The study involved significant activities in estimating the current size of the Artificial Intelligence (AI) in healthcare market. Exhaustive secondary research was done to collect information on the Artificial Intelligence (AI) in healthcare market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Different approaches, such as top-down and bottom-up, were employed to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and subsegments of the Artificial Intelligence (AI) in healthcare market.

Secondary Research

This research study involved the wide use of secondary sources, directories, and databases such as Dun & Bradstreet, Bloomberg Businessweek, and Factiva; white papers, annual reports, and companies’ house documents; investor presentations; and the SEC filings of companies. The market for the companies offering Artificial Intelligence (AI) in healthcare solutions is arrived at by secondary data available through paid and unpaid sources, analyzing the product portfolios of the major companies in the ecosystem, and rating the companies by their performance and quality. Various sources were referred to in the secondary research process to identify and collect information for this study. The secondary sources include annual reports, press releases, investor presentations of companies, white papers, journals, certified publications, and articles from recognized authors, directories, and databases.

Various secondary sources were referred to in the secondary research process to identify and collect information related to the study. These sources included annual reports, press releases, investor presentations of Artificial Intelligence (AI) in healthcare vendors, forums, certified publications, and whitepapers. The secondary research was used to obtain critical information on the industry’s value chain, the total pool of key players, market classification, and segmentation from the market and technology-oriented perspectives.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. Primary sources are mainly industry experts from the core and related industries and preferred suppliers, manufacturers, distributors, technology developers, researchers, and organizations related to all segments of this industry’s value chain. In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts (SMEs), C-level executives of key market players, and industry consultants, among other experts, to obtain and verify the critical qualitative and quantitative information as well as assess prospects.

Primary research was conducted to identify segmentation types, industry trends, key players, and key market dynamics such as drivers, restraints, opportunities, challenges, industry trends, and strategies adopted by key players.

After the complete market engineering (calculations for market statistics, market breakdown, market size estimations, market forecasting, and data triangulation), extensive primary research was conducted to gather information and verify and validate the critical numbers arrived at.

In the complete market engineering process, the top-down and bottom-up approaches and several data triangulation methods were extensively used to perform the market estimation and market forecasting for the overall market segments and subsegments listed in this report. Extensive qualitative and quantitative analysis was performed on the complete market engineering process to list the key information/insights throughout the report.

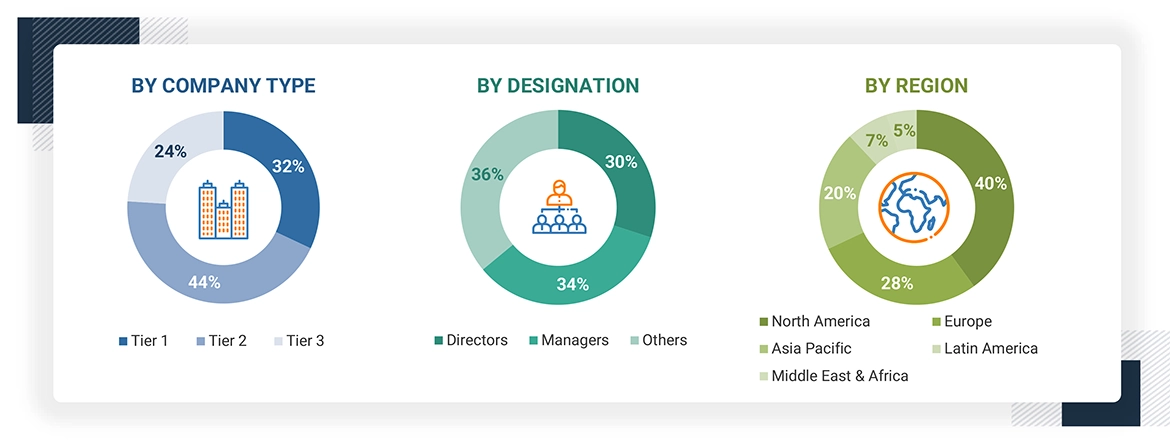

Breakdown of the Primary Respondents:

Note: Other designations include sales managers, marketing managers, and product managers.

Note: Tiers are defined based on a company’s total revenue as of 2024: Tier 1 = >USD 1 billion, Tier 2 = USD 500 million to USD 1 billion, and Tier 3 = < USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The market size estimates and forecasts provided in this study are derived through a mix of the bottom-up approach (revenue share analysis of leading players) and top-down approach (assessment of utilization/adoption/penetration trends by offering, function, application, deployment, tool, end user, and region).

Data Triangulation

After arriving at the overall market size—using the market size estimation processes—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and sub-segment, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the Artificial Intelligence (AI) in healthcare market.

Market Definition

Artificial Intelligence (AI) in healthcare market encompasses the application of artificial intelligence technologies, such as machine learning, natural language processing, computer vision, and robotics, to improve healthcare delivery, enhance operational efficiencies, and provide personalized care. These solutions address a wide range of use cases, including diagnostic imaging, predictive analytics, drug discovery, patient engagement, remote monitoring, and administrative workflows, enabling healthcare providers, payers, and pharmaceutical companies to drive innovation and improve outcomes.

Stakeholders

-

AI in healthcare software vendors

-

AI in healthcare service providers

-

Independent software vendors (ISVs)

-

Platform providers

-

Technology providers

-

System integrators

-

Cloud service providers

-

Healthcare IT service providers

-

Hospitals and surgical centers

-

Diagnostic imaging centers

-

Academic institutes and research laboratories

-

Forums, alliances, and associations

-

Government organizations

-

Institutional investors and investment banks

-

Investors/Shareholders

-

Venture capitalists

-

Research and consulting firms

Report Objectives

-

To define, describe, and forecast the global Artificial Intelligence (AI) in healthcare market based on offering, function, application, deployment, tools, end user, and region

-

To provide detailed information regarding the factors influencing the growth of the market (such as the drivers, restraints, opportunities, and challenges)

-

To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall Artificial Intelligence (AI) in healthcare market

-

To analyze market opportunities for stakeholders and provide details of the competitive landscape for market leaders

-

To forecast the size of the Artificial Intelligence (AI) in healthcare market in five main regions (along with their respective key countries): North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa

-

To profile key players and comprehensively analyze their product portfolios, market positions, and core competencies in the market

-

To track and analyze competitive developments such as product & service launches, expansions, partnerships, agreements, and collaborations; and acquisitions in the Artificial Intelligence (AI) in healthcare market

-

To benchmark players within the Artificial Intelligence (AI) in healthcare market using the Company Evaluation Matrix framework, which analyzes market players on various parameters within the broad categories of business strategy, market share, and product offering

winsay

May, 2022

Interested about how AI will change the treatment process and its benefits. .

Payush

Nov, 2017

I was going through the ToC of AI in Healthcare market, I would like to understand, what are the requirements to perform in the fields of AI? .

Payush

Nov, 2017

I was going through the ToC of AI in Healthcare market, I would like to understand, what are the requirements to perform in the fields of AI? .

Riju

Dec, 2018

We have specific interests in global AI in healthcare market and the US AI in healthcare market. Any further details related to market size of AI for early disease detection (for global and USA) would be appreciated. .

Asghar

Feb, 2019

I am looking to purchase this report to see the implications of AI on the workforce in Norway..

Tanuj

May, 2019

I am interested in understanding the market size and related insights on computer-assisted physician documentation (CAPD), clinical documentation improvement (CDI), computer-assisted coding (CAC), ambient voice and voice assistants, NLP, and machine learning for clinical, operational, and financial healthcare scenarios in AI in healthcare..

Narayan

Dec, 2019

I am an automation enthusiast and would like to understand the impact of AI in healthcare. Could you provide me some brochure and sample to get into details..

Kevin

May, 2019

I am conducting a research project on AI in healthcare as a part of my MHA/MBA marketing course. Could you share some relevant information in the form of sample brochure and estimated cost of the report, post discount mentioned on the website?.

Vishal

Feb, 2019

We are redeveloping our chart for Artificial Intelligence in Healthcare Market. Does your report covers regional market insights..