Asia Pacific Microirrigation Systems Market

Asia Pacific Microirrigation Systems Market by Type (Drip & Microsprinklers), Crop Type (Orchard Crops & Vineyards, Field Crops, Plantation Crops), & End User (Farmers, Industrial Users) - Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

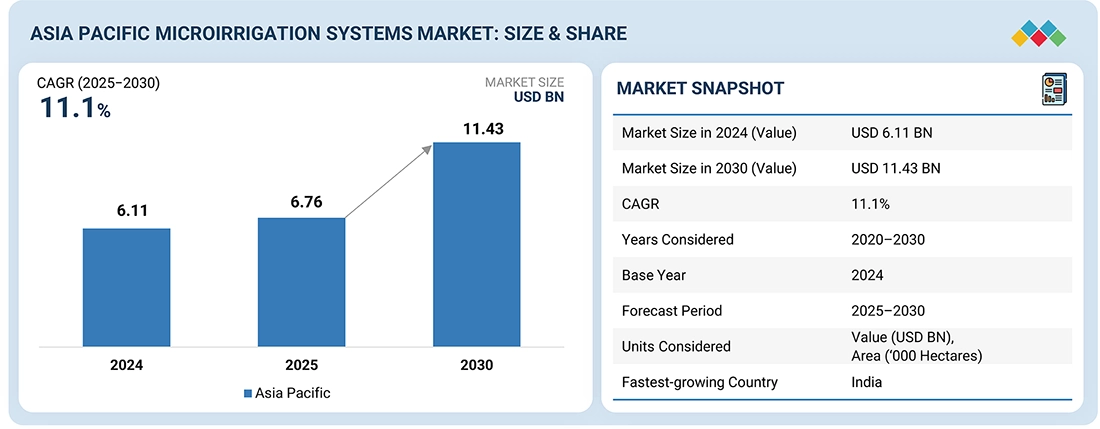

The Asia Pacific microirrigation systems market is anticipated to grow from USD 6.76 billion in 2025 to USD 11.43 billion in 2030, growing at a CAGR of 11.1%. The Asia Pacific region is witnessing a healthy growth rate in the microirrigation systems market due to the increased rate of groundwater depletion and drought conditions. In addition, the government is supporting market growth through initiatives to promote water management. In the key agricultural markets of China, India, and Australia, farmers are increasingly adopting microirrigation system solutions to increase crop productivity, thus addressing water and energy-related issues. The demand for the product is high mainly because farmers are shifting from traditional irrigation practices to microirrigation. Also, the government is offering subsidies for irrigation, which is further boosting the market. In water-scarce regions, the adoption of the product is very high, especially where crops such as fruits, vegetables, and plantation crops are grown with the help of greenhouse microirrigation.

KEY TAKEAWAYS

-

By CountryIndia accounted for 69.4% of the Asia Pacific microirrigation systems market in 2024.

-

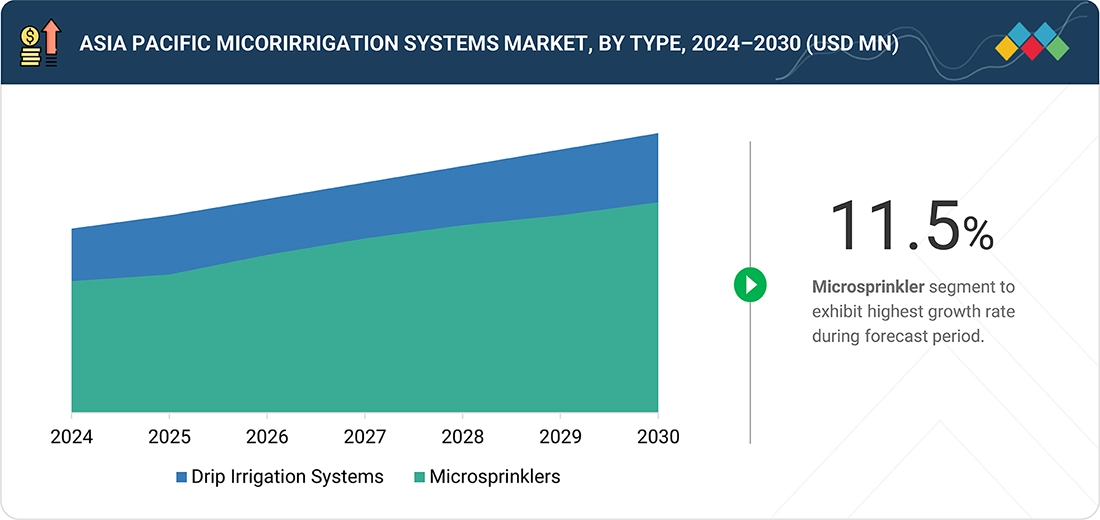

By TypeBy type, the microsprinkler segment is expected to register the highest CAGR of 11.5% during the forecast period.

-

By Crop TypeBy crop type, the orchard crops & vineyards segment dominated the market with a share of 55.7% in 2024.

-

By End UserBy end user, industrial users are likely to record the highest growt rate during the forecast period.

-

Competitive Landscape – Key PlayersKey players include The Toro Company, Rivulis, and Rain Bird Corporation supported by strong brand equity and regional distribution.

-

Competitive Landscape – StartupsEmerging companies such as Kothari Group and Metro Irrigation are gaining traction in drip and sprinkler irrigation segments.

The Asia Pacific microirrigation systems market is projected to grow from USD 6.73 billion in 2025 to USD 11.43 billion by 2030, at a CAGR of 11.1%. The Asia Pacific commercial agriculture sector is increasingly reaching a stage where efficient irrigation is essential, driven by growing water scarcity, rapid groundwater depletion, and stronger policy focus on water-use efficiency. At the same time, rising energy, labor, and input costs are reshaping farm economics, further accelerating demand for precise and reliable irrigation solutions. Across much of the region, irrigation decisions are closely tied to water availability, government support programs, and long-term farm sustainability. As a result, microirrigation is becoming a core component of farm viability and resilience, positioning it as critical infrastructure rather than an optional productivity enhancement.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

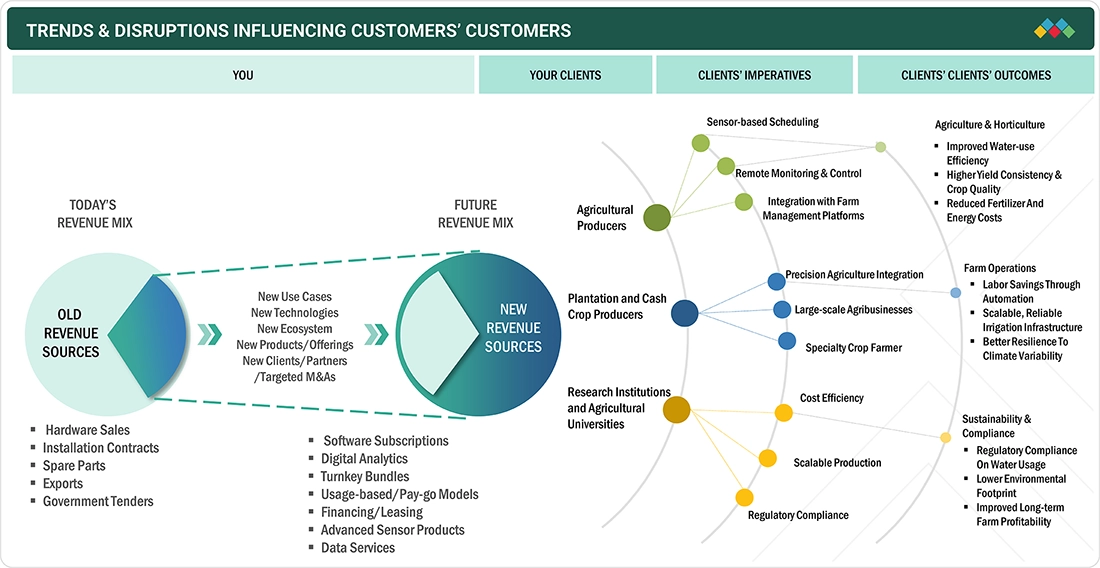

The microirrigation systems market is gradually tranforming from traditional, hardware-driven revenue models toward integrated, technology-enabled solution offerings aligned with evolving customer needs. Historically, revenue has been primarily generated through equipment sales, installation services, spare parts, exports, and government tenders. However, future revenue growth is expected to stem from software subscriptions, digital analytics, turnkey solutions, usage-based business models, financing programs, advanced sensor technologies, and data-driven services. The ecosystem mapping highlights key client segments, including agricultural producers, plantation and cash crop growers, and research institutions, each requiring differentiated capabilities such as sensor-based scheduling, remote monitoring, precision agriculture integration, and scalable production systems. These capabilities address broader client imperatives such as cost efficiency, regulatory compliance, and production scalability, ultimately delivering outcomes including improved water-use efficiency, enhanced crop quality, labor optimization, climate resilience, and long-term sustainability. Overall, the image emphasizes a strategic industry shift toward service-led, outcome-oriented value creation driven by digitalization and precision agriculture advancements.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

•Rising water scarcity, groundwater depletion, and erratic rainfall across South and East Asia

-

•Strong government focus on water-use efficiency and food security

Level

-

§ Sensitivity to energy costs for pressurized irrigation systems

-

§ Limited access to affordable financing for small and marginal farmers

Level

-

§Increasing use of fertigation, low-flow systems, and modular designs

-

§Expansion of high-value crops, plantations, and greenhouse cultivation

Level

-

§Highly fragmented landholdings complicating system design and scale-up

-

§Inconsistent after-sales service and installer capability in rural regions

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rising water scarcity, groundwater depletion, and erratic rainfall across South and East Asia

Water scarcity is increasingly emerging as a structural challenge across South and East Asia, as groundwater extraction in many areas continues at nearly twice the natural recharge rate. In major agricultural economies such as India, China, and Southeast Asia, farming accounts for the majority of freshwater consumption. The combined effects of intensive irrigation, population growth, and rising urban and industrial water demand have led to declining water tables and deeper pumping requirements, increasing both energy costs and supply risks for farmers. Climate change has further intensified these pressures by disrupting rainfall patterns, resulting in shorter monsoon seasons, uneven precipitation, and more frequent droughts and floods. This growing variability has reduced the reliability of traditional flood- and canal-based irrigation systems, exposing crops to moisture stress during critical growth stages. Consequently, farmers are increasingly adopting irrigation solutions that enable precise control, regulation, and predictability of water supply, making these factors key drivers of microirrigation demand across the Asia Pacific region.

Restraint: Sensitivity to energy costs for pressurized irrigation systems

Across the Asia Pacific region, sensitivity to energy costs remains a key constraint on the adoption of pressurized microirrigation systems that rely on pumping. Pumping often accounts for a significant portion of on-farm operating expenses, and as groundwater levels decline, farmers are required to extract water from deeper depths, increasing electricity or diesel consumption. This trend heightens irrigation cost volatility, particularly in regions with unreliable power supply or rising fuel prices. Although some countries provide electricity subsidies, they are often inconsistent or being gradually reduced, exposing farmers to higher, less predictable energy costs. As a result, many farmers, particularly smallholders with limited financial capacity, remain cautious about investing in pressurized irrigation systems. Adoption rates are therefore likely to remain constrained unless supported by energy-efficient system designs, low-pressure operating technologies, solar-powered pumping solutions, and accessible financing or subsidy programs.

Opportunity: Increasing use of fertigation, low-flow systems, and modular designs

The Asia Pacific microirrigation systems market is benefiting significantly from the increased usage of fertigation, low-flow systems, and modular irrigation designs. Essentially, fertigation enables farmers to apply water and nutrients simultaneously and directly to the root zone of plants, thereby greatly improving nutrient uptake efficiency while reducing fertilizer waste and runoff. This is an indispensable tool in areas where input costs are high and soils are degraded, since accurate nutrient management can lead to noticeable yield and profit increases. Low-flow drip and microsprinkler systems are becoming popular choices because they reduce water and energy consumption; thus, they are highly recommended for areas experiencing water scarcity and facing rising power tariffs. On the other hand, modular system designs give farmers the freedom to initially set up small installations and later expand them as their cash flow improves or their cropping patterns change. These characteristics, in tandem, reduce entry barriers, raise investment returns, and make microirrigation more viable for the fragmented landholdings and diverse crop systems prevalent in the Asia Pacific region.

Challenge: Highly fragmented landholdings complicating system design and scale-up

Microirrigation system design and deployment are becoming increasingly complex and costly due to the highly fragmented landholding structure prevalent across the Asia Pacific region. Small and irregular farm plots, often cultivating multiple crops and relying on varied water sources, limit standardization, reduce economies of scale, and slow the adoption of automation technologies. This fragmentation increases the need for customized, modular system configurations, along with strong technical and after-sales support from local distributors and service providers.

ASIA PACIFIC MICROIRRIGATION SYSTEMS MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Drip and microsprinkler solutions for high-value crops, orchards, plantations, and commercial landscaping across Australia, China, India, and Southeast Asia, supported by smart controls and automation | Improved irrigation precision | Reduced labor and energy costs | Scalable deployment across farm sizes | Higher return on irrigation investment |

|

Systems for permanent crops, plantations, and open-field agriculture, including pressure-compensated drip and microsprinklers suited for uneven terrain and variable water availability | Uniform water distribution | Adaptability to uneven land | Reduced input losses | Improved yield stability |

|

Drip and microsprinkler solutions for orchards, horticulture, plantations, and greenhouse cultivation, integrated with fertigation, automation, and digital agronomy support | High water-use efficiency | Consistent crop quality | Compliance with EU water regulations |Improved long-term farm profitability |

|

Drip and microirrigation systems for agriculture, greenhouses, turf, and landscape applications with strong emphasis on system reliability | Reduced water wastage | Improved crop and landscape performance | Regulatory compliance | Lower lifecycle maintenance needs |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The Asia Pacific microirrigation systems ecosystem consists of interconnected stakeholders that support technology development, policy implementation, adoption, and innovation. Manufacturers such as Toro, Netafim, Rivulis, Valmont, and Rain Bird form the core of the ecosystem by developing and supplying drip irrigation, sprinkler systems, and digital irrigation management solutions tailored to diverse regional agricultural needs. Regulatory bodies drive market growth by establishing water conservation policies, efficiency standards, and subsidy programs. Government agencies across countries such as India and China, along with regional organizations like the Network of Asian River Basin Organizations (NARBO), promote sustainable irrigation adoption and ensure regulatory compliance. End users, including farmer associations, agricultural cooperatives, and commercial growers, serve as primary demand drivers. Organizations such as the National Farmers Federation and Victorian Farmers Federation support farmer awareness, training, and access to modern irrigation technologies, thereby accelerating adoption. Research and academic institutions, including the International Water Management Institute (IWMI), IHE Delft Institute for Water Education, and regional technical institutes, contribute through technology development, water efficiency research, and capacity-building initiatives. Together, these stakeholders create a collaborative ecosystem that advances sustainable irrigation practices and enhances agricultural productivity across the Asia Pacific region.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Asia Pacific Microirrigation Market, By Type

Drip irrigation represents the biggest and most mature product segment in the Asia Pacific microirrigation systems market, by volume. This is mainly due to the region's focus on improving water-use efficiency amid groundwater depletion, erratic rainfall, and rising irrigation costs. Drip systems are widely used in orchards, plantations, vegetable and fruit production, and greenhouse cultivation, where accurate delivery of water and nutrients is essential for stable yields and crop quality under changing climatic conditions. The prevalence of drip irrigation in the Asia Pacific is also supported by government-led irrigation modernization programs, subsidy schemes, and the growing adoption of fertigation and low-pressure systems. As water becomes scarcer and farming is directed towards high-value, export-oriented crops, drip irrigation remains the most viable solution for both commercial farms and smallholders seeking microirrigation technology that is scalable and cost-effective across the region.

Asia Pacific Microirrigation Market, By Crop Type

Orchards and plantations account for the largest share of the Asia Pacific microirrigation systems market, primarily due to the region’s extensive cultivation of permanent, high-value crops. This dominance is supported by the large-scale production of fruits and plantation crops such as citrus, mango, banana, grapes, apples, tea, coffee, and oil palm across India, China, Australia, and Southeast Asia. For these crops, consistent and precise irrigation plays a critical role in maintaining yield quality and managing climate-related variability. Microirrigation, particularly drip and low-flow microsprinkler systems, enables highly targeted delivery of water and nutrients by wetting only a limited portion of the root zone, thereby reducing water stress and supporting long-term plant health. The adoption of automation technologies, soil moisture monitoring sensors, and pressure-compensated irrigation components is also increasing across the region, improving irrigation efficiency across diverse soil conditions and uneven terrain. Given the permanent nature of orchards and plantations, their higher capital investment requirements, and the growing pressure to optimize water usage, these crop segments are expected to remain key drivers of microirrigation demand in the Asia Pacific in the coming years.

Asia Pacific Microirrigation Market, By End User

Farmers account for the largest share of the Asia Pacific microirrigation systems market, driven by their need to improve water management efficiency, stabilize crop yields, and mitigate climate-related risks. Adoption is particularly strong among producers of permanent, high-value crops such as orchards, plantations, fruits, vegetables, and horticultural produce, where crop quality and profitability depend significantly on precise irrigation practices. Drip irrigation and microsprinkler systems enable targeted delivery of water and nutrients, minimizing resource losses and supporting consistent yields despite increasingly unpredictable rainfall and temperature conditions. Farmer-driven demand across the Asia Pacific is strongly influenced by economic and policy incentives, including government subsidy programs, irrigation modernization initiatives, and sustainability-focused efforts designed to enhance water-use efficiency. Rising labor costs, declining groundwater availability, and the growing need for automated irrigation management are further accelerating adoption. As farmers across the region continue to prioritize productivity improvement, cost optimization, and long-term operational resilience, they are expected to remain the leading end-user segment driving demand for microirrigation systems in the Asia Pacific.

REGION

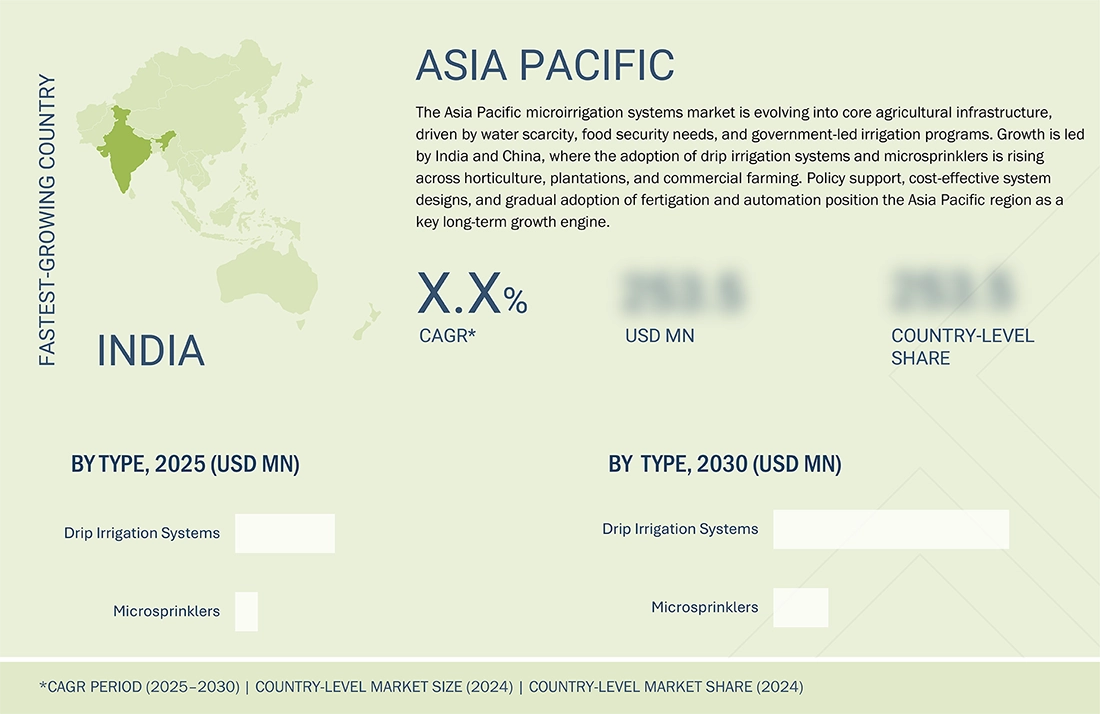

India to be fastest-growing country in Asia Pacific microirrigation systems market during forecast period

India is expected to emerge as the fastest-growing microirrigation systems market in the Asia Pacific region, driven by acute water scarcity, strong government support for the adoption of water-efficient irrigation technologies, and accelerating farmer adoption. Declining groundwater levels, increasingly unpredictable monsoon patterns, and rising energy and labor costs are encouraging farmers to shift from conventional flood irrigation to drip and microsprinkler systems. In addition, extensive government subsidy programs, expanding cultivation of high-value crops such as horticultural produce, fruits, and plantation crops, and improvements in dealer networks and financing accessibility are supporting adoption across farms of varying sizes. Together, these factors are contributing to India’s rapid and structurally sustained growth in the microirrigation systems market.

ASIA PACIFIC MICROIRRIGATION SYSTEMS MARKET: COMPANY EVALUATION MATRIX

Netafim and China Drip Irrigation Equipment Company are the star players, with the latter being an emerging company in the Asia Pacific Microirrigation Systems market. Netafim is one of the top companies within the Asia Pacific microirrigation market. Netafim has developed a reputation as a leader in the industry due to its over 45 years of global experience, its regional presence, and its advanced technologies used in irrigation systems. By providing integrated solutions that combine hardware and digital technologies to monitor and support agronomy, Netafim is seen as a partner in agricultural technology rather than simply an equipment supplier. Furthermore, Netafim's focus on providing its customers with water-efficient solutions to improve their farm operations helps sustain land and water resources challenged by drought, poor climate conditions, and rapidly changing weather patterns. Additionally, collaboration with government agencies (at the federal, state, and local levels), a strong brand reputation, and local manufacturing operations will continue to provide Netafim with an even greater competitive advantage across the Asia Pacific region. Chinese drip irrigation equipment companies are emerging as major players in the Asia Pacific microirrigation systems market due to cost-competitive manufacturing, strong domestic demand, government support for agricultural modernization, and growing exports to price-sensitive regional markets.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Netafim (Israel)

- Rain Bird Corporation (US)

- The Toro Company (US)

- Rivulis (US)

- Valmont Industries (US)

- HUNTER INDUSTRIES (US)

- Nelson Irrigation (US)

- Finolex Plasson (India)

- Chinadrip Irrigation Equipment Co., Ltd. (China)

- Antelco (Australia)

- Mahindra EPC Irrigation Limited (India)

- Metro Irrigation (India)

- Kothari Group (India)

- HARVEL AGUA INDIA PRIVATE LIMITED (India)

- Heibei Plentirain Irrigation Equipment Ltd (China)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 6.11 Billion |

| Market Size in 2030 (Value) | USD 11.43 Billion |

| Growth Rate | CAGR of 11.1% from 2025–2030 |

| Years Considered | 2020–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Billion), Area ('000 Hectares) |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

|

| Countries Covered | China, India, Australia, Thailand, Indonesia, Philippines, Uzebkistan, Kazakhstan, Israel and Rest of Asia Pacific |

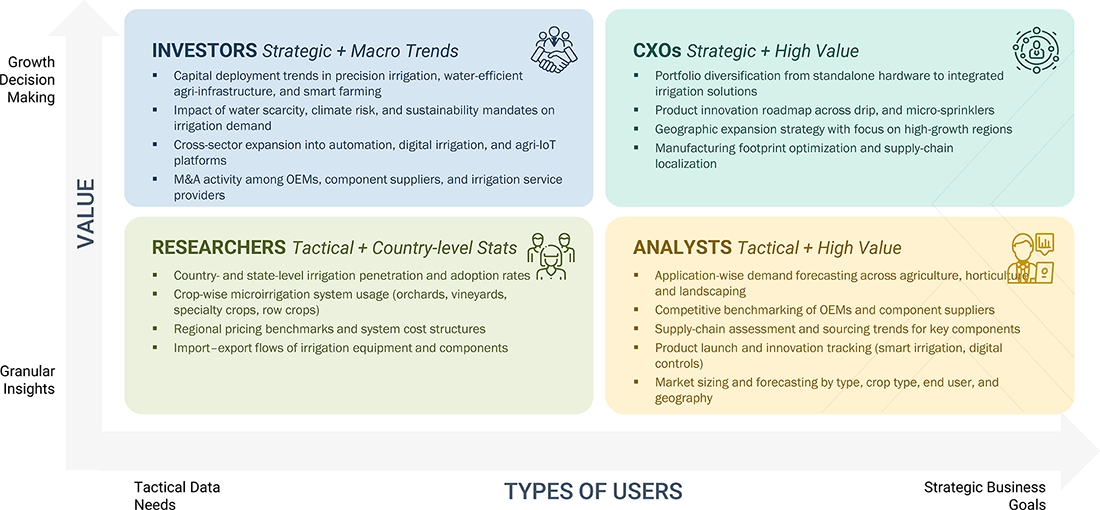

WHAT IS IN IT FOR YOU: ASIA PACIFIC MICROIRRIGATION SYSTEMS MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Microirrigation Systems Market Overview (Asia Pacific) |

|

|

| Crop-wise Demand Analysis |

|

|

| End User & Channel Analysis |

|

|

RECENT DEVELOPMENTS

- February 2025 : Netafim launched a patented Hybrid Dripline system, positioning it as the first integral dripline with a built-in outlet, combining the advantages of integral and on-line dripper systems into a single solution. This innovation addresses key operational pain points in orchards, vineyards, and greenhouse cultivation, where labor availability, installation complexity, and system reliability increasingly constrain irrigation efficiency.

- April 2024 : Rivulis launched the D4000 PC drip line, a thin-wall, pressure-compensated system designed to expand drip irrigation into previously unsuitable terrains. By delivering uniform water distribution across long runs and sloped or uneven landscapes, the product removes key limitations of conventional thin-wall drip. Strategically, this innovation broadens Rivulis’ addressable market, supports higher grower productivity and profitability, and strengthens its position in precision irrigation for challenging field conditions.

- March 2023 : The acquisition of Jain Irrigation Systems Limited’s international irrigation business by Rivulis, supported by Temasek, represents a transformational consolidation move in the global microirrigation systems industry. By integrating Jain’s international irrigation operations with Rivulis’ existing portfolio, the transaction establishes a global irrigation and climate solutions leader with an estimated annual revenue of approximately USD 750 million.

- March 2022 : Singapore's Sentosa Golf Club announced a 10-year partnership with Toro and local Toro distributor Jebsen & Jessen. The formal agreement included a complete fleet of Toro golf course maintenance equipment & irrigation products, landscaping tools, training, and on-site service and support.

Table of Contents

Methodology

This research study involved the extensive use of secondary sources—directories and databases, such as Bloomberg Businessweek and Factiva—to identify and collect information useful for a technical, market-oriented, and commercial study of the Asia Pacific Microirrigation System Market. In-depth interviews were conducted with various primary respondents—such as key industry participants, subject matter experts (SMEs), C-level executives of key market players, and industry consultants—to obtain and verify critical qualitative and quantitative information, as well as to assess prospects.

Secondary Research

The secondary sources referred to for this research study include government sources (such as the Food and Agriculture Organization (FAO), the International Commission on Irrigation & Drainage (ICID), The Organization for Economic Co-operation and Development (OECD), United States Department of Agriculture (USDA), and the World Bank, corporate filings (such as annual reports, press releases, investor presentations, and financial statements)), and trade, business, and professional associations, among others. The secondary data was collected and analyzed to arrive at the overall Asia Pacific Microirrigation System Market size, which was further validated by primary research.

Primary Research

The market comprises several stakeholders in the supply chain; these include suppliers, manufacturers, and end-use product manufacturers. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The primary interviewees from the demand side include key opinion leaders, executives, vice presidents, and CEOs of the agriculture industry. The primary sources from the supply side include research institutions involved in R&D activities, key opinion leaders, and manufacturers of microirrigation systems.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the Asia Pacific Microirrigation System Market. These approaches were also used extensively to determine the size of various subsegments in the market. The research methodology used to estimate the market size includes the following details:

- The key players in the industry and the markets were identified through extensive secondary research.

- The Asia Pacific Microirrigation System Market was determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All macroeconomic and microeconomic factors affecting the growth of the Asia Pacific Microirrigation System Market were considered while estimating the market size.

- All parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain final quantitative and qualitative data.

Market Size Estimation: Bottom-up Approach

The figure represents the overall market size estimation process employed through the bottom-up approach for this study.

The bottom-up approach was implemented for data extracted from secondary research to validate the market segment sizes obtained, which is explained below:

- The market for microirrigation systems was identified based on factors, such as COVID-19 impact on the trade and supply of agricultural inputs, company presence, and their revenues and product availability; crop production, exports, and imports; the adoption of organic farming based on key crops, and average usage of drip & micro-sprinkler irrigation systems on crop application rates in the industry.

- For each country, the increase in microirrigation area was considered, along with the replacement rate of microirrigation equipment in the existing area to arrive at the market demand. This area with potential market demand was then multiplied with the average selling price (ASP) of microirrigation equipment per hectare to arrive at the country's market size. Similar ASP was considered across all the countries in the region, with certain price variations done based on product availability and export/import dependency of the country for drip equipment. After arriving at each country's market value, these market values were summed to arrive at the regional Asia Pacific Microirrigation System Market size. This was checked with the Asia Pacific Microirrigation System Market share splits provided by the industry experts. A similar approach was performed for other regions as well.

- Following this, the market size for each region was estimated by summing up the country-level data. Further, the market size at the global level was estimated by summing up the regional level data, which has been validated through primary interviews conducted with microirrigation system manufacturers, government institutions, research organizations, suppliers, and distributors.

- The global number for microirrigation systems was arrived at after giving certain weightage factors for secondary sources, and primary sources obtained.

Market Size Estimation: Top-Down Approach

The top-down approach was used to triangulate the data obtained through this study:

The top-down approach was also implemented for the data extracted from secondary research to validate the share of the market segment obtained. For the calculation of the Asia Pacific Microirrigation System Market, the revenues of the major players operating in the Asia Pacific Microirrigation System Market were considered. The global share of the major players in the Asia Pacific Microirrigation System Market was validated with the primary respondents. The regional splits were arrived at by considering the presence and number of products sold by the company in the particular region alongside the land area being brought under microirrigation systems.

Asia Pacific Microirrigation System Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall Microirrigation System Market size from the above estimation process using both top-down and bottom-up approaches, the total market was split into several segments and subsegments. To complete the overall Asia Pacific Microirrigation System Market estimation and arrive at the exact statistics for all segments and subsegments, the data triangulation and market breakdown procedures were employed wherever applicable. The data was triangulated by studying various factors and trends from the demand and supply sides

Market Definition

According to US EPA (United States Environmental Protection Agency), microirrigation is a low-pressure, low-flow-rate type of irrigation that can reduce the likelihood of overwatering a landscape. This form of irrigation delivers water directly to where it is needed most-the root zone of plants. It also delivers the water slowly and over a longer period of time, preventing runoff and reducing evaporation. Microirrigation systems use 20 to 50 percent less water than conventional sprinkler systems and can reduce residential or commercial landscape irrigation water use.

According to F.R. Lamm, J.E. Ayars, and F.S. Nakayama in the book titled ‘Microirrigation for Crop Production: Design, Operation and Management,’ microirrigation is defined as:

“Microirrigation is the slow application of water on, above, or below the soil by surface drip, subsurface drip, bubbler, and micro sprinkler systems. Water is applied as discrete or continuous drips, tiny streams, or miniature spray through emitters or applicators placed along a water delivery line adjacent to the plant row.”

Microirrigation systems include drip method and micro-sprinkler method of irrigation systems. The approach in both systems involves a controlled supply of water in small quantities with the required consistency. Microirrigation is low pressure and low-volume irrigation system suitable for high-return value crops such as fruit and vegetable crops. Microirrigation is a modern method of irrigation; by this method, water is irrigated through drippers, micro-sprinklers, foggers, and other emitters on the surface or subsurface of the land

Key Stakeholders

- Microirrigation systems manufacturers

- Microirrigation systems importers and exporters

- Microirrigation systems traders, distributors, and suppliers

- Government and research organizations

-

Government regulatory agencies

- Food and Agriculture Organization (FAO)

- United States Department of Agriculture (USDA)

- Environmental Protection Agency (EPA)

- Department of Environment, Food, and Rural Affairs (DEFRA)

Report Objectives

Market Intelligence

- To determine and project the size of the Asia Pacific Microirrigation System Market with respect to type, crop type, end user, and region

- To identify the attractive opportunities in the market by determining the largest and fastest-growing segments across regions

- To provide detailed information about the key factors influencing the market growth (drivers, restraints, opportunities, and challenges)

- To provide the regulatory framework and market entry process related to the Asia Pacific Microirrigation System Market

- To analyze the micromarkets with respect to individual growth trends, prospects, and their contribution to the total market

Competitive Intelligence

- To identify and profile the key players in the Asia Pacific Microirrigation System Market

- To provide a comparative analysis of market leaders based on the following:

- Product offerings

- Business strategies

- Strengths and weaknesses

- Key financials

- To understand the competitive landscape and identify the major growth strategies adopted by players across countries

To provide insights on key product innovations and investments in the Asia Pacific Microirrigation System Market

Customization Options

MarketsandMarkets offers customizations according to client-specific scientific needs with the given market data.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

- Further breakdown of the Asia Pacific Microirrigation System Market forecast into Germany, UK, the Netherlands, and other EU and non-EU countries.

Company Information

- Detailed analyses and profiling of additional market players (up to five)

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Asia Pacific Microirrigation Systems Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Asia Pacific Microirrigation Systems Market