors to minimize vibration transmission and enhance passenger comfort. | Improves passenger comfort, reduces structural fatigue, and extends aircraft component lifespan. |

|

Integrated into appliances and electronic devices like washing machines and smartphones to reduce operational noise and improve stability. | Increases product durability, reduces operational noise, and enhances user experience. |

|

Used in turbines, compressors, and generators to control vibration, improving equipment efficiency and lifespan. | Minimizes mechanical wear, improves energy efficiency, and reduces maintenance frequency. |

|

Implemented in locomotives and rail systems to dampen structural vibrations, enhancing durability and passenger comfort. | Enhances ride smoothness, extends component life, and reduces noise levels for |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The vibration damping materials ecosystem includes companies which are manufacturing range of damping solutions, from viscoelastic polymers to composite sheets, leveraging advanced R&D and proprietary technologies, such as 3M, Nitto Denko Corporation, LINTEC Corporation, Gummiwerk KRAIBURG, Sorbothane Inc., Countervail Products LLC, Marian Inc., Trelleborg AB, Kitagawa Industries Co., Ltd., Megasorber Pty Ltd, Stockwell Elastomerics, Technicon Acoustics, Inc., and others.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Vibration Damping Materials Market, By Type

The metals segment is expected to be the third fastest-growing segment in the vibration damping materials market in terms of value-that is, during the forecast period from 2025 to 2030. Metals such as aluminum, copper, and steel have high durability, thermal stability, and damping characteristics; therefore, they are widely employed in applications that include automotive manufacture, aerospace, and industrial machinery. The increasing demand for high-performance damping of heavy applications and structural components is a significant factor in this growth. The recent innovations in metal-based composite materials and their incorporation into hybrid damping systems offer huge potential expansion for these materials as core players in vibration control technology.

Vibration Damping Materiala Market, By Form

The foams & gaskets segment is projected to be the third fastest growing segment of the vibration damping materials market in terms of value. This growth will be a result of rising adoption of lightweight and flexible solutions for the automotive, electronics, and industrial machinery applications. Dust and dirt protection, and temperature barriers, are among the outstanding attributes of foams and gaskets, which also serve in areas where impact shock absorption, sound attenuation, and added durability under dynamic environments are needed. Demand from the industry is further propelled by increased application for low-cost, high efficiency sealing solutions for items like electric vehicles, aerospace and defense, and precision equipment. Besides, continued innovation in foams based on polyurethane and silicone may improve their function and widen the applications for which they are useful.

Vibration Damping Materiala Market, By End-use Industry

The industrial machinery segment is projected to grow at a brisk rate, which makes it the third fastest-growing end-use industry in the vibration damping materials market during the forecast period from 2025 to 2030. This growth is majorly driven by the increasing demand for high-precision and low-noise machinery used in manufacturing, heavy equipment, and automation industries. As industrial operations become more automated and efficient, so does the need to control vibrations to enhance equipment life, reduce maintenance costs, and safely operate work-life. Another factor that adds to demand is the use of advanced materials and smart damping technologies in robotics, CNC machines, and heavy-duty machinery.

REGION

Asia Pacific is expected to be the largest and fastest growing market for vibration damping materials during the forecast period

The vibration damping materials market is expected to grow at the fastest rate in Asia-Pacific, because of rapid infrastructural development, urbanization, and industrialization in the regions. Moreover, the growing automotive sector- along with the burgeoning penetration of electric vehicles (EVs)- is the reason for increasing demand for noise, vibration, and harshness (NVH) solutions. Growth in the market is also driven by the trade in aerospace and defence industry, high-speed rail projects, and increased manufacturing operations. Affordable, efficient, and improved durable products are being developed in these countries-including China, Japan, South Korea, and India-to make automobiles and electronics as well as industrial demands better: because of stringent environmental regulations, high performance, and lightweight demands for damping solutions, Asia-Pacific is seeing increasingly rise as a market for cutting-edge green technologies for improved vibration control.

Vibration Damping Materials Market: COMPANY EVALUATION MATRIX

In the Vibration Damping Materials Market matrix, 3M (Star) leads with a strong market presence and wide product portfolio, driving large-scale adoption across applications. Gummiwerk KRAIBURG GmbH & Co. KG (Emerging Leader) is gaining traction due to its diversified product portfolio and continuous investment in R&D. While 3M dominates with scale, Gummiwerk KRAIBURG GmbH & Co. KG shows strong growth potential to advance toward the leaders’ quadrant.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size Value in 2024 | USD 10.70 BN |

| Revenue Forecast in 2030 | USD 14.16 BN |

| Growth Rate | CAGR of 4.81% from 2025-2030 |

| Actual data | 2020−2030 |

| Base year | 2024 |

| Forecast period | 2025−2030 |

| Units considered | Value (USD Billion) and Volume (Kiloton) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regional Scope | Asia Pacific, Europe, North America, Middle East & Africa, and South America |

WHAT IS IN IT FOR YOU: Vibration Damping Materials Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Europe -based Vibration Damping Mateials Manufacturer | • Detailed Europe based company profiles of competitors (financials, product portfolio) • Customer landscape mapping by application sector • Partnership ecosystem analysis | • Identify interconnections and supply chain blind spots • Detect customer migration trends across the industry • Highlight untapped customer clusters for market entry |

| Asia Pacific-based Vibration Damping Materials Manufacturer | • Global & regional production capacity benchmarking • Customer base profiling across the applications | • Strengthen forward integration strategy • Identify high-demand customers for long-term supply contracts • Assess supply-demand gaps for competitive advantage |

RECENT DEVELOPMENTS

- January 2024 : 3M launched a 13.5 mil thick aluminum foil-backed tape that reduces structure-borne noise and fatigue in metal and composite panels with minimal surface coverage.

- January 2023 : Nitto Denko Corporation launched a specialized damping material designed to reduce rainfall noise on metal ceilings, providing stable adherence and effective noise reduction across various temperatures

- October 2022 : Nitto Denko Corporation transferred a portion of its NVH business to Parker Corporation, aligning with its strategic focus on next-generation mobility while strengthening its NVH segment through a strategic partnership.

- May 2022 : 3M lanched a 7.5 mil thick, silver, dead soft aluminum foil tape designed to reduce noise and absorb vibration, primarily in metal and composite panels.

- November 2020 : Marian Inc. expanded its Indianapolis headquarters in 2020, adding 30,000+ square feet to enhance die-cutting and converting capabilities, supporting increased demand for precision-engineered solutions, including vibration damping materials.

Table of Contents

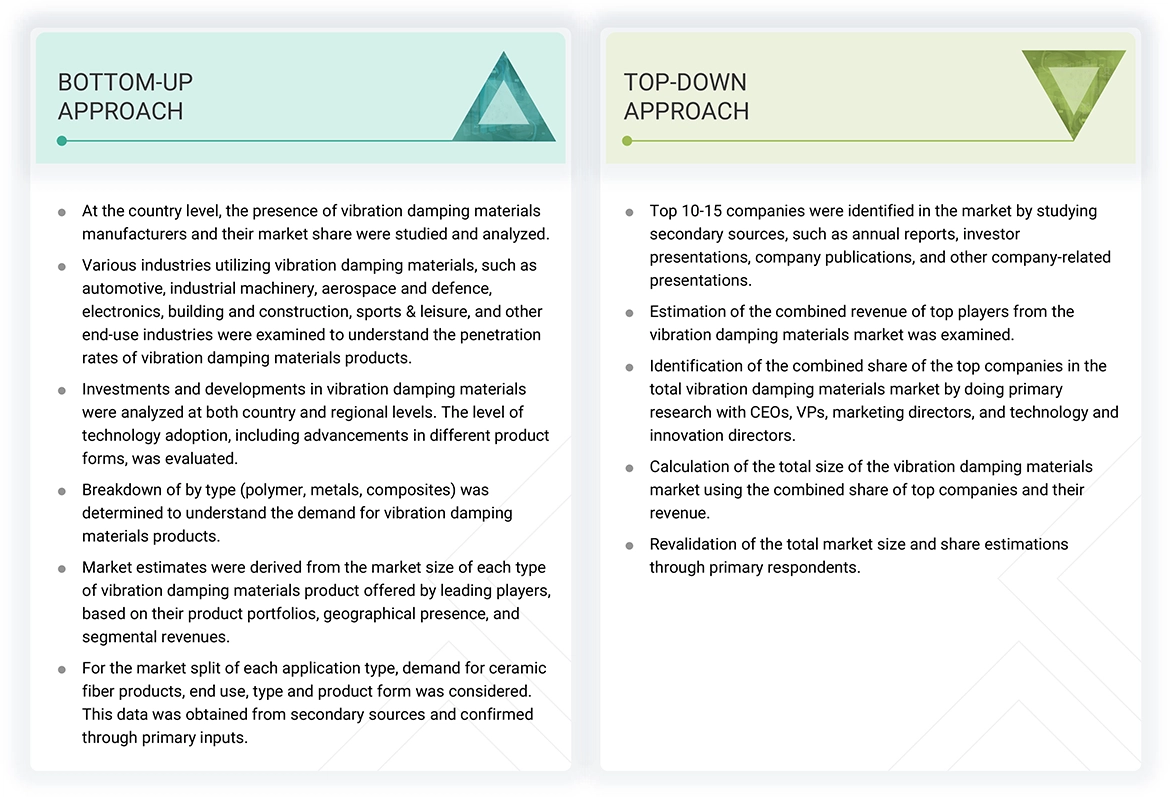

Methodology

The study involved four major activities in estimating the market size for vibration damping materials. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Post that, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

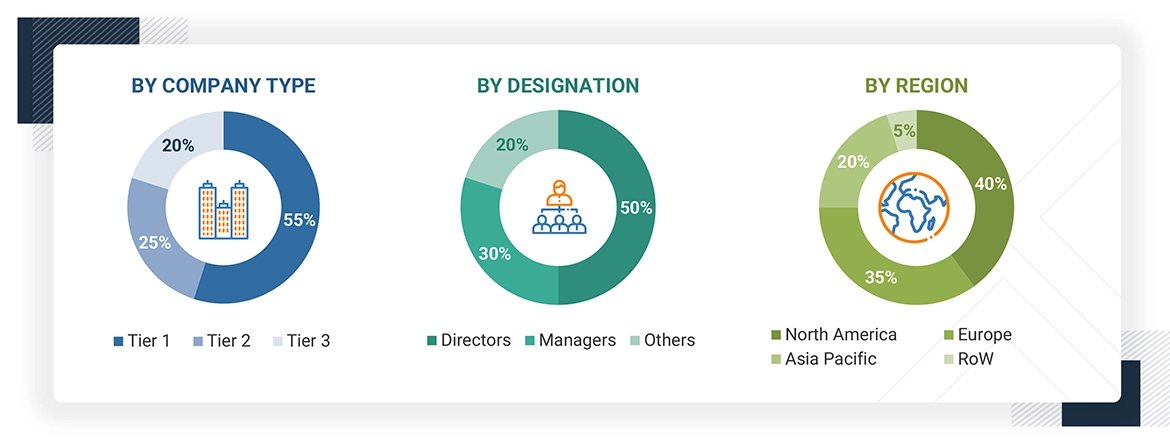

Secondary sources used in this study included annual reports, press releases, and investor presentations of companies; white papers; certified publications; articles from recognized authors; and gold standard & silver standard websites such as Factiva, ICIS, Bloomberg, and others. The findings of this study were verified through primary research by conducting extensive interviews with key officials such as CEOs, VPs, directors, and other executives. The breakdown of profiles of the primary interviewees is illustrated in the figure below:

Primary Research

The vibration damping materials market comprises several stakeholders, such as raw material suppliers, end-product manufacturers, and regulatory organizations in the supply chain. The demand side of this market is characterized by the automotive, industrial machinery, aerospace and defence, electronics, building and construction, sports & leisure, and others. The supply side is characterized by advancements in technology and diverse end-use industries. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative informations.

Breakdown of Primary Participants

Note: Tier 1, Tier 2, and Tier 3 companies are classified based on their market revenue in 2023 available in the public domain, product portfolios, and geographical presence.

Other designations include consultants and sales, marketing, and procurement managers.

To know about the assumptions considered for the study, download the pdf brochure

| COMPANY NAME | DESIGNATION | |

|---|---|---|

| 3M | Director of Marketing | |

| Nitto Denko Corporation | Manager- Sales & Marketing | |

| Trelleborg AB | Sales Manager | |

| LINTEC Corporation | Production Manager | |

| Kitagawa Industries Co., Ltd. | Manager | |

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the vibration damping materials market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry have been identified through extensive secondary research.

- The supply chain of the industry has been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

Vibration Damping Materials Market: Top-Down Approach

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the vibration damping materials industry.

Market Definition

According to the International Institute of Noise Control Engineering (I-INCE), vibration damping materials are specialized materials designed to reduce noise, vibrations, and harshness (NVH) in various applications across industries. These materials help in absorbing and dissipating vibrational energy, preventing excessive wear and structural fatigue in machinery, vehicles, and infrastructure. Even under extreme operating conditions, they enhance stability, minimize resonance, and improve overall system efficiency. Vibration damping materials are specifically engineered for use in high-performance applications, including automotive, industrial machinery, electronics, and building & construction, where noise reduction, durability, and enhanced operational lifespan are critical. These materials play an essential role in optimizing system performance, extending component life, and improving user comfort and safety across diverse sectors.

Stakeholders

- Vibration Damping Materials Manufacturers

- Vibration Damping Materials Traders, Distributors, and Suppliers

- End-use Market Participants of Different Segments of Vibration Damping Materials

- Government and Research Organizations

- Associations and Industrial Bodies

- Research and Consulting Firms

- R&D Institutions

- Environment Support Agencies

- Investment Banks and Private Equity Firms

Report Objectives

- To define, describe, and forecast the vibration damping materials market in terms of value and volume

- To provide detailed information regarding the drivers, opportunities, restraints, and challenges influencing market growth

- To estimate and forecast the market size by type, by form, end-use industries, and region

- To forecast the size of the market for five main regions: Europe, North America, Asia Pacific, South America, and the Middle East & Africa, along with their key countries

- To strategically analyze micromarkets1 with respect to their growth trends, prospects, and contribution to the overall market

- To analyze opportunities in the market for stakeholders and provide a competitive landscape for market leaders

- To analyze competitive developments, such as deals and expansions, in the market

- To analyze the impact of the recession on the market

- To strategically profile key players and comprehensively analyze their growth strategies

Key Questions Addressed by the Report

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Vibration Damping Materials Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Vibration Damping Materials Market