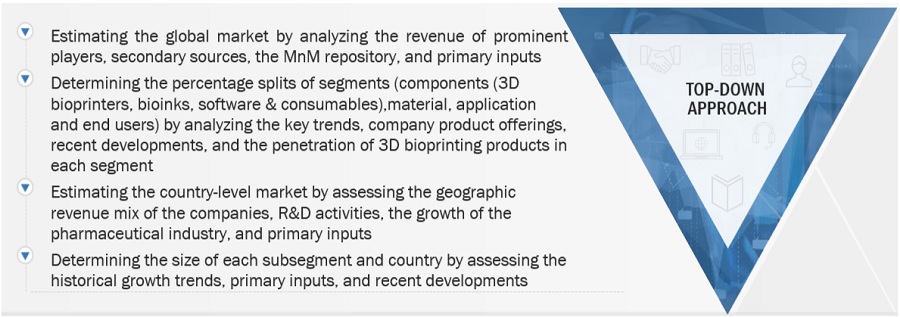

This study involved four major activities in estimating the current size of the 3D bioprinting market. Exhaustive secondary research was carried out to collect information on the market, its peer markets, and its parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation procedures were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary research was used mainly to identify and collect information for the extensive technical, market-oriented, and commercial study of the 3D bioprinting market. The secondary sources used for this study include World Health Organization (WHO), Food and Drug Administration (US), National Health Service (NHS), ClinicalTrials.Gov, National Institutes of Health (NIH), Elsevier, Canadian Manufacturers & Exporters (CME) , Ministry of Science and Technology (China), Dubai Health Authority (DHA), South African Department of Science and Technology (DST), Ministry of Food and Drug Safety (South Korea), Organ Procurement and Transplantation Network (OPTN), OrganDonor.gov, Eurotransplant (ET), Centre for Commercialization of Regenerative Medicine (CCRM), Networks of Centres of Excellence (NCE), Human Tissue Authority (HTA), Human Fertilisation and Embryology Authority (HFEA), Medicines and Healthcare Products Regulatory Agency (MHRA), Advanced Research Projects Agency for Health (ARPA-H), American Public Health Association (APHA), American Public Health Association (APHA), National Kidney Foundation (NKF), National University Centre for Organ Transplantation (NUCOT), ACS Journals; Corporate filings such as annual reports, SEC filings, investor presentations, and financial statements; research journals; press releases; and trade, business, and professional associations. Secondary data was collected and analyzed to arrive at the overall size of the global 3D bioprinting market, which was validated through primary research.

Primary Research

In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts (SMEs), C-level executives of key market players, and industry consultants, among other experts, to obtain and verify the critical qualitative and quantitative information as well as assess future prospects of the market. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The following is a breakdown of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

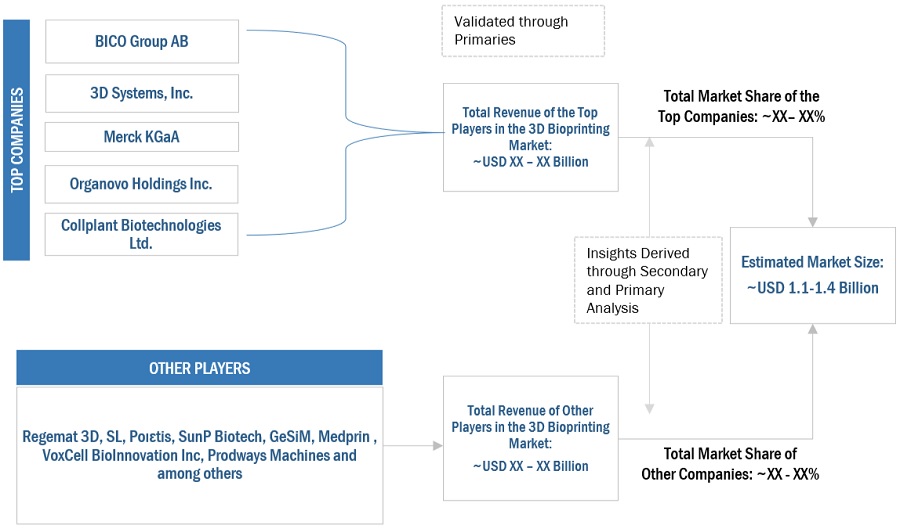

The global size of the 3D bioprinting market was estimated through multiple approaches. A detailed market estimation approach was followed to estimate and validate the value of the market and other dependent submarkets. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

-

The major players in the industry and market have been identified through extensive primary and secondary research.

-

The revenues generated from the 3D bioprinting business of players operating in the market have been determined through secondary research and primary analysis.

-

All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Global 3D bioprinting Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Top-down Approach-

Data Triangulation

After estimating the overall market size from the market size estimation process, the total market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

Bioprinting is a technology where bioinks and biomaterials, mixed with cells, are 3D printed, often to construct living tissue models. Bioprinting, in general, is defined as the deposition of living cells in combination with biological substances, such as collagen, fibrin, and gelatin, for the growth of complete tissues and organs. The 3D bioprinting process starts with the creation of an architectural design that is based on the fundamental composition of the organs or target tissues and makes use of living cells, molecules, and biomaterials to produce complex living and non-living biological products.

Key Stakeholders

-

Academic Research Institutes

-

Pharmaceutical & Biotechnology Companies

-

Life Science Companies

-

Venture Capitalists and Investors

-

Government Organizations

-

Private Research Firms

-

Contract Research Organizations (CROs)

-

Contract Development and Manufacturing Organizations (CDMOs)

-

Research and Development (R&D) Companies

-

3D Cell Culture Product Manufacturers

Report Objectives

-

To define, describe, and forecast the 3D bioprinting market based on component, material, application, end user, and region

-

To provide detailed information regarding the major factors influencing the market growth (such as drivers, restraints, opportunities, and challenges)

-

To analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall 3D Bioprinting market

-

To analyze the opportunities for stakeholders and provide details of the competitive landscape for market leaders

-

To forecast the market size of the segments with respect to six regions: North America, Europe, Asia Pacific, Latin America, Middle East, and Africa

-

To profile the key players and analyze their market shares and core competencies2

-

To track and analyze competitive developments, such as acquisitions, product launches, expansions, agreements, partnerships, and collaborations

-

To benchmark players within the market using the proprietary “Company Evaluation Matrix” framework, which analyzes market players on various parameters within the broad categories of business and product excellence strategies, including trends/disruptions impacting customers’ business, pricing analysis, supply/value chain analysis, ecosystem analysis, technology analysis, patent analysis, trade analysis, key conferences & events in 2024-2025, key stakeholders & buying criteria, and investment & funding scenario.

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for this report:

Product Analysis

-

Product matrix, which provides a detailed comparison of the product portfolio of each company in the 3D bioprinting Market

Growth opportunities and latent adjacency in 3D Bioprinting Market