Fleet Management Software Market for AGV & AMR Growth, Size, Share and Trends 2032

Fleet Management Software Market for AGV & AMR (Cloud & On-premises Fleet Management Platform), AMR (Picking, Sorting, Transportation, Collaborative), AGV (Tow, Tugger, Unit Load, Pallet Truck, Assembly Line), Platform (Single, Multi-Vendor, Mixed-Robot Fleet Management) - Global Forecast to 2032

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The global AMR/AGV fleet management software market is projected to grow from USD 1.58 billion in 2025 to USD 5.23 billion by 2032, registering a CAGR of 18.7%. Market expansion is driven by the rising deployment of mobile robots across warehouses, manufacturing plants, logistics hubs, and e-commerce fulfillment centers. The integration of AI-based orchestration, real-time traffic control, predictive maintenance, and cloud-enabled optimization is improving fleet utilization, workflow accuracy, and operational cost efficiency. In addition, strong investment in automation programs and national initiatives supporting digital transformation are accelerating the adoption of advanced fleet management platforms across Asia Pacific, Europe, and North America.

KEY TAKEAWAYS

-

BY REGIONAsia Pacific leads the AMR/AGV Fleet Management Software Market in 2024 with a market share of 39.3%.

-

BY FLEET TYPEThe Autnomous Mobile Robots (AMRs) is projected to grow at the highest CAGR of 20.5% from 2025 to 2032

-

BY PLATFORM TYPEMulti-vendor Fleet Platforms are expected to grow at the highest CAGR of 20.9% driven by increasing adoption of mixed AMR and AGV fleets and the need for unified fleet control.

-

COMPETITIVE LANDSCAPEKUKA, ABB, and Omron Corporation were identified as some of the star players in the AMR/AGV Fleet Management Software Market (global), given their strong market share and extensive product footprint.

The AMR/AGV Fleet Management Software Market is set for strong expansion as companies increase the use of mobile robots across warehouses, factories, logistics hubs, and ecommerce fulfillment centers. Rising demand for faster and more accurate material handling is driving adoption of software platforms that coordinate routing, traffic flow, task allocation, and real time fleet visibility. Advances in AI driven optimization, predictive maintenance, and cloud based control are improving efficiency, scalability, and overall fleet performance. With industries accelerating automation to reduce costs and increase throughput, fleet management software is becoming a key enabler of connected, high productivity robotic operations.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on customers’ business in the AMR/AGV fleet management software industry is driven by the growing need for efficient, scalable, and real-time coordinated mobile robot operations. End users across warehouses, manufacturing facilities, ecommerce fulfillment centers, and logistics hubs are investing in advanced fleet management platforms to improve throughput, accuracy, and workflow reliability. The integration of AI-driven routing, traffic coordination, digital twins, and predictive maintenance is transforming operational efficiency, reducing downtime, and improving resource utilization. These advancements are accelerating the adoption of next-generation fleet orchestration systems that support multi-robot environments and enable continuous, high-performance automation, shaping the market’s long-term growth trajectory.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rising adoption of warehouse and factory automation supported by rapid deployment of AMRs and AGVs

-

Growing demand for centralized fleet orchestration

Level

-

High complexity of integrating fleet software with existing WMS, MES, ERP, and OT systems

Level

-

Rising shift toward multi-vendor robotic fleets that require unified and vendor neutral fleet platforms for coordination and real time control

-

Increasing shift toward Robotics as a Service models which drives demand for subscription based and cloud managed fleet software platforms

Level

-

Difficulty in standardizing communication protocols across robots from different vendors

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rising adoption of warehouse and factory automation supported by rapid deployment of AMRs and AGVs

Growing demand for faster order fulfillment, reduced manual labor, and scalable intralogistics is accelerating the adoption of AMRs and AGVs, pushing enterprises to rely on fleet management software for coordinated, real time operations.

Restraint: Growing demand for centralized fleet orchestration

Legacy infrastructure, incompatible protocols, and multi vendor environments make integration challenging, increasing deployment timelines and requiring additional customization and engineering support.

Opportunity:Rising shift toward multi vendor robotic fleets requiring unified and vendor neutral fleet platforms

As warehouses adopt diverse robots for picking, sorting, and transport, the need for centralized, interoperability focused fleet platforms is creating strong demand for advanced orchestration software.

Challenge: Difficulty in standardizing communication protocols across robots from different vendors

Lack of universal standards for navigation, traffic rules, and messaging limits seamless coordination, creating barriers for multi vendor fleet deployments and increasing reliance on custom integration layers.

amr-agv-fleet-management-software-market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

KUKA’s fleet management software enables coordinated control of AMRs and AGVs across manufacturing, assembly, and intralogistics environments. The platform provides real-time routing, traffic control, task assignment, battery monitoring, and seamless integration with MES, ERP, and warehouse automation systems. | Enhances operational efficiency with optimized multi robot routing and traffic control. Improves safety and workflow continuity. Maximizes asset utilization and uptime through predictive charging and centralized orchestration. |

|

ABB delivers enterprise-level fleet management systems for automated material movement, production line support, and facility-wide logistics automation. Its software enables task scheduling, dynamic path planning, collision avoidance, and integration with robotics, conveyors, and control systems. | Improves productivity through synchronized AGV and AMR operations. Reduces manual handling and downtime with automated job assignment. Enables scalable automation adoption through modular and interoperable fleet control. |

|

Omron’s fleet management platform provides autonomous navigation, multi-robot coordination, load handoff automation, and real-time workflow optimization. The system integrates with Omron controllers, vision systems, and safety solutions to support end-to-end industrial automation. | Strengthens throughput with efficient robot to robot communication. Increases safety with dynamic zoning and intelligent traffic rules. Ensures reliable operations through predictive maintenance and full fleet visibility. |

|

Geekplus offers cloud-based fleet management software built for high volume e-commerce, retail fulfillment, and warehouse automation. It coordinates large fleets of AMRs with intelligent task prioritization, zone routing, high speed picking workflows, and performance analytics. | Boosts order fulfillment speed and accuracy in large warehouses. Supports rapid scalability using cloud fleet control. Reduces operating costs through optimized paths, energy management, and real time data analytics. |

|

Addverb’s fleet management solution supports AMRs, AGVs, and sorting systems with real-time orchestration, dynamic task allocation, traffic balancing, and IoT-enabled workflow optimization. It integrates with WMS, WES, and enterprise automation platforms. | Improves logistics efficiency with synchronized fleet behavior. Reduces delays and errors using data driven routing. Enables flexible, scalable operations for dynamic warehouse and manufacturing needs. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The AMR/AGV fleet management software market ecosystem comprises a coordinated network of fleet software providers, robotics manufacturers, and automation-driven end users, enabling scalable warehouse and factory automation. Key fleet management software and robotics solution providers include KUKA, ABB, Omron, Geekplus, Addverb, and Locus Robotics, offering advanced platforms for multi-robot coordination, traffic control, task scheduling, and real-time monitoring. Leading end users such as Amazon, DHL, FedEx, UPS, JD Logistics, Maersk, Walmart, and major 3PL operators play a crucial role in driving demand for intelligent fleet orchestration as they scale high-volume warehouse fulfillment, last-mile logistics, and manufacturing operations. Their growing need for high throughput, efficient navigation, and fully automated intralogistics continues to accelerate the adoption of AMR/AGV fleet management software across global supply chains.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

AMR/AGV Fleet Management Software Market, By Industry

Logistics/3PL are expected to grow at the highest CAGR in the AMR/AGV Fleet Management Software Market, driven by their critical need for real-time fleet orchestration, high-speed order fulfillment, and coordinated operation of large robotic fleets. Rapid warehouse automation, rising e-commerce volumes, and the shift toward multi-robot environments are further boosting demand for advanced fleet management platforms that enhance accuracy, reliability, and throughput across modern distribution and fulfillment centers.

AMR/AGV Fleet Management Software Market, By Fleet Type

AMRs are expected to hold the highest market share in the AMR/AGV Fleet Management Software Market during the forecast period, supported by their flexibility, ease of deployment, and strong suitability for dynamic warehousing and manufacturing environments. Their ability to navigate autonomously, adapt to real-time workflow changes, and integrate seamlessly with fleet management platforms continues to reinforce their dominant position across modern intralogistics operations.

AMR/AGV Fleet Management Software Market, By Offering

Software is projected to grow with the highest CAGR in the AMR/AGV Fleet Management Software Market, driven by rising demand for real time fleet orchestration, intelligent traffic control, task automation, and data driven optimization across large scale robotic operations.

REGION

Asia Pacific to be fastest-growing region in global AMR/AGV Fleet Management Software Market during forecast period

Asia Pacific is projected to grow at the highest CAGR in the AMR/AGV fleet management software market during the forecast period, driven by rapid adoption of warehouse automation, expansion of large-scale e-commerce fulfillment centers, and strong government-backed Industry 4.0 initiatives. Countries such as China, Japan, South Korea, and India are accelerating investments in smart factories, digital logistics, and robotics deployment, creating strong demand for advanced fleet orchestration platforms. The region’s significant presence of leading AMR and AGV manufacturers, along with increasing integration of AI-driven navigation, cloud-based fleet control, and real-time optimization tools, reinforces its leadership in this market. With rising throughput demands, growing 3PL operations, and expanding retail and manufacturing ecosystems, Asia Pacific continues to emerge as the hub for next-generation AMR/AGV fleet management software innovation and large-scale automation adoption.

amr-agv-fleet-management-software-market: COMPANY EVALUATION MATRIX

In the AMR/AGV fleet management software market matrix, KUKA AG (Star) leads with an integrated automation ecosystem combining advanced fleet orchestration, real-time traffic control, and seamless interoperability across mixed robotic fleets, supported by AI-driven navigation and scalable warehouse automation software. Its strong system integration capabilities and global partnerships position it as a key enabler of high-throughput, precision-focused intralogistics. Locus Robotics (Emerging Leader) is expanding rapidly through strategic collaborations and continuous enhancements to its cloud-native fleet management platform, driving the adoption of adaptive routing, data-driven labor optimization, and high-efficiency multi-robot coordination, thereby strengthening its position in the leaders’ quadrant of this evolving software market.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- KUKA SE & Co. KGaA (Germany)

- ABB (Switzerland)

- OMRON Corporation (Japan)

- Geekplus Technology Co., Ltd. (China)

- Addverb Technologies Limited (India)

- Siemens (Germany)

- Ocado Group plc (UK)

- MITSUBISHI LOGISNEXT CO., LTD. (Japan)

- Fives (France)

- Mobile Industrial Robots (Denmark)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 1.37 Billion |

| Market Forecast in 2032 (Value) | USD 5.23 Billion |

| Growth Rate | CAGR of 18.7% from 2025-2032 |

| Years Considered | 2021-2032 |

| Base Year | 2024 |

| Forecast Period | 2025–2032 |

| Units Considered | Value (USD Billion) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends. |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe & RoW |

WHAT IS IN IT FOR YOU: amr-agv-fleet-management-software-market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Warehouse & Logistics Provider |

|

|

| Manufacturing Enterprise |

|

|

| Software Vendor / System Integrator |

|

|

RECENT DEVELOPMENTS

- October 2024 : MiR launched MiR Fleet Enterprise, a software platform for managing autonomous mobile robots. The platform enhances scalability, security, and efficiency for internal logistics and material handling.

- March 2024 : Addverb Technologies Limited announced a strategic partnership with DHL Supply Chain to deploy 52 sorting robots (Zippy) and its enterprise software platform, including Fleet Management Software (FMS), at DHL’s Columbus, Ohio distribution facility. The collaboration enhances throughput, scalability, and operational efficiency across DHL’s warehouse operations in North America.

- November 2023 : Symbotic Inc. entered a strategic agreement with Southern Glazer’s Wine & Spirits to deploy its AI-powered robotic automation system across select distribution centers. The deployment aims to enhance fill rates, improve order accuracy, extend facility capacity, and build mixed-case pallets for efficient route-stop delivery.

Table of Contents

- 5.1 PORTER’S FIVE FORCES ANALYSIS

-

5.2 MACROECONOMICS INDICATORSINTRODUCTIONGDP TRENDS AND FORECASTTRENDS IN THE GLOBAL AUTOMOTIVE INDUSTRYTRENDS IN GLOBAL E-COMMERCE & RETAIL INDUSTRY

- 5.3 VALUE CHAIN ANALYSIS

- 5.4 ECOSYSTEM ANALYSIS

-

5.5 PRICING ANALYSISAVERAGE SELLING PRICE TREND OF FLEET MANAGEMENT SOFTWARE, BY KEY PLAYERS (2021–2024)AVERAGE SELLING PRICE TREND, BY REGION (2021–2024)

-

5.6 TRADE ANALYSISIMPORT SCENARIOEXPORT SCENARIO

- 5.7 KEY CONFERENCES AND EVENTS, 2025–2026

- 5.8 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.9 INVESTMENT AND FUNDING SCENARIO

- 5.10 CASE STUDY ANALYSIS

-

5.11 IMPACT OF 2025 US TARIFF – AMR/AGV FLEET MANAGEMENT SOFTWARE MARKETINTRODUCTIONKEY TARIFF RATESPRICE IMPACT ANALYSISIMPACT ON COUNTRIES/REGIONSIMPACT ON INDUSTRIES

- 6.1 KEY EMERGING TECHNOLOGIES

- 6.2 COMPLEMENTARY TECHNOLOGIES

- 6.3 TECHNOLOGY ROADMAP

- 6.4 PATENT ANALYSIS

-

6.5 IMPACT OF AI ON AMR/AGV FLEET MANAGEMENT SOFTWARE MARKETTOP USE CASES AND MARKET POTENTIALBEST PRACTICES IN THE AMR/AGV FLEET MANAGEMENT SOFTWARE MARKETCASE STUDIES OF AI IMPLEMENTATION IN THE AMR/AGV FLEET MANAGEMENT SOFTWARE MARKETINTERCONNECTED ADJACENT ECOSYSTEM AND IMPACT ON MARKET PLAYERSCLIENTS’ READINESS TO ADOPT AI IN THE AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET

-

7.1 REGIONAL REGULATIONS AND COMPLIANCEREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONSINDUSTRY STANDARDS

- 8.1 DECISION-MAKING PROCESS

- 8.2 BUYER STAKEHOLDERS AND BUYING EVALUATION CRITERIA

- 8.3 ADOPTION BARRIERS & INTERNAL CHALLENGES

- 8.4 UNMET NEEDS FROM VARIOUS APPLICATIONS

- 9.1 ROLE OF AI & ML IN TASK ALLOCATION

- 9.2 DIGITAL TWIN FOR FLEET SIMULATION

- 9.3 5G AND EDGE COMPUTING FOR REAL-TIME COORDINATION

- 9.4 COMPUTER VISION

- 9.5 BLOCKCHAIN FOR FLEET TRACKING

-

9.6 INTEROPERABILITY STANDARDSVDA 5050OPC UNIFIED ARCHITECTURE (UA)MQTT

- 10.1 REAL-TIME FLEET MONITORING

- 10.2 ROUTE OPTIMIZATION

- 10.3 TRAFFIC MANAGEMENT

- 10.4 COLLISION AVOIDANCE

- 10.5 BATTERY MANAGEMENT

- 10.6 PREDICTIVE MAINTENANCE

- 10.7 PERFORMANCE ANALYTICS

- 10.8 MULTI-BRAND ROBOT COORDINATION

- 11.1 INTRODUCTION

-

11.2 SOFTWARECLOUD-BASED ORCHESTRATION PLATFORMSON-PREMISES ORCHESTRATION PLATFORMSHYBRID PLATFORMS

-

11.3 SERVICESCONSULTING & SYSTEM DESIGNIMPLEMENTATION & INTEGRATIONTRAINING & SUPPORTMAINTENANCE & UPDATESMANAGED SERVICES

- 12.1 INTRODUCTION

- 12.2 SINGLE-VENDOR FLEET PLATFORM

- 12.3 MULTI-VENDOR FLEET PLATFORM

- 13.1 INTRODUCTION

-

13.2 AUTONOMOUS MOBILE ROBOTS (AMRS)PICKING & SORTING AMRSTRANSPORTATION AMRSCOLLABORATIVE AMRS

-

13.3 AUTOMATED GUIDED VEHICLES (AGVS)TOW/TUGGER AGVSUNIT LOAD AGVSPALLET TRUCK AGVSASSEMBLY LINE AGVS

- 13.4 HYBRID FLEETS (MIXED ROBOT TYPES)

- 14.1 INTRODUCTION

- 14.2 INTRALOGISTICS & MATERIAL TRANSPORT MANAGEMENT

- 14.3 ORDER FULFILLMENT & PICKING OPERATIONS

- 14.4 PACKAGING, PALLETIZING & LINE FEEDING

- 14.5 CROSS-DOCKING & DOCK-TO-DOCK TRANSFERS

- 14.6 SORTING & ALLOCATION MANAGEMENT

- 14.7 FLEET COORDINATION & ZONE MANAGEMENT

- 15.1 INTRODUCTION

- 15.2 LARGE ENTERPRISES

- 15.3 SMALL & MEDIUM ENTERPRISES (SMES)

- 16.1 INTRODUCTION

- 16.2 AUTOMOTIVE

- 16.3 E-COMMERCE & RETAIL

- 16.4 CHEMICALS

- 16.5 SEMICONDUCTOR & ELECTRONICS

- 16.6 FOOD & BEVERAGES

- 16.7 HEALTHCARE

- 16.8 AVIATION

- 16.9 LOGISTICS/3PL

- 16.10 OTHER INDUSTRIES (METAL & HEAVY MACHINERY, PULP & PAPER)

- 17.1 INTRODUCTION

-

17.2 NORTH AMERICAUSCANADAMEXICO

-

17.3 EUROPEGERMANYUKFRANCEITALYREST OF EUROPE

-

17.4 ASIA PACIFICCHINAJAPANINDIASOUTH KOREAREST OF ASIA PACIFIC

-

17.5 ROWMIDDLE EAST- GCC Countries- Rest of Middle EastAFRICASOUTH AMERICA

- 18.1 OVERVIEW

- 18.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 18.3 REVENUE ANALYSIS, 2020-2024

- 18.4 MARKET SHARE ANALYSIS, 2024

- 18.5 BRAND/PRODUCT COMPARISON

-

18.6 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTSCOMPANY FOOTPRINT: KEY PLAYERS, 2024- Company Footprint- Region Footprint- Offering Footprint- Fleet Type Footprint- Industry Footprint

-

18.7 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024PROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKSCOMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024- Detailed List of Key Startups/SMEs- Competitive Benchmarking of Key Startups/SMEs

- 18.8 COMPANY VALUATION AND FINANCIAL METRICS

-

18.9 COMPETITIVE SCENARIOPRODUCT LAUNCHESDEALSEXPANSIONS

-

19.1 INTRODUCTIONKEY PLAYERS- KUKA AG- ABB- Omron Corporation- Ocado Group plc.- Geekplus Technology- Mobile Industrial Robots- Addverb Technologies Limited- Locus Robotics- GreyOrange- MITSUBISHI LOGISNEXT CO., LTD.- Fives Group- KNAPP AG- OTTO- KINEXON- Symbotic Inc.- Seegrid- SiemensOTHER PLAYERS- BlueBotics- SYNAOS- WAKU Robotics GmbH- Formant- DEUS ROBOTICS- InOrbit, Inc.- Wewo Techmotion- Suzhou Casun Intelligent Robot Co., Ltd.- Navitec Systems- SIGMATEK GmbH & Co KG

-

20.1 RESEARCH DATASECONDARY DATA- Key Data from Secondary SourcesPRIMARY DATA- Key Data from Primary Sources- Key Primary Participants- Breakdown of Primary Interviews- Key Industry Insights

-

20.2 MARKET SIZE ESTIMATIONBOTTOM-UP APPROACHTOP-DOWN APPROACHBASE NUMBER CALCULATION

-

20.3 MARKET FORECAST APPROACHSUPPLY SIDEDEMAND SIDE

- 20.4 DATA TRIANGULATION

- 20.5 FACTOR ANALYSIS

- 20.6 RESEARCH ASSUMPTIONS

- 20.7 RESEARCH LIMITATIONS AND RISK ASSESSMENT

Methodology

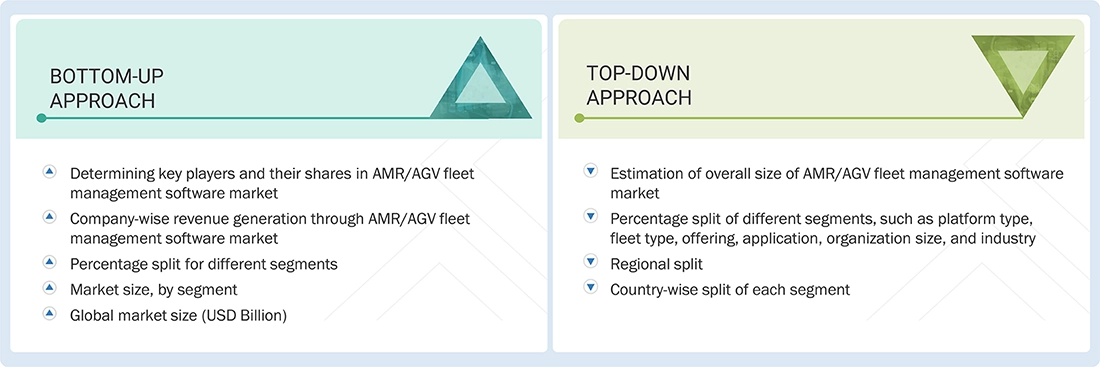

The study involved four major activities in estimating the current size of the AMR/AGV fleet management software market. Exhaustive secondary research has been conducted to gather information on the market, adjacent markets, and the overall AMR/AGV fleet management software landscape. These findings, along with assumptions and projections, were validated through primary research involving interviews with industry experts and key stakeholders across the value chain. Both top-down and bottom-up approaches were utilized to estimate the overall market size. Subsequently, market breakdown and data triangulation techniques were applied to determine the sizes of various segments and subsegments. Two key sources, secondary and primary, were leveraged to conduct a comprehensive technical and commercial assessment of the AMR/AGV fleet management software market.

Secondary Research

Various secondary sources have been referred to in the secondary research process to identify and collect important information for this study. The secondary sources include annual reports, press releases, and investor presentations of companies; white papers; journals and certified publications; and articles from recognized authors, websites, directories, and databases. Secondary research has been conducted to obtain key information about the industry’s supply chain, the market’s value chain, the total pool of key players, market segmentation according to the industry trends (to the bottom-most level), regional markets, and key developments from market- and technology-oriented perspectives. The secondary data has been collected and analyzed to determine the overall market size, further validated by primary research.

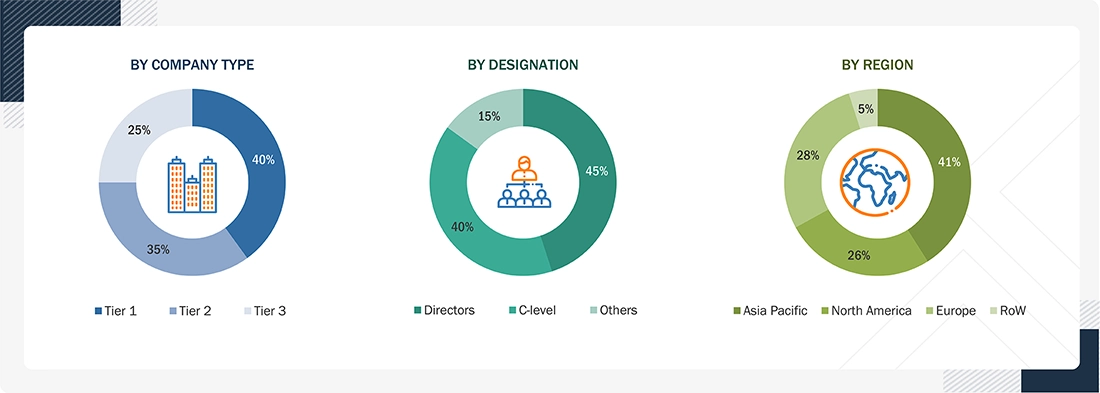

Primary Research

Extensive primary research was conducted after gaining knowledge about the current scenario of the AMR/AGV fleet management software market through secondary research. Several primary interviews were conducted with experts from the demand and supply sides across four major regions—North America, Europe, Asia Pacific, and RoW. This primary data was collected through questionnaires, emails, and telephonic interviews.

Note: The RoW region includes the Middle East, Africa, and South America. Other designations include product, sales, and marketing managers. Three tiers of companies have been defined based on their total revenue as of 2024: Tier 3, with revenue less than USD 300 million; Tier 2, with revenue between USD 300 million and USD 1 billion; and Tier 1, with revenue more than USD 1 billion.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the total size of the AMR/AGV fleet management software market. These methods have also been used extensively to estimate the size of various subsegments in the market. The following research methodology has been used to estimate the market size:

- Major players in the industry and markets have been identified through extensive secondary research.

- The industry’s value chain and market size (in terms of value) have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Fleet Management Software Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall size of the AMR/AGV fleet management software market from the market size estimation process explained above, the total market has been split into several segments and subsegments. Data triangulation and market breakdown procedures have been employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments of the market. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size has been validated using both top-down and bottom-up approaches.

Market Definition

AMR/AGV fleet management software market refers to the market for software platforms that enable centralized monitoring, control, and optimization of fleets of Autonomous Mobile Robots (AMRs) and Automated Guided Vehicles (AGVs) operating in warehouses, factories, logistics hubs, hospitals, and other facilities. This includes solutions that manage traffic and routing, task allocation and scheduling, battery and charging, collision avoidance, and real-time tracking, while integrating with WMS, MES, ERP, and other automation systems. The market encompasses revenues generated from software licenses, subscriptions, and associated services (such as configuration, customization, analytics, and support) offered by technology vendors to end-users and system integrators deploying AMR/AGV fleets. The scope encompasses both proprietary software provided by robot manufacturers for their own fleets and third-party solutions that can manage heterogeneous fleets from multiple manufacturers.

Key Stakeholders

- AMR and AGV Manufacturers

- Fleet Management Software Providers

- Warehouse Management System (WMS), MES, and ERP Solution Providers

- System Integrators Specializing in Warehouse & Factory Automation

- Technology Providers (AI, IoT, Edge Computing, Sensors, Cloud Platforms)

- Semiconductor & High-Tech Manufacturing Facilities

- Consulting Firms Specializing in Automation & Digital Transformation

- Government Bodies, Regulatory Agencies, and Warehouse Safety Authorities

- Venture Capitalists, Private Equity Firms, and Automation-Focused Investors

- Research Organizations, Robotics Labs, and Industrial Consortia

- Cloud Service Providers and Industrial Networking Providers

Report Objectives

- To define, describe, and forecast the AMR/AGV fleet management software market, in terms of platform type, fleet type, offering, application, organization size, industry, and region.

- To describe and forecast the market, in terms of value, with regard to four main regions: North America, Europe, Asia Pacific, and Rest of the World (RoW), along with their respective countries.

- To provide detailed information regarding major factors influencing market growth (drivers, restraints, opportunities, and challenges)

- To offer a detailed overview of the value chain of the AMR/AGV fleet management software market.

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the AMR/AGV fleet management software market

- To analyze opportunities in the market for stakeholders by identifying high-growth segments of the AMR/AGV fleet management software market.

- To strategically profile key players and comprehensively analyze their market position in terms of ranking and core competencies, along with detailing the competitive landscape for market leaders

- To analyze competitive strategies, such as product launches, expansions, mergers, and acquisitions, adopted by key market players in the AMR/AGV fleet management software market.

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Company Information:

- Detailed analysis and profiling of additional market players (up to 5)

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Fleet Management Software Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Fleet Management Software Market