High-end Refractometer Market Size, Share & Trends, 2025 To 2032

High-end Refractometer Market By Abbe Refractometers, Inline Process Refractometers, Connectivity, Interface Type, Measurement Principle, Temperature Control System, Food & Beverage Quality Testing, Configuration, Region - Global Forecast to 2032

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The high-end refractometer market is projected to reach USD 0.38 billion by 2032 from USD 0.23 billion in 2025 at a CAGR of 7.3% during the forecast period. The market growth is driven by the increasing deployment of high-end refractometers across pharmaceutical manufacturing, food and beverage processing, petrochemical plants, academic laboratories, and quality control environments. The rising demand for precise concentration measurement, automated workflows, and enhanced product quality verification is fueling adoption. In addition, advancements in optical sensing, AI-assisted data interpretation, and cloud-integrated calibration and monitoring platforms are accelerating market expansion. In the industrial sector, chemical and petrochemical facilities are increasingly integrating advanced refractometry systems for continuous process monitoring and formulation control, while in food and beverage environments, high-end refractometers are enabling rapid quality testing, standardization, and regulatory compliance. The growing implementation of digital laboratory initiatives and smart manufacturing programs is further strengthening the adoption of high-end refractometers globally.

KEY TAKEAWAYS

-

By RegionThe Asia Pacific is projected to register the highest CAGR of 9.4%.

-

By TypeThe inline process refractometer segment dominated the market with a share of ~27% in 2024.

-

By Automation LevelThe market for fully automatic refractometers is projected to grow at a CAGR of 8.8%.

-

By Sales ChannelThe direct sales segment dominated the market with a share of ~44% in 2024.

-

By ConnectivityThe USB connectivity segment dominated the market with a share of ~32% in 2024.

-

By Interface TypeThe digital display with physical controls segment dominated the market with a share of ~34% in 2024.

-

By Measurement PrincipleThe market for fresnel reflection method is projected to grow at a CAGR of 9.5%.

-

By Temperature Control SystemThe integrated advanced temperature control segment dominated the market with a share of ~45% in 2024.

-

By ConfigurationThe benchtop high-end refractometer segment dominated the market with a share of ~53% in 2024.

-

BY ApplicationThe market for food & beverage quality testing is projected to grow at a CAGR of 10.1%.

-

Competitive Landscape - Key PlayersAnton Paar GmbH (US), METTLER TOLEDO (US), ATAGO (Japan), Vaisala (Finland), and Reichert, Inc. (US) were identified as star players in the high-end refractometer market (global), given their strong market share and product footprint.

-

Competitive Landscape - StartupsMilwaukee Instruments, HM Digital, and MISCO Refractometer have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders.

The high-end refractometer industry is projected to grow significantly over the next decade, driven by rising demand across pharmaceutical quality control, food and beverage testing, petrochemical processing, laboratory research, and industrial manufacturing applications. The increasing adoption of automated measurement technologies, precision optical instruments, and real-time process monitoring, along with advancements in IoT-enabled connectivity, AI-based data analytics, and compact modular refractometry systems, is further accelerating global market expansion.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The high-end refractometer market is witnessing a transition toward new revenue sources driven by the integration of advanced technologies such as AI-assisted measurement, automated calibration, digital interfaces, and cloud-based data connectivity. The use of traditional refractometers in pharmaceuticals, food and beverage processing, healthcare diagnostics, and industrial quality control is evolving into intelligent analytical ecosystems that enhance accuracy, operational efficiency, and real-time decision-making. AI-enabled refractometry platforms are gaining traction across laboratories and production environments, enabling faster, hands-free measurement, improved data integrity, and enhanced regulatory compliance. Cloud-managed refractometer systems are transforming chemical, petrochemical, and research sectors by supporting remote monitoring, digital workflow management, and real-time data synchronization. These next-generation solutions represent key future growth drivers, expanding the revenue mix toward AI-enabled, connected, and analytics-driven refractometry platforms expected to dominate the market in the coming years.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rising demand for ultra-precise concentration and purity measurement across pharmaceuticals and biotechnology industries

-

Shift toward automation and digitalization of quality inspection in food, beverage, and industrial production

Level

-

High initial cost and complex system integration

-

Availability of alternative analytical technologies

Level

-

Increasing transition toward inline and real-time concentration monitoring

-

Product innovation around AI-based calibration and predictive measurement

Level

-

Precision stability under varying industrial conditions

-

Standardization of measurement protocols across industries

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rising demand for ultra-precise concentration and purity measurement across pharmaceuticals and biotechnology industries

High-end refractometers are increasingly being adopted across industries such as pharmaceuticals, biotechnology, food and beverage, chemicals, and petrochemicals to provide secure, contactless, and highly accurate measurement experiences. The shift toward digital analysis and automated quality-control workflows is accelerating adoption, particularly, in these industries, due to the high demand higher precision and operational efficiency. The integration of AI, IoT, and digital connectivity is further enhancing refractometer functionality, enabling personalized calibration services, data-driven reporting, and remote management. Additionally, the expansion of smart laboratory projects and digital transformation initiatives in emerging economies is boosting the deployment of high-end refractometry solutions across research institutions and industrial testing environments.

Restraint: High initial cost and complex system integration

Despite their advantages, high-end refractometers involve high initial investment due to advanced optical components, digital integration features, and automation capabilities. Maintenance costs, including regular software updates, calibration services, security upgrades, and hardware replacements, add to the total cost of ownership. Small and medium enterprises often face budget constraints that limit large-scale deployment. Moreover, environmental exposure in industrial settings demands robust designs, increasing production and servicing costs. These issues collectively restrict adoption in price-sensitive markets, particularly among smaller laboratories and regional manufacturers.

Opportunity: Increasing transition toward inline and real-time concentration monitoring

The growing implementation of AI and cloud-based analytics in refractometry is opening new growth avenues in the pharmaceuticals, food, chemicals, and industrial processing segments. Smart refractometer systems equipped with AI-enabled calibration, automated measurement workflows, and advanced data interpretation are improving accuracy and enabling autonomous quality verification. In healthcare and bioprocessing, these systems are being used for patient sample analysis, data verification, and tele-lab diagnostics, while in chemical plants, they facilitate online concentration monitoring and digital documentation. Integration with e-manufacturing systems and IoT platforms is transforming refractometers into multipurpose analytical hubs, enabling long-term operational efficiency.

Challenge: Precision stability under varying industrial conditions

One of the key challenges in the high-end refractometer market is ensuring consistent accuracy and performance across diverse environmental conditions. Refractometers deployed in outdoor, industrial, or high-humidity areas are prone to wear, vibration, and temperature fluctuations, which may impact optical stability and sensor responsiveness. Additionally, data privacy and cybersecurity regulations require strict compliance for refractometers handling sensitive process or laboratory information. Adherence to industry standards and validation guidelines adds to the design, testing, and integration complexities, compelling manufacturers to invest in advanced hardware and software solutions.

high-end-refractometer-market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Deployed Vaisala PR-43 inline refractometers across juice and dairy production lines for real-time Brix and concentration monitoring integrated directly into pasteurization and mixing processes | Eliminated manual sampling, reduced batch variability, minimized product losses during startup, and improved uniformity across global facilities with lower QC labor time |

|

Integrated Anton Paar high-precision refractometers into PAT workflows for API concentration and buffer preparation, ensuring compliant analytical control during high-purity drug manufacturing | Enabled faster batch releases, reduced solvent usage, improved analytical precision, and ensured GMP-aligned documentation for regulatory compliance |

|

Adopted Rudolph Research Analytical refractometers with automatic temperature control for chocolate fillings, syrups, and emulsions to improve formulation standardization | Delivered better texture consistency, reduced batch rejections, and enhanced formulation repeatability across confectionery production lines |

|

Implemented METTLER TOLEDO InPro and Reacto series inline refractometers for CMP slurry and photoresist concentration control in semiconductor fabrication | Achieved tighter process tolerances, reduced wafer scrap, enhanced yield, and ensured ultra-stable chemical compositions for advanced node production |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The high-end refractometer market ecosystem comprises established providers, which include Anton Paar (Austria), METTLER TOLEDO (US), ATAGO (Japan), Vaisala (Finland), and Reichert Technologies under AMETEK (US). The synergy among these stakeholders is fostering continuous innovation across the advanced refractometry ecosystem, enabling advancements in precision optics, sensor technologies, digital integration, and AI-enhanced analytical interfaces. Collaborations between R&D engineers, hardware manufacturers, and service providers are creating robust, connected, and customizable refractometry platforms. These collaborations are enhancing performance, accuracy, and usability, while end users in industries, such as pharmaceuticals, food and beverage, chemicals, and biotechnology, are driving adoption through increased demand for digital transformation and automated quality assurance globally.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

High-end Refractometer Market, By Type

The inline process refractometer segment accounted for the largest market share in 2024, as these systems are widely used for continuous concentration monitoring, product consistency control, and real-time quality assurance in food processing, pharmaceuticals, chemicals, and petrochemicals. Inline high-end refractometers are increasingly adopted across beverage plants, dairy lines, chemical reactors, and refinery pipelines to enhance operational efficiency, reduce manual sampling, and streamline production workflows.

High-end Refractometer Market, By Automation Level

The fully automatic refractometer segment accounted for a significant share in 2024, supported by the rising adoption of automated measurement systems for self-calibration, hands-free operation, and digital reporting. Additionally, the pharmaceutical, biotechnology, and food industries are witnessing growing deployment of automated refractometers for sample verification, formulation control, and compliance with stringent quality standards, improving measurement efficiency and accessibility.

High-end Refractometer Market, By Sales Channel

The direct sales segment accounted for the largest share in 2024, driven by the increasing integration of advanced optical sensors, high-precision modules, and intelligent software platforms in refractometry solutions. The growing demand for durable, contamination-resistant instruments and high-accuracy systems is further supporting market growth. Meanwhile, the software and services segments are expanding with the rising need for remote system management and calibration support.

High-end Refractometer Market, By Connectivity

The USB connectivity segment accounted for the largest market share in 2024, as refractometers are extensively deployed in research labs, production facilities, and industrial environments where secure data transfer, calibration management, and digital logging are essential. The IoT and wireless connectivity segments are also witnessing robust growth driven by the increasing deployment of cloud-connected laboratory systems and automated process monitoring solutions.

High-end Refractometer Market, By Interface Type

The digital display with physical controls segment accounted for the largest market share in 2024, due to their widespread use in laboratory, pharmaceutical, and industrial sectors for real-time measurement visibility and precise manual operation. Touchscreen and PC-connected refractometers are also gaining traction, especially in environments where advanced data analytics and software integration are key.

High-end Refractometer Market, By Measurement Principle

The critical angle method segment accounted for the largest market share in 2024, due to the rising preference for refractometers that offer high accuracy, excellent optical stability, and reliable performance across a variety of liquids and solutions. Large-format optical systems are increasingly adopted in industrial and pharmaceutical settings, while compact critical-angle refractometers find usage in portable testing and laboratory workflows.

High-end Refractometer Market, By Temperature Control System

The integrated advanced temperature control segment accounted for the largest market share in 2024, as high-end refractometers are extensively deployed in laboratories, pharmaceutical plants, chemical processing units, and food production environments where precise temperature compensation is critical for achieving accurate and repeatable measurements. The segment is also witnessing strong growth due to the rising adoption of automated temperature-regulated systems for 24/7 continuous monitoring.

High-end Refractometer Market, By Applcation

The food and beverage quality testing segment accounted for the largest market share in 2024, due to their widespread use in beverage plants, sugar processing, dairy testing, and formulation verification. Laboratory and industrial users are also increasingly deploying high-end refractometers for pharmaceutical analysis, biotechnology workflows, and chemical concentration measurement where precision and regulatory compliance are key.

High-end Refractometer Market, By Configuration

The benchtop high-end refractometer segment accounted for the largest market share in 2024 due to the rising preference for high-precision instruments offering superior optical accuracy, stability, and advanced data management features. Large-format benchtop systems are increasingly adopted in pharmaceutical and research laboratories, while portable and handheld units find usage in field-testing, process lines, and fast quality verification scenarios.

REGION

Asia Pacific is projected to register the highest CAGR in the global high-end refractometer market during the forecast period.

The Asia Pacific market is projected to be the fastest-growing during the forecast period, driven by rapid industrial digitalization, strong government initiatives supporting advanced manufacturing, and expanding pharmaceutical, biotechnology, and food processing infrastructure across countries such as China, Japan, South Korea, and India. Additionally, the growing adoption of automated laboratory technologies in healthcare, chemicals, and academic research sectors, coupled with increasing investment in AI-enabled analytical instruments and smart quality control systems, is further accelerating market growth. The region’s large-scale production capabilities, strong optical component supply chain, and cost advantages also make it a major hub for high-end refractometer innovation and manufacturing.

high-end-refractometer-market: COMPANY EVALUATION MATRIX

In the high-end refractometer market, Anton Paar (Star) leads with a strong global presence and a comprehensive product portfolio spanning precision laboratory refractometers, process refractometry systems, automated quality-control instruments, and advanced temperature-regulated measurement platforms. Its focus on integrating AI-driven analytics, automated calibration, and seamless digital data-management capabilities positions it as a key innovator in enhancing accuracy, reliability, and measurement efficiency across pharmaceuticals, chemicals, food and beverage, and biotechnology industries. Other major manufacturers such as METTLER TOLEDO, ATAGO, Vaisala, and Reichert (Ametek) continue to strengthen their positions through advancements in optics, modular system design, and robust software integration, driving widespread adoption across laboratory and industrial environments. While Anton Paar dominates with its extensive solution portfolio and established client base, these leading players demonstrate strong potential to enhance their market positioning through ongoing innovation in high-precision refractometry, process automation, and connected analytical ecosystems.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS - High-end Refractometer Companies

- Anton Paar GmbH (Austria)

- Mettler-Toledo International Inc. (US)

- Vaisala (Finland)

- Atago Co., Ltd. (Japan)

- Reichert, Inc. (US)

- Rudolph Research Analytical (US)

- Xylem Analytics Germany Sales GmbH & Co. KG. (US)

- A. KRÜSS Optronic GmbH (Germany)

- Hanna Instruments, Inc. (US)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 0.21 BN |

| Market Forecast in 2032 (Value) | USD 0.38 BN |

| Growth Rate | 7.3% |

| Years Considered | 2021–2032 |

| Base Year | 2024 |

| Forecast Period | 2025–2032 |

| Units Considered | Value (USD Billion), Volume (Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regional Scope | North America, Europe, Asia Pacific, and RoW |

WHAT IS IN IT FOR YOU: high-end-refractometer-market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| High-end Refractometer Manufacturer | Detailed competitive profiling across laboratory and process refractometer suppliers by type, application, and technology | Technology roadmap mapping by optical principle, automation level, and temperature control systems |

| Food and Beverage Processing Company | Comprehensive mapping of refractometer vendors offering inline concentration monitoring, quality testing, and formulation control solutions | Benchmarking across inline, benchtop, and handheld high-precision measurement systems |

| Pharmaceutical/Healthcare Laboratory | Profiling of refractometer providers specialized in drug formulation, purity testing, bioprocess monitoring, and regulated laboratory workflows | Evaluation of 21 CFR Part 11–compliant data security, audit trail features, and digital documentation capabilities |

| Chemical and Petrochemical Producer | Patent and product mapping of advanced refractometry systems for continuous process monitoring and high-temperature, corrosive media environments | Evaluation of refractometer integration with DCS, SCADA, IoT-enabled analytics, and automated calibration platforms |

RECENT DEVELOPMENTS

- June 2025 : METTLER TOLEDO partnered with APC, a drug process development. This partnership was to advance digitalization in pharmaceutical process analytics, combining PAT instruments (including refractometers) with APC’s digital CMC solutions.

- July 2024 : ATAGO introduced the CM-BASE-MAX, a next-gen inline Brix and salt concentration monitor designed for continuous process measurement in harsh industrial environments.

- March 2024 : Anton Paar GmbH introduced upgraded Abbemat refractometers offering ±0.00002 nD precision, 1.26–1.72 nD range, enhanced thermal stability, and improved QC performance for pharmaceutical and chemical labs.

Table of Contents

Methodology

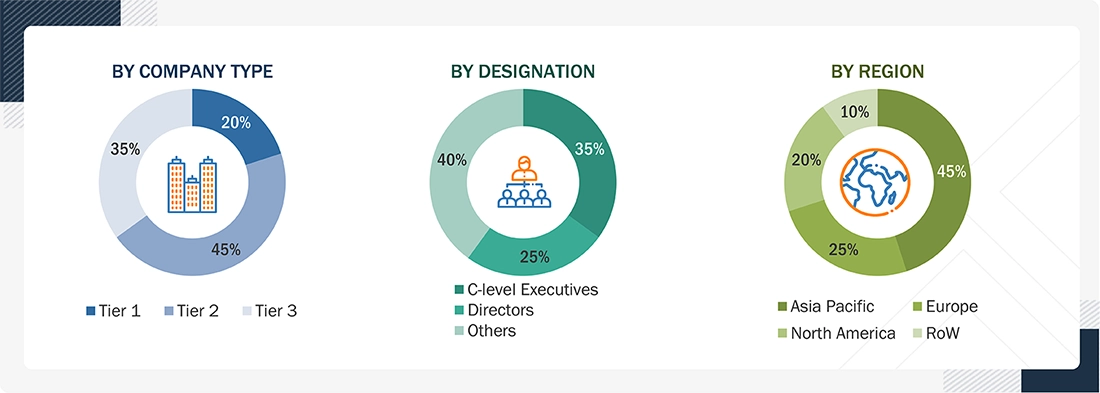

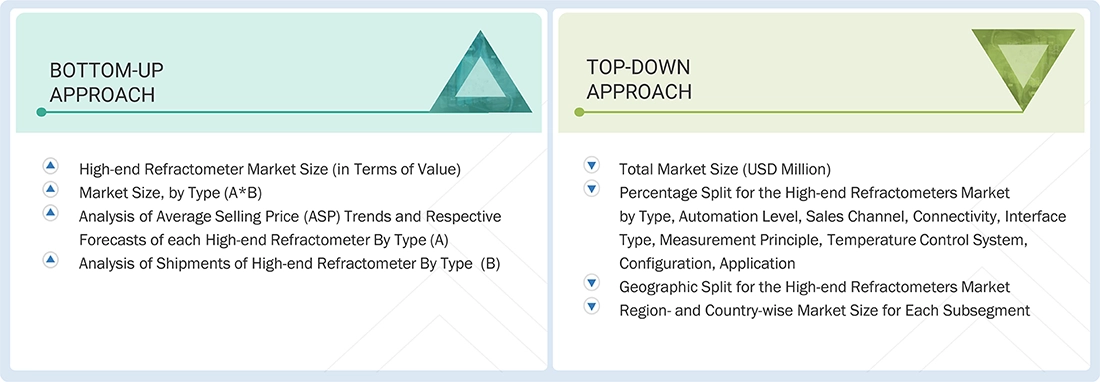

The study involved four major activities in estimating the current size of the high-end refractometer market. Exhaustive secondary research was conducted to gather information on the market, adjacent markets, and the overall high-end refractometer landscape. These findings, along with assumptions and projections, were validated through primary research involving interviews with industry experts and key stakeholders across the value chain. Both top-down and bottom-up approaches were utilized to estimate the overall market size. Subsequently, market breakdown and data triangulation techniques were applied to determine the sizes of various segments and subsegments. Two key sources, secondary and primary, were leveraged to conduct a comprehensive technical and commercial assessment of the high-end refractometer market.

Secondary Research

The secondary research process involved various secondary sources to identify and collect necessary information for this study. The secondary sources included annual reports, press releases, and investor presentations of companies; white papers; journals and certified publications; and articles from recognized authors, websites, directories, and databases. Secondary research was conducted to obtain key information about the industry’s supply chain, the market’s value chain, the total pool of key players, market segmentation according to the industry trends (to the bottom-most level), regional markets, and key developments from market- and technology-oriented perspectives. The secondary data was collected and analyzed to determine the overall market size, which is further validated through primary research.

Primary Research

Extensive primary research was conducted after gaining knowledge about the current scenario of the high-end refractometer market through secondary research. Several primary interviews were conducted with experts from the demand and supply sides across four major regions—North America, Europe, the Asia Pacific, and the RoW. This primary data was collected through questionnaires, emails, and telephonic interviews.

Notes: The three tiers of companies have been defined based on their total revenue as of 2024. The categorization given below has been applied:

Tier 1: >USD 1 billion, Tier 2: USD 250 million–USD 1 billion, and Tier 3: USD 250 million.

Others include sales managers, marketing managers, and product managers.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the high-end refractometer market. These methods were also applied to estimate the size of individual subsegments across type, connectivity, application, automation level, and sales channel. The following research methodology was used to estimate the market size:

- Identifying high-end refractometer products currently offered or expected to be launched by major providers

- Tracking leading manufacturers such as Anton Paar, METTLER TOLEDO, Vaisala, ATAGO, Reichert, and other key industry participants

- Estimating the high-end refractometer market size by analyzing the product portfolios, ASP trends, and shipment volumes for each refractometer type

- Tracking ongoing and upcoming product launches—such as next-generation inline refractometers, wireless-enabled systems, and multi-wavelength platforms—and forecasting the market impact of these developments

- Conducting multiple interviews with key opinion leaders to understand demand trends and analyzing the scope of operations carried out by major refractometer manufacturers across regions

- Arriving at market estimates by evaluating revenues generated by companies across their operating countries and combining region-wise and country-wise data to derive global estimates

- Assigning a percentage of each company’s total revenue—or relevant segment revenue—to high-end refractometers based on product portfolio mapping, target applications, and end-user industries served

- Verifying and cross-checking market estimates at each stage through discussions with CXOs, directors, product managers, laboratory experts, and domain specialists at MarketsandMarkets

High-end Refractometer Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall size of the high-end refractometer market using the market size estimation process explained above, the total market was split into several segments and subsegments. Data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments of the market. The data was triangulated by studying various factors and trends from the demand and supply sides. The market size was also validated using both the top-down and bottom-up approaches.

Market Definition

A high-end refractometer is an advanced optical measurement instrument designed to provide exceptionally high accuracy, precision, and stability in determining the refractive index, concentration, purity, or composition of liquids, semi-solids, or transparent materials. These instruments feature digitally controlled optics, Peltier-based temperature regulation, automated measurement workflows, and multi-parameter sensing to ensure laboratory-grade reliability and traceability.

High-end refractometers typically integrate advanced automation, multi-wavelength measurement, AI-enhanced data analytics, IoT connectivity, compliance-ready data management, and modular or inline configurations for real-time quality control in demanding environments. They are used extensively in pharmaceuticals, food & beverage, chemicals, petrochemicals, clinical diagnostics, semiconductor process fluids, and research laboratories, where ultra-high measurement accuracy, regulatory compliance, and process consistency are critical.

Key Stakeholders

- Raw material and optical component suppliers

- Raw material and optical component suppliers

- Display and touchscreen manufacturers

- Hardware component suppliers

- Software and platform developers

- Original equipment manufacturers (OEMs)

- Original design manufacturers (ODMs) and optical instrument integrators

- System integrators and solution providers

- Data analytics and AI solution providers

- Networking and connectivity providers

- Distributors and retailers

- Research and development organizations

- Technology standards organizations, forums, alliances, and associations

- Technology investors and venture capital firms

Report Objectives

- To describe and forecast the size of the high-end refractometer market by type, measurement principle, application, automation level, configuration, temperature control system, interface type, connectivity, sales channel, and region in terms of value

- To describe and forecast the market size of various segments across four key regions—North America, Europe, the Asia Pacific, and Rest of the World (RoW), in terms of value

- To forecast the size of the high-end refractometer type, in terms of volume

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the growth of the high-end refractometer market

- To analyze the high-end refractometer value chain and ecosystem, along with the average selling price of the high-end refractometer type

- To strategically analyze the regulatory landscape, standards, patents, Porter’s five forces, import and export scenarios, AI/Gen AI impact, trade values, the 2025 US tariffs, and case studies pertaining to the market under study

- To strategically analyze micromarkets1 with regard to individual growth trends, prospects, and contributions to the overall market

- To analyze opportunities in the market for stakeholders by identifying high-growth segments

- To provide details of the competitive landscape for market leaders

- To provide details of the macroeconomic outlook for regions

- To analyze strategies, such as product launches, partnerships, collaborations, and acquisitions, adopted by players in the market

- To profile key players in the market and comprehensively analyze their market ranking based on their revenue, market share, and core competencies

Customization Options:

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Company Information:

- Detailed analysis and profiling of additional market players (up to five)

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the High-end Refractometer Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in High-end Refractometer Market