AIoT Market

AIoT Market by Platform (IoT Device Management, IoT Application Enablement Platforms, IoT Connectivity Management, IoT Cloud, IoT Advanced Analytics), Technology (Machine Learning, NLP, Computer Vision, Context Aware AI) - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The AIoT market is expected to grow from USD 25.44 billion in 2025 to USD 81.04 billion by 2030 at a CAGR of 26.1% during the forecast period. The development of smart cities and smart infrastructure, along with cloud computing and AI-integrated edge computing, is progressively boosting AIoT implementation. These technologies not only enhance organizational efficiencies but also undertake energy efficiency and sustainability measures, making AIoT indispensable in sectors such as smart grids and smart transportation.

KEY TAKEAWAYS

-

BY OFFERINGAn AIoT system comprises various components, including platforms, solutions, and services. Most global vendors, including IBM, Google, Microsoft, and AWS, offer AIoT solutions. Some private players, such as Uptake Technologies Inc., Wiliot, and Falkonry, provide solutions in the AIoT market. The platforms segment is further segmented into IoT device management, IoT application enablement platforms, IoT connectivity management, IoT cloud, and IoT advanced analytics.

-

BY TECHNOLOGYThe AIoT market comprises four broad technologies: ML, NLP, computer vision, and Context-Aware Artificial Intelligence (CAAI). Since AI technology enables machines to perform tasks similar to those of human beings, it has opened up enormous market opportunities across various application areas, including predictive maintenance, smart grids, connected vehicles, and risk management. The development of AI in IoT technology was driven by the need for various heavy industries, including manufacturing, energy and utilities, logistics and transportation, and government and defense.

-

BY DEPLOYMENT TYPEThe AIoT market by deployment type is segmented into cloud-based AIoT and edge-based AIoT. The cloud-based AIoT enables the integration of IoT devices with AI capabilities on cloud platforms, where data is stored, processed, and analyzed remotely. This deployment type offers excellent scalability for businesses to handle large volumes of data generated by IoT devices and provide AI-driven analytics for insights and informed decision-making.

-

BY VERTICALWith the rise of technological advancements, digital transformations, and AI implementation across various sectors, the demand for AIoT is expected to gain traction in the coming years. The verticals that the AIoT vendors cater to include consumer electronics, BFSI, manufacturing, healthcare, government & defense, energy & utilities, retail, transportation & logistics, and other verticals (telecom, agriculture, and oil & gas). Enterprises are leveraging AIoT to boost operational efficiency, enhance privacy, and optimize bandwidth utilization. Moreover, enterprises could win, serve, and retain their customers through a more efficient, secure, and engaging commerce experience.

-

BY REGIONThe Asia Pacific is expected to grow fastest, with a CAGR of 28.0%, fueled by some of the world's fastest-growing economies, including China, India, and Japan. These areas are known for their young, tech-savvy populations that are driving a demand for digital transformation and advancements in AI and IoT platforms and solutions.

-

COMPETITIVE LANDSCAPEMajor market players have adopted both organic and inorganic strategies, including partnerships, collaborations, and investments. For instance, in May 2025, Lumen Technologies and IBM announced a collaboration to develop enterprise-grade AI solutions at the edge, integrating WatsonX, IBM's portfolio of AI products, with Lumen's Edge Cloud infrastructure and network. Together, Lumen and IBM aim to bring powerful, real-time AI inferencing closer to where data is generated, helping companies overcome cost, latency, and security barriers as they scale AI adoption and enhance customer experiences.

The seamless integration of AI into IoT systems, which businesses increasingly recognize as vital for enhancing efficiency and staying competitive in today’s fast-paced digital world, is expected to drive market growth. Moreover, the emergence of Generative AI technologies adds to this urgency, with many companies identifying them as essential for their future strategies. As the regulatory framework for the use of AI becomes more defined, especially for corporations, these provisions are regarded as safeguards and structures that promote sustainable management.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The AIoT market faces disruptions impacting buyers and customers. The integration of AI and IoT increases complexity, emphasizing edge computing and real-time decision-making, and needing advanced infrastructure. Data privacy and security concerns, driven by regulations like GDPR, boost demand for secure systems. High costs and scalability issues strain buyers, while AI-driven automation disrupts traditional roles. Rapid AI tech advances, such as machine learning, demand continuous updates, overwhelming customers. Industry-specific customization and regulatory changes in healthcare and manufacturing complicate the adoption process. Global supply chain disruptions, especially in semiconductors, delay deployments, and the push for energy-efficient solutions supports sustainability. Ethical concerns about AI transparency and accountability influence buyer expectations. The rollout of 5G is crucial for advanced AIoT applications, although coverage gaps and infrastructure upgrades present challenges.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Exponential growth of data from IoT devices

-

Demand for automation and enhanced operational efficiency

Level

-

High costs of implementation

-

Limited interoperability and fragmented standards

Level

-

Rising investments in IoT

-

Growing need for advanced security solutions

Level

-

Lack of skills and awareness related to AIoT technologies

-

Data privacy and security concerns

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Exponential growth of data from IoT devices

The increasing data rate from lot devices is one of the key factors influencing the AloT market today. Billions of IoT devices are present in various industries, including smart home systems, healthcare facilities, and manufacturing industries, among others, which means that huge quantities of data are generated in real-time continuously. This data is large and diverse, which currently cannot be handled and analyzed without the use of AI technologies. Al also improves IoT systems by allowing data to be processed in real-time, decisions to be made automatically, and operations to be optimized for critical applications when lives are at stake, especially in the manufacturing and automobile industries. Additionally, Al supports the scale issue rooted in large volumes of data and cybersecurity, working in synergy with cloud and edge computing solutions. This increasing mass of data also carries security implications, where AI is used for identifying unusual behavior or preventing cyber-attack threats within IoT networks. With the rising rate of IoT implementation, AI can deliver custom user engagements and efficient predictive maintenance on the production line in industrial processes. They can also contribute to the efficiency improvements in smart cities.

Restraint: Limited interoperability and fragmented standards

Lack of integration and variation in the standards are the biggest challenges in the AI market for the IoT sector. Lacking a global standard for the communication interface, most vendors provide proprietary solutions, which cause interoperability problems, preventing all systems and devices from easily integrating and interacting. This leads to increased system integration issues, which are addressed by expensive and complex middleware to link two dissimilar systems. Unlike the traditional Internet, consisting of computers and software, IoT requires a set of standards to be adhered to by all the connected systems; the lack of such standards results in architecture divergence and new-device design and data-exchange methodologies, stalling industry-wide implementation and aggravating R&D cycles. Moreover, greater expense is incurred since companies have to work with multiple, sometimes contradictory, standards in order to avoid being locked into a specific vendor, and because upgrading to a better solution can be excessively cumbersome. Silent standards are decentralized, which limits cooperation within the ecosystem; partners’ integration and overall innovation are constrained.

Opportunity: Growing need for advanced security solutions

This trend shows rising demand for advanced products, highlighting the security industry's market potential for AI in IoT. As device connections and network complexity grow, traditional security fails. AI solutions improve threat detection using behavioral analysis and real-time monitoring, enabling automated responses, identifying unknown risks like zero-days, and enhancing privacy without risking data. They also help organizations meet standards by managing large data volumes, making AI integral to IoT security. The shift to advanced security boosts AI investments, revealing a market with great growth potential.

Challenge: Lack of skills and awareness related to AIoT technologies

One of the major challenges identified in the AloT market is the shortage of a qualified workforce; the primary reason stems from the fact that the integration of AI algorithms with IoT systems requires a distinguished knowledge of both these domains. This is compounded by a problem of a scarcity of trained individuals, as academic and training bodies fail to keep up with the improved technologies in these fields and find it difficult to prepare individuals for specialized positions that are much sought after. Again, there is always a high cost of recruiting and training the personnel while struggling to match the constantly evolving AI and IoT technology that may make many of the skills and knowledge valued today redundant tomorrow. This shortage affects innovative technology implementation particularly in developing product solutions, meaning Al-driven loT solutions will likely be slowed and made less effective.

AIoT market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

SUEZ is a French water and waste management group and the world's leading private water supplier. To optimize its activities and increase efficiency, the company initiated a data transformation project. | SUEZ developed the CoDAI (Collaborative Data & Artificial Intelligence) platform with the help of Avanade and Microsoft. This portal catalogs AI projects and algorithms, allowing users, such as program managers, to find and test existing solutions. The CoDAI platform is backed by Microsoft Azure machine learning and Azure DevOps, which makes it possible to reduce the time-to-market needed to deploy an AI model in production, making it ready for use in a project. Within a year of being commissioned, the platform hosted roughly 40 projects, three of which have been fully put into production. |

|

Failure in any of the HVAC or water-heating systems installed in the field can have a severe impact on operations for enterprise clients. Upon failure, replacement parts or skilled technicians to resolve an issue may not be readily available, leading to further downtime and losses. Its customers wanted the ability to predict system anomalies and automate maintenance requests or alerts for immediate corrective actions. | Orion developed and implemented an AI/ML-based IoT solution to track system anomalies and suggest corrective measures. Orion identified 200+ potentially faulty systems in two months. Along with accurate observations regarding failures, its team delivered a detailed analysis and solution for its customers. |

|

In Xiaoshan district, Hangzhou, ET City Brain enabled smart automation of traffic signals. This implementation shortened daily commutes by three minutes and increased travel speed by 15%. Further, the city administrators used this system to prioritize the passage of emergency response vehicles. | Alibaba Cloud’s ET City Brain solution helped city administrators in Downtown Hangzhou analyze the live streams from its traffic cameras. ET City Brain is an intelligent system that uses big data computing and deep neural networks to process massive logs, videos, and data streams from systems and sensors across an urban center. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The ecosystem of the AIoT market includes hardware providers, analysis, algorithm & model providers, platform, solutions & service providers and the regulatory bodies. The convergence of AI and IoT has created a powerful synergy, enabling devices to process and analyze data locally or remotely, leading to more intelligent and autonomous systems.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

AIoT Market, By Technology

Machine learning technology, a core component of the AIoT market, encompasses several approaches, including supervised, unsupervised, and reinforcement learning. Supervised learning involves training algorithms on a labeled dataset, where the input data is paired with the correct output. This approach is used extensively in applications such as image and speech recognition, medical diagnosis, and predictive analytics. Supervised learning models can make accurate predictions or classifications on new, unseen data by learning from the examples. Techniques such as decision trees, support vector machines, and neural networks are common in supervised learning, enabling systems to perform tasks such as spam detection in emails and recommendation systems in e-commerce.

REGION

North America is estimated to account for the largest market share during the forecast period

North America is one of the most technologically advanced regions in the world. It has frequently set the pace for global IoT growth. In terms of IoT, the region excels at innovation and developing fresh approaches to common issues. Due to the increasing adoption of artificial intelligence of things (AIoT) by the manufacturing and automotive industries and the presence of significant solution providers in this region, North America is anticipated to dominate the growth of the global artificial intelligence of things (AIoT) market. Several large manufacturing sectors have embraced AIoT technology to a large extent. This technology is used to produce food, beverages, machinery, automobiles, and their components, fabricated metal goods, motor vehicle parts, etc. Tuya Smart, a leading worldwide AI + IoT (AIoT) platform, has recently made significant strides in the North American market.

AIoT market: COMPANY EVALUATION MATRIX

In the AIoT market matrix, AWS (Star) leads with its robust AI and IoT integration capabilities, extensive cloud infrastructure, and comprehensive portfolio spanning edge analytics, data management, and AI-driven automation. The company’s strong ecosystem and scalable platforms empower enterprises to enhance operational efficiency, accelerate innovation, and enable intelligent decision-making across connected environments. PTC (Emerging Leader) is rapidly strengthening its position by leveraging its deep expertise in industrial IoT and digital twin technologies, delivering advanced AIoT solutions that optimize manufacturing, asset management, and remote operations for improved productivity and business agility.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 20.01 Billion |

| Market Forecast in 2030 (Value) | USD 81.04 Billion |

| Growth Rate | CAGR of 26.1% from 2025-2030 |

| Years Considered | 2020–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Million/Billion) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

WHAT IS IN IT FOR YOU: AIoT market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Leading Service Provider (US) | Regional Analysis: Further breakdown of the mraket in North America, Europe, APAC, MEA, and LATAM |

|

| Company Information | Detailed analysis and profiling of additional market players (up to 5) |

|

RECENT DEVELOPMENTS

- May 2025 : Lumen Technologies and IBM announced a collaboration to develop enterprise-grade AI solutions at the edge, integrating watsonx, IBM's portfolio of AI products, with Lumen's Edge Cloud infrastructure and network. Together, Lumen and IBM aim to bring powerful, real-time AI inferencing closer to where data is generated, helping companies overcome cost, latency, and security barriers as they scale AI adoption and enhance customer experiences.

- May 2025 : IBM collaborated with Oracle to bring the power of watsonx, IBM’s flagship portfolio of AI products, to Oracle Cloud Infrastructure (OCI). Leveraging OCI’s native AI services, the latest milestone in IBM’s technology partnership with Oracle is designed to fuel a new era of multi-agentic, AI-driven productivity and efficiency across the enterprise.

- May 2025 : Cisco collaborated with HUMAIN, to help build the world’s most open, scalable, resilient and cost-efficient AI infrastructure.

- April 2025 : Amazon Bedrock has seen a series of updates focused on expanding model support, enhancing capabilities, and increasing regional availability. Key additions include support for new models like Anthropic Claude 3.5 Sonnet V2, DeepSeek-R1, Llama 3, and Cohere Embed, along with features like Amazon Bedrock Flows for workflow automation and Amazon Bedrock Agents for task completion. Bedrock also now supports guardrails to enforce content policies, knowledge bases to connect to structured data, and the ability to manage state for generative AI applications. These updates make Bedrock more versatile and accessible for a wider range of AI applications.

- January 2025 : AWS and General Catalyst partnered to advance AI-powered solutions in healthcare, focusing on personalized care, interoperability, and operational efficiency. The partnership aims to address critical needs such as predictive diagnostics and patient engagement by combining AWS' AI technology with General Catalyst's healthcare expertise. Collaborations with healthcare organizations to refine and test solutions emphasize real-world impact, with potential benefits including enhanced patient communication and reduced administrative burdens. This initiative seeks to establish a cycle of innovation applicable to other industries.

Table of Contents

Methodology

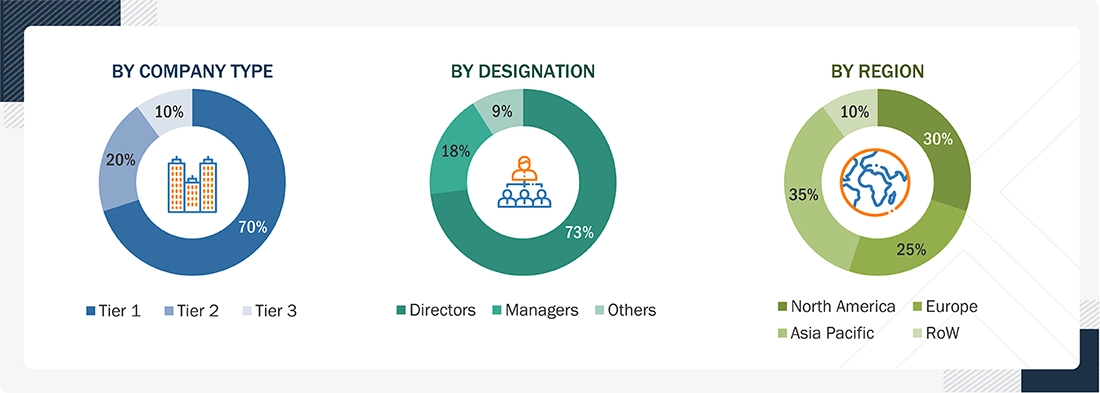

This research study involved extensive secondary sources, directories, and databases, such as Dun & Bradstreet (D&B) Hoovers and Bloomberg BusinessWeek, to identify and collect valuable information for a technical, market-oriented, and commercial study of the AIoT market. The primary sources have been mainly industry experts from the core and related industries and preferred suppliers, manufacturers, distributors, service providers, technology developers, alliances, and organizations related to all segments of the value chain of this market. In-depth interviews have been conducted with various primary respondents, including key industry participants, subject matter experts, C-level executives of key market players, and industry consultants, to obtain and verify critical qualitative and quantitative information.

Secondary Research

The market for companies offering AIoT platforms, solutions and services to different verticals has been estimated and projected based on the secondary data made available through paid and unpaid sources and by analyzing their product portfolios in the ecosystem of the AIoT market. It also involved rating company products based on their performance and quality. In the secondary research process, various sources such as the International Journal of AIoTs and Networking (IJSCN), the International Journal of Remote Sensing, and the Einstein International Journal Organization (EIJO) have been referred to for identifying and collecting information for this study on the AIoT market. The secondary sources included annual reports, press releases, investor presentations of companies, white papers, journals, certified publications, and articles by recognized authors, directories, and databases. Secondary research has been mainly used to obtain essential information about the supply chain of the market, the total pool of key players, market classification, segmentation according to industry trends to the bottommost level, regional markets, and key developments from both market- and technology-oriented perspectives that primary sources have further validated.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, including Chief Experience Officers (CXOs); Vice Presidents (VPs); directors from business development, marketing, and product development/innovation teams; related critical executives from AIoT service vendors, SIs, professional service providers, and industry associations; and key opinion leaders. Primary interviews were conducted to gather insights, such as market statistics, revenue data collected from services, market breakups, market size estimations, market forecasts, and data triangulation. Primary research also helped in understanding various trends related to technologies, applications, deployments, and regions. Stakeholders from the demand side, such as Chief Information Officers (CIOs), Chief Technology Officers (CTOs), Chief Strategy Officers (CSOs), and end users using AIoT services, were interviewed to understand the buyer’s perspective on suppliers, products, service providers, and their current usage of AIoT services which would impact the overall AIoT market.

Note: Others include sales managers, marketing managers, and product managers.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Multiple approaches were adopted to estimate and forecast the size of the AIoT market. The first approach involves estimating market size by summing up the revenue generated by companies through the sale of AIoT offerings.

Both top-down and bottom-up approaches were used to estimate and validate the total size of the AIoT market. These methods were extensively used to estimate the size of various segments in the market. The research methodology used to estimate the market size includes the following:

- Key players in the market have been identified through extensive secondary research.

- In terms of value, the industry’s supply chain and market size have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakups have been determined using secondary sources and verified through primary sources.

AIoT Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size, the AIoT market was divided into several segments and subsegments. A data triangulation procedure was used to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, wherever applicable. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with data triangulation and market breakdown, the market size was validated by the top-down and bottom-up approaches.

Market Definition

AIoT is the amalgamation of AI technologies with IoT infrastructure to achieve efficient IoT operations. Major IoT vendors integrate AI capabilities, such as ML-based analytics, into their solutions to obtain critical business insights from the huge pile of data IoT devices generate. The IoT solutions integrated with AI capabilities help enterprises across major verticals to become proactive, thus replacing traditional business intelligence tools for analyzing IoT data with advanced tools. This, in turn, helps make operational predictions with enhanced agility and accuracy and improves human-machine interactions.

Stakeholders

- AIoT Platform Providers

- AIoT Solution Providers

- AIoT Service Providers

- Communication Service Providers (CSPs)

- Application Providers

- Managed Service Providers (MSPs)

- Third-party System Integrators

- Regional and Global Government Organizations

- Investors and Venture Capitalists

- Value-Added Resellers (VARs) and Distributors

- System Integrators

- Technologists

Report Objectives

- To determine, segment, and forecast the AIoT market by offering, technology, deployment type, vertical, and region in terms of value

- To forecast the size of the market segments concerning 5 main areas: North America, Europe, Asia Pacific, Middle East & Africa, and Latin America

- To provide detailed information about the major factors (drivers, restraints, opportunities, and challenges) influencing the market's growth.

- To study the complete supply chain and related industry segments and perform a supply chain analysis of the market landscape

- To strategically analyze the macro and micro-markets with respect to individual growth trends, prospects, and contributions to the total market

- To analyze the industry trends, pricing data, patents, and innovations related to the market

- To analyze the opportunities for stakeholders by identifying the high-growth segments of the market

- To profile the key players in the market and comprehensively analyze their market share/ranking and core competencies

- To track and analyze competitive developments, such as mergers & acquisitions, product launches & developments, partnerships, agreements, collaborations, business expansions, and R&D activities

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Country-wise information

- Analysis for additional countries (up to five)

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the AIoT Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in AIoT Market