Wastewater Surveillance Market Size, Growth, Share & Trends Analysis

Wastewater Surveillance Market by Product (Instruments & Equipment (Samplers, Ultracentrifuge, qPCR, Portable), Assays & Kits, Consumables), Application (Pathogen Detection, AMR Tracking), End User (Public Health, Govt, Hospitals) - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The global wastewater surveillance market is expected to see substantial growth, with projections indicating it will reach USD 1.22 billion by 2030 from USD 0.88 billion in 2025, with a CAGR of 6.7%. Wastewater surveillance is increasingly seen as a reliable early warning tool for public health threats, including asymptomatic infections like polio, mpox, and antimicrobial resistance (AMR). Governments and health agencies are more often integrating these systems into standard epidemiological frameworks following COVID-19. Meanwhile, advances in real-time analytics, genomic sequencing, and biosensor technologies are enhancing the sensitivity and speed of wastewater-based detection.

KEY TAKEAWAYS

-

BY TYPEThe wastewater surveillance market is divided into segments based on product types, including instruments & equipment, detection assays & testing kits, software solutions, and consumables & accessories. Instruments and equipment, especially automated wastewater samplers, PCR/qPCR devices, and NGS sequencers, dominate because they are essential for enabling accurate, large-scale, and repeatable testing processes

-

BY APPLICATIONThe wastewater surveillance market can be divided into four main application areas: infectious disease surveillance, antimicrobial resistance (AMR) monitoring, industrial and environmental pollution detection, and other applications. Among these, infectious disease surveillance has the largest share due to its proven ability to provide early, population-wide indicators of disease outbreaks before clinical cases are reported.

-

BY END USERThe wastewater surveillance market can be divided into following end users: government & regulatory agencies, public health authorities, research & academic institutions, wastewater treatment plants, contract testing & analytical laboratories, and other end users. Among these, in 2024, government and municipal agencies lead the wastewater surveillance market due to their role in protecting public health, ensuring regulatory compliance, and monitoring environmental quality.

-

BY REGIONThe wastewater surveillance market covers Europe, North America, the Asia Pacific, South America, and Middle East, and Africa. North America is the largest market for wastewater surveillance services due to its strong institutional framework, advanced technological integration, and proactive public health initiatives. A key driver is the Centers for Disease Control and Prevention’s (CDC) National Wastewater Surveillance System (NWSS), which monitors pathogens like SARS-CoV-2, Influenza A, RSV, and MPOX across a broad network of communities.

-

COMPETITIVE LANDSCAPEThe major market players have adopted both organic and inorganic strategies including partnerships and investments. For instance, Thermo Fisher Scientific Inc. (US), Bio-Rad Laboratories (US), and IDEXX Laboratories (US) are entered into number of agreements and partnerships to cater the growing demand for wastewater surveillance.

The surge is fueled by increased global focus on public health preparedness, the need for early outbreak detection, and rising regulatory emphasis on environmental monitoring. Governments, utilities, and research institutions are incorporating wastewater surveillance into routine health security systems, supported by growing investments in advanced molecular diagnostics and automated sampling technologies. Progress in PCR, digital PCR, next-generation sequencing, biosensors, and cloud-based analytics is enabling faster, more accurate, and scalable monitoring capabilities across geographies.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The global wastewater surveillance market is undergoing significant changes driven by technological innovation, regulatory requirements, and increasing public health awareness. Improvements in real-time monitoring, AI-driven analytics, and IoT-enabled sensors are allowing faster and more precise detection of contaminants. At the same time, stricter environmental and health regulations are prompting businesses and municipalities to invest in comprehensive surveillance systems. Disruptions such as decentralized treatment solutions, cloud-based data platforms, and the growing demand for predictive insights are transforming traditional operational models, forcing customers worldwide to balance cost, compliance, and performance in a more dynamic and competitive market.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Institutional rollout and official programs

-

Broader pathogen scope & public-health adoption

Level

-

Fragmented procurement and limited long-term budgets

-

Analytical and interpretation complexity

Level

-

Integration of wastewater surveillance with digital epidemiology and AI analytics

-

Expansion to multi-parameter public health and environmental intelligence platform from pandemic-driven pathogen monitoring tool

Level

-

Fragmented regulatory framework and lack of global standardization

-

High operational costs and infrastructure limitations in resource-poor settings

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Institutional rollout and official programs.

Government programs serve as the main structural drivers for wastewater surveillance because they generate sustained, large-scale demand and predictable procurement cycles. In the US, CDC’s National Wastewater Surveillance System (NWSS) has evolved into a national backbone: the CDC reports approximately 1,602 wastewater sampling sites reporting in the last two months, covering an estimated 151 million people (~45% of the U.S. population), up from just a few hundred sites early in the pandemic. These scale figures matter because NWSS recommends sampling twice weekly at many sites to produce timely trend signals — a schedule that boosts sample throughput, recurring consumable purchases, and lab demand. Europe’s shift toward centralized data collection is similarly significant: the European Commission launched the European Wastewater Surveillance Dashboard on January 29, 2025, to unify national and research dashboards (initially integrating data from more than a handful of countries—press coverage cited about 11 countries at launch). This demonstrates the EU’s commitment to routine wastewater monitoring and establishes cross-border comparability needs for vendors. In summary: institutional programs turn pilot projects into recurring budgets, justify investments in autosamplers and lab automation, and push buyers toward comprehensive solutions (sampling, lab work, analytics, dashboards). The scale (thousands of sites, over 100 million people covered) and the recommended sampling cadence (twice weekly) are the key operational factors that transform program mandates into sustained market demand.

Restraint: Lack of global sampling, processing, and reporting standardization and comparability

One of the main obstacles to scaling wastewater surveillance is the lack of universally accepted standards for sampling, processing, and reporting. Programs vary on key parameters: sampling method (composite vs. grab vs. passive samplers), sampling frequency, concentration techniques (PEG precipitation, ultrafiltration, adsorption–elution), and normalization strategies (e.g., PMMoV, crAssphage, ammonia). A 2023 WHO review found that over 70% of the surveyed national programs used different viral concentration methods, and more than half applied different normalization markers—making comparisons between countries unreliable. In Europe, the Joint Research Centre (JRC) has pointed out that data from more than 10 EU member states cannot be directly combined without post-hoc harmonization, which delays the release of useful EU-level indicators. Even within a single country, variability can be significant. For instance, in the U.S., some NWSS sites report results in copies per liter of wastewater, others in flow-normalized values, and some as percentile ranks—forcing public health agencies to operate with multiple interpretation frameworks. The lack of standardization not only impairs epidemiological analysis but also impacts vendor sales. Without agreed-upon technical standards, procurement specifications vary greatly, making it difficult for equipment manufacturers and assay providers to scale with a single validated product line. Ongoing efforts toward standardization, such as the EU’s work on minimum performance criteria for SARS-CoV-2 wastewater assays and ISO discussions on environmental surveillance protocols, are positive developments. However, until these are widely adopted, inconsistent methods will continue to prevent wastewater data from being fully integrated into national and global decision-making, thereby slowing the growth of commercial use.

Opportunity: Integration of wastewater surveillance with digital epidemiology and AI analytics

The convergence of wastewater-based epidemiology (WBE) with advanced analytics is unlocking new capabilities for predictive public health. Machine learning algorithms can now process high-frequency sampling data to detect infection surges several days before clinical cases are reported. For example, during 2023–2024, AI-driven wastewater data integration in several U.S. states enabled COVID-19 outbreak detection up to 7–10 days earlier than traditional testing data. Globally, the market for AI-enabled epidemiological platforms is projected to grow at over 20% CAGR by 2028, creating a parallel boost in demand for digitized WBE solutions. Cloud-based dashboards allow the integration of pathogen load data with clinical, demographic, and mobility data, enabling hyper-local alerts for hospitals, schools, and municipalities. Governments are funding such initiatives; the U.S. CDC’s NWSS program allocated $30 million in 2024 specifically for digital data infrastructure in wastewater surveillance. As sequencing throughput costs decline (Illumina and Oxford Nanopore reporting 20–35% per-sample cost reductions in 2024), the volume of genomic data from WBE will increase, further amplifying the role of analytics platforms. This integration presents a significant opportunity for companies offering combined hardware, cloud, and AI analytics services, especially in urban centers with smart-city infrastructure. In the next 3–5 years, scalable analytics will be a critical differentiator, positioning suppliers to capture both municipal and industrial clients seeking early-warning capabilities

Challenge: High operational costs and infrastructure limitations in resource-poor settings

Although WBE is cost-effective on a per-capita basis, initial deployment costs remain prohibitive in many regions. A typical automated composite sampler can cost between USD 5,000 and USD 15,000 per unit, and advanced sequencing-based assays can cost USD 80 to USD 200 per sample, excluding labor and logistics. In LMICs, where over 60% of urban wastewater is discharged untreated, the lack of centralized sewage networks makes representative sampling difficult. In sub-Saharan Africa, fewer than 10% of households are connected to piped sewer systems, meaning WBE must rely on decentralized sampling from open drains or septic systems — which increases contamination risk and reduces sample consistency. Additionally, cold-chain transport for RNA integrity preservation can add 20–30% to operational costs in hot climates. Skilled labor shortages also limit scalability; training a field technician in qPCR sampling and analysis can take 3–6 months, with retention rates often below 50% in low-wage markets. These challenges mean that, without significant donor support or low-cost portable testing innovations, WBE expansion in resource-poor settings will be slower than expected — limiting market penetration for high-end technology providers.

Wastewater Surveillance Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Provides wastewater-based epidemiology for SARS-CoV-2, opioids, and other health indicators across hundreds of U.S. municipalities. | • Early outbreak detection and trend tracking |

|

Laboratory network offering turnkey sampling, molecular analysis (RT-qPCR/NGS), and reporting for pathogens and chemical biomarkers. | • Nationwide scalability through accredited labs |

|

IoT-enabled sewer monitoring platform using AI to pinpoint infection clusters down to neighbourhood level. | • High-resolution “street-level” surveillance |

|

Federally coordinated network collecting data from >1,000 U.S. sites for COVID-19, influenza, and RSV. | • Standardized national database for policy decisions |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The wastewater surveillance ecosystem includes a wide network of stakeholders working together to provide effective monitoring solutions. At the center are technology developers and manufacturers who design and produce advanced sensors, reagents, and analytical platforms. These companies work closely with research institutions and government agencies to promote innovation and secure funding. Raw material suppliers provide vital components, while distributors and logistics partners handle timely delivery to end users. Major customers include municipal authorities, industrial firms, public health organizations, and environmental consultants who depend on these products to meet regulatory standards and protect public health.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Wastewater Surveillance Market, By Product Type

The wastewater surveillance market can be divided into segments based on product types, including instruments and equipment, detection assays & testing kits, software solutions, and consumables & accessories. Instruments and equipment, especially automated wastewater samplers, PCR/qPCR devices, and NGS sequencers, dominate because they are essential for enabling accurate, large-scale, and repeatable testing processes. Automated wastewater samplers are crucial for collecting representative samples, reducing variability caused by manual methods, and ensuring that subsequent testing accurately reflects the true prevalence of pathogens. PCR and qPCR instruments continue to serve as the standard for detecting viral RNA and bacterial DNA with high sensitivity, while NGS sequencers are increasingly utilized for broader genomic surveillance, enabling the identification of emerging variants and new pathogens. The use of portable field-testing devices is also growing, driven by the need for rapid, on-site results to support urgent public health decisions.

Wastewater Surveillance Market, By Application

The wastewater surveillance market can be divided into four main application areas: infectious disease surveillance, antimicrobial resistance (AMR) monitoring, industrial and environmental pollution detection, and other uses. Among these, infectious disease surveillance has the largest share due to its proven ability to provide early, population-wide indicators of disease outbreaks before clinical cases are reported. This method is especially effective for tracking highly transmissible pathogens such as SARS-CoV-2, poliovirus, norovirus, and hepatitis A, enabling timely public health responses. Wastewater-based infectious disease monitoring offers significant benefits—they are non-invasive, cost-effective, and capable of collecting data from symptomatic, asymptomatic, and under-reported cases.

Wastewater Surveillance Market, By End Users

From the end user's perspective, in 2024, government and municipal agencies lead the wastewater surveillance market. Their role in protecting public health, ensuring regulatory compliance, and monitoring environmental quality drives widespread adoption of wastewater monitoring systems. Municipal utilities and public health departments rely on wastewater surveillance for early detection of infectious diseases, tracking antimicrobial resistance, and identifying chemical pollutants aimed at safeguarding communities and enabling swift public health responses. These agencies prioritize solutions that deliver reliable, timely, and actionable data for decision-making, making them the main buyers of surveillance technologies and services. Recent advancements, including automated composite samplers, rapid PCR/dPCR assays, next-generation sequencing, and cloud-based data analytics, have greatly enhanced detection speed, accuracy, and coverage. Government and municipal agencies quickly adopt these innovations to strengthen health security frameworks and stay compliant with changing environmental and epidemiological regulations.

REGION

Asia Pacific to be fastest-growing region in global Wastewater Surveillance market during forecast period

The wastewater surveillance market is divided into five main regions: North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa. The market is growing quickly in the Asia Pacific region. Key factors driving this growth include increased government investments in public health monitoring, a rising number of infectious disease outbreaks, and rapid urbanization that promotes wastewater infrastructure development.

Wastewater Surveillance Market: COMPANY EVALUATION MATRIX

In the wastewater surveillance market landscape, Thermo Fisher Scientific, IDEXX Laboratories, and Hach (Danaher) (Stars) lead in instrumentation, reagents, and field sampling platforms, providing end-to-end solutions widely adopted by laboratories, utilities, and public health agencies. Eurofins (Star) dominates the services segment with high-precision wastewater testing and comprehensive sampling-to-report capabilities, while Biobot Analytics specializes in biosurveillance, real-time monitoring, and innovative testing methods. The rest of the market is fragmented, consisting of regional manufacturers, niche reagent suppliers, and startups offering specialized, cost-effective, or localized solutions, often partnering with larger companies or targeting areas like antimicrobial-resistance monitoring, industrial effluent testing, and illicit-drug surveillance.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- • Thermo Fisher Scientific (US)

- • Bio-Rad Laboratories (US)

- • IDEXX Laboratories (US)

- • Eurofins Scientific (Luxembourg)

- • GT Molecular (US)

- • Illumina (US)

- • Oxford Nanopore (UK)

- • Hach (Danaher) (US)

- • Teledyne ISCO (US)

- • LuminUltra (Canada)

- • Biobot Analytics (US)

- • Modern Water (DeepVerge) (UK)

- • Promega (US)

- • Aquamonitrix (Ireland)

- • PathogenDx (US)

- • Zymo Research (US)

- • Kando (Israel)

- • 4sight Analytics (US) among others.

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size Value in 2024 | USD 0.82 BN |

| Market Size Value in 2030 | USD 1.22 BN |

| CAGR (2025-2030) | 6.7% |

| Years Considered | 2022–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD BN) |

| Fastest Growing | Asia Pacific |

WHAT IS IN IT FOR YOU: Wastewater Surveillance Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Global pharmaceutical companies | Competitive profiling of leading analytical labs (financials, accreditations, technology portfolio) | Identify qualified wastewater testing partners and global lab coverage gaps |

| Multinational food & beverage manufacturers | Benchmarking of wastewater testing methodologies across geographies and product categories | Detect cost-reduction opportunities and improve supply-chain and operational safety |

| Specialty chemical & industrial materials suppliers | Market-adoption benchmarking for AI-enabled and real-time wastewater testing technologies | Pinpoint cross-industry substitution risks (in-house vs outsourced labs) |

| Government agencies & environmental regulators | Switching-cost analysis between in-house and outsourced testing | Enable targeting of high-growth public-health and environmental sustainability programs |

| R&D-intensive enterprises | Technical & economic assessment of rapid molecular, spectroscopy, and microfluidics platforms for wastewater analysis | Identify long-term opportunities in green-chemistry and low-waste laboratory practices |

| Strategic investors / large lab networks | Global & regional laboratory capacity benchmarking (expansions & regulatory approvals) | Support early-mover advantage in emerging compliance regimes and long-term service contracts |

| Broad market stakeholders | Patent landscape & IP-strength mapping for novel wastewater detection methods and reagents | Provide actionable intelligence to secure competitive advantage and guide M&A decisions |

RECENT DEVELOPMENTS

- January 2025 : Illumina Inc. (US) launched the NovaSeq X Series (Sequencing System with Software and Kits). The NovaSeq X Series is a high-throughput, single-flow-cell sequencing platform enhanced with the latest software upgrade and new 25B kits, enabling versatile, cost-effective multi-omic and single-cell applications with improved accuracy and data quality.

- February 2024 : BlueDot improved its surveillance platform by adding wastewater data for early detection of Influenza-Like Illness (ILI) trends and released an Avian Influenza Pulse Report for quick, actionable outbreak insights.

- September 2024 : Veolia launched a suite of next-generation water and wastewater treatment technologies centered on sustainability, circular resource utilization, and decarbonization. Backed by proprietary innovations, a strong IP portfolio, and a strategic investment of USD 2.2 billion, this move strengthens Veolia’s market leadership, enhances operational efficiency, and supports its long-term growth strategy.

- October 2024 : Illumina Inc. (US) launched the MiSeq i100 Series (Benchtop Sequencers). The MiSeq i100 Series delivers fast, simple, and affordable benchtop sequencing with room-temperature reagent storage, enabling same-day results and flexible workflows for labs of all experience levels.

Table of Contents

Methodology

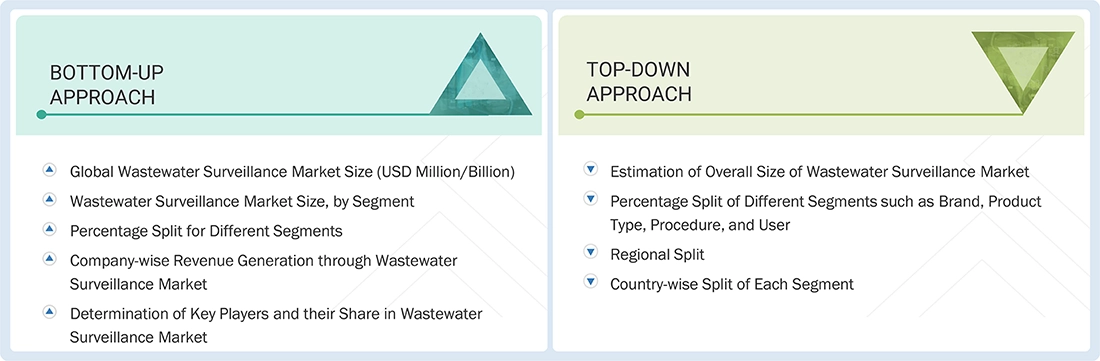

The size of the wastewater surveillance market was determined based on four primary studies to ensure accuracy. Initial data for the wastewater surveillance market and related sectors were collected from 3 to 5 secondary sources. This information was then validated through primary research to confirm the assumptions and overall market sizing. Both top-down and bottom-up approaches were used to estimate the total market size, which was subsequently broken down into segment and subsegment sizes. Finally, data triangulation was performed to verify the accuracy of the findings.

Secondary Research

Secondary research sources included directories, Factiva, white papers, Bloomberg Business, annual reports, SEC filings, business filings, and investor presentations. These sources provided valuable insights into market leaders, sector divisions, and technological differences within various segments of the wastewater surveillance industry.

Primary Research

Primary research involved gathering both quantitative and qualitative insights through interviews with key stakeholders. On the demand side, participants included public health officers, researchers, department heads, epidemiologists, hospitals, and research institutes. On the supply side, interviews were conducted with CEOs, product managers, sales leaders, and other top executives from relevant companies. These direct conversations helped confirm the findings from secondary research and provided an opportunity to directly ask questions and verify information assumptions.

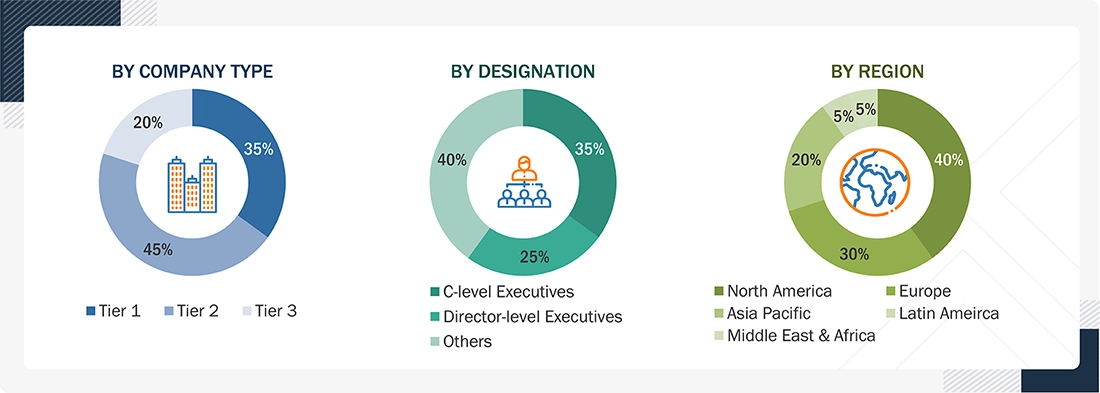

A breakdown of the primary respondents is provided below.

Note q: Others include sales managers, marketing managers, business development managers, product managers, distributors, and suppliers.

Note 2: Companies are classified into tiers based on their total revenue. As of 2024, Tier 1 = >USD 1 billion, Tier 2 = < USD 500 million, and Tier 3 = < USD 100 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

This report uses revenue share analysis of major companies to assess the size of the global wastewater surveillance market. This analysis involves identifying key market participants and calculating their revenue from wastewater surveillance based on data collected during both primary and secondary research phases. Secondary research included reviewing the annual and financial reports of leading market players. Meanwhile, primary research comprised detailed interviews with influential thought leaders, including directors, CEOs, and key marketing executives.

To determine the overall market value, the segmental revenue was calculated by mapping the revenue of the leading solution and service providers. The process involved several steps.

Making a list of leading international companies in the wastewater surveillance industry

Charting annual profits made by leading companies in the wastewater surveillance sector (or the closest stated business unit/product category)

2024 revenue mapping of leading companies to cover a significant portion of the global market

Calculating the global value of the wastewater surveillance industry

Global Wastewater Surveillance Market: Bottom-up and Top-down Approach

Data Triangulation

The wastewater surveillance market includes a range of technologies, products, and services used to detect, monitor, and analyze biological or chemical targets in wastewater systems. Its purpose is to evaluate public health trends, detect environmental contamination, and ensure regulatory compliance. This involves collecting sewage samples, testing for pathogens (such as viruses like SARS-CoV-2, bacteria, and antimicrobial resistance genes), and identifying pharmaceutical residues, narcotics, or industrial pollutants. The insights gained are then used to inform government agencies, utilities, healthcare organizations, and industries. The market features a wide array of products, including instruments and equipment like automated samplers, filtration systems, PCR/qPCR platforms, sequencers, and portable analyzers, along with detection assays and testing kits aimed at pathogens, resistance genes, and contaminants. Additionally, it is supported by software solutions for data analysis and by consumables and accessories needed for sample collection and testing workflows.

Market Definition

To ensure accurate data, the wastewater surveillance market was divided into various segments and subsegments. A data triangulation process using both top-down and bottom-up approaches was employed. This involved analyzing factors and trends from both the demand and supply sides to validate the findings for each segment. The combination of this segmentation with the triangulation process helps ensure that the market data is both accurate and reliable.

Stakeholders

- Manufacturers of wastewater surveillance.

- Healthcare providers such as hospitals, public health labs, diagnostic centers, and community clinics

- Public health authorities and environmental agencies, using wastewater surveillance insights for outbreak detection and antimicrobial resistance tracking

- Public health funding agencies

- Healthcare professionals, including epidemiologists, microbiologists, environmental scientists, and lab technicians, are involved in sample analysis and interpretation

- Regulatory bodies overseeing standards and safety

- Suppliers and distributors of wastewater surveillance products

- Research & development firms focusing on innovation and technology in wastewater surveillance

Report Objectives

- To define, describe, and forecast the wastewater surveillance market based on product type, application, end user, and region

- To provide detailed information regarding the major factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the total market

- To analyze opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To forecast the revenue of the market segments with respect to five regions: North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa

- To profile the key players and comprehensively analyze their market ranking and core competencies

- To benchmark players within the market using a proprietary Company Evaluation Matrix framework, which analyzes market players on various parameters within the broad categories of business strategy excellence and strength of product portfolio

- To analyze competitive developments such as product launches, agreements, expansions, collaborations, and acquisitions in the wastewater surveillance market

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Wastewater Surveillance Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Wastewater Surveillance Market