Asia Pacific Lithium-ion Battery Recycling Market

Asia Pacific Lithium-ion Battery Recycling Market by Source (Automotive, Non-Automotive), Battery Chemistry (LFP, NMC, LMO, NCA, LTO), Component, Recycling Process (Hydrometallurgical, Pyrometallurgy, Physical/Mechanical), and Country - Forecast to 2032

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

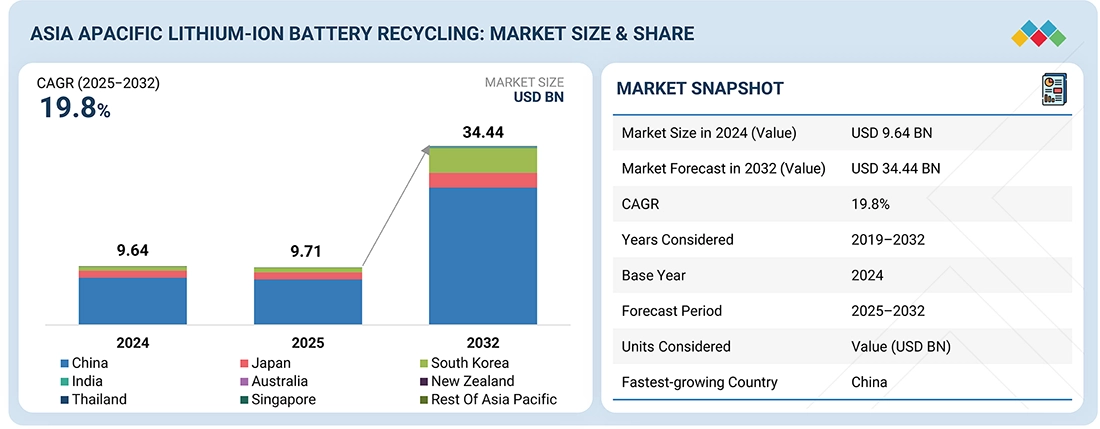

The Asia Pacific lithium-ion battery recycling market is projected to grow from USD 9.71 billion in 2025 to USD 34.44 billion by 2032, at a CAGR of 19.8% during the forecast period. The growth of the market in the region is owed to the rapid adoption of electric vehicles (EVs), the expansion of energy storage installations, and the increasing use of consumer electronics. China, South Korea, Japan, and India are among the countries that produce an increasing number of end-of-life batteries and manufacturing scraps, which are the primary source of the recycling pipeline. Governments are implementing supportive policies and circular economy initiatives to enhance battery collection and material recovery processes. The leading players in the region are investing heavily in recycling technology to extract the largest quantities possible of lithium, nickel, cobalt, and other critical materials. The aforementioned reasons, along with the massive production of batteries and electrification, are expected to create a significant demand for efficient lithium-ion battery recycling solutions.

KEY TAKEAWAYS

-

BY COUNTRYAustralia is projected to register the highest CAGR of 46.4% in the Asia Pacific lithium-ion battery recycling market during the forecast period.

-

BY CHEMISTRYBy chemistry, the lithium iron phosphate segment accounted for a 57.0% share of the overall market in 2024.

-

BY SOURCEBy source, the non-automotive segment is expected to register the highest CAGR of 26.1% during the forecast period.

-

BY RECYCLING PROCESSBy recycling process, the hydrometallurgical recycling process is expected to dominate the market.

-

BY BATTERY COMPONENTBy battery component, the active material segment is estimated to dominate the market.

-

Competitive Landscape - Key PlayersContemporary Amperex Technology Co., Limited (China), GEM Co., Ltd. (China), and SK Tes (Singapore) were identified as some of the star players in the North America lithium-ion battery recycling market, given their strong market share and product footprint.

-

Competitive Landscape - StartupsACE Green Recycling Inc., Envipro Holdings Inc., Batx Energies, and others have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders.

The lithium-ion battery recycling market in Asia Pacific is witnessing strong growth, driven by the rapid expansion of EV adoption, increasing deployment of energy storage systems, and a rising volume of end-of-life lithium-ion batteries entering the supply chain. Supportive government policies, growing emphasis on circular economy practices, and the need to secure domestic supplies of critical minerals such as lithium, nickel, and cobalt are accelerating investments in advanced recycling facilities across countries such as China, Japan, and South Korea.

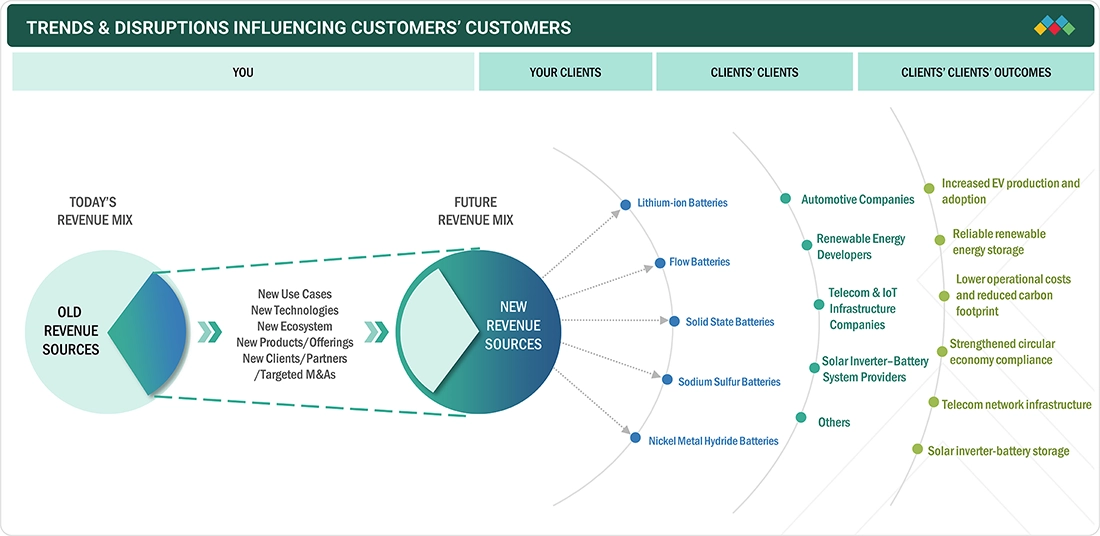

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on consumers' businesses arises from evolving customer trends or market disruptions. The growth of end-use industries, such as automotive batteries, industrial batteries, consumer & electronics batteries, and energy storage systems (ESS) batteries, is driving the market. These megatrends are expected to drive growth and increase the market's revenue.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Growing adoption of lithium-ion batteries in energy storage systems (ESS)

-

Rapid electric vehicle (EV) adoption

Level

-

Safety and handling concerns

Level

-

Price decline of lithium-ion batteries

Level

-

Underdeveloped infrastructure for lithium-ion battery recycling

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Growing adoption of lithium-ion batteries in energy storage systems (ESS)

The Asia Pacific region is witnessing a substantial increase in the adoption of lithium-ion batteries for energy storage systems. The integration of renewable energy sources on a large scale and the need for grid stability are the primary factors driving this rise. China, India, Japan, South Korea, and Australia are among the countries that are installing utility-scale energy storage systems (ESS) to facilitate solar and wind power production, which will in turn lead to a substantial increase in battery demand. Additionally, the application of lithium-ion batteries for grid stabilization, backup power, and industrial storage will result in a high volume of future end-of-life ESS batteries. The growing use of technology is leading to the establishment of a robust long-term recycling pipeline, and therefore, investments will be made in efficient recovery technologies. The use of batteries for energy storage applications will be a key driver for the Asian recycling market of lithium-ion batteries, given the strong commitment of the region to clean power and decarbonization.

Restraint: Safety and handling concerns

Safety and handling issues are the primary constraints on the Asia Pacific lithium-ion battery recycling market, as batteries nearing the end of their life pose a high risk of fire, explosion, and thermal runaway if not properly managed. There are several risks of accidents and operational process interruptions during collection and transportation, including incorrect discharging, dismantling, or storage. The majority of recycling facilities in developing Asia Pacific countries lack advanced safety systems, trained personnel, and adequate fire suppression infrastructure. The transportation of damaged or used batteries is also heavily controlled, which makes the whole process more complicated and costly. Moreover, the unevenness in compliance with safety standards in the region results in high insurance costs, which discourage new investments in the recycling industry.

Opportunity: Price decline of lithium-ion batteries

The decline in prices of lithium-ion batteries has been constant, and now it is accelerating their use in electric vehicles, consumer electronics, and energy storage systems, thereby resulting in a rapidly increasing installed base. As more batteries are used, the number of waste batteries sent for recycling is expected to increase in the next few years. The already growing amount of discarded batteries is making it easier for recycling plants to get the raw material they need, and economically, it is also making it possible for them to work with more advanced and thus cheaper technologies. All in all, the reduction in battery prices indirectly strengthens the recycling market through increased demand, usage, and ultimately, a pool of recoverable materials.

Challenge: Underdeveloped infrastructure for lithium-ion battery recycling

Inadequate infrastructure for lithium-ion battery collection, storage, and recycling still exists in several Asia Pacific countries, thereby limiting the efficient movement of spent batteries through the value chain. The existence of insufficient collection networks of end of life batteries, a very few recycling facilities, and weak enforcement of regulations leads to the situations where recovery rates of metals from used batteries becomes low and the supply of feedstock for recyclers becomes inconsistent. These problems also result in handling risks and operational costs, which in turn affect the scalability of recycling companies. Thus, the infrastructure remains to be one of the most significant obstacles for the development and modernization of the lithium-ion battery recycling market.

ASIA PACIFIC LITHIUM-ION BATTERY RECYCLING MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

It operates large-scale recycling facilities that process end-of-life EV batteries and production scrap through advanced hydrometallurgical and material-regeneration technologies. The company integrates recycling directly with its battery manufacturing ecosystem, enabling a closed-loop system that feeds recovered materials back into new battery production. | Enhances circularity in the EV-battery supply chain, reduces dependence on mined raw materials, improves material security for high-volume battery production, lowers environmental impact, and supports long-term cost efficiency through resource recovery |

|

It manages extensive collection and recycling operations for spent lithium-ion batteries, consumer electronics batteries, and EV battery scrap. Using advanced urban mining and hydrometallurgical processes, GEM recovers nickel, cobalt, lithium, and other high-value metals at a large scale for reuse in battery precursors. | Strengthens critical-mineral reuse, reduces waste generation, supports China's closed-loop battery ecosystem, improves sustainability performance for OEMs, and helps stabilize raw-material supply for cathode production |

|

Attero operates integrated e-waste and lithium-ion battery recycling facilities across India, using mechanical, thermal, and hydrometallurgical processes to recover key materials from spent EV, consumer electronics, and energy-storage batteries. The company manages nationwide collection networks and provides end-to-end recycling services for OEMs and enterprises. | Supports domestic material recovery, reduces reliance on imported battery minerals, ensures environmentally responsible recycling, improves circularity in India’s battery value chain, and strengthens supply security for local manufacturers |

|

Umicore offers high-efficiency lithium-ion battery recycling through advanced pyro-hydrometallurgical technology that processes EV packs, industrial batteries, and battery manufacturing scrap. The company integrates recovered metals into its cathode-material production, enabling a closed-loop manufacturing cycle. | Provides high-yield recovery of cobalt, nickel, and lithium; reduces carbon footprint and environmental risks; enhances raw-material independence; and supports sustainable battery manufacturing for global OEMs through closed-loop material flows |

|

It operates a global network of lithium-ion battery recycling facilities that handle EV batteries, energy-storage batteries, and consumer battery scrap. Using a combination of mechanical pre-processing and hydrometallurgical refining, the company recovers valuable battery metals and supplies them back to manufacturers. | Expands global circular-economy capabilities, reduces waste and landfill risks, strengthens secure supply chains for battery metals, enhances ESG performance for partners, and supports sustainable EV and ESS battery production |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

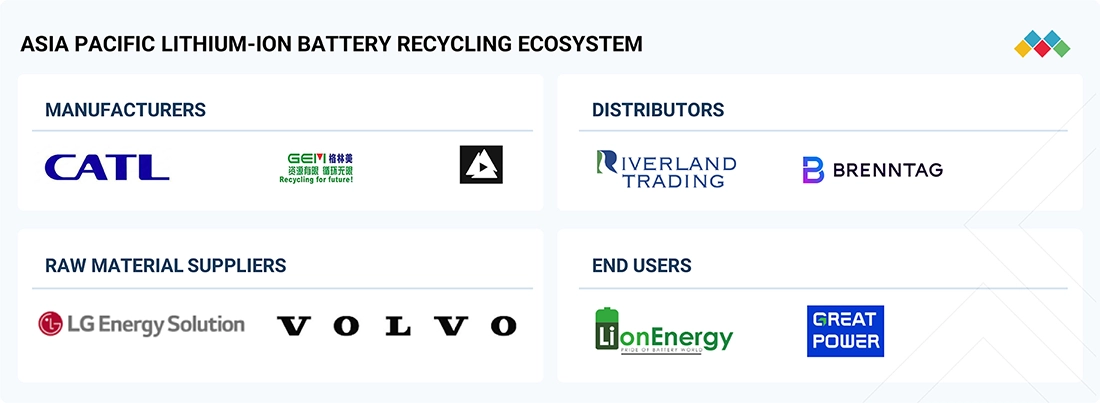

MARKET ECOSYSTEM

The Asia Pacific lithium-ion battery recycling ecosystem consists of raw material suppliers (e.g., LG Energy Solution, Volvo, and others), producers (e.g., Contemporary Amperex Technology Co., Limited, GEM Co., Ltd., SK Tes ), distributors (e.g., Brenntag N.V., Riverland Trading), and end users (e.g., Huanyu Battery Co., Ltd., Lio Energy, and others).

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Asia Pacific Lithium-ion Battery Recycling Market, By Chemistry

The LFP (Lithium Iron Phosphate) segment is projected to witness significant growth in the market. LFP batteries are being increasingly used across EVs, energy storage, and industrial applications, and this growth is being helped by solid manufacturing bases in China and South Korea. The major benefits associated with LFP technology, including safety, long cycle life, and low production costs, are drawing the attention of both manufacturers and end-users throughout the Asia Pacific region. The production of LFP batteries, especially for renewable energy and grid stabilization, is taking place at large-scale energy storage projects, which further accelerates the adoption of LFP. With the widespread use of LFP in Asia Pacific, the volume of end-of-life LFP batteries is expected to rise sharply, thus creating the need for more efficient lithium recovery and recycling solutions. As a result, the LFP recycling segment is poised for significant growth in the region over the next few years.

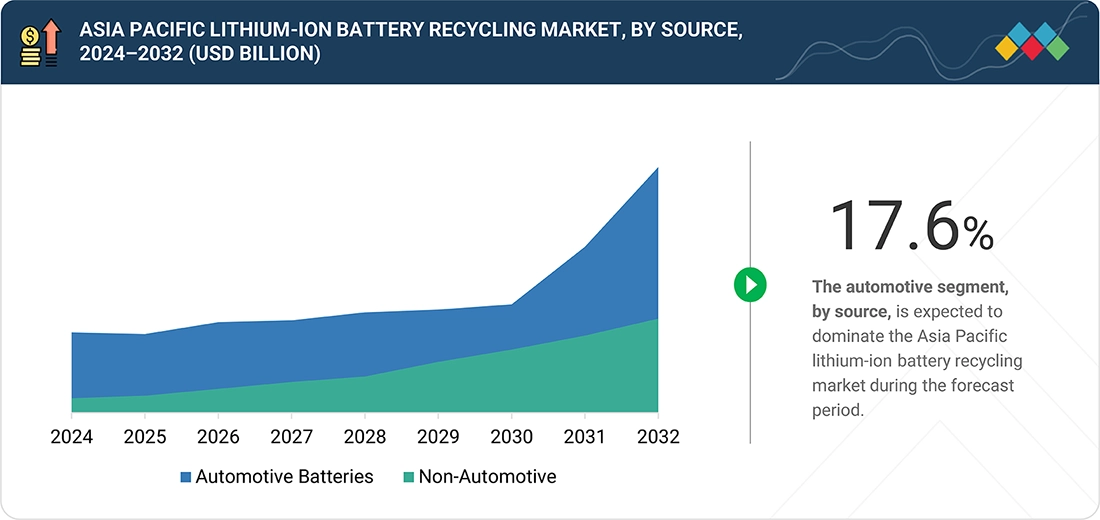

Asia Pacific Lithium-ion Battery Recycling Market, By Source

By source, the non-automotive segment is expected to register the highest growth in the market. One of the primary factors driving the extensive use of lithium-ion batteries in the Asia Pacific region is the increasing demand for consumer electronics, power tools, marine equipment, and industrial machinery, resulting in a larger volume of end-of-life batteries. Besides this, the rapid growth of renewable energy projects is increasing battery consumption for purposes such as grid balancing, energy storage systems, and backup power, which will eventually add to the recycling stream at a faster rate. The non-automotive sector is now a major contributor to the market’s growth, as lithium-ion batteries become increasingly integrated into daily operations and industrial workflows. In addition, the continuous electrification in the marine, logistics, and manufacturing industries is increasing the battery deployment and recycling needs of the future. Materials recovery from non-automotive applications is becoming stronger.

REGION

Australia to be fastest-growing country in Asia Pacific lithium-ion battery recycling market during forecast period

Australia is expected to register the highest growth in the Asia Pacific lithium-ion battery recycling market. There is a high level of electric vehicle adoption in the country, which has increased the need for lithium-ion battery recycling. Additionally, the increase in energy storage installations, along with the demand for consumer electronics, has also led to a rise in the amount of end-of-life batteries. Due to this, the Australian government has enforced strict waste management and stewardship policies, such as the B-cycle battery recycling scheme, which is significantly improving the collection rates of discarded Li-ion batteries. The local recycling capability in Australia is reinforced by increasing investments from both domestic companies and new recyclers. Due to the rapid installation of renewable energy storage projects and the shift toward a circular economy, the quantity of end-of-life lithium-ion batteries is expected to increase significantly. Consequently, the need for effective material recovery processes, particularly for lithium, cobalt, and nickel, is growing rapidly, making Australia a key player in the lithium-ion battery recycling market in the Asia Pacific region.

ASIA PACIFIC LITHIUM-ION BATTERY RECYCLING MARKET: COMPANY EVALUATION MATRIX

In the Asia Pacific lithium-ion battery recycling market matrix, Contemporary Amperex Technology Co., Limited (Star) leads with its integrated supply chain to maximize market reach and product diversification. Players under the Stars category primarily focus on new service & technology launches, as well as acquiring leading market positions through the provision of broad portfolios, catering to the different requirements of customers. They are also focused on innovations and are geographically diversified. They also have broad industry coverage. Apart from that, they possess strong operational and financial strength, endeavoring to grow both organically and inorganically in the market. Tata Chemicals Limited (Emerging Leader) has a strong potential to build strategies to expand its business and stay on par with the star players. However, emerging leaders have not adopted effective growth strategies for their overall business.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Contemporary Amperex Technology Co., Ltd. (China)

- Tata Chemicals Limited (India)

- Attero Recycling (India)

- Sk Tes (Singapore)

- Umicore (Belgium)

- Glencore (Switzerland)

- Neometals Ltd (Australia)

- Ace Green Recycling, Inc. (Singapore)

- Envipro Holdings Inc. (Japan)

- Batx Energies (India)

- Gem Co., Ltd. (China)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 9.64 BN |

| Market Forecast in 2032 (Value) | USD 34.44 BN |

| CAGR (2025–2030) | 19.8% |

| Years Considered | 2019–2032 |

| Base Year | 2024 |

| Forecast Period | 2025–2032 |

| Units Considered | Value (USD Billion) |

| Report Coverage | Revenue forecast, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Countries Covered | China, Japan, South Korea, India, Australia, New Zealand, Thailand, Singapore, Rest of Asia Pacific |

WHAT IS IN IT FOR YOU: ASIA PACIFIC LITHIUM-ION BATTERY RECYCLING MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Support in planning end-of-life EV battery recovery and closed-loop recycling | We analyzed EV retirement timelines, chemistry-wise recycling economics, and optimal reverse-logistics networks. The study also mapped US/Canada regulatory requirements and benchmarked hydrometallurgical and direct recycling options to help OEMs design effective take-back programs. | This enabled OEMs to secure critical minerals through closed-loop systems, reduce supply-chain risk, and meet compliance and sustainability goals while lowering long-term material costs. |

| Optimize recycling of production scrap and evaluate in-house vs. outsourced recycling | We assessed scrap generation trends across cell formats, modeled black mass output, and compared the economics of on-site preprocessing with third-party recyclers. Incentive mapping helped identify federal and provincial funding opportunities for domestic recovery. | Clients reduced waste-handling costs, improved recovery yields, and strengthened eligibility for critical-mineral tax credits, supporting more resilient and sustainable manufacturing. |

| Improve recovery and safe handling of small-format Li-ion batteries | We evaluated collection networks, safe disassembly processes, and revenue potential from cobalt-rich chemistries. Regulatory and export compliance assessments supported secure and efficient material flows. | Clients enhanced recycling margins, minimized safety risks, and strengthened adherence to e-waste stewardship requirements. |

| Assess end-of-life pathways and second-life potential for ESS batteries | We modeled ESS retirement cycles, compared second-life reuse with direct recycling, and evaluated compliance with NFPA and UL standards. Market insights supported strategic planning for future feedstock volumes. | Clients identified cost-effective repurposing opportunities, extended asset value, and ensured regulatory compliance while preparing for rising recycling demand. |

RECENT DEVELOPMENTS

- April 2024 : GEM signed a Strategic Cooperation Framework Agreement with Guangzhou Automobile Group (GAC Group) to jointly build a full life-cycle value chain for new energy vehicles. This collaboration focuses on integrating EV recycling, battery recycling, raw material recovery for nickel, cobalt, and lithium, and battery material regeneration into a unified circular system. The partnership aims to strengthen a global closed-loop model for new energy batteries, advancing the industry from “green manufacturing” toward a fully “green and circular” ecosystem.

- April 2023 : Glencore, FCC Ambito (a subsidiary of FCC Servicios Medio Ambiente), and Iberdrola (a renewable energy company) announced their plans to partner to provide lithium-ion battery recycling solutions for Spain and Portugal. The deal includes establishing a battery recycling facility at FCC Ambito, which focuses on the pre-processing of lithium-ion batteries & battery scrap, as well as the recovery of battery metals.

- February 2023 : CATL, Mercedes-Benz, and GEM Co., Ltd. signed a memorandum of understanding, under which CATL recycles cobalt, nickel, manganese, and lithium metals from spent electric vehicle batteries of Mercedes-Benz and remanufacture them into battery cathode materials. Thus, reproduced batteries are supplied back to Mercedes-Benz, forming a closed-loop value chain.

Table of Contents

Methodology

The study involved four major activities in estimating the current size of the Asia Pacific lithium-ion battery recycling market. Exhaustive secondary research was done to collect information on the market, peer markets, and parent market. The next step was to validate these findings, assumptions, and sizing with the industry experts across the Asia Pacific lithium-ion battery recycling value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary sources for this research study include annual reports, press releases, and investor presentations of companies; white papers; certified publications; and articles by recognized authors; gold- and silver-standard websites; Asia Pacific lithium-ion battery recycling manufacturing companies, regulatory bodies, trade directories, and databases. The secondary research was mainly used to obtain key information about the industry’s supply chain, the total pool of key players, market classification, and segmentation according to industry trends to the bottom-most level and regional markets. It has also been used to obtain information about key developments from a market-oriented perspective.

Primary Research

The Asia Pacific lithium-ion battery recycling market comprises several stakeholders, such as such as raw material suppliers, technology support providers, lithium-ion battery recyclers, and regulatory organizations in the supply chain. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Primary sources from the supply side included industry experts such as Chief Executive Officers (CEOs), vice presidents, marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the Asia Pacific lithium-ion battery recycling market. Primary sources from the demand side included directors, marketing heads, and purchase managers from various sourcing industries. Following is the breakdown of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches have been used to estimate and validate the total size of the Asia Pacific lithium-ion battery recycling market. These approaches have also been used extensively to estimate the size of various dependent subsegments of the market. The research methodology used to estimate the market size included the following:

The following segments provide details about the overall market size estimation process employed in this study

- The key players in the market were identified through secondary research.

- The market shares in the respective regions were identified through primary and secondary research.

- The value chain and market size of the Asia Pacific lithium-ion battery recycling market, in terms of value, were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research included the study of annual and financial reports of the top market players and interviews with industry experts, such as CEOs, VPs, directors, sales managers, and marketing executives, for key insights, both quantitative and qualitative.

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the oil & gas sector.

Market Definition

Lithium-ion battery recycling refers to the reuse and reprocessing of spent lithium-ion batteries to reduce their disposal as municipal solid waste or material waste. Lithium-ion batteries contain several toxic chemicals & heavy metals and disposing of them as trash has raised environmental and health concerns due to water pollution and soil contamination. Lithium-ion battery recycling is important not only for the recovery of valuable materials and metals but also for efficient waste management. Various types of lithium-ion batteries are available in the market, including lithium-titanate oxide (LTO), lithium-manganese oxide (LMO), lithium-iron phosphate (LFP), lithium-nickel cobalt aluminum oxide (NCA), and lithium-nickel manganese cobalt (Li-NMC). These batteries are majorly used in the automotive and non-automotive industries such as marine, power, industrial, and others. Li-ion batteries provide the required amount of power at a low cost and help reduce the weight and size of products, which are the major factors leading to the market growth. The rising demand for Li-ion batteries in electric vehicles is expected to lead to the growth of the lithium-ion battery recycling market during the forecast period.

Key Stakeholders

- Raw material manufacturers

- Technology support providers

- Recyclers of Lithium-ion battery

- Traders, distributors, and suppliers

- Regulatory Bodies and Government Agencies

- Research & Development (R&D) Institutions

- End-use Industries

- Consulting Firms, Trade Associations, and Industry Bodies

- Investment Banks and Private Equity Firms

Report Objectives

- To analyze and forecast the market size of Asia Pacific lithium-ion battery recycling market in terms of value

- To provide detailed information regarding the major factors (drivers, restraints, challenges, and opportunities) influencing the regional market

- To analyze and forecast the Asia Pacific lithium-ion battery recycling market on the basis of battery chemistry, source, recycling process, battery component, and region

- To analyze the opportunities in the market for stakeholders and provide details of a competitive landscape for market leaders

- To track and analyze the competitive developments, such as acquisitions, partnerships, collaborations, agreements and expansions in the market

- To strategically profile the key players and comprehensively analyze their market shares and core competencies

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the client-specific needs.

The following customization options are available for the report:

- Additional country-level analysis of the Asia Pacific lithium-ion battery recycling market

- Profiling of additional market players (up to 5)

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Asia Pacific Lithium-ion Battery Recycling Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Asia Pacific Lithium-ion Battery Recycling Market