AI Assistant Market

AI Assistant Market by Offering (Research, Sales, Presentation, Developer Assistants), Application (Meeting Transcription, Document Search, Email Sequencing, Scheduling, Code Completion, Design, Data Exploration, Spreadsheet AI) - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The AI assistant market is projected to grow significantly, increasing from USD 3.35 billion in 2025 to USD 21.11 billion by 2030, with a robust CAGR of 44.5%.

This rapid expansion is driven by enterprises increasingly adopting domain-specific AI fine-tuned tools equipped with advanced LLMs that understand industry-specific jargon, workflows, and compliance requirements. The growth is further fueled by the explosive rise of plug-in ecosystems, which enable seamless integration between AI assistants and diverse SaaS platforms, CRMs, and custom databases, leading to unmatched productivity gains. AI coding assistants accelerate developer tasks and greatly reduce manual coding time. The market’s growth across various segments, from integration types like SaaS-native and browser extensions to applications such as writing, meeting collaboration, and code review, reflects rising demand across industries.

KEY TAKEAWAYS

- North America dominates the AI Assistants market by 36.3% share in 2025.

- By offering, the Knowledge & Research Assistants is expected to have the highest CAGR of 49.3%, during the forecast period.

- By integration type, the Standalone Assistants segment dominates by 33.3% market share in 2025.

- By application, the knowledge retreival & document search segment is expected to dominate the market.

- By end user, the professional service providers segment is projected to grow at the fastest rate, during the forecast period.

- Microsoft, Google and Salesforce are identified as some of the star players in the AI Assistants market, given their strong market share and product footprint.

- Jasper, Quillbot and Descript, among others, have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging leaders.

AI Assistants are intelligent, software-embedded tools that support knowledge workers, professionals, and teams in performing high-value, context-aware, task-specific activities across communication, productivity, research, collaboration, scheduling, analysis, and content creation.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The business impact on end-users is influenced by market trends and disruptions, which then affect revenue across the entire value chain. AI assistant providers and their targeted applications are key players in this ecosystem. Changes in these trends or new market disruptions directly impact end-user revenue. This fluctuation in end-user revenue subsequently influences the revenue of the AI assistant clients, ultimately shaping the financial performance of the AI assistant providers.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

§Modular deployment of AI assistants within SaaS platforms accelerating enterprise adoption

-

§Real-time behavioral and contextual data enables highly personalized user support

Level

-

§Fragmented digital ecosystems hinder unified AI assistant experiences across tools

-

§Understanding unstructured data continues to limit assistant intelligence and adaptability

Level

-

§Low-code customization and multilingual support unlock broader enterprise adoption

-

§Federated learning for performance enhancement

Level

-

§Limits in generalization across roles and workflows restrict long-term scalability of AI assistants

-

§Rapid evolution of AI capabilities may outpace employee adaptation and organizational readiness

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Real-time behavioral and contextual data enables highly personalized user support

The AI assistants market is rapidly evolving because users want more than generic bots; they want smart, personalized AI assistants that adapt to their workflows. By utilizing real-time behavioral and contextual data, modern AI assistants can analyze calendars, tasks, emails, and workflows to provide timely suggestions. For instance, a contextual AI assistant might remind a sales executive about overdue follow-ups, automatically draft custom emails, or highlight priority tasks before meetings. This creates the impression of an always-on productivity partner rather than just a static tool. Companies like Microsoft Copilot, Google Duet AI, and Salesforce Einstein GPT demonstrate how real-time context makes assistants more relevant, helping workers save hours on repetitive tasks.

Restraint: Fragmented digital ecosystems hinder unified AI assistant experiences across tools

One of the restraints in the AI assistant market is that workers use dozens of disconnected tools every day. People switch between Slack, Zoom, Notion, Jira, Asana, and many other apps, but these tools don’t always share data seamlessly. This makes it difficult for even the best enterprise AI assistants to provide a unified, contextual experience. For example, an AI assistant might retrieve meeting notes from Zoom but can’t match tasks from Asana if the data isn’t integrated. This lack of smooth cross-platform AI integration causes assistants to operate in silos and limits their full potential. Many companies end up restricting AI assistants to just one app to avoid data privacy risks and compliance issues. Managing permissions, APIs, and secure access across scattered systems adds extra work for IT teams.

Opportunity: Federated learning for performance enhancement

A significant opportunity in the AI assistant market is the adoption of federated learning, a machine learning technique that enhances AI performance without transferring raw user data to central servers. For industries handling sensitive or regulated information such as finance, healthcare, or legal services, federated learning mitigates privacy risks by training models locally and sharing only encrypted updates instead of raw data. This allows AI-powered assistants to learn user behaviors, task patterns, and workflow preferences without breaching strict data privacy rules like GDPR or HIPAA. The approach aligns with increasing market demands for data localization, zero-trust security, and context-rich personalization. It also provides vendors scalable ways to deliver intelligent, privacy-preserving AI solutions that meet complex enterprise requirements. Incorporating federated learning can be a strategic advantage for providers targeting privacy-conscious sectors or government clients.

Challenge: Limits in generalization across roles and workflows restrict long-term scalability of AI assistants

One of the ongoing challenges in scaling enterprise AI assistants is their limited ability to adapt across multiple roles, diverse workflows, and highly specialized industry settings. While many AI assistants excel at narrowly defined tasks such as scheduling meetings, taking notes, or summarizing information, they often struggle when asked to operate across different departments with unique jargon, workflows, or data structures. For example, an AI assistant built for sales tasks like follow-ups or pipeline updates might perform poorly if used within a legal team that requires precise, domain-specific knowledge and context awareness. This lack of cross-functional adaptability can slow down enterprise-wide deployment and reduce the overall return on investment for companies. A generic, one-size-fits-all AI assistant may result in lower user trust, subpar performance, or frequent retraining, leading to hidden costs for organizations. For AI vendors and solution providers, the key opportunity is in developing modular and flexible architectures that enable assistants to adapt dynamically to different contexts without needing to rebuild from scratch each time.

AI Assistant Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Jasper empowers Cushman & Wakefield to scale real estate content creation. | Faster content turnaround, consistent brand messaging, improved marketing productivity, and reduced manual writing workload |

|

Regie.ai helps Crunchbase boost prospecting personalization and outreach | Higher response rates, more qualified leads, improved rep productivity, and scalable prospecting workflows |

|

Replit enables Zinus to accelerate development cycles and collaboration | Faster development iterations, streamlined team collaboration, quicker feature rollouts, and improved developer satisfaction |

|

Descript supports Hubspot in streamlining audio and video content production | 5x faster editing time, easier collaboration, increased podcast output, and smoother content repurposing |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The AI assistant ecosystem is evolving quickly, shaped by diverse offerings that meet different business needs across industries. From writing and content creation to meeting collaboration, developer productivity, knowledge search, sales engagement, and design support, specialized AI assistants are becoming essential tools in modern workflows. By combining advanced features with specific use cases, these solutions enable organizations to automate repetitive tasks, improve efficiency, and make smarter decisions. This interconnected ecosystem of services shows how AI assistants are becoming a vital part of digital work environments.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

AI Assistant Market, by Offering

By offering segment, knowledge and research assistants are set to experience the strongest growth as organizations increasingly prioritize AI-driven insights to enhance decision-making. These assistants streamline knowledge discovery, research synthesis, and data interpretation, enabling faster innovation cycles. Enterprises are leveraging them to strengthen competitive positioning by improving workforce productivity and unlocking actionable intelligence from vast information sources. Their role as strategic enablers of smarter business outcomes positions them as a core offering within the AI assistant landscape.

AI Assistant Market, by Integration Type

Based on integration type, API-based AI assistants are expected to grow quickly as businesses aim for smooth integration of intelligent features into daily tools and platforms. By incorporating capabilities such as natural language understanding, contextual responses, and task automation directly into workflows, APIs reduce friction and improve scalability. This approach allows companies to customize AI assistants for industry-specific needs, boosting operational efficiency and user engagement. The increasing adoption of SaaS ecosystems and platform-based business models further speeds up this trend, making APIs a key driver of growth.

AI Assistant Market, by Application

By application segment, AI-powered writing and editing tools currently dominate the AI assistant market, addressing the surging demand for faster, higher-quality content creation. These assistants empower marketing teams, publishers, and enterprises to streamline copy generation, content optimization, and grammar refinement with consistency and scale. By improving brand communication and reducing manual effort, they serve as a productivity multiplier. As digital content consumption continues to rise, organizations view AI-driven writing and editing not just as support tools but as essential enablers of real-time business communication.

AI Assistant Market, by End User

Individual end users represent the fastest-growing segment as AI assistants become part of everyday life through mobile-first solutions and generative AI applications. From task automation and personalized learning to smart recommendations, consumers are embracing assistants that simplify routines and enhance productivity. Accessibility through smartphones, voice platforms, and cloud-based tools is accelerating adoption across demographics. With increasing familiarity and trust in AI technologies, individuals are expected to drive significant market momentum, highlighting the expanding relevance of AI assistants beyond enterprises.

REGION

Asia Pacific to be fastest-growing region in global Deepfake AI Market during forecast period

Asia Pacific is emerging as the fastest-growing region in the AI assistant market, driven by rapid digital adoption, expanding internet and mobile penetration, and strong government initiatives supporting AI innovation. Enterprises across BFSI, retail, healthcare, and education are actively deploying AI assistants to improve customer engagement and operational efficiency, positioning the region as a key growth hub for the coming years.

AI Assistant Market: COMPANY EVALUATION MATRIX

The competitive landscape of the AI assistant market is rapidly evolving, with established players like Microsoft positioned as market Stars, leveraging scale and innovation to strengthen their dominance. At the same time, emerging leaders such as Dropbox are gaining traction through focused solutions and expanding integrations, signaling strong potential to transition into the Star category as adoption and enterprise demand continue to accelerate.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 2.15 Billion |

| Market Forecast in 2030 (value) | USD 21.11 Billion |

| Growth Rate | CAGR of 44.5% from 2025-2030 |

| Years Considered | 2020 – 2030 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Units Considered | USD Million/Billion |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, Latin America, Middle East & Africa |

WHAT IS IN IT FOR YOU: AI Assistant Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Leading AI Assistant Vendor | Product Analysis: Product Matrix, which gives a detailed comparison of the product portfolio based on numerous parameters | Enhanced understanding of competitive positioning and product offerings |

| Leading AI Assistant Vendor | Company Information: Detailed analysis and profiling of additional market vendors | Deeper insights into market dynamics and potential strategic partnerships |

RECENT DEVELOPMENTS

- May 2025 : Salesforce signed a definitive agreement to acquire Convergence.ai, a London-based AI agent company recognized for advancing autonomous systems that perform complex, human-like tasks within digital environments. This move aims to accelerate the development of Agentforce, Salesforce’s next-generation AI platform, and position the company at the forefront of intelligent business automation.

- April 2025 : Adobe announced a significant expansion of its AI capabilities for creators by integrating partner models from leading innovators, notably Google Cloud and OpenAI, into the all-in-one Firefly platform. This partnership marks a critical evolution, enabling creative professionals to ideate, generate, and produce visual, audio, and vector content with unprecedented control, flexibility, and creative breadth—all from a unified workspace.

- April 2025 : Dropbox announced the acquisition of Promoted.ai, marking a strategic step toward advancing AI-powered productivity in the workplace. Through this partnership, Promoted.ai’s expertise in search infrastructure and marketplace optimization will be integrated into Dropbox Dash, elevating search, ranking, and discovery for business collaboration and content management.

- March 2025 : Google announced the signing of a definitive agreement to acquire Wiz to strengthen cloud security for organizations worldwide. With this agreement, Wiz will join Google Cloud, accelerating the delivery of unified, AI-powered security solutions for businesses and governments. The integration aims to provide customers with robust, real-time threat protection, operational efficiency, and enhanced visibility across multicloud environments, including AWS, Microsoft Azure, and Oracle Cloud.

- January 2025 : Microsoft and Pearson formed a multiyear strategic partnership to transform learning and work with AI. Pearson to deploy Microsoft 365 Copilot across workforce and power content with Azure Cloud Computing and AI infrastructure, addressing skills gap with AI-powered products and services.

Table of Contents

Methodology

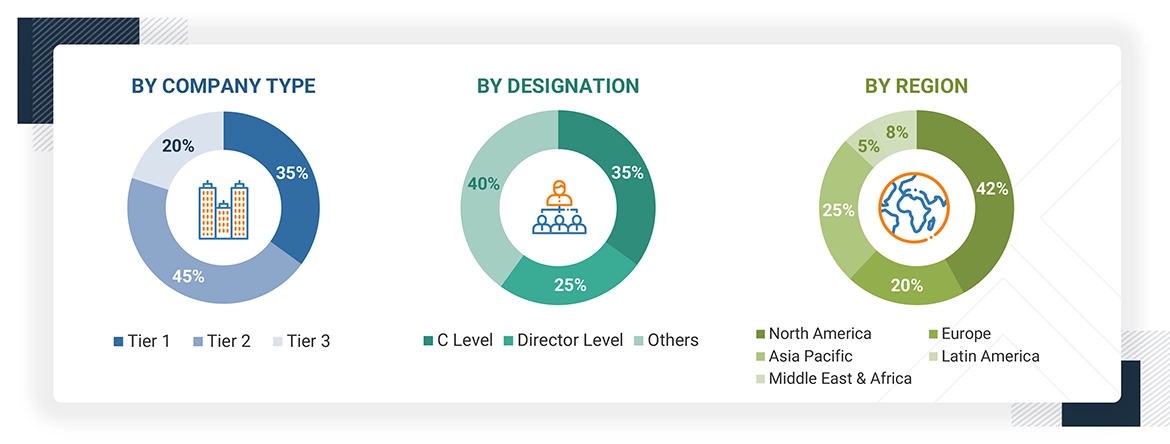

The research study for the AI assistants market involved extensive secondary sources, directories, journals, and paid databases. Primary sources were mainly industry experts from the core and related industries, preferred AI assistants providers, third-party service providers, consulting service providers, end users, and other commercial enterprises. In-depth interviews with primary respondents, including key industry participants and subject matter experts, were conducted to obtain and verify critical qualitative and quantitative information and assess the market’s prospects.

Secondary Research

In the secondary research process, various sources were referred to identify and collect information for the study. The secondary sources included annual reports, press releases, investor presentations of companies, white papers, journals, certified publications, and articles from recognized authors, directories, and databases. The data was also collected from other secondary sources, such as AI conferences and related magazines. Additionally, the AI assistants' spending in various countries was extracted from respective sources. Secondary research was used to obtain key information about the industry’s supply chain to identify key players by solution, service, market classification, and segmentation according to the offerings of major players and industry trends related to solutions, applications, verticals, and regions, and key developments from both market and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, including Chief Experience Officers (CXOs) and vice Presidents (VPs); directors from business development, marketing, and AI assistants expertise; related key executives from AI assistants solution vendors, SIs, managed service providers, and industry associations; and key opinion leaders.

Primary interviews were conducted to gather insights, such as market statistics, revenue data collected from solutions and services, market breakups, market size estimations, market forecasts, and data triangulation. Primary research also helped understand various trends related to technologies, applications, integration types, offering types, end users, and regions. Stakeholders from the demand side, such as Chief Information Officers (CIOs), Chief Technology Officers (CTOs), Chief Strategy Officers (CSOs), and end users using AI assistant solutions, were interviewed to understand the buyer’s perspective on suppliers, products, and their current usage of AI assistants, which would impact the overall AI assistants market.

Note: Tier 1 companies account for annual revenue of >USD 10 billion; tier 2 companies’ revenue

ranges between USD 1 and 10 billion; and tier 3 companies’ revenue ranges between USD 500 million–USD 1 billion

Source: MarketsandMarkets Analysis

To know about the assumptions considered for the study, download the pdf brochure

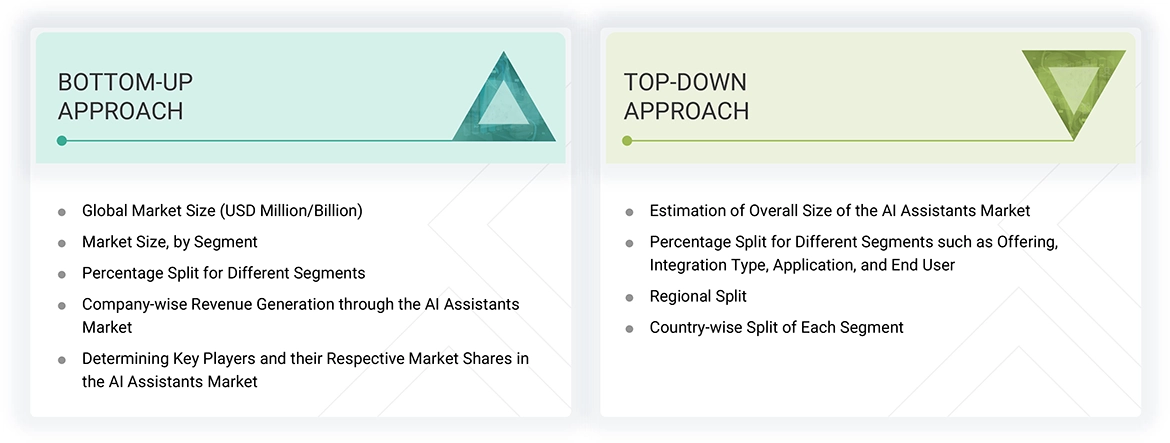

Market Size Estimation

Multiple approaches were adopted to estimate and forecast the AI assistants market. The first approach involves estimating the market size by summing up the companies’ revenue generated by selling solutions.

Market Size Estimation Methodology- Top-down approach

In the top-down approach, an exhaustive list of all the vendors offering solutions in the AI assistants market was prepared. The revenue contribution of the market vendors was estimated through annual reports, press releases, funding, investor presentations, paid databases, and primary interviews. Each vendor's offerings were evaluated based on the breadth of solutions according to solution type, technology, integration type, and end users. The aggregate of all the companies’ revenue was extrapolated to reach the overall market size. Each subsegment was studied and analyzed for its global market size and regional penetration. The markets were triangulated through both primary and secondary research. The primary procedure included extensive interviews for key insights from industry leaders, such as CIOs, CEOs, VPs, directors, and marketing executives. The market numbers were further triangulated with the existing MarketsandMarkets repository for validation.

Market Size Estimation Methodology-Bottom-up approach

In the bottom-up approach, the adoption rate of AI assistant solutions among different end users in key countries with respect to their regions contributing the most to the market share was identified. For cross-validation, the adoption of AI assistant solutions among industries, along with different use cases with respect to their regions, was identified and extrapolated. Use cases identified in different regions were given weightage for the market size calculation.

Based on the market numbers, the regional split was determined by primary and secondary sources. The procedure included the analysis of the AI assistants market’s regional penetration. Based on secondary research, the regional spending on Information and Communications Technology (ICT), socio-economic analysis of each country, strategic vendor analysis of major AI assistant providers, and organic and inorganic business development activities of regional and global players were estimated. With the data triangulation procedure and data validation through primary interviews, the exact values of the overall AI assistants market size and the segments’ size were determined and confirmed using the study.

AI Assistant Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size using the market size estimation processes explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakup procedures were employed, wherever applicable. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Market Definition

AI assistants are intelligent, software-embedded tools that support knowledge workers, professionals, and teams in performing high-value, context-aware, task-specific activities across communication, productivity, research, collaboration, scheduling, analysis, and content creation.

Stakeholders

- AI assistant software providers

- Third-party administrators

- Business analysts

- Cloud service providers

- Consulting service providers

- Enterprise end users

- Distributors and value-added resellers (VARs)

- Government agencies

- Independent software vendors (ISVs)

- Market research and consulting firms

- Support & maintenance service providers

- System integrators (SIs)/Migration service providers

- Technology providers

Report Objectives

- To define, describe, and forecast the AI assistants market by offering, integration type, application, and end user

- To provide detailed information related to major factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the market growth

- To analyze the micro markets with respect to individual growth trends, prospects, and their contribution to the total market

- To analyze the opportunities in the market for stakeholders by identifying the high-growth segments of the AI assistants market

- To analyze opportunities in the market and provide details of the competitive landscape for stakeholders and market leaders

- To forecast the market size of segments for the five main regions: North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America

- To profile the key players and comprehensively analyze their market ranking and core competencies

- To analyze competitive developments, such as partnerships, product launches, and mergers and acquisitions, in the AI assistants market

Available Customizations

With the given market data, MarketsandMarkets offers customizations to meet your company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product quadrant, which gives a detailed comparison of the product portfolio of each company.

Geographic Analysis as per Feasibility

- Further breakup of the North American AI assistants market

- Further breakup of the European AI assistants market

- Further breakup of the Asia Pacific AI assistants market

- Further breakup of the Middle East & African AI assistants market

- Further breakup of the Latin American AI assistants market

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Key Questions Addressed by the Report

What are AI assistants?

AI assistants are intelligent, software-embedded tools that support knowledge workers, professionals, and teams in performing high-value, context-aware, task-specific activities across communication, productivity, research, collaboration, scheduling, analysis, and content creation.

What are the key benefits of using AI assistants?

AI assistants improve knowledge worker productivity by automating repetitive tasks such as summarizing calls, writing drafts, extracting insights, and scheduling meetings. They enhance decision-making and collaboration by surfacing relevant information at the right moment, eliminating the need for manual search across fragmented tools. AI assistants also support better consistency and quality in content, communication, and reporting.

What industries benefit most from AI assistants offerings?

AI assistants deliver measurable value across various enterprise sectors, especially those with high knowledge intensity and repetitive task loads. Professional services firms benefit by embedding AI in research, drafting, and client communication processes. BFSI institutions use AI assistants for real-time compliance support, document summarization, and intelligent knowledge retrieval, improving productivity and audit-readiness. Retail and e-commerce companies gain value from AI-driven content generation, campaign planning, and internal workflow automation. In healthcare and life sciences, AI assistants assist clinicians and researchers with notetaking, literature synthesis, and structured data entry, helping reduce administrative burden while improving documentation accuracy.

What trends are shaping the AI assistants market?

The AI assistants market is evolving rapidly and is driven by several transformative trends. Context-aware intelligence is gaining prominence. AI assistants are now tapping into user calendars, documents, emails, and chats to deliver hyper-relevant support in real time. The rise of role-specific assistants tailored for sales reps, software developers, HR teams, and analysts is replacing one-size-fits-all tools. Third, there's increasing focus on on-device or enterprise-grade privacy, using approaches like federated learning to ensure sensitive data stays within organizational boundaries. Vendors are embedding assistants directly into enterprise SaaS platforms, which improves adoption and stickiness.

How do organizations choose the right AI assistants?

Enterprises evaluate AI assistant solutions based on alignment with their workflow needs, user context, and security standards. Key factors include whether the assistant is embedded in employees' tools and whether it supports domain-specific tasks like research summarization, meeting transcription, or code generation. Organizations also assess context-awareness capabilities, ensuring the assistant can draw from calendars, documents, messages, and cloud storage to deliver relevant outputs. Enterprise buyers prioritize privacy controls, data residency compliance, and auditability, especially in regulated sectors. Flexibility is another deciding factor; solutions with low-code customization, modular deployment, and multilingual support are often preferred.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the AI Assistant Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in AI Assistant Market