Asia-Pacific (APAC) Missile Market Size, Share & Analysis, 2025 To 2030

Asia-Pacific (APAC) Missile Market by (Cruise, Ballistic, Interceptors, Anti-Tank, Anti-Ship, Submarine Launched Missiles), Component (Airframe, Guidance, Navigation, Control, Propulsion, Warhead, Battery), Speed, End User - Regional Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The APAC Missile Market is projected to reach USD 6.26 billion by 2030 from USD 3.69 billion in 2025 at a CAGR of 11.1% from 2025 to 2030. The growth is driven by rising defense modernization programs, escalating regional security tensions, and increased investments in advanced missile technologies.

KEY TAKEAWAYS

- Japan is expected to account for a 23.6% share of the APAC missile market in 2025.

- By type, the air-to-surface segment is projected to grow at the fastest rate of 20.2%.

- By component, the warheads segment is projected to grow at the fastest CAGR of 13.1%.

- By end user, the army segment is expected to account for the largest market share during the forecast period.

- BrahMos Aerospace, LIG Nex1, and Mitsubishi Heavy Industries were identified as some of the star players in the APAC missile market (global), given their strong market share and product footprint.

- Tata Advanced Systems, Godrej & Boyce, and Astra Microwave Products Ltd., among others, have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Escalating geopolitical tensions to prompt missile proliferation

Ongoing border disputes, maritime conflicts, and regional rivalries are pushing APAC countries to rapidly expand missile arsenals for deterrence and preparedness.

Restraint: High development and procurement costs

Indigenous missile development and advanced imports strain defense budgets, limiting smaller economies from large-scale acquisitions.

Opportunity: Strategic integration of hypersonic missiles into joint defense exercises

APAC militaries are increasingly exploring hypersonic systems for multinational drills, boosting interoperability and future readiness.

Challenge: Export control regimes and MTCR compliance constraints

Strict global regulations and technology transfer limits hinder APAC countries from accessing or exporting advanced missile technologies.

Asia-Pacific (APAC) Missile Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

India’s DRDO and BEL developed and inducted the Akash-NG (Next Generation) Surface-to-Air Missile system (2021–2023), designed for improved range and faster reaction against aerial threats. | Provided extended range (up to 70 km), improved reaction time, and higher kill probability, strengthening India’s layered air defense capability |

|

South Korea’s LIG Nex1 successfully developed and delivered the Cheongung-II (M-SAM Block-II) air defense system (2017–2023), deployed to replace legacy Nike and Hawk systems. | Offered enhanced interception of ballistic missiles, higher mobility, and improved accuracy, reinforcing South Korea’s missile defense shield |

|

Japan’s Mitsubishi Heavy Industries (MHI), in partnership with the Japanese MoD, advanced the Type 12 Surface-to-Ship Missile modernization program (2022–2025), focusing on extended range and network-centric warfare. | Boosted long-range strike capability (up to 1,000 km), reduced reliance on foreign imports, and enhanced deterrence against regional threats |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The APAC missile market ecosystem involves government organizations driving R&D and procurement, manufacturers delivering advanced systems, and end users such as regional armed forces driving demand. Collaboration across stakeholders strengthens indigenous development, modernization, and regional defense preparedness.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

APAC Missile Market, By Type

Surface-to-surface missiles account for the largest share, driven by their extensive deployment for land-attack and strategic deterrence roles across India and China.

APAC Missile Market, By Component

Guidance, navigation, and control systems dominate the APAC missile market, with countries like India and South Korea investing heavily in precision-strike capabilities and advanced targeting technologies.

APAC Missile Market, By Speed

Supersonic missiles led the APAC missile market with widespread adoption in China, India, and Japan to counter regional threats through high-speed interception and strike systems.

APAC Missile Market, By End User

The Army held the largest share of the APAC missile market supported by ongoing modernization programs in India, South Korea, and China focusing on surface-to-surface and surface-to-air missile systems.

REGION

India to be fastest-growing country in APAC missile market during forecast period

India is expected to be the fastest-growing country in the APAC missile market during the forecast period, driven by rising defense modernization programs, escalating border tensions, indigenous missile development initiatives, and strong government support for advanced missile technologies.

Asia-Pacific (APAC) Missile Market: COMPANY EVALUATION MATRIX

In the APAC missile market matrix, BrahMos (Star) leads with strong market share and broad product adoption, driven by its supersonic capabilities and joint India–Russia development. Lockheed Martin (Emerging Leader) is strengthening its position through advanced missile systems and partnerships in the region, showing potential to move toward the leaders’ quadrant as regional defense demand intensifies.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

List of Top Asia-Pacific (APAC) Missile Market Companies

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 3.62 Billion |

| Market Forecast in 2030 (Value) | USD 6.26 Billion |

| Growth Rate | CAGR of 11.1% from 2025 to 2030 |

| Years Considered | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | Asia Pacific (APAC) |

WHAT IS IN IT FOR YOU: Asia-Pacific (APAC) Missile Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Leading manufacturer | Additional segment breakdown for countries | Additional country-level market sizing tables for segments/sub-segments covered at regional/global level to gain an understanding on market potential by each country |

| Emerging leader | Additional company profiles | Competitive information on targeted players to gain granular insights on direct competition |

| Regional market leader | Additional country market estimates | Additional country-level deep dive for a more targeted understanding on the total addressable market |

RECENT DEVELOPMENTS

- February 2025 : BDL (India) entered a memorandum of understanding (MoU) with Russia’s Rosoboronexport (ROE) to collaborate on Pantsir variants. This air-defense missile-gun system will be manufactured by BDL (India) and supplied to the Indian Armed Forces.

- April 2024 : RTX (US) received a contract to produce the SM-2 Block IIICU and SM-6 Block IU missiles for USD 344 million. These missiles, intended for the US and allied nations, including Australia, Canada, Japan, and South Korea, will share a common guidance section, target detection device, flight termination system, and electronics unit.

- January 2024 : Mitsubishi Heavy Industries Ltd. (Japan) and Northrop Grumman Corporation (US) signed a teaming agreement to collaborate on integrated air and missile defense capabilities, contributing to Japan’s defense posture and developing networking solutions.

- December 2024 : The Japanese Ministry of Defense conducted a series of ground-to-ship test firings of the improved Type 12 surface-to-ship guided missile made by Mitsubishi Heavy Industries Ltd. (Japan).

Table of Contents

Methodology

This research study on the Asia-Pacific (APAC) missile market involved extensively using secondary sources, directories, and databases, such as Hoovers, Bloomberg BusinessWeek, and Factiva, to identify and collect information relevant to the market. Primary sources included industry experts, service providers, manufacturers, solution providers, technology developers, alliances, and organizations related to all segments of this industry’s value chain. In-depth interviews with primary respondents, including key industry participants, subject matter experts, industry consultants, and C-level executives, were conducted to obtain and verify critical qualitative and quantitative information about the Asia-Pacific (APAC) missile market and assess the market’s growth prospects.

Secondary Research

The market share of companies in the Asia-Pacific (APAC) missile market was determined using the secondary data acquired through paid and unpaid sources and by analyzing the product portfolios of major companies operating in the market. These companies were rated based on the performance and quality of their products. Primary sources further validated these data points.

Secondary sources referred to for this research study on the Asia-Pacific (APAC) missile market included government sources, such as the country’s defense budget; SIPRI; corporate filings, such as annual reports, investor presentations, and financial statements; and trade, business, and professional associations; among others. Secondary data was collected and analyzed to determine the overall size of the Asia-Pacific (APAC) missile market, which primary respondents further validated.

Primary Research

After acquiring information on the Asia-Pacific (APAC) missile market scenario through secondary research, extensive primary research was conducted. Several primary interviews were conducted with market experts from the demand and supply sides across major countries of the Asia Pacific region. Primary data was collected through questionnaires, emails, and telephone interviews.

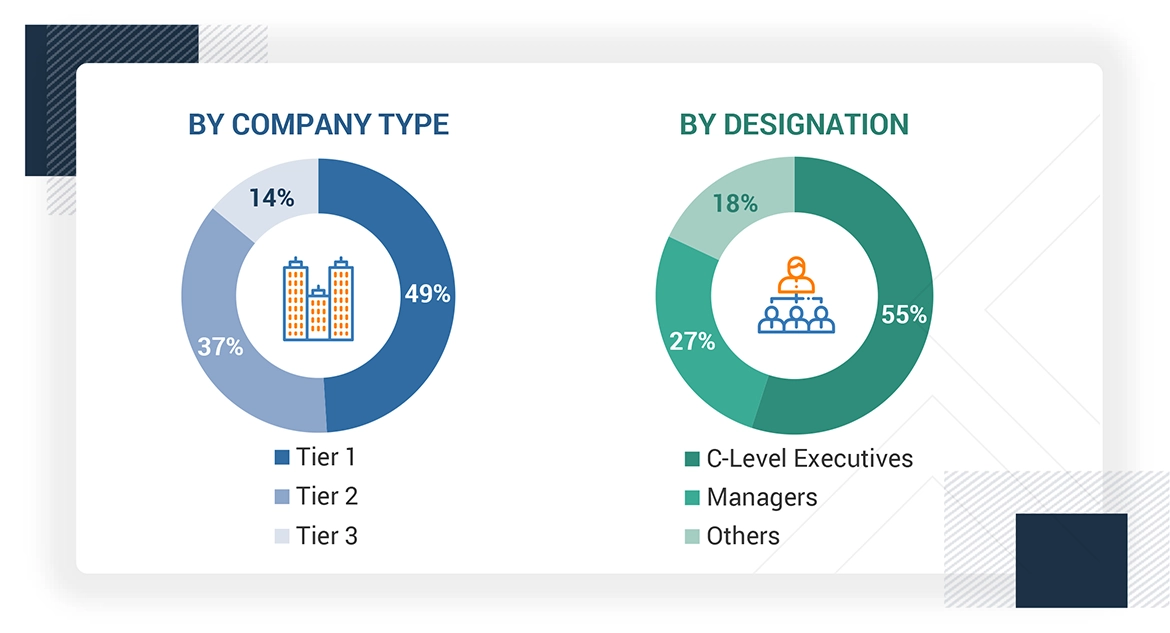

Note 1: C-level Executives include the CEO, COO, and CTO, among others.

Note 2: Others include sales managers, marketing managers, and product managers.

Note 3: Tiers of companies have been defined based on their total revenue as of 2024 (Tier 1 = > USD 1 billion, Tier 2 = USD 100 million to USD 1 billion, and Tier 3 = < USD 100 million).

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated, enhanced with detailed inputs, analyzed by MarketsandMarkets, and presented in this report.

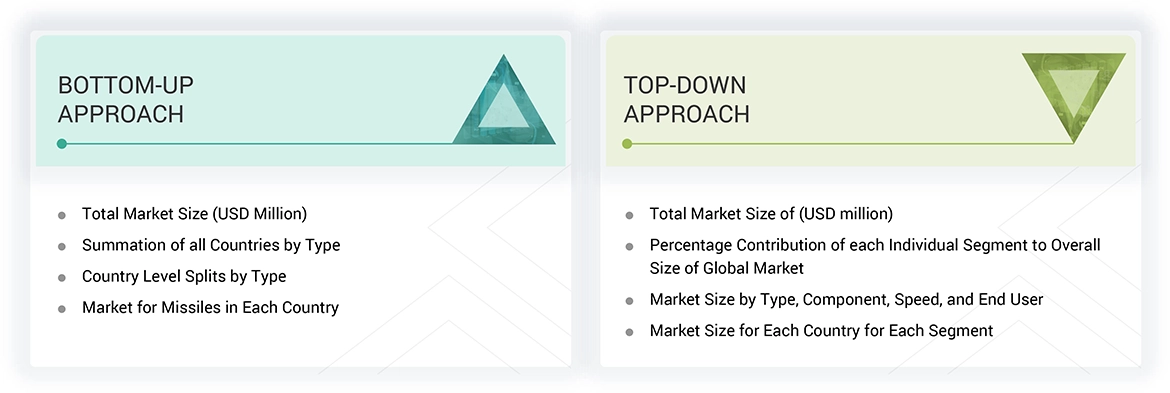

- Both top-down and bottom-up approaches were used to estimate and validate the Asia-Pacific (APAC) missile market size.

- Key players were identified through secondary research, and their market ranking was determined through primary and secondary research. This included a study of annual and financial reports of the top market players and extensive interviews with leaders, including CEOs, directors, and marketing executives.

Asia-Pacific (APAC) Missile Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall size of the Asia-Pacific (APAC) missile market from the market size estimation process explained above, the total market was split into several segments and subsegments. Wherever applicable, data triangulation and market breakdown procedures described below were implemented to complete the overall market engineering process and arrive at the exact statistics for various market segments and subsegments. The data was triangulated by studying different factors and trends from the demand and supply sides. Additionally, the market size was validated using both top-down and bottom-up approaches.

Market Definition

A missile is a weapon designed to be launched or propelled toward a target to deliver an explosive payload, offering precision-strike capability across tactical and strategic scenarios. These airborne weapons combine propulsion, guidance, and warhead subsystems to engage targets at ranges from a few kilometers to intercontinental distances.

The Asia-Pacific (APAC) missile market includes producing and procuring missiles within APAC countries for strategic and tactical applications. The market is segmented by type, component, speed, end user, and region. By type, the Asia-Pacific (APAC) market is divided into surface-to-surface, surface-to-air, air-to-air, air-to-surface, and subsea-to-surface segments.

Key Stakeholders

- Missile Manufacturers

- Defense Contractors

- Original Equipment Manufacturers

- Military Service Providers

- Payload & Warhead Suppliers

- Research Organizations

- Investors and Venture Capitalists

- Ministries of Defense

- R&D Companies

Report Objectives

- To define, describe, and forecast the size of the Asia-Pacific (APAC) missile market based on type, component, speed, end user, and country

- To identify and analyze key drivers, restraints, opportunities, and challenges influencing market growth

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and their contribution to the market

- To analyze opportunities for stakeholders in the market by identifying key market trends

- To analyze competitive developments, such as contracts, acquisitions, expansions, agreements, joint ventures, partnerships, product developments, and research and development (R&D) activities in the market

- To provide a detailed competitive landscape of the market, in addition to an analysis of business and corporate strategies adopted by leading market players

- To strategically profile key market players and comprehensively analyze their core competencies

Available Customizations

Along with the market data, MarketsandMarkets offers customizations to meet the specific needs of companies. The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each companyy

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Key Questions Addressed by the Report

- Recent breakthroughs in seeker design, like modular multi-spectral sensors paired with adaptive guidance software, have given APAC missiles unprecedented responsiveness and target discrimination in contested environments.

- Innovations in composite propellant formulations and precision additive manufacturing have produced lighter, more efficient booster assemblies, extending the range and streamlining logistics for regional strike systems.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Asia-Pacific (APAC) Missile Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Asia-Pacific (APAC) Missile Market