Optical (Laser) Satellite Communication Market Size & Growth

Optical Satellite Communication Market by Laser Type (Semiconductor Diode, Fiber, Solid State), Data Rate (Below 2.5 Gbps, 2.5 to 10 Gbps, above 10 Gbps), Platform, Application, Component, and Region - Global Forecast to 2030

OVERVIEW

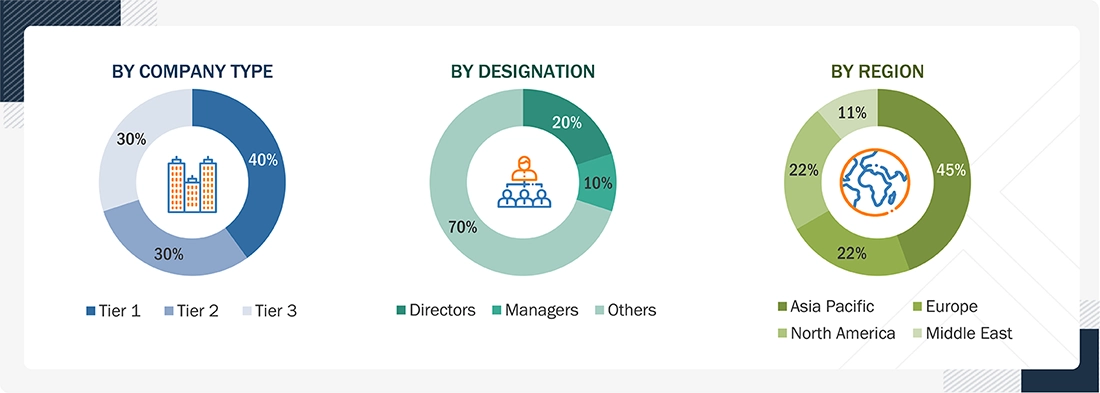

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The Optical (Laser) Satellite Communication Market is projected to grow from USD 0.62 billion in 2025 to USD 1.56 billion by 2030 at a CAGR of 20.4%. In terms of volume, the optical (laser) satellite communication terminal is expected to grow from 10,791 units in 2025 to 19,484 units in 2030; this growth is driven by rising demand for high-capacity data links, secure communications, and the growing adoption of laser inter-satellite links across LEO constellations.

KEY TAKEAWAYS

-

By RegionThe North American optical satellite communication market accounted for a 67.9% revenue share in 2024.

-

By PlatformBy platform, the airborne terminal segment is expected to register the highest CAGR of 140.4%.

-

By ApplicationBy application, the network backbone & relay communications segment is projected to be the most dominant during the forecast period.

-

Competitive LandscapeThales Alenia Space, SpaceX, and Mynaric AG were identified as some of the star players in the optical (laser) satellite communication market (global), given their strong market share and product footprint.

The Optical (Laser) Satellite Communication Industry is growing steadily, driven by a growing need for secure, high-capacity data links across space missions, defense applications, and commercial satellite networks. Improvements in laser terminal pointing and tracking systems, along with AI-based link management, are making these systems more reliable and easier to operate. This is helping adoption increase across LEO, MEO, and GEO satellite deployments as operators seek better performance without adding too much complexity.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on customers’ customers in the optical (laser) satellite communication market is driven by rising demand for high-capacity, low-latency, and secure data connectivity across space networks, pushing end users toward space-based optical mesh architectures. There is growing emphasis on real-time data relay, resilient communications, and multi-orbit networking, reshaping service delivery and driving demand for advanced optical terminals, feeder links, and network services.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Expansion of LEO broadband constellations requiring high-capacity optical inter-satellite backbones

-

Growth in earth observation data volumes requiring high-speed optical downlinks

Level

-

Atmospheric turbulence and cloud cover affecting space-to-ground optical link availability

-

Higher optical ground station density increasing capital and operational complexity

Level

-

Emergence of pace-to-air optical links enabling airborne communication nodes

-

RF spectrum congestion supporting adoption of spectrum-independent optical transport links

Level

-

Technology readiness, production scale-up, and qualification timelines across constellations

-

Pointing, acquisition, and tracking precision requirements for mobile and multi-orbit architectures

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Expansion of LEO broadband constellations requiring high-capacity optical inter-satellite backbones

Large LEO constellations require multi-Gbps inter-satellite links to route data in space and reduce dependence on ground gateways. Optical backbones enable low-latency, secure, and scalable mesh networking critical for broadband and data-relay missions.

Restraint: Atmospheric turbulence and cloud cover affecting space-to-ground optical link availability

Optical downlinks are sensitive to weather, which can reduce link availability and throughput. This limits continuous service delivery and increases reliance on site-diverse ground stations and hybrid RF-optical architectures.

Opportunity: Emergence of space-to-air optical links enabling airborne communication nodes

Space-to-air optical links enable aircraft, UAVs, and high-altitude platforms to serve as relay nodes between satellites and ground networks. This enables new use cases for resilient communications, ISR data relay, and low-latency airborne connectivity.

Challenge: Technology readiness, production scale-up, and qualification timelines across constellations

Optical terminals must meet strict space-qualification and reliability standards, which can slow production ramp-up. This creates risk when constellation deployment timelines outpace terminal manufacturing and validation cycles.

OPTICAL (LASER) SATELLITE COMMUNICATION MARKET SIZE & GROWTH: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

-satellite-communication-market-sda.svg) |

Required a secure, low-latency space network for missile tracking and tactical defense communications beyond RF limitations. | Enables jam-resistant mesh networking, improves global coverage, and supports real-time defense data transfer. |

-satellite-communication-market-spacex.svg) |

Needed high-capacity space-based routing to deliver low-latency broadband over remote and underserved regions. | Reduces ground gateway dependence and enables continuous global broadband coverage. |

-satellite-communication-market-nasa.svg) |

Required terabit-class downlinks to transmit large science and EO datasets beyond RF capacity limits. | Delivers ultra-high data rates and accelerates access to mission data. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The optical (laser) satellite communication market ecosystem comprises satellite OEMs and prime integrators, including BAE Systems, Northrop Grumman, Thales Alenia Space, and General Atomics, supported by specialized optical terminal providers such as Mynaric, TESAT Spacecom, and BridgeComm. These players integrate laser terminals, payloads, and space-qualified electronics to enable high-capacity inter-satellite and space-to-ground links. Collaboration among system integrators, component suppliers, and end users is driving the scalable deployment of secure, low-latency optical networks across defense and commercial satellite programs.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Optical (Laser) Satellite Communication Market, By Platform

The satellite platform dominates the market, with optical terminals primarily deployed on LEO, MEO, and GEO satellites to enable inter-satellite and space-to-ground links. Large constellation rollouts are driving higher terminal volumes and system integration demand.

Optical (Laser) Satellite Communication Market, By Component

The pointing, acquisition, and tracking (PAT) module leads the market due to its critical role in maintaining precise laser alignment between fast-moving satellites. High-accuracy tracking is essential for stable, high-data-rate optical links in dense LEO constellations.

Optical (Laser) Satellite Communication Market, By Application

Network backbone and relay communications dominate as operators deploy optical inter-satellite links to build space-based mesh networks. These networks reduce reliance on ground stations and enable low-latency global data routing.

Optical (Laser) Satellite Communication Market, By Laser Type

Fiber lasers hold the largest share due to their high efficiency, beam quality, and reliability in space environments. Their scalability and compatibility with compact satellite terminals enable widespread adoption across commercial and defense missions.

REGION

Asia-Pacific to be fastest-growing region in global optical (laser) satellite communication market during forecast period

The Asia Pacific optical (laser) satellite communication market is expected to register the highest CAGR during the forecast period, driven by large-scale government-backed LEO constellation deployments and growing investment in indigenous optical terminal development across China, India, Japan, and South Korea.

OPTICAL (LASER) SATELLITE COMMUNICATION MARKET SIZE & GROWTH: COMPANY EVALUATION MATRIX

In the optical (laser) satellite communication market matrix, BAE Systems (Star) leads with a strong market share and broad product footprint, supported by its integration of defense-grade optical terminals and space-based communication systems across large-scale satellite programs. Safran (Emerging Leader) is strengthening its position through advanced space optics, precision pointing systems, and greater participation in European and defense-led optical communication initiatives. While BAE Systems maintains dominance through scale and program integration, Safran shows strong potential to move toward the leaders’ quadrant as adoption of secure, high-capacity laser communication links accelerates across commercial and government satellite networks.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

List of Top Optical Satellite Communication Market Companies

- Thales Alenia Space (France)

- Mynaric AG (Germany)

- SpaceX (US)

- Tesat-Spacecom GmbH (Germany)

- BridgeComm Inc. (US)

- BAE Systems (UK)

- Honeywell International Inc. (US)

- Mitsubishi Electric Corporation (Japan)

- Sony Space Communications (Japan)

- AAC Clyde Space (Sweden)

- NEC Space Technologies (Japan)

- Skyloom Global (US)

- General Atomics (US)

- Space Micro (US)

- Northrop Grumman (US)

- Safran (France)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 2.15 Billion |

| Market Forecast in 2030 (Value) | USD 4.83 Billion |

| Growth Rate | CAGR of 14.2% from 2025-2030 |

| Years Considered | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/Billion), Volume (Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, Middle East and the Rest of the World |

WHAT IS IN IT FOR YOU: OPTICAL (LASER) SATELLITE COMMUNICATION MARKET SIZE & GROWTH REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Leading Manufacturer | Additional segment breakdown for countries | Additional country-level market sizing tables for segments/sub-segments covered at the regional/global level to gain an understanding of market potential by each country |

| Emerging Leader | Additional company profiles | Competitive information on targeted players to gain granular insights on direct competition |

| Regional Market Leader | Additional country market estimates | Additional country-level deep dive for a more targeted understanding of the total addressable market |

RECENT DEVELOPMENTS

- October 2025 : Tesat delivered SCOT80 Scalable Optical Communication Terminals for demonstration on a Global Positioning Satellite built by Lockheed Martin. The terminals enable optical crosslinks with data rates up to 100 Gbps and are compliant with SDA OCT standards.

- October 2025 : Muon Space partnered with SpaceX to integrate SpaceX’s Starlink “mini-laser” optical inter-satellite terminals into its Halo satellite platform so its satellites become part of Starlink’s in-orbit laser mesh network enabling high-speed, low-latency optical connectivity for Muon’s constellation customers.

- February 2025 : Thales Alenia Space received a contract from the European Space Agency under the HydRON programme to design, develop, deploy, and demonstrate the Demonstration System Element #2, which aims to validate a fully optical, multi-orbit high-data-rate space communication network, including optical terminals and end-to-end laser data relay capabilities.

Table of Contents

Methodology

The study involved four major activities in estimating the current size of the Optical satellite communication Market. Exhaustive secondary research was done to collect information on the Optical satellite communication market, its adjacent markets, and its parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Demand-side analyses were carried out to estimate the overall size of the market. After that, market breakdown and data triangulation procedures were used to estimate the sizes of different segments and subsegments of the Optical satellite communication Market.

Secondary Research

The market ranking of companies was determined using secondary data made available through paid and unpaid sources and by analyzing the product portfolios of major companies. These companies the performance on the basis of the performance and quality of their products. These data points were further validated by primary sources.

Secondary sources referred to for this research study included financial statements of companies offering Optical Satellite Communication hardware and information from various trade, business, and professional associations. The secondary data was collected and analyzed to arrive at the overall size of the Optical Satellite Communication market, which was validated by primary respondents.

Primary Research

Extensive primary research was conducted after acquiring information regarding the Optical Satellite Communication market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand and supply sides across major countries of North America, Europe, Asia Pacific, ROW which includes the Middle East & Africa, and Latin America. Primary data was collected through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The market sizing of the market was undertaken from the demand side. The market was upsized at a regional level based on procurements and modernizations in the land fixed, land mobile, airborne, naval, and portable platforms. Such procurements provide information on each platform's demand aspects of Optical satellite communication products. For each platform, all possible application areas where Optical satellite communication is integrated or installed were mapped.

Note: An analysis of technological, military funding, year-on-year launches, and operational cost were carried out to arrive at the CAGR and understand the market dynamics of all countries in the report. The market share for all type, component, application, and laser type was based on the recent and upcoming launches of Optical satellite communication products in every country from 2020 to 2028.

Data Triangulation

After arriving at the overall size from the market size estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for various market segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

The following figure indicates the market breakdown structure and the data triangulation procedure that was implemented in the market engineering process to make this report on the Optical Satellite Communication market.

Market Definition

The optical satellite communication market refers to the sector that deals with developing, manufacturing, and deploying satellite communication systems that utilize optical technology for data transmission. Optical satellite communication (free-space optical communication (FSO) involves sending data through laser beams or infrared signals instead of traditional radio frequency (RF) signals used in most satellite communication systems. This technology offers high data transmission rates, low latency, and increased security for sensitive data transfer. With a growing demand for global connectivity and data-intensive applications, optical communication presents a potential solution to meet these needs. Despite challenges related to atmospheric conditions, advancements in technology are continuously improving its viability.

Optical Satellite communication consists of Satellite-To-Satellite Communication Payloads: Satellite-to-satellite communication payload encompasses inter-satellite links (ISLs) deployed within satellites to facilitate optical communication between these spaceborne platforms.

Ground -To- Satellite- Communication Terminals: Ground-to-satellite communication terminals encompass optical ground terminals, including optical ground stations and optical terminals, employed for laser communication between the terrestrial infrastructure and satellite systems.

Market Stakeholders

- Manufacturers of Optical satellite

- System Integrators

- Original Equipment Manufacturers (OEM)

- Service Providers

- Research Organizations

- Investors and Venture Capitalists

- Ministries of Defense

Report Objectives

- To define, describe, and forecast the size of the Optical satellite communication market based on type, component, application, laser type, and region.

- To indicate the size of the various segments of the Optical satellite communication market based on five regions North America, Europe, Asia Pacific, Rest of the world along with key countries in each of these regions.

- To identify and analyze key drivers, restraints, opportunities, and challenges influencing the growth of the market.

- To determine industry trends, market trends, and technology trends prevailing in the market

- To analyze micro markets concerning individual technological trends, prospects, and their contribution to the overall market

- To provide a detailed competitive landscape of the market and analyze competitive growth strategies such as product launches and developments, contracts, partnerships, agreements, and collaborations adopted by key players in the market.

- To identify the detailed financial positions, product portfolios, and key developments of leading companies in the market

- To strategically profile key market players and comprehensively analyze their market rank analysis and core competencies.

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

- Additional country-level analysis of the Optical satellite communication Market

- Profiling of other market players (up to 5)

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company in the Optical satellite communication Market.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Optical Satellite Communication Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Optical Satellite Communication Market