Asia Pacific Small Satellite Market Size & Growth Analysis

Asia Pacific Small Satellite Market by System (Satellite Bus, Payloads, Satellite Antenna, Others), Propulsion Technology (Chemical, Electric, Other Technologies), Customer, Frequency, Mass, Application - Forecast To 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

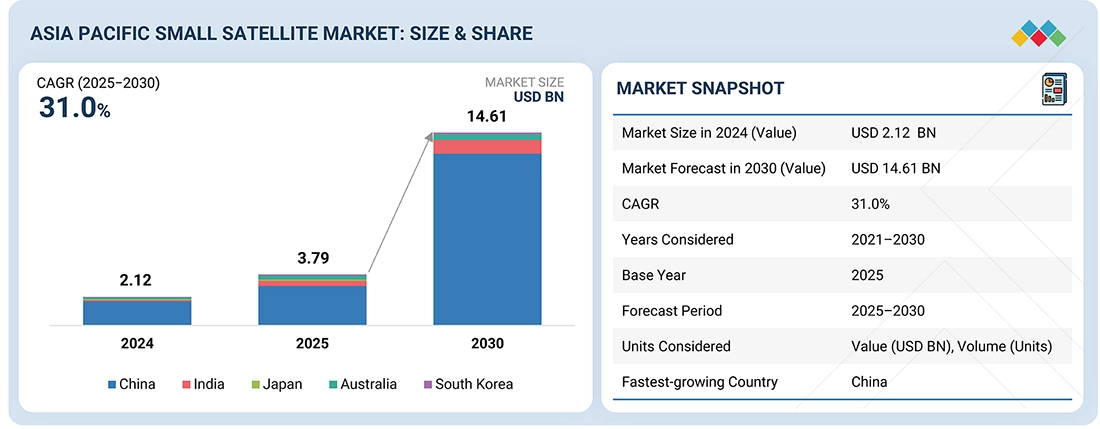

The Asia Pacific Small Satellite Market is projected to grow from USD 3.79 billion in 2025 to USD 14.61 billion by 2030 at a CAGR of 31.0%. In terms of volume, the market is expected to grow from 242 units in 2025 to 765 units by 2030. There is an increasing need for low-cost satellite solutions to be used for communications, remote imaging, and homeland defense services in the region.

KEY TAKEAWAYS

-

By CountryChina accounted for a 77.4% share in 2025 in the Asia Pacific small satellite market.

-

By CustomerThe commercial segment is expected to register the highest CAGR of 40.8% during the forecast period.

-

By SystemThe satellite bus segment is projected to be the dominant during the forecast period.

-

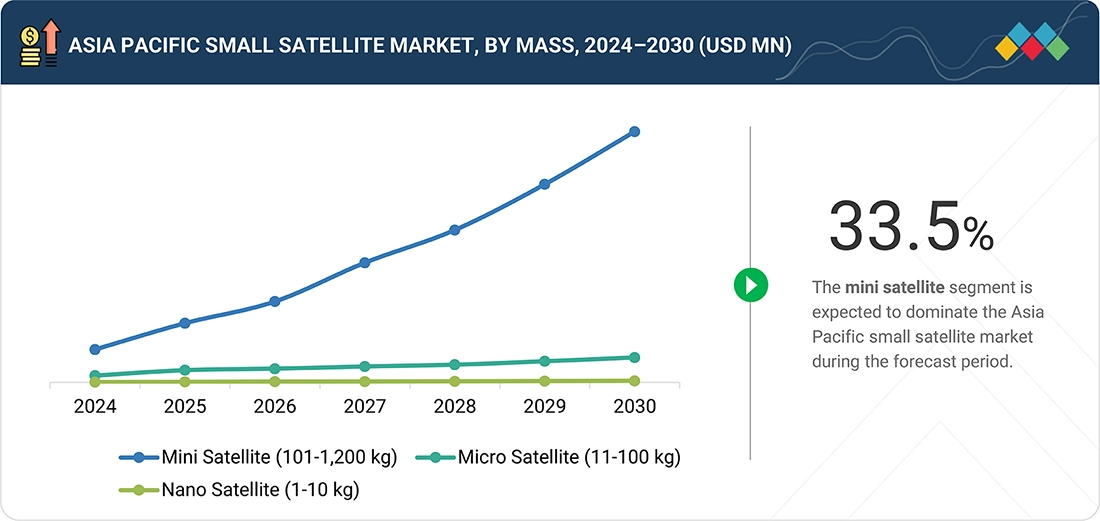

By MassThe mini satellite(101-1,200 KG) segment is expected to dominate the market during the forecast period.

-

By FrequencyThe L-band (1 to 2 GHz) segment is projected to grow at the fastest rate from 2025 to 2030.

-

By ApplicationThe communication satellite segment is expected to grow at the fastest rate during the forecast period.

-

By Propulsion TechnologyThe electric segment is expected to dominate the market during the forecast period.

-

Competitive LandscapeChina Aerospace Science and Technology Corporation (China), Mitsubishi Heavy Industries (Japan), and NEC Corporation (Japan) were identified as some of the star players in the Asia Pacific small satellite market, given their strong market share and produc

The Asia Pacific small satellite market is witnessing growth driven by the rising need for timely and reliable connectivity.

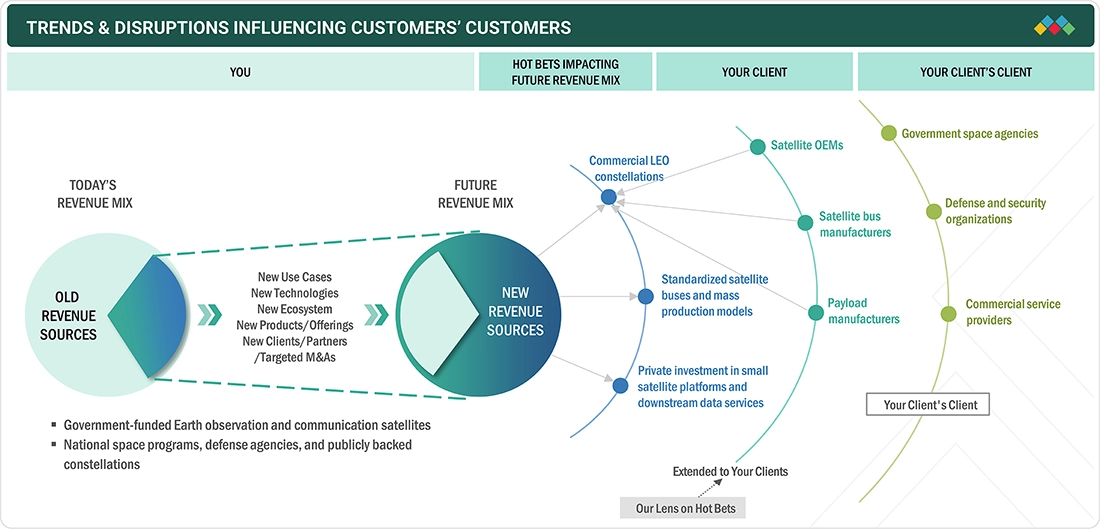

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on consumer business in the Asia Pacific small satellite market stems from evolving expectations for greater reliability and quicker delivery of data-based services by consumers in the Asia Pacific region. As a result of this growing trend, consumers expect to have an uninterrupted connection, as well as improved quality of service in both urban and remote locations.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Strong government support for space programs

-

Rising need for affordable satellite connectivity

Level

-

Launch delays and limited access

-

High cost of space-grade components

Level

-

Growth of commercial LEO constellations

-

Demand for data-driven satellite services

Level

-

Management of space congestion and orbital debris

-

Technical limits of small satellites

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Strong government support for space programs

Governments across the Asia Pacific have begun to make significant investments in space to strengthen their communications, Earth observation, and strategic capabilities. Commercial users are opting for small satellites as they provide a fast and cost-effective method of launching and deploying space-based services.

Restraint: Launch delays and limited access

Launch schedule delays can disrupt planning and slow down satellite programs. In addition, the cost of certified space-grade components continues to place pressure on budgets, particularly for smaller operators, acting as a restraint to the market.

Opportunity: Growth of commercial LEO constellations

Low Earth orbit constellations have created a continual demand for connectivity, Internet of Things (IoT), and data utilization across various industries. The demand for satellite-derived data has grown significantly during disaster response, agricultural monitoring, and infrastructure planning within the Asia Pacific region.

Challenge: Management of space congestion and orbital debris

As more satellites are launched, crowded orbits and safety risks are becoming bigger issues. Small satellite developers need to carefully control satellite size, power use, and operating life while still making sure the mission works as planned.

ASIA PACIFIC SMALL SATELLITE MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Develops and deploys small satellites for Earth observation, communication, and national space programs throughout the Asia Pacific region | Facilitates large-scale satellite launches; fulfils mission reliability; supports strategic and civilian space needs for the region |

|

Integrates small satellite platforms and onboard systems to provide communication, navigation support, and observation missions | Improves system performance; increases reliability of data, and provides for long-term operational stability |

|

Deploys commercial small satellite constellations providing connectivity and positioning services and related mobility applications | Provides scalable commercial services; improves regional connectivity; provides data-driven mobility solutions |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The key stakeholders in the Asia Pacific small satellite market ecosystem are prominent companies, private and small enterprises, and end users. Collaboration among manufacturers, system suppliers, and end users drives continuous innovation and supports the expansion of operational requirements in the small satellite domain.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Asia Pacific Small Satellite Market, By Mass

The mini satellite(101-1,200 KG) segment is projected to dominate the market in 2025, driven by steady demand for mid-capacity communication payloads that balance coverage and cost in the region.

Asia Pacific Small Satellite Market, By System

The satellite bus segment is expected to capture the largest market share owing to the rising need in the region for modular and power-efficient platforms that support high-throughput communication missions.

Asia Pacific Small Satellite Market, By Customer

The commercial segment is projected to dominate the market in 2025, driven by growing investments from operators rolling out LEO broadband and direct-to-device services in the region.

Asia Pacific Small Satellite Market, By Frequency

The Ku-band (12 to 18 GHz) segment is expected to capture the largest market share owing to the rising adoption for mobility and enterprise connectivity.

Asia Pacific Small Satellite Market, By Propulsion Technology

The electric segment is projected to dominate the market, driven by its improved efficiency compared to other segments. Also, its lower operating cost and its ability to work with smaller satellite platforms are driving the segmental growth.

Asia Pacific Small Satellite Market, By Application

The communication satellites segment is projected to dominate the market, driven by increasing demand by consumers for a higher level of connectivity within the region for better data transfer and coverage area.

REGION

China to be fastest-growing country in Asia Pacific small satellite market during forecast period

China is projected to register the highest CAGR during the forecast period in the Asia Pacific small satellite market, driven by the investments by the government and established national space programs. The market growth rate is increasing as more satellites are being launched, and also due to the rapid development of domestic constellations.

ASIA PACIFIC SMALL SATELLITE MARKET: COMPANY EVALUATION MATRIX

The company evaluation matrix for the Asia Pacific small satellite market evaluates players based on product footprint and market share. It highlights their competitive positioning and ranks them according to market strength and growth strategies. China Aerospace Science and Technology Corporation (China) leads the Asia Pacific small satellite market with a strong product portfolio, manufacturing technologies, and a broad customer base, while Pixxel (India) is recognized as an emerging leader in this market.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- China Aerospace Science and Technology Corporation (China)

- Mitsubishi Electric Corporation (Japan)

- NEC Corporation (Japan)

- Geely Space (China)

- Axelspace Corporation (Japan)

- Satrec Initiative Co., Ltd. (South Korea)

- Korea Aerospace Industries (South Korea)

- Pixxel (India)

- Inovor Technologies (India)

- Gilmour Space Technologies (Australia)

- Mu Space Corp. (Thailand)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 2.12 Billion |

| Market Forecast in 2030 (Value) | USD 14.61 Billion |

| Growth Rate | CAGR of 31.0% from 2025-2030 |

| Years Considered | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/Billion), Volume (Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Countries Covered | China, India, Japan, Australia, and South Korea |

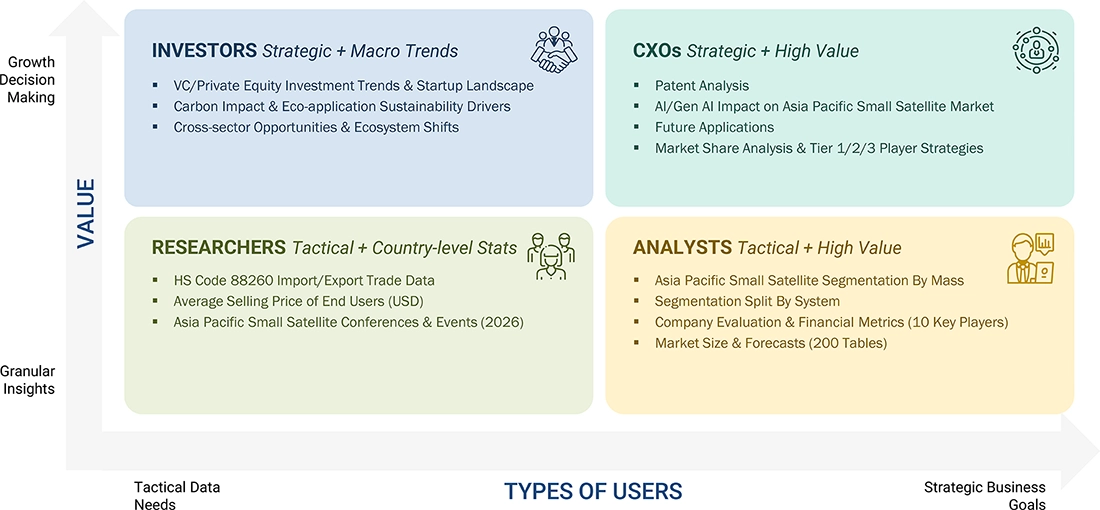

WHAT IS IN IT FOR YOU: ASIA PACIFIC SMALL SATELLITE MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Leading Manufacturer | Additional segment breakdown for countries | Additional country-level market sizing tables for segments/sub-segments covered at the regional/global level to gain an understanding of market potential by each country |

RECENT DEVELOPMENTS

- September 2024 : NEC Corporation (Japan) was selected by the Japanese government to design and assemble small, low-cost satellite systems as part of a regional satellite communication and storage plan for utilizing users throughout the Asia Pacific region.

- June 2024 : Axelspace (Japan) received permission during the second half of June 2024 from a government-supported Japanese client to construct and maintain microsatellites for supplying Earth observation data services.

- October 2023 : Pixxel (India) entered into a contract with the Indian Space Research Organisation (ISRO) for the production of a fleet of hyperspectral small satellites for Pixxel's global commercial Earth observation program.

Table of Contents

Methodology

The study involved four major activities in estimating the current size of the Asia Pacific Small Satellite Market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

The ranking analysis of companies in the Asia Pacific Small Satellite Market was carried out using secondary data from paid and unpaid sources, as well as by analyzing the product portfolios and service offerings of key companies operating in the market. These companies were rated based on the performance and quality of their products. These data points were further validated by primary sources.

Secondary sources referred for this research study included the European Space Agency (ESA), the National Aeronautics and Space Administration (NASA), the United Nations Conference on Trade and Development (UNCTAD), the Satellite Industry Association (SIA), corporate filings such as annual reports, investor presentations, and financial statements of trade, business, and professional associations. The secondary data was collected and analyzed to arrive at the overall size of the market, which was validated by primary respondents.

Primary Research

Extensive primary research was conducted after obtaining information regarding the Asia Pacific Small Satellite Market scenario through secondary research. Several primary interviews were conducted with market experts from both, the demand and supply sides across Asia Pacific. Primary data was collected through questionnaires, emails, and telephonic interviews. The primary sources from the supply side included various industry experts, such as Chief X Officers (CXOs), Vice Presidents (VPs), Directors, from business development, marketing, product development/innovation teams, and related key executives from small satellite vendors; system integrators; component providers; distributors; and key opinion leaders.

Primary interviews were conducted to gather insights such as market statistics, data of revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to technology, application, vertical, and region. Stakeholders from the demand side, such as CIOs, CTOs, and CSOs, and installation teams of the customer/end users who are using small satellite were interviewed to understand the buyer’s perspective on the suppliers, products, component providers, and their current usage of small satellite and future outlook of their business which will affect the overall market.

Market Size Estimation

The research methodology used to estimate the size of the Asia Pacific Small Satellite Market includes the following details.

- The top-down and bottom-up approaches were used to estimate and validate the size of the Asia Pacific Small Satellite Market. The research methodology used to estimate the market size includes the following details.

- The key players were identified through secondary research, and their market ranking was determined through primary and secondary research. This included a study of the annual and financial reports of the top market players and extensive interviews of leaders, including chief executive officers (CEO), directors, and marketing executives.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated, enhanced with detailed inputs, analyzed by MarketsandMarkets, and presented in this report.

Data Triangulation

After arriving at the overall size of the Asia Pacific Small Satellite Market from the market size estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for various segments and sub-segments of the market. The data was triangulated by studying various factors and trends from both the demand and supply sides. The market size was validated using both top-down and bottom-up approaches.

Market Definition

A small satellite, or smallsat, encompasses any satellite with a mass from approximately 1 to 1000 kilograms. These satellites are engineered to perform space missions similar to larger satellites but are constructed using smaller, lighter, and often commercially available components. The classification includes various subcategories like small, mini, micro, nano, and CubeSats, based on their mass. Small satellite typically leverages advancements in miniaturization of technology and are launched either independently or as secondary payloads, allowing for cost-effective access to space and opportunities for high-frequency mission updates and constellation deployment. These satellites are typically used by businesses and governments for a variety of applications including communication, earth observation, and scientific research.

Market Stakeholders

- Satellite Component Manufacturers

- Satellite Manufacturers

- Satellite Integrators

- Launch Service Providers

- Government and Civil Organizations Related to the Market

- Small Satellite Companies

- Payload Suppliers

- Scientific Institutions

- Meteorological Organizations

- Component Suppliers

- Technologists

- R&D Staff

Report Objectives

- To define, describe, and forecast the size of the Asia Pacific Small Satellite Market based on mass, subsystem, end use, application, frequency, orbit, and region

- To identify and analyze key drivers, restraints, opportunities, and challenges influencing the growth of the Asia Pacific Small Satellite Market

- To analyze technological advancements and product launches in the market

- To strategically analyze micro markets, with respect to their growth trends, prospects, and their contribution to the market

- To provide a detailed competitive landscape of the market and analyze competitive growth strategies such as new product developments, contracts, partnerships, joint ventures, agreements, and collaborations adopted by key players in the market

- To identify the detailed financial position, key products, unique selling points, and key developments of leading companies in the market

- To strategically profile key market players and comprehensively analyze their market ranking and core competencies.

Available Customizations:

MarketsAndMarkets offers the following customizations for this market report:

- Additional country-level analysis of the Asia Pacific Small Satellite Market

- Profiling of additional market players (up to 5)

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company in the Asia Pacific Small Satellite Market

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Asia Pacific Small Satellite Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Asia Pacific Small Satellite Market