AI-powered Storage Market Size, Share & Growth (2025-2035)

AI-powered Storage Market by Offering (Hardware, Software), Storage System (DAS, NAS, SAN), Storage Architecture (File & Object-Based Storage), Storage Medium (SSD, HDD), & End User (Enterprises, CSP, Government, Telecom) - Global Forecast to 2035

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The AI-Powered Storage market is projected to reach USD 321.93 billion by 2035 from USD 36.28 billion in 2025, at a CAGR of 24.4% from 2025 to 2035. The AI-powered storage market is expanding rapidly as enterprises generate massive volumes of unstructured data and require high-performance, low-latency storage to feed AI/ML workloads. Growth is further driven by the rise of hybrid/multi-cloud environments and the need for automated, intelligent data management at scale. Additionally, advancements in flash, NVMe and software-defined architectures are enabling more efficient, AI-optimized storage deployments across data centers and edge environments.

KEY TAKEAWAYS

-

By RegionAsia Pacific will be the fastest-growing regional market for AI-powered storage, driven by hyperscale data center expansion and accelerating enterprise AI adoption.

-

By Storage SystemBy storage system, the Network-Attached Storage (NAS) segment is expected to dominate the market as AI workloads increasingly require scalable, high-throughput file access.

-

By Storage MediumBy storage medium, Solid State Drives (SSDs) will register the highest CAGR due to AI’s need for low-latency, high-IOPS performance.

-

By DeploymentBy deployment, the cloud segment will hold the largest market share, while hybrid deployment will grow at the fastest rate through 2035.

-

By End UserBy end user, cloud service providers and hyperscalers will dominate adoption, while BFSI and healthcare enterprises will be the fastest-growing enterprise verticals.

The AI-powered storage market is expanding rapidly as organizations require high-throughput, low-latency data infrastructures to support increasingly complex AI, ML, and GPU-accelerated workloads. Demand is being propelled by the explosive growth of unstructured data, large-scale model training, and real-time analytics across cloud, edge, and enterprise environments. Advancements in NVMe, all-flash arrays, software-defined storage, and unified file-object architectures are enabling faster data access and improved scalability. Major vendors such as VAST Data, WEKA, NetApp, and Lightbits are launching AI-optimized storage platforms, while cloud providers and hyperscalers continue to invest in next-generation data fabrics to remove GPU bottlenecks. Strategic partnerships between storage vendors, semiconductor suppliers, and AI infrastructure providers are accelerating innovation and strengthening the global ecosystem for AI-centric storage solutions.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The AI-powered storage ecosystem spans specialized storage vendors, flash and NVMe providers, software-defined storage platforms, and AI infrastructure integrators who together deliver the high-performance data backbone required for modern AI workloads. These players ultimately serve hyperscalers, data center operators, AI developers, enterprises, and vertical industries like healthcare, BFSI, automotive, and telecom—each relying on fast, scalable, and intelligent data pipelines. The end outcomes include accelerated model training, higher GPU utilization, lower latency across cloud and edge environments, stronger data security, and reduced operational costs, enabling organizations to deploy and scale AI applications more efficiently.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rapid growth of unstructured data and AI/ML workloads

-

Expansion of hybrid and multi-cloud environments

Level

-

High upfront investment

-

Data privacy and regulatory constraints

Level

-

Rising adoption of edge AI and inference workloads

-

Growth of AI model training and multimodal workloads

Level

-

Managing exponential data growth

-

Eliminating data bottlenecks between storage and GPUs

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rising Adoption of AI/ML Workloads

The rapid expansion of AI and machine learning applications is creating unprecedented demand for high-performance, low-latency storage infrastructure. As enterprises scale GPU clusters and train larger multimodal models, they require storage systems capable of delivering massive throughput, intelligent data tiering, and real-time access to unstructured datasets. This surge in AI workloads is directly accelerating investments in AI-optimized storage platforms across cloud, hybrid, and on-prem environments.

Restraint: High Unfront Investment

Despite strong demand, the market faces adoption barriers due to the high capital expenditure associated with implementing AI-optimized storage systems such as all-flash arrays, NVMe fabrics, and AI-driven data management software. Many mid-sized enterprises struggle with the upfront investment required to modernize legacy storage architectures, slowing market penetration and widening the gap between large hyperscale operators and smaller AI adopters.

Opportunity: Expansion of Edge AI and 5G Infrastructure

The rise of edge AI, autonomous systems, and 5G networks is opening new opportunities for AI-powered storage vendors to deliver distributed, low-latency storage solutions. As analytics shift closer to the data source, organizations increasingly require intelligent, compact, and high-throughput storage architectures at the edge to support real-time inference, video analytics, and IoT-driven AI workloads—creating a fast-growing frontier for solution providers.

Challenge: Eliminating Data Bottlenecks for GPUs

A critical challenge for the industry is delivering storage fast enough to keep GPUs fully utilized, especially during large-scale model training and inference operations. As compute power outpaces storage throughput, even high-end AI clusters risk idle time due to inefficient data pipelines, metadata bottlenecks, or insufficient bandwidth. Overcoming this imbalance requires significant innovation in parallel file systems, caching algorithms, and NVMe-over-Fabrics technologies.

ai-powered-storage-market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

A global AI research lab deployed VAST Data’s AI-native storage platform to unify file-object access and feed large GPU clusters with high-throughput data pipelines for model training and inference. | Delivered consistently high GPU utilization and faster model-training cycles by eliminating data bottlenecks and enabling low-latency access at petabyte scale. |

|

A hyperscale AI compute provider integrated WEKA’s high-performance data platform to accelerate multimodal model training and real-time inference across hybrid and multi-cloud environments. | Enabled ultra-low-latency data delivery and accelerated time-to-insight by keeping GPU fleets fully saturated with optimized data throughput. |

|

A cloud service provider adopted Lightbits’ NVMe/TCP-based disaggregated storage to support large AI workloads requiring scalable, high-performance block storage for distributed training clusters. | Improved training stability and reduced infrastructure cost by delivering cloud-native, high-IOPS storage with predictable low latency. |

|

A robotics AI company used Hammerspace’s global data platform to orchestrate data across edge sites, private cloud and GPU training clusters to support continuous model updates. | Enabled seamless data mobility and faster model iteration by providing a single global namespace with automated, AI-driven data placement. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The AI-powered storage market is supported by a broad and interconnected ecosystem of technology providers, infrastructure operators, and solution innovators working together to meet the rising demands of modern AI workloads. This landscape continues to evolve as organizations accelerate digital transformation and look for more efficient ways to manage, process, and scale their data. Growing adoption of AI across industries is driving continuous advancement, collaboration, and investment throughout the ecosystem, strengthening its role in enabling next-generation computing.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

AI-Powered Storage Market, By Storage System

The Network-Attached Storage (NAS) segment is expected to lead the AI-powered storage market through 2035, supported by the rapid rise of unstructured data and the need for scalable, high-throughput file systems for AI and ML workflows. As enterprises and hyperscalers expand their GPU clusters, NAS platforms deliver the parallel access, metadata handling, and data-sharing capabilities required for large-scale training and inference. With AI workloads increasingly dependent on high-bandwidth, multi-node data pipelines, NAS will remain the preferred storage system architecture across cloud and enterprise environments.

AI-Powered Storage Market, By Storage Medium

Solid State Drives (SSDs) are projected to dominate the AI-powered storage market and record the highest growth rate through 2035, driven by AI’s demand for ultra-low latency and high IOPS performance. As model sizes grow and training cycles accelerate, SSDs particularly NVMe-based systems enable faster data retrieval, parallelism, and sustained throughput essential for keeping GPU clusters saturated. With declining flash prices and expanding adoption of all-flash arrays, SSDs will continue to outpace HDDs and tapes in AI-centric deployments.

AI-Powered Storage Market, By Deployment

The cloud segment is expected to maintain the largest market share, while hybrid deployments will witness the fastest growth through 2035 as organizations balance scalability with data governance needs. AI workloads increasingly leverage cloud-based storage for elasticity, distributed access, and rapid provisioning of high-performance data pipelines. At the same time, hybrid architectures are becoming critical for enterprises managing sensitive data, enabling seamless movement of datasets between on-premise environments and cloud platforms. This dual demand positions both cloud and hybrid models as central pillars of future AI storage strategies.

AI-Powered Storage Market, By Storage Architecture

File-and-object-based storage is set to dominate the AI-powered storage market through 2035, reflecting the explosive rise of unstructured data used for model training, multimodal processing, and analytics. These architectures offer the scalability, parallel access, and flexible metadata structures necessary for modern AI workflows, outperforming legacy file-only or block-only systems. As enterprises adopt unified data lakes and GPU-powered analytics pipelines, file-object architectures will serve as the backbone of next-generation AI storage infrastructures.

AI-Powered Storage Market, By End User

Cloud service providers and hyperscalers are expected to be the largest and fastest-growing end-user segment, driven by their massive investments in AI compute, data centers, and large-scale storage infrastructure. As generative AI, LLM training, and real-time inference workloads surge, hyperscalers require advanced storage architectures capable of delivering extreme bandwidth and reliability at multi-petabyte scale. With continuous expansion of global cloud regions and edge footprints, they will remain the primary demand engine shaping the AI-powered storage market through 2035.

REGION

Asia Pacific to be fastest-growing region in global AI-Powered Storage market during forecast period

Asia Pacific will experience strong growth in the AI-powered storage market as hyperscalers, cloud providers, and semiconductor manufacturers rapidly expand regional AI infrastructure and data center capacity. Rising enterprise adoption of AI/ML across automotive, telecom, and manufacturing, combined with supportive government digital-transformation policies, will further accelerate demand for high-performance, scalable storage.

ai-powered-storage-market: COMPANY EVALUATION MATRIX

In the AI-powered storage market matrix, Dell Technologies (Star) stands at the forefront with a broad, market-leading portfolio of all-flash arrays, software-defined storage, and integrated AI infrastructure that delivers high-performance, scalable data pipelines for enterprise and cloud AI workloads. Its deep ecosystem partnerships and continuous investment in NVMe platforms, intelligent automation, and hybrid cloud capabilities reinforce its leadership in enabling modern AI environments. NetApp (Emerging Leader) is rapidly strengthening its position through its unified file-object architectures and ONTAP AI ecosystem, leveraging strong collaborations with hyperscalers and GPU vendors to deliver efficient, hybrid-ready data fabrics tailored for AI training and inference workloads.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 29.05 BN |

| Market Forecast in 2030 (Value) | USD 321.93 BN |

| Growth Rate | 24.40% |

| Years Considered | 2021–2035 |

| Base Year | 2024 |

| Forecast Period | 2025–2035 |

| Units Considered | Value (USD Billion) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Europe, Asia Pacific, RoW |

WHAT IS IN IT FOR YOU: ai-powered-storage-market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

| AI Infrastructure Provider / Hyperscaler |

|

|

| Enterprise IT / Data Center Operator |

|

|

| Storage Hardware Manufacturer (SSD/NVMe/HDD) |

|

|

| Software-Defined Storage (SDS) Vendor |

|

|

| AI/ML Platform Company |

|

|

| Telecom / 5G & Edge Computing Provider |

|

|

RECENT DEVELOPMENTS

- January 2025 : Dell Technologies unveiled its next-generation PowerScale and PowerFlex AI-optimized storage platforms, integrating enhanced NVMe performance, automated data tiering, and GPU-aware data paths designed to accelerate generative AI training and inference pipelines in hybrid and multicloud environments.

- November 2024 : NetApp expanded its ONTAP AI ecosystem with new unified file-object architectures and tighter integrations with NVIDIA DGX systems, enabling higher throughput and lower latency for large-scale LLM training while simplifying data mobility across cloud and on-prem deployments.

- October 2024 : VAST Data launched its latest Universal Storage platform update featuring a new AI-driven data management engine and massively parallel data pipelines purpose-built to keep GPU clusters saturated, supporting petabyte-scale workloads for hyperscalers and enterprise AI labs.

- August 2024 : WEKA introduced its NeuralMesh™ data platform upgrade with enhanced metadata acceleration and multicloud deployment capabilities, delivering improved performance for generative AI workflows, real-time inference, and high-bandwidth distributed training environments.

- June 2024 : Lightbits Labs released an enhanced version of its NVMe-over-TCP storage software optimized for AI cluster elasticity, providing predictable low-latency block storage for cloud-native GPU workloads and reducing TCO for large-scale model training operations.

Table of Contents

- 5.1 INTRODUCTION

-

5.2 PORTERS FIVE FORCE ANALYSISTHREAT FROM NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

5.3 MACROECONOMICS INDICATORSINTRODUCTIONGDP TRENDS AND FORECASTTRENDS IN GLOBAL AI-POWERED STORAGE MARKET

-

5.4 TRADE ANALYSISIMPORT SCENARIOEXPORT SCENARIO

- 5.5 VALUE CHAIN ANALYSIS

- 5.6 ECOSYSTEM ANALYSIS

- 5.7 PRICING ANALYSIS

- 5.8 KEY CONFERENCES AND EVENTS, 2025–2026

-

5.9 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESSINVESTMENT AND FUNDING SCENARIOCASE STUDY ANALYSISIMPACT OF 2025 US TARIFF – AI-POWERED STORAGE MARKET- Introduction- Key Tariff Rates- Price Impact Analysis- Impact on Countries/Regions- Impact on Applications

- 6.1 KEY EMERGING TECHNOLOGIES

- 6.2 COMPLEMENTARY TECHNOLOGIES

- 6.3 ADJACENT TECHNOLOGIES

- 6.4 TECHNOLOGY ROADMAP

- 6.5 PATENT ANALYSIS

- 6.6 FUTURE APPLICATIONS

-

6.7 IMPACT OF AI/GEN AI ON AI-POWERED STORAGE MARKETTOP USE CASES AND MARKET POTENTIALBEST PRACTICES IN AI-POWERED STORAGE USAGECASE STUDIES OF AI IMPLEMENTATION IN THE AI-POWERED STORAGE MARKETINTERCONNECTED ADJACENT ECOSYSTEM AND IMPACT ON MARKET PLAYERSCLIENTS’ READINESS TO ADOPT AI IN THE AI-POWERED STORAGE MARKET

-

7.1 REGIONAL REGULATIONS AND COMPLIANCEREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONSINDUSTRY STANDARDS

- 8.1 DECISION-MAKING PROCESS

-

8.2 BUYER STAKEHOLDERS AND BUYING EVALUATION CRITERIAKEY STAKEHOLDERS IN THE BUYING PROCESSBUYING CRITERIA

- 8.3 ADOPTION BARRIERS & INTERNAL CHALLENGES

- 8.4 UNMET NEEDS FROM VARIOUS APPLICATIONS

- 8.5 MARKET PROFITABILITY

- 9.1 INTRODUCTION

- 9.2 DIRECT-ATTACHED STORAGE (DAS)

- 9.3 NETWORK-ATTACHED STORAGE (NAS)

- 9.4 STORAGE AREA NETWORK (SAN)

- 10.1 INTRODUCTION

- 10.2 HARD DISK DRIVE (HDD)

- 10.3 SOLID STATE DRIVE (SDD)

- 10.4 TAPES

- 11.1 INTRODUCTION

- 11.2 CLOUD

- 11.3 ON-PREMISES

- 11.4 HYBRID

- 12.1 INTRODUCTION

-

12.2 FILE-AND-OBJECT-BASED STORAGEFILE STORAGEOBJECT STORAGE

- 12.3 BLOCK STORAGE

- 13.1 INTRODUCTION

-

13.2 ENTERPRISESBFSIMANUFACTURINGCONSUMER GOODS & RETAILHEALTHCARE & LIFE SCIENCESMEDIA & ENTERTAINMENTOTHER ENTERPRISES

- 13.3 GOVERNMENT BODIES

- 13.4 CLOUD SERVICE PROVIDERS/HYPERSCALERS

- 14.1 INTRODUCTION

-

14.2 NORTH AMERICAUSCANADAMEXICO

-

14.3 EUROPEGERMANYUKFRANCEITALYREST OF EUROPE

-

14.4 ASIA PACIFICCHINAJAPANSOUTH KOREAINDIAREST OF ASIA PACIFIC

-

14.5 ROWMIDDLE EAST & AFRICA- GCC- Rest of the Middle EastSOUTH AMERICA

- 15.1 INTRODUCTION

- 15.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 15.3 REVENUE ANALYSIS

- 15.4 MARKET SHARE ANALYSIS, 2024

- 15.5 COMPANY VALUATION AND FINANCIAL METRICS

- 15.6 PRODUCT/BRAND COMPARISON

-

15.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTSCOMPANY FOOTPRINT: KEY PLAYERS, 2024- Company Footprint- Region Footprint- End User Footprint- Storage System Footprint- Storage Type Footprint

-

15.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024PROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKSCOMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024- Detailed List of Key Startups/SMEs- Competitive Benchmarking of Key Startups/SMEs

-

15.9 COMPETITIVE SCENARIOPRODUCT LAUNCHESDEALS

-

16.1 KEY PLAYERSDELL TECHNOLOGIESHEWLETT PACKARD ENTERPRISE (HPE) COMPANYIBMHUAWEI TECHNOLOGIESPURE STORAGEVAST DATANETAPPSAMSUNG ELECTRONICSCOHESITY, INC.- Cloudian, Inc.

- 16.2 OTHER PLAYERS

- 17.1 RESEARCH DATA

-

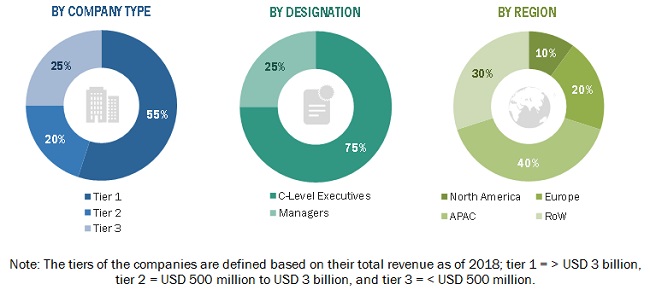

17.2 SECONDARY DATAKEY DATA FROM SECONDARY SOURCESPRIMARY DATA- Key Data from Primary Sources- Key Primary Participants- Breakdown of Primary Interviews- Key Industry InsightsMARKET SIZE ESTIMATION- Bottom-Up Approach- Top-Down Approach- Base Number CalculationMARKET FORECAST APPROACH- Supply Side- Demand SideDATA TRIANGULATIONRESEARCH ASSUMPTIONSRESEARCH LIMITATIONS AND RISK ASSESSMENT

- 18.1 DISCUSSION GUIDE

- 18.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 18.3 AVAILABLE CUSTOMIZATIONS

- 18.4 RELATED REPORTS

- 18.5 AUTHOR DETAILS

- AI-POWERED STORAGE Market, by storage system

- INTRODUCTION

The AI-powered storage market has been segmented by storage system.

TABLE 1AI-POWERED STORAGE Market, By storage system, 2021–2024 (USD MILLION)

|

Storage System |

2021 |

2022 |

2023 |

2024 |

CAGR (2021–2024) |

|

Direct-Attached Storage (DAS) |

xx |

xx |

xx |

xx |

xx% |

|

Network-Attached Storage (NAS) |

xx |

xx |

xx |

xx |

xx% |

|

Storage Area Network (SAN) |

xx |

xx |

xx |

xx |

xx% |

|

Total |

xx |

xx |

xx |

xx |

xx% |

Source: Secondary Research, Interviews with Experts, and MarketsandMarkets Analysis

TABLE 2AI-POWERED STORAGE Market, By storage system, 2025–2035 (USD MILLION)

|

Storage System |

2025 |

2026 |

2027 |

2028 |

2029 |

2031 |

2033 |

2035 |

CAGR |

|

Direct-Attached Storage (DAS) |

xx |

xx |

xx |

xx |

xx |

xx |

xx |

xx |

xx% |

|

Network-Attached Storage (NAS) |

xx |

xx |

xx |

xx |

xx |

xx |

xx |

xx |

xx% |

|

Storage Area Network (SAN) |

xx |

xx |

xx |

xx |

xx |

xx |

xx |

xx |

xx% |

|

Total |

xx |

xx |

xx |

xx |

xx |

xx |

xx |

xx |

xx% |

Source: Secondary Research, Interviews with Experts, and MarketsandMarkets Analysis

- AI-POWERED STORAGE Market, by storage medium

- INTRODUCTION

The AI-powered storage market has been segmented based on storage medium.

TABLE 3AI-POWERED STORAGE Market, By storage medium, 2021–2024 (USD MILLION)

|

Storage Medium |

2021 |

2022 |

2023 |

2024 |

CAGR (2021–2024) |

|

Hard Disk Drive (HDD) |

xx |

xx |

xx |

xx |

xx% |

|

Solid State Drive (SDD) |

xx |

xx |

xx |

xx |

xx% |

|

Tapes |

xx |

xx |

xx |

xx |

xx% |

|

Total |

xx |

xx |

xx |

xx |

xx% |

Source: Secondary Research, Interviews with Experts, and MarketsandMarkets Analysis

TABLE 4AI-POWERED STORAGE Market, By storage medium, 2025–2035 (USD MILLION)

|

Storage Medium |

2025 |

2026 |

2027 |

2028 |

2029 |

2031 |

2033 |

2035 |

CAGR |

|

Hard Disk Drive (HDD) |

xx |

xx |

xx |

xx |

xx |

xx |

xx |

xx |

xx% |

|

Solid State Drive (SDD) |

xx |

xx |

xx |

xx |

xx |

xx |

xx |

xx |

xx% |

|

Tapes |

xx |

xx |

xx |

xx |

xx |

xx |

xx |

xx |

xx% |

|

Total |

xx |

xx |

xx |

xx |

xx |

xx |

xx |

xx |

xx% |

Source: Secondary Research, Interviews with Experts, and MarketsandMarkets Analysis

- AI-POWERED STORAGE Market, by deployment

- INTRODUCTION

The AI-powered storage market has been segmented based on deployment.

TABLE 5AI-POWERED STORAGE Market, By deployment, 2021–2024 (USD MILLION)

|

Deployment |

2021 |

2022 |

2023 |

2024 |

CAGR (2021–2024) |

|

Cloud |

xx |

xx |

xx |

xx |

xx% |

|

On-premises |

xx |

xx |

xx |

xx |

xx% |

|

Hybrid |

xx |

xx |

xx |

xx |

xx% |

|

Total |

xx |

xx |

xx |

xx |

xx% |

Source: Secondary Research, Interviews with Experts, and MarketsandMarkets Analysis

TABLE 6AI-POWERED STORAGE Market, By deployment, 2025–2035 (USD MILLION)

|

Deployment |

2025 |

2026 |

2027 |

2028 |

2029 |

2031 |

2033 |

2035 |

CAGR |

|

Cloud |

xx |

xx |

xx |

xx |

xx |

xx |

xx |

xx |

xx% |

|

On-premises |

xx |

xx |

xx |

xx |

xx |

xx |

xx |

xx |

xx% |

|

Hybrid |

xx |

xx |

xx |

xx |

xx |

xx |

xx |

xx |

xx% |

|

Total |

xx |

xx |

xx |

xx |

xx |

xx |

xx |

xx |

xx% |

Source: Secondary Research, Interviews with Experts, and MarketsandMarkets Analysis

- AI-POWERED STORAGE Market, by storage architecture

- INTRODUCTION

The AI-powered storage market has been segmented based on storage architecture.

TABLE 7AI-POWERED STORAGE Market, By storage architecture, 2021–2024 (USD MILLION)

|

Storage Architecture |

2021 |

2022 |

2023 |

2024 |

CAGR (2021–2024) |

|

File-and-Object-Based Storage

|

xx |

xx |

xx |

xx |

xx% |

|

Block Storage |

xx |

xx |

xx |

xx |

xx% |

|

Total |

xx |

xx |

xx |

xx |

xx% |

Source: Secondary Research, Interviews with Experts, and MarketsandMarkets Analysis

TABLE 8AI-POWERED STORAGE Market, By storage architecture, 2025–2035 (USD MILLION)

|

Storage Architecture |

2025 |

2026 |

2027 |

2028 |

2029 |

2031 |

2033 |

2035 |

CAGR |

|

File-and-Object-Based Storage

|

xx |

xx |

xx |

xx |

xx |

xx |

xx |

xx |

xx% |

|

Block Storage |

xx |

xx |

xx |

xx |

xx |

xx |

xx |

xx |

xx% |

|

Total |

xx |

xx |

xx |

xx |

xx |

xx |

xx |

xx |

xx% |

Source: Secondary Research, Interviews with Experts, and MarketsandMarkets Analysis

- AI-POWERED STORAGE Market, by End User

- INTRODUCTION

The AI-powered storage market has been segmented based on end user.

TABLE 9AI-POWERED STORAGE Market, By end user, 2021–2024 (USD MILLION)

|

End User |

2021 |

2022 |

2023 |

2024 |

CAGR (2021–2024) |

|

Enterprises

|

xx |

xx |

xx |

xx |

xx% |

|

Government Bodies |

xx |

xx |

xx |

xx |

xx% |

|

Cloud Service Providers |

xx |

xx |

xx |

xx |

xx% |

|

Telecom Companies |

xx |

xx |

xx |

xx |

xx% |

|

Total |

xx |

xx |

xx |

xx |

xx% |

Source: Secondary Research, Interviews with Experts, and MarketsandMarkets Analysis

TABLE 10AI-POWERED STORAGE Market, By end user, 2025–2035 (USD MILLION)

|

End User |

2025 |

2026 |

2027 |

2028 |

2029 |

2031 |

2033 |

2035 |

CAGR |

|

Enterprises

|

xx |

xx |

xx |

xx |

xx |

xx |

xx |

xx |

xx% |

|

Government Bodies |

xx |

xx |

xx |

xx |

xx |

xx |

xx |

xx |

xx% |

|

Cloud Service Providers |

xx |

xx |

xx |

xx |

xx |

xx |

xx |

xx |

xx% |

|

Telecom Companies |

xx |

xx |

xx |

xx |

xx |

xx |

xx |

xx |

xx% |

|

Total |

xx |

xx |

xx |

xx |

xx |

xx |

xx |

xx |

xx% |

Source: Secondary Research, Interviews with Experts, and MarketsandMarkets Analysis

- AI-POWERED STORAGE Market, by region

- INTRODUCTION

The AI-powered storage market has been segmented based on region.

TABLE 11AI-POWERED STORAGE Market, By region, 2021–2024 (USD MILLION)

|

Region |

2021 |

2022 |

2023 |

2024 |

CAGR (2021–2024) |

|

North America

|

xx |

xx |

xx |

xx |

xx% |

|

Europe |

xx |

xx |

xx |

xx |

xx% |

|

Asia Pacific |

xx |

xx |

xx |

xx |

xx% |

|

RoW |

xx |

xx |

xx |

xx |

xx% |

|

Total |

xx |

xx |

xx |

xx |

xx% |

Source: Secondary Research, Interviews with Experts, and MarketsandMarkets Analysis

TABLE 12AI-POWERED STORAGE Market, By Region, 2025–2035 (USD MILLION)

|

Region |

2025 |

2026 |

2027 |

2028 |

2029 |

2031 |

2033 |

2035 |

CAGR |

|

North America

|

xx |

xx |

xx |

xx |

xx |

xx |

xx |

xx |

xx% |

|

Europe |

xx |

xx |

xx |

xx |

xx |

xx |

xx |

xx |

xx% |

|

Asia Pacific |

xx |

xx |

xx |

xx |

xx |

xx |

xx |

xx |

xx% |

|

RoW |

xx |

xx |

xx |

xx |

xx |

xx |

xx |

xx |

xx% |

|

Total |

xx |

xx |

xx |

xx |

xx |

xx |

xx |

xx |

xx% |

Source: Secondary Research, Interviews with Experts, and MarketsandMarkets Analysis

LIST OF TABLES

|

TABLE 1 |

AI-POWERED STORAGE MARKET: RISK ANALYSIS |

|

TABLE 2 |

AI-POWERED STORAGE MARKET: IMPACT OF PORTER’S FIVE FORCES |

|

TABLE 3 |

GDP PERCENTAGE CHANGE, BY KEY COUNTRY, 2021–2029 |

|

TABLE 4 |

ROLE OF PLAYERS IN AI-POWERED STORAGE ECOSYSTEM |

|

TABLE 5 |

AVERAGE SELLING PRICE OF OFFERED BY TOP 3 PLAYERS, BY PROCSSOR TYPE (USD/UNIT), 2024 |

|

TABLE 6 |

AVERAGE SELLING PRICE OF AI-POWERED STORAGE, BY REGION, 2021–2024 (USD/UNIT) |

|

TABLE 7 |

IMPORT DATA FOR HS CODE-COMPLIANT PRODUCTS, BY COUNTRY, 2020–2024 (USD MILLION) |

|

TABLE 8 |

EXPORT DATA FOR HS CODE-COMPLIANT PRODUCTS, BY COUNTRY, 2020–2024 (USD MILLION) |

|

TABLE 9 |

AI-POWERED STORAGE MARKET: KEY CONFERENCES AND EVENTS, 2025–2026 |

|

TABLE 10 |

US ADJUSTED RECIPROCAL TARIFF RATES |

|

TABLE 11 |

INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 END USERS (%) |

|

TABLE 12 |

KEY BUYING CRITERIA FOR TOP THREE END USERS |

|

TABLE 13 |

UNMET NEEDS IN AI-POWERED STORAGE MARKET BY END USERS |

|

TABLE 14 |

NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS |

|

TABLE 15 |

EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS |

|

TABLE 16 |

ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS |

|

TABLE 17 |

REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS |

|

TABLE 18 |

LIST OF APPLIED/GRANTED PATENTS RELATED TO AI-POWERED STORAGE MARKET, AUGUST 2023–JULY 2025 |

|

TABLE 19 |

TOP USE CASES AND MARKET POTENTIAL |

|

TABLE 20 |

BEST PRACTICES: COMPANIES IMPLEMENTING USE CASES |

|

TABLE 21 |

AI-POWERED STORAGE MARKET: CASE STUDIES RELATED TO AI IMPLEMENTATION |

|

TABLE 22 |

INTERCONNECTED ADJACENT ECOSYSTEM AND IMPACT ON MARKET PLAYERS |

|

TABLE 23 |

AI-POWERED STORAGE MARKET, BY STORAGE SYSTEM, 2021–2024 (USD MILLION) |

|

TABLE 24 |

AI-POWERED STORAGE MARKET, BY STORAGE SYSTEM, 2025–2032 (USD MILLION) |

|

TABLE 25 |

STORAGE SYSTEM: AI-POWERED STORAGE MARKET, BY REGION, 2021–2024 (USD MILLION) |

|

TABLE 26 |

STORAGE SYSTEM: AI-POWERED STORAGE MARKET, BY REGION, 2025–2032 (USD MILLION) |

|

TABLE 27 |

STORAGE SYSTEM: AI-POWERED STORAGE MARKET, BY END USER, 2021–2024 (USD MILLION) |

|

TABLE 28 |

STORAGE SYSTEM: AI-POWERED STORAGE MARKET, BY END USER, 2025–2032 (USD MILLION) |

|

TABLE 29 |

AI-POWERED STORAGE MARKET, BY STORAGE MEDIUM, 2021–2024 (USD MILLION) |

|

TABLE 30 |

AI-POWERED STORAGE MARKET, BY STORAGE MEDIUM, 2025–2032 (USD MILLION) |

|

TABLE 31 |

STORAGE MEDIUM: AI-POWERED STORAGE MARKET, BY REGION, 2021–2024 (USD MILLION) |

|

TABLE 32 |

STORAGE MEDIUM: AI-POWERED STORAGE MARKET, BY REGION, 2025–2032 (USD MILLION) |

|

TABLE 33 |

STORAGE MEDIUM: AI-POWERED STORAGE MARKET, BY END USER, 2021–2024 (USD MILLION) |

|

TABLE 34 |

STORAGE MEDIUM: AI-POWERED STORAGE MARKET, BY END USER, 2025–2032 (USD MILLION) |

|

TABLE 35 |

AI-POWERED STORAGE MARKET, BY DEPLOYMENT, 2021–2024 (USD MILLION) |

|

TABLE 36 |

AI-POWERED STORAGE MARKET, BY DEPLOYMENT, 2025–2032 (USD MILLION) |

|

TABLE 37 |

DEPLOYMENT: AI-POWERED STORAGE MARKET, BY REGION, 2021–2024 (USD MILLION) |

|

TABLE 38 |

DEPLOYMENT: AI-POWERED STORAGE MARKET, BY REGION, 2025–2032 (USD MILLION) |

|

TABLE 39 |

DEPLOYMENT: AI-POWERED STORAGE MARKET, BY END USER, 2021–2024 (USD MILLION) |

|

TABLE 40 |

DEPLOYMENT: AI-POWERED STORAGE MARKET, BY END USER, 2025–2032 (USD MILLION) |

|

TABLE 41 |

AI-POWERED STORAGE MARKET, BY STORAGE ARCHITECTURE, 2021–2024 (USD MILLION) |

|

TABLE 42 |

AI-POWERED STORAGE MARKET, BY STORAGE ARCHITECTURE, 2025–2032 (USD MILLION) |

|

TABLE 43 |

STORAGE ARCHITECTURE: AI-POWERED STORAGE MARKET, BY REGION, 2021–2024 (USD MILLION) |

|

TABLE 44 |

STORAGE ARCHITECTURE: AI-POWERED STORAGE MARKET, BY REGION, 2025–2032 (USD MILLION) |

|

TABLE 45 |

STORAGE ARCHITECTURE: AI-POWERED STORAGE MARKET, BY END USER, 2021–2024 (USD MILLION) |

|

TABLE 46 |

STORAGE ARCHITECTURE: AI-POWERED STORAGE MARKET, BY END USER, 2025–2032 (USD MILLION) |

|

TABLE 47 |

AI-POWERED STORAGE MARKET, BY END USER, 2021–2024 (USD MILLION) |

|

TABLE 48 |

AI-POWERED STORAGE MARKET, BY END USER, 2025–2032 (USD MILLION) |

|

TABLE 49 |

END USER: AI-POWERED STORAGE MARKET, BY REGION, 2021–2024 (USD MILLION) |

|

TABLE 50 |

APPLICATION: AI-POWERED STORAGE MARKET, BY REGION, 2025–2032 (USD MILLION) |

|

TABLE 51 |

END USER: AI-POWERED STORAGE MARKET, BY STORAGE SYSTEM, 2021–2024 (USD MILLION) |

|

TABLE 52 |

END USER: AI-POWERED STORAGE MARKET, BY STORAGE SYSTEM, 2025–2032 (USD MILLION) |

|

TABLE 53 |

AI-POWERED STORAGE MARKET, BY REGION, 2021–2024 (USD MILLION) |

|

TABLE 54 |

AI-POWERED STORAGE MARKET, BY REGION, 2025–2032 (USD MILLION) |

|

TABLE 55 |

NORTH AMERICA: AI-POWERED STORAGE MARKET, BY STORAGE SYSTEM, 2021–2024 (USD MILLION) |

|

TABLE 56 |

NORTH AMERICA: AI-POWERED STORAGE MARKET, BY STORAGE SYSTEM, 2025–2032 (USD MILLION) |

|

TABLE 57 |

NORTH AMERICA: AI-POWERED STORAGE MARKET, BY STORAGE MEDIUM, 2021–2024 (USD MILLION) |

|

TABLE 58 |

NORTH AMERICA: AI-POWERED STORAGE MARKET, BY STORAGE MEDIUM, 2025–2032 (USD MILLION) |

|

TABLE 59 |

NORTH AMERICA: AI-POWERED STORAGE MARKET, BY DEPLOYMENT, 2021–2024 (USD MILLION) |

|

TABLE 60 |

NORTH AMERICA: AI-POWERED STORAGE MARKET, BY DEPLOYMENT, 2025–2032 (USD MILLION) |

|

TABLE 61 |

NORTH AMERICA: AI-POWERED STORAGE MARKET, BY STORAGE ARCHITECTURE, 2021–2024 (USD MILLION) |

|

TABLE 62 |

NORTH AMERICA: AI-POWERED STORAGE MARKET, BY STORAGE ARCHITECTURE, 2025–2032 (USD MILLION) |

|

TABLE 63 |

NORTH AMERICA: AI-POWERED STORAGE MARKET, BY END USER, 2021–2024 (USD MILLION) |

|

TABLE 64 |

NORTH AMERICA: AI-POWERED STORAGE MARKET, BY END USER, 2025–2032 (USD MILLION) |

|

TABLE 65 |

NORTH AMERICA: AI-POWERED STORAGE MARKET, BY COUNTRY, 2021–2024 (USD MILLION) |

|

TABLE 66 |

NORTH AMERICA: AI-POWERED STORAGE MARKET, BY COUNTRY, 2025–2032 (USD MILLION) |

|

TABLE 67 |

EUROPE: AI-POWERED STORAGE MARKET, BY STORAGE SYSTEM, 2021–2024 (USD MILLION) |

|

TABLE 68 |

EUROPE: AI-POWERED STORAGE MARKET, BY STORAGE SYSTEM, 2025–2032 (USD MILLION) |

|

TABLE 69 |

EUROPE: AI-POWERED STORAGE MARKET, BY STORAGE MEDIUM, 2021–2024 (USD MILLION) |

|

TABLE 70 |

EUROPE: AI-POWERED STORAGE MARKET, BY STORAGE MEDIUM, 2025–2032 (USD MILLION) |

|

TABLE 71 |

EUROPE: AI-POWERED STORAGE MARKET, BY DEPLOYMENT, 2021–2024 (USD MILLION) |

|

TABLE 72 |

EUROPE: AI-POWERED STORAGE MARKET, BY DEPLOYMENT, 2025–2032 (USD MILLION) |

|

TABLE 73 |

EUROPE: AI-POWERED STORAGE MARKET, BY STORAGE ARCHITECTURE, 2021–2024 (USD MILLION) |

|

TABLE 74 |

EUROPE: AI-POWERED STORAGE MARKET, BY STORAGE ARCHITECTURE, 2025–2032 (USD MILLION) |

|

TABLE 75 |

EUROPE: AI-POWERED STORAGE MARKET, BY END USER, 2021–2024 (USD MILLION) |

|

TABLE 76 |

EUROPE: AI-POWERED STORAGE MARKET, BY END USER, 2025–2032 (USD MILLION) |

|

TABLE 77 |

EUROPE: AI-POWERED STORAGE MARKET, BY COUNTRY, 2021–2024 (USD MILLION) |

|

TABLE 78 |

EUROPE: AI-POWERED STORAGE MARKET, BY COUNTRY, 2025–2032 (USD MILLION) |

|

TABLE 79 |

ASIA PACIFIC: AI-POWERED STORAGE MARKET, BY STORAGE SYSTEM, 2021–2024 (USD MILLION) |

|

TABLE 80 |

ASIA PACIFIC: AI-POWERED STORAGE MARKET, BY STORAGE SYSTEM, 2025–2032 (USD MILLION) |

|

TABLE 81 |

ASIA PACIFIC: AI-POWERED STORAGE MARKET, BY STORAGE MEDIUM, 2021–2024 (USD MILLION) |

|

TABLE 82 |

ASIA PACIFIC: AI-POWERED STORAGE MARKET, BY STORAGE MEDIUM, 2025–2032 (USD MILLION) |

|

TABLE 83 |

ASIA PACIFIC: AI-POWERED STORAGE MARKET, BY DEPLOYMENT, 2021–2024 (USD MILLION) |

|

TABLE 84 |

ASIA PACIFIC: AI-POWERED STORAGE MARKET, BY DEPLOYMENT, 2025–2032 (USD MILLION) |

|

TABLE 85 |

ASIA PACIFIC: AI-POWERED STORAGE MARKET, BY STORAGE ARCHITECTURE, 2021–2024 (USD MILLION) |

|

TABLE 86 |

ASIA PACIFIC: AI-POWERED STORAGE MARKET, BY STORAGE ARCHITECTURE, 2025–2032 (USD MILLION) |

|

TABLE 87 |

ASIA PACIFIC: AI-POWERED STORAGE MARKET, BY END USER, 2021–2024 (USD MILLION) |

|

TABLE 88 |

ASIA PACIFIC: AI-POWERED STORAGE MARKET, BY END USER, 2025–2032 (USD MILLION) |

|

TABLE 89 |

ASIA PACIFIC: AI-POWERED STORAGE MARKET, BY COUNTRY, 2021–2024 (USD MILLION) |

|

TABLE 90 |

ASIA PACIFIC: AI-POWERED STORAGE MARKET, BY COUNTRY, 2025–2032 (USD MILLION) |

|

TABLE 91 |

ROW: AI-POWERED STORAGE MARKET, BY STORAGE SYSTEM, 2021–2024 (USD MILLION) |

|

TABLE 92 |

ROW: AI-POWERED STORAGE MARKET, BY STORAGE SYSTEM, 2025–2032 (USD MILLION) |

|

TABLE 93 |

ROW: AI-POWERED STORAGE MARKET, BY STORAGE MEDIUM, 2021–2024 (USD MILLION) |

|

TABLE 94 |

ROW: AI-POWERED STORAGE MARKET, BY STORAGE MEDIUM, 2025–2032 (USD MILLION) |

|

TABLE 95 |

ROW: AI-POWERED STORAGE MARKET, BY DEPLOYMENT, 2021–2024 (USD MILLION) |

|

TABLE 96 |

ROW: AI-POWERED STORAGE MARKET, BY DEPLOYMENT, 2025–2032 (USD MILLION) |

|

TABLE 97 |

ROW: AI-POWERED STORAGE MARKET, BY STORAGE ARCHITECTURE, 2021–2024 (USD MILLION) |

|

TABLE 98 |

ROW: AI-POWERED STORAGE MARKET, BY STORAGE ARCHITECTURE, 2025–2032 (USD MILLION) |

|

TABLE 99 |

ROW: AI-POWERED STORAGE MARKET, BY END USER, 2021–2024 (USD MILLION) |

|

TABLE 100 |

ROW: AI-POWERED STORAGE MARKET, BY END USER, 2025–2032 (USD MILLION) |

|

TABLE 101 |

ROW: AI-POWERED STORAGE MARKET, BY COUNTRY, 2021–2024 (USD MILLION) |

|

TABLE 102 |

ROW: AI-POWERED STORAGE MARKET, BY COUNTRY, 2025–2032 (USD MILLION) |

|

TABLE 103 |

OVERVIEW OF STRATEGIES ADOPTED BY AI-POWERED STORAGE PROVIDERS |

|

TABLE 104 |

DEGREE OF COMPETITION, 2024 |

|

TABLE 105 |

AI-POWERED STORAGE MARKET: REGIONAL FOOTPRINT, 2024 |

|

TABLE 106 |

AI-POWERED STORAGE MARKET: STORAGE SYSTEM FOOTPRINT, 2024 |

|

TABLE 107 |

AI-POWERED STORAGE MARKET: STORAGE MEDIUM FOOTPRINT, 2024 |

|

TABLE 108 |

AI-POWERED STORAGE MARKET: DEPLOYMENT FOOTPRINT, 2024 |

|

TABLE 109 |

AI-POWERED STORAGE MARKET: END USER FOOTPRINT, 2024 |

|

TABLE 110 |

AI-POWERED STORAGE MARKET: LIST OF KEY STARTUPS/SMES, 2024 |

|

TABLE 111 |

AI-POWERED STORAGE MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES, 2024 |

|

TABLE 112 |

AI-POWERED STORAGE MARKET: PRODUCT LAUNCHES, JANUARY 2021−SEPTEMBER 2025 |

|

TABLE 113 |

AI-POWERED STORAGE MARKET: DEALS, JANUARY 2021−SEPTEMBER 2025 |

|

TABLE 114 |

DELL TECHNOLOGIES: COMPANY OVERVIEW |

|

TABLE 115 |

DELL TECHNOLOGIES: PRODUCTS OFFERED |

|

TABLE 116 |

DELL TECHNOLOGIES: PRODUCT LAUNCHES |

|

TABLE 117 |

DELL TECHNOLOGIES: DEALS |

|

TABLE 118 |

HEWLETT PACKARD ENTERPRISE (HPE): COMPANY OVERVIEW |

|

TABLE 119 |

HEWLETT PACKARD ENTERPRISE (HPE): PRODUCTS OFFERED |

|

TABLE 120 |

HEWLETT PACKARD ENTERPRISE (HPE): PRODUCT LAUNCHES |

|

TABLE 121 |

HEWLETT PACKARD ENTERPRISE (HPE): DEALS |

|

TABLE 122 |

IBM: COMPANY OVERVIEW |

|

TABLE 123 |

IBM: PRODUCTS OFFERED |

|

TABLE 124 |

IBM: PRODUCT LAUNCHES |

|

TABLE 125 |

IBM: DEALS |

|

TABLE 126 |

HUAWEI TECHNOLOGIES: COMPANY OVERVIEW |

|

TABLE 127 |

HUAWEI TECHNOLOGIES: PRODUCTS OFFERED |

|

TABLE 128 |

HUAWEI TECHNOLOGIES: PRODUCT LAUNCHES |

|

TABLE 129 |

HUAWEI TECHNOLOGIES: DEALS |

|

TABLE 130 |

PURE STORAGE: COMPANY OVERVIEW |

|

TABLE 131 |

PURE STORAGE: PRODUCTS OFFERED |

|

TABLE 132 |

PURE STORAGE: PRODUCT LAUNCHES |

|

TABLE 133 |

PURE STORAGE: DEALS |

|

TABLE 134 |

VAST DATA: COMPANY OVERVIEW |

|

TABLE 135 |

VAST DATA: PRODUCTS OFFERED |

|

TABLE 136 |

VAST DATA: PRODUCT LAUNCHES |

|

TABLE 137 |

VAST DATA: DEALS |

|

TABLE 138 |

NETAPP: COMPANY OVERVIEW |

|

TABLE 139 |

SAMSUNG ELECTRONICS: COMPANY OVERVIEW |

|

TABLE 140 |

COHESITY, INC.: COMPANY OVERVIEW |

|

TABLE 141 |

CLOUDIAN, INC.: COMPANY OVERVIEW |

|

TABLE 142 |

PEAKAIO.: COMPANY OVERVIEW |

|

TABLE 143 |

LIGHTBITS: COMPANY OVERVIEW |

|

TABLE 144 |

SILK: COMPANY OVERVIEW |

|

TABLE 145 |

VDURA: COMPANY OVERVIEW |

|

TABLE 146 |

DATACORE SOFTWARE: COMPANY OVERVIEW |

|

TABLE 147 |

WEKA IO: COMPANY OVERVIEW |

|

TABLE 148 |

MODAL: COMPANY OVERVIEW |

|

TABLE 149 |

XINNOR: COMPANY OVERVIEW |

|

TABLE 150 |

SCALITY: COMPANY OVERVIEW |

|

|

|

Methodology

The study involved 4 major activities to estimate the current size of the AI-powered storage market. Exhaustive secondary research was done to collect information on the market, including the peer market and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both, top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation methods were used to estimate the market size of segments and subsegments.

Secondary Research

The research methodology used to estimate and forecast the AI-powered storage market begins with capturing data on revenues of the key vendors in the market through secondary research. This study involves the use of extensive secondary sources, directories, and databases such as Hoovers, Bloomberg Businessweek, Factiva, and OneSource to identify and collect information useful for the technical and commercial study of the AI-powered storage market. Moreover, secondary sources include annual reports, press releases, and investor presentations of companies; white papers, certified publications, and articles from recognized authors; directories; and databases. Secondary research has been mainly done to obtain key information about the industry’s supply chain, the market’s value chain, the total pool of key players, market classification and segmentation according to industry trends, geographic markets, and key developments from both market- and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain the qualitative and quantitative information relevant to the AI-powered storage market. Primary sources from the supply side include experts such as CEOs, vice presidents, marketing directors, technology and innovation directors, application developers, application users, and related executives from various key companies and organizations operating in the ecosystem of the AI-powered storage market.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Top-down and bottom-up approaches have been used to estimate and validate the size of the AI-powered storage market and various other dependent submarkets. Key players in the market have been identified through secondary research, and their market shares in respective regions have been determined through primary and secondary research. This entire research methodology includes the study of annual and financial reports of top players, as well as interviews with experts (such as CEOs, VPs, directors, and marketing executives) for key insights (both quantitative and qualitative). All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources. All the possible parameters that influence the markets covered in this research study have been accounted for, viewed in detail, verified through the primary research, and analyzed to obtain the final quantitative and qualitative data. This data has been consolidated and supplemented with detailed inputs and analysis from MarketsandMarkets and presented in this report. Figures in the next sections show the overall market size estimation process employed for this study.

Data Triangulation

After arriving at the overall market size through the processes explained in the earlier sections, the total market has been split into several segments. To complete the overall market engineering process and arrive at the exact statistics for all segments, the market breakdown and data triangulation procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Moreover, the market has been validated using both top-down and bottom-up approaches.

Study Objectives

- To describe and forecast the AI-powered storage market, by offering, storage system, storage architecture, storage medium, end user, and region, in terms of value

- To describe and forecast the market for various segments, by region—North America, Europe, Asia Pacific (APAC), and the Rest of the World (RoW)

- To provide detailed information regarding drivers, restraints, opportunities, and challenges that influence the growth of the AI-powered storage market

- To analyze micromarkets1 with respect to individual growth trends, prospects, and contribution to the overall AI-powered storage market

- To analyze opportunities in the market for stakeholders by identifying the high-growth segments of the AI-powered storage market, and provide details of the competitive landscape for the market leaders

- To profile key players in the AI-powered storage market and comprehensively analyze their market ranking in terms of revenues, shares, and core competencies2

- To analyze growth strategies, such as product launches and developments, acquisitions, partnerships, collaborations, and agreements, adopted by major players in the AI-powered storage market

- To analyze competitive strategies such as product launches and developments, alliances, joint ventures, and mergers and acquisitions in the global AI-powered storage market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

- Company Information:

Detailed analysis and profiling of additional market players on the basis of various blocks of the value chain

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the AI-powered Storage Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in AI-powered Storage Market