Asia Pacific Polymer Foam Market

Asia Pacific Polymer Foam Market by Resin Type (PU, PS, PO, Phenolic), Foam Type (Flexible and Rigid), End-use Industry (Building & Construction, Bedding & Furniture, Packaging, Automotive, Footwear, Sports & Recreational), and Country - Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The Asia Pacific polymer foam market is projected to grow from USD 44.03 billion in 2024 to USD 63.93 billion by 2030, at a CAGR of 6.4% during the forecast period. The Asia Pacific polymer foam market is experiencing rapid growth, driven by strong demand from construction, automotive, furniture, and packaging industries, supported by rapid urbanization and expanding manufacturing capacity. Increasing adoption of energy-efficient building materials, Asia Pacific’s dominant global vehicle production, and large-scale investments in MDI/TDI production are boosting PU availability and reducing costs. Growing e-commerce, appliance output, and rising middle-class consumption further accelerate PU foam use in comfort and packaging applications, making it the region’s most rapidly expanding resin type.

KEY TAKEAWAYS

-

BY COUNTRYIndia is the fastest-growing country, in terms of value, at a projected CAGR of 7.2% during the forecast period.

-

BY RESIN TYPEPolyurethane segment accounted for 52.0% share, in terms of value, of the overall Asia Pacific polymer foam market in 2024.

-

BY FOAM TYPEBy foam type, the flexible foam segment is expected to dominate the Asia Pacific polymer foam market during the forecast period.

-

BY END-USE INDUSTRYBy end-use industry, the building & construction is the largest end user of polymer foam market, accounting for a 32.8% share of the market in terms of value in 2024.

-

Competitive Landscape - Key PlayersSheela Foam Ltd., Dura Foam Industries Pvt. Ltd., and Duroflex Foam are identified as some of the star players in the Asia Pacific polymer foam market due to their strong market share and product footprint.

-

Competitive Landscape - StartupsJoy Foam, Inoac Corporation, and Ucifoamer Sdn. Bhd., among others, have distinguished themselves as startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders.

Rapid urbanization, strong construction activity, and high automotive production is driving the demand for lightweight and energy-efficient materials in Asia Pacific. Expanding PU manufacturing capacity, competitive production costs, and rising consumption of furniture, bedding, and packaging goods further support accelerated growth across key Asia Pacific economies.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The Asia Pacific polymer foam market is evolving rapidly, driven by strong industrial growth, urban infrastructure development, and the increasing adoption of sustainable construction materials. Rising demand for lightweight, high-performance foams such as polyurethane, polystyrene, and polyolefin is supported by expanding applications in construction, automotive, and packaging. Regional manufacturers are investing in advanced foam technologies, including spray, extruded, and structural insulation foams, to meet energy efficiency and durability standards. With growing emphasis on affordable housing, eco-friendly materials, and circular manufacturing practices, Asia Pacific is emerging as a key innovation hub for next-generation polymer foam solutions.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rapid urbanization and construction growth

-

Expanding automotive manufacturing base

Level

-

Environmental restrictions on single-use plastics

-

Inconsistent building codes and standards

Level

-

Shift toward EV manufacturing

-

Growth of cold-chain logistics

Level

-

Technological gaps in advanced foam processing

-

Environmental backlash against foam waste

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rapid urbanization and construction growth

The speeding up of urbanization and the rapid increase in construction in the Asia Pacific region are the primary drivers of the polymer foam market. Urbanization in Asia is not only through residential buildings but also through the ever-increasing infrastructure for commercial and industrial activities. Heavy investments are made in countries like China, India, Indonesia, Vietnam, and the Philippines on large-scale housing, smart city projects, transportation corridors, and industrial facilities that lead to a massive increase in demand for insulation, cushioning, and structural foam. The construction sector of China accounts for more than a quarter to a third of the construction output worldwide, while India is already predicted to be the third-biggest construction market by 2030 due to the combination of low-cost housing and rapid metro expansions. These developments boost the consumption of polyurethane (PU), polystyrene (PS), and polyolefin (PO) foams. Rising energy-efficiency regulations, including China's green building standards and India's ECBC norms, further accelerate the adoption of high-performance insulation foams. Overall, Asia Pacific's fast-growing construction ecosystem creates sustained and long-term demand for polymer foams across multiple application areas.

Restraint: Environmental restrictions on single-use plastics

The polymer foam market in Asia Pacific has been significantly affected by environmental limitations on single-use plastics, as governments are passing more regulations to reduce plastic waste and pollution. China, India, Thailand, Indonesia, and Vietnam, among others, have resorted to banning, debasing, or imposing hefty fines on the use of non-recyclable and single-use materials, with polystyrene (PS) foam being one of them, as it is often labelled as difficult to recycle and a main contributor to marine and urban litter. For instance, the 2022 nationwide ban in India on 19 categories of single-use plastics (among them, certain foams) was the largest and most impactful ban so far, while China's Plastic Pollution Control Plan has, on the whole, restricted the use of PS food containers in many provinces. In addition, Southeast Asian countries have also been active in terms of plastic-free campaigns as they are dealing with some of the world's highest mismanaged plastic waste rates. These regulatory measures indirectly affect foam packaging in the food-service industry, thereby forcing manufacturers to replace them with recyclable or biodegradable alternatives. The management of foam producers will have to consider compliance costs, reduction of market opportunities in banned product categories, and the continuous pressure to innovate sustainable foam solutions as part of their strategy development.

Opportunity: Shift toward EV manufacturing

The turnaround in the Asia Pacific region towards electric vehicle (EV) manufacturing is a big bet for the polymer foam market. Over 55% of global EV output comes from China. The country is ramping up its battery plants and assembling lines for electric vehicles, along with the setup of the supply chain ecosystem, which fuels the demand for lightweight PU, PE, and specialty foams that are utilized in thermal insulation, battery cushioning, acoustic control, and interior components. The FAME II program and huge investments by the OEMs are promoting the use of high-performance foams in seating, dashboards, doors, and NVH (noise, vibration, and harshness) applications in India. Along with new regulations and escalation in battery manufacturing, Thailand and Indonesia are quickly establishing themselves as significant players in the electric vehicle production industry. The adoption of polymer foams have been a major driver behind the weight reduction of EVs; they have also significantly improved passengers’ comfort and protected the thermal management systems surrounding the batteries from overheating.

Challenge: Technological gaps in advanced foam processing

The advanced foam processing technology gap is a serious hindrance for the polymer foam market in the Asia Pacific region, especially in the manufacturing sector of the developing countries. Countries like China, Japan, and South Korea have already put their money on high-precision foam technologies, while other countries of the region like India, Indonesia, Vietnam, and the Philippines have been practicing traditional foam production methods, which are not only less automated but also have poor process efficiency and inconsistent product quality. Advanced technologies like high-pressure PU foaming, CO2-based blowing agents, microcellular foaming, and precision extrusion systems are not so common because of the high capital costs and limited access to specialist equipment. This technology gap makes it impossible for local manufacturers to satisfy the strict requirements of performance and sustainability for the automotive, electronics, and high-end construction applications. The region has also been suffering from a lack of skilled manpower and R&D facilities, which has been causing a delay in the development of recyclable and low-emission foam technologies. The situation gets worse as global OEMs are increasingly going for the lightweight, low-VOC, and high-performance foams. Technological limitations are keeping Asia Pacific manufacturers from being fully present in the premium market segments and competing with the technological advanced players from North America and Europe.

Asia Pacific Polymer Foam Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Polyurethane foam used in car seats, headrests, armrests, dashboard padding, and NVH insulation | Lightweight improves vehicle fuel efficiency | Enhanced comfort and durability | Better acoustic absorption and vibration control | Cost-effective mass production |

|

PU and polystyrene foams used in wall insulation, roofing boards, HVAC insulation, sealing, and structural panels | Superior thermal insulation, reducing energy bills by 20-40% | Improved fire resistance and moisture control | High mechanical strength for structural applications | Meets green building and energy-saving standards |

|

Flexible PU foam used for mattresses, sofas, cushions, pillows, and ergonomic bedding | High comfort and pressure relief | Long product life and shape retention | Wide density range for premium comfort products | Lightweight and easy to fabricate |

|

Expanded polyethylene (EPE), expanded polystyrene (EPS), and EPP foam used for packaging electronics, appliances, and fragile goods | Excellent shock absorption and drop protection | Lightweight reduces logistics cost | Reusable and recyclable in many formats | Suitable for precision electronics due to anti-static options |

|

EVA, PU, and PE foams used in midsoles, protective gear, helmets, and yoga mats | Superior cushioning and energy return | Impact resistance for sports safety | Lightweight for performance products | High flexibility and comfort |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The Asia Pacific polymer foam market ecosystem is highly integrated, comprising a strong network of manufacturers, raw material suppliers, distributors, and end-use industries. Leading foam producers such as Sheela Foam, Toray, and Duroflex drive large-scale production across flexible, rigid, and specialty foam categories to serve rapidly growing markets in construction, automotive, furniture, and electronics. Global chemical companies like BASF and Covestro supply key raw materials, including polyols, MDI, TDI, and specialty additives, ensuring continuous innovation in performance, sustainability, and cost efficiency. Distributors such as Foamtec International support supply chain reach by enabling efficient material flow across industrial and consumer segments. Major end users like Hyundai Engineering & Construction, Daikin, and Larsen & Toubro further anchor demand through expanding regional infrastructure, HVAC installations, appliance manufacturing, and automotive production. Together, this interconnected ecosystem accelerates product innovation, ensures stable supply chains, and supports strong market growth across Asia Pacific.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Polymer Foam Market, By Resin Type

Polyurethane (PU) will be one of the most demanded resin type in the Asia Pacific polymer foam market. The rapid industrial development in the region has made PU foam one of the most widely used materials across diverse sectors like construction, automotive, furniture, packaging, and consumer goods. Countries like China, India, Indonesia, and Vietnam are estimated to be the major consumers for this segment. The Asia Pacific construction industry is contributing to the demand of PU insulation foams, accounting for approximately 45-50% of global construction spending. Factors such as rising adoption of energy-efficient building materials and government-driven green building mandates have also led to an increase in the demand of PU insulation foams. In addition, the region accounts for more than half of the world's total car production, which subsequently raises the demand for PU foams in seating, interior components, and NVH applications. The fast-growing furniture and bedding market dominated by large players in India and China fuels the demand for PU, especially in flexible foam grades. The rise of the middle-class consumer, along with the packaging needs of e-commerce, and the MDI/TDI production capacity expansion, all contribute to the cost-effective and reliable supply of PU foam. T

Polymer Foam Market, By End-Use Industry

The building & construction industry accounts for the largest share of the polymer foams market in Asia Pacific. This is mainly attributed to the tremendous infrastructure developments and the growing demand for energy-efficient structures. The region accounts for over 45% of the global construction spending. China, India, Indonesia, and Vietnam are significantly investing in the construction of residential, commercial, and smart city projects. The demand for polymer foams, particularly PU, PS, and PO foams, is increasing in applications such as insulation boards, roofing systems, wall panels, HVAC ducts, sealants, and waterproofing. Countries like China and India are setting up stringent green building standards and energy regulations, such as China’s GB/T building efficiency norms and India’s ECBC, which are resulting in the quick adoption of high-performance insulation foams. The upward trend of urbanization, increase in the number of high-rise buildings, and development of cold-chain infrastructure are some of the factors that make foam use for thermal efficiency and structural support more attractive. The building & construction sector is likely to continue to be the main driver of polymer foam consumption in the region as construction activities are escalating rapidly in the emerging countries of Asia.

REGION

China is estimated to account for the largest market during the forecast period

China is estimated to be the largest player in the Asia Pacific polymer foam market during the forecast period. This is attributed to its huge manufacturing base, massive construction activities, and the strong presence of the downstream industries. As the second-largest economy in the world and the largest industrial center, China is ahead in the production of cars, electronics, appliances, packaging materials, and furniture, all of which are major consumers of polymer foams like PU, PS, and PO. Furthermore, the country is responsible for nearly one-fourth to one-third of global construction activity. This, in turn, leads to a significant requirement for insulation foams that are used in roofing, wall systems, and HVAC applications. China is the leading supplier of crucial raw materials such as MDI, TDI, polyols, and styrene. The country’s e-commerce sector, which is growing at a fast pace, and already accounts for over 40% of the world's online retail sales, also makes a large demand for packaging of products with protective and cushioning foams. Strong government backing for energy-efficient buildings, electric vehicle (EV) production, and modernizing industry continues to secure China’s position as the biggest and most important market of polymer foams in the Asia Pacific region.

Asia Pacific Polymer Foam Market: COMPANY EVALUATION MATRIX

In the polymer foam market matrix, Sheela Foam Limited (Star) leads with a strong market share and extensive product footprint, driven by its polymer foam solutions which is adopted by various end users. Duroflex Foam (Emerging Leader) demonstrate substantial product innovations compared to its competitors. While Sheela Foam Limited dominates through scale and diversified portfolio, Duroflex’s Polymer Foam shows significant potential to move toward the leaders’ quadrant as demand for polymer foam continues to rise.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Sheela Foam Ltd. (India)

- Dura Foam Industries Pvt. Ltd. (India)

- Duroflex Foam (India)

- Toray Industries, Inc. (Japan)

- King Koil India (India)

- Joy Foam (India)

- JSP (Japan)

- Inoac Corporation

- Mattech Manufacturing Sdn. Bhd. (Malaysia)

- Ucifoamer Sdn Bhd (Malaysia)

- Kaneka Corporation (Japan)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2023 (Value) | USD 41.37 BN |

| Market Forecast in 2030 | USD 63.93 BN |

| CAGR (2024–2030) | 6.4% |

| Years Considered | 2019–2030 |

| Base Year | 2023 |

| Forecast Period | 2024–2030 |

| Units Considered | Value (USD Million/Billion) and Volume (Kiloton) |

| Report Coverage | The report defines, segments, and projects the Asia Pacific polymer foam market size based on resin type, foam type, end-use industry, and region. It strategically profiles the key players and comprehensively analyzes their market share and core competencies. It also tracks and analyzes competitive developments, such as new product development, agreements, acquisitions, and expansions, they undertake in the market. |

| Segments Covered | • Resin Type (Polyurethane, Polystyrene, Polyolefin, Phenolic, and Other Resin Types) |

| Regional Scope | China, Japan, India, South Korea, Indonesia, Thailand, and Rest of Asia Pacific |

WHAT IS IN IT FOR YOU: Asia Pacific Polymer Foam Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Polymer Foam Manufacturers (PU, PS, PO, Phenolic) |

|

|

| Automotive OEMs & Tier-1 Suppliers (Seating, Interiors, NVH Components) |

|

|

| Building & Construction Companies (Insulation, Panels, Roofing) |

|

|

| Furniture & Bedding Manufacturers (Mattresses, Cushions, Upholstery) |

|

|

| Packaging & E-Commerce Logistics Companies |

|

|

RECENT DEVELOPMENTS

- December 2025 : Furlenco raised USD 1.4 million in a new funding round led by Sheela Foam Ltd., as it prepares for a potential future IPO. The company will use the funds to expand in existing and new Indian markets, enhance product innovation and technology, improve customer experience, strengthen its supply chain, broaden its furniture and home-lifestyle portfolio, and scale its offline and omnichannel presence to reach more urban consumers.

- December 2022 : Sheela Foam, India’s largest mattress maker, is reportedly set to acquire its competitor Kurlon for about USD 23 million. Kurlon, known for its Kurl-on branded mattresses, has a strong nationwide presence with 10,000+ dealers, 72 branches and stock points, and nine manufacturing facilities across several states, including Karnataka, Odisha, Madhya Pradesh, Uttarakhand, and Gujarat. The acquisition would significantly expand Sheela Foam’s market footprint.

Table of Contents

Methodology

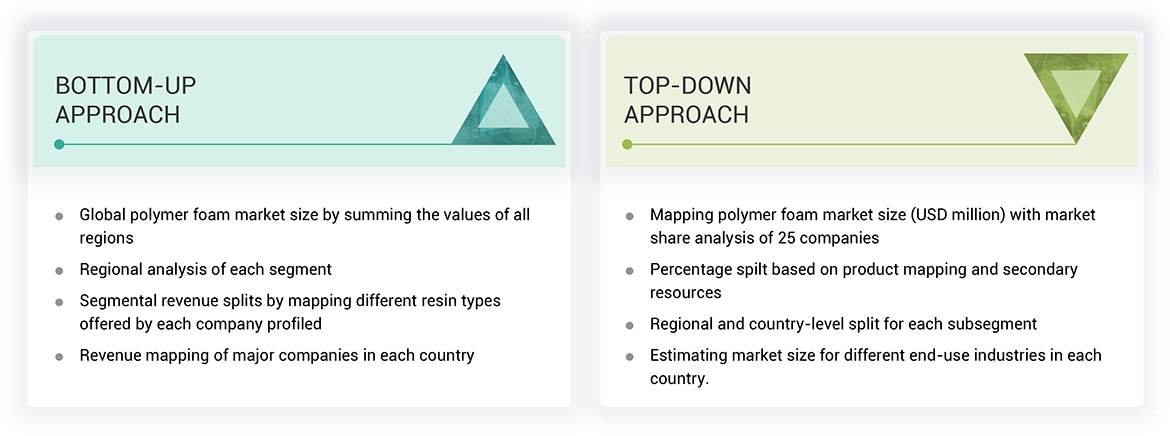

The study involved four major activities in estimating the current size of the polymer foam market—exhaustive secondary research collected information on the market, peer markets, and parent markets. The next step was to validate these findings, assumptions, and sizing with the industry experts across the polymer foam value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary sources for this research study include annual reports, press releases, and investor presentations of companies; white papers; certified publications; and articles by recognized authors; gold- and silver-standard websites; polymer foam manufacturing companies, regulatory bodies, trade directories, and databases. The secondary research was mainly used to obtain critical information about the industry’s supply chain, the pool of key players, market classification, and segmentation according to industry trends to the bottom-most level and regional markets. It has also been used to obtain information about key developments from a market-oriented perspective.

Primary Research

The polymer foam market comprises several stakeholders, such as raw material suppliers, technology support providers, manufacturers, and regulatory organizations in the supply chain. Various primary sources from the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Primary sources from the supply side included industry experts such as Chief Executive Officers (CEOs), vice presidents, marketing directors, technology and innovation directors, and related key executives from various companies and organizations operating in the polymer foam market. Primary sources from the demand side included directors, marketing heads, and purchase managers from various sourcing industries.

Market Size Estimation

Both the top-down and bottom-up approaches have been used to estimate and validate the total size of the polymer foam market. These approaches have also been used extensively to estimate the size of various dependent market subsegments. The research methodology used to estimate the market size included the following:

The following segments provide details about the overall market size estimation process employed in this study

- The key players in the market were identified through secondary research.

- The market shares in the respective regions were identified through primary and secondary research.

- The value chain and market size of the polymer foam market, in terms of value, were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research included the study of annual and financial reports of the top market players and interviews with industry experts, such as CEOs, VPs, directors, sales managers, and marketing executives, for critical insights, both quantitative and qualitative

Data Triangulation

The market was split into several segments and sub-segments after arriving at the overall market size using the market size estimation processes as explained above. Data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from both the demand and supply sides in the polymer foam sector.

Market Definition

Asia pacific polymer foams are made of polymers, blowing agents, and additives. They are produced using different processing methods, such as slab-stock by pouring, extrusion, and other molding forms. They are used in various industries, such as packaging, furniture and bedding, building and construction, and automotive. These foams are classified based on their structures as closed and open cells. Closed-cell foam is rigid, whereas open-cell foam is flexible.

Stakeholders

- Raw material manufacturers

- Technology support providers

- Manufacturers of polymer foam

- Traders, distributors, and suppliers

- Regulatory Bodies and Government Agencies

- Research & Development (R&D) Institutions

- End-use Industries

- Consulting Firms, Trade Associations, and Industry Bodies

- Investment Banks and Private Equity Firms

Report Objectives

- To analyze and forecast the market size of the polymer foam market in terms of value

- To provide detailed information regarding the major factors (drivers, restraints, challenges, and opportunities) influencing the regional market

- To analyze and forecast the Asia Pacific polymer foam market based on foam type, resin type, end-use industry, and region

- To analyze the opportunities in the market for stakeholders and provide details of a competitive landscape for market leaders

- To forecast the size of various market segments based on five major regions: North America, Europe, Asia Pacific, Middle East & Africa, and South America, along with their respective key countries

- To track and analyze the competitive developments, such as acquisitions, partnerships, collaborations, agreements, and expansions in the market

- To strategically profile the key players and comprehensively analyze their market shares and core competencies

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Asia Pacific Polymer Foam Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Asia Pacific Polymer Foam Market