Yellow Phosphorus & Derivatives Market

Yellow Phosphorus & Derivatives Market by Derivative (Thermal Phosphoric Acid, Phosphorus Trichloride, Phosphorous Pentoxide, Red Phosphorus), End Use (Agriculture, Chemicals, Pharmaceutical, Lithium-ion Batteries), Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The global yellow phosphorus & derivatives market is projected to grow from USD 4.66 billion in 2025 to USD 5.94 billion by 2030, at a CAGR of 5.0% during the forecast period. As a key industrial chemical, yellow phosphorus is processed into thermal phosphoric acid and phosphorus pentoxide, with derivatives supporting agriculture, agrochemicals, food, plastics, and animal nutrition. Its flexibility in supply forms and broad usage in sectors such as agriculture, chemicals, energy storage, and pharmaceuticals underscore its importance. Market growth is fueled by rising food needs, phosphate fertilizer dependence, advanced material innovation, and expanding chemical and energy storage applications.

KEY TAKEAWAYS

-

BY REGIONBy region, the Asia Pacific yellow phosphorus & derivatives market is expected to register the highest CAGR of 5.3% during the forecast period.

-

BY DERIVATIVEBy derivative, the thermal phosphoric acid segment dominated the market, accounting for a share of 42.7% in terms of volume in 2024.

-

BY FORMBy form, the solid segment is expected to lead the market during the forecast period.

-

BY APPLICATIONBy application, the fertilizers segment is expected to dominate the market during the forecast period.

-

BY END-USEBy end-use, the agriculture segment dominated the market, accounting for a share of 41.4% in terms of value in 2024.

-

Competitive Landscape - Key PlayersHubei Xingfa Chemicals Group Co., Ltd., NDPP, Sichuan Chuantou Chemical Industry Group Co., Ltd., Bayer AG, and Jiangsu Chengxing Phosph-Chemicals Co., Ltd. were identified as some of the leading players in this market, given their strong market share and product footprint.

-

Competitive Landscape - StartupsYibin Tianyuan Group Co., Ltd. and Guizhou Sino-Phos Chemical Co., Ltd., among others, have become leading startups or SMEs because they identify niche gaps early and deliver solutions that precisely match unmet customer needs. Their agility, faster decision-making, and ability to innovate continuously allow them to outperform larger, less flexible competitors.

The global yellow phosphorus & derivatives market is projected to witness steady growth during the forecast period, supported by strong demand in fertilizers, flame retardants, specialty chemicals, and battery applications. As a critical industrial chemical, yellow phosphorus is converted into thermal phosphoric acid and phosphorus pentoxide, with its derivatives serving key roles in agriculture, agrochemicals, food processing, plastics, and animal nutrition. Its adaptability across supply forms and widespread use in agriculture, chemicals, energy storage, and pharmaceuticals highlight its significance. Growth is further driven by increasing global food requirements, reliance on phosphate-based fertilizers, innovations in advanced materials, and the expanding applications of chemicals and energy storage solutions.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on consumers' business emerges from customer trends or disruptions. The yellow phosphorus & derivatives market is currently being reshaped by a "purity pivot," where the surge in LFP and LMFP cathode production has elevated high-purity thermal phosphoric acid from a specialty chemical to a strategic battery asset. This transition is further disrupted by the emergence of phosphorus sulfides as critical precursors for next-generation solid-state electrolytes, shifting the industry's center of gravity away from traditional agrochemicals toward high-margin energy materials. Consequently, businesses are navigating a volatile landscape defined by energy-intensive production constraints and geopolitical supply risks.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Growth in demand from EV battery industry

-

Constant demand for phosphorus-based agrochemicals and intermediates

Level

-

Stringent environmental and safety regulations regarding hazardous materials

-

Complex handling requirements and health and safety risks

Level

-

Growing demand for flame retardants and plastic additives

-

Rising demand in food & beverage industry

Level

-

Supply chain reliability issues due to geopolitical uncertainties

-

Volatility in raw material prices

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Growth in demand from EV battery industry

The enduring requirement for phosphorus agrochemicals and the increasing use of yellow phosphorus in cutting-edge battery materials are two of the most powerful forces influencing this market. Phosphorus derivatives like thermal phosphoric acid, phosphorus trichloride, and phosphorus sulfides are commonly employed as intermediates for fertilizers and pesticides, which are still essential for modern agriculture. With the global population expanding and the ever-present requirement to increase crop yields, phosphate fertilizers and crop protection chemicals have a demand that is not just stable but is actually increasing steadily. This dependency on yellow phosphorus-based agrochemicals guarantees a steady demand for yellow phosphorus as a feedstock for agriculture. Moreover, a more recent yet important channel for the growth of this market has opened with the surging adoption of EVs, wherein the derivatives of yellow phosphorus find some role in lithium-ion battery chemistries. Phosphorus chemistry in lithium iron phosphate (LFP) type batteries enables stable, safe, and cost-effective energy storage. The fast-moving global transition to clean mobility and energy storage is consequently extending the use of phosphorus. These agricultural and energy demands, taken together, balance volume-driven stability with high-value technological growth, cementing yellow phosphorus as a foundational material for both the old and new economy.

Restraints: Stringent environmental and safety regulations

The growth of the yellow phosphorus & derivatives market is significantly restrained by stringent environmental and safety regulations, coupled with the complex handling requirements associated with this material. Yellow phosphorus is reactive, flammable, and toxic, and so its manufacture, shipping, storage, and use must be carefully regulated in accordance with health and safety standards. Regulators impose rigorous emission, waste, and workplace safety rules, as any kind of mismanagement can cause huge levels of pollution, and it can also cost lives. Meeting these regulatory requirements often requires some combination of heavy investment in specialty refrigeration, state-of-the-art warehousing, protective packaging, and real-time monitoring — all of which contribute to producers’ overhead. Moreover, the hazardous nature of yellow phosphorus requires trained employees, specialized as well as dedicated transportation facilities, and occupational health and safety rules specially designed for work happening around yellow phosphorus. Furthermore, yellow phosphorus derivative industries must also undergo regulatory approvals, particularly in stringent environmental countries, which can decelerate development and limit market expansion. All these factors can restrain the growth of this market. The balance between ensuring safety and maintaining competitiveness remains a key restraint influencing the dynamics of the yellow phosphorus & derivatives industry.

Opportunity: Growing demand for flame retardants and plastic additibes

The market for yellow phosphorus & derivatives is expected to experience significant growth, largely driven by increasing demand for flame retardants and for phosphorus derivatives used in food and beverage applications. Flame retardants based on yellow phosphorus, and more specifically red phosphorus, and phosphorus derivatives are growing in popularity as industries look for safer and/or more environmentally friendly alternatives to halogenated flame retardants. The demand for fire safety products translates into stable and consistent consumption of yellow phosphorus-based flame retardants, which is driven by increasing consumption of products and components used in electronics, automotive parts, textiles, and built materials. In addition to flame retardants, food and beverage is another high-value, high-growth sector. Thermal phosphoric acid and its derivatives are common food additives that act as acidity regulators and preservatives, and are ubiquitous in beverages, processed foods, and nutritional supplements sold in food and beverage channels. Additionally, the increasing worldwide consumption of processed, convenience, and health products is enhancing the importance of yellow phosphorus-based ingredients. Overall, these opportunities reflect a shift in demand from strictly agriculture-based applications toward more specialized, high-margin applications and/or industries. By finding alignment with materials safety regulations and consumer-driven trends in food quality, the yellow phosphorus & derivatives sector is poised to take full advantage through these growing opportunities and factors in the long term.

Challenge: Supply chain reliability issues due to geopolitical uncertainties

The yellow phosphorus & derivatives market faces challenges primarily due to price fluctuations and uncertain supply chain reliability, particularly in light of geopolitical risk. Yellow phosphorus is energy-intensive to produce and is concentrated in a limited number of regions, making the price of yellow phosphorus vulnerable to fluctuations in electricity prices, raw material shortages, and government policy changes. These price fluctuations present a state of volatility for the downstream industry where firms extracting value from yellow phosphorus in the production of fertilizer, agrochemicals, and flame retardants depend on stable, cost-effective feed stocks for production efficiency. Supply chain reliability is often put to the test by geopolitical factors such as trade sanctions, export restrictions, progress of local conflicts, and obtaining a reliable, on-time supply of yellow phosphorus in downstream applications across global supply chains. Due to this, producers and end users often find themselves forced to develop plans to support their risk management and minimize supply chain breakdown, either by way of stockpiling goods or investing in alternative feed stocks to make up a deficit. Additionally, transportation, logistics, and supply chains function in an often unpredictable regulated space; thus, supplying a continuous and leveled stream of yellow phosphorus remains a difficult undertaking. Collectively, all these conditions erode confidence in the market, lessen the ability of manufacturers to plan beyond their annual budget, and discourage new investments. Thus, while downstream demand is substantial, the degree of price instability, uncertainty, and supply issues means that price volatility and supply chain uncertainty are key challenges for the sustainable growth of the yellow phosphorus & derivatives market.

YELLOW PHOSPHORUS & DERIVATIVES MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Production of yellow phosphorus and derivatives for fertilizers, food additives, and electronics. | Integrated supply chain | High export quality | Support for agriculture and electronic sectors |

|

Large-scale yellow phosphorus supply for industrial chemicals, flame retardants, and batteries. | Secures reliable feedstock for multiple critical industries | Energy-efficient operations |

|

Manufacture of agrochemical and industrial phosphorus intermediates using yellow phosphorus. | Global reach | Support for crop yield and protection | Reliable input for industrial chemicals. |

|

Yellow phosphorus is used in agrochemicals, detergents, and flame-retardant additives. | Focus on green manufacturing | Broad customer base | Industry certifications. |

|

Production of yellow phosphorus and derivatives for fertilizers, flame retardants, food additives, and industrial chemicals. | Stable supply from integrated mining and production | Cost-competitive due to low energy/raw material sourcing | Diverse high-quality product portfolio supporting multiple sectors |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The yellow phosphorus & derivatives market ecosystem consists of raw material suppliers (OCP, Nutries, Devdhar Chemicals), manufacturers (Bayer, Yunphos, DGC), and end users (FOSFA, Nippon Chemical Industrial). Yellow phosphorus is primarily processed into derivatives such as thermal phosphoric acid, phosphorus trichloride, and phosphorus pentoxide, which serve as critical building blocks for downstream industries. These derivatives are used to produce fertilizers that boost agricultural productivity, flame retardants for plastics and electronics, specialty chemicals for industrial processes, and additives in animal nutrition and food processing. Manufacturers innovate to deliver advanced phosphorus derivatives suited for a variety of applications. Collaboration throughout the value chain is crucial for maintaining quality, ensuring regulatory compliance, and supporting continuous market growth in agriculture, electronics, chemicals, and specialty sectors.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Yellow Phosphorus Market, By Derivative

Thermal phosphoric acid, by derivative, is expected to exhibit the second-highest CAGR in the yellow phosphorus & derivatives market over the forecast period, from 2025 to 2030, primarily due to its centrality in various high-demand industries. Being one of the primary intermediates of yellow phosphorus, thermal phosphoric acid has become indispensable for fertilizer production, and in particular phosphate-based fertilizers that are essential to maintaining the agricultural production levels. With rising global population and food security threats, the demand for fertilizers is expected to continue to expand, thus making the consumption of thermal phosphoric acid large-scale and persistent over the forecast period. Thermal phosphoric acid also has a large number of uses in the food and beverage industry as an acidifier and as a preservative, with much of this growth coming from increasing processed and convenience food consumption. The industrial sector also relies upon thermal phosphoric acid for water processing, cleaning metals, and as a precursor for specialty chemicals, to name a few. In addition, thermal phosphoric acid is becoming increasingly relevant in novel applications in energy storage and lithium-ion battery technologies, exemplified by the emergence of phosphate-based materials as the preferred ingredient trend for safer and cheaper energy storage. Therefore, thermal phosphoric acid's wide range of applications, from more traditional volume-based industries to emerging high-value sectors, establishes it as one of the fastest-growing derivatives and a vital driver of this market.

Yellow Phosphorus Market, By End-use

The lithium-ion batteries segment, by end-use, is expected to record the highest CAGR during the forecast period, driven by the ongoing global transition to clean energy and the electrification of mobility. A key derivative in this market, thermal phosphoric acid is also used to produce lithium iron phosphate (LFP) cathode materials, which have emerged as one of the most preferred and established chemistries in electric vehicles, energy storage systems, and more. LFP batteries are sought after due to their good safety and thermal stability, long cycle life, and affordability relative to other chemistries, which hence leads to the rapid growth of the EV industry. At the same time, governments and manufacturers worldwide are progressing to complete electrification on a far greater scale as well as renewable integration; therefore, demand will continue for LFP batteries requiring yellow phosphorus-based materials for the foreseeable future. In addition to electric vehicles, lithium-ion batteries also find usage in advanced systems and residential grid-level storage, portable electronic systems, and industrial systems, meaning demand is growing across a wider variety of end-use. Further investments into gigafactories and enhancement of energy storage and logistics infrastructure will continue to exacerbate this trend and position lithium-ion batteries as the most dynamic end-use of yellow phosphorus. Therefore, sustained momentum occurring in advanced energy technologies is hence altering the demand for yellow phosphorus, meaning it will not just be important for agriculture and chemicals, but also through lithium-ion battery (including LFP) systems that will be pivotal to the global energy transition and acceleration from fossil fuels for decades to come.

REGION

Asia Pacific to be fastest-growing region in global yellow phosphorus & derivatives market during forecast period

The Asia Pacific yellow phosphorus & derivatives market is expected to register the highest CAGR during the forecast period. This growth is primarily driven by the region's relatively high industrial base, the booming agriculture sector, and fast-evolving, technologically advanced applications. The region is also an important fertilizer production hub with a large reliance on phosphate-based fertilizers (essential for sustaining agricultural productivity) to meet the large population's growing food demands. This creates a steady (and large-scale) demand pull for yellow phosphorus and its derivatives. Moreover, the Asia Pacific region sits at the very center of the electric vehicle shift revolution. China is not only a leading producer of lithium-ion batteries but is also actively investing in gigafactories. The market benefits from both high-volume traditional applications and emerging high-value technologies that utilize yellow phosphorus. Additionally, there is a growing proliferation of chemical and pharmaceutical manufacturing. There is a diverse range of applications involving yellow phosphorus, including both traditional and emerging technologies. These applications encompass flame retardants, food additives, and specialty chemicals. Asia Pacific also tends to have strong government support in developing new industries and infrastructure. Thus, Asia Pacific, by way of both traditional applications (high-volume) and new technology applications, represents the fastest-growing market for yellow phosphorus & derivatives.

YELLOW PHOSPHORUS & DERIVATIVES MARKET: COMPANY EVALUATION MATRIX

In the yellow phosphorus & derivatives market matrix, Hubei Xingfa stands out as a star performer, securing its competitive edge through strong vertical integration. The company’s operations cover the entire value chain, from raw material mining to the final production of yellow phosphorus. This self-sufficient approach offers significant benefits in controlling costs, ensuring a steady supply of raw materials, and maintaining high product quality. Yuntianhua Co., Ltd., identified as an emerging leader, specializes in phosphate-based chemical manufacturing and resource development. Its main business areas include fertilizer production, phosphate mining and beneficiation, fine chemicals, new energy materials, commerce and logistics, and international trade. The company also produces key downstream products, such as yellow phosphorus, 100,000 tons per year.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Hubei Xingfa Chemicals Group Co., Ltd. (China)

- NDPP (Kazakhstan)

- Sichuan Chuantou Chemical Industry Group Co., Ltd. (China)

- Bayer AG (Germany)

- JIANGSU CHENGXING PHOSPH-CHEMICALS CO., LTD. (China)

- Yunnan Mile Phosphorus Electricity Co., Ltd. (China)

- Duc Giang Chemicals Group Joint Stock Company (Vietnam)

- Vietnam Phosphorus JSC (Vietnam)

- Yuntianhua Co., Ltd. (China)

- VIET NAM APATITE – PHOSPHORUS JOINT STOCK COMPANY (Vietnam)

- Guizhou Qianneng Tianhe Phosphorus Industry Co., Ltd. (China)

- Kazphosphate LLP (Kazakhstan)

- Yunnan Chengjiang Huaye Phosphorus Chemicals Co., Ltd. (China)

- Yunphos (China)

- CHENGDU WINTRUE HOLDING CO., LTD. (China)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 4.13 BN |

| Market Forecast in 2030 (value) | USD 5.94 BN |

| Growth Rate | CAGR of 5.0% from 2025 to 2030 |

| Years Considered | 2020-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/Billion), Volume (Kiloton) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends. |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, Rest of the World |

WHAT IS IN IT FOR YOU: YELLOW PHOSPHORUS & DERIVATIVES MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Leading Fertilizer Producer |

|

|

| Industrial Chemical Maker |

|

|

| Agrochemical Manufacturer |

|

|

| Raw Material Supplier |

|

|

| Food/Additive Producer |

|

|

RECENT DEVELOPMENTS

- July 2023 : Duc Giang Chemicals Group Joint Stock Company acquired Phosphorus 6 Joint Stock Company. Duc Giang Chemicals said that the acquisition of Phosphorus 6 will create a deep processing product chain for 3PO4 products, Sodium Tripoly Phosphate - STPP (Na5P3O10), at the same time exporting phosphorus and increasing revenue for the group.

- April 2023 : Duc Giang Chemicals Group Joint Stock Company (Duc Giang) agreed to acquire Phosphorus 6 Joint Stock Company, with the board of directors of Duc Giang having approved the transaction. Phosphorus 6 Joint Stock Company’s facilities include a yellow phosphorus furnace with a capacity of 9,800 tons/year.

Table of Contents

Methodology

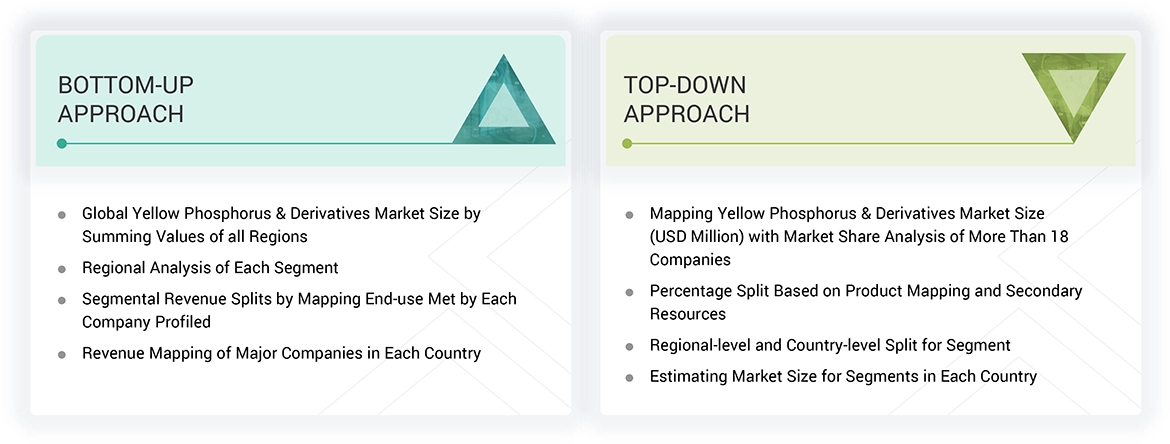

The research encompassed four primary actions in assessing the present market size of yellow phosphorus & derivatives. Comprehensive secondary research was conducted to gather information on the market, the peer market, and the parent market. The subsequent stage involved corroborating these findings, assumptions, and dimensions with industry specialists throughout the yellow phosphorus & derivatives value chain via primary research. The total market size is ascertained with both top-down and bottom-up methodologies. Subsequently, market segmentation analysis and data triangulation were employed to ascertain the dimensions of the market segments and sub-segments.

Secondary Research

The research approach employed to assess and project the access control market initiates with the collection of revenue data from prominent suppliers using secondary research. In the course of the secondary research, many secondary sources, such as Hoovers, Bloomberg BusinessWeek, Factiva, the World Bank, and industry magazines, were utilized to identify and compile information for this study. The secondary sources comprised annual reports, press releases, and investor presentations from corporations; white papers; accredited periodicals; writings by esteemed authors; announcements from regulatory agencies; trade directories; and databases. Vendor offerings have been considered to ascertain market segmentation.

Primary Research

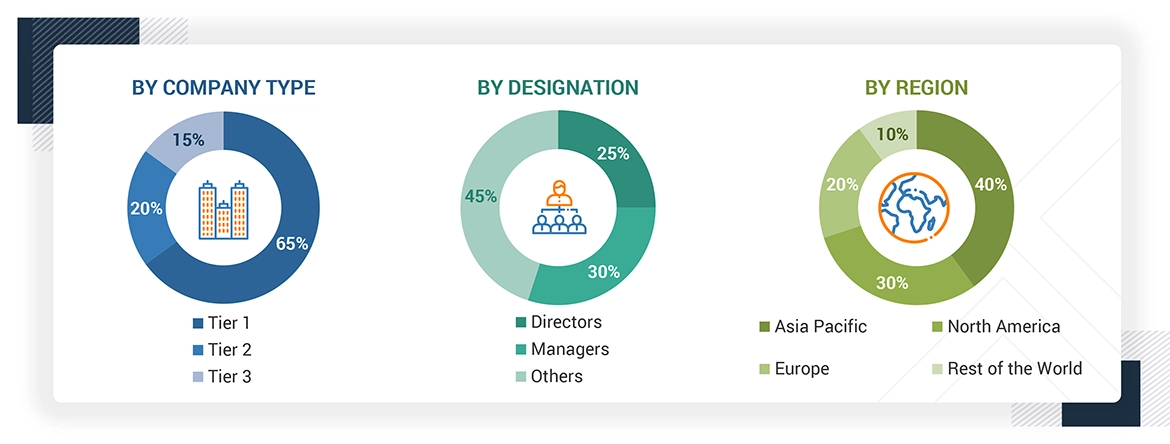

The yellow phosphorus & derivatives market comprises several stakeholders, such as manufacturers, suppliers, traders, associations, and regulatory organizations, in the supply chain. The demand side of this market is characterized by the development of fertilizers, chemical manufacturing industry, fertilizers, flame retardants, animal feed additives, and other applications. Advancements in technology characterize the supply side. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of interviews with experts:

The following is a breakdown of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the yellow phosphorus & derivatives market. These methods were also used extensively to determine the size of various sub-segments in the market. The research methodology used to estimate the market size included the following:

- The key players were identified through extensive primary and secondary research.

- The value chain and market size of the yellow phosphorus & derivatives market, in terms of value, were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research included the study of reports, reviews, and newsletters of top market players, along with extensive interviews for opinions from key leaders, such as CEOs, directors, and marketing executives.

Global Yellow Phosphorus & Derivatives Market Size: Bottom Up and Top Down Approach

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakdown procedures were employed, wherever applicable. The market size was calculated globally by summing up the country-level and regional-level data.

Market Definition

Yellow phosphorus is a highly reactive allotrope of elemental phosphorus, primarily produced through the thermal reduction of phosphate rock in electric arc furnaces. It serves as a fundamental raw material for a broad range of derivatives. These include thermal phosphoric acid, which is essential in fertilizers, food processing, and industrial chemicals; phosphorus trichloride, which is widely applied in pesticides, flame retardants, and plastic additives; phosphorus pentoxide, which functions as a strong dehydrating agent and is used in the production of polyphosphoric acids; phosphorus sulfides, which find use in matches, pyrotechnics, and lubricant additives; and red phosphorus, which is valued in flame retardants, safety matches, and electronic components. Yellow phosphorus is supplied in different forms such as solid, liquid, and slurry, allowing it to be adapted to various handling and processing needs. Its applications extend across fertilizers, pesticides, flame retardants, animal feed additives, and other specialized uses. The demand for yellow phosphorus is supported by a wide set of end-use industries, including agriculture, chemicals, food and beverage, pharmaceuticals, lithium-ion batteries, and other industrial sectors. This makes yellow phosphorus a cornerstone intermediate that underpins diverse downstream chemical processes and industrial value chains.

Stakeholders

- Yellow Phosphorus & Derivatives Manufacturers

- Yellow Phosphorus & Derivatives Suppliers

- Yellow Phosphorus & Derivatives Traders, Distributors, and Suppliers

- Investment Banks and Private Equity Firms

- Raw Material Suppliers

- Government and Research Organizations

- Consulting Companies/Consultants in the Chemicals and Materials Sectors

- Industry Associations

- Contract Manufacturing Organizations (CMOs)

- NGOs, Governments, Investment Banks, Venture Capitalists, and Private Equity Firms

Report Objectives

- To define, describe, and forecast the size of the global yellow phosphorus & derivatives market in terms of volume and value

- To provide detailed information regarding the key factors, such as drivers, restraints, opportunities, and industry-specific challenges, influencing the growth of the global yellow phosphorus & derivatives market

- To analyze and forecast the size of various segments (derivative and end-use) of the yellow phosphorus & derivatives market based on five major regions—North America, Asia Pacific, Europe, CIS Countries, and Rest of World—along with key countries in each of these regions

- To analyze recent developments and competitive strategies, such as agreements, partnerships, product launches, and joint ventures, to draw the competitive landscape of the market

- To strategically profile the key players in the market and comprehensively analyze their core competencies

Key Questions Addressed by the Report

What is the critical driver for the yellow phosphorus & derivatives market?

The growth of the yellow phosphorus & derivatives market is attributed to sustained demand for phosphorus-based agrochemicals and intermediates.

Which region is expected to register the highest CAGR in the yellow phosphorus & derivatives market during the forecast period?

The yellow phosphorus & derivatives market in Asia Pacific is projected to register the highest CAGR during the forecast period.

What is the primary end-use industry of yellow phosphorus?

Agriculture is the major end-use industry for yellow phosphorus.

Who are the major players in the yellow phosphorus & derivatives market?

The key players include Hubei Xingfa Chemicals Group Co., Ltd. (China), Kazphosphate LLP (Kazakhstan), Sichuan Chuantou Chemical Industry Group Co., Ltd. (China), Bayer AG (Germany), and Jiangsu Chengxing Phosph-Chemicals Co., Ltd. (China).

What is expected to be the CAGR of the yellow phosphorus & derivatives market between 2025 and 2030?

The market is expected to record a CAGR of 4.1% between 2025 and 2030.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Yellow Phosphorus & Derivatives Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Yellow Phosphorus & Derivatives Market