Gelatin Market Overview: Insights, Developments, and Future Prospects

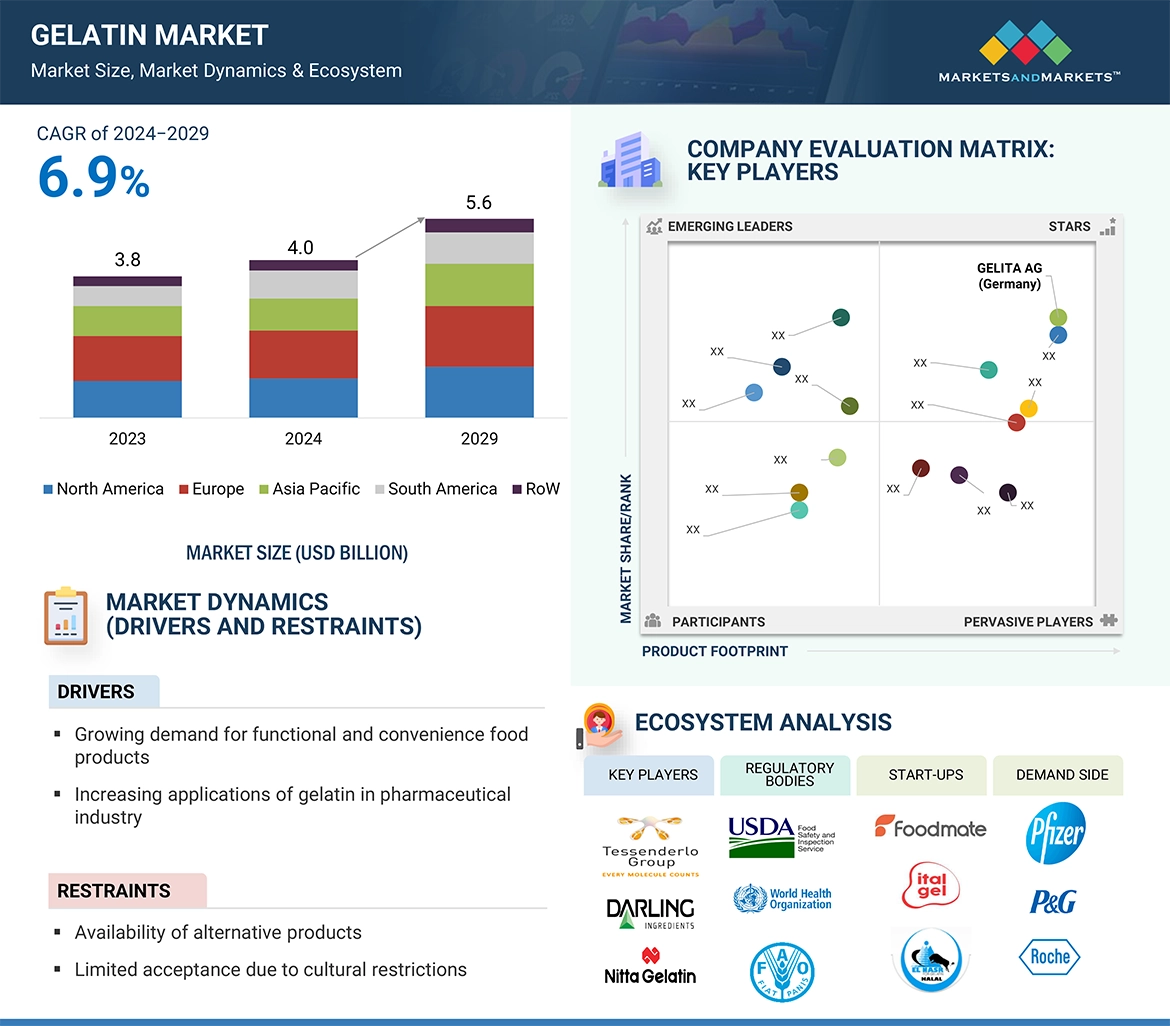

The gelatin market size, valued at USD 4.0 billion in 2024, is set to reach USD 5.6 billion by 2029, growing at a CAGR of 6.9%. This steady rise is driven by increasing health consciousness among consumers, a growing preference for nutritive ingredients, and technological advances that have broadened gelatin’s applications across industries.

The gelatin market overview shows that gelatin, derived from both plant and animal sources, is now being integrated into a diverse range of food and beverage products, enhancing texture, stability, and nutritional value.

Bovine Gelatin Leads the Market Share

Within the source segment, bovine gelatin is expected to hold a dominant share. Extracted from bovine skins and bones, this type of gelatin is widely used in food, pharmaceuticals, and cosmetics.

Connect with our Analysts for a discussion about your business priorities

A notable development occurred in August 2022 when JBS S.A. inaugurated a collagen and gelatin production facility with a USD 77.45 million investment. The plant, with an annual capacity of 6,000 tonnes, caters to growing demand in both food and pharmaceutical applications, reinforcing the market’s upward trajectory.

Pharmaceuticals Emerge as the Fastest-Growing Segment

The gelatin market trends indicate that the pharmaceutical industry is projected to be the fastest-growing application segment from 2024 to 2029. Its uses range from hard and soft capsules to tablet coatings, surgical sponges, and microencapsulation.

Gelatin’s biocompatibility, non-toxicity, and easy absorption make it ideal for medicinal and nutritional preparations, including blood plasma substitutes and hemostatic agents for surgeries.

In October 2022, PB Leiner expanded its gelwoRx Dsolve portfolio with three new pharmaceutical-grade products designed to enhance capsule dissolution and reduce crosslinking, demonstrating ongoing innovation in this sector.

North America Maintains a Strong Market Position

North America is expected to capture a significant share of the gelatin industry, supported by the region’s robust pork and beef industries, rising consumption of bakery and ready-to-eat foods, and a growing focus on fortified nutrition.

The Gelatin Manufacturers Institute of America (GMIA) oversees industry standards, with major gelatin manufacturers such as Nitta Gelatin, Weishardt, Gelita, PB Leiner, and Rousselot active in the market.

Additionally, the increasing prevalence of arthritis—projected to affect over 78 million people in the US by 2040—is expected to boost gelatin demand, given its role in supporting joint health and bone strength.

Key Players Driving the Industry

Prominent gelatin manufacturers include Darling Ingredients, Tessenderlo Group, GELITA AG, Nitta Gelatin Inc., Lapi Gelatine S.p.a., India Gelatine & Chemicals Ltd., Narmada Gelatines Limited, Nippi Inc., Weishardt, Trobas Gelatine B.V., Sterling Biotech Ltd, Roxlor, Suheung, Ewald-Gelatin GmbH, and Geltech Co., Ltd.

With applications expanding from food and beverages to advanced pharmaceutical uses, the market is on a steady growth path. Technological innovations, rising health awareness, and strategic investments in production are expected to keep the industry dynamic through 2029.

Key Questions Addressed by Gelatin Market Report

1. What is driving the growth of the gelatin market?

The growth is driven by rising consumer demand for health-oriented products, expanding pharmaceutical applications, and innovations in food technology that allow gelatin to be used in a broader range of products.

2. Which source segment dominates the gelatin market?

Bovine gelatin, extracted from skins and bones, holds a significant share due to its wide use in food, pharmaceuticals, and cosmetics.

3. Which application segment is expected to grow fastest?

The pharmaceutical sector is expected to be the fastest-growing segment, with increasing use of gelatin in capsules, tablet coatings, surgical sponges, and nutritional supplements.

4. Why is North America a strong market for gelatin?

North America benefits from a large pork and beef industry, a growing food processing sector, and rising consumer interest in fortified and ready-to-eat products.

5. Who are some leading gelatin manufacturers?

Key players include Darling Ingredients, GELITA AG, Nitta Gelatin Inc., PB Leiner, Weishardt, and Rousselot, among others.

6. How is gelatin used in the pharmaceutical industry?

It is used for making capsules, coating tablets, microencapsulation, surgical sponges, and as a component in certain medical treatments due to its biocompatibility.

7. Is the demand for plant-based gelatin increasing?

Yes, plant-based alternatives are gaining interest, especially among vegetarian and vegan consumers, although animal-based gelatin still dominates the market.

8. What are the key gelatin market trends for the future?

Trends include cleaner label products, increased use in functional foods, expansion into nutraceuticals, and technological innovations to improve product performance.

80% of the Forbes Global 2000 B2B companies rely on MarketsandMarkets to identify growth opportunities in emerging technologies and use cases that will have a positive revenue impact.

- Food Packaging Market Size Set for Strong Growth Through 2030 Amid Rising Demand for Convenience Foods

- Fertilizers Industry Set to Grow at 4.1% CAGR Through 2030

- Leading Automated Guided Vehicle Companies 2024: An In-depth Analysis

- CHARGED UP: SHIFT TO E-MOBILITY AND THE EVOLUTION OF TRANSPORTATION

- Global Automotive Market: Predictions For 2024